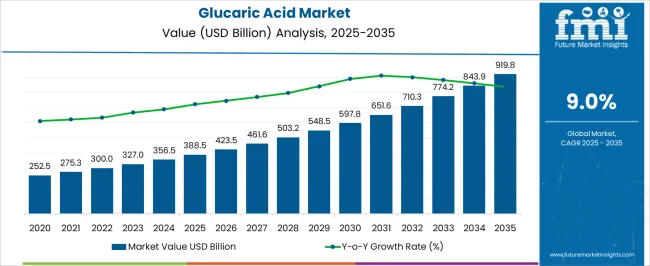

The glucaric acid market will rise from USD 388.5 million in 2025 to USD 919.8 million by 2035, driven by eco-friendly detergents, corrosion control, and polymer uses. Between 2030 and 2034, the market rises from USD 461.6 million to USD 710.3 million, adding USD 248.7 million in value, supported by technological advancements in oxidation processes, improved yields in production, and expansion into high-value sectors like pharmaceuticals and water treatment.

Partnerships between chemical manufacturers and biotechnology firms also accelerate commercialization. The glucaric acid market is positioned for robust growth, driven by environmental compliance, innovation in bio-based chemistry, and expanding applications across multiple industrial sectors.

| Metric | Value |

|---|---|

| Glucaric Acid Market Estimated Value in (2025 E) | USD 388.5 billion |

| Glucaric Acid Market Forecast Value in (2035 F) | USD 919.8 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The glucaric acid market is experiencing progressive growth, supported by increasing regulatory pressure to phase out environmentally harmful chemicals and a rising shift toward bio-based ingredients. The market is being shaped by advancements in green chemistry and fermentation technologies that have enabled cost-effective, scalable production of glucaric acid and its derivatives.

Demand is further accelerated by the growing consumer and industrial preference for sustainable cleaning agents, corrosion inhibitors, and biodegradable additives. Policy shifts aimed at reducing phosphates and other non-biodegradable substances in cleaning products are creating favorable conditions for glucaric acid adoption across multiple applications.

Additionally, expanding R&D investments into functional bio-chemicals and rising public-private collaboration in biomanufacturing ecosystems are reinforcing market confidence. Going forward, opportunities are expected to emerge from performance optimization in downstream formulations and integration of glucaric acid into high-value industrial cleaning and food protection processes.

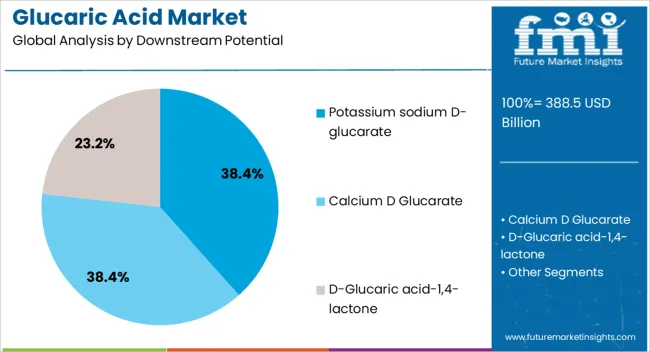

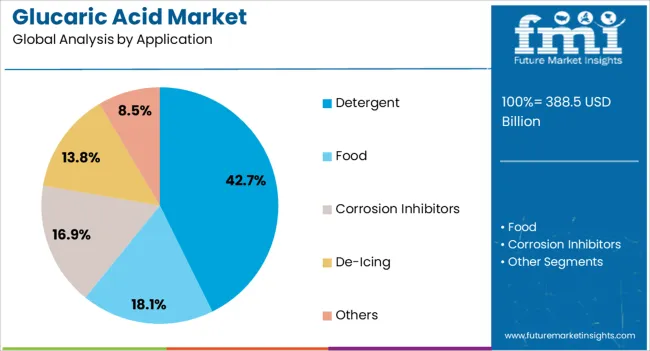

The glucaric acid market is segmented by downstream potential, application, and region. By downstream potential, the market is divided into potassium sodium D-glucarate, calcium D-glucarate, and D-glucaric acid-1,4-lactone. In terms of application, it is classified into detergents, food, corrosion inhibitors, de-icing, and others. Regionally, the glucaric acid industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Potassium sodium D-glucarate is projected to account for 38.40% of the glucaric acid market revenue in 2025, positioning it as the leading downstream product. This growth is being driven by the compound’s multifunctional properties, including its ability to bind toxins and support detoxification, which has expanded its usage in both nutraceuticals and cleaning formulations.

Its water-soluble nature and stability in alkaline environments make it ideal for applications requiring consistent performance across diverse pH conditions. As regulatory and consumer scrutiny over synthetic additives intensifies, potassium sodium D-glucarate has gained acceptance as a bio-based, non-toxic alternative.

Increasing application in industrial cleaners and corrosion inhibitors has further contributed to its segmental lead. Additionally, manufacturing improvements have enhanced yield efficiency, making the product commercially viable for broader-scale applications across industrial, environmental, and consumer sectors.

Detergent applications are expected to represent 42.70% of total market revenue in 2025, making it the dominant application area for glucaric acid. This leadership stems from the growing need for eco-friendly and phosphate-free cleaning agents, particularly in household and institutional cleaning products. Glucaric acid and its salts have demonstrated high chelation efficiency, scale removal, and pH stability—key requirements for effective detergent performance.

Regulatory restrictions on phosphates in developed regions have further created a market pull for safe, biodegradable alternatives. Glucaric acid’s ability to enhance surfactant efficiency and reduce mineral buildup without harming wastewater treatment systems has accelerated its adoption.

Manufacturers are also integrating it into concentrated and low-water formulations, aligned with sustainability goals. With increasing environmental compliance mandates and a global push toward greener chemistry, the detergent segment is poised to remain the most commercially attractive application area.

Glucaric acid adoption is growing across cleaning, corrosion control, polymers, and food-pharma sectors. Strong compliance, biodegradability, and versatile performance underpin its expanding role in industrial and consumer markets.

The adoption of glucaric acid in detergents and cleaners is rising due to its performance as a phosphate-free chelating agent, offering strong mineral-binding capabilities in hard water conditions. Manufacturers in home care and industrial cleaning segments value its biodegradability and safety profile, enabling compliance with regional chemical regulations. Its integration in laundry detergents, dishwashing formulations, and surface cleaners enhances cleaning efficiency while supporting low-phosphate and eco-friendly product portfolios. Industrial-scale availability of glucaric acid has improved as production technologies advance, lowering costs and enabling wider market penetration. This segment benefits from a growing preference for effective, non-toxic ingredients in everyday cleaning products across residential, commercial, and institutional applications.

Glucaric acid has gained traction as a biodegradable corrosion inhibitor in industrial and automotive sectors, offering metal protection without the environmental drawbacks of traditional inhibitors. It performs effectively in water treatment systems, heat exchangers, and closed-loop cooling systems where corrosion control is critical for operational longevity. Its compatibility with various metals and minimal environmental persistence make it attractive for compliance-conscious industries. The product is often used in combination with other organic acids to enhance performance, especially in mixed-metal systems. Demand is supported by regulatory restrictions on toxic corrosion inhibitors, prompting manufacturers to seek alternatives that provide equal or better results while meeting performance and environmental safety standards.

Glucaric acid and its derivatives are increasingly utilized in specialty polymer production, particularly in the development of recyclable and high-performance materials. Glucarate-based monomers contribute to the manufacturing of polyesters and nylons with enhanced mechanical strength, thermal resistance, and chemical durability. These materials are finding applications in automotive components, packaging films, and consumer goods where long service life and end-of-life recyclability are valued. The integration of glucaric acid into polymer supply chains has been supported by consistent product quality and compatibility with existing manufacturing infrastructure. This growth is reinforced by rising demand for advanced materials that meet both performance specifications and regulatory compliance criteria in global markets.

The food and pharmaceutical sectors are exploring glucaric acid for its functional benefits, including its role as a dietary supplement, additive, and pH regulator. In food processing, it offers stability in formulations and serves as an additive in beverages, dairy products, and fortified foods. In pharmaceuticals, research is underway into its potential health benefits, such as detoxification support and metabolic regulation. Its recognition as a Generally Recognized as Safe (GRAS) substance in some regions has encouraged further adoption. Product differentiation in these sectors is enhanced by glucaric acid’s clean-label appeal and compatibility with consumer trends toward natural, plant-based ingredients that maintain efficacy and safety across applications.

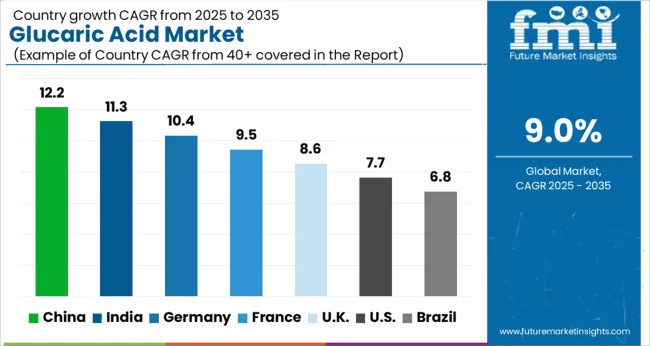

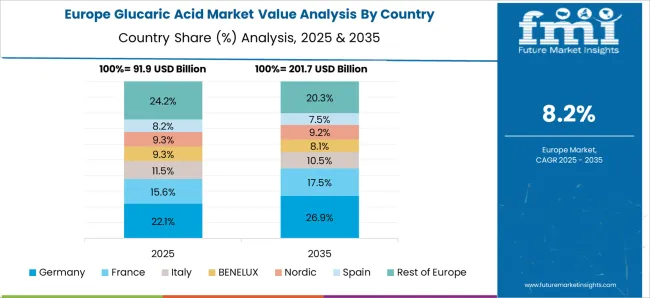

The glucaric acid market is projected to expand globally at a CAGR of 9.0% from 2025 to 2035, driven by rising adoption in detergents, corrosion inhibitors, specialty polymers, and food-pharma applications. China leads with a CAGR of 12.2%, supported by large-scale chemical manufacturing capacity, strong demand from industrial cleaning products, and increased use in polymer-grade monomer production. India follows at 11.3%, benefiting from expanding detergent manufacturing, water treatment infrastructure, and integration into biodegradable corrosion control solutions. France records 9.5%, aided by specialty chemical applications in coatings, sealants, and food-grade formulations.

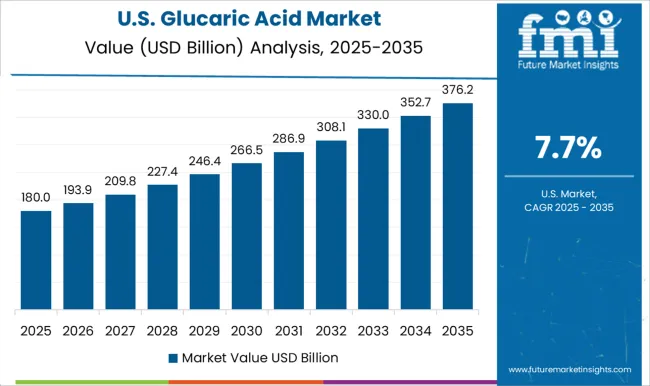

The United Kingdom grows at 8.6%, supported by industrial cleaning and corrosion control needs, while the United States reaches 7.7%, with steady demand from PU foams, lubricants, and fortified food products. This performance profile highlights Asia-Pacific as the principal growth hub due to capacity scale and end-use diversity, while Europe and North America represent important markets for compliance-driven, high-performance applications of glucaric acid.

China is projected to record a CAGR of 12.2% during 2025–2035, clearly above the global 9.0% path as large detergent, water treatment, and polymer plants keep scaling orders for high-purity grades. During 2020–2024, growth was estimated near 10.8%, supported by early adoption in phosphate-free cleaners and corrosion inhibitor packages for industrial systems. The faster slope into 2025–2035 is expected from higher-capacity catalytic oxidation units, tighter cleaning standards across municipalities, and expanding use of glucarate-based monomers in recyclable polyesters. E-commerce fulfillment hubs and food processors are likely to widen consumption through hygiene programs and packaging materials. China’s blend of volume scale and application breadth will continue to outpace peers as procurement teams prioritize stable quality and dependable supply chains.

India is forecasted to deliver a 2025–2035 CAGR of 11.3%, propelled by detergent plants, institutional cleaning suppliers, and corrosion control in expanding industrial corridors. Between 2020–2024, CAGR is gauged around 9.9%, driven by phosphate curbs in cleaning products and rising closed-loop cooling maintenance. The acceleration stems from improved domestic glucose feedstock logistics, contract manufacturing for specialty grades, and wider qualification by beverage, dairy, and food processors seeking dependable chelation. Water treatment contractors are integrating glucaric acid into blended inhibitors for multi-metal systems, improving lifecycle costs. I expect India to keep a growth premium as formulators capture value from dosage efficiency, stable sourcing, and targeted application support from suppliers.

France is anticipated to post a 9.5% CAGR for 2025–2035 as specialty formulators in coatings, sealants, and cleaners emphasize performance with safer profiles. For 2020–2024, momentum sat near 8.2%, enabled by early movement to phosphate-free laundry and warewashing products and pilot use in corrosion control for HVAC assets. The step-up reflects tighter standards in institutional hygiene, deeper penetration into polymer chains for recyclable materials, and consistent collaboration between producers and OEMs to tune purity and particle size for processing stability. Food-grade applications contribute incremental demand through acidity regulation and stabilization functions. In my assessment, France will monetize quality and compliance, yielding steady compound gains above many mature peers.

The UK is expected to achieve an 8.6% CAGR during 2025–2035, close to but below the 9.0% global line, as demand consolidates in industrial cleaning, water treatment, and corrosion inhibitor packages for district energy and commercial real estate. The 2020–2024 CAGR is calculated at about 6.9%, inferred from slower post-pandemic industrial throughput, logistics frictions, and limited early capacity for high-purity grades. The rise from 6.9% to 8.6% is explained by normalized supply chains, improved catalytic yields that lower cost per active, and expanded approvals in facilities management contracts across healthcare and education. My view is that procurement discipline, private-label home care expansion, and OEM-backed trials in polymer modifiers now support a firmer growth runway.

The USA is projected to grow at 7.7% for 2025–2035 as municipal and industrial buyers standardize phosphate-free cleaners, water treatment blends, and corrosion control for mixed-metal assets. During 2020–2024, CAGR is assessed near 6.6%, supported by institutional cleaning upgrades and selective polymer trials. The modest acceleration is tied to wider distributor education, competitive pricing from scaled glucose oxidation, and stronger validation in beverage plants, food processors, and data center cooling loops. Specialty polymers should add incremental volume through glucarate-based monomers where recyclability and thermal profile matter. My judgment is that the USA will show steady, quality-led adoption with emphasis on verified efficacy and predictable total cost of ownership.

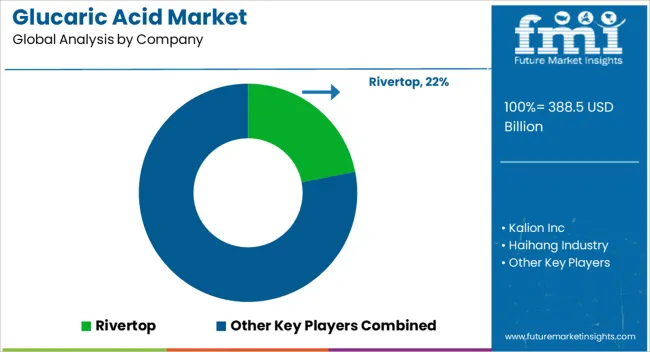

The glucaric acid market features a mix of specialized biochemical innovators and established fine chemical manufacturers such as Rivertop, Kalion Inc, Haihang Industry, Alfa Chemistry, Cayman Chemical. Rivertop holds a notable position with its proprietary oxidation technologies, supplying high-purity glucaric acid for applications in detergents, water treatment, and corrosion inhibition. Kalion Inc focuses on bio-based chemical production through advanced microbial fermentation, catering to specialty polymers and high-value industrial formulations.

Haihang Industry leverages its extensive chemical distribution network in Asia, ensuring steady supply to domestic and export markets for cleaning and industrial applications. Alfa Chemistry positions itself as a research-oriented supplier, offering glucaric acid and derivatives in small to bulk volumes for R&D and specialty applications. Cayman Chemical provides analytical-grade glucaric acid to the pharmaceutical and life sciences sectors, reinforcing its expertise in biochemical standards and specialty reagents.

The competitive dynamics are shaped by innovation in bio-based production methods, expansion into high-purity specialty grades, and strategic partnerships to enhance distribution channels. These companies prioritize consistency in product quality, regulatory compliance, and application-driven development to strengthen their foothold across detergents, polymers, water treatment, and life sciences markets.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Downstream Potential | Potassium sodium D-glucarate, Calcium D Glucarate, and D-Glucaric acid-1,4-lactone |

| Application | Detergent, Food, Corrosion Inhibitors, De-Icing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rivertop, Kalion Inc, Haihang Industry, Alfa Chemistry, Cayman Chemical, and Rennovia |

| Additional Attributes | Dollar sales, share, regional growth trends, competitive landscape, end-use sector demand, pricing analysis, raw material cost trends, regulatory impact, capacity expansions, trade flow data, product innovation pipeline, distribution strategy insights. |

The global glucaric acid market is estimated to be valued at USD 388.5 billion in 2025.

The market size for the glucaric acid market is projected to reach USD 919.8 billion by 2035.

The glucaric acid market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in glucaric acid market are potassium sodium d-glucarate, calcium d glucarate and d-glucaric acid-1,4-lactone.

In terms of application, detergent segment to command 42.7% share in the glucaric acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Humic Acid Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA