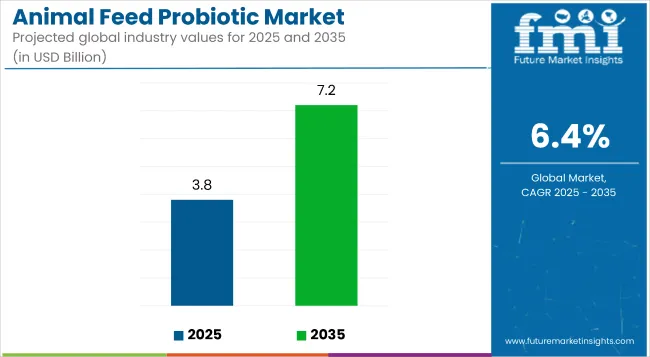

The global animal feed probiotic market is projected to grow from USD 3.8 billion in 2025 to USD 7.2 billion by 2035, registering a CAGR of 6.4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.8 billion |

| Industry Value (2035F) | USD 7.2 billion |

| CAGR (2025 to 2035) | 6.4% |

The market expansion is driven by the increasing demand for sustainable and natural feed additives to improve animal health, productivity, and overall well-being. As concerns over antibiotic resistance grow, the adoption of probiotics as a natural alternative is gaining momentum, particularly in livestock sectors such as poultry, cattle, and swine.

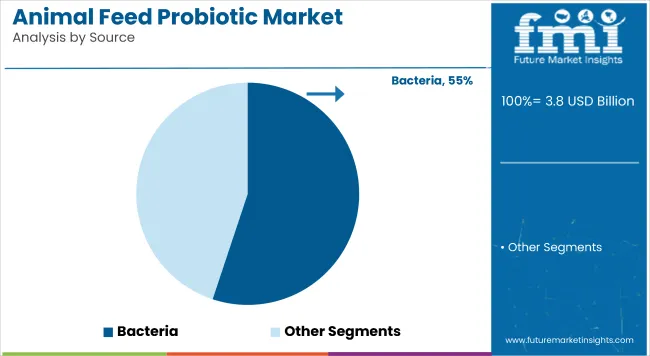

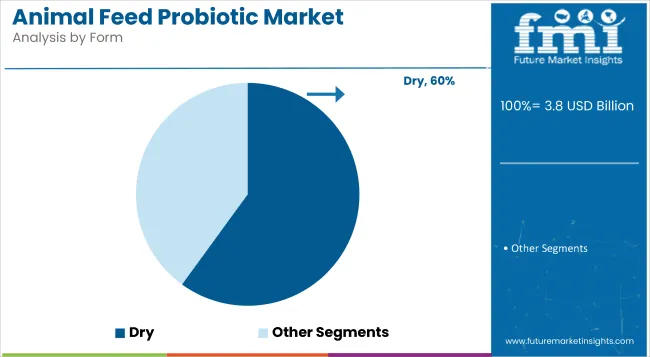

The market holds an 55.1% share for bacteria-based probiotics, driven by their proven efficacy in improving gut flora and enhancing animal immunity. Within the form segment, dry probiotics dominate with 60% share, owing to their longer shelf life, ease of handling, and compatibility with various feed types. Together, these segments play a critical role in advancing livestock nutrition and health through targeted microbial solutions

Government regulations impacting the market focus on promoting animal welfare, sustainable farming practices, and safe feed products. Regulatory bodies in regions such as the European Union, the USA, and India are encouraging the use of natural additives like probiotics, particularly as alternatives to antibiotics. These evolving regulations, alongside growing scientific validation of strain-specific benefits, are accelerating the adoption of probiotics across the animal feed sector.

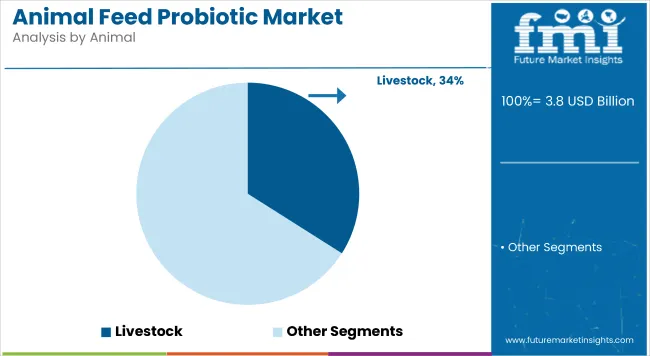

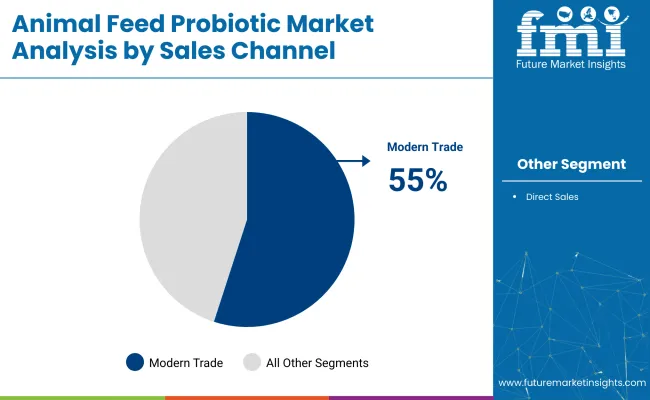

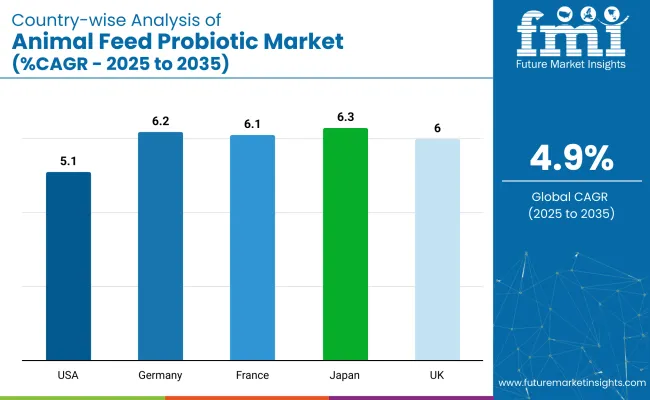

Japan is projected to be the fastest-growing market, expanding at a CAGR of 6.3% from 2025 to 2035. Dry will lead the form segment with a 60% share, while bacteria will dominate the source segment with 55.1%. The livestock is likely to capture 34% of the animal type segment. Modern trade will account for 55% of total sales. The USA and France markets are expected to grow at CAGRs of 5.1% and 6.1%, respectively.

The market is segmented by source, animal, form, sales channel, and region. By source, the market is bifurcated into bacteria and non-bacteria. Based on animal, the market is classified into companion animal, livestock, equine, swine, and aquaculture. In term of form, the market is divided into liquid and dry.

By sales channel, the market is bifurcated into modern trade and direct sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

Bacteria are expected to lead the source segment, accounting for 55.1% of the market share by 2025.Their ability to improve digestion, boost immunity, and enhance nutrient absorption make them a leading choice among livestock farmers, feed manufacturers, and animal nutritionists.

Livestock is expected to dominate the animal segment,accounting for 34% of the market share by 2025.Their significant role in global meat, dairy, and animal product production, make it a preferred choice among commercial livestock farmers and integrated animal husbandry operations.

Dry is expected to dominate the form segment, accounting for 60% of the market share by 2025.Their stability, cost-effectiveness, and compatibility with feed manufacturing processes make them a preferred choice among feed producers, livestock farmers, and animal nutrition companies.

Modern trade is expected to dominate the sales channel segment, accounting for 55% of the market share in 2025.Their benefits such as bulk purchasing, consistent product availability, and trusted quality standards make it a leading choice among commercial livestock farmers, distributors, and feed retailers.

The global animal feed probiotic market has been experiencing steady growth, driven by the increasing demand for natural and sustainable feed additives to enhance animal health and productivity. Probiotics play a crucial role in improving gut health, boosting immunity, and promoting overall animal well-being, while addressing the rising concerns over antibiotic resistance in livestock farming.

Recent Trends in the Animal Feed Probiotic Market

Challenges in the Animal Feed Probiotic Market

Japan leads the animal feed probiotic market, driven by its advanced farming practices and strong demand for natural, antibiotic-free solutions in poultry, livestock, and aquaculture sectors.

In Germany and France, growth rates of 5.7% and 5.5% CAGR, respectively, are being recorded,with market expansion supported by EU regulations under broader frameworks like the Green Deal are indirectly influencing probiotic adoption by pressuring livestock producers to reduce antibiotic use and comply with stricter animal welfare and environmental standards. The USA market is projected to grow at a CAGR of 5.1%,the UK at a CAGR of (6%), and Japan at a CAGR of 6.3%.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan animal feed probiotic revenue is growing at a CAGR of 6.3% from 2025 to 2035. Growth is driven by ultra-efficient farming practices in the poultry and livestock sectors, alongside a strong preference for natural, antibiotic-free solutions.

The sales of animal feed probiotics in Germany are expected to expand at a 6.2% CAGR during the forecast period.Growth is driven by the country's strong focus on antibiotic-free livestock farming, which promotes the use of probiotics to support gut health and reduce reliance on conventional treatments.

The demand for animal feed probiotic in France is projected to grow at a 6.1% CAGR during the forecast period. Demand is driven by the national focus on reducing antibiotic use in agriculture, alongside stringent animal health regulations.

The USA animal feed probiotic market is projected to grow at a 5.1% CAGR from 2025 to 2035. Growth is driven by regulations promoting antibiotic-free farming, with a focus on poultry, cattle, and swine sectors.

The UK animal feed probiotic revenue is projected to grow at a 6% CAGR from 2025 to 2035. Growth is supported by national regulations on animal health and a shift towards more sustainable farming practices in the poultry and dairy industries.

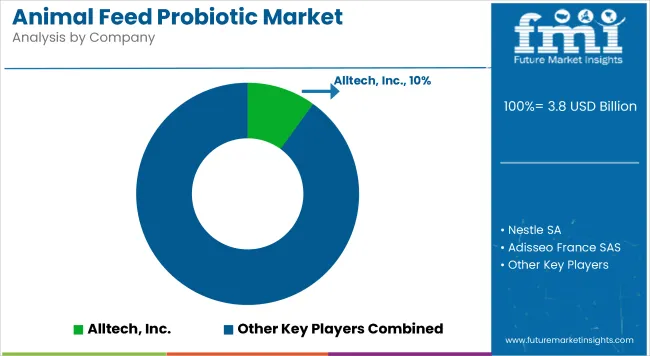

The market is moderately consolidated, with leading players like Alltech, Inc., Nestle SA, Adisseo France SAS, Novus International, Inc., and Calpis Co., Ltd. dominating the industry. These companies provide advanced, efficient probiotic solutions for animal nutrition, catering to sectors such as livestock, poultry, and aquaculture. Alltech, Inc. specializes in gut health solutions, while Nestle SA focuses on high-quality, sustainable animal feed additives.

These leading players offer innovative and specialized probiotic solutions to enhance animal health and feed efficiency. Adisseo, Novus, and DuPont provide performance-focused feed solutions, while Lallemand and Chr. Hansen emphasize natural and gut-health-oriented probiotics. Evonik, DSM, and Kerry Group contribute advanced microbial and functional ingredients, making them key drivers in the development of next-generation animal feed probiotics.

Recent Animal Feed Probiotic Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.8 billion |

| Projected Market Size (2035) | USD 7.2 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| By Source | Bacteria and Non-Bacteria |

| By Animal Type | Companion Animal, Livestock, Equine, Swine, and Aquaculture |

| By Form | Liquid and Dry |

| By Sales Channel | Modern Trade and Direct Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Alltech, Inc., Nestle SA, Adisseo France SAS, Novus International, Inc., Calpis Co., Ltd., Lallemand Inc., DuPont Company, Evonik Industries AG, Koninklijke DSM N.V., Kerry Group plc, and Chr. Hansen Holding A/S |

| Additional Attributes | Dollar sales by animal type, share by source, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The market is valued at USD 3.8 billion in 2025.

The market is forecasted to reach USD 7.2 billion by 2035, reflecting a CAGR of 6.4%.

Bacteria will lead the source segment, accounting for 55.1% of the global market share in 2025.

Dry will dominate the form segment with a 60% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Digest Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Intestinal Health Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA