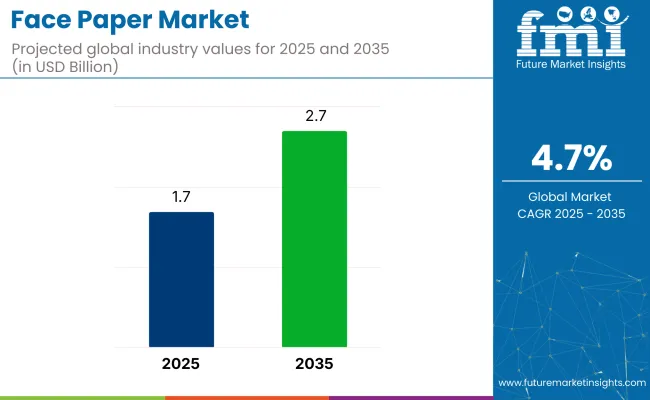

Between 2025 and 2035, the face paper market is forecast to witness growth from USD 1.7 billion to USD 2.7 billion, achieving a 4.7% CAGR. Growth is being led by rising demand for pressure-sensitive labels used in retail, logistics, healthcare, and personal care packaging.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Market Size (2035) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.7% |

Face paper plays a key role in delivering sharp print quality, durability, and label functionality. Increasing adoption of digital and flexographic printing has heightened the need for surfaces that support fast, high-resolution output.

The facial paper market, including tissues, wipes, and napkins, holds distinct shares across its parent markets. In the pulp industry, facial papers account for 8-10% of global pulp demand, relying on premium softwood fibers for quality. The packaging industry sees a minimal share (below 2%) since facial papers are consumer goods rather than packaging materials.

Within the tissue and hygiene sector, facial papers make up 30-35% of demand, driven by household and commercial usage. The recycling industry supplies 15-20% of fiber for facial papers, as brands increasingly adopt recycled content. The printing and publishing sector has almost no overlap, with facial papers holding less than 1% relevance. Growth in this market depends on consumer preferences, eco-friendly trends, and raw material availability.

Kimberly-Clark CEO Mike Hsu discusses the changing landscape of the facial tissue market, noting that innovation now addresses more than just softness. Consumers increasingly prioritize green usage, such as the company's plant-based packaging, as well as wellness-focused features.

This trend is fueling premiumization in developed markets, while affordability remains crucial for growth in emerging economies. Hsu's remarks underscore the dual challenge of meeting higher-value demands in mature markets while maintaining accessibility in price-sensitive regions. The company's strategy reflects an industry-wide shift toward balancing functionality and cost across diverse consumer markets.

In North America and Europe, demand for premium labels is increasing due to advanced branding, serialization, and compliance needs. As packaging becomes a key tool for product differentiation, the global face paper market is gaining momentum, driven by digital printing and green material preferences.

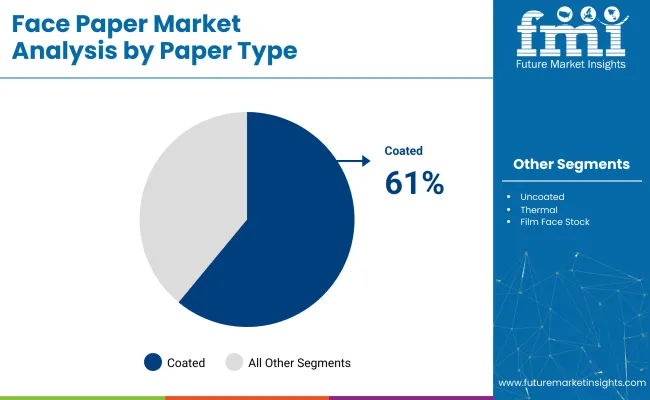

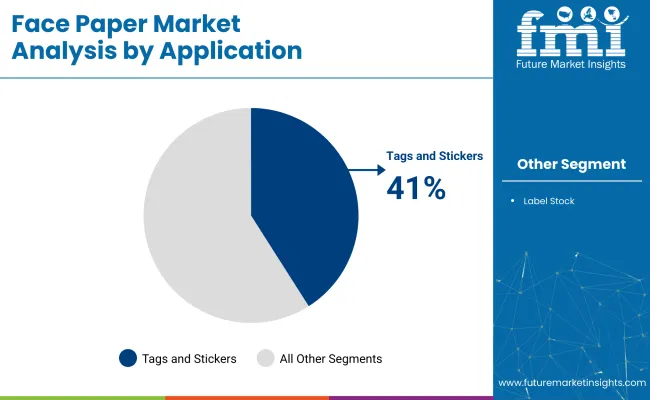

The global face paper market is experiencing strong demand across coated paper, tags & stickers, permanent adhesives, and glossy finishes. These four segments collectively account for over 70% of the total market share in 2025, driven by high label turnover and product visibility requirements in logistics, packaging, and retail.

Coated paper dominates the product type segment, holding a 61% market share in 2025. Known for its clarity, smoothness, and ink retention, it is a standard material for pressure-sensitive label production.

Companies like UPM Raflatac, Avery Dennison, and Mondi Group are expanding their coated paper portfolios to serve high-volume converters across electronics, logistics, and retail. Its resistance to wear and ability to support complex graphics make it the preferred substrate across industries that prioritize label longevity and clarity under varying conditions.

The tags and stickers segment leads the application category, accounting for 41% of demand in 2025. As essential tools in retail labelling, inventory tracking, and promotional displays, they are widely used in e-commerce, fashion, and FMCG packaging.

Companies such as LINTEC Corporation, Flexcon, and Herma GmbH continue to innovate fast-drying and high-tack face paper grades for efficient performance in high-speed application systems. This segment is crucial to brands seeking both functionality and aesthetics in a compact format.

Permanent adhesives command a 54% share of the adhesive compatibility segment in 2025, driven by their essential role in industrial and regulatory labeling. Used extensively across chemicals, logistics, and consumer goods, these adhesives support labels that must remain intact through transportation and usage. Major players like 3M, Henkel, and Avery Dennison focus on peel-resistant and multi-surface adhesion formulations designed for demanding storage and transit conditions.

Glossy finishes account for 47% of the finish type segment in 2025, primarily used for their visual appeal and print vibrancy. Brands operating in cosmetics, luxury retail, and specialty packaging rely on glossy paper for high-end shelf impact and premium unboxing experiences. Key manufacturers like Sappi, Arconvert, and Fedrigoni are optimizing gloss substrates for compatibility with various ink types and digital presses.

Packaging emerges as the leading end-use category, holding 33% of the market in 2025. From primary product labels to secondary packaging identification, face paper is integral to consumer communication and regulatory compliance. Companies such as Wausau Coated, UPM, and Nippon Paper are focusing on durable, scannable, and tamper-indicative solutions for FMCG and export sectors. The packaging boom from D2C models and e-commerce fulfillment centers further amplifies demand.

The face paper industry is advancing on the back of evolving labeling needs across FMCG, pharma, and logistics. Digital commerce expansion and stricter regulations on product traceability have amplified demand for premium, compliant labeling materials. To maintain competitiveness, major producers are accelerating investments in recyclable substrates, FSC-certified grades, and low-VOC adhesive technologies.

Strategic Innovation & Steady Expansion

Between 2024 and mid-2025, global manufacturers increased the volume share of FSC-certified face papers by 18%, led by UPM Raflatac’s expansion across Europe and Asia. Avery Dennison unveiled a new wash-off label series designed for closed-loop PET recycling systems, targeting beverage and personal care brands.

Sappi’s partnership with Xeikon yielded digitally optimized face paper stocks compatible with low-migration inks, streamlining adoption among short-run converters. Meanwhile, Mondi modernized its German facility to scale up uncoated paper output, addressing a 12% YoY increase in demand for plastic-free labeling options.

Application-Specific Product Launches

Lintec Corporation launched oil-resistant face papers engineered for foodservice packaging, catering to elevated hygiene standards in QSR chains and ready-to-eat products. Across Asia-Pacific, matte-finish face papers gained traction in pharmaceuticals and nutraceuticals as local players adapted to serialization mandates.

Premium wine and spirits segments in Europe continued favoring textured and embossed finishes, now capturing 28% of specialty label demand by mid-2025.

Cost Pressures & Material Substitution

Volatility in pulp and paper chemicals resulted in 9-13% fluctuations in base material costs between 2024 and early 2025. This squeezed converter margins, prompting a shift toward thinner substrates and optimized grammage ranges.

Competitive pressures from synthetic alternatives, such as BOPP and PET-based labels, began reshaping purchase criteria in the food and household product sectors. Regulatory uncertainty surrounding adhesives with high migration potential led to delayed product approvals across North America and the EU, creating backlogs in new SKU rollouts.

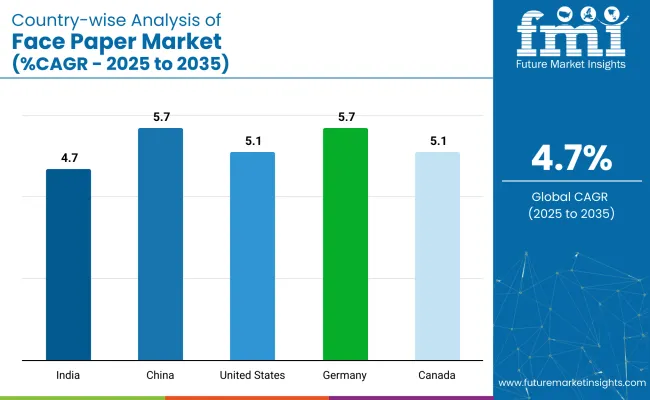

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

| China | 5.7% |

| United States | 5.1% |

| Germany | 5.7% |

| Canada | 5.1% |

Global demand for Face Paper is projected to grow at a 5.3% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, Germany and China lead at 5.7% each, followed by the United States and Canada at 5.1%, and India at 4.7%.

These growth rates translate to a +7.5% premium for Germany and China, -3.8% for the USA and Canada, and a -11.3% discount for India compared to the baseline. Divergence in growth is driven by strong demand for high-performance label stock and retail packaging in Germany and China, consistent application in North American consumer goods, and comparatively slower expansion in India due to infrastructure and value chain limitations.

The report covers a detailed analysis of 40+ countries, with the top five countries shared as a reference.

Face paper usage in India is growing at a 4.7% CAGR, influenced by vernacular packaging needs, high SKU rotation, and sachet-heavy distribution across personal care and OTC categories. Regional converters in Delhi NCR, Gujarat, and Tamil Nadu have scaled up on matte and semi-gloss coated substrates designed for flexo and digital presses.

More than 150 mid-size print suppliers now focus on low-batch orders with high ink holdout, for Ayurveda, cosmetic, and grooming brands. Direct-to-retail packaging, combined with rural marketing formats, has widened the specification mix for reel and sheet configurations.

China’s face paper industry is expanding at a 5.7% CAGR, driven by thermal-receptive label consumption in B2C shipping, logistics automation, and regional warehousing. Over 320,000 metric tons of face paper were processed in 2024 by converters across Jiangsu, Zhejiang, and Guangdong.

These zones anchor the country’s role in supplying logistics-grade substrates across BRICS and ASEAN trade routes. Demand for heat-sensitive labels and real-time QR coding surged with e-commerce volumes surpassing 310 million parcels daily, prompting rapid reel reconfiguration in second-tier inland hubs.

Face paper demand in the USA is advancing at a 5.1% CAGR, supported by medical labeling, prescription compliance, and supply chain visibility protocols. FDA-approved packaging lines in California, New Jersey, and Illinois have standardized acid-free and repositionable face paper across regulated categories.

In 2024, over 230 million prescription containers used scuff-resistant face labels to meet barcode readability under refrigeration. E-commerce and logistics players rely heavily on serialized QR overlays and water-resistant finishes, especially in pharmaceuticals and clinical trial logistics.

Germany’s face paper industry is growing at a 5.7% CAGR, led by requirements from industrial goods exports, automotive parts labeling, and EU directive compliance. Converters in Bavaria and Saxony operated above 90% utilization in 2024, fulfilling orders for double-coated, tear-resistant substrates suited for cross-border freight and hazardous goods.

Labeling protocols tied to REACH and DIN standards have shaped product specifications. Over 215,000 metric tons of face paper were consumed last year, with consistent reorders from logistics providers and heavy equipment assemblers.

The industry in Canada is tracking a 5.1% CAGR in face paper usage, shaped by bilingual packaging regulations, cannabis product labeling, and demand from wellness food brands. Ontario and Quebec converters shipped over 87,000tons of press-compatible face paper in 2024, with growth highest in roll-fed, peelable formats.

Cold-chain-ready substrates are being used in institutional foodservice, meal kits, and therapeutic supplements. The push toward hybrid presses and small-batch runs continues to drive demand for flexible-width digital reels that support French-English compliance layouts.

Leading Player-UPM Adhesive Materials with 18% industry share.

The face paper industry is dominated by key players like UPM Adhesive Materials, Delfort Group, Emax Label Solution, and Whitlam Group, each employing distinct strategies to maintain competitiveness. UPM focuses on expanding its product portfolio through targeted R&D, recently launching a high-performance face paper for extreme conditions.

Delfort Group emphasizes quality and customization, catering to niche markets like luxury packaging. Emax Label Solution leverages cost-effective production techniques, while Whitlam Group strengthens its distribution network to enhance market reach.

Emerging players are entering the market with specialized offerings, though high entry barriers like stringent regulatory standards and established supply chains limit new competition. The market remains fragmented, with consolidation trends emerging as larger firms acquire smaller innovators to diversify capabilities.

Recent Face Paper Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Paper Types Analyzed | Coated Paper, Uncoated Paper, Film Face Stock, Thermal Paper |

| Adhesive Compatibility | Permanent, Removable, Freezer-grade |

| Finish Types Analyzed | Glossy, Matte, Semi-gloss |

| Applications Analyzed | Label Stock (Food Labels, Barcode Labels, Industrial Labels), Tags & Stickers (Retail Stickers, Apparel Tags) |

| End-Use Industries Analyzed | Packaging, Retail, Logistics, Healthcare, Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, Brazil, China, India, South Korea, UAE |

| Key Players | UPM Adhesive Materials, Delfort Group, Emax Label Solution, Whitlam Group |

| Additional Attributes | Dollar sales, demand shifts toward recyclable and compostable paper stocks, integration with smart labeling tech (RFID, barcoding), growth in logistics and healthcare end uses, regional regulatory shifts around packaging waste, and evolving consumer preferences for matte and semi-gloss finishes. |

The segment includes Coated Paper, Uncoated Paper, Film Face Stock, and Thermal Paper.

This category comprises Permanent, Removable, and Freezer-grade adhesives.

Segmented into Glossy, Matte, and Semi-gloss finishes.

Segmented into Label Stock(Food Labels, Barcode Labels, Industrial Labels), Tags & Stickers(Retail Stickers, Apparel Tags).

Segmented into Packaging, Retail, Logistics, Healthcare, and Industrial sectors.

Industry performance assessed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The face paper market is expected to grow from USD 1.7 billion in 2025 to USD 2.7 billion by 2035, at a CAGR of 4.7%.

Coated paper leads the market with a 61% share in 2025 due to its durability and high-quality finish.

Tags and stickers hold the largest share at 41%, driven by demand in retail, labeling, and branding applications.

Germany and China are key growth regions, each projected to grow at a 5.7% CAGR due to rising industrial and packaging demands.

UPM Adhesive Materials dominates the market with an 18% industry share, thanks to its strong product portfolio and global presence.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.