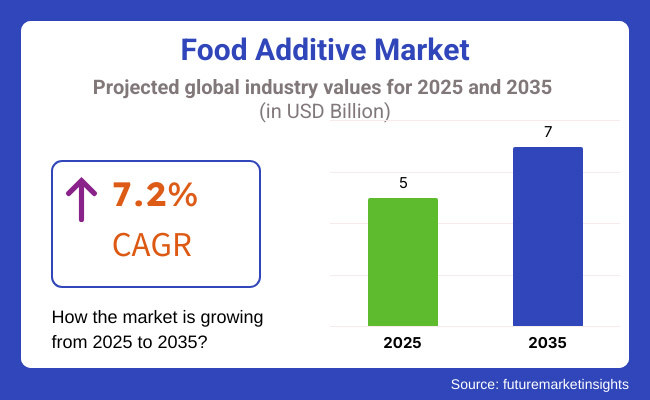

The global food additive market is estimated to be worth USD 5 billion by 2025 and is projected to reach a value of USD 7 billion by 2035, reflecting a CAGR of 7.2% over the assessment period 2025 to 2035.

This anticipated growth is underpinned by a dynamic shift in global food systems where manufacturers are increasingly leveraging multifunctional additives to address consumer expectations for texture enhancement, extended shelf life, and clean-label compliance.

Growing population, evolving dietary preferences, and increasing demand for processed foods continue to serve as central catalysts for the integration of additives across categories such as dairy, bakery, beverages, and confectionery.

Within this context, the dairy industry is expected to remain the dominant end-use sector, accounting for the largest application share in 2025. This segmental leadership is primarily attributed to the intensifying need for emulsifiers, stabilizers, and hydrocolloids that enable desirable textures and stability in products like flavored milk, yogurt, and dairy-based desserts. Notably, hydrocolloids such as carrageenan, guar gum, and pectin are playing an increasingly critical role in clean-label product development without compromising on sensory appeal.

Food safety authorities and regulatory bodies have strengthened oversight and encouraged the use of naturally derived or bio-based additives, which has positively influenced R&D initiatives and innovation pipelines among leading companies.

Stakeholders are actively investing in advanced formulation techniques to reduce dependency on synthetic ingredients while improving functional efficacy, creating opportunities for innovation in enzymes, natural preservatives, and flavor enhancers.

Furthermore, emerging technologies such as microencapsulation and precision fermentation are being explored to enhance the stability, bioavailability, and controlled release of key additive components. These advancements are expected to redefine value propositions and unlock new commercialization channels in both developed and developing economies.

With sustained demand growth across ready-to-eat meals and functional foods, manufacturers are also realigning their strategies to integrate regional ingredient sourcing, vertical partnerships, and cleaner production methodologies.

As of 2025, the market remains moderately fragmented, with multinational corporations consolidating their footprint while niche players leverage formulation agility and region-specific regulatory approvals to capture white space.

The dairy industry application segment is projected to maintain a commanding 54% share of the global food additives market in 2025, advancing at a CAGR of around 6.9% through 2035. This sustained dominance is rooted in the rising functional and formulation demands across both traditional and modern dairy portfolios.

Dairy manufacturers have been increasingly dependent on food additives to meet consumer expectations for textural appeal, stability, and shelf life in value-added formats. In particular, emulsifiers, stabilizers, and hydrocolloids have been positioned as essential formulation tools amid the growing demand for protein-rich, indulgent, and clean-label dairy products.

The expansion of flavored and fortified dairy beverages has further elevated the need for additives that can maintain emulsion integrity, optimize mouthfeel, and withstand cold-chain inconsistencies across global distribution.

As plant-based and hybrid dairy alternatives gain relevance, the technical challenge of mimicking the structural behavior of traditional dairy matrices has reinforced the strategic significance of additives. Leading brands have been recalibrating R&D efforts toward natural or bio-derived alternatives, driven by evolving regulatory scrutiny and consumer aversion to artificial components.

Over the forecast period, dairy processors that embrace additive-enabled innovation-while navigating transparency and sustainability benchmarks-will be positioned to lead in both volume growth and premium product differentiation.

Bakery and confectionery applications are anticipated to grow at a CAGR of approximately 7.4% through 2035, accounting for a notable share of total additive demand by volume. The segment’s expansion reflects evolving formulation complexities aligned with clean-label expectations and the reengineering of legacy recipes to meet functional health trends.

Food additives have become increasingly indispensable in bakery manufacturing as producers respond to rising demand for shelf-stable, soft-textured, and allergen-friendly baked goods. The adoption of dough conditioners, stabilizers, and leavening agents has enabled consistent output despite variability in raw ingredient quality. Concurrently, emulsifiers are being used strategically to maintain moisture retention, reduce staling, and support reduced-fat formulations without sacrificing sensory quality.

In confectionery, where texture and appearance strongly influence consumer purchase, additives continue to serve as critical enablers of visual appeal, shape retention, and gloss control. Moreover, sugar reduction initiatives have accelerated interest in additive systems that can maintain viscosity, mouthfeel, and stability amid formulation shifts.

As bakers and confectioners prioritize health-forward innovation, the need for multifunctional, minimally processed additives is likely to intensify. Market participants capable of providing customizable additive solutions tailored to specific product matrices will gain competitive advantage as functional formulation becomes a key brand differentiator.

Demand for functional food additives is Driving the Market Growth

The growing consumption of foods with high nutritional value is expected to increase demand for functional food additives which in turn is expected to support the growth of the food additives market. Seaweed derivatives for example are used by food and beverage producers to lower sugar levels by replacing fat and stevia-based sweeteners.

Rich in vital nutrients and antioxidants functional food additives reduce the risk of chronic illnesses and stop cell damage among other health benefits. Consequently, the growing demand for processed foods is expected to drive up demand for food additives over the projection period. Consequently, the food additives industrys revenue is driven.

During the period 2020 to 2024, the sales grew at a CAGR of 6.8%, and it is predicted to continue to grow at a CAGR of 7.2% during the forecast period of 2025 to 2035.

One of the primary factors anticipated to propel the market for food additives is the growth of the processed food and convenience industries particularly in developing nations. In a similar vein rising consumer expenditure on packaged foods will probably boost demand for food additives through 2035.

In areas like the Middle East and East Asia there is a noticeable increase in demand for processed foods with longer shelf lives. This is because of rising per capita consumer income and fast urbanization. As a result, food additive sales are expected to rise quickly during the evaluation period because they are now necessary components of these food items.

Tier 1 companies comprises industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 50%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 5.9%, 4.8% and 9.2%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.9% |

| Germany | 4.8% |

| India | 9.2% |

The fast-paced lifestyle in the United States has led to a sharp increase in the demand for processed and convenient foods. Since food additives are frequently used in these products to improve their taste appearance and shelf life this is anticipated to boost sales of food additives.

The food processing sector is well-established in the USA. The introduction of modified products that satisfy the changing needs of consumers is the main focus of many prominent companies in this industry. Their demand is fueled by the various food additives they use for this purpose.

New ingredients and their possible uses are being actively researched by major manufacturers. For example, research is being done on the use of fibers and carbohydrates as food additives to improve texture bulking and sweetening. In the USA food additive market food fortification is becoming a major trend.

Foods with extra health benefits are becoming more and more popular in the country. Food manufacturers are using food additives as a result of this. Consumers growing health concerns are predicted to increase demand for healthy food additives such as low-calorie sweeteners. Similarly, the United States market share for food additives is expected to grow through 2035 as more attention is paid to extending the shelf life of packaged food items.

As lifestyles change and urbanization increases more Indian consumers are gravitating toward quick and simple food solutions. Foods with longer shelf lives better flavors and higher nutritional content appeal to consumers. As a result, the use of food additives will keep growing.

Manufacturers are being prompted by shifting consumer preferences to use a range of conventional or natural additive sources. Furthermore, more natural and functional additives are being used in food products as a result of rising consumer awareness of the value of health and wellness.

Indias food additive market is expected to grow even more as a result of the expanding food and beverage sector and rising disposable income. The use of additives is then encouraged by regulatory actions to guarantee food safety and quality standards.

In terms of food additives Germany is the biggest market in Europe holding about 20% of the regional market by 2025. The robust food processing industry and strong technological capabilities of the nation are responsible for its market leadership manufacturing of food ingredients. German manufacturers focus heavily on research and development particularly in natural and substances with clean labels.

The country’s market is characterized by high-quality standards innovative product development and a strong focus on environmentally friendly production techniques. The existence of significant research institutes and food processing companies enhances Germanys standing in the European market even more.

The market for food additives will continue to grow as a result of major players in the industry making significant investments in R&D to broaden their product lines. In order to increase their market share market players are also engaging in a number of strategic initiatives.

Key market developments include the introduction of new products contracts mergers and acquisitions increased investments and partnerships with other businesses. To grow and thrive in a more competitive and growing market environment the food additives industry needs to provide affordable products.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 7: North America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 19: Europe Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 20: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 21: Europe Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 22: Europe Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 23: Europe Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 24: Europe Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 25: East Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: East Asia Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 28: East Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 29: East Asia Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 30: East Asia Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 31: South Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 32: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 33: South Asia Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 34: South Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 35: South Asia Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 36: South Asia Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 37: Oceania Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 38: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 39: Oceania Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 40: Oceania Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 41: Oceania Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 42: Oceania Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Table 43: Middle East & Africa Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 44: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 45: Middle East & Africa Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 46: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 47: Middle East & Africa Market Value (US$ billion) Forecast by End-use Application, 2019 to 2034

Table 48: Middle East & Africa Market Volume (MT) Forecast by End-use Application, 2019 to 2034

Figure 1: Global Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 3: Global Market Value (US$ billion) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 13: Global Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End-use Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 21: North America Market Value (US$ billion) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 31: North America Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End-use Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ billion) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 49: Latin America Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End-use Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Europe Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 56: Europe Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 57: Europe Market Value (US$ billion) by Country, 2024 to 2034

Figure 58: Europe Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 59: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Europe Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 63: Europe Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Europe Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 67: Europe Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 70: Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Europe Market Attractiveness by End-use Application, 2024 to 2034

Figure 72: Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: East Asia Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 74: East Asia Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 75: East Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 76: East Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 81: East Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: East Asia Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 85: East Asia Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 88: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 89: East Asia Market Attractiveness by End-use Application, 2024 to 2034

Figure 90: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 92: South Asia Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 93: South Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 94: South Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 103: South Asia Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 104: South Asia Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 106: South Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia Market Attractiveness by End-use Application, 2024 to 2034

Figure 108: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 109: Oceania Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 110: Oceania Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 111: Oceania Market Value (US$ billion) by Country, 2024 to 2034

Figure 112: Oceania Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Oceania Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 117: Oceania Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: Oceania Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 121: Oceania Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 122: Oceania Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 124: Oceania Market Attractiveness by Product Type, 2024 to 2034

Figure 125: Oceania Market Attractiveness by End-use Application, 2024 to 2034

Figure 126: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East & Africa Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 128: Middle East & Africa Market Value (US$ billion) by End-use Application, 2024 to 2034

Figure 129: Middle East & Africa Market Value (US$ billion) by Country, 2024 to 2034

Figure 130: Middle East & Africa Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 131: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 132: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East & Africa Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East & Africa Market Value (US$ billion) Analysis by End-use Application, 2019 to 2034

Figure 139: Middle East & Africa Market Volume (MT) Analysis by End-use Application, 2019 to 2034

Figure 140: Middle East & Africa Market Value Share (%) and BPS Analysis by End-use Application, 2024 to 2034

Figure 141: Middle East & Africa Market Y-o-Y Growth (%) Projections by End-use Application, 2024 to 2034

Figure 142: Middle East & Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East & Africa Market Attractiveness by End-use Application, 2024 to 2034

Figure 144: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

The market is expected to grow at a CAGR of 7.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 7 Billion.

Demand for functional Food Additive is increasing demand for Food Additive.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Chr. Hansen Holding A/S, Royal DSM N.V., BASF SE and more.

Explore Functional Food Ingredients Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.