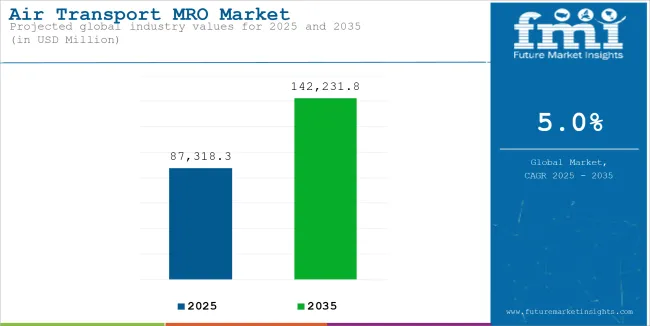

The Air Transport Maintenance, Repair, and Overhaul (MRO) market is set to experience steady growth over the forecast period, driven by the rising global fleet size, increasing aircraft utilization, and the growing need for cost-efficient maintenance solutions. In 2025, the market is projected to be valued at USD 87,318.3 million, and by 2035, it is expected to reach USD 142,231.8 million, growing at a CAGR of 5%.

The progressive rise of commercial aviation, along with the need to comply with the rigorous safety measures, is creating a market for MRO services. Airlines are now very much concentrated on maximizing the aircraft longevity value and at the same time, this mentality is being in turn, a major factor for the investment growth in predictive maintenance technologies and digital MRO solutions.

The implementation of new technologies such as data analytics, AI, and automation, in the maintenance area has reached a new dimension, which further believes MRO effective. Furthermore, the increasing number of low-cost carriers and the growth of air traffic in the developing countries have made the market grow bigger.

Air Transport MRO market is anticipated to flourish in a long-lasting way, owing to the growing fleet of aircraft, the innovations in technology, and the mandated efficiency of the maintenance process. MRO practitioners will be instrumental in this effort and will see to it that the flying machines are safe, reliable, and cost cutting as the aviation branch develops.

The field is projected to change with the prevalent transition to the electronic framework, hoisting the automation, predictive maintenance, and digitalization, which will culminate into the reduction of the unplanned downtimes of the operators and optimization of the performance.

Not only this, but also due to the fact of sustainability being the central objective, maintenance, repair, and overhaul enterprises will be burdened with the task of making a resort to solve the phenomena that pollution problems by introducing environmentally friendly modalities into their maintenance practices.

The use of developing sustainable aviation fuels (SAF) that are sustainable in nature, lightweight airplane components, and maintenance procedures that are more ecological will likely bring about a new style of industry over the next years.

The industry's rules and regulations will not cease to shape, and safety, as well as emissions constraints, will have a strong influence on market dynamics. Elevated compulsory compliance costs will be a driving force for the innovation of tools in maintenance due to stringent safety and emissions standards.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 87,318.3 million |

| Industry Value (2035F) | USD 142,231.8 million |

| CAGR (2025 to 2035) | 5% |

The Air Transport MRO market's future outlook is optimistic, that's for sure. This is typified by a strong priority on efficiency, sustainability, and technological progress that is most evident throughout the sector.

As the global demand for airline travel picks up and airlines look for the cheapest means of maintaining their fleets the MRO providers that will put their money on technology, environmental conservation, and educating their workforce will have the upper hand. In the next decade, the aircraft industry will face a shift in maintenance that will lead to a digitized, smarter, and more sustainable aviation sector.

North America continues to be a central location for the Maintenance, Repair, and Overhaul (MRO) market due to the presence of many major airlines, aircraft manufacturers, and global MRO service providers.

With the USA leading the region, the country is pouring money into next-generation maintenance technologies, encompassing predictive maintenance, AI-driven diagnostics, and digital twin simulations thereby, increasing the efficiency and reducing the downtime of aircraft.

The Federal Aviation Administration (FAA) imposes strict safety measures, thereby securing a high-quality standard of maintenance across the industry. Moreover, the increasing acceptance of autonomous maintenance systems which track and efficiently deliver aircraft parts are speeding up the servicing of aircraft.

The growth of low-cost carriers (LCCs) and the post-covid cases of increased air travel are in turn driving the demand for efficient and cost-effective MRO services. North America is also boosting its green projects by investing in maintenance solutions that are environmentally friendly and aircraft retrofits that are fuel-efficient.

Europe’s MRO is a market that is constantly being influenced by the fact that most of the machines are old with environmental problems and a lot of companies are trying to be more environmental friendly. For example, Germany, France, and the UK are very much affixed on airplanes repair and maintenance technologies to their maximum utility first requirements of time and reduction in carbon footprints.

The European Union Aviation Safety Agency (EASA) has put forth severe guidelines concerning the environment and maintenance that push MRO companies to apply fuel-efficient retrofitting and new sustainable aviation technologies.

Use of digital for maintenance of aircraft, such as AI-based fault detection and paperless maintenance logs becoming more prevalent. Furthermore, the European airline industry is switching over to hybrid-electric aircraft and lightweight materials which will be needed special maintenance services.

The prospect of European MRO becoming a leading player in the field is primarily driven by innovation in sustainable MRO facilities and strategy of the airlines partnerships with the maintenance companies that operate in a sustainable way.

Asia-Pacific has been seeing a very rapid rise in the MRO market, which has been spurred by the increase in air travel, the delivery of aircraft, and the expansion of airline operations. The likes of China, India, and Singapore are grasping such opportunities to establish global MRO hubs through monumental investments in maintenance facilities and the latest cutting-edge repair technologies.

The region's fast-growing aviation sector, fueled by low-cost carriers (LCCs) and rising middle-class travelers, is driving high demand for aircraft maintenance services. Singapore always being the forerunner in aerospace technology is becoming a premier MRO service hub while China and India are planning to construct their own maintenance structures with the goal of decreasing their dependencies on foreign MRO sources.

Also, adding aviation infrastructure development goes along with government initiatives like tax incentives and the promotion of the MRO industry to become more robust.

The MRO market in the Middle East, Latin America, and Africa, is slowly growing due to increased airline operations, investments in infrastructure, and global MRO providers' partnerships. The middle east is so far managing to get itself together as it is transforming into a well-known aviation center where UAE and Saudi Arabia have awarded contracts for state-of-the-art MRO facilities that would serve their increasing fleets of airlines.

Dubai and Abu Dhabi are the main MRO service hubs that both regional and international carriers are using. In Latin America, the modernization of the fleet and the increase in air traffic are two factors contributing to the need for low-cost maintenance services.

On the other hand, Africa's booming aviation sector is profiting from governmental efforts to create local MRO facilities, which will decrease the dependency on external providers of maintenance services. The air traffic along these routes is bound to trigger the development of these two facilities by way of the joint-venture agreements.

High Costs and Complexity of Aircraft Maintenance

Specific challenges the Air Transport MRO market deals with are the high maintenance costs and operational complexity. Aircraft maintenance is a complicated process that includes labor-intensive inspections, costly spare parts, and strict adherence to aviation safety regulations among others, which greatly add to MRO expenses.

Maintenance is one of the most significant expenditures for airlines, consuming up to 15 percent of their total operation costs, thus, the cost optimization challenge is a priority for them. Migrating from coe1360 the use of aluminum to advanced polymer composites and digital electrical systems now also implies the need for more complex, specific maintenance, further resulting in extra costs.

Moreover, the global offering of certified MRO technicians being short poses a difficulty as it translates into longer periods for fixing the asset. Airlines, in a bid to cure these problems, have been patronizing predictive maintenance technology, automation, and outsourcing in a strategic way thus enhancing their performance and diminishing all without compromising onboard safety.

Supply Chain Disruptions Impacting Spare Parts Availability

The aircraft spare parts and components availability have been significantly affected by the global supply chain crisis leading to delays in maintenance operations. In recent times, the whole MRO supply chains suffered from disruptions after the COVID-19 pandemic, geopolitical tensions, and raw material shortages, thus, making it a very tough task for the airlines to acquire necessary components such as engines, avionics, and landing gear.

The long lead times which can add material costs and eventually ground aircraft for a longer period of time, affect fleet usage and the company profits have been some of the main concerns of the airline industry.

Strategies like inventory optimization, localized manufacturing, and strategic supplier partnerships are some of the means the industry is looking to mitigate risk factors that come from the disruption of supply chains.

Growth is also being seen in the airline sector due to the use of 3D printing and digital inventory management systems, which are streamlining parts procurement and reducing the dependency on traditional supply channels.

Growing Demand for Predictive and AI-Driven Maintenance

The growth of predictive maintenance and AI-based analytics is the basic factor for the transformation of the Air Transport MRO market. Airline companies and MRO service providers have been using big data, IoT sensors, and AIobothob algorithm combinations in the real-time monitoring of aircraft health and predicting potential failures before they occur.

This full data approach provides opportunities for better maintenance planning, less time for unpredicted downtime, and better reliability for aircraft. For example, mainstream airlines like Delta and Lufthansa have invested in predictive analytics platforms, which have led to cost savings and increased operational effectiveness.

The increase in the digital technology of twins and MRO cloud management systems is the next stage of the optimization of maintenance workflows. As the aviation industry actively introduces automation and smart maintenance solutions, the use of predictive MRO technologies globally is expected to change the way people work on aircraft.

Expansion of Low-Cost Carriers and Fleet Modernization

The quick increase of low-cost carriers (LCCs) and fleet modernization programs is the main driver for the MRO sector's growth. LCCs are expanding their fleets to meet the ever-increasing demand for air travel especially in Asia-Pacific, Latin America, and the Middle East and this would consequently result in a bigger market for sound maintenance solutions.

Besides, airlines are upgrading fleets by acquiring fuel-efficient new planes such as the Boeing 737 MAX and Airbus A320neo, which in turn adds to the demand for specialized MRO services. Another aspect, green issues and the drive for lower carbon emissions, when taken into consideration, but also push ahead the funding of projects such as adding new technology engines or using lightweight materials in retrofitting existing aircraft.

As the fleets of airlines continue to grow and change, MRO companies will have a bright prospect in providing customized maintenance plans and upgrading services with advanced technology.

The MRO sector in Air Transport has been consistently transforming due to the wave of changing air travel demand patterns, new technological arrivals, and regulatory revisions ranging from 2020 to 2024. The COVID-19 pandemic resulted in an initial downtrodden path for MRO services; however, the later a recovery led to an increase in investments to digital solutions, predictive maintenance, and automation.

Airlines concentrated on cut bonus and on renew their fleet with innovative equipment, which resulted in the huge demand for new models maintenance tools soaring.

Forecasting the years between 2025 and 2035, the market will be led by the advancements of the aviation industry in terms of sustainability, the implementation of AI and the use of new materials by aircraft maintenance. This new approach to predictive analytics and block chain-based maintenance tracking will contribute to higher operational efficiency.

In addition, the conventional and hybrid power flyers brought into operation the need for new and maintenance, consequently the MRO industry will be influenced.

The Air Transport MRO market is on a course that speeds up, influenced by technological advances and sustainability strategy fulfillment. For the upcoming decade, the digitalization and AI-boosted systems will take over the maintenance processes, while the new regulatory framework will steer the industry to greener and more efficient management. As air travel grows, the MRO will benefit from the expand and continue. It will create spaces for innovation power and market growth.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter safety regulations, pandemic-related restrictions. |

| Technological Advancements | Adoption of digital twins, predictive maintenance, and automation. |

| Industry-Specific Demand | Recovery-driven demand, cost-cutting measures, fleet upgrades. |

| Sustainability & Circular Economy | Initial steps towards greener MRO practices, reduced carbon footprint. |

| Production & Supply Chain | Disruptions due to global crises, adaptation to digitalized supply chains. |

| Market Growth Drivers | Post-pandemic recovery, fleet expansion, digital transformation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Emphasis on sustainable aviation, AI-driven compliance monitoring. |

| Technological Advancements | Expansion of AI, block chain for MRO tracking, and advanced composite materials. |

| Industry-Specific Demand | Increased electric and hybrid aircraft maintenance needs, sustainable aviation fuel (SAF) adoption. |

| Sustainability & Circular Economy | Full-scale implementation of eco-friendly maintenance processes and circular economy integration. |

| Production & Supply Chain | AI-driven supply chain management, localized repair hubs for enhanced efficiency. |

| Market Growth Drivers | Rising air traffic, technological advancements, sustainability initiatives. |

The continuous development of the MRO market in the United States is largely attributed to the commercial aviation sector, which is the largest in the world, the increasing size of the aircraft fleet, and compliance with strict regulatory directives.

The Federal Aviation Administration (FAA) orders regular inspections of aircraft and necessary repairs which, in turn, are the reason for the ongoing demand for MRO services. Besides, the innovative new-generation planes, the technological strides made in the area of predictive maintenance, and digital transformation became a focus were the main drivers of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The accomplishments of the UK's MRO market can be attributed to its vibrant aviation sector, which is solidly backed by the government's initiatives aimed at boosting the sustainability of air travel and the regularity of changes in aircraft fleets.

The strategic positional advantage, coupled with the existing MRO centers in the Heathrow and Manchester airports, enhances the effectiveness of the local market, both servicing domestic and international airlines. These centers not only facilitate efficient processes, but they are also active contributors to the global aviation network.

Moreover, the focus on sustainability and the introduction of innovative practices, as well as the digital technologies such as predictive maintenance and real-time monitoring, are not only enhancing innovation but are also bringing down costs in the market. Hence, these developments present the UK as a trailblazer in the MRO industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

MRO sector in the European Union area is extensively supported by solid regulations in aviation and the rise of aircraft leasing. Aviation industry operators in the EU made MRO services a must because one of the main regulators in the region, the European Union Aviation Safety Agency (EASA), implemented the rules of the security and the maintenance which are compulsory for all airlines.

Such preventive measures ensure both high safety degrees and reliance on MRO service. In addition, there is an upward trend in the use of smart maintenance like predictive analytics and digital tools, thus operational efficiency will be even more.

Discussions about sustainability are plentiful, yet it is the development of energy-saving MRO technologies that brings real results. This move towards MRO's sustainability backs up the overall EU objectives for cleaner environmental aviation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

The MRO market in Japan grows prosperously owing to sophisticated technology utilization, high safety standards, and increased airline activities. Japan is globally recognized for its high susceptance to detail hence as an aircraft maintenance servicing center is now available.

The country has a well-respected image internationally as the MRO service provider that guarantees aircraft full-scale repair success. The standout issue at hand is the transition from manual to robotic and automated MRO solutions, which provide the maintenance processes with increased speed and lower human error. These novel solutions allow for cost, and safety improvements in the technology area which thus render Japan a vital player in aircraft industry MRO globally.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The MRO market in South Korea is expanding rapidly in line with the country's burgeoning aerospace sector, the rise of airline operations, and government-backed initiatives supporting aviation. The nation's strong commitment to technological development in aerospace industry and regulatory effectiveness is what makes it an appealing site for MROs.

Major investment in MRO base development is carried out to fit service abilities, and on the other hand, the digital solution which track the maintenance status via predictive maintenance and real-time monitoring is the most recognized ones. The introduction of these progresses facilitates managerial efficiency and, jointly with the above, positions South Korea as one of the main countries in the MRO industry both regionally and globally.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Air Transport Maintenance, Repair, and Overhaul (MRO) market is one of the most essential markets in the aviation sector that maintains the airworthiness and operational efficiency of airplanes. It is counted among the sectors and domains with a high-over potential gear to is including increase the global air traffic, the increasing number of aircrafts that year's fleet and more stringent safety regulations.

Airlines, third-party service providers, and original equipment manufacturers (OEMs) battle it out to deliver the most reasonable prices and the best technical innovations in MRO services.

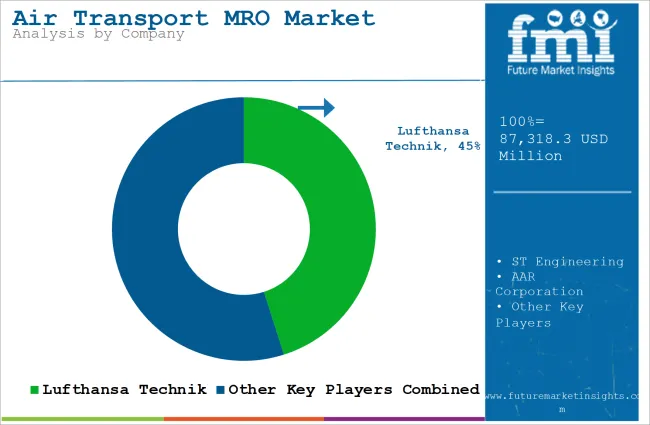

Some major market players include Lufthansa Technik, ST Engineering, AAR Corporation, Airbus, and Boeing Global Services, to name a few. The sector sees the occurrence of various phenomena like the introduction of digital equipment, predictive maintenance, and the acquisition of complex composite repair technologies all of which strive to benefit service quality and aircraft lifecycle management.

The transpiration outcry MRO market is likely to maintain the constant increase of the sector as airlines have been forever in a pursuit of maintaining repairs in a more economical way while achieving the top safety and operability requisites. The companies that are to be more likely the winners in this respect, who will use technologies such as automation, diagnostics, which are driven by AI, and implement sustainable MRO processes.

With innovations in diagnostic technologies, MRO practices are changing significantly. The leading prominent players such as Lufthansa Technik, ST Engineering, and AAR Corporation continue their stronghold. With the rise of new entrants who focus on specialized and economical MRO services.

Market predictions confirm further development is achievable through factors of the global air travel increase and the aircraft fleets age out. The investments in machines, real-time monitoring, and environmental-friendly solutions in the maintenance sector would be the primary keys for favorable competition in the rising industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lufthansa Technik | 10-14% |

| ST Engineering | 8-12% |

| AAR Corporation | 7-10% |

| Airbus MRO Services | 6-9% |

| Boeing Global Services | 5-8% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lufthansa Technik | Global leader in aircraft maintenance, engine repair, and component overhaul. Focuses on digital MRO solutions. |

| ST Engineering | Specializes in heavy maintenance, engine services, and aircraft modifications, with a strong presence in Asia. |

| AAR Corporation | Provides cost-effective third-party MRO services, including inventory management and component repair. |

| Airbus MRO Services | Offers tailored maintenance solutions and advanced analytics for Airbus aircraft operators. |

| Boeing Global Services | Focuses on OEM-backed maintenance solutions, spare parts logistics, and predictive maintenance. |

Key Company Insights

Lufthansa Technik

Lufthansa Technik is a global powerhouse in the aircraft maintenance, engine repair, and component overhaul. The organization has made large scale investments in the digital MRO solutions as they include things like predictive analytics and the use of AI-driven diagnostics.

Lufthansa Technik has aligned its capabilities with the new reality of maintenance by focusing on sustainable aircraft operations, therefore, zero-fuel, entire life cycle cost-optimized/deconstructed engine repairs and lightweight materials. The business stands out with its extensive global network of maintenance facilities and is a trustworthy partner for both private operators and commercial airlines.

ST Engineering

ST Engineering has cut a niche in the hard maintenance, aircraft modifications, and engine servicing areas. The firm has an extensive presence in the Asia-Pacific region and acts as a primary partner for a wide range of carriers both locally and internationally.

Known for its ability to convert passenger aircrafts to freighters (P2F) and repair components, this company decided to take a step further in sustainable MRO practices, thus focusing on carbon reduction technologies, and enhanced fuel efficiency.

AAR Corporation

AAR Corporation is a leading independent MRO player, providing airlines and cargo operators with affordable maintenance options thus becoming an integral partner to them. The firm offers services mainly in the field of inventory management, component repair, and third-party logistics.

AAR Corporation has tied up with several airlines to offer integrated fleet support services, which in turn have led them to improve turnaround times while at the same time reduce operating costs. With more and more activities being outsourced to MRO firms, AAR is in a constant expansion investment cycle.

Airbus MRO Services

Being a division of the Airbus ecosystem, Airbus MRO Services offers OEM-backed maintenance and modification services for its aircraft range. The company is applying the big data analysis and AI forecasting tools to make predictive maintenance skills better.

Besides that, it is taking care of new-generation planes' upkeep efficiency-wise, for instance, with A350 and A320neo aircraft, which are known for their fuel-efficient operation. The company's user-centric approach and its peculiarity of having access to sole aircraft data hinge it in an advantage.

Boeing Global Services

Boeing Global Services is a supplier of various maintenance, engineering, and logistics solutions to commercial operators all over the world. The company has a dedicated smart maintenance technology platform that utilizes real-time digital twin models and aircraft health information to improve its logistics.

The Boeing has also made strong efforts in the repairing and maintenance equipment fields, which include the establishment of a connection with the global spare parts network, so that customers can get their orders much quicker. In recent times, the topics of sustainability and automation have drawn more focus so the Boeing Global Services remains a ferocious opponent in MRO sector.

In terms of Application Type: the industry is divided into Airframe, Engine, Component, Line

In terms of Aircraft Type: the industry is divided into Narrow Body Aircraft, Wide-Body Aircraft, Regional Jet, Turbo Prop

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Air Transport MRO Market is projected to reach USD 87,318.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5% over the assessment period.

By 2035, the Air Transport MRO Market is expected to reach USD 142,231.8 million.

The Engine segment lies expected to hold a significant share due to increasing urbanization, driving the Air Transport MRO Market.

Major companies operating in the Air Transport MRO Market Lufthansa Technik, ST Engineering AAR Corporation, Airbus MRO Services, Boeing Global Services.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 13: Global Market Attractiveness by Application Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 28: North America Market Attractiveness by Application Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Application Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 58: Europe Market Attractiveness by Application Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Application Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Application Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Application Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 118: MEA Market Attractiveness by Application Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA