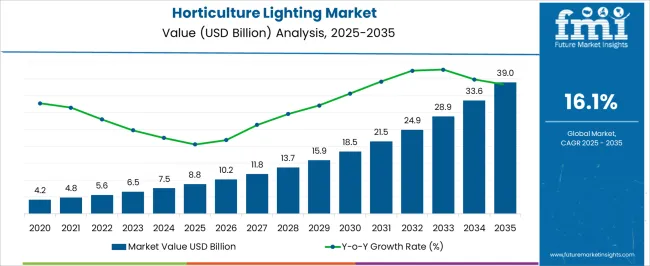

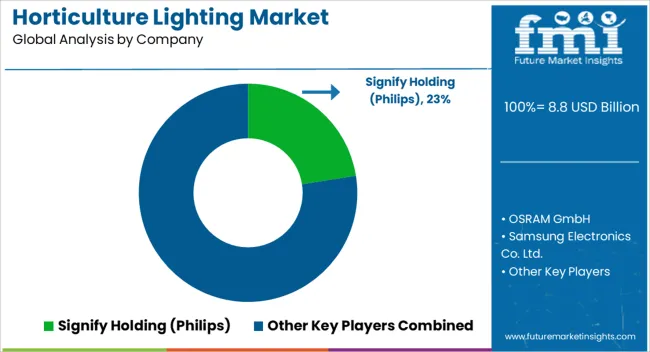

The horticulture lighting market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 39.0 billion by 2035, registering a compound annual growth rate (CAGR) of 16.1% over the forecast period.

The horticulture lighting market, valued at USD 8.8 billion in 2025 and projected to reach USD 39.0 billion by 2035 with a CAGR of 16.1%, reflects a complex cost-structure and value-chain dynamic shaped by technology, manufacturing, and distribution components. The primary cost component is LED and advanced lighting systems, which account for a substantial proportion of overall expenditure. These systems require precision engineering, high-quality semiconductors, and thermal management solutions, contributing significantly to capital and operational costs. Ancillary costs include drivers, power supply units, and control systems that regulate light intensity, spectrum, and photoperiod, which are essential for optimizing plant growth and energy efficiency.

The value-chain begins with raw material sourcing, particularly high-purity semiconductors and specialized optical components. Manufacturing processes involve high-precision assembly, testing, and quality assurance to meet horticultural performance standards. Integration of smart controls and IoT-enabled monitoring adds technological value and supports higher adoption rates in commercial agriculture and controlled environment farming. Distribution and installation represent additional cost layers, encompassing logistics, labor, and technical support for end-users.

After-sales services, including maintenance, firmware updates, and energy optimization consulting, further enhance value capture. Over the forecast period, economies of scale and technological innovations are expected to reduce unit costs, while value-chain complexity increases due to software and automation integration. The market’s expansion from USD 8.8 billion to USD 39.0 billion underscores that cost-structure optimization and value-chain efficiency will be critical drivers of competitiveness and adoption in global horticulture lighting applications.

| Metric | Value |

|---|---|

| Horticulture Lighting Market Estimated Value in (2025 E) | USD 8.8 billion |

| Horticulture Lighting Market Forecast Value in (2035 F) | USD 39.0 billion |

| Forecast CAGR (2025 to 2035) | 16.1% |

The horticulture lighting market represents a specialized segment within the global agricultural technology and controlled environment farming industry, emphasizing optimized plant growth, energy efficiency, and crop yield enhancement. Within the broader agricultural equipment and solutions sector, it accounts for about 5.4%, driven by adoption in greenhouses, vertical farms, and indoor cultivation systems. In the LED and smart lighting systems segment, it holds nearly 4.8%, reflecting demand for precision light spectra, energy-efficient designs, and long operational lifespans.

Across the indoor farming and plant cultivation market, the share is 4.2%, supporting year-round crop production and productivity improvement. Within the greenhouse infrastructure and controlled environment agriculture category, it represents 3.9%, highlighting its role in climate-adaptive and high-density cultivation systems. In the horticulture and specialty crop production sector, it secures 3.5%, emphasizing applications in floriculture, high-value vegetables, and medicinal plants. Recent developments in this market have focused on spectral optimization, energy efficiency, and automation integration. Innovations include full-spectrum LEDs, tunable light systems, and IoT-enabled lighting controls for real-time monitoring of plant growth cycles.

Key players are collaborating with agritech firms, research institutions, and greenhouse operators to improve crop quality, reduce energy consumption, and enable predictive cultivation. Adoption of vertical lighting, modular fixtures, and remote management software is gaining traction to enhance scalability and flexibility in farming operations. The integration with hydroponic, aeroponic, and sensor-driven cultivation systems is being deployed to maximize yield and resource efficiency. These trends demonstrate how technological innovation, energy management, and crop optimization are shaping the market.

The horticulture lighting market is experiencing accelerated growth due to the rising adoption of controlled environment agriculture and the need for optimized crop yield in both urban and rural farming operations. Increasing global demand for year-round cultivation, coupled with advancements in energy-efficient lighting technologies, has expanded the deployment of horticulture lighting systems across greenhouses and vertical farms.

Government support for sustainable agricultural practices and incentives for energy-efficient installations are further driving adoption. Integration of smart lighting controls and spectrum-tuning capabilities is enabling growers to optimize light intensity and wavelength for specific plant growth stages, improving quality and productivity.

With expanding urbanization and food security concerns, the market outlook remains positive as horticulture lighting becomes central to high-efficiency, resource-conscious farming models.

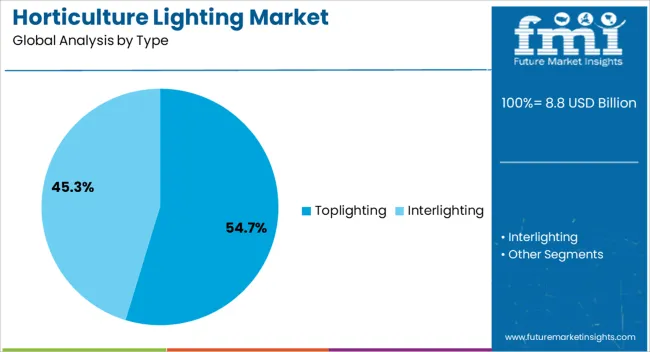

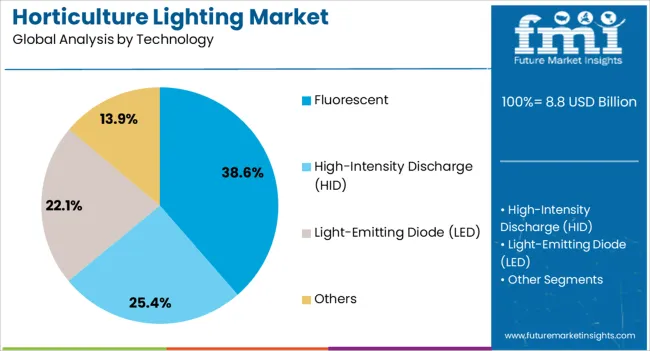

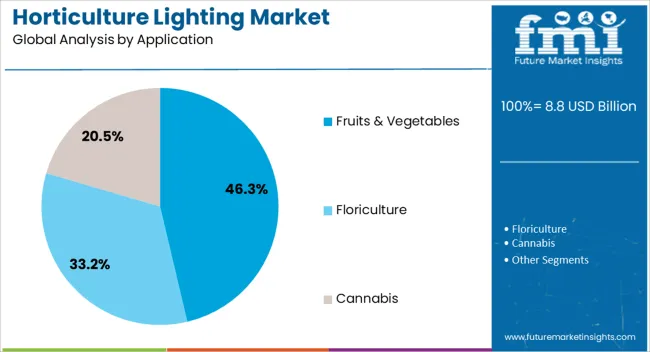

The horticulture lighting market is segmented by type, technology, application, end-use industry, and geographic regions. By type, horticulture lighting market is divided into toplighting and interlighting. In terms of technology, horticulture lighting market is classified into fluorescent, high-intensity discharge (HID), light-emitting diode (LED), and others. Based on application, horticulture lighting market is segmented into fruits & vegetables, floriculture, and cannabis. By end-use industry, horticulture lighting market is segmented into vertical farming, greenhouses, indoor farms, and others. Regionally, the horticulture lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The toplighting segment accounts for 54.7% of total revenue by 2025 within the type category, making it the leading segment. Its dominance is driven by its suitability for large-scale greenhouse environments where light penetration from above ensures uniform coverage and optimal photosynthetic activity.

Toplighting systems are valued for their ability to supplement natural sunlight and extend growing hours, resulting in increased crop yield and quality. The compatibility of toplighting with advanced control systems enables growers to fine-tune light conditions according to crop requirements, further enhancing productivity.

These benefits have reinforced toplighting’s leadership in the horticulture lighting market.

The fluorescent technology segment holds 38.6% of total market revenue by 2025, leading the technology category. Its strong position is supported by its cost-effectiveness, widespread availability, and proven performance in promoting seedling growth and propagation.

Fluorescent lights are particularly suited for crops requiring lower light intensities and for applications where heat output must be minimized. Their long lifespan and adaptability to various growing setups make them a preferred choice in certain commercial and research settings.

Continued demand from small and medium-scale growers sustains the prominence of this technology segment.

The fruits and vegetables application segment represents 46.3% of total market revenue by 2025, making it the largest application category. Growth in this segment is driven by rising consumer demand for fresh produce year-round and the increasing use of greenhouse and vertical farming methods to meet this demand.

Horticulture lighting in this application ensures consistent growth cycles, improved nutritional quality, and enhanced flavor profiles. Producers benefit from the ability to control environmental factors, resulting in reduced crop losses and higher marketable yields.

These advantages have established fruits and vegetables as the dominant application segment in the horticulture lighting market.

The market has expanded rapidly due to growing adoption of controlled environment agriculture and vertical farming systems. These lighting solutions provide tailored light spectra that optimize plant growth, flowering, and yield in greenhouses, indoor farms, and plant factories. Market growth has been driven by rising demand for year-round crop production, advancements in LED technology, and energy-efficient lighting systems. Increased investment in indoor farming infrastructure and urban agriculture initiatives has further strengthened the market. The integration of smart lighting controls, IoT connectivity, and automated scheduling has enabled precise cultivation management, reducing operational costs and improving overall crop quality and consistency across diverse horticultural applications.

LED technology has been a major driver in the horticulture lighting market due to its energy efficiency, long lifespan, and customizable light spectra. LED systems allow growers to control light intensity, wavelength, and photoperiod, which directly influence plant photosynthesis, morphology, and secondary metabolite production. Traditional lighting solutions such as high-pressure sodium or fluorescent lamps are being replaced by LEDs, as they reduce energy consumption and heat output, minimizing cooling requirements in indoor facilities. The scalability of LED systems has also enabled adoption across small-scale urban farms, commercial greenhouses, and research-oriented plant growth chambers, making them a versatile solution for controlled cultivation environments globally.

Technological advancements have enhanced the capabilities of horticulture lighting systems, enabling precise manipulation of light quality for different plant species. Tunable spectra, dimming controls, and integration with environmental sensors allow growers to optimize growth cycles and improve crop yield and quality. Smart lighting platforms can adjust intensity based on real-time feedback from plant sensors, creating automated growth environments. These innovations have facilitated accelerated flowering, uniform fruiting, and increased nutrient content in crops. The improved fixture designs and spectral optimization have supported energy conservation, reduced maintenance, and lower operational costs, which has expanded the adoption of horticulture lighting in commercial, research, and residential farming applications.

Indoor farming, vertical farming, and greenhouse cultivation have increasingly relied on horticulture lighting to ensure consistent plant production throughout the year. Controlled environment systems allow for high-density planting, extended crop cycles, and efficient resource use, driving demand for specialized lighting. Leafy greens, herbs, and high-value crops such as tomatoes, peppers, and strawberries have become key applications due to their responsiveness to optimized light conditions. Urban agriculture initiatives and smart city farming projects have further fueled demand, as growers seek to reduce reliance on natural sunlight and maximize output in limited spaces. The integration of horticulture lighting with hydroponic, aeroponic, and aquaponic systems has strengthened adoption across multiple cultivation formats.

Despite benefits, horticulture lighting systems face challenges related to upfront investment and operational complexity. High installation costs for LED fixtures, control systems, and integration with automated platforms can deter smaller growers. Energy consumption and heat management remain considerations, particularly in large-scale facilities. Selecting appropriate light spectra and scheduling requires technical expertise to optimize plant response and avoid suboptimal growth. The maintenance, fixture replacement, and calibration of sensor-based systems contribute to operational expenses. Addressing cost-effectiveness, providing modular scalable solutions, and offering technical support are critical for broader adoption, ensuring that growers can maximize both efficiency and crop productivity in diverse horticultural environments.

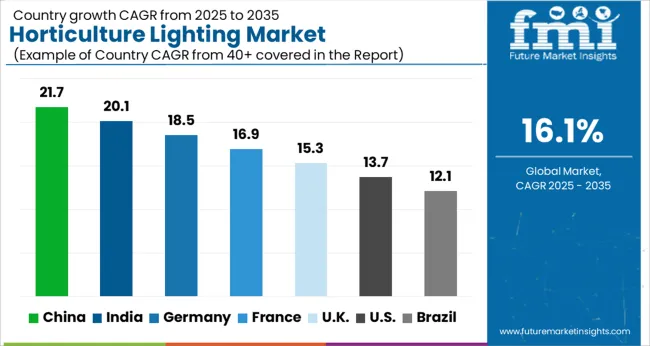

| Country | CAGR |

|---|---|

| China | 21.7% |

| India | 20.1% |

| Germany | 18.5% |

| France | 16.9% |

| UK | 15.3% |

| USA | 13.7% |

| Brazil | 12.1% |

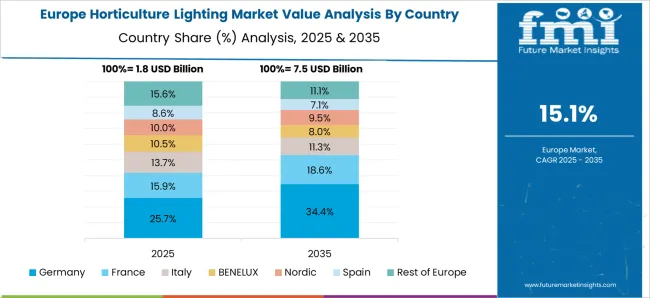

The market is set to expand at a CAGR of 16.1% from 2025 to 2035, driven by adoption of energy-efficient and high-yield lighting solutions. Germany reached 18.5%, reflecting integration of advanced lighting technologies in controlled environment agriculture. China recorded 21.7%, where growth in vertical farming and greenhouse cultivation supported market expansion. India achieved 20.1%, fueled by increasing investment in modern farming infrastructure and agritech solutions. The United Kingdom posted 15.3%, driven by research in LED horticulture lighting and sustainable production practices. The United States reached 13.7%, where deployment in commercial greenhouses and plant research centers contributed to steady growth. Collectively, these countries illustrate a global landscape of production, deployment, and technological innovation in horticulture lighting. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 21.7%, supported by the rapid expansion of controlled environment agriculture, vertical farming, and greenhouse projects. Adoption has been reinforced by domestic LED manufacturers focusing on energy efficient, high intensity, and full spectrum lighting systems designed for different plant cycles. Government initiatives promoting food security and high yield production in urban and peri urban areas have strengthened the market. Integration with IoT, smart sensors, and automated growth control systems enables precise energy management and maximized crop productivity. Large scale commercial farms and research facilities continue to drive demand, while domestic producers increasingly compete with international brands to supply tailored solutions.

India is expected to expand at a CAGR of 20.1%, driven by rising demand for greenhouse cultivation, high value crops, and floriculture in controlled environments. Adoption has been reinforced by domestic and imported LED lighting solutions offering optimized spectral outputs, energy efficiency, and extended product life. Government programs promoting smart agriculture, subsidies for horticulture infrastructure, and agritech adoption support market growth. Regional variations are notable, with northern and western India leading greenhouse projects for vegetables and flowers. The integration of automated timers, climate control systems, and remote monitoring strengthens adoption in commercial farming and research facilities.

Germany is projected to grow at a CAGR of 18.5%, driven by precision agriculture, research institutions, and commercial greenhouse adoption. Advanced greenhouse operations and vertical farming require high efficiency, spectrum controlled LED systems, which domestic manufacturers focus on developing. Adoption has been reinforced by integration with climate control, IoT based monitoring, and automated nutrient delivery systems. Imports of premium horticulture lighting systems complement domestic offerings, especially for specialty crops like berries and herbs. Regulatory emphasis on energy efficiency and sustainability has further accelerated the shift from traditional HPS lighting to LEDs.

The United Kingdom is expected to grow at a CAGR of 15.3%, supported by adoption in commercial greenhouses, indoor urban farms, and research facilities. Imports dominate high end horticulture lighting solutions, while domestic companies provide standard LED products suitable for vegetables, floriculture, and herbs. Market expansion is reinforced by the increasing focus on food quality, year round production, and controlled environment crop optimization. Energy efficiency and operational cost reduction remain critical decision factors for commercial growers. The rise of urban and vertical farms in London and other metropolitan areas continues to shape the demand pattern.

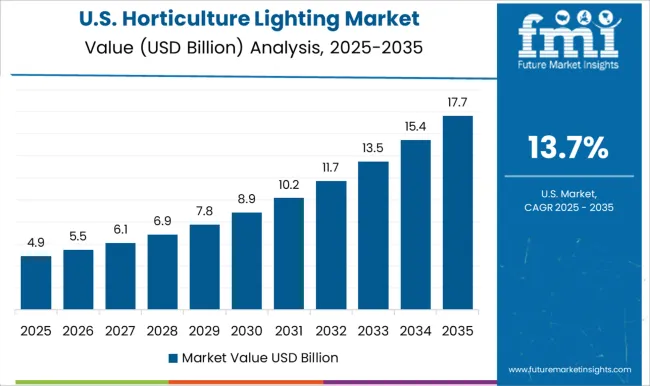

The United States is forecast to grow at a CAGR of 13.7%, supported by greenhouse expansions, indoor vertical farming, and research driven cultivation of high value crops. Adoption has been reinforced by technological innovations such as spectrum tuning LEDs, automated light intensity control, and integration with smart irrigation and climate management systems. Domestic manufacturers collaborate with agritech companies and research institutes to deliver scalable solutions for both commercial and specialty crop growers. Market growth is also supported by increasing interest in local, fresh produce and investment in energy efficient indoor cultivation.

The market is shaped by leading global lighting manufacturers, technology innovators, and specialized horticultural solutions providers. Signify Holding (Philips) holds a strong position through advanced LED horticultural solutions, energy-efficient lighting systems, and extensive global distribution networks. OSRAM GmbH leverages its expertise in lighting technology and research-driven product development to offer horticulture-specific lamps and LEDs tailored to plant growth cycles.

Samsung Electronics Co. Ltd. and Lumileds Holding BV focus on high-performance LED modules and smart lighting solutions, providing scalable and efficient options for commercial and vertical farming applications. Everlight Electronics Co. Ltd. emphasizes cost-effective, high-quality LED solutions that cater to both small-scale growers and industrial operations. Specialized companies such as Gavita International BV and Heliospectra AB concentrate on precision horticultural lighting, offering tunable spectra, advanced control systems, and IoT-enabled solutions that enhance crop yield, growth rate, and energy efficiency.

Market competitiveness is increasingly influenced by innovation in spectrum optimization, energy efficiency, integration with automated farming systems, and sustainability-focused solutions that support year-round cultivation across diverse geographies.

| Items | Values |

|---|---|

| Quantitative Units | USD 8.8 billion |

| Type | Toplighting and Interlighting |

| Technology | Fluorescent, High-Intensity Discharge (HID), Light-Emitting Diode (LED), and Others |

| Application | Fruits & Vegetables, Floriculture, and Cannabis |

| End-use Industry | Vertical Farming, Greenhouses, Indoor Farms, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Signify Holding (Philips), OSRAM GmbH, Samsung Electronics Co. Ltd., Lumileds Holding BV, Everlight Electronics Co. Ltd., Gavita International BV, and Heliospectra AB |

| Additional Attributes | Dollar sales by lighting type and application, demand dynamics across greenhouse, vertical farming, and indoor cultivation sectors, regional trends in controlled environment agriculture adoption, innovation in spectrum optimization, energy efficiency, and smart control systems, environmental impact of energy consumption and light pollution, and emerging use cases in year-round crop production, urban farming, and high-value specialty crops. |

The global horticulture lighting market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the horticulture lighting market is projected to reach USD 39.0 billion by 2035.

The horticulture lighting market is expected to grow at a 16.1% CAGR between 2025 and 2035.

The key product types in horticulture lighting market are toplighting and interlighting.

In terms of technology, fluorescent segment to command 38.6% share in the horticulture lighting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horticulture Film Market Analysis by Material, Application, and Region through 2025 to 2035

Industry Share & Competitive Positioning in Horticulture Film Production

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA