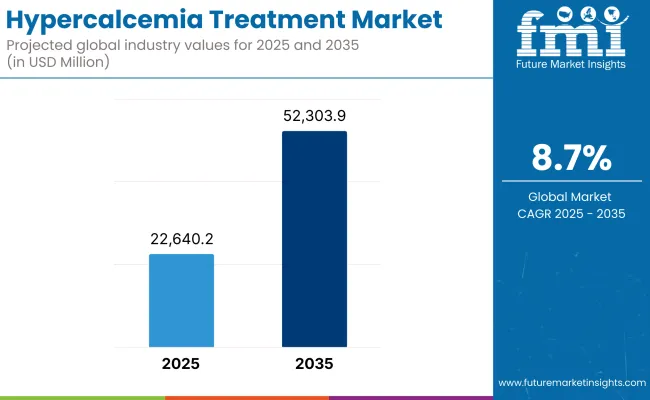

The global Hypercalcemia Treatment Market is estimated to be valued at USD 22,640.2 million in 2025 and is projected to reach USD 52,303.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. This growth is driven by the increasing prevalence of conditions such as hyperparathyroidism, malignancy-associated hypercalcemia, and chronic kidney disease (CKD).

The rising incidence of these conditions necessitates effective management strategies, thereby driving demand for hypercalcemia treatments. Advancements in therapeutic options, along with heightened awareness among healthcare providers and patients, are further contributing to market expansion.

Additionally, supportive government initiatives enhancing access to treatment, particularly in developing economies. The market's growth is further bolstered by ongoing research and development efforts aimed at introducing novel therapies with improved efficacy and safety profiles.

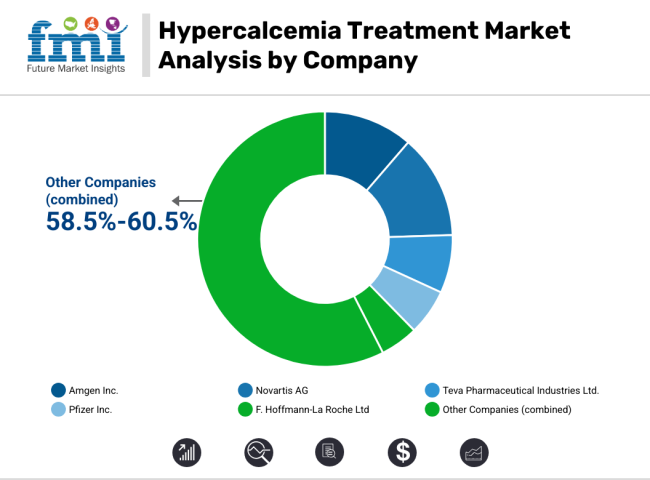

Leading manufacturers in the hypercalcemia treatment market include Amgen Inc., Novartis AG, AstraZeneca plc, and Fresenius Kabi. These companies are actively engaged in developing innovative therapies and expanding their product portfolios to address the growing demand for effective hypercalcemia treatments.

In 2025, Fresenius Kabi launched a synthetic Calcitonin Salmon Injection, USP, for the treatment of hypercalcemia and related bone disorders. This product introduction reflects the company's commitment to enhancing patient care through the provision of reliable and accessible treatment options. “We continue to broaden our portfolio of essential medicines in the USA with the launch of Calcitonin Salmon. At Fresenius Kabi, every product addition further underscores our commitment to the ‘supply chain of care’ for patients”, stated Arunesh Verma, President, Fresenius Kabi USA.

In 2025, The FDA has approved two new biosimilars of denosumab where OSENVELT® is approved to prescribe to treat skeletal-related events for patients with multiple myeloma and those with bone metastases from solid tumors. Further, this is also expanded to treat hypercalcemia of malignancy refractory to bisphosphonate therapy. These biosimilars offer cost-effective alternatives to existing therapies, thereby increasing accessibility for patients and reducing the financial burden on healthcare systems.

North America dominates the Hypercalcemia Treatment Market, This dominance has been driven by the existence of a well-established treatment access, and the strong presence of leading market players in the USA. Market growth has been further supported early adoption of innovative therapies and launch of new developed drugs. Greater awareness regarding hypercalcemia has been observed among both healthcare professionals which has contributed significantly to the region’s leadership in the global market.

A steady growth is expected in Europe region supported by the increasing prevalence of hyperparathyroidism and chronic kidney disease. Market expansion has been facilitated by regional initiatives focused on improving healthcare accessibility and outcomes, along with favorable regulatory policies. Moreover, patient access to therapies has been enhanced by the rising uptake of biosimilars and cost-effective treatment alternatives across the region.

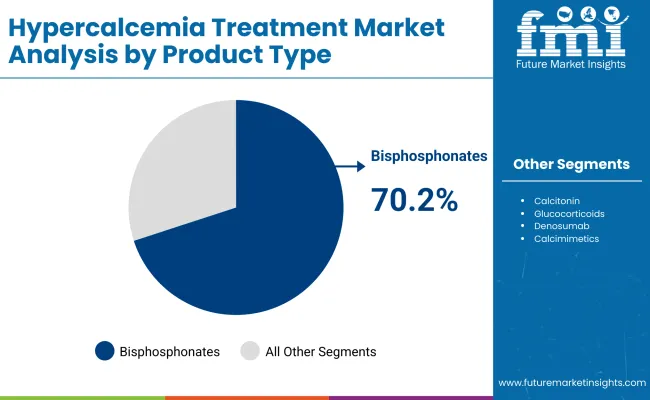

The bisphosphonates segment is anticipated to hold a dominant share of approximately 70.2% in the global hypercalcemia treatment market in 2025. This leadership position has been attributed to their well-established clinical efficacy in managing malignancy-associated hypercalcemia, particularly in patients with bone metastases.

Bisphosphonates such as zoledronic acid and pamidronate have been widely utilized due to their proven ability to inhibit osteoclast-mediated bone resorption, thereby reducing elevated calcium levels effectively. The growth of this segment is also attributed by support of strong physician familiarity and favorable reimbursement policies healthcare systems.

Moreover, bisphosphonates have been extensively studied, which has led to high prescriber confidence in terms of safety and long-term outcomes. Their extended duration of action and established regulatory approvals for various cancer-related indications have further solidified their market position. With increasing detection of hypercalcemia in oncology settings, there is a greater demand for bisphosphonate-based regimens.

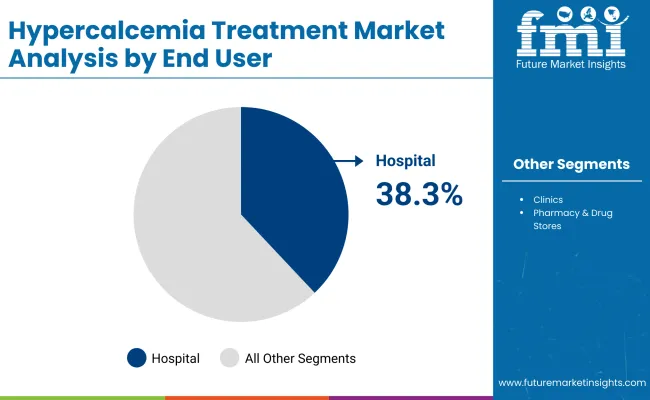

The hospital segment is projected to account for approximately 38.3% of the revenue share in the global hypercalcemia treatment market in 2025. This dominance has been driven by the increasing reliance on hospital settings for the administration of intravenous therapies such as bisphosphonates and denosumab, which require close monitoring and professional supervision.

Hypercalcemia which is particularly associated with malignancies, is often diagnosed and managed in acute care settings due to its potential for rapid onset and severity, necessitating immediate intervention. The growing incidence of oncology cases treated in tertiary care institutions has also supported this segment's prominence.

Inpatient settings have allowed for better adherence to treatment protocols and management of comorbidities such as chronic kidney disease, which often complicate hypercalcemia treatment. With updation of Treatment guidelines and growing number of hospital-based infusion centers have enhanced accessibility and improved patient outcomes.

Challenges

Challenges Hindering the Adoption and Expansion of Hypercalcemia Treatment

Obstacles Hindering Adoption and Progression of Hypercalcemia Treatment Dynamic therapies for hypercalcemia have many constraints that limit their wider access and effectiveness. Probably the most glaring is the cost of biologic drugs that make treatment beyond reach and unaffordable for many patients, particularly in poorer regions.

Further, even if patients see medical facilities in developed countries, the limited awareness of and exposure in some poorer-developed countries result in underdiagnosis and delay in treatment, leading to worsening disease.

The multidisciplinary nature of hypercalcemia necessitates coordination between nephrologists, endocrinologists, and oncologists regarding treatment. Adherence to long-term therapies continues to be a challenge, especially in the case of chronic patients requiring pharmacological help and lifestyle changes.

Variability across reimbursement policies and regulatory restrictions also cripple the delivery of newer and more efficient treatments to patients. Therefore, organizations in both health care provision and pharmaceutical manufacturing must start realizing cost-effective measures, patient education, and regulatory harmony to improve treatment accessibility across the globe.

Opportunities

Advancing Hypercalcemia Treatment: Development of Long-Acting Drug Formulations And Novel Combination Therapies

Calcimimetics' and monoclonal antibodies' growth potential as a treatment of hypercalcemia is one of the biggest market opportunities. Increasing adherence to treatment, which comes down to enhanced patient outcomes, can be achieved through the formation of new extended-release drug preparations and combination products.

In parallel, the ongoing advancements in AI-based diagnostics and predictive analytics applied in nephrology and endocrinology will fulfil the promise of early disease detection and personally tailored treatments. Moreover, continuing digitalization of health platforms and monitoring patients remotely regarding metabolic disorders will drive much-engagement and adherence in treatment.

At the same time, increased investment in drug discovery for non-invasive approaches and better calcium-lowering agents in the pharmaceutical research avenues will increase the market growth.

Trends

Emergence of Targeted and Personalized Therapies for Hypercalcemia

Precision medicine, genetic-based calcium control, and patient-tailored treatment regimens determine the horizon of hypercalcemia treatment and present new options for the application of more efficient and targeted interventions. Personalized medicine is already one of the leading trends due to the capability to tailor therapy on the basis of genetic and metabolic characteristics to provide improved efficacy and safety.

Increased accessibility also follows from increasing availability of biosimilars, which represent cheaper substitutes to expensive biologics The emergence of strategic alliances between pharmaceutical companies and research institutions is expected to generate new advances in the therapeutic pipeline and thereby guarantee the continuous progress of hypercalcemia treatments.

The evolving market will require every partner in the field to focus on drug compliance with regulations, affordability, and patient-centric care models in order to satisfy the differing emerging needs of patients worldwide.

Progress in Calcimimetic and Monoclonal Antibody Therapies

Emerging Issues in Calcimimetic and Monoclonal Antibody Therapies: Increasing application of calcimimetics in the regulation of calcium levels in addition to monoclonal antibodies targeting pathways of parathyroid hormones offers enhanced efficacy of treatment and improves patient outcomes.

Increased growth in Biosimilars and Generic Alternatives is increasing availability and accessibility of treatment in price-sensitive markets with increased absorption rates of all biosimilar calcitonins and bisphosphonates. These reforms in reimbursement medications largely aim at improving the awareness of chronic diseases' outcomes and at endorsement of research for new approaches of hypercalcemia treatment in patients.

In summary, hypercalcemia treatment will continue to grow because of technological innovations, a growing interest in personalized solutions for patient care, and efforts to increase treatment accessibility for varied populations. However, industry players must remain adaptable to changes brought by varying regulations, continue investing in research and development to meet the changing needs of patients worldwide, and continue adapting to various regulations.

Market Outlook

The growth thrust of the USA hypercalcemia treatment market is innovation in therapies and increased access to care for patients, prompted by pharmaceutical companies and healthcare providers. As the number of people diagnosed with hypercalcemia increases occasioned by various hypercalcemia-associated conditions, including cancer-induced hypercalcemia and primary hyperparathyroidism, there is a corresponding increase caused by the demand for effective treatment solutions among patients.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

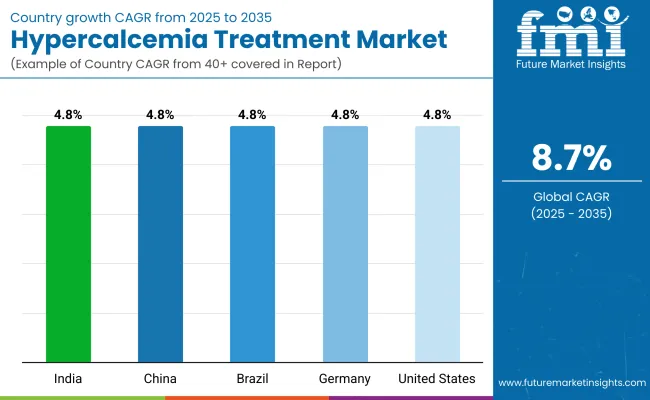

| United States | 4.8% |

Market Outlook

The hypercalcemia treatment market in India is poised for growth as enhanced healthcare infrastructures drive more patient demand for better treatments. Most patients will have access to timely and effective treatments as more awareness of and advancement in medical technology goes hand in hand with the growing access to specialized care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.8% |

Market Outlook The hypercalcemia treatment market in China is rushing ahead with demand spurred by a large patient population and an expanding healthcare sector for better treatments. As the medical technology is improving, investments in healthcare increase, and access to specialized care are improving, so an increasing number of patients are getting the benefit of efficacious therapies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

Market Outlook Germany's hypercalcemia treatment market is steadily expanding due to its strong healthcare system and highly aware patients. With the medical system in place, the availability of specialized care is extensive and so is the early diagnosis, meaning that patients are treated effectively and efficiently.

Another factor aiding the growth of the hypercalcemia therapies market is the active research and innovations ongoing in the therapy field, with a good reimbursement policy for the offered treatments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.8% |

Market Outlook High investments in healthcare mean better availability of advanced treatments for patients, thus leading to the expansion of Brazil's market for hypercalcemia treatment. The rising number of hypercalcemia cases has also prompted an increasing number of patients to seek an early diagnosis and treatment. Further, government measures to upgrade healthcare infrastructure and make treatments affordable have made them accessible, thus acting as a further driver of market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.8% |

The market for treating hypercalcemia is very competitive as it grows with an increase in the prevalence of hypercalcemia conditions like cancer-related hypercalcemia and primary hyperparathyroidism. Firms are developing new calcimimetics, bisphosphonates, and monoclonal antibodies to retain a competitive position. The market is influenced by established pharmaceutical players, biotech pioneers, and new drug makers, which continue to change the dynamics of hypercalcemia treatment options.

Amgen Inc.

which has a leading position in the hypercalcemia treatment market and has Xgeva and Prolia, both of which deal with calcium imbalances, is further bolstered in oncology and osteoporosis patients.

Considered a significant player in metabolic disorders, Novartis has introduced Sensipar, a prominent calcimimetic for managing hypercalcemia in parathyroid conditions.

Teva Pharmaceutical Industries Ltd.

It is a very important innovator in terms of bisphosphonate treatments, but will continue to provide biomedical treatment for hypercalcemia management.

Besides, it is also one of those strong competitors in endocrinology, with making several new medicines for calcium metabolism diseases.

F. Hoffmann-La Roche Ltd.

Thus, Sanofi, an increasing player in calcium regulation therapies, is focusing on developing RANK ligand inhibitors coupled with biologics for the treatment of hypercalcemia.

Beyond Key Players

These Companies have Other Different Major Players in the Market.

Bisphosphonates (Clodronate, Etidronate, Ibandronate, Pamidronate and Zoledronic Acid) Calcitonin, Glucocorticoids, Denosumab, Calcimimetics

Hospitals, Clinics and Independent Pharmacy & Drug Stores

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Hypercalcemia Treatment Market was USD 22,640.2 million in 2025.

The Hypercalcemia Treatment Market is expected to reach USD 52,303.9 million in 2035.

Rising Prevalence of Cancer-Related Hypercalcemia has significantly increased the demand for Hypercalcemia Treatment Market.

The top key players that drives the development of Hypercalcemia Treatment Market are Amgen Inc., Novartis AG, Teva Pharmaceutical Industries Ltd., Pfizer Inc. and F. Hoffmann-La Roche Ltd.

Stem Cell Therapy is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA