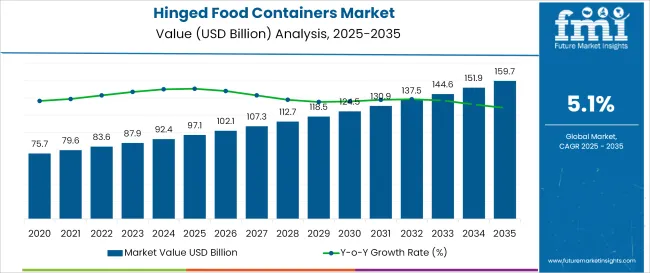

The global hinge food container market is valued at USD 97.1 billion in 2025 and is expected to reach USD 159.7 billion by 2035, registering a CAGR of 5.1%. Growth is primarily driven by the rising demand for convenient, cost-effective, and sustainable food packaging solutions across quick-service restaurants (QSRs), cloud kitchens, and retail food chains.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 97.1 billion |

| Market Value (2035F) | USD 159.7 billion |

| CAGR (2025 to 2035) | 5.1% |

The surge in e-commerce-driven food delivery, demand for tamper-evident and resealable packaging, and eco-conscious consumer behavior are key factors boosting market adoption.

The hinge food container market accounts for approximately 6.5% of the total rigid plastic packaging industry, with a substantial share in takeaway food services (8.1%), institutional catering (4.9%), and retail-ready packaging (3.7%). In bakery and deli packaging, it contributes around 7.3%, highlighting its importance in display-ready convenience formats. Applications in frozen and chilled food are increasing rapidly, with a 5.6% to 6.5% market share, due to the need for durable, leak-proof, and stackable packaging.

Government regulations impacting the market focus on regulatory shifts promoting food safety, hygiene, and recyclability have further catalyzed innovation in hinge container design and material development. Compostable and biodegradable options, microwaveable trays, and containers with built-in ventilation and secure locking mechanisms are becoming mainstream. Additionally, design customization and lightweight solutions are becoming critical to meet the logistical needs of food retailers and delivery partners.

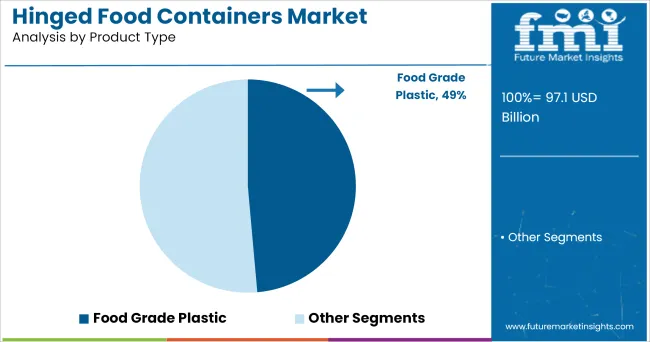

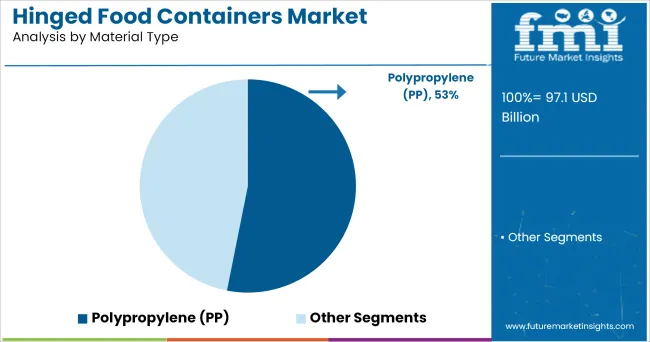

The UK is projected to be the fastest-growing country in this market, expanding at a CAGR of 3.8% from 2025 to 2035, driven by sustainability trends and takeaway culture.The hinge food container market is led by polypropylene (PP) as the dominant material, accounting for 53% of the market share in 2025, owing to its durability, heat resistance, and recyclability. Food grade plastics emerge as the leading product type segment, holding a 49% market share due to rising demand for safe and hygienic packaging.

The hinge food container market is segmented by material, product type, and region. By Material, the market is segmented into Polypropylene (PP), PET, Polystyrene, Paperboard, and Others. Based on Product Type, the market includes and Food Grade Plastics, Eco-Friendly Biodegradable Containers, Foam Containers, Microwaveable Trays.

Regionally, the market is classified into North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Food grade plastic containers will dominate the product type segment in 2025, thanks to their wide adoption in QSRs, retail deli counters, and food delivery. Their durability, affordability, and regulatory compliance make them the preferred choice for safe and hygienic food handling.

Polypropylene (PP) is projected to lead the material segment due to its superior heat resistance, clarity, and cost-effectiveness. It is ideal for microwaveable and reusable food containers used in meal prep, fast food, and grocery chains.

The global hinge food container market has been experiencing steady growth, fueled by rising demand for convenient, tamper-evident, and eco-friendly packaging across foodservice and retail sectors. As consumers increasingly seek portability, hygiene, and sustainability in food packaging, hinge containers are gaining prominence in ready meals, fresh produce, and takeaway services.

Their secure closure, stackability, and microwave compatibility enhance user convenience and product safety. Moreover, growing environmental awareness is accelerating the shift toward recyclable and compostable materials, pushing manufacturers to innovate with bio-based plastics and sustainable designs in line with circular economy principles.

Recent Trends in the Market

Key Challenges in the Market

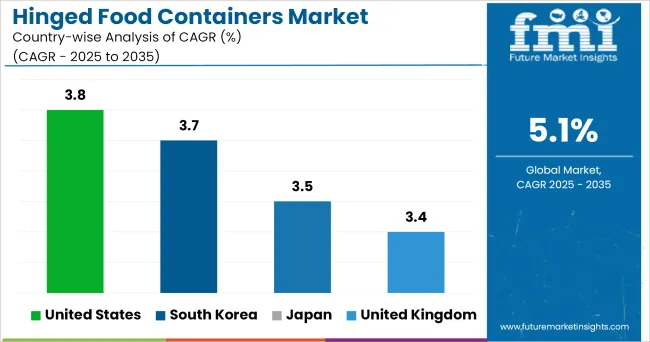

The USA dominates the hinge food container market, driven by robust demand from quick-service restaurants, meal delivery services, and retail-ready packaging. Innovation in microwave-safe and compostable containers supports sustained growth. The UK and South Korea are also key players, leveraging advanced manufacturing and high adoption of ready-to-eat meals.

China and India are emerging as major manufacturing hubs, supported by cost-effective production and expanding domestic consumption. The Asia Pacific region is witnessing accelerated growth due to urbanization, rising disposable incomes, and a booming food delivery ecosystem.

The USA hinge food container market is projected to grow at a CAGR of 3.8% from 2025 to 2035. This growth is driven by increasing consumer demand for convenient, eco-friendly, and tamper-resistant packaging in both retail and foodservice segments. The booming e-commerce grocery sector and expanding takeout culture further contribute to the rising adoption of hinge containers across multiple food categories.

The South Korea hinge food container market is forecasted to grow at a CAGR of 3.7% from 2025 to 2035. Market expansion is fueled by increasing urbanization, rising single-person households, and a fast-paced lifestyle encouraging the consumption of ready-to-eat meals. The surge in convenience store chains and online food platforms also stimulates container usage.

The hinge food container market in Japan is expected to grow at a CAGR of 3.5% from 2025 to 2035. Growth is supported by Japan’s emphasis on meticulous food presentation, hygiene, and advanced packaging formats. Demand is prominent in both traditional bento packaging and modern convenience food sectors. The market is also characterized by increasing use of antimicrobial, microwave-safe, and multi-compartment containers.

The UK hinge food container market is projected to grow at a CAGR of 3.4% from 2025 to 2035. Growth is led by the expanding ready-to-eat food industry, increased preference for sustainable packaging, and high demand in takeaway and food delivery services. Efforts to reduce single-use plastic have encouraged innovation in compostable and reusable hinge container solutions.

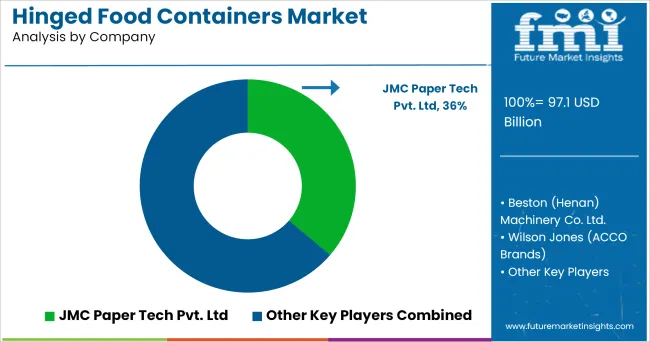

The hinge food container market is moderately fragmented, with several key players competing on the basis of innovation, material sustainability, and supply chain strength. Major companies such as Pactiv Evergreen Inc., Genpak LLC, Dart Container Corporation, Sabert Corporation, Placon Corporation, Anchor Packaging Inc., Fabri-Kal, and Novolex Holdings LLC are leading the market through the development of eco-friendly, durable, and convenience-driven packaging solutions. These players are investing in recyclable plastics, compostable materials like bagasse and PLA, and microwave-safe product innovations to meet evolving consumer and regulatory demands.

Top hinge container manufacturers are actively expanding their production capabilities across North America, Europe, and Asia to meet rising global demand, particularly from fast-food chains, meal prep services, and supermarket deli counters.

Strategic collaborations with food delivery platforms and grocery brands are becoming common to co-develop packaging tailored to temperature control, leak prevention, and branding needs. Customization, tamper-evidence, and stackability continue to be key product differentiators. Compliance with food safety regulations and increasing alignment with circular economy goals remain essential competitive advantages as the industry shifts toward more sustainable and user-friendly packaging formats.

Recent Hinge Food Container Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 97.1 billion |

| Projected Market Size (2035) | USD 159.7 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in million units |

| By Material | Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Polylactic Acid (PLA), Bagasse, Others |

| By Product Type | Food Grade Plastics, Compostable Containers, Microwave-Safe Containers, Tamper-Evident Containers, Recyclable Containers |

| Regions Covered | United North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Japan, South Korea, Germany, China, India, Australia, Canada, Brazil, and 40+ countries |

| Key Players | Pactiv Evergreen Inc., Dart Container Corporation, Genpak LLC, Sabert Corporation, Anchor Packaging Inc., Placon Corporation, Novolex Holdings LLC, Fabri-Kal, BioPak, Eco-Products Inc. |

| Additional Attributes | Dollar sales by container type, share by usage (retail/takeaway), regional demand trends, material sustainability benchmarking, regulatory compliance, innovation mapping |

The market size is valued at USD 97.1 billion in 2025.

The market is forecasted to reach USD 159.7 billion by 2035, reflecting a CAGR of 5.1%.

Polypropylene (PP) leads the material segment, accounting for 53% of the global market share in 2025.

Food grade plastics dominate the product type segment with a 49% share in 2025.

The UK is the fastest-growing market with a CAGR of 3.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hinged Dual Flap Caps Market Size and Share Forecast Outlook 2025 to 2035

Hinged Lid Tins Market Size and Share Forecast Outlook 2025 to 2035

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Hinged Deli Containers Market Growth & Trends 2025 to 2035

Hinged Lid Compostable Container Market

PET Hinged Container Market Innovations & Trends 2024-2034

Foam Hinged Take-Out Containers Market

Clear Hinged Container Market

Smooth Hinge Caps And Closure Market

Automotive Door Hinges Market Growth - Trends & Forecast 2025 to 2035

Bi-Injected Snap Hinge Closure Market Size and Share Forecast Outlook 2025 to 2035

Automotive Door Latch and Hinges Market Analysis by Type, Application, and Region Forecast Through 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA