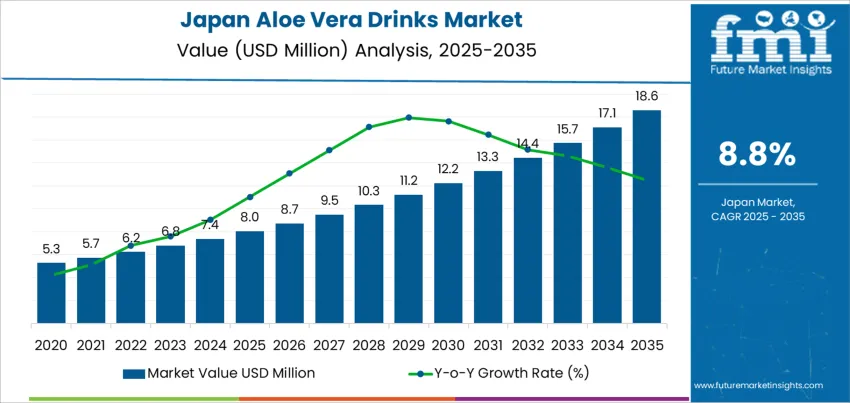

The demand for aloe vera drinks in Japan is expected to grow from USD 8.0 million in 2025 to USD 18.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.8%. Aloe vera drinks, known for their numerous health benefits, including digestion improvement, immunity boosting, and hydration, are becoming increasingly popular among health-conscious consumers. As more individuals seek natural alternatives to sugary sodas and artificial beverages, aloe vera drinks have gained prominence due to their refreshing taste and functional wellness benefits. The rising awareness of aloe vera’s nutritional value will continue to drive its popularity, positioning it as a key product in the functional beverage sector.

The availability of aloe vera drinks in supermarkets, health food stores, and online platforms will expand, making them more accessible to a growing number of health-conscious consumers. As consumer awareness about the benefits of aloe vera continues to spread, the demand for aloe vera drinks in Japan will continue to grow. Innovations in packaging, such as eco-friendly and sustainable options, will further support this industry expansion. With increasing demand for natural, functional, and plant-based beverages, aloe vera drinks will remain a prominent choice for consumers in Japan throughout the forecast period.

From 2025 to 2030, demand for aloe vera drinks is expected to grow from USD 8.0 million to USD 12.2 million, adding USD 4.2 million in value. This phase of growth will be primarily driven by the increasing consumer shift towards plant-based, clean-label, and functional drinks. Health-conscious individuals, particularly those looking for alternatives to traditional sugary drinks, will drive the adoption of aloe vera drinks. The growing focus on natural ingredients and the increasing consumer interest in digestive health, immunity, and hydration will further fuel demand. Product innovation, such as new flavors, sugar-free options, and functional ingredients, will help expand the appeal of aloe vera drinks, attracting a broader audience.

From 2030 to 2035, demand will continue to rise from USD 12.2 million to USD 18.6 million, contributing USD 6.4 million in value. During this period, demand will be supported by the continued trend toward healthier beverage options, driven by the increasing awareness of the importance of overall wellness and healthy living. Aloe vera drinks, which are marketed as natural and functional, will continue to appeal to consumers who prioritize their health and seek plant-based, nutritious beverages. As the industry for clean-label and sustainable products grows, aloe vera drinks will increasingly meet these demands, further promoting their use among a wider range of consumers.

| Metric | Value |

|---|---|

| Demand for Aloe Vera Drinks in Japan Value (2025) | USD 8.0 million |

| Demand for Aloe Vera Drinks in Japan Forecast Value (2035) | USD 18.6 million |

| Demand for Aloe Vera Drinks in Japan Forecast CAGR (2025-2035) | 8.8% |

The demand for aloe vera drinks in Japan is growing due to the increasing focus on health and wellness among consumers. Aloe vera drinks, known for their hydrating and digestive health benefits, are becoming a popular alternative to traditional sugary beverages. As consumers in Japan become more health-conscious, particularly with a growing interest in functional beverages, aloe vera drinks are gaining popularity as a natural, refreshing option that promotes digestive health and skin hydration.

A major driver of this growth is the rising awareness of the health benefits of aloe vera, which includes supporting hydration, boosting immunity, and aiding digestion. With an increasing focus on natural ingredients and wellness, more Japanese consumers are turning to aloe vera-based products as part of their daily routines. Aloe vera drinks are often marketed as low-calorie, antioxidant-rich beverages, making them an attractive option for health-conscious individuals.

The growing trend of clean-label products, where consumers are seeking products with minimal additives, is contributing to the rise in demand for aloe vera drinks. As more consumers prioritize products with fewer artificial ingredients and preservatives, aloe vera drinks are becoming a popular choice. The expanding availability of aloe vera drinks in both retail and online channels is also making these beverages more accessible to a wider audience. As these trends continue, the demand for aloe vera drinks in Japan is expected to continue growing through 2035.

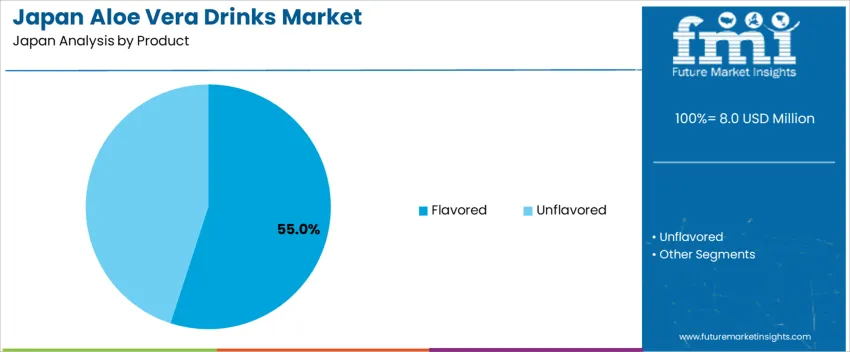

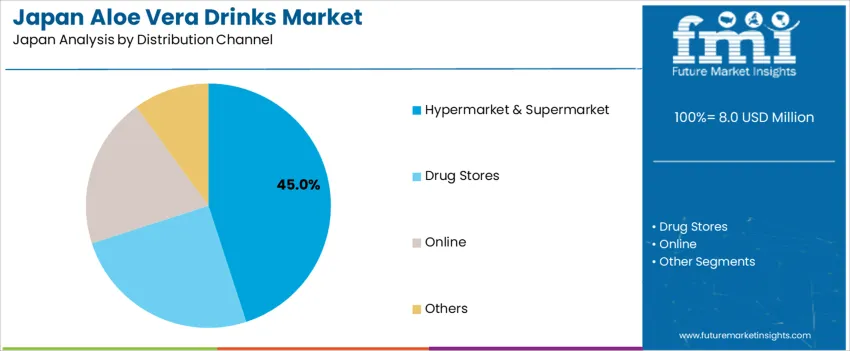

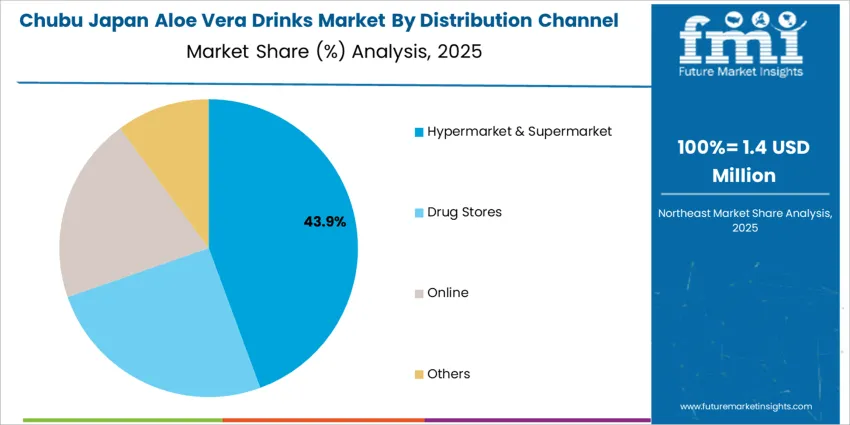

Demand for aloe vera drinks in Japan is segmented by product type, distribution channel, and region. By product type, demand is divided into flavored and unflavored aloe vera drinks, with flavored aloe vera drinks leading at 55%. The demand is also segmented by distribution channel, including hypermarkets & supermarkets, drug stores, online, and others, with hypermarkets & supermarkets accounting for 45%. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the rest of Japan.

Why Do Flavored Aloe Vera Drinks Lead the Demand in Japan?

Flavored aloe vera drinks account for 55% of the demand in Japan, driven by their refreshing taste and wide appeal. Flavored options, often infused with fruit juices and other natural ingredients, make aloe vera drinks more palatable and enjoyable for consumers, especially those who may find the taste of unflavored aloe vera too strong or bitter. Flavored aloe vera drinks cater to the growing demand for healthier, natural beverages that also offer functional benefits, such as hydration and digestion support. The increasing interest in health-conscious, plant-based products and the popularity of aloe vera as a versatile wellness ingredient further drive the demand for flavored aloe vera drinks. As consumers continue to seek out healthy, convenient beverages, flavored aloe vera drinks are expected to remain the dominant choice in Japan's aloe vera drink industry.

Why Do Hypermarkets & Supermarkets Lead the Demand for Aloe Vera Drinks in Japan?

Hypermarkets & supermarkets account for 45% of the demand for aloe vera drinks in Japan, driven by their broad selection, convenience, and accessibility. These retail outlets offer a variety of aloe vera drink options in one location, making it easier for consumers to compare different brands, flavors, and sizes. The popularity of health-oriented and functional beverages in Japan has led to the increased availability of aloe vera drinks in these stores. Supermarkets and hypermarkets are often the first place consumers turn to when purchasing aloe vera drinks, as they combine a wide range of products with the convenience of one-stop shopping. The presence of aloe vera drinks in major retail chains, alongside other health-focused beverages, ensures continued demand, as consumers seek both convenience and variety in their beverage choices. Hypermarkets and supermarkets remain the dominant distribution channel in Japan for aloe vera drinks.

Aloe vera drinks are perceived as natural alternatives to sugary sodas, offering benefits like hydration and digestive support. The increasing focus on wellness and plant-based diets drives consumer interest in products that promote health and wellness. Aloe vera’s ability to offer antioxidants and support digestion has made it popular among health-conscious consumers. The trend towards clean-label and less-processed drinks is fueling demand. Challenges such as the high cost of production, due to the complex processing and raw material requirements, limit affordability. Supply chain issues, especially those related to sourcing high-quality aloe vera, also create barriers.

Why is Demand for Aloe Vera Drinks Growing in Japan?

The demand for aloe vera drinks is rising in Japan due to the growing consumer focus on health and wellness. Aloe vera is marketed as a natural, functional beverage with various health benefits, including digestive aid and hydration. These attributes appeal to consumers seeking alternatives to sugary or artificially flavored drinks. As Japan's population becomes more health-conscious, the popularity of functional beverages like aloe vera drinks has grown. The trend toward plant-based products is also contributing to this increase in demand. Aloe vera drinks are considered a clean-label option, as they are perceived to be free from artificial ingredients, attracting consumers seeking healthier, minimally processed options. The rise of convenience-oriented shopping through supermarkets, convenience stores, and online platforms has made aloe vera drinks more accessible to a broader audience. These factors combined have helped fuel sustained growth in the demand for aloe vera drinks in Japan.

How are Technological & Industry Innovations Driving Demand for Aloe Vera Drinks in Japan?

Technological innovations are significantly enhancing the appeal of aloe vera drinks in Japan. Advances in extraction methods have improved the efficiency and quality of aloe vera juice, enhancing its taste and nutritional value. The development of better packaging technologies has increased the shelf-life of aloe vera drinks, making them more convenient for consumers and easier to distribute across long distances. Producers are also diversifying their product offerings, introducing flavored aloe vera drinks and combining aloe vera with other functional ingredients like coconut water or vitamins, further broadening their appeal. Technological improvements in processing have allowed for better preservation of aloe vera’s beneficial properties, helping it reach a larger industry. As consumer demand for health-conscious beverages rises, these innovations have made aloe vera drinks more attractive to a wider range of consumers.

What are the Key Challenges and Risks That Could Limit Aloe Vera Drink Demand in Japan?

One of the primary obstacles is the higher cost of production, which makes aloe vera drinks more expensive than conventional beverages. The price point may limit their appeal, especially among price-sensitive consumers. The raw material for aloe vera drinks relies heavily on imported aloe vera, which can create supply chain issues and result in fluctuations in product availability. These challenges could affect both the consistency of the product and the overall industry supply. The industry faces intense competition from other functional beverages, such as plant-based drinks, herbal teas, and even traditional Japanese beverages, which may limit the potential for aloe vera drinks to capture a larger share of the industry. Consumer skepticism about health claims and unfamiliarity with the product also presents a challenge.

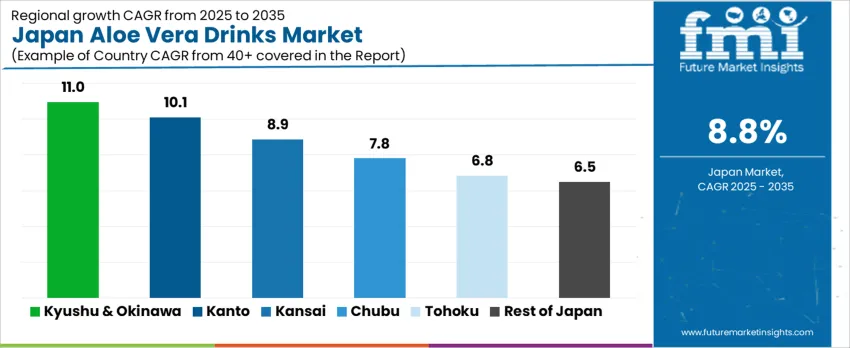

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 11.0% |

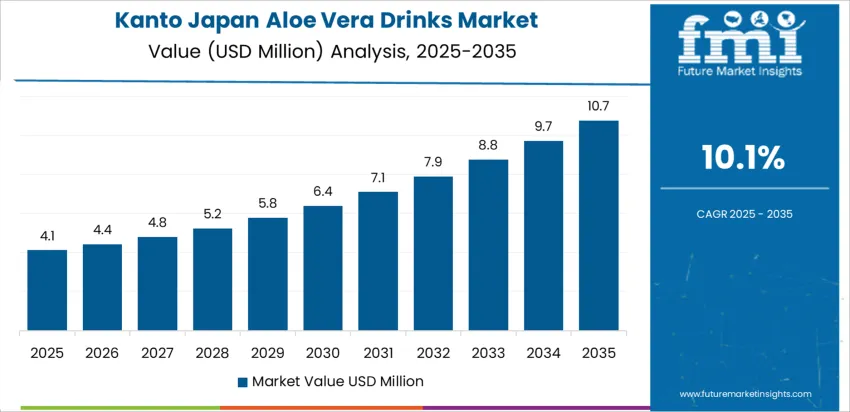

| Kanto | 10.1% |

| Kansai | 8.9% |

| Chubu | 7.8% |

| Tohoku | 6.8% |

| Rest of Japan | 6.5% |

Demand for aloe vera drinks in Japan is growing steadily, with Kyushu & Okinawa leading at an 11.0% CAGR, driven by the region’s warm climate and rising health-consciousness. Kanto follows with a 10.1% CAGR, fueled by urban demand for health-focused beverages. Kansai shows an 8.9% CAGR, supported by its growing focus on wellness and plant-based alternatives. Chubu experiences a 7.8% CAGR, with steady growth driven by increasing awareness of the benefits of aloe vera drinks. Tohoku and the Rest of Japan see moderate growth at 6.8% and 6.5%, respectively, reflecting broader consumer trends toward healthier living. As the trend toward functional beverages continues to rise, aloe vera drinks will see continued growth across Japan.

Kyushu & Okinawa leads the demand for aloe vera drinks, growing at an 11.0% CAGR. The region’s warm climate, particularly in Okinawa, plays a key role in driving the popularity of refreshing drinks like aloe vera beverages. Health-conscious consumers increasingly seek natural, hydrating drinks with additional benefits, such as digestive and immune system support. Aloe vera drinks are highly favored for their wellness benefits, which resonate with the region’s rising focus on health. The vibrant tourism industry in Okinawa boosts demand, as visitors seek local products like aloe vera drinks. The region’s preference for plant-based and natural beverages further supports this trend. With the growing wellness movement and health-focused lifestyle, demand for aloe vera drinks in Kyushu & Okinawa is expected to remain strong, particularly as consumers continue to prioritize functional beverages that offer both refreshment and health benefits.

Kanto is experiencing steady demand for aloe vera drinks, with a 10.1% CAGR. The region’s large urban population, particularly in Tokyo, is a significant driver of this trend. Consumers are increasingly focused on health and wellness, seeking beverages that provide hydration and added health benefits, such as improved digestion and immune support. Aloe vera drinks, known for these benefits, are becoming increasingly popular among health-conscious individuals. Kanto’s growing focus on plant-based and natural products has also contributed to the demand for aloe vera drinks, which align with these preferences. The increasing availability of aloe vera drinks in supermarkets, convenience stores, and cafes has made them more accessible to a wider audience. As more consumers prioritize functional beverages that support overall well-being, demand for aloe vera drinks in Kanto is expected to continue its steady rise, driven by urban health trends and consumer preferences for natural, wellness-focused products.

Kansai is seeing steady demand for aloe vera drinks, growing at an 8.9% CAGR. The region’s health-conscious population, particularly in cities like Osaka and Kyoto, is increasingly seeking natural, functional beverages that align with wellness trends. Aloe vera drinks, known for their digestive and hydration benefits, are becoming a popular choice among consumers who prioritize health. Kansai’s active lifestyle and rising awareness of the importance of nutrition and hydration are key factors contributing to the demand for aloe vera drinks. The growing availability of these drinks in retail outlets such as supermarkets and health food stores makes them easily accessible. As more people in Kansai embrace healthy lifestyles and move towards natural alternatives to sugary beverages, the demand for aloe vera drinks is expected to continue growing steadily, supported by the region’s focus on wellness and sustainable living.

Chubu is experiencing steady demand for aloe vera drinks, with a 7.8% CAGR. The region’s growing interest in health and wellness, coupled with increasing awareness of the benefits of plant-based and functional products, is driving the rise in demand for aloe vera drinks. Consumers in Chubu are increasingly turning to healthier beverage alternatives, and aloe vera drinks, known for their skin health, digestive, and hydrating properties, are gaining traction. The region’s growing retail presence, including supermarkets and convenience stores, has made aloe vera drinks more accessible. As consumers continue to prioritize health and sustainability, the demand for aloe vera drinks in Chubu is expected to rise steadily. The increasing focus on eco-friendly, natural products aligns with the region’s health-conscious lifestyle, and as awareness of the benefits of aloe vera grows, its popularity is likely to continue to expand in this region.

Tohoku is seeing moderate demand for aloe vera drinks, with a 6.8% CAGR. While the region's industry for aloe vera drinks is smaller compared to more urbanized areas, there is steady growth as consumer preferences shift toward healthier beverage options. Tohoku’s consumers are becoming more aware of the health benefits of aloe vera, including its digestive and immune-boosting properties. The rising focus on wellness and functional foods in Tohoku, coupled with increasing access to health-conscious beverages, is driving demand. As more consumers in rural areas adopt healthier lifestyles, aloe vera drinks are becoming a popular choice for hydration and wellness. While growth is slower compared to urban regions, Tohoku’s increasing interest in natural products and functional beverages ensures steady demand for aloe vera drinks. The region’s growing focus on self-care and wellness will likely continue to support this upward trend.

The Rest of Japan is experiencing steady demand for aloe vera drinks, growing at a 6.5% CAGR. While demand is smaller compared to major urban regions, there is consistent growth as awareness of health and wellness continues to rise across these areas. Consumers are becoming more interested in natural and functional beverages, and aloe vera drinks, with their benefits for digestion, hydration, and skin health, are gaining popularity. Access to health-conscious beverages in rural and suburban areas is improving, making aloe vera drinks more widely available. As people in the Rest of Japan embrace healthier living trends and focus on wellness, demand for aloe vera drinks will continue to rise steadily. The growing awareness of functional food products and the increasing availability of aloe vera drinks in retail outlets further support this gradual but consistent demand across rural and suburban regions.

The demand for aloe vera drinks in Japan is steadily increasing, driven by growing consumer interest in natural and functional beverages that offer a range of health benefits. Aloe vera is well-known for its digestive, skin, and overall wellness benefits, making it a popular ingredient in health-focused drinks. With Japan's strong emphasis on longevity and health, aloe vera drinks are becoming a common choice among consumers looking to support their well-being with plant-based and natural products. The increasing focus on hydration and functional beverages that offer additional health benefits is helping to drive the industry's growth, as aloe vera drinks are seen as a refreshing and health-promoting option.

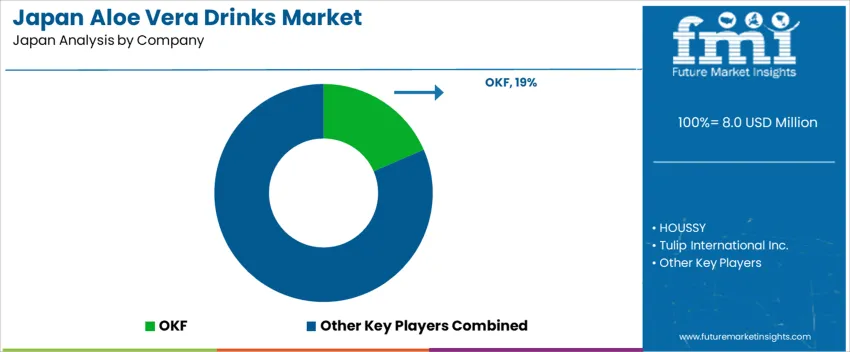

Key players shaping the aloe vera drinks industry in Japan include OKF, HOUSSY, Tulip International Inc., LOTTE, and Forever Living.com, LLC. OKF leads the industry with an impressive 18.5% share, thanks to its extensive range of aloe vera-based drinks that cater to diverse consumer preferences. These companies focus on developing high-quality, flavorful beverages that combine aloe vera with other functional ingredients to enhance the overall health benefits. Through strong marketing strategies and widespread distribution networks, they continue to capture the attention of health-conscious consumers in Japan.

The growth of the aloe vera drinks industry is also supported by increasing consumer awareness of the importance of wellness and healthy lifestyles. As interest in plant-based products and functional beverages grows, aloe vera drinks are positioned to thrive in this evolving industry. Consumers are looking for beverages that not only taste good but also provide tangible health benefits, making aloe vera a key ingredient in the expanding category of functional drinks. As the demand for natural health products rises, the aloe vera drinks industry is expected to experience continued growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Flavored, Unflavored |

| Distribution Channel | Hypermarket & Supermarket, Drug Stores, Online, Others |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | OKF, HOUSSY, Tulip International Inc., LOTTE, Forever Living.com, LLC |

| Additional Attributes | Dollar sales by product type and distribution channel; regional CAGR and growth outlook for aloe vera drinks; market penetration of online vs offline channels; consumer preference for flavored vs unflavored drinks; emerging trends in health-conscious consumption; regulatory compliance for beverage products in Japan. |

The demand for aloe vera drinks in Japan is estimated to be valued at USD 8.0 million in 2025.

The market size for the aloe vera drinks in Japan is projected to reach USD 18.6 million by 2035.

The demand for aloe vera drinks in Japan is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in aloe vera drinks in Japan are flavored and unflavored.

In terms of distribution channel, hypermarket & supermarket segment is expected to command 45.0% share in the aloe vera drinks in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Aloe Vera Extracts Market Size, Growth, and Forecast for 2025 to 2035

Competitive Landscape of Aloe Vera Gel Providers

Aloe Vera Gel Market Demand & Insights 2024 to 2034

Fusion Beverages in Japan Market Analysis – Size, Share & Growth 2025-2035

Resveratrol Industry Analysis in Japan Growth, Trends and Forecast from 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA