The demand for bone grafts and substitutes in Japan is valued at USD 174.5 million in 2025 and is projected to reach USD 219.6 million by 2035, reflecting a compound annual growth rate of 2.3%. Growth is shaped by steady utilization across orthopedic, spinal and dental procedures where grafting materials support bone repair, reconstruction and fusion. As Japan’s aging population drives higher incidence of fractures, degenerative conditions and joint-related disorders, clinical demand for reliable graft materials remains consistent. Both natural and synthetic substitutes retain relevance, with continued preference for options that offer structural integrity and predictable integration. Hospitals and surgical centers maintain regular procurement cycles, reinforcing incremental adoption throughout the forecast horizon.

The growth curve shows a smooth and gradual ascent, beginning at USD 155.5 million in earlier years and rising to USD 174.5 million in 2025 before progressing toward USD 219.6 million by 2035. Yearly values increase at modest, even intervals, moving from USD 178.5 million in 2026 to USD 182.7 million in 2027 and continuing with similar spacing across subsequent years. This pattern indicates a stable market with limited volatility, driven by consistent surgical volumes and ongoing use of graft solutions across orthopedic practices. As treatment protocols evolve and improved biomaterials enter routine use, demand continues to follow a predictable upward path shaped by persistent clinical needs rather than sharp fluctuations in adoption across Japan.

Demand in Japan for bone grafts and substitutes is projected to grow from USD 174.5 million in 2025 to USD 219.6 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 2.3%. Starting from USD 155.5 million in 2020, the value rises each year reaching USD 170.5 million in 2024 and USD 174.5 million in 2025. Between 2025 and 2030 the demand increases to around USD 195.7 million and continues its ascent toward USD 219.6 million by 2035. Growth is supported by Japan’s ageing population, the higher incidence of osteoporosis and bone defects, and increased adoption of surgical interventions requiring bone grafts and synthetic substitutes across orthopaedics, trauma and spinal procedures.

Over the forecast period the total value uplift is USD 45.1 million (from USD 174.5 million to USD 219.6 million). Early in the decade the increase is driven primarily by unit volume gains as more procedures are performed and hospitals adopt graft/substitute usage. In the latter part of the forecast period value growth becomes more significant—driven by premiumisation of graft technologies such as biologics, synthetic composites and hybrid materials, as well as higher unit price procedures and replacement cycles of older graft systems. Suppliers offering advanced functionality and differentiated materials are best positioned to capture the incremental value toward USD 219.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 174.5 million |

| Forecast Value (2035) | USD 219.6 million |

| Forecast CAGR (2025–2035) | 2.3% |

The demand for bone grafts and substitutes in Japan is increasing due to a rising incidence of orthopedic conditions and an ageing population that experiences more bone defects, fractures and degenerative diseases. Many surgeries for spinal fusion, joint reconstruction and trauma repair involve bone grafting procedures that require materials to promote bone healing and regeneration. Hospitals and surgical centres in Japan are upgrading treatment protocols and using bone graft substitutes more frequently because they avoid donor-site morbidity associated with autografts and speed up recovery for patients. The growth in reconstructive and revision surgeries further supports uptake of these biomaterials.

In addition, there is increasing utilization of advanced substitute materials in dental, maxillofacial and orthopedic applications in Japan. Manufacturers and providers are turning to synthetic, allograft and composite materials that align with physician preferences for predictable outcomes and ready availability. Dental implant procedures and sinus-lift treatments in Japan also contribute significantly to demand for graft materials. Cost pressures and strict reimbursement policies remain considerations for hospitals and clinics, yet the combined effect of demographic change, surgical volume growth and greater clinical adoption means the demand for bone grafts and substitutes in Japan is expected to maintain steady growth.

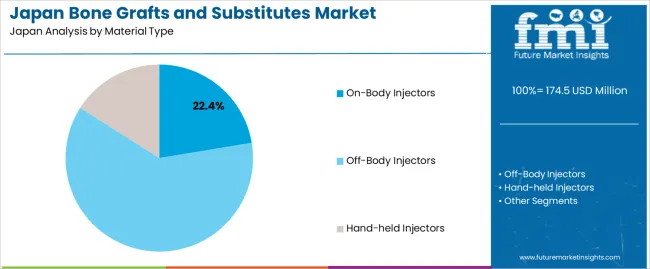

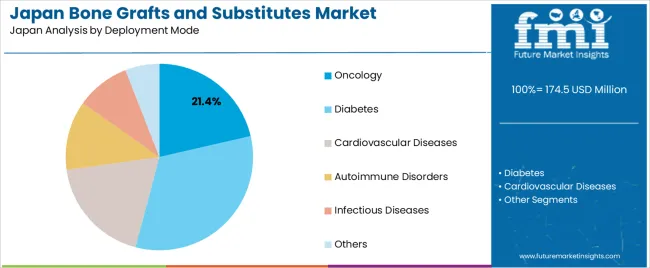

The demand for bone grafts and substitutes in Japan is shaped by the material types listed in the provided segments and the deployment modes used across medical treatments. Material types include on-body injectors, off-body injectors and hand-held injectors, each offering different handling characteristics and procedure suitability. Deployment modes span oncology, diabetes, cardiovascular diseases, autoimmune disorders, infectious diseases and other categories, reflecting varied clinical pathways. As healthcare providers focus on consistent delivery performance and manageable device formats, the combination of injector design and deployment requirements guides adoption across Japan’s medical settings.

On-body injectors account for 22% of total demand within the listed material type category. Their leading position reflects the advantage of controlled, hands-free medication delivery that supports predictable dosing and consistent administration schedules. These devices allow patients to receive treatment without extensive clinical supervision, which assists in managing conditions requiring steady therapeutic levels. Healthcare providers value the simplified operation and stable performance that align with everyday patient routines. These qualities strengthen the role of on-body injectors in settings seeking practical, low-intervention delivery methods.

Demand for on-body injectors also grows as facilities support outpatient care strategies that reduce in-clinic time. The devices help maintain adherence by minimizing manual steps and allowing treatments to occur during daily activities. Their compact form and straightforward instructions appeal to patients across different age groups. These factors support consistent patient acceptance and reinforce routine use. As medical teams adopt delivery options that support independence and convenience, on-body injectors continue to influence equipment selection across Japan.

Oncology accounts for 21.4% of total demand within the deployment mode categories. This leading share reflects the need for dependable delivery systems that support structured cancer treatment schedules. Oncology care often requires precise dosing over extended periods, making consistent delivery performance essential. Providers select systems that support comfortable patient experience and steady therapeutic administration. The role of oncology departments in managing repeated treatments across broad patient groups reinforces frequent use of the listed injector types.

Demand for oncology deployment also increases as treatment regimens integrate devices that reduce procedure time and support smoother patient workflows. These systems help clinicians maintain predictable dosing while enabling patients to follow treatment plans with reduced disruption. Their compatibility with various clinical routines assists in managing diverse oncology cases. As cancer care continues prioritizing reliable, patient-friendly delivery options, oncology remains a leading deployment mode shaping equipment preferences in Japan.

Demand for bone grafts and substitutes in Japan is increasing as orthopaedic, spine and dental procedures rise alongside an ageing population. Hospitals and clinics are adopting synthetic grafts and engineered biomaterials to reduce donor-site morbidity and improve consistency in surgical outcomes. Growth is also supported by advances in minimally invasive surgery and higher procedure volumes in trauma and degenerative conditions. At the same time, barriers include the high cost of advanced graft materials, strict regulatory pathways and competition from autograft or lower-priced alternatives. These elements shape adoption across Japan’s healthcare settings.

How Are Demographic and Clinical Practice Shifts Driving Demand for Bone Grafts and Substitutes in Japan?

Japan’s rapidly ageing demographic results in more cases of osteoporosis, fractures, spinal degeneration and joint deterioration, all increasing the need for bone repair and fusion procedures. Surgeons are relying more on graft substitutes to avoid complications linked to autograft harvesting. Growth in dental implants, craniofacial reconstruction and revision surgeries further strengthens demand. Clinical preference is shifting toward materials that offer predictable integration, ease of handling and reduced operative time. These combined pressures support steady demand for bone grafts and substitutes in Japan.

Where Are Growth Opportunities Emerging for Bone Grafts and Substitutes in Japan’s Market?

Opportunities exist in spinal fusion, revision joint replacement, trauma reconstruction and dental bone augmentation. Synthetic grafts, including ceramics and composite materials, present strong potential due to their uniformity and lack of donor-site risks. Demand is also increasing in outpatient and specialised surgical centres looking for ready-to-use graft products with high handling efficiency. Dental applications, particularly in implant preparation and ridge preservation, continue to grow. Manufacturers offering diverse sizing, improved bioactive properties and strong clinical support can capture expanding opportunities in Japan.

What Challenges Are Limiting Wider Adoption of Bone Grafts and Substitutes in Japan?

Key challenges include the high price of advanced synthetic grafts and limited reimbursement in some settings, which can restrict adoption by smaller hospitals and dental clinics. Regulatory reviews for new biomaterials are rigorous, contributing to longer market entry times. Some surgeons remain cautious about substituting well-established autograft practices, especially in procedures where cost sensitivity or tradition plays a role. Supply-chain complexity for specialised graft products also affects availability. These factors collectively moderate how quickly bone grafts and substitutes are adopted nationwide.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.9% |

| Kanto | 2.7% |

| Kinki | 2.3% |

| Chubu | 2.1% |

| Tohoku | 1.8% |

| Rest of Japan | 1.7% |

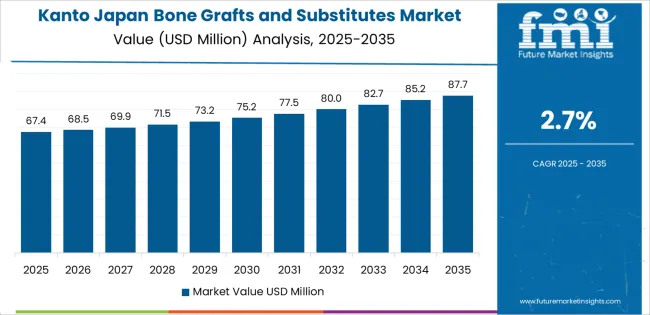

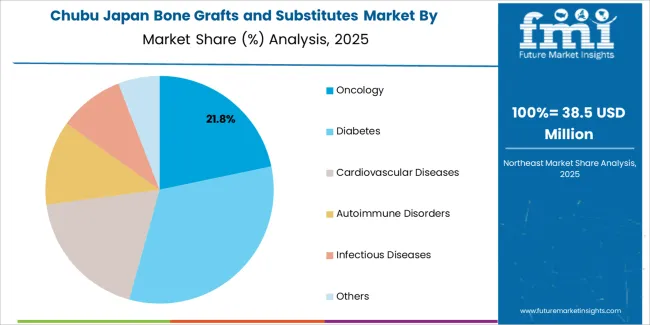

Demand for bone grafts and substitutes in Japan is rising gradually across regions. Kyushu and Okinawa lead at 2.9%, supported by expanding orthopedic services and steady demand for graft materials used in trauma and degenerative conditions. Kanto follows at 2.7%, driven by its concentration of major hospitals and high procedural volumes across urban centers. Kinki records 2.3%, shaped by consistent use of graft materials in orthopedic and spinal procedures. Chubu grows at 2.1%, influenced by mid-sized hospitals and routine surgical needs. Tohoku reaches 1.8%, with gradual uptake in regional facilities. The rest of Japan posts 1.7%, reflecting stable but modest adoption across smaller healthcare systems.

Kyushu & Okinawa is projected to grow at a CAGR of 2.9% through 2035 in demand for bone grafts and substitutes. Hospitals, orthopedic clinics, and surgical centers in Fukuoka are increasingly adopting autografts, allografts, and synthetic bone substitutes for fracture repair, spinal fusion, and dental applications. Rising demand for minimally invasive procedures, faster healing, and surgical precision drives adoption. Manufacturers provide high-quality graft materials suitable for orthopedic and dental surgeries. Healthcare distributors ensure accessibility across urban and semi-urban medical facilities. Hospital upgrades, orthopedic procedures, and dental implant demand support steady adoption in Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 2.7% through 2035 in demand for bone grafts and substitutes. Tokyo and surrounding hospitals and surgical centers are increasingly using autografts, allografts, and synthetic substitutes for orthopedic, spinal, and dental procedures. Rising surgical volumes, patient awareness, and focus on faster recovery drive adoption. Manufacturers supply high-quality graft materials compatible with hospital surgical workflows. Distributors ensure access to urban hospitals, clinics, and dental centers. Investment in medical infrastructure, orthopedic and dental surgical growth, and hospital modernization support steady adoption of bone grafts and substitutes across Kanto.

Kinki is projected to grow at a CAGR of 2.3% through 2035 in demand for bone grafts and substitutes. Cities including Osaka and Kyoto are increasingly using autografts, allografts, and synthetic substitutes in hospitals, orthopedic clinics, and dental centers. Rising demand for minimally invasive surgeries, improved patient outcomes, and faster healing drives adoption. Manufacturers provide graft materials compatible with surgical workflows and patient safety standards. Distributors expand access to urban and suburban healthcare facilities. Surgical procedure growth, orthopedic hospital expansion, and dental implant demand ensure steady adoption of bone grafts and substitutes across Kinki.

Chubu is projected to grow at a CAGR of 2.1% through 2035 in demand for bone grafts and substitutes. Urban centers, particularly Nagoya, are gradually adopting autografts, allografts, and synthetic bone substitutes for orthopedic, spinal, and dental procedures. Rising surgical efficiency, patient awareness, and procedural precision drive adoption. Manufacturers supply high-quality materials compatible with hospital operations and dental clinics. Distributors ensure access across urban and semi-urban medical facilities. Orthopedic surgery expansion, hospital upgrades, and dental procedure growth support steady adoption of bone grafts and substitutes in Chubu.

Tohoku is projected to grow at a CAGR of 1.8% through 2035 in demand for bone grafts and substitutes. Hospitals, clinics, and dental centers in Sendai and surrounding areas are gradually adopting autografts, allografts, and synthetic substitutes. Rising demand for minimally invasive procedures, surgical accuracy, and improved recovery drives adoption. Manufacturers supply durable and compatible materials suitable for orthopedic, spinal, and dental applications. Distributors expand availability across urban and semi-urban healthcare facilities. Hospital upgrades, regional orthopedic surgeries, and dental implant procedures ensure steady adoption of bone grafts and substitutes across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 1.7% through 2035 in demand for bone grafts and substitutes. Smaller towns and rural medical facilities gradually adopt autografts, allografts, and synthetic substitutes for orthopedic, dental, and spinal procedures. Rising awareness of surgical quality, faster recovery, and patient outcomes drives adoption. Manufacturers provide graft materials suitable for smaller hospitals and clinics. Distributors expand access to semi-urban and rural medical facilities. Gradual adoption in smaller regions, surgical procedure growth, and dental implant demand support steady growth of bone grafts and substitutes across the Rest of Japan.

The demand for bone grafts and substitutes in Japan is primarily driven by the country’s ageing population and rising incidence of degenerative bone conditions, fractures and spinal disorders. Surgical volumes in orthopedics and spinal fusion are increasing as Japan manages greater numbers of elderly patients with osteoporosis and joint deterioration. At the same time, hospitals and surgical centres are investing in advanced grafting materials that support faster healing, reduced complications and improved patient outcomes. Further demand is driven by the shift toward minimally invasive procedures and the need for biomaterials that offer osteoconductive or osteoinductive properties especially given Japan’s strict regulatory and clinical standards for implantable devices.

Key companies shaping the bone grafts and substitutes segment in Japan include AlloSource, DePuy Synthes Inc., Baxter, NuVasive Inc. and Smith & Nephew. These firms offer a wide array of products such as allograft bone chips, demineralised bone matrix, synthetic bone substitutes and regenerative biologic materials designed for Japanese surgical workflows. Their strategies involve localisation of supply, regulatory compliance, surgeon training and evidence-based clinical support to address Japanese market requirements. Through partnerships with Japanese hospitals and distributors, these companies influence how grafting materials are selected and integrated into surgical protocols across Japan’s orthopaedic and spinal care segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Material Type | On-Body Injectors, Off-Body Injectors, Hand-held Injectors |

| Deployment Mode | Oncology, Diabetes, Cardiovascular Diseases, Autoimmune Disorders, Infectious Diseases, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | AlloSource, DePuy Synthes Inc., Baxter, NuVasive Inc., Smith & Nephew |

| Additional Attributes | Dollar by sales by material type and deployment mode; regional CAGR and growth trends; adoption across orthopedic, spinal, and dental procedures; preference for natural vs synthetic grafts; integration in minimally invasive surgery; clinical adoption patterns in hospitals and surgical centers; aging population and fracture incidence impact; reimbursement and regulatory considerations; incremental uptake of premium graft materials, biologics, and synthetic composites; replacement versus new procedure demand; supplier clinical support and training programs; hospital procurement cycles; niche applications in dental implants, sinus-lift, and trauma reconstruction; challenges include cost, reimbursement limits, and regulatory approval. |

The demand for bone grafts and substitutes in japan is estimated to be valued at USD 174.5 million in 2025.

The market size for the bone grafts and substitutes in japan is projected to reach USD 219.6 million by 2035.

The demand for bone grafts and substitutes in japan is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in bone grafts and substitutes in japan are on-body injectors, off-body injectors and hand-held injectors.

In terms of deployment mode, oncology segment is expected to command 21.4% share in the bone grafts and substitutes in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bone Grafts and Substitutes Market Overview - Size, Share & Forecast 2025 to 2035

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bone Densitometers in Japan Size and Share Forecast Outlook 2025 to 2035

Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Bone Metabolism Test Market Size and Share Forecast Outlook 2025 to 2035

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Bone Densitometer Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometers Analysis by Product Type, by Technology and by End User through 2035

Bone Growth Stimulators Market is segmented by product type, application and end user from 2025 to 2035

Bone Graft Fixation System Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA