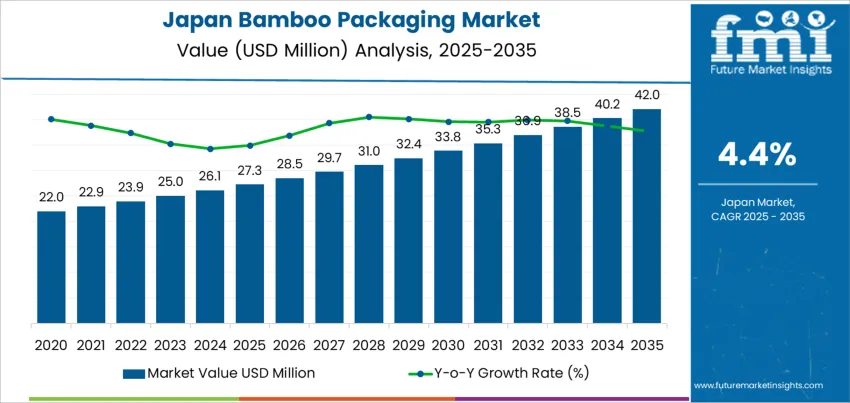

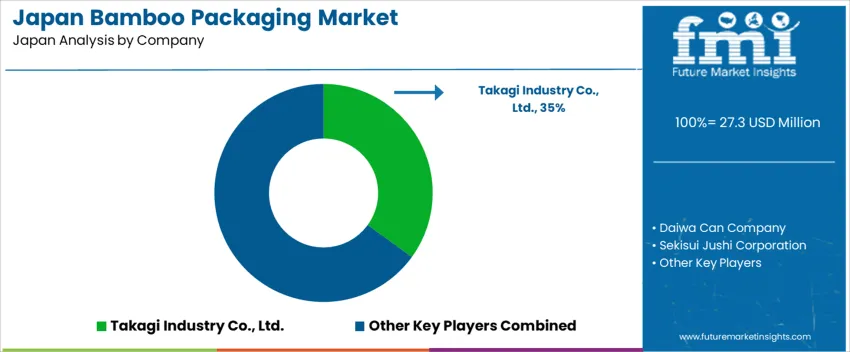

The Japan bamboo packaging demand is valued at USD 27.3 million in 2025 and is forecasted to reach USD 42.0 million by 2035, recording a CAGR of 4.4%. Demand is driven by increased focus on sustainable packaging solutions, reduced reliance on plastic materials, and growing adoption of biodegradable food and consumer-goods packaging. Government-led waste-reduction initiatives and stronger environmental criteria in procurement standards also contribute to rising utilization. Virgin pulp remains the leading pulp type due to its strength characteristics, suitability for direct food-contact applications, and ease of conversion into rigid and semi-rigid formats. Packaging producers continue to explore hybrid structures that combine bamboo fibres with paper materials to optimize durability, shelf life, and printing performance.

Kyushu & Okinawa, Kanto, and Kansai show strong adoption linked to established food processing clusters, retail distribution centers, and sustainability-focused consumer segments. Urban hospitality businesses and premium food brands are integrating bamboo-based trays, containers, and wraps into eco-friendly packaging portfolios. Key suppliers include Takagi Industry Co., Ltd., Daiwa Can Company, Sekisui Jushi Corporation, Maruai Co., Ltd., and Kyoshin Co., Ltd. Their development focus includes improved fibre processing, increased recyclability, and scalable production technologies aligned with consumer-goods and food-service applications.

Demand for bamboo packaging in Japan remains below saturation and is still transitioning from niche adoption to broader commercial usage. Early growth stems from sustainability initiatives across foodservice providers, personal care brands, and retailers seeking reduced plastic dependency. These sectors form the primary adoption base, but current market penetration remains selective rather than universal.

Saturation pressure appears where cost sensitivity influences packaging decisions. Bamboo formats typically carry higher unit costs than plastic or paper alternatives, limiting widespread conversion. Functional constraints such as moisture resistance and printability also slow mass adoption in high-volume fast-moving goods. As a result, product rollout is paced by brand positioning and environmental messaging rather than compulsory regulation.

The saturation trajectory reflects a long-term pathway. While environmental awareness prevents stagnation, full penetration levels remain distant due to price and performance considerations. Growth continues with moderate velocity as technological refinements and material-hybrid designs improve usability. The category’s progress depends on balancing sustainability objectives with supply-chain economics, suggesting a steady but non-saturated future in Japan’s packaging portfolio.

| Metric | Value |

|---|---|

| Japan Bamboo Packaging Sales Value (2025) | USD 27.3 million |

| Japan Bamboo Packaging Forecast Value (2035) | USD 42.0 million |

| Japan Bamboo Packaging Forecast CAGR (2025-2035) | 4.4% |

Demand for bamboo packaging in Japan is increasing because brand owners and retailers seek sustainable materials that reduce dependence on petroleum based plastics while maintaining product protection and visual appeal. Bamboo is viewed positively due to its fast growth, renewability and alignment with traditional Japanese appreciation for natural materials. Foodservice operators and convenience stores adopt bamboo trays, cutlery and containers to support waste reduction targets and respond to consumer interest in ecofriendly dining options. Personal care and gift product manufacturers use bamboo packaging to differentiate premium lines and enhance tactile presentation in department stores and specialty shops.

Growth in e commerce packaging encourages adoption of strong and lightweight protective components made from bamboo fiber that withstand shipping conditions. Municipal initiatives promoting circular economy practices reinforce procurement decisions in both public and private sectors. Constraints include higher production and import costs compared with standard pulp or plastic packaging, as well as limited domestic processing capacity that may restrict large scale supply. Moisture sensitivity in some applications requires coating or liners, which can affect recyclability if materials are mixed. Smaller retailers may introduce bamboo packaging selectively until long term demand stability is confirmed.

Demand for bamboo packaging in Japan is increasing due to sustainability commitments, reduced reliance on plastic, and supportive waste-management regulations. Bamboo is valued for rapid renewability, lightweight strength, and a clean aesthetic that supports premium positioning. Adoption grows across retail and foodservice categories emphasizing eco-friendly branding. Manufacturers invest in biodegradable coatings and improved molding technology to expand compatibility with both dry and liquid products. Growth is reinforced by rising consumer awareness of environmentally responsible packaging and preference for products aligned with circular economy goals.

Virgin pulp accounts for 58.0%, driven by higher durability, smoother surface finish, and strong acceptance in premium food, beverage, and cosmetic applications where product safety, hygiene, and contamination control remain critical. Virgin fibers also enable precise molding of structural packaging such as trays and takeaway containers. Recycled pulp represents 42.0%, advancing due to sustainability incentives and Japan’s strong fiber recovery infrastructure. However, quality consistency and mechanical strength limitations restrict its use in packaging requiring waterproofing or enhanced shelf presence. Product selection reflects Japan’s balance between sustainability targets and the functional requirements of high-quality consumer packaged goods across food retail, beauty, and e-commerce distribution.

Key Points:

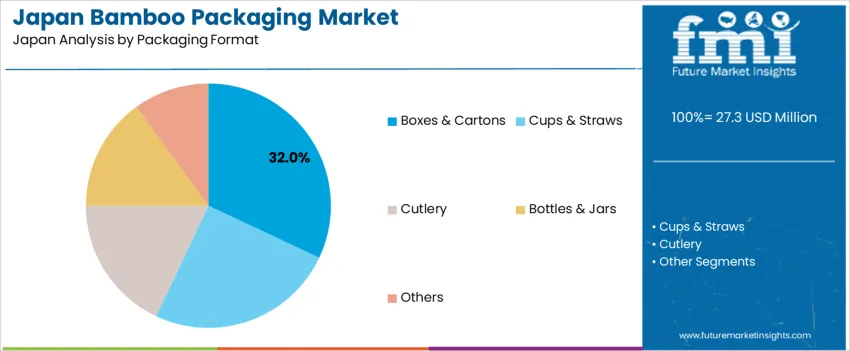

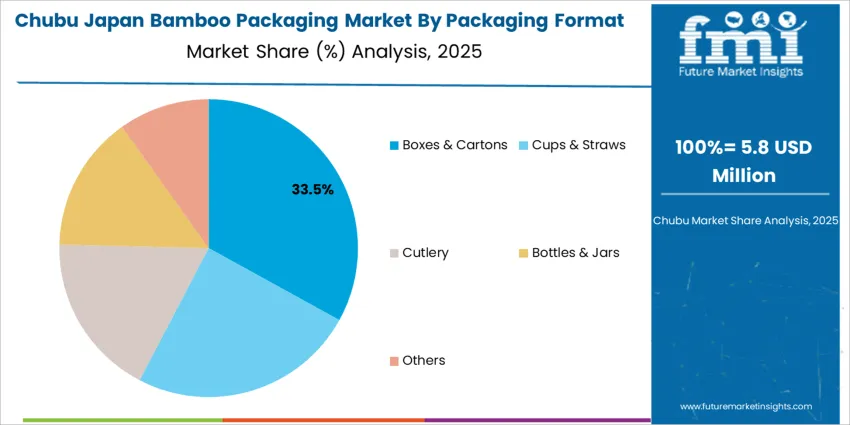

Boxes and cartons hold 32.0%, supported by wide applicability in retail-ready food packaging, takeaway meals, and subscription delivery models. Cups and straws represent 25.0%, benefiting from restrictions on single-use plastics and demand in cafés and quick-service restaurants. Cutlery holds 18.0%, especially in convenience meal solutions as reusable alternatives increase. Bottles and jars represent 15.0%, emerging slowly due to higher cost and structural complexity. Other formats account for 10.0%, including wraps and blister replacements used in niche FMCG categories. Format selection follows Japanese consumer emphasis on biodegradable packaging, compact storage, and modern minimalist branding.

Key Points:

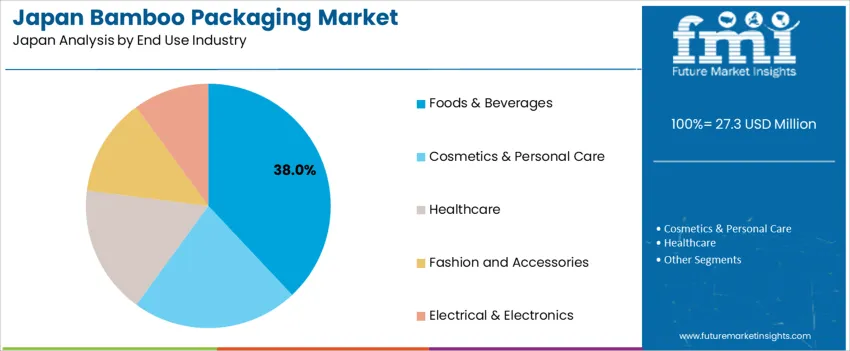

Foods and beverages account for 38.0%, driven by takeaway meal expansion, bento consumption culture, and sustainability expectations in foodservice chains. Cosmetics and personal care represent 22.0%, where bamboo enhances natural brand positioning and shelf visibility. Healthcare holds 17.0%, using bamboo trays and sterile-ready packaging in select categories. The fashion and accessories segment accounts for 13.0%, driven by branded eco-gifting and protective inserts. Electrical and electronics represent 10.0%, applying bamboo molded parts as a recyclable alternative to plastic cushioning. End-use patterns reflect Japan’s shift toward reducing polymer waste, especially in fast-moving consumer categories.

Key Points:

Expansion of plastic waste reduction initiatives, increased interest in natural materials and rising demand for premium sustainable packaging are driving demand.

In Japan, bamboo packaging adoption rises as national and municipal programs encourage reduced dependence on single-use plastics in food service and retail. Convenience stores and supermarkets explore bamboo trays and containers for fresh produce and ready meals to align with recycling and composting goals. Gift-oriented food producers and confectionery brands use bamboo packaging to enhance presentation for seasonal events such as New Year and mid-year gifting, supporting strong demand for well-crafted premium formats. Manufacturers highlight bamboo’s domestic cultural connection and rapid resource renewal, gaining approval from consumers who favor eco-aligned purchasing. Regional tourism markets also adopt bamboo-based cutlery and take-out packaging for cafes and traditional food stalls, contributing to niche but visible deployment.

Higher material and processing costs, limited standardization for food safety compliance and slower adoption among cost-sensitive operators restrain demand.

Bamboo packaging often requires specialized forming and coating processes that raise unit costs compared with lightweight plastics or paperboard. Food safety regulations require validated barrier treatments to prevent moisture absorption, adding testing expenses for producers. Smaller restaurants and bento suppliers focus on low-cost packaging to support daily high-volume sales, making premium bamboo solutions less accessible. Disposal practices vary across municipalities, leading to uncertainty among consumers about how to sort bamboo items in household waste streams. These factors create measured uptake across large-scale retail networks.

Shift toward hybrid paper-bamboo structures, increased demand in convenience food categories and rising collaboration with domestic craft producers define key trends.

Producers are developing hybrid packaging that combines bamboo fibers with recyclable paper to improve functional strength while reducing plastic content. Convenience-food chains are testing bamboo lids and trays for ready meals consumed during commuting, supporting durable performance in thermal environments. Collaboration with craft manufacturers in regions such as Kumamoto and Kyoto encourages development of visually appealing designs that highlight local identity. Hotels and ryokan are adopting bamboo amenities to improve sustainability credentials for inbound tourists. These trends indicate gradual but culturally aligned growth for bamboo packaging within Japan’s premium and eco-focused sectors.

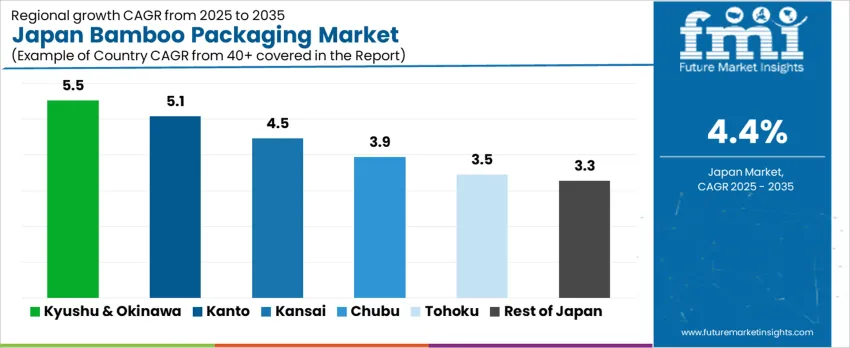

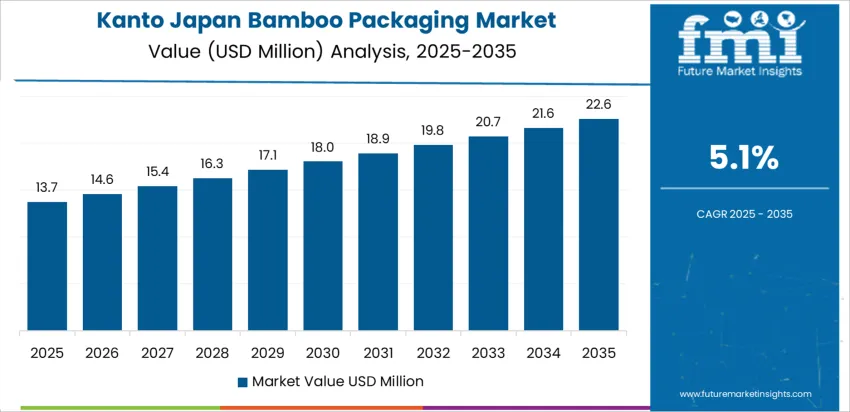

Demand for bamboo packaging in Japan reflects transitions toward recyclable materials in food service, personal-care goods, and gift-oriented retail. Growth depends on regional availability of sustainable packaging initiatives, logistics coverage for specialty materials, and tourism-linked sales. Kyushu & Okinawa lead at 5.5% CAGR, followed by Kanto (5.1%), Kansai (4.5%), Chubu (3.9%), Tohoku (3.5%), and the Rest of Japan (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.5% |

| Kanto | 5.1% |

| Kansai | 4.5% |

| Chubu | 3.9% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

Kyushu & Okinawa reach 5.5% CAGR driven by sustainable dining operations, artisanal souvenir markets, and distribution ties with bamboo-growing areas. Food stalls and casual dining venues adopt bamboo trays and cutlery to reduce plastic dependency while meeting waste-sorting expectations across urban centers such as Fukuoka. Tourism exposure remains strong throughout Okinawa, enabling packaged souvenirs like confectionery boxes and premium beverage sets that incorporate bamboo-based wrapping. Retailers evaluate packaging durability in humid coastal environments where moisture resistance ensures maintained form. SMEs favor reliable procurement cycles with regional supply partners capable of consistent sizing and strength. Local governments promote green packaging within public venues, encouraging procurement alignment across vendors. Seasonal festivals expand high-volume use for takeaway food items.

Kanto posts 5.1% CAGR enabled by Tokyo’s retail density and growing sustainability messaging in convenience and supermarket categories. Food brands diversify packaging for ready-to-eat meals aligned with waste-reduction policies in transit-heavy areas. Personal-care companies introduce bamboo packaging for select premium SKUs intended for aesthetics and recyclability. E-commerce fulfillment centers evaluate protective bamboo-based cushioning solutions for fragile goods. Buyers track performance across automated filling lines to ensure compatibility with existing sealing formats. Retailers highlight eco-packaging in end-caps to encourage trial adoption.

Kansai records 4.5% CAGR linked to dining culture, gift shopping in Kyoto tourist areas, and active packaging substitution trials in Osaka distribution channels. Bamboo packaging appeals to consumers seeking traditional aesthetic alignment in confectionery and craft goods. Restaurants adopt sturdy bamboo trays for dine-in and short-distance takeaway. Vendors evaluate material consistency for smooth stacking and efficient storage. Universities and corporate campuses increase purchasing for catered events using lower-impact tableware. Local logistics partners maintain cold-chain compliance for food items packaged in bamboo when temperature fluctuations require rigidity retention.

Chubu reaches 3.9% CAGR shaped by procurement in manufacturing-supporting communities, convenience retail, and hospitality. Tourism around Nagoya boosts decorative packaging for sweets and local specialties. Retailers maintain supply for seasonal gift baskets with bamboo-based presentation value. Buyers monitor cost stability across bulk orders to align with standardized product lines. Transport through inland delivery networks requires packaging strength during vibration exposure.

Tohoku achieves 3.5% CAGR, supported by gradual integration into supermarket packaging and artisanal food products. Household shopping patterns favor affordable adoption when small premium increases are justified by recyclability. Packaging must perform under colder seasonal conditions without brittleness. Retailers expand options slowly to match consumer familiarity.

The Rest of Japan posts 3.3% CAGR with demand supported by small-format retail, traditional confectionery outlets, and environmentally conscious public venues. Packaging choices emphasize simplicity and brand recognition for consistent consumer comfort. Local distributors supply standard trays and wrappers that integrate into existing workflows without equipment change.

Demand for bamboo-based packaging in Japan reflects a fragmented supplier structure. Many domestic converters operate in food service, retail, and traditional goods channels, supplying trays, bento packaging, and small container formats. The largest share is held by Takagi Industry Co., Ltd., estimated at 30.0%, supported by consistent product quality and retail distribution in convenience and supermarket networks. The company supplies bamboo-derived disposable items with reliable supply continuity and stable performance in food handling environments.

Daiwa Can Company contributes presence through hybrid material packaging that incorporates bamboo fibers alongside paper substrates, supporting beverage and food categories requiring shape stability. Sekisui Jushi Corporation maintains participation with molded packaging solutions where durability and smooth surface finishing are required. Maruai Co., Ltd. is active in luxury-oriented secondary packaging using natural fibers, serving confectionery and gifting applications. Kyoshin Co., Ltd. supports demand in traditional craft-aligned packaging, focusing on bamboo trays and wrappers used in prepared foods.

Competition focuses on material strength, moisture resistance, and alignment with Japan’s recycling and composting specifications. Demand continues as distributors and retailers expand adoption of renewable packaging that satisfies consumer interest in reduced plastic dependency while maintaining handling reliability across cold-chain and quick-service food operations.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Pulp Type | Virgin Pulp, Recycled Pulp |

| Packaging Format | Boxes & Cartons, Cups & Straws, Cutlery, Bottles & Jars, Others |

| End Use Industry | Foods & Beverages, Cosmetics & Personal Care, Healthcare, Fashion and Accessories, Electrical & Electronics |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Takagi Industry Co., Ltd., Daiwa Can Company, Sekisui Jushi Corporation, Maruai Co., Ltd., Kyoshin Co., Ltd. |

| Additional Attributes | Dollar demand by pulp type and packaging formats; share of bamboo-based solutions as a replacement for plastics and paper; adoption trends in disposable foodservice, premium retail packaging, and sustainable e-commerce packaging; influence of Japan’s plastic waste reduction policies and circular economy initiatives; supply chain integration with bamboo cultivation and material processing; growth opportunities in compostable and biodegradable product development. |

The demand for bamboo packaging in Japan is estimated to be valued at USD 27.3 million in 2025.

The market size for the bamboo packaging in Japan is projected to reach USD 42.0 million by 2035.

The demand for bamboo packaging in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in bamboo packaging in Japan are virgin pulp and recycled pulp.

In terms of packaging format, boxes & cartons segment is expected to command 32.0% share in the bamboo packaging in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

Japan Stick Packaging Market Insights – Size, Demand & Trends 2025-2035

Japan Sachet Packaging Market Outlook – Share, Growth & Forecast 2025-2035

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Premade Pouch Packaging Industry Analysis by Material Type, Closure Type, End Use, and Region through 2025 to 2035

Japan Pharmaceutical Packaging Market Report – Demand, Growth & Innovations 2025-2035

Japan Flexible Plastic Packaging Market Report – Demand, Trends & Industry Forecast 2025-2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Demand for Bamboo Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Demand for Bamboo Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Packaging Tubes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Green Packaging Film in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Juice Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cannabis Packaging Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Molded Fiber Pulp Packaging Market Trends – Growth & Forecast 2023-2033

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA