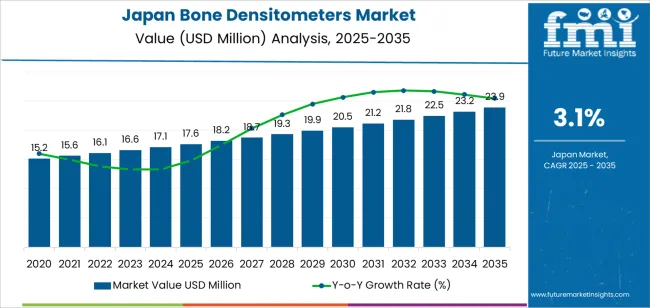

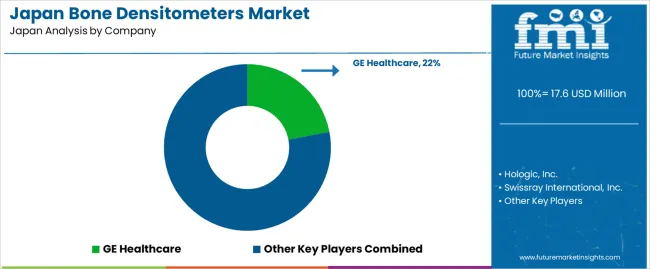

The demand for bone densitometers in Japan is valued at USD 17.6 million in 2025 and is projected to reach USD 23.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.1%. This growth is driven by the increasing prevalence of osteoporosis and other bone-related conditions, particularly among the aging population in Japan. As the demand for early detection and preventive healthcare measures rises, bone densitometers are becoming more integral in both clinical and research settings. Additionally, advancements in technology and increased awareness of bone health are contributing to the growing adoption of these devices.

The market shows a steady and consistent growth trajectory over the forecast period. Starting at USD 15.2 million in earlier years, the demand increases gradually each year, reaching USD 17.6 million by 2025, and continuing to rise to USD 23.9 million by 2035. The annual growth is modest but stable, reflecting a consistent rise in demand for bone densitometers. This steady expansion pattern suggests the market is experiencing sustainable growth driven by both the aging population and growing health awareness, which will continue to fuel demand for these medical devices throughout the forecast period.

Demand for bone densitometers in Japan is expected to increase from USD 17.6 million in 2025 to USD 23.9 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.1%. Starting at USD 15.2 million in 2020, the demand gradually rises to USD 17.6 million by 2025. From 2025 to 2030, the demand increases steadily, reaching USD 19.9 million, driven by factors like the growing elderly population and the rising incidence of osteoporosis. By 2035, the demand will reach USD 23.9 million, supported by greater awareness, more screening programs, and the ongoing replacement of older equipment with advanced bone densitometers that offer improved accuracy and functionality. Technological advancements and regulatory support will further boost adoption during this period.

The growth contribution from volume and price will be significant over the next decade. Volume growth will account for approximately 65% of the overall demand increase, driven by the expansion of clinical adoption and rising awareness about osteoporosis prevention. By 2035, an estimated 65% of the demand increase will be attributed to more units being installed in hospitals, clinics, and diagnostic centers. The remaining 35% will come from price growth, which includes the adoption of advanced models with higher capabilities, such as enhanced imaging features, portability, and faster throughput. These product improvements will drive a steady increase in the per-unit value, contributing to the overall market growth in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 17.6 million |

| Forecast Value (2035) | USD 23.9 million |

| Forecast CAGR (2025 to 2035) | 3.1% |

The demand for bone densitometers in Japan is shaped by the country’s demographic profile, particularly its rapidly ageing population and rising incidence of osteoporosis and osteopenia. Many older adults require bone mineral density assessments to estimate fracture risk and monitor treatment outcomes. Clinics and hospitals in Japan are increasing assets for bone health diagnostics as preventive care gains prominence. The expanding number of outpatient imaging centres and diagnostic laboratories has broadened access to bone densitometry consultations across the country.

Healthcare policies and reimbursement frameworks in Japan are also influencing demand for bone densitometers. Medical providers and equipment manufacturers respond to national initiatives that promote early diagnosis of bone related conditions and fracture prevention programmes. As equipment lifecycles mature, healthcare facilities are replacing older densitometry units or adding portable and peripheral devices to reach underserved areas or enable community screening. Cost pressures and device procurement budgets remain considerations, yet the overall demand for bone densitometers in Japan continues to rise steadily.

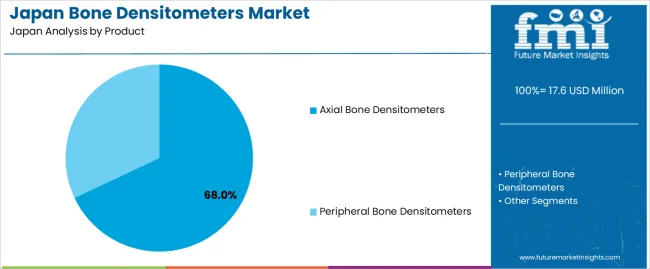

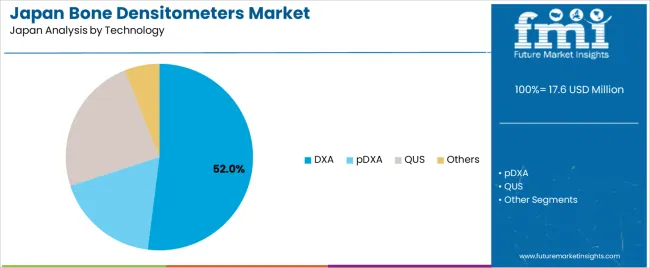

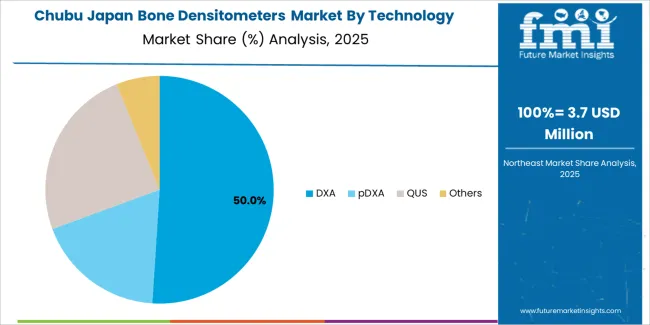

The demand for bone densitometers in Japan is influenced by both the product type and the technology used in these devices. Product types include axial bone densitometers, peripheral bone densitometers, and other specialized models. These are paired with various technologies such as DXA (Dual-energy X-ray Absorptiometry), pDXA (Peripheral DXA), QUS (Quantitative Ultrasound), and other advanced methods. These segments highlight the growing need for accurate bone density measurement devices in Japan, where osteoporosis and other bone-related conditions are prevalent due to the aging population and the need for preventative healthcare solutions.

Axial bone densitometers account for 68% of the total demand for bone densitometers in Japan. This high demand is driven by the widespread use of axial bone densitometry in clinical settings, especially for diagnosing osteoporosis and assessing fracture risks in patients. Axial devices, which measure bone density at central skeletal sites like the spine and hip, are considered the gold standard in bone density measurement due to their accuracy and ability to predict fracture risk in high-risk patients. The increasing awareness of osteoporosis among Japan’s aging population further supports the demand for axial bone densitometers.

The technological advancements in axial bone densitometers, particularly in DXA, which is capable of providing highly precise and reproducible results, are key drivers of this demand. As the healthcare system in Japan emphasizes preventive care, especially for the elderly, axial bone densitometers are essential in managing and monitoring bone health. The device’s proven effectiveness in screening and early diagnosis makes it a critical tool in Japan’s healthcare infrastructure, ensuring its continued dominance in the market.

DXA technology accounts for 52.0% of the total demand for bone densitometers in Japan. DXA is widely considered the most accurate and reliable technology for measuring bone mineral density (BMD), making it the preferred choice in clinical settings. The demand for DXA is driven by its ability to provide fast, precise measurements with minimal radiation exposure, which is essential for regular monitoring of bone health, particularly in patients at risk for osteoporosis. The Japanese healthcare system's focus on precision medicine and early detection of bone diseases further boosts the demand for DXA-equipped bone densitometers.

Additionally, the use of DXA technology extends beyond osteoporosis detection to assessing overall bone health, enabling healthcare professionals to better manage treatments for patients with bone-related conditions. As the aging population in Japan continues to grow, DXA technology plays a critical role in early intervention and the prevention of fractures, contributing to its dominant position in the bone densitometer market. The continued investment in and adoption of DXA systems ensure that this technology remains a key driver in the demand for bone densitometers.

The demand for bone densitometers in Japan is primarily driven by the country’s aging population and the increasing prevalence of osteoporosis and bone-related conditions. The rising awareness of bone health, along with the need for early detection and prevention of fractures, is fueling growth. However, high initial costs, ongoing maintenance, and uneven availability of advanced screening technologies across smaller clinics and rural areas pose significant challenges. Understanding these factors is crucial for stakeholders aiming to expand the use of bone densitometers in Japan’s healthcare sector.

Japan's rapidly aging population is a key driver of the growing demand for bone densitometers. As the number of elderly individuals increases, so does the incidence of osteoporosis and other bone-related disorders. With an aging population more prone to fractures, healthcare providers are increasingly focusing on early diagnosis to manage bone health. Bone densitometers, particularly those offering quick and non-invasive screening, are becoming vital tools in hospitals and clinics across the country to detect osteoporosis early and prevent fractures, thus expanding their demand.

There is a significant opportunity to expand the use of bone densitometers in Japan’s outpatient settings and regional healthcare facilities. With an increasing emphasis on preventive healthcare, many clinics are looking to adopt cost-effective, portable densitometer options. The Japanese government’s focus on improving healthcare access for rural populations also opens up avenues for mobile or compact densitometer solutions that can be used in remote areas. These devices could be integrated into national screening programs for osteoporosis, creating a large-scale opportunity for growth.

Despite favorable demand drivers, there are several barriers to widespread adoption of bone densitometers in Japan. The high cost of purchasing and maintaining advanced densitometry equipment remains a significant challenge for smaller clinics and outpatient settings. Additionally, limited reimbursement for preventive screening and the need for trained technicians to operate the equipment further complicate adoption in non-hospital environments. These factors may slow the rate of market penetration, particularly in regions with fewer healthcare resources or limited budgets.

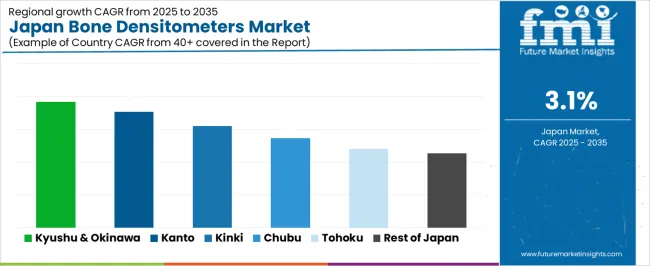

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8% |

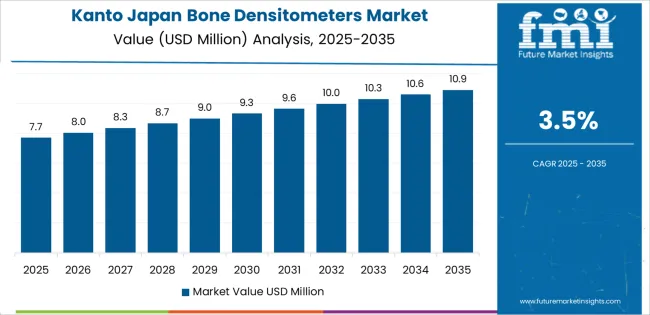

| Kanto | 3.5% |

| Kinki | 3.1% |

| Chubu | 2.7% |

| Tohoku | 2.4% |

| Rest of Japan | 2.3% |

The demand for bone densitometers in Japan is experiencing steady growth across all regions. Kyushu and Okinawa lead with a 3.8% CAGR, driven by the aging population and increasing healthcare awareness regarding bone health. Kanto follows at 3.5%, with demand fueled by advanced medical facilities and a high concentration of elderly residents. Kinki records 3.1%, supported by urban healthcare centers and a rising focus on osteoporosis diagnosis. Chubu grows at 2.7%, with steady demand driven by regional hospitals and clinics. Tohoku reaches 2.4%, influenced by healthcare access in rural areas. The rest of Japan shows a 2.3% growth, reflecting slower but consistent adoption in less densely populated regions.

Kyushu & Okinawa is projected to grow at a CAGR of 3.8% through 2035 in demand for bone densitometers. The region’s increasing healthcare focus, especially in cities like Fukuoka, drives the adoption of advanced diagnostic equipment. With an aging population and rising concerns over osteoporosis, the demand for bone density testing to assess bone health grows. The healthcare system in Kyushu & Okinawa continues to invest in improving diagnostic services, leading to increased use of bone densitometers. The region’s commitment to improving elderly healthcare further contributes to the growth of this market.

Kanto is projected to grow at a CAGR of 3.5% through 2035 in demand for bone densitometers. With a strong healthcare infrastructure in cities like Tokyo, Kanto remains a leading region in the adoption of medical diagnostic devices. The growing elderly population and increasing awareness of osteoporosis contribute to the rising demand for bone density testing. As healthcare providers in the region focus on preventive care and early diagnosis, the use of bone densitometers in hospitals, clinics, and specialized centers continues to rise.

Kinki is projected to grow at a CAGR of 3.1% through 2035 in demand for bone densitometers. The region’s medical sector, particularly in Osaka, sees consistent demand for bone density testing due to the high prevalence of osteoporosis among the elderly. Kinki’s well-established healthcare system supports the integration of advanced diagnostic equipment, including bone densitometers, into hospitals and outpatient centers. As the focus on osteoporosis prevention and early detection increases, the demand for these devices continues to grow, especially in senior care facilities and specialized healthcare centers.

Chubu is projected to grow at a CAGR of 2.7% through 2035 in demand for bone densitometers. The region’s healthcare industry, including cities like Nagoya, continues to expand, contributing to steady demand for bone density testing. As the population ages and the prevalence of osteoporosis increases, the need for diagnostic tools such as bone densitometers rises. Chubu’s healthcare providers are increasingly adopting advanced diagnostic equipment to improve early detection and prevention of bone-related disorders, further stimulating the market for bone densitometers in the region.

Tohoku is projected to grow at a CAGR of 2.4% through 2035 in demand for bone densitometers. While Tohoku’s healthcare system is less developed compared to other regions, the increasing elderly population in the region drives the need for bone health diagnostic tools. With rising awareness of osteoporosis and its impact on quality of life, healthcare facilities in cities like Sendai are investing in bone densitometers to provide better care for their aging population. The growing demand for early diagnosis and preventive healthcare continues to drive the market.

The Rest of Japan is projected to grow at a CAGR of 2.3% through 2035 in demand for bone densitometers. Although less populous than other regions, this area continues to see steady adoption of bone health diagnostic tools due to an aging population and increasing healthcare initiatives. Rural areas and smaller cities are increasingly investing in advanced medical technology, including bone densitometers, to better address the needs of their elderly populations. The demand for preventive health services in these regions contributes to the consistent growth of this market.

The demand for bone densitometers in Japan is driven by a combination of demographic, clinical and technological factors. Japan’s aging population and the associated rise in osteoporosis and bone fragility conditions are increasing the need for routine bone mineral density assessment. Preventive care initiatives and expanded screening protocols in hospitals and clinics are encouraging investment in densitometry equipment. Technological improvements, including the development of portable units, advanced imaging systems and streamlined workflows, are making these devices more accessible to outpatient settings. The emphasis on early diagnosis, risk assessment of fractures and long term monitoring of bone health is helping to elevate demand across diagnostic centres, orthopedic departments and general hospitals in Japan.

Major companies active in Japan’s bone densitometer sector include GE Healthcare, Hologic Inc., Swissray International Inc., DMS Imaging and BeamMed Ltd. These firms offer a range of densitometry technologies, such as dual energy X ray absorptiometry (DXA) systems, peripheral scanners, and bone health monitoring platforms. GE Healthcare and Hologic typically serve large hospital installations with high end axial scanners, while Swissray, DMS Imaging and BeamMed focus on niche or peripheral applications, including smaller clinics and mobile screening setups. Their strategies involve product adaptation, service availability and regulatory compliance in Japan to match local clinical needs. These providers thus play a key role in shaping how bone densitometer adoption evolves in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use | Hospitals, Diagnostic Imaging Centers, Specialty Clinics |

| Product Type | Axial Bone Densitometers, Peripheral Bone Densitometers |

| Technology | DXA, pDXA, QUS, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | GE Healthcare, Hologic Inc., Swissray International Inc., DMS Imaging, BeamMed Ltd. |

| Additional Attributes | Dollar by sales across product type, technology, and application sectors, healthcare provider adoption rates, demographic trends, advancements in device functionality, regulatory compliance, and patient demand for early detection and preventive care. |

The demand for bone densitometers in Japan is estimated to be valued at USD 17.6 million in 2025.

The market size for the bone densitometers in Japan is projected to reach USD 23.9 million by 2035.

The demand for bone densitometers in Japan is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in bone densitometers in Japan are axial bone densitometers and peripheral bone densitometers.

In terms of technology, dxa segment is expected to command 52.0% share in the bone densitometers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA