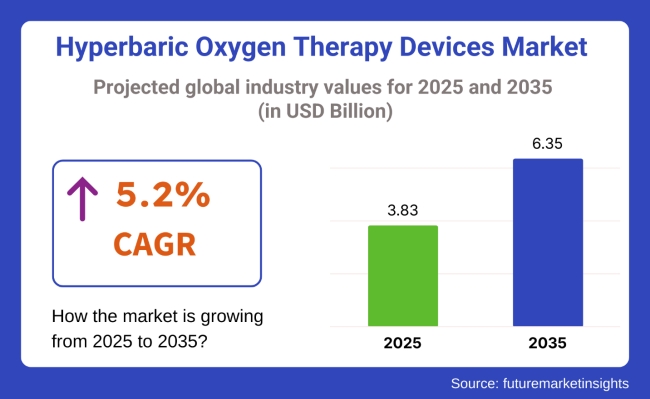

The global hyperbaric oxygen therapy (HBOT) devices market is forecasted to expand from USD 3.83 billion in 2025 to USD 6.35 billion by 2035, reflecting a CAGR of 5.2%. This growth is underpinned by the rising global burden of chronic wounds, post-surgical complications, and decompression illnesses. Increasing awareness among clinicians and patients about the therapeutic benefits of HBOT has prompted hospitals, specialty clinics, and outpatient centers to adopt these devices as part of integrated treatment protocols.

Mono-place hyperbaric chambers are increasingly preferred due to their cost-effectiveness, safety, and compact design. They are widely deployed in outpatient settings for diabetic ulcers, surgical wound management, and neurological applications. The USA remains a key market due to insurance coverage and FDA-recognized indications. However, the fastest growth is concentrated in emerging markets, such as India and China, supported by investments in hospital infrastructure and a rise in medical tourism.

In May 2025, iCRYO partnered with OxyHealth to jointly promote high-performance HBOT chambers at the 2025 Health Optimization Summit. According to Mayur Patel, CEO of OxyHealth mentioned that hyperbaric oxygen therapy is integral to the future of health and performance. This technology can accelerate recovery, improve cognitive function, extend longevity, and enhance healthspan.

Patel emphasized the company’s ongoing investment in R&D and its commitment to making HBOT more accessible through innovation. The adoption of HBOT in outpatient wound care, orthopedic rehabilitation, sports medicine, and post-radiation therapy is rising as clinical awareness increases. Regulatory approvals for new indications-particularly in adjunctive care-are also broadening HBOT’s scope within evidence-based medical practice.

Technological innovations are also fueling demand. Advanced chambers with real-time pressure monitoring, oxygen concentration control, and infection prevention systems are in focus. Additionally, growing clinical validation and government support for wound care protocols are reinforcing long-term demand. As regulatory clarity improves and clinical guidelines expand, HBOT devices are expected to become more mainstream in non-healing wound and emergency care treatment across both developed and developing economies.

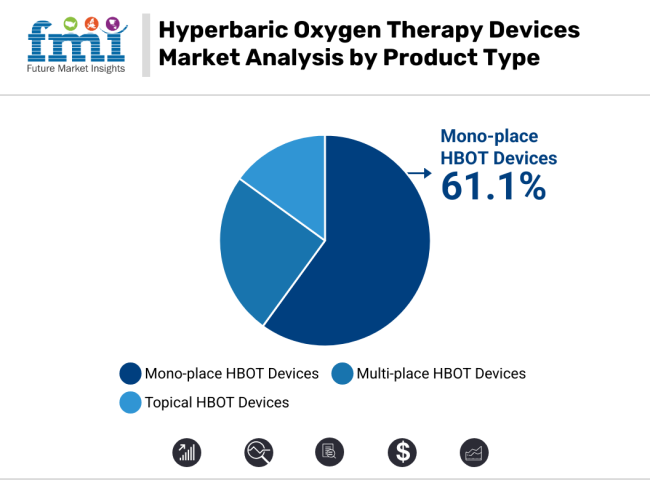

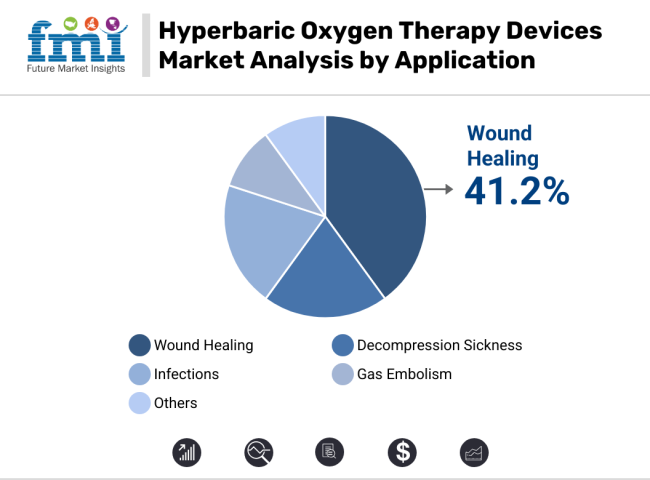

Mono-place HBOT devices dominate with a 61.1% share in 2025, favored for their cost efficiency and outpatient suitability. Wound healing leads applications at 41.2%, driven by rising chronic wounds and aging populations. Advancements, clinical endorsements, and improved reimbursements support long-term growth in non-hospital HBOT adoption.

Mono-place hyperbaric oxygen therapy devices account for approximately 61.1% of global revenue in 2025. These systems cater to individual patients, offering reduced cross-contamination risks, cost efficiency, and streamlined operation. Their appeal lies in compact design, simplified staffing requirements, and ease of integration into smaller outpatient wound care facilities. Compared to multi-place chambers, mono-place units require significantly lower initial investments and offer shorter patient turnaround times.

This device type is widely used in post-operative recovery and rehabilitation scenarios. Chronic care hospitals, sports medicine clinics, and private practices favor mono-place models for their ability to deliver 100% oxygen at controlled pressures. The segment is bolstered by innovations from Sechrist Industries and OxyHealth, including mobile-ready and modular chambers. Demand is likely to increase with expanded FDA indications, improved billing codes, and broader acceptance by physicians in non-hospital environments.

The wound healing segment remains the largest clinical application, holding a 41.2% share of global market revenue in 2025. The surge in non-healing wounds linked to diabetes, cancer therapies, and an aging population has elevated the role of HBOT as a frontline therapeutic option. Clinical evidence shows HBOT improves microcirculation, reduces oxidative stress, and enhances collagen matrix development-factors critical in treating diabetic foot ulcers and radiation necrosis.

Healthcare providers increasingly integrate HBOT within multidisciplinary wound care teams. With the endorsement of clinical bodies like the Undersea and Hyperbaric Medical Society (UHMS), HBOT is now embedded in treatment pathways for stage 3 and 4 pressure ulcers. As guidelines solidify, insurance approval and therapy reimbursements are improving. The expanding elderly population and the rise of oncology-related skin complications ensure this segment continues to anchor future market revenue.

The hyperbaric oxygen therapy (HBOT) devices market is influenced by the global rise in chronic health conditions, the need for non-invasive wound care solutions, and technological innovations such as portable chambers and real-time monitoring systems. However, regulatory complexity and limited public awareness continue to slow adoption across emerging and underdeveloped healthcare systems.

Rising incidence of diabetes and aging populations fuel HBOT adoption in chronic wound care

The global increase in diabetic patients and aging populations has led to a sharp rise in chronic, non-healing wounds such as diabetic foot ulcers and pressure sores. These conditions require advanced, supportive therapies beyond traditional wound management. HBOT offers proven clinical benefits by promoting angiogenesis, collagen synthesis, and tissue regeneration under oxygen-rich, pressurized environments.

As a result, it is becoming a key tool in multidisciplinary wound care programs across hospitals and specialty clinics. Healthcare investments and improved clinical guidelines are further encouraging the inclusion of HBOT in standard protocols for treating ischemic injuries and radiation-induced skin damage, particularly in the United States and Western Europe.

High equipment and operating costs remain a critical barrier in low-resource settings

The cost of acquiring, installing, and maintaining HBOT chambers remains a significant barrier, especially for smaller hospitals and standalone clinics. Many of these institutions lack the financial capacity to invest in high-end multi-place systems or train dedicated technicians for 24/7 chamber operations.

Additionally, reimbursement coverage is limited in several countries, with insurers approving treatment only for a restricted list of conditions. These challenges are most visible in emerging economies, where budget constraints and inconsistent policy frameworks deter broader adoption. Without expanded insurance schemes or targeted subsidies, accessibility to HBOT remains largely confined to high-income, urban centers.

Emerging portable and modular HBOT systems create new growth avenues

To expand their market reach, manufacturers are innovating with portable and modular hyperbaric systems that reduce space, cost, and staffing requirements. These compact units are easier to integrate into small-scale clinics and outpatient wound care centers. Some companies are even exploring home-based HBOT units for chronic care patients with recurring wound complications.

In parallel, the integration of IoT-based monitoring, oxygen dosage tracking, and automated pressure control allows clinicians to ensure treatment precision and safety. These innovations could help unlock underpenetrated markets by offering a viable alternative to bulky, expensive institutional chambers.

Lack of awareness and complex regulations hinder market scalability and access

Public and provider-level awareness of HBOT’s full clinical potential remains low outside specialized practices. Many physicians are unfamiliar with its broader use beyond decompression sickness or gas embolism. Additionally, stringent regulatory approval processes-especially in Europe under MDR-complicate new product launches.

Device classification inconsistencies and the need for extensive clinical validation delay time-to-market and inflate development costs. This poses a risk for small-to-mid-tier manufacturers without the resources to navigate complex legal frameworks. Unless harmonized policies and targeted educational programs are implemented, the market will struggle to scale beyond its current niche.

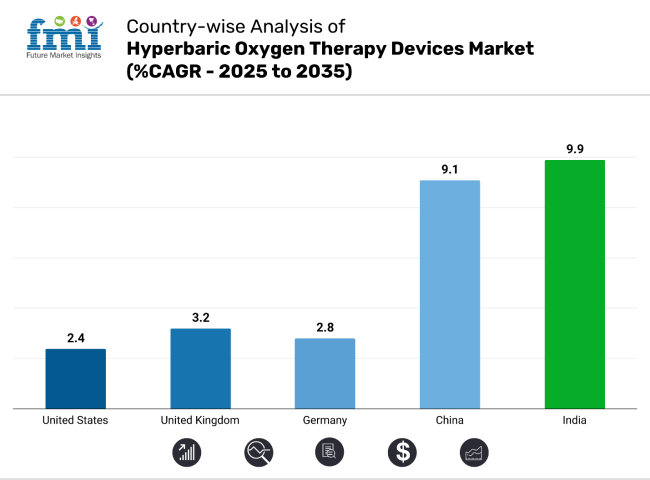

The global hyperbaric oxygen therapy devices market is shaped by varied growth trajectories across key countries. The United States leads in absolute market share due to strong reimbursement and outpatient infrastructure. Meanwhile, India and China demonstrate the fastest growth, fueled by diabetic burden and government-backed care access. Germany and the UK reflect mature, protocol-driven adoption.

The United States remains the largest contributor to the global HBOT devices market, growing at a steady CAGR of 2.4% between 2025 and 2035. Its dominance is underpinned by widespread reimbursement support through Medicare and private insurance, which covers a range of conditions including diabetic ulcers and radiation injuries. The proliferation of outpatient wound care centers and rehabilitation chains has significantly improved patient access to HBOT services.

Companies such as Environmental Tectonics Corporation (ETC) and Perry Baromedical are prominent suppliers, offering advanced mono-place and multi-place systems across clinical networks. Technological improvements, including integration with electronic health records and real-time monitoring, are actively deployed in high-volume centers.

Regulatory clarity from the FDA and ongoing inclusion of new indications further stimulate procedural demand. Strategic investments in outpatient infrastructure and procedural billing mechanisms are expected to preserve the USA’s lead in the market.

In the United Kingdom, the hyperbaric oxygen therapy devices market is projected to grow at a CAGR of 3.2% from 2025 to 2035. The National Health Service (NHS) supports limited yet structured deployment of hyperbaric chambers, primarily for indications such as post-radiotherapy complications, carbon monoxide poisoning, and chronic wounds.

The regulatory environment favors evidence-backed integration, with multiple academic centers such as Oxford and Cambridge leading multicenter trials to expand clinical indications. Companies like SOS Group Global Ltd. are actively partnering with public hospitals to introduce advanced mono-place units in targeted facilities.

Clinical trials around neuroprotection and sports injury recovery are also underway, highlighting a diversification in application areas. NHS procurement remains centralized, focusing on safety, CE-compliance, and cost-effectiveness, which ensures stable but controlled volume growth. Structured training programs and policy-guided rollout make the UK a model for organized public adoption of HBOT therapies.

The hyperbaric oxygen therapy devices market in China is projected to grow at a robust compound annual growth rate (CAGR) of 9.1%, driven by the expansion of healthcare infrastructure and national screening programs for chronic diseases. Government-led initiatives to detect ischemic wounds, diabetic complications, and radiation-related injuries at earlier stages are creating substantial demand for HBOT.

Public sector investment in tier-2 and tier-3 city hospitals is accelerating the installation of both mono-place and multi-place chambers. Domestic players like Hearmec and Hyperbaric SAC are gaining notable traction by offering locally manufactured, cost-effective devices that comply with national regulatory frameworks.

The inclusion of HBOT in public insurance coverage for selected conditions has further incentivized uptake among general hospitals and surgical clinics. The rise of specialized wound care units in provincial hospitals reflects China’s long-term commitment to building a distributed HBOT service network. Collaborative projects with domestic tech companies to integrate AI-based oxygen monitoring are also emerging trends in hospital tenders.

India is the fastest-growing market for hyperbaric oxygen therapy devices, with a projected CAGR of 9.9% from 2025 to 2035. The increasing burden of diabetic foot ulcers, surgical infections, and radiotherapy injuries fuels this growth. The Ayushman Bharat program and other government-led universal healthcare initiatives are expanding HBOT access in public hospitals.

Simultaneously, private hospital chains in major metro cities are investing in advanced wound care centers that include HBOT services. Local firms such as Meril Life Sciences are entering strategic partnerships with global players to provide CE-certified chambers and training. Multispecialty hospitals are actively adopting mono-place systems to reduce infection risks and manage patient turnover efficiently.

Training programs supported by the Indian Society of Wound Management are raising awareness among clinicians about the benefits of HBOT. As infrastructure and awareness continue to improve, India is poised to become a leading supplier and adopter of HBOT solutions in Asia.

The hyperbaric oxygen therapy devices market in Germany is projected to grow at a compound annual growth rate (CAGR) of 2.8% between 2025 and 2035, indicating a stable and mature environment. Deployment is concentrated in university hospitals and orthopedic centers where hyperbaric therapy is used for diabetic ulcers, ischemic conditions, and select post-surgical applications.

German healthcare policies require stringent adherence to treatment protocols and device standards, ensuring consistent clinical outcomes. Local manufacturers like HAUX-LIFE-SUPPORT GmbH collaborate closely with academic institutions to co-develop chambers that meet both CE and MDR requirements.

Public insurance schemes reimburse HBOT for certified indications, making it accessible through statutory healthcare networks. Training, maintenance, and operational guidelines are standardized, reducing variability in patient care. Germany also exports advanced HBOT systems across Europe and Middle Eastern markets. The focus on clinical validation, technological refinement, and academic collaboration positions Germany as a benchmark for the global adoption of quality-focused HBOT.

The hyperbaric oxygen therapy devices market is moderately consolidated with a mix of global leaders and regional specialists. Sechrist Industries, Perry Baromedical, and Environmental Tectonics Corporation (ETC) dominate institutional procurement, offering FDA-cleared models with advanced safety features.

Fink Engineering and HAUX-LIFE-SUPPORT GmbH cater to premium European clients with high-pressure systems. OxyHealth targets outpatient centers and private clinics with modular mono-place designs. Hearmec and Hyperbaric SAC are expanding across Asia through strategic partnerships. Firms are investing in antimicrobial materials, digital chamber interfaces, and transportable models. Regulatory certifications (FDA, CE) and insurance coverage form key competitive differentiators in market expansion strategies.

In February 2024, Sechrist Industries launched its new “Sechrist 4100H” mono-place system designed for high-throughput wound care clinics. It features enhanced ventilation, touch-screen control, and auto-decompression modes aimed at improving patient comfort and safety. The device received FDA 510(k) clearance, reinforcing the company’s USA leadership in hyperbaric care solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.83 billion |

| Projected Market Size (2035) | USD 6.35 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Mono-place HBOT Devices, Multi-place HBOT Devices, Topical HBOT Devices |

| Applications Analyzed (Segment 2) | Wound Healing, Decompression Sickness, Infections, Gas Embolism, Others |

| End Users Analyzed | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Other End User |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia and Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players Influencing the Hyperbaric Oxygen Therapy Devices Market | Perry Baromedical, Sechrist Industries, Inc., Environmental Tectonics Corporation (ETC), Fink Engineering, HAUX-LIFE-SUPPORT GmbH, Hearmec Co. Ltd, Hyperbaric SAC, Hyperbaric Modular Systems, Inc. (HMS), OxyHealth, SOS Group Global Ltd. |

| Additional Attributes | Dollar sales opportunity analysis, Increased use of HBOT for chronic wound care and diabetic ulcers, Technological innovations in chamber design, Growing preference for mono-place systems in outpatient centers, Military and sports medicine applications, Integration of HBOT with regenerative therapies, Rising investments in hospital-based wound care infrastructure |

By product, the hyperbaric oxygen therapy devices market includes mono-place HBOT devices, multi-place HBOT devices, and topical HBOT devices.

By application, the key segments are wound healing, decompression sickness, infections, gas embolism, and others.

By end user, the hyperbaric oxygen therapy devices market is categorized into hospitals, ambulatory surgical centers, specialty clinics, and other end users.

By region, the hyperbaric oxygen therapy devices market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The hyperbaric oxygen therapy devices market is valued at USD 3.83 billion in 2025.

The hyperbaric oxygen therapy devices market is expected to reach USD 6.35 billion by 2035.

Sechrist Industries, Perry Baromedical, ETC, and OxyHealth lead globally.

Mono-place chambers lead with over 61% share in 2025.

India leads with a 9.9% CAGR from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type of Products, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type of Products, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type of Products, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type of Products, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type of Products, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type of Products, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type of Products, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type of Products, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type of Products, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type of Products, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type of Products, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type of Products, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type of Products, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type of Products, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type of Products, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oxygen-Scavenger Sachet Feeders Market Forecast and Outlook 2025 to 2035

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Barrier Films And Coatings For Dry Food Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Scavenger Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in Oxygen Indicator Labels Manufacturing

Oxygen Barrier Films Market

Oxygen Delivery Units Market

Oxygen Scavenger Market

Oxygen Market

Oxygen Conservation Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Oxygen Therapy Equipment Market Insights – Trends & Forecast 2024 to 2034

Trace Oxygen Analyzer Market Analysis - Size, Share & Forecast 2025-2035

Nasal Oxygen Cannula Market

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Global Portable Oxygen Concentrator Market Analysis – Size, Share & Forecast 2024-2034

Aircraft Oxygen System Market

Dissolved Oxygen Meters and Controllers Market Size and Share Forecast Outlook 2025 to 2035

High-Flow Oxygen Therapy Devices Market Analysis – Size, Share & Growth 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA