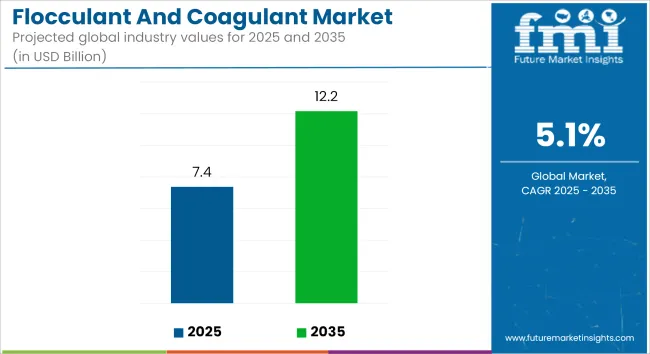

The global flocculant and coagulant market is projected to grow from USD 7.37 Billion to USD 12.16 Billion, advancing at a CAGR of 5.1%. This growth is driven by rising demand for municipal and industrial water treatment, tightening effluent regulations, and increased investment in water infrastructure across both developed and developing economies.

The adoption of advanced sludge minimization methods and a shift toward environmentally compliant chemistries are reshaping procurement strategies in key end-use industries.

Municipalities and sectors such as oil and gas, pulp and paper, and food processing are deploying flocculation and coagulation systems to comply with evolving discharge standards. Regulatory frameworks like the European Union’s Water Framework Directive and the USA EPA’s Clean Water Act are driving the transition from metal-based to low-toxicity or metal-free formulations.

Manufacturers are responding by introducing biodegradable and low-sludge-generating products. Metal-free coagulants and natural flocculants, including chitosan and starch derivatives, are gaining industry acceptance as part of broader efforts to reduce chemical residues in sludge and improve treatment efficiency.

Increased emphasis is being placed on process optimization and digitalization. Smart dosing systems using machine learning and real-time sensors are being integrated into water treatment facilities to enhance chemical dosing accuracy and reduce operational costs.

Technology providers are introducing cloud-based platforms to track influent water quality and automatically adjust coagulant and flocculant dosages. These developments are especially relevant in municipal settings, where cost and compliance pressures are high.

Bio-based formulations are gaining traction as part of circular economy goals. These coagulants and flocculants are designed for compatibility with downstream sludge valorization processes such as composting or land application.

Market participants are also exploring synthetic biology approaches to improve the stability and solubility of naturally derived compounds under fluctuating water conditions.

Challenges persist regarding the disposal of sludge containing residual chemical additives and the management of process efficiency under variable influent loads.

However, the industry is moving toward integrated solutions that combine sustainability, compliance, and performance. Innovations in nanostructured coagulants and electrochemical separation technologies are anticipated to provide further opportunities for performance enhancement and cost savings across multiple applications.

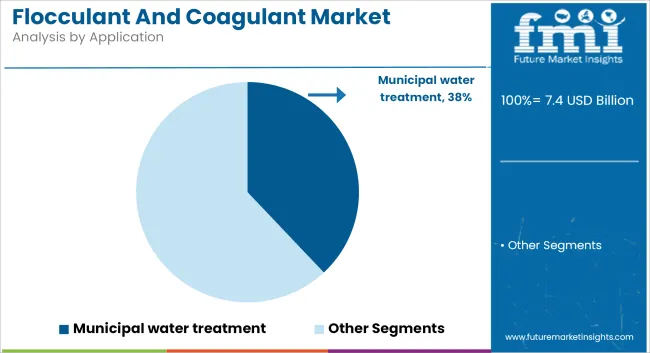

Municipal water treatment is estimated to hold approximately 38% of the global coagulant and flocculant market share in 2025 and is expected to grow at a CAGR of 5.2% through 2035. Coagulants and flocculants are essential for removing suspended solids, organic matter, and pathogens in drinking water and wastewater treatment plants.

As urban populations rise and freshwater resources face contamination, municipal authorities are upgrading treatment systems to comply with stricter environmental and health standards. Governments in regions such as Asia-Pacific, the Middle East, and Sub-Saharan Africa are increasing investments in water quality infrastructure, creating sustained demand for efficient and cost-effective chemical treatment solutions.

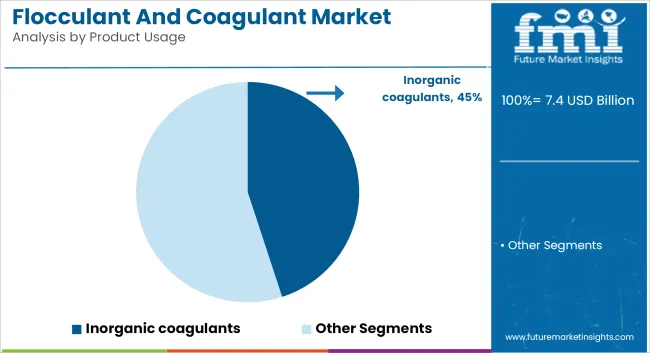

Inorganic coagulants are projected to account for approximately 45% of the global market share in 2025 and are expected to grow at a CAGR of 5.0% through 2035. Common types such as aluminum sulfate, ferric chloride, and polyaluminum chloride (PAC) are widely used across municipal and industrial water treatment facilities for coagulation of fine particles and color removal.

Their effectiveness in a wide pH range and compatibility with high-volume treatment operations make them the preferred choice for large-scale processes.

Despite the growing interest in bio-based and organic alternatives, the established performance of inorganic coagulants ensures their continued dominance in primary treatment stages. Suppliers are focusing on developing low-sludge, high-efficiency formulations to reduce operational costs and environmental impact.

Environmental Regulations and Concerns Over Chemical-Based Water Treatment

The flocculant and coagulant market faces growing regulatory scrutiny due to the potential environmental impact of synthetic chemical agents. Some coagulants, such as aluminium and metal salts, can result in sludge production, a change in the acidity of the water, and environmental harm.

Governments across the globe are tightening the regulations on the use of hazardous coagulants in their countries, where industries are looking for sustainable alternatives. Tight regulations such as the Safe Drinking Water Act (SDWA) in the USA and EU Water Framework Directive, along with strict industrial wastewater discharge standards, are enforcing limits on toxic chemical effluent, further fuelling demand for biodegradable and non-toxic alternatives.

Moreover, coagulation sludge generates disposal costs for municipal and industrial clients are not finding easy to overcome as treatment plants will add equipment to handle the sludge and dewater it. Focusing towards the heavy metal content in a coagulant raises questions of long-term contamination potential for both aquatic environments and groundwater stores.

This leads to focusing on the research for alternatives in formulations to less sludge generation and more efficient water treatment without harming the environmental safety.

Emergence of Green and Bio-Based Coagulation Technologies

Rise of plant-based polymeric flocculants and natural coagulants to protect the environment globally. Water treatment industries are ever-searching for solutions that are non-toxic, which is eco-friendly alternatives including chitosan-based and starch-derived flocculants are gaining traction. Biodegradable reduces not only chemical waste but also minimizes sludge generation, making it suitable as a green alternative for metal salt-based coagulants.

Moreover, advancements in nanotechnology-based coagulants and bio-engineered polymer flocculants are enhancing product capabilities increasing performance while minimizing chemical consumption. Synthetic biology has been adopted by researchers to modify these natural coagulants, in order to make them more effective, stable, and soluble and work better in various water conditions.

AI-driven dosing systems and real-time monitoring technologies being integrated to optimize bio-based coagulant application, drive down costs, and improve overall water treatment efficiency. Rising in need for circular economy solutions and low-carbon footprint water treatment chemicals drive the major growth of bio-based coagulants and will be the scaling factor for the future market growth.

The (North) USA flocculant and coagulant market is witnessing an expansion at a steady rate with the growing demand from municipal water treatment plants is contributing to the market growth in the country. End users are thus following suit with high-performance coagulation & flocculation solutions to meet the environmental regulations set out by the Environmental Protection Agency (EPA)regarding the quality of water discharged, as well as effluent discharged from industries.

The increase of oil & gas operations, particularly in the case of hydraulic fracturing (fracking) methods, is contributing to the growth of demand for produced water treatment. The development of advanced flocculant formulations, specifically designed for solid-liquid separation efficiency, is also boosting the food & beverage and pharmaceuticals and chemical manufacturing sector. In this regard, there is a growing trend towards biodegradable and environmentally friendly coagulants.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

The United Kingdom flocculant and coagulant market is growing at a steady pace, supported by water quality regulations, growing urbanization, and rising demand for sustainable water treatment solutions.

The UK Water Industry Research (UKWIR) and the Environment Agency (EA) have enforced strict discharge limits on industrial effluents and sewage treatment plants, driving the need for effective coagulation and flocculation technologies.

Concern over climate change, and rising water scarcity, is fuelling increased adoption of high-performance water treatment chemicals at desalination and water recycling plants. In addition, the growth of the UK's food & beverage and dairy sectors is creating a demand for coagulants applied for process water purification and wastewater treatment. Increasing use of environmental friendly alternative to aluminum-based coagulants, such as organic polymer-based coagulants, is likely to drive segment growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The European Union flocculant and coagulant market is expanding significantly attributed to stringent water quality standards for various applications, the expansion of the wastewater treatment facilities across various industries, and the investment towards sustainable water management in the EU members.

A European Water Framework Directive (WFD) sets severe discharge limits for pollutants, forcing industries to use high performance coagulants and flocculants to meet demand.

Germany, France, and Italy are among the top countries to adopt bio-based coagulants as EU policies back chemical sustainability and lower environmental impact.

Moreover, the increasing number of urban wastewater treatment projects is driving the demand for flocculants that improve dewatering efficiency of sludge.

Growing demand for flocculants in sectors like mining, paper production, and textile effluent treatment will provide additional impetus to the market growth. In addition, the development of nanotechnology-based coagulants is enhancing contaminant removal efficiency and minimizing the sludge production.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

The Japan flocculant and coagulant market is growing at a steady rate driven by high standards of water treatment, rising industrial wastewater treatment needs, and advancements in chemical formulations. Japan has stringent environmental regulations, which mandate zero liquid discharge (ZLD) in numerous industries, and this trend is driving demand for high-performance coagulants.

Japan’s semiconductor and electronics industry growth has also driven demand for ultra-pure water treatment solutions, which require specific flocculants to remove trace contaminants. Japan’s increasing desalination and water recycling projects are also fuelling acceptance of coagulants in brine treatment and industrial wastewater reuse. Hybrid polymeric flocculants with self-tuning coagulation properties are an emerging technology in smart water treatment applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The growth of the South Korea flocculant and coagulant market can also be attributed to increasing industrialization, growing investment in treating municipal wastewater, and stringent government regulations regarding water pollution control. Korean Ministry of Environment (MoE) imposing stricter guidelines on industrial effluent release to wastewater systems, the demand for advanced Flocculant and Coagulant in the manufacturing and chemical sectors has expanded.

The growth of South Korea’s semiconductor and battery manufacturing industries is also increasing demand for ultra-pure water treatment solutions, which need higher-performing coagulants that are low-residue and have high-purity formulations. Market for Polymer & Organics Coagulant are growing with the increasing infrastructure for water recycling or treatment in urban areas. South Korea, as a leader in smart water treatment systems, has developed real-time flocculation monitoring and AI-optimized coagulants dosing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

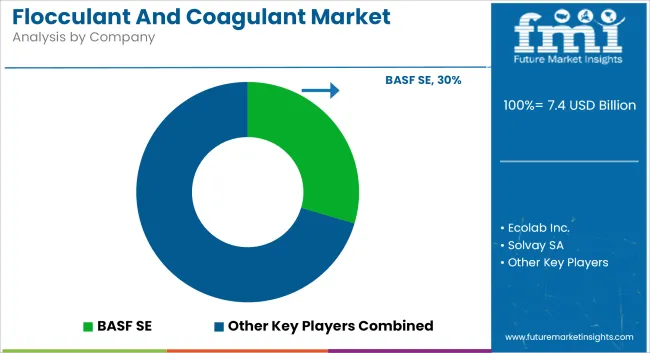

Companies are investing in the development of hybrid organic-inorganic blends, low-sodium variants, and biodegradable flocculants tailored to industry-specific wastewater profiles. BASF and Kemira have focused on scaling bio-based formulations to reduce residual toxicity and sludge volumes. In 2024, SNF expanded production capacity in Asia Pacific to support growing municipal demand. Ecolab is integrating AI-based chemical management platforms into its offering, targeting predictive dosing. Product differentiation in terms of sludge minimization, polymer activity, and compliance with evolving regulatory frameworks is shaping the competitive edge through 2035.

The global Flocculant and Coagulant market is projected to reach USD 7,372.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Flocculant and Coagulant market is expected to reach USD 12,163.3 million.

The industrial water treatment sector is experiencing significant growth, as industries such as chemical processing, oil & gas, food & beverage, and pharmaceuticals seek efficient wastewater treatment solutions to comply with environmental mandates.

Key players in the Road Marking Paints and Coatings market include Feralco Group, Chemtrade Logistics Inc., IXOM Holdings Pty Ltd., Kurita Water Industries Ltd., Aditya Birla Chemicals, Buckinghams Industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA