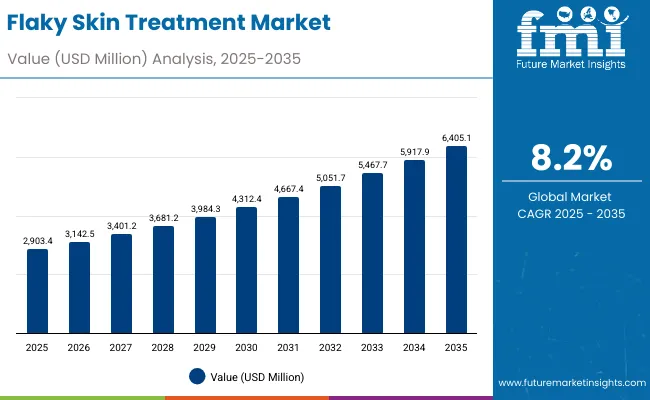

The Flaky Skin Treatment Market is expected to record a valuation of USD 2,903.4 million in 2025 and USD 6,405.1 million in 2035, with an increase of USD 3,501.7 million, which equals a growth of over 120% across the decade. The overall expansion represents a CAGR of 8.2% and a 2.2X increase in market size.

Flaky Skin Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| Flaky Skin Treatment Market Estimated Value in (2025E) | USD 2,903.4 million |

| Flaky Skin Treatment Market Forecast Value in (2035F) | USD 6,405.1 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,903.4 million to USD 4,312.4 million, adding USD 1,409.0 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption among adults who represent nearly 60% of the demand, with creams dominating as the most accessible and trusted product type. Demand is further fueled by high usage in pharmacies and drugstores, as these remain the most convenient retail channels globally for both over-the-counter and dermatologist-recommended formulas. Adults drive adoption in this phase with eczema-related dryness and seasonal skin conditions as primary targets.

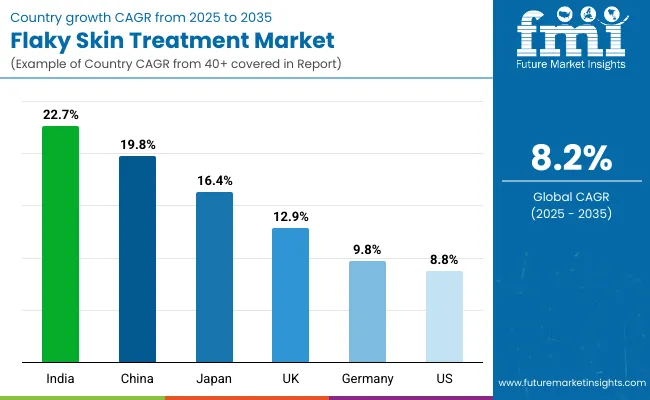

The second half from 2030 to 2035 contributes USD 2,092.7 million, equal to over 60% of total growth, as the market jumps from USD 4,312.4 million to USD 6,405.1 million. This acceleration is powered by strong growth in Asia-Pacific countries, particularly India and China, which record CAGRs of 22.7% and 19.8% respectively. Rising middle-class incomes, increased dermatology clinic visits, and growing consumer awareness of skincare contribute significantly to this surge. Japan strengthens its premium dermo-cosmetic positioning with a 16.4% CAGR, while Western markets such as the USA grow steadily, crossing USD 1,261.6 million in 2035. Balms and oils see faster adoption in the latter half due to increased consumer preferences for natural and clean-label solutions, while e-commerce channels significantly expand, overtaking mass retail in many emerging economies.

From 2020 to 2024, the Flaky Skin Treatment Market expanded steadily, rising from around USD 2,100 million to nearly USD 2,800 million, driven by higher consumer awareness of chronic skin dryness linked to eczema and psoriasis. During this period, the competitive landscape was dominated by pharmaceutical skincare brands and dermo-cosmetic players controlling nearly 70% of the value, with leaders such as CeraVe, Eucerin, and La Roche-Posay focusing on ceramide- and urea-based formulas backed by dermatologist endorsements.

Competitive differentiation relied heavily on clinical validation, product tolerability, and distribution via pharmacies and dermatology clinics. Clean-label and fragrance-free claims began gaining traction, but natural formulations like shea butter and colloidal oatmeal were still considered niche offerings, representing less than 15% of total sales.

Demand for flaky skin treatments will expand to USD 2,903.4 million in 2025, and the revenue mix will gradually shift as natural active ingredients such as shea butter and colloidal oatmeal gain share, while traditional ceramide-dominant brands continue to lead. By 2030, over 50% of products will carry dermatologist-tested and hypoallergenic claims, reflecting the global consumer preference for safety and skin barrier protection. From 2030 onwards, e-commerce will rise as a primary channel, especially in China and India, where direct-to-consumer online platforms and subscription-based skincare services are scaling rapidly.

Western markets such as the USA and Europe will consolidate, with pharmacies and drugstores retaining a strong foothold, while emerging Asia-Pacific markets accelerate growth through localized product innovation and rising adoption among younger demographics. The competitive advantage is shifting from pharmacy distribution alone to multi-channel retail presence, scientific claims, and brand trust combined with affordability and accessibility.

The Flaky Skin Treatment Market is witnessing rapid growth due to rising incidences of eczema-related and psoriasis-related dryness, which affect millions globally and require long-term treatment. Adults account for nearly 60% of demand, driven by higher exposure to urban pollution, stress, and seasonal variations in skin health. The increasing popularity of dermatologist-tested and fragrance-free claims reflects growing consumer demand for safe, clinically backed solutions that minimize irritation and strengthen the skin barrier.

Another major growth driver is the expansion of product accessibility across retail and e-commerce channels. Pharmacies and drugstores remain the most dominant distribution channels, holding nearly 48% of global share in 2025, supported by consumer trust in medical-grade skincare. However, e-commerce is gaining strong momentum, especially in Asia-Pacific, where platforms such as Tmall, Flipkart, and Amazon are reshaping consumer access to international and local dermo-cosmetic brands. Segment growth is led by creams, which remain the go-to product type for consumers due to ease of application, affordability, and clinical endorsement, while balms and oils are rapidly growing as consumers seek natural, moisturizing alternatives.

The market is segmented by condition target, active ingredient, product type, claim, channel, and end user. Condition targets include eczema-related dryness, psoriasis-related dryness, seasonal dryness, and general skin flaking, reflecting the diverse clinical and lifestyle-driven needs of consumers. Active ingredients are led by ceramides, colloidal oatmeal, shea butter, urea, and glycerin, each offering distinct hydration and barrier-repair properties.

Product types include creams, balms, oils, and ointments, with creams holding the largest share due to clinical trust and wider availability. Claims driving growth include dermatologist-tested, fragrance-free, hypoallergenic, and clean-label, which highlight consumer preference for safety and sustainability. Distribution channels span pharmacies/drugstores, e-commerce, mass retail, and dermatology clinics, while end users include adults, children/babies, and seniors, with adults remaining the dominant consumer group globally.

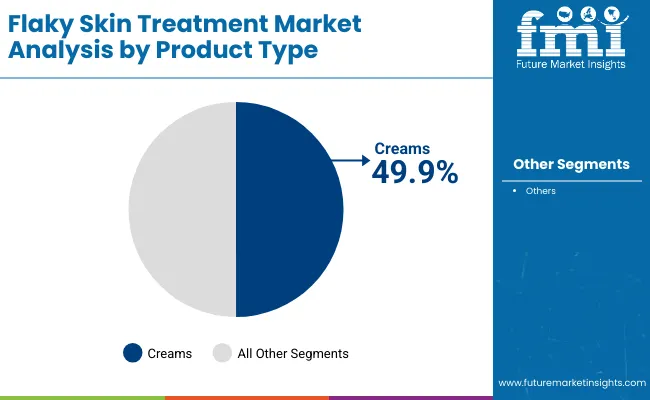

| Product Type | Value Share% 2025 |

|---|---|

| Creams | 49.9% |

| Others | 50.1% |

The creams segment is projected to contribute 49.9% of the Flaky Skin Treatment Market revenue in 2025, maintaining its lead as the dominant product type. This is driven by their widespread acceptance among consumers, dermatologist recommendations, and proven ability to deliver consistent hydration for eczema, psoriasis, and seasonal dryness. Creams remain the most accessible and trusted solution, available across pharmacies, dermatology clinics, and e-commerce platforms worldwide.

The segment’s growth is also supported by innovations in formulation, including ceramide-enriched, colloidal oatmeal-based, and fragrance-free variants designed to suit sensitive skin. Convenience of application and strong clinical validation give creams a competitive edge over oils, balms, and ointments. As clean-label and hypoallergenic claims gain momentum, leading brands are reformulating creams to include natural actives such as shea butter and glycerin, while maintaining dermatologist-tested credentials. The creams segment is expected to retain its position as the backbone of the global flaky skin treatment category.

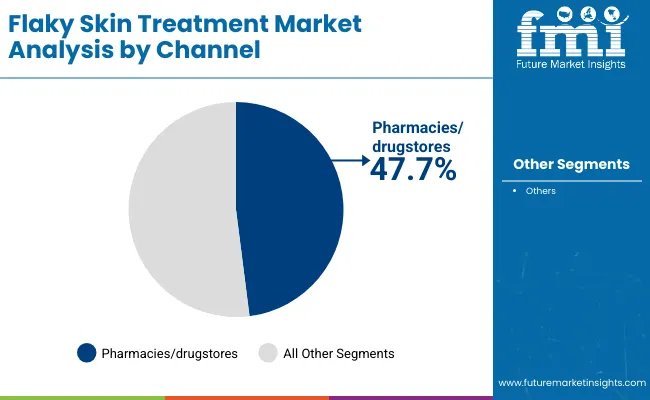

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 47.7% |

| Others | 52.3% |

The pharmacies/drugstores segment is forecasted to hold 47.7% of the market share in 2025, led by its role as the most trusted distribution channel for medical-grade skincare and dermatologist-recommended treatments. Consumers seeking reliable solutions for chronic conditions like eczema and psoriasis prefer pharmacy-based purchases, where credibility and clinical backing are central. These outlets also enable effective consumer education, as pharmacists often act as advisers in recommending dermatologist-tested and hypoallergenic formulas.

Pharmacies and drugstores are also heavily leveraged by leading brands such as CeraVe, Cetaphil, and Eucerin to launch new products, ensuring wide accessibility across global regions. Growth is further bolstered by the increasing presence of dermatology clinics attached to pharmacy chains, particularly in North America and Europe, enhancing the trust factor. While e-commerce is growing rapidly, pharmacies remain the dominant sales driver, especially in developed markets. The segment is expected to continue its dominance, anchored by consumer trust, regulatory oversight, and medical-grade positioning.

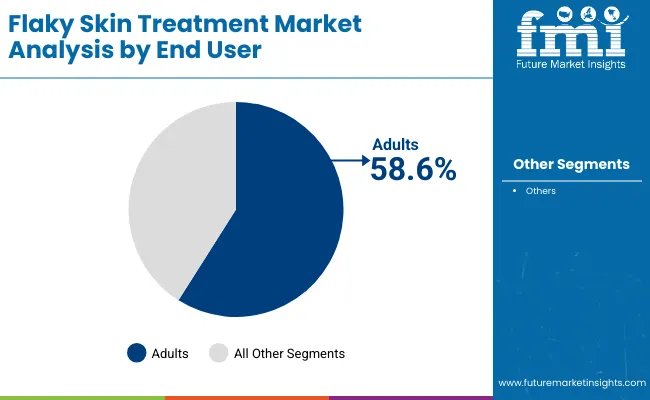

| End User | Value Share% 2025 |

|---|---|

| Adults | 58.6% |

| Others | 41.4% |

The adults segment is projected to account for 58.6% of the Flaky Skin Treatment Market revenue in 2025, establishing it as the leading end-user category. Adults are more susceptible to chronic skin dryness caused by eczema, psoriasis, environmental pollution, and lifestyle-related stress. As such, they form the largest consumer base for both prescription and over-the-counter flaky skin treatments. This group drives demand across multiple product formats, from intensive creams and ointments to natural oils and balms, with a notable emphasis on dermatologist-tested and fragrance-free formulations.

Rising skincare awareness, supported by aggressive marketing campaigns from dermo-cosmetic brands, has further accelerated adoption among adults. In addition, adults in emerging economies are driving online sales, while consumers in developed countries continue to rely heavily on pharmacies and dermatology clinics. With consistent exposure to environmental triggers and a heightened focus on personal care, adults are expected to remain the cornerstone of demand in the Flaky Skin Treatment Market.

Rising Prevalence of Chronic Skin Conditions Linked to Autoimmune Disorders

A significant driver of the Flaky Skin Treatment Market is the rising incidence of autoimmune-related skin conditions such as eczema and psoriasis, which are increasingly being diagnosed in adults and children alike. These conditions create a constant demand for long-term treatment options, where ceramide-based creams and dermatologist-tested ointments are viewed as essential daily-use products rather than discretionary purchases.

In markets like the USA and Europe, where medical dermatology is well established, this results in recurring pharmacy-driven sales. Meanwhile, in high-growth markets like India and China, increased awareness of psoriasis and eczema as chronic medical conditions has led to higher clinic visits and product prescriptions, boosting consistent uptake. This chronic condition-driven demand ensures the category remains resilient even during economic downturns, differentiating it from more discretionary skincare markets.

Accelerated Adoption of E-commerce as a Trusted Medical Skincare Channel in Emerging Asia

Another powerful driver is the rapid expansion of e-commerce platforms as credible distribution channels for clinical-grade skincare. Unlike traditional cosmetics, flaky skin treatment products have historically been pharmacy-dominated, but platforms such as Tmall in China, Flipkart in India, and Amazon’s specialized health & wellness verticals have transformed accessibility. For instance, in China, creams already account for over 50% of product sales (USD 162.9 million in 2025), with a large portion driven by cross-border e-commerce and direct-to-consumer brand strategies.

Online channels also facilitate subscription-based replenishment models, appealing to chronic skin condition patients who need continuous treatment. This shift is particularly impactful in Asia-Pacific, where consumer trust in online pharmacies and regulated digital health platforms is rising quickly.

Price Sensitivity and Limited Affordability in Emerging Markets

Although the market is expanding globally, one key restraint is the high cost of clinically validated, dermatologist-tested formulas. In emerging markets such as India and Southeast Asia, price sensitivity remains high, and premium products from global brands like La Roche-Posay and CeraVe are often unaffordable for a majority of consumers. This has created a two-tier market, where international brands dominate niche urban segments, while mass consumers are left with less effective, lower-priced generic alternatives. The lack of affordable yet clinically proven mid-market options slows down the adoption curve and can limit overall market penetration despite high potential demand.

Regulatory Complexity in Claim Validation and Market Entry

A major restraint is the tightening global regulatory scrutiny around skincare claims such as "dermatologist-tested," "hypoallergenic," and "clean-label." For flaky skin treatments, where products border between cosmetic and therapeutic categories, compliance varies across regions. For example, in the USA and EU, ceramide- and urea-based treatments often undergo stricter oversight, while in Asia, regulatory ambiguity slows down product launches. This fragmented regulatory environment not only increases time-to-market but also drives up costs for global players, creating barriers for new entrants and smaller domestic brands trying to scale internationally.

Premiumization of Everyday Care Through Dermatology-backed Skincare

A notable trend is the increasing premiumization of daily skincare routines, where consumers view flaky skin treatment products as long-term essentials rather than occasional remedies. Adults, who make up nearly 60% of global demand (USD 1,699 million in 2025), are driving this shift, especially in developed regions like the USA, Germany, and the UK Here, dermatologist-endorsed, prescription-strength products are migrating into mainstream retail through partnerships with pharmacy chains and dermo-cosmetic outlets. This "medicalization of skincare" is elevating consumer willingness to pay more for trusted, clinically validated solutions, boosting both margins and brand loyalty for leading players.

Local Ingredient-driven Innovation in High-growth Asian Markets

Another important trend shaping the market is the rise of locally relevant formulations in high-growth markets like China and India. While global brands rely heavily on ceramides and urea, domestic players are innovating with culturally resonant ingredients such as Ayurvedic botanicals in India and fermented skincare actives in East Asia, blending tradition with clinical positioning. This not only allows local brands to resonate more deeply with regional consumers but also creates a competitive threat to global incumbents by addressing the price sensitivity barrier while aligning with clean-label and natural product preferences. The trend is particularly strong in markets like India, which is projected to grow at 22.7% CAGR, signaling both opportunity and rising competition for international brands.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The Flaky Skin Treatment Market shows a highly diverse growth trajectory across key countries. India (22.7% CAGR) and China (19.8% CAGR) stand out as the fastest-growing markets, fueled by rising disposable incomes, urbanization, and a surge in awareness of skin health. In these countries, a combination of increasing dermatology clinic visits, expanding e-commerce penetration, and strong marketing by both domestic and international brands is accelerating adoption.

For example, in China, creams already capture over half of the product mix, with growth further supported by cross-border e-commerce. In India, Ayurvedic and botanical-inspired innovations complement established dermo-cosmetic solutions, creating unique hybrid offerings that resonate with a price-sensitive but rapidly expanding consumer base. Japan (16.4% CAGR) also shows robust growth, driven by its strong culture of preventive skincare, premium positioning of products, and high consumer trust in dermatologist-backed solutions.

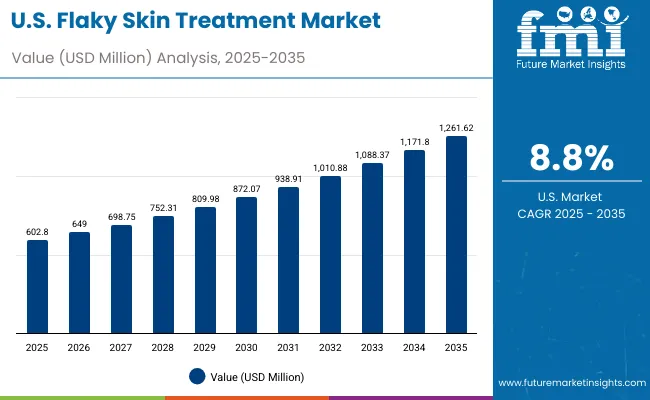

Meanwhile, Western markets exhibit steadier but substantial growth. The USA (8.8% CAGR) remains the largest market in absolute terms, expected to reach USD 1,261.6 million by 2035, with adults representing nearly 60% of demand. Growth here is anchored by pharmacy-dominated distribution and rising demand for fragrance-free and hypoallergenic products that address chronic conditions like eczema and psoriasis.

Germany (9.8% CAGR) and the UK (12.9% CAGR) highlight Europe’s evolving landscape, where regulatory scrutiny is high, but consumers are increasingly drawn to clean-label and dermatologist-tested formulations. Germany continues to drive demand through its strong dermo-cosmetic heritage and pharmacy networks, while the UK benefits from rising consumer adoption of online skincare platforms. Collectively, these diverse growth patterns illustrate a global market where Asia-Pacific drives acceleration, and North America and Europe sustain steady, trust-driven expansion.

| Year | USA Flaky Skin Treatment Market (USD Million) |

|---|---|

| 2025 | 602.80 |

| 2026 | 649.00 |

| 2027 | 698.75 |

| 2028 | 752.31 |

| 2029 | 809.98 |

| 2030 | 872.07 |

| 2031 | 938.91 |

| 2032 | 1,010.88 |

| 2033 | 1,088.37 |

| 2034 | 1,171.80 |

| 2035 | 1,261.62 |

The Flaky Skin Treatment Market in the United States is projected to grow at a CAGR of 8.8%, led by high demand for dermatologist-tested and fragrance-free solutions addressing chronic conditions like eczema and psoriasis. Adults form the largest consumer base, representing nearly 60% of sales in 2025, supported by strong retail access through pharmacies and drugstores. The USA market also shows increasing adoption of hypoallergenic and clean-label formulations as awareness of sensitive skin care rises. Growth is further supported by e-commerce expansion, though pharmacies remain the primary retail driver due to consumer trust in medical-grade skincare.

The Flaky Skin Treatment Market in the United Kingdom is expected to grow at a CAGR of 12.9%, supported by rising consumer awareness and demand for dermatologist-tested, sensitive-skin solutions. British consumers show strong preference for fragrance-free and clean-label products, a trend accelerated by regulatory oversight and marketing campaigns emphasizing safety. Pharmacies and drugstores remain important distribution hubs, while online platforms are becoming increasingly popular for specialty products. Premium brands such as La Roche-Posay and Bioderma are expanding through both pharmacies and e-commerce, while mass-market players continue to build share.

India is witnessing rapid growth in the Flaky Skin Treatment Market, which is forecast to expand at a CAGR of 22.7% through 2035, the fastest among leading countries. Growth is supported by expanding e-commerce penetration in tier-2 and tier-3 cities, where affordability and accessibility of creams and balms are driving adoption. Rising disposable incomes and dermatology awareness campaigns are fueling increased diagnosis of eczema and psoriasis, creating strong long-term demand. Local players are incorporating Ayurvedic botanicals with ceramides and glycerin to offer hybrid solutions at competitive price points, catering to cost-sensitive but aspirational consumers.

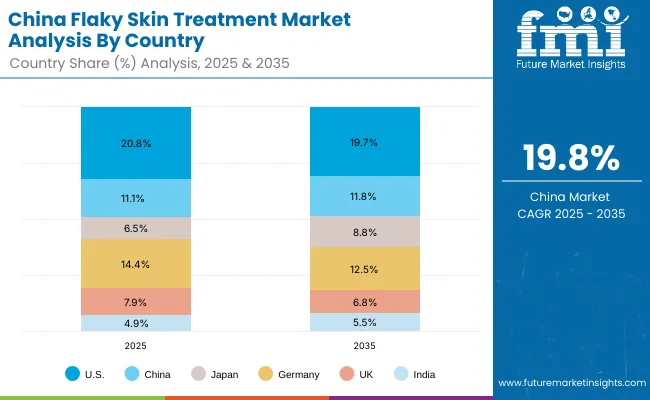

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.7% |

| China | 11.8% |

| Japan | 8.8% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The Flaky Skin Treatment Market in China is expected to grow at a CAGR of 19.8%, among the highest globally. Growth momentum is supported by strong demand for creams, which already account for over 50% of the product mix (USD 162.9 million in 2025). E-commerce and cross-border retail platforms like Tmall and JD.com dominate distribution, providing consumers access to both global dermo-cosmetic brands and innovative local players. Government-led awareness programs on dermatological care and the increasing role of dermatology clinics in urban centers further drive growth. Affordable formulations from domestic brands, combined with premium imports, are enabling broader adoption across consumer groups.

| USA by End User | Value Share% 2025 |

|---|---|

| Adults | 59.9% |

| Others | 40.1% |

The Flaky Skin Treatment Market in the United States is projected at USD 602.8 million in 2025, growing at a steady 8.8% CAGR through 2035. Adults dominate consumption with a 59.9% share (USD 361.0 million), reflecting the high prevalence of eczema- and psoriasis-related dryness in the population. Chronic dermatological conditions drive consistent pharmacy purchases, where clinically validated, fragrance-free, and hypoallergenic products are in strongest demand.

The USA market is defined by its reliance on pharmacy and dermatology clinic distribution, which continues to hold nearly half of all sales. While e-commerce platforms are expanding their role, consumer trust in pharmacist-recommended and dermatologist-tested products remains a defining factor. Innovation is focused on formulas enriched with ceramides and urea, which are widely recognized for repairing the skin barrier. The rise of subscription-based e-commerce platforms and digital health channels is expected to further increase product accessibility and repeat purchases.

| China by Product Type | Value Share% 2025 |

|---|---|

| Creams | 50.7% |

| Others | 49.3% |

The Flaky Skin Treatment Market in China is valued at USD 321.6 million in 2025, with creams leading at 50.7% (USD 162.9 million), followed by balms, oils, and ointments collectively holding 49.3% (USD 158.6 million). The dominance of creams reflects their affordability, versatility, and alignment with consumer preference for fast-absorbing, multi-purpose treatments. The strong positioning of international brands alongside domestic players has made creams the most accessible and trusted format.

China’s market expansion, at a CAGR of 19.8%, is fueled by e-commerce dominance through platforms like Tmall and JD.com, which enable consumers to access both global dermo-cosmetic brands and competitively priced domestic solutions. Public health initiatives promoting dermatological awareness, combined with urban consumers’ growing demand for dermatologist-tested and hypoallergenic products, are driving strong uptake. Local firms are also innovating with urea- and shea butter-based creams, while premium imports target higher-income consumers.

| Global Value Share 2025 | |

| CeraVe | 8.3% |

| Others | 91.7% |

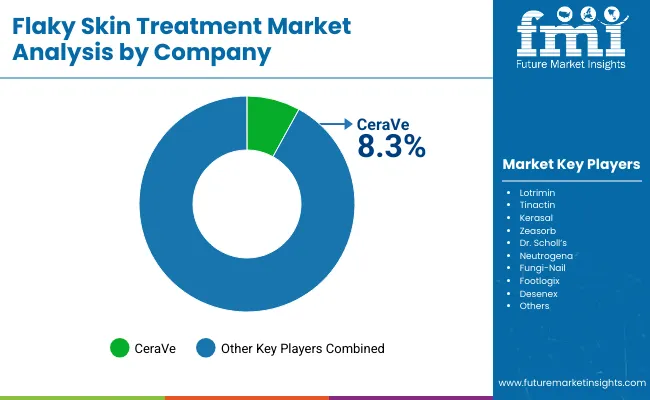

The Flaky Skin Treatment Market is moderately fragmented, with leading multinational dermo-cosmetic brands, established pharmacy-backed players, and natural care specialists competing for share. CeraVe leads the market in 2025 with an 8.3% global share, supported by its ceramide-rich formulations, strong pharmacy presence, and dermatologist endorsements, particularly in the USA and Europe. The brand’s ability to scale across both clinical and consumer segments has been central to its leadership. Other global players such as Aveeno, Cetaphil, Eucerin, La Roche-Posay, Neutrogena, and Bioderma hold significant positions by offering dermatologist-tested and fragrance-free products that dominate pharmacy shelves in North America and Europe. Their strategies increasingly emphasize clean-label claims, digital outreach, and expansion through e-commerce in Asia-Pacific.

Natural skincare specialists including Burt’s Bees and Mustela focus on botanically derived ingredients like shea butter, colloidal oatmeal, and glycerin, appealing to consumers seeking gentle, hypoallergenic solutions for children and babies. These brands are expanding their footprint in Europe and Asia by leveraging trust in "family-safe" products. Paula’s Choice, on the other hand, is gaining traction in premium e-commerce channels with its transparency-driven, ingredient-focused formulations. Competitive differentiation is shifting away from product availability alone toward integrated positioning around safety, dermatologist validation, and sustainability. Companies that successfully balance clinical claims with natural and clean-label positioning are best positioned to capture the dual demand of medical necessity and lifestyle-driven skincare.

Key Developments in Flaky Skin Treatment Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Condition Target | Eczema-related dryness, Psoriasis-related dryness, Seasonal dryness, and General skin flaking |

| Active Ingredient | Ceramides, Colloidal oatmeal, Shea butter, Urea, and Glycerin |

| Product Type | Creams, Balms, Oils, and Ointments |

| Claim | Dermatologist-tested, Fragrance-free, Hypoallergenic, and Clean-label |

| Channel | Pharmacies/drugstores, E-commerce, Mass retail, and Dermatology clinics |

| End User | Adults, Children/babies, and Seniors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aveeno, CeraVe, Cetaphil, Eucerin, Burt’s Bees, La Roche-Posay, Neutrogena, Mustela, Paula’s Choice, and Bioderma |

| Additional Attributes | Dollar sales by product type and channel, adoption trends in eczema- and psoriasis-related care, rising demand for fragrance-free and hypoallergenic treatments, sector-specific growth in adult and pediatric dermatology, clean-label and natural formulation innovation, revenue segmentation by retail pharmacy vs e-commerce, integration of digital health and subscription-based models, regional trends influenced by urbanization and rising skincare awareness, and innovations in ceramide, urea, and colloidal oatmeal formulations. |

The Flaky Skin Treatment Market is estimated to be valued at USD 2,903.4 million in 2025.

The market size for the Flaky Skin Treatment Market is projected to reach USD 6,405.1 million by 2035.

The Flaky Skin Treatment Market is expected to grow at a CAGR of 8.2% between 2025 and 2035.

The key product types in the Flaky Skin Treatment Market are creams, balms, oils, and ointments.

In terms of channel, pharmacies/drugstores are projected to command a 47.7% share in the Flaky Skin Treatment Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA