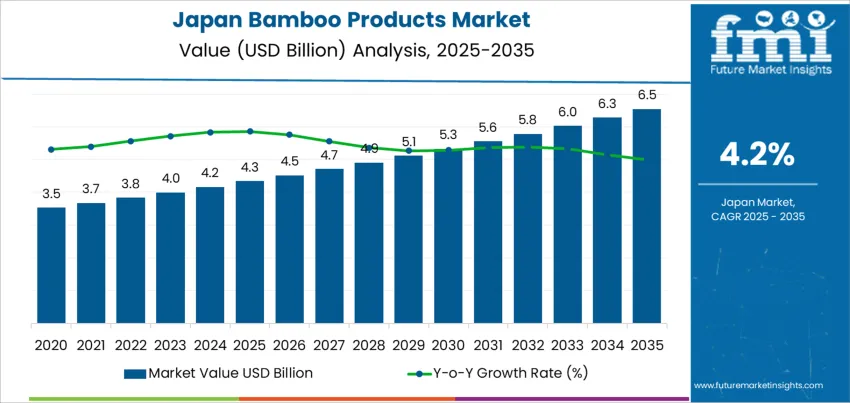

The demand for bamboo products in Japan is expected to grow from USD 4.3 billion in 2025 to USD 6.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.2%. Bamboo products, including furniture, textiles, paper, flooring, and eco-friendly items, are gaining popularity due to their sustainability, strength, and versatility. As Japan continues to embrace environmentally friendly materials and practices, the demand for bamboo products is expected to rise steadily, driven by consumer preferences for sustainable goods and the growing use of bamboo across various industries.

The market will experience consistent growth over the forecast period, starting at USD 4.3 billion in 2025 and increasing to USD 4.5 billion in 2026. By 2027, demand for bamboo products will rise to USD 4.7 billion, continuing to grow each year, reaching USD 5.1 billion by 2029. By 2035, the market is forecasted to reach USD 6.5 billion, reflecting steady growth driven by the increasing adoption of bamboo products in the consumer, construction, and eco-friendly product sectors.

The bamboo products market in Japan is expected to grow steadily over the next decade. From USD 4.3 billion in 2025, the market will increase to USD 4.5 billion in 2026, USD 4.7 billion in 2027, and USD 4.9 billion in 2028. By 2029, the market will reach USD 5.1 billion, continuing to expand at a steady pace. By 2035, the demand for bamboo products is forecasted to reach USD 6.5 billion, driven by the growing focus on sustainability, green building practices, and the widespread appeal of bamboo as an eco-friendly material.

The growth momentum analysis indicates that the demand for bamboo products will see consistent and moderate growth throughout the forecast period. Early years (2025–2029) will show steady incremental increases in demand, with a slight acceleration in the latter part of the forecast period (2029–2035). This reflects the increasing adoption of bamboo products across multiple sectors, particularly in the construction, home goods, and fashion industries. As the market matures, demand will continue to rise at a stable pace, driven by a heightened focus on sustainability and the ongoing shift toward eco-friendly alternatives.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 4.3 billion |

| Industry Forecast Value (2035) | USD 6.5 billion |

| Industry Forecast CAGR (2025-2035) | 4.2% |

Demand for bamboo products in Japan is rising as interest in sustainable, eco friendly, and renewable materials gains traction among consumers, businesses, and the construction sector. Bamboo offers advantages over conventional materials because it grows rapidly, regenerates easily, and requires less intensive cultivation than hardwood trees. As environmental awareness increases, many buyers prefer bamboo for its lower environmental impact and renewable nature. These preferences support demand for bamboo across multiple applications including furniture, flooring, interior design elements, household items, textiles, and decorative crafts.

Bamboo’s versatility and traditional cultural value also support its adoption in modern contexts. In architecture and interior design, bamboo is used for flooring, wall finishes, partitions, and decorative components blending traditional aesthetics with contemporary design sensibilities. Demand rises for bamboo furniture and home goods because of its durability, light weight, and natural look. In textiles and home textiles, bamboo fiber products appeal to consumers seeking soft, breathable, and moisture wicking materials. As more people in Japan prioritise sustainable lifestyles and eco friendly consumption, bamboo based textile, home and lifestyle products find growing acceptance.

At the same time, policy support and growing interest in sustainable construction amplify demand. Some Japanese building projects increasingly use bamboo materials as sustainable alternatives to conventional wood or synthetic materials. Bamboo’s strength, flexibility and renewability make it suitable for structural elements, interior finishes, and sustainable housing solutions. As building designers and consumers seek materials combining environmental responsibility with traditional aesthetic appeal, demand for bamboo-based construction and home use products is likely to remain strong.

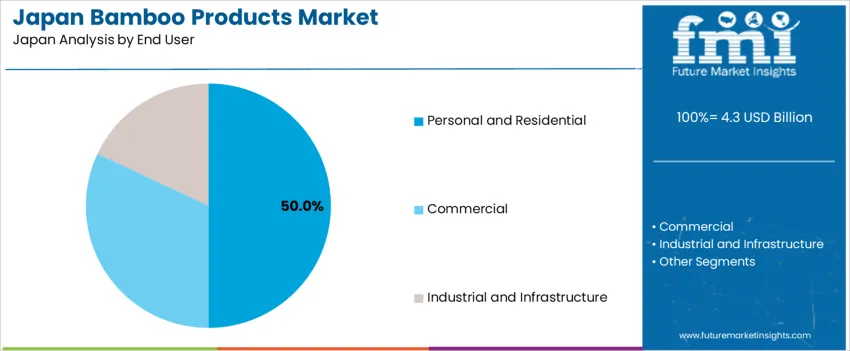

The demand for bamboo products in Japan is driven by product type and end-use. The leading product type is lifestyle products, accounting for 28% of the market share, while personal and residential use dominates the end-use sector, capturing 50% of the demand. Bamboo products, known for their sustainability and eco-friendly qualities, are gaining popularity across various sectors, including home décor, kitchenware, and personal accessories. The growing preference for natural, renewable materials in Japan continues to drive demand for bamboo products in both personal and commercial settings.

Lifestyle products lead the demand for bamboo products in Japan, holding 28% of the market share. Bamboo is increasingly used in lifestyle products due to its versatility, natural aesthetics, and sustainability. These products include bamboo-based personal accessories, clothing, bags, and even eco-friendly personal care items. Bamboo’s lightweight yet durable properties make it an ideal material for a wide range of consumer goods, appealing to environmentally conscious consumers who prioritize sustainability in their purchasing decisions.

The demand for bamboo lifestyle products is driven by the growing trend of sustainability and eco-consciousness among Japanese consumers. As more people look for products that are both functional and environmentally friendly, bamboo offers an attractive alternative to traditional materials. With Japan’s increasing focus on reducing plastic use and embracing renewable resources, bamboo products are expected to maintain their strong position in the lifestyle segment. Their combination of practicality, natural appeal, and environmental benefits ensures bamboo remains a preferred choice for many consumers in Japan.

Personal and residential use is the leading end-use sector for bamboo products in Japan, capturing 50% of the market share. Bamboo products are commonly used in residential settings, including furniture, home décor, kitchenware, and personal accessories. The appeal of bamboo in the personal and residential sector lies in its sustainability, aesthetic appeal, and functionality. Consumers increasingly choose bamboo for products such as flooring, furniture, and kitchen utensils due to its durability, natural look, and renewable sourcing.

The demand for bamboo products in the personal and residential sector is driven by the growing preference for natural materials in home interiors and the desire to live more sustainably. As Japanese households place greater emphasis on eco-friendly living and reducing environmental impact, bamboo products are seen as a way to achieve these goals while maintaining a stylish, functional home. The trend of incorporating sustainable materials into home décor, combined with the practical benefits of bamboo, ensures that personal and residential use will continue to lead the demand for bamboo products in Japan.

Demand for bamboo products in Japan is rising, driven by growing consumer interest in eco friendly and sustainable materials. Bamboo is increasingly being used across multiple sectors, including furniture, household goods, kitchenware, textiles, and construction. The popularity of bamboo products is supported by its versatility and the growing preference for natural, renewable, and biodegradable materials. As Japanese consumers become more environmentally conscious and design-oriented, bamboo products are experiencing renewed interest, not only for their sustainability but also for their aesthetic appeal and functional benefits.

What are the Drivers of Demand for Bamboo Products in Japan?

One major driver is the rising consumer preference for eco friendly and renewable materials. Bamboo grows quickly and can be harvested sustainably, making it an attractive alternative to wood and synthetic materials. Another driver is bamboo's versatility; it can be used in furniture, kitchenware, textile fibers, building materials, and everyday household items. Additionally, increasing interest in minimalist and natural design home décor and the appeal of traditional craftsmanship with modern sensibilities support demand for bamboo products. Furthermore, the textile and home textile sectors are using bamboo fiber for clothing, bedding, and towels, driven by the demand for soft, breathable, and environmentally friendly fabrics.

What are the Restraints on Demand for Bamboo Products in Japan?

Despite its growth, there are several restraints on the demand for bamboo products. Durability and maintenance concerns may limit adoption, as untreated bamboo can be susceptible to moisture and insect damage. Additionally, some bamboo products, particularly higher quality or treated bamboo goods, may be more expensive than alternatives, making them less appealing to budget-conscious consumers. Another restraint is limited awareness of bamboo products as modern or premium, which may reduce their appeal among certain consumer segments. Finally, issues related to the consistent supply of quality bamboo raw material or skilled craftsmanship may hinder large-scale production of high-end bamboo products.

What are the Key Trends Influencing Demand for Bamboo Products in Japan?

A key trend is the shift toward sustainable lifestyle choices, with consumers increasingly seeking eco friendly alternatives to plastic and non-renewable materials. Bamboo products are seen as an environmentally friendly option, appealing to consumers who prioritize sustainability. Another trend is the expanding use of bamboo beyond traditional crafts, with products ranging from kitchenware and furniture to textiles and home décor. There is also a growing fusion of traditional craftsmanship with modern design, with artisan bamboo goods gaining popularity. Finally, the growth of online retail and e commerce is helping to make bamboo products more accessible to consumers across Japan, especially in urban areas.

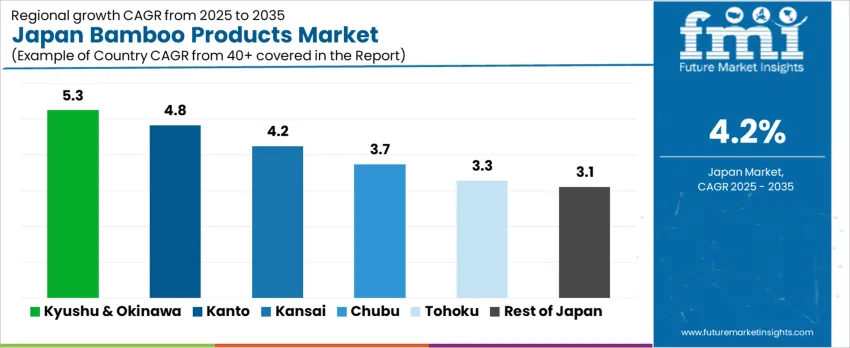

The demand for bamboo products in Japan shows a consistent upward trend across regions, with Kyushu & Okinawa leading at a CAGR of 5.3%. Kanto follows with a CAGR of 4.8%, reflecting strong urban demand for eco friendly and sustainable goods. The Kinki region exhibits moderate growth at 4.2%, while Chubu, Tohoku, and the Rest of Japan show more modest growth, with CAGRs of 3.7%, 3.3%, and 3.1% respectively. These regional differences reflect varying levels of consumer awareness, cultural preference, retail distribution, and interest in sustainable materials across Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.3 |

| Kanto | 4.8 |

| Kinki | 4.2 |

| Chubu | 3.7 |

| Tohoku | 3.3 |

| Rest of Japan | 3.1 |

In Kyushu & Okinawa, the demand for bamboo products is projected to grow at a CAGR of 5.3%. The region has long traditions associated with bamboo crafts and uses, and growing environmental awareness is encouraging consumers to return to sustainable natural materials. Bamboo products such as kitchenware, home décor, furniture, and personal use items are gaining popularity among consumers seeking eco friendly alternatives to plastics and synthetic materials. In addition, the region’s tourism sector-especially in Okinawa-promotes handcrafted goods and local crafts that often use bamboo, which boosts demand. As younger and environmentally conscious consumers embrace sustainable living, bamboo products are becoming more visible in retail outlets, local markets, and artisanal shops. The combination of cultural heritage, rising environmental awareness, and tourism led demand supports relatively strong growth in bamboo product consumption in Kyushu & Okinawa.

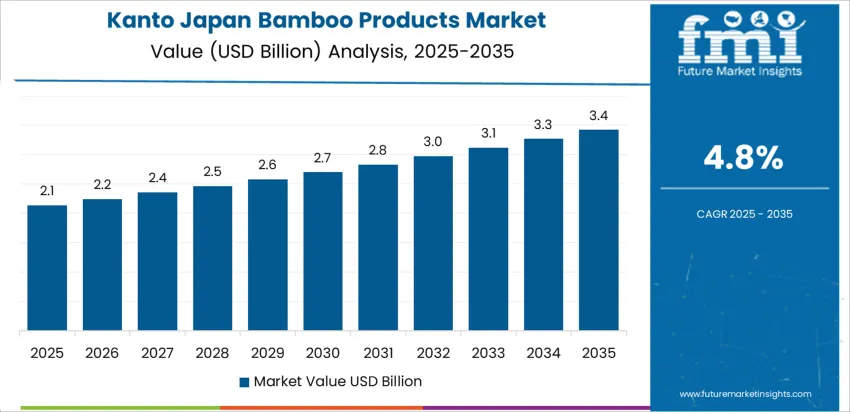

In Kanto, demand for bamboo products is expected to grow at a CAGR of 4.8%. As Japan’s most populous and urbanized region, Kanto hosts a consumer base that increasingly values eco friendly, sustainable, and minimalist design items. Urban consumers often live in smaller dwellings and seek lightweight, space efficient, and eco-conscious household items. Bamboo products-being durable, renewable, and visually appealing-meet these criteria. The growing trend for natural materials in home décor, kitchenware, and personal accessories drives adoption. Retailers and online marketplaces in large cities are expanding their catalogues to include bamboo based goods catering to environmentally aware shoppers. As environmental sustainability becomes more mainstream, bamboo items gain traction among families, young professionals, and design savvy consumers, contributing to the steady growth of demand in Kanto.

In Kinki, demand for bamboo products is projected to grow at a CAGR of 4.2%. The region, which includes urban centers such as Osaka and Kyoto, benefits from a mix of traditional craftsmanship heritage and modern consumer trends. Bamboo products that combine traditional techniques with contemporary designs-such as furniture, storage items, bamboo fibre textiles, and home dé-are gradually gaining acceptance. As some consumers shift toward sustainable and natural materials for home improvement and interior design, bamboo represents a viable, eco conscious alternative. Furniture manufacturers, home goods retailers, and artisanal workshops in Kinki are increasingly offering bamboo based products. While growth is not as rapid as in regions with stronger tourism or environmental activism, the combination of heritage, craftsmanship, and rising demand for sustainable goods ensures stable adoption in Kinki.

In Chubu, demand for bamboo products is expected to grow at a CAGR of 3.7%. The region has a mix of urban and semi urban populations. Consumers here are gradually embracing bamboo products, especially in categories like kitchenware, utensils, small furniture, and lifestyle goods. As awareness about sustainability and renewable resources spreads, more households are choosing bamboo-based items over plastic or metal alternatives. However, adoption remains more modest compared to regions with stronger consumer interest in eco friendly goods or higher exposure to global trends. The growth reflects a slow but steady shift in consumer preferences, with potential for growth if retail availability and consumer awareness increase further.

In Tohoku, demand for bamboo products is projected to grow at a CAGR of 3.3%. The region tends to have lower population density and more conservative consumer behavior compared to urban centers. Traditional consumption patterns, limited retail variety, and lower exposure to global eco design trends contribute to slower growth. Still, there is gradual interest in sustainable living and natural home goods among younger demographics and households seeking simple, eco conscious products. Small boutiques, local markets, or online retail may gradually increase their offering of bamboo items. As awareness of environmental issues grows and sustainable materials gain social acceptance, demand in Tohoku is likely to increase, albeit more gradually than in urban zones.

In the Rest of Japan, demand for bamboo products is expected to grow at a CAGR of 3.1%. This region encompasses rural and less urbanized areas with lower exposure to global lifestyle trends. Consumer purchasing power and access to specialty retailers tend to be lower. Still, as environmental awareness spreads and interest in traditional crafts and natural materials increases, some households are shifting toward bamboo-based items. Demand is more modest but stable-often driven by local crafts, family traditions, or niche markets for eco friendly goods. As supply chains improve (e.g., online retail), availability of bamboo products may rise, enabling gradual growth across this region.

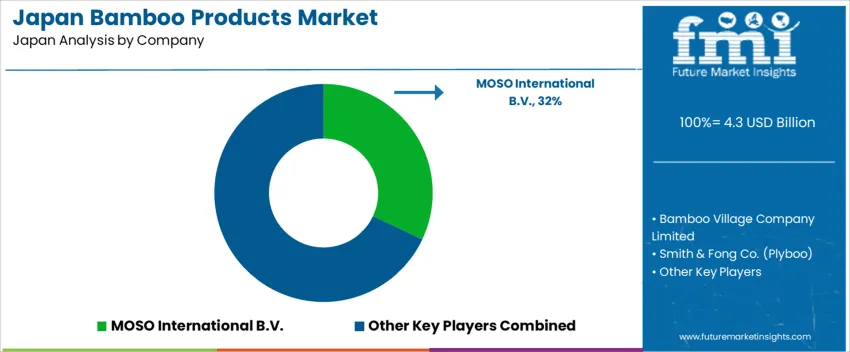

Demand for bamboo based products in Japan is rising as consumers and businesses grow more interested in sustainable, eco friendly materials suited to furniture, home goods, construction, and decorative items. Bamboo’s widespread use owes much to its strength, light weight, and renewability. Among leading suppliers in this sector are MOSO International B.V. (with about 32% share), Bamboo Village Company Limited, Smith & Fong Co. (Plyboo), EcoPlanet Bamboo Group, and The Bamboo Company.

Producers and suppliers compete on product quality, versatility, and sustainability credentials. Bamboo products must meet expectations around durability, ease of maintenance, and resistance to changes in humidity-traits desirable in Japanese homes where space constraints and changing seasons matter. Manufacturers emphasize the renewable nature of bamboo, its natural resistance to pests and moisture when properly treated, and the minimal energy required for cultivation and processing relative to traditional hardwoods. Another axis of competition lies in breadth of product range: furniture, flooring, kitchenware, interior décor, construction materials, and daily use items. Suppliers offering well finished, high quality bamboo products suitable for modern interiors-combining traditional material benefits with contemporary design-tend to perform better. Finally, reliability of supply and consistent material quality help companies meet demand from both individual consumers and commercial buyers. Firms that balance sustainability, practicality, and design fit are best positioned to expand in Japan’s evolving bamboo products market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Lifestyle Products, Furniture, Home Décor Items, Kitchenware & Cutlery, Personal Accessories |

| End User | Personal and Residential, Commercial, Industrial and Infrastructure |

| Sales Channel | Offline, Online |

| Key Companies Profiled | MOSO International B.V., Bamboo Village Company Limited, Smith & Fong Co. (Plyboo), EcoPlanet Bamboo Group, The Bamboo Company |

| Additional Attributes | The demand for bamboo products in Japan is driven by the increasing consumer interest in sustainable and eco-friendly alternatives to traditional materials. Products like lifestyle goods, furniture, and kitchenware are popular in both residential and commercial segments. Bamboo is being increasingly used for its strength, lightweight properties, and environmental benefits. Online sales channels are growing rapidly, although offline sales remain significant in stores that emphasize eco-conscious products. Companies like MOSO International, EcoPlanet Bamboo, and Smith & Fong Co. are key players in the Japanese market, focusing on product innovation, quality, and sustainability. The market is expected to expand as more consumers and industries adopt bamboo for both its environmental advantages and versatility across product categories. |

The demand for bamboo products in Japan is estimated to be valued at USD 4.3 billion in 2025.

The market size for the bamboo products in Japan is projected to reach USD 6.5 billion by 2035.

The demand for bamboo products in Japan is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in bamboo products in Japan are lifestyle products, furniture, home décor items, kitchenware & cutlery and personal accessories.

In terms of end user, personal and residential segment is expected to command 50.0% share in the bamboo products in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Demand for Bamboo Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bamboo Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Baby Personal Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Dishwashing Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tracheal Tubes and Airway Products in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA