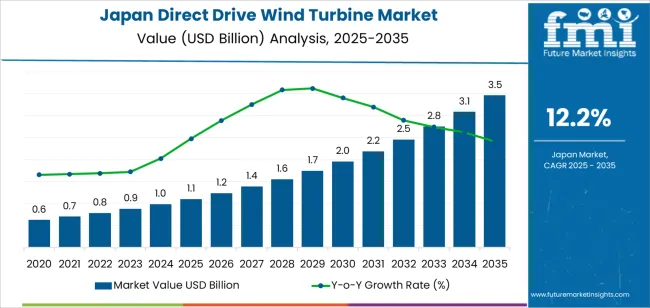

The demand for direct drive wind turbines in Japan is valued at USD 1.1 billion in 2025 and is projected to reach USD 3.5 billion by 2035, reflecting a compound annual growth rate of 12.2%. Growth is shaped by continued expansion of wind energy installations and broader adoption of turbine systems that reduce mechanical complexity by eliminating gearbox components. Direct drive configurations support lower maintenance needs and improved efficiency across varied wind conditions, which encourages adoption across coastal and upland projects. As Japan seeks stable long-term generation assets and project developers refine installation capacity, demand for direct drive units increases in line with project pipelines across the forecast horizon.

The year-on-year growth pattern shows consistent acceleration as values rise from USD 0.6 billion in earlier years to USD 1.1 billion in 2025 before reaching USD 3.5 billion by 2035. YoY gains increase from roughly USD 0.1 billion between 2025 and 2026 to larger increments by the early 2030s. Values step upward from USD 1.2 billion in 2026 to USD 1.4 billion in 2027, followed by continued rises to USD 1.7 billion in 2029 and USD 2.1 billion in 2031. The most pronounced gains appear from 2032 onward, where YoY increases widen as demand reaches USD 2.5 billion in 2032 and USD 3.0 billion in 2034. This trajectory reflects widening project deployment and increased reliance on direct drive designs in Japan’s evolving wind energy landscape.

Between 2025 and 2035, the demand for direct drive wind turbines in Japan is forecast to climb from USD 1.1 billion to USD 3.5 billion, representing a CAGR of approximately 12.2%. This steep trajectory is underpinned by Japan’s accelerating commitment to renewable energy expansion especially offshore wind and the technical advantages of direct drive systems, which replace geared drivetrains, improve reliability, and reduce maintenance. Early in this period, most of the value increase comes from higher volumes of installations as Japan pursues aggressive capacity targets. From USD 0.6 billion in 2020, the value rises to USD 1.0 billion in 2024 and reaches USD 1.1 billion in 2025, climbing to USD 1.6 billion by 2028 and ultimately USD 3.5 billion by 2035.

In the latter half of the decade, value growth becomes more pronounced as technological enhancements drive higher per unit spend. Direct drive turbines are increasingly preferred for large scale offshore and high wind resource sites in Japan, where reduced mechanical complexity and better performance under harsh conditions matter. Larger-capacity models with enhanced features, including higher rotor diameters, improved generators, and digital monitoring systems, contribute to higher average transaction values. Regulatory support, domestic supply-chain localisation, and premium pricing for advanced systems collectively bolster per-unit value. Suppliers focusing on high-spec installations and leveraging scale are positioned to capture the significant USD 2.4 billion uplift in demand from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.1 billion |

| Forecast Value (2035) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The demand for direct drive wind turbines in Japan is increasing as the country expands its wind-energy capacity and places stronger emphasis on offshore development. Direct drive turbines are favored in these settings because they eliminate the gearbox and reduce mechanical complexity, which lowers maintenance needs in harsh marine environments. Japan’s coastal and deep-sea wind zones require equipment that can operate reliably with limited on-site servicing, and direct drive systems provide consistent power output under variable wind conditions. As national plans encourage growth in both offshore and onshore wind installations, developers and operators are selecting technologies that offer durability, efficiency and long service life.

Momentum is also shaped by regional wind resources and infrastructure planning. Areas such as Hokkaido, Tohoku and Kyushu have favourable wind conditions and expanded grid connections, which support investment in new wind projects. Local energy policies encourage diversification of power sources and create demand for turbines that integrate smoothly into existing grids. Direct drive designs offer advantages in noise reduction and operational stability, which is beneficial in regions balancing community acceptance with renewable-energy goals. High capital cost and limited domestic turbine manufacturing remain constraints, yet the shift toward reliable, low-maintenance wind systems ensures steady demand for direct drive wind turbines in Japan.

The demand for direct drive wind turbines in Japan is shaped by the capacity ranges selected for project sites and the generator technologies used to support stable electricity production. Capacity categories include less than 1 MW, 1 MW to 3 MW and more than 3 MW, each aligning with distinct project scales and land availability. Technology options include permanent magnet synchronous generators and electrically excited synchronous generators, which differ in efficiency, component structure and maintenance requirements. As developers focus on consistent output, low mechanical complexity and suitability for Japan’s varied wind conditions, the combination of capacity and technology guides equipment preferences across the country.

Less than 1 MW accounts for 46% of total demand across capacity categories in Japan. This leading share reflects the suitability of smaller turbines for distributed generation sites, community projects and areas with limited land availability. These turbines support installations near populated regions where noise and footprint constraints are important. Operators value their manageable size, predictable installation needs and lower structural requirements. The capacity range aligns well with local-scale energy programs seeking stable output without extensive grid upgrades. These characteristics contribute to steady reliance on small-capacity direct drive turbines across Japan’s diverse terrain and settlement patterns.

Demand for less than 1 MW turbines also grows as municipalities and independent producers pursue localized renewable projects. Smaller turbines integrate well into microgrids and help communities meet energy goals with simpler permitting and construction processes. Their performance in moderate wind regions reinforces adoption where large-scale units are impractical. Developers appreciate their reduced mechanical complexity and manageable maintenance routines. As Japan continues encouraging regional energy independence, these turbines maintain a strong role in meeting distributed wind development needs.

Permanent magnet synchronous generators account for 56.4% of total demand across technology categories in Japan. Their leading position reflects the efficiency benefits and reduced component count that suit direct drive configurations. These generators deliver steady output without the need for excitation systems, supporting predictable operation across varied wind speeds. Developers value their compact form and suitability for low-maintenance environments. The high torque generation at low rotational speeds enhances performance in sites that experience fluctuating wind conditions common across Japan’s coastal and inland regions.

Demand for permanent magnet synchronous generators increases as operators prioritize equipment that minimizes downtime and supports long service life. The technology’s stable performance and reduced mechanical wear align with project goals focused on operational reliability. The generators integrate smoothly into turbines designed for constrained sites where mechanical simplicity is critical. As Japan expands wind capacity with focus on long-term efficiency, permanent magnet synchronous generators remain the preferred technology across direct drive installations.

Demand for direct-drive wind turbines in Japan is rising as the country expands offshore wind capacity and seeks stable long-term generation suited to its coastal geography. Interest is shaped by Japan’s focus on typhoon-resilient turbine designs, the shift toward larger offshore platforms and redevelopment of ageing onshore wind sites. At the same time, obstacles include high installation costs in deep coastal waters, local procurement requirements that slow project timelines and limited domestic capability for large direct-drive nacelle production. These conditions define how quickly direct-drive systems gain traction across Japan’s wind sector.

Japan’s dependence on imported fuel has intensified focus on offshore wind as a domestic energy source, especially in northern and western coastal regions where wind resources are stronger. Direct-drive turbines appeal because their simplified drivetrain reduces maintenance needs, which is valuable for remote offshore sites where service crews face harsh weather and limited access windows. Local conditions such as frequent typhoons and seismic risk also make gearless systems attractive due to fewer mechanical stress points. These Japan-specific factors strengthen demand for durable direct-drive designs.

Opportunities emerge in designated offshore wind promotion zones where the government awards long-term capacity contracts. Northern prefectures with consistent wind patterns, ports installing specialised heavy-lift infrastructure and coastal industrial zones seeking repowering solutions are central to this growth. There is also potential in projects aiming to localise components, as domestic firms explore partnerships to manufacture parts compatible with direct-drive architecture. Repowering older onshore fleets in Hokkaido and Tohoku offers another avenue for introducing mid-scale direct-drive turbines.

Challenges include high capital cost for large offshore units, which weighs heavily on developers bidding into Japan’s price-competitive auction system. Deep seabed conditions in many Japanese coastal regions demand expensive foundations and vessels, increasing financial risk. Domestic production of large permanent-magnet components remains limited, leading to reliance on imports that complicate project timelines. Regulatory reviews, port-capacity constraints and community negotiations also slow deployment. These Japan-specific hurdles moderate the overall pace at which direct-drive systems scale across national wind projects.

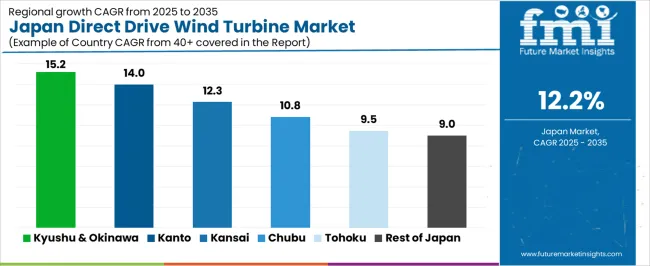

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 15.2% |

| Kanto | 14.0% |

| Kinki | 12.3% |

| Chubu | 10.8% |

| Tohoku | 9.5% |

| Rest of Japan | 9.0% |

Demand for direct drive wind turbines in Japan is rising across regions, with Kyushu and Okinawa leading at 15.2%. Growth in this area reflects active wind power development and steady installation of turbines suited for coastal and island environments. Kanto follows at 14.0%, supported by regional energy programs and interest in reliable turbine systems that require fewer mechanical components. Kinki records 12.3%, shaped by ongoing power generation projects and regional investment in new turbine installations. Chubu grows at 10.8%, where inland and coastal sites continue to adopt direct drive units. Tohoku reaches 9.5%, influenced by favorable wind conditions. The rest of Japan posts 9.0%, showing consistent uptake across smaller project areas.

Kyushu & Okinawa is projected to grow at a CAGR of 15.2% through 2035 in demand for direct drive wind turbines. Renewable energy projects in Fukuoka and surrounding areas are increasingly adopting direct drive turbines for onshore and offshore wind farms. Rising focus on carbon emission reduction, energy efficiency, and reliable renewable power generation drives adoption. Manufacturers provide high-capacity, low-maintenance turbines suitable for diverse wind conditions. Distributors and developers ensure accessibility across energy infrastructure projects. Growth in wind energy capacity, government support, and private investment supports steady adoption of direct drive wind turbines in Kyushu & Okinawa.

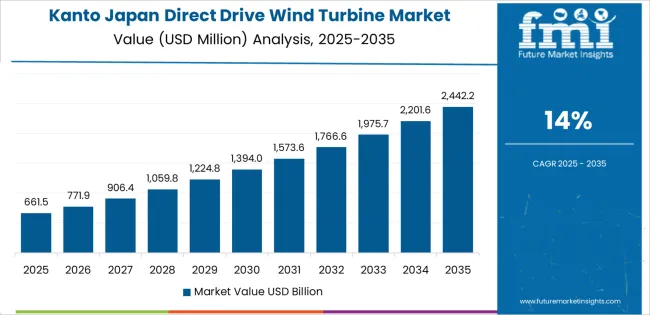

Kanto is projected to grow at a CAGR of 14.0% through 2035 in demand for direct drive wind turbines. Tokyo and surrounding prefectures are increasingly implementing direct drive turbines for onshore and offshore wind energy projects. Rising demand for clean energy, grid reliability, and sustainable power generation drives adoption. Manufacturers provide high-performance, low-maintenance turbines compatible with various wind speeds and site conditions. Distributors and project developers ensure accessibility across energy infrastructure networks. Expansion of renewable energy capacity, government incentives, and private sector investments support steady adoption of direct drive wind turbines across Kanto.

Kinki is projected to grow at a CAGR of 12.3% through 2035 in demand for direct drive wind turbines. Osaka, Kyoto, and surrounding prefectures are increasingly implementing direct drive turbines for onshore wind projects. Rising demand for renewable energy, emission reduction, and reliable electricity drives adoption. Manufacturers provide turbines optimized for low maintenance, high efficiency, and variable wind conditions. Distributors and project developers ensure accessibility across urban and semi-urban renewable energy sites. Expansion in wind power projects, infrastructure upgrades, and private investments supports steady adoption of direct drive wind turbines across Kinki.

Chubu is projected to grow at a CAGR of 10.8% through 2035 in demand for direct drive wind turbines. Nagoya and surrounding areas are increasingly adopting turbines for onshore and small offshore wind energy projects. Rising demand for clean electricity, energy efficiency, and emission reduction drives adoption. Manufacturers supply high-performance turbines suitable for variable wind speeds and low-maintenance operations. Distributors and project developers ensure accessibility across urban and semi-urban wind farms. Wind energy infrastructure expansion, regional renewable initiatives, and investment growth support steady adoption of direct drive wind turbines in Chubu.

Tohoku is projected to grow at a CAGR of 9.5% through 2035 in demand for direct drive wind turbines. Sendai and surrounding areas are gradually adopting turbines for onshore wind energy projects. Rising focus on renewable energy generation, emission reduction, and operational efficiency drives adoption. Manufacturers provide high-efficiency turbines compatible with various wind conditions. Distributors and developers expand accessibility across urban and semi-urban wind energy facilities. Expansion of regional wind farms, renewable energy incentives, and private sector investments support steady adoption of direct drive wind turbines across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 9.0% through 2035 in demand for direct drive wind turbines. Smaller towns and rural regions gradually adopt turbines for onshore renewable energy projects. Rising demand for emission reduction, energy reliability, and renewable capacity drives adoption. Manufacturers supply turbines suitable for low-maintenance operations and variable wind conditions. Distributors and project developers ensure accessibility across urban, semi-urban, and rural wind energy sites. Gradual adoption, infrastructure investment, and renewable energy policy support steady adoption of direct drive wind turbines across the Rest of Japan.

The demand for direct-drive wind turbines in Japan is fueled by the nation’s accelerated push toward offshore wind power and grid resilience. With targets set for significant growth in wind capacity, especially from offshore zones, turbine designers favour direct-drive systems because they reduce mechanical complexity, maintenance costs and downtime. Japan’s island geography and challenging wind-farm environments amplify the appeal of gear-less generators that offer higher reliability under harsh conditions. Moreover, increasing partnerships between Japanese utilities and global turbine suppliers encourage investment in advanced turbine technologies that fit Japan’s regulatory and coastal project requirements.

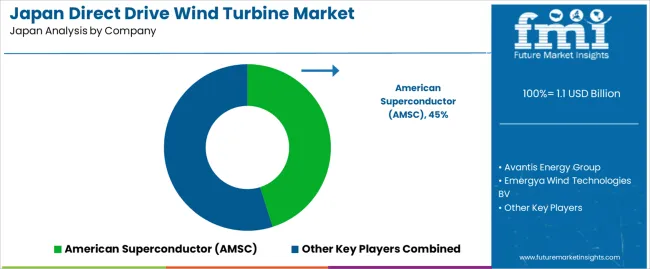

Major companies active in Japan’s direct-drive wind-turbine segment include American Superconductor (AMSC), Avantis Energy Group, Emergya Wind Technologies BV, Enercon GmbH and GE Renewable Energy. These firms deliver direct-drive turbine offerings or key components suited to Japanese offshore and on-shore projects. AMSC brings superconducting generator innovation. Avantis and Emergya focus on integrated power-systems for wind farms. Enercon is known for gear-less wind-turbine design. GE Renewable Energy supports large-scale turbine roll-out in Japan’s emergent wind zones. Their involvement, technical expertise and local alliances help shape how Japan adopts direct-drive wind-turbine solutions in its renewable-energy strategy.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Capacity | Less than 1 MW, 1 MW to 3 MW, More than 3 MW |

| Technology | Permanent Magnet Synchronous Generator, Electrically Excited Synchronous Generator |

| Application | Offshore, Onshore |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | American Superconductor (AMSC), Avantis Energy Group, Emergya Wind Technologies BV, Enercon GmbH, GE Renewable Energy |

| Additional Attributes | Dollar by sales by capacity and technology; regional CAGR and adoption trends; uptake across offshore and onshore projects; preference for permanent magnet synchronous generators; role of low-maintenance, gear-less designs in coastal and island wind zones; impact of typhoon- and seismic-resilient design on demand; early adoption in Kyushu & Okinawa and Kanto; projected growth toward USD 3.5 billion by 2035; integration with local supply chains and premium turbine models. |

The demand for direct drive wind turbine in japan is estimated to be valued at USD 1.1 billion in 2025.

The market size for the direct drive wind turbine in japan is projected to reach USD 3.5 billion by 2035.

The demand for direct drive wind turbine in japan is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in direct drive wind turbine in japan are less than 1mw, 1mw to 3mw and more than 3mw.

In terms of technology, permanent magnet synchronous generator segment is expected to command 56.4% share in the direct drive wind turbine in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Drive Wind Turbine Market Growth - Trends & Forecast 2025 to 2035

Demand for Direct Drive Wind Turbine in USA Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Pitch and Yaw Drive Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Forging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Market Analysis and Insights - 2025 to 2035

Wind Turbine Automation Market Insights - Growth & Forecast through 2035

Wind Turbine Composite Material Market Size 2024-2034

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Wind Turbine Shaft Market

Small Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Marine Wind Turbine Market

Onshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Demand for Microturbines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Direct Thermal Printing Film in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA