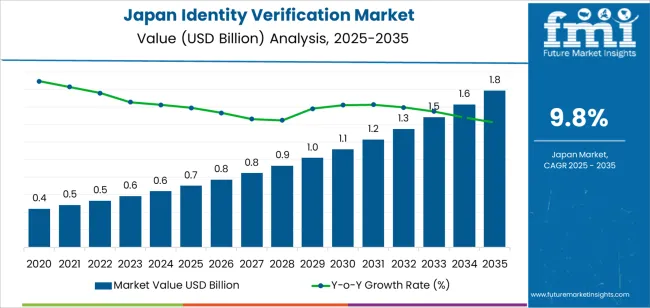

The Japan identity verification demand is valued at USD 0.7 billion in 2025 and is estimated to reach USD 1.7 billion by 2035, recording a CAGR of 9.8%. Demand is driven by expanding digital onboarding requirements across banking, telecommunications, healthcare, and government services. Increased use of remote authentication, tighter fraud-prevention measures, and wider deployment of biometric and document-verification tools continue to shape procurement patterns. Growth is reinforced by regulatory expectations for secure account access, strengthened compliance procedures, and rising transaction volumes across online service channels.

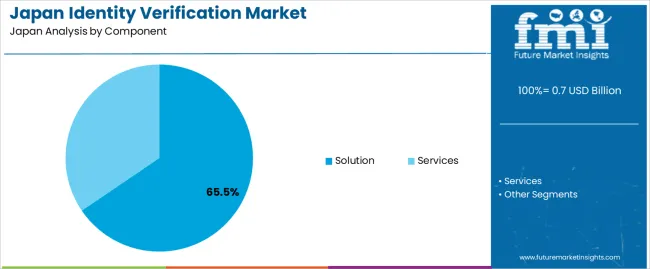

Solutions represent the leading component category, supported by their central role in document authentication, biometric matching, and automated risk checks. These systems integrate facial-recognition tools, liveness-detection methods, and optical document analysis to verify identities at scale with reduced manual review. Improvements in algorithm accuracy, multilingual document coverage, and workflow integration are contributing to broader adoption among enterprises and public organisations.

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, where financial institutions, technology providers, and public-service platforms rely on structured verification frameworks. Key suppliers include Entrust, Onfido, IDEMIA, Transmit Security, and Secret Double Octopus, offering identity-verification technologies suited to regulated and high-volume environments.

Growth rate volatility analysis indicates a moderate volatility index during the early years, shaped by regulatory adoption cycles, enterprise digitisation timelines, and varying investments in fraud-prevention systems. Between 2025 and 2028, annual growth may fluctuate as financial institutions, government bodies, and digital-service providers adjust onboarding frameworks to comply with evolving KYC and AML requirements. Shifts in biometric-authentication usage and document-verification volumes will contribute to short-term variations.

From 2029 to 2035, the volatility index is expected to decline as identity-verification tools become standard across banking, telecom, e-commerce, and mobility platforms. Wider integration of automated risk scoring, liveness detection, and multi-factor authentication will support stable, recurring procurement through subscription-based models. Replacement and optimisation cycles will shape consistent demand, reducing dependence on one-time adoption surges. While policy revisions and cybersecurity events may create limited variation, overall volatility will remain contained. The long-term pattern reflects a maturing digital-security segment defined by uniform adoption, predictable compliance requirements, and steady reliance on identity-verification infrastructure across Japan’s public and private sectors.

| Metric | Value |

|---|---|

| Japan Identity Verification Sales Value (2025) | USD 0.7 billion |

| Japan Identity Verification Forecast Value (2035) | USD 1.7 billion |

| Japan Identity Verification Forecast CAGR (2025 to 2035) | 9.8% |

Demand for identity verification in Japan is increasing because digital services across banking, e-commerce, sharing economy and government platforms require trustworthy authentication to prevent fraud and ensure compliance with regulations. Expansion of mobile-based services and remote onboarding heightens need for reliable identity proofing and biometric document verification. Technological advances such as IC-chip card reading, facial recognition and AI-powered document checks improve accuracy and user experience which supports uptake among businesses.

The Japanese government’s push toward digital identity initiatives and national ID integration raises awareness and facilitates enterprise adoption of verification solutions. Constraints include stringent data privacy regulations and cultural concerns around personal information and surveillance which may slow adoption of new verification methods. Implementation costs and deployment across multiple legacy IT systems also pose challenges particularly for smaller firms. Some businesses may delay transition until regulatory or competitive pressures mandate adoption.

Demand for identity-verification systems in Japan reflects the need for accurate user authentication, compliance with financial regulations, and secure access management across digital platforms. Adoption patterns differ across component types, industry groups, and deployment models, shaped by organisational security requirements and the extent of digital transformation across public and private sectors. These patterns indicate how Japanese enterprises integrate verification tools into onboarding, transaction monitoring, and access-control procedures.

Identity-verification solutions hold 65.5% of demand in Japan, making them the dominant component category. Solutions include document authentication tools, biometric verification modules, and database-matching systems used in onboarding and access workflows. Organisations adopt solutions to support compliance, reduce fraud, and maintain accuracy in user verification. Services represent 34.5%, covering system integration, maintenance, and workflow optimisation. Service demand remains important for institutions requiring customised configurations or complex identity-management frameworks. Component distribution reflects sector-specific regulatory needs, infrastructure maturity, and the reliance on automated systems to reduce manual verification tasks across high-volume operations within financial, retail, and healthcare settings.

Key drivers and attributes:

BFSI holds 32.7% of identity-verification demand in Japan and represents the leading industry segment. Financial institutions rely on verification systems to meet KYC and AML regulations, manage account onboarding, and authenticate transactions. Retail and e-commerce account for 20.8%, driven by the need to limit fraudulent orders and ensure secure digital customer journeys. Healthcare represents 17.6%, using verification tools for patient identification and data-access control. IT and telecom hold 15.1%, applying verification in user account creation and device-access management. Government and defense represent 13.8%, supporting controlled access, identity issuance, and secure administrative workflows. Industry distribution reflects varying risk levels, regulatory oversight, and digital-service volume.

Key drivers and attributes:

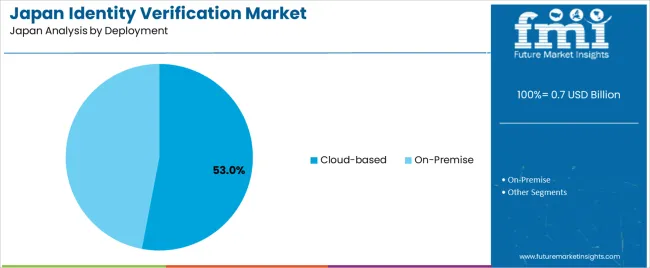

Cloud-based identity-verification systems hold an estimated 53.0% of demand in Japan, making them the largest deployment category. Cloud platforms offer scalability, rapid updates, and flexible integration with digital applications used across industries. Their structure supports remote verification, mobile onboarding, and real-time authentication. On-premise systems represent 47.0%, serving organisations that require full control over data storage, security policies, and system governance. These deployments are common in regulated sectors where internal data management remains a priority. Deployment distribution reflects organisational security preferences, the structure of existing IT environments, and the degree of digital-service adoption across Japanese enterprises.

Key drivers and attributes:

Increased digital services, stringent regulatory frameworks and rising fraud risks drive demand.

Demand for identity verification solutions in Japan is growing as government and commercial entities expand digital access programs, e-commerce services and remote onboarding for banking, telecom and utilities. Financial institutions and fintech firms face requirements under anti-money-laundering and customer-identification mandates which support investment in verification solutions. The rise in online transactions, mobile applications and cross-border trade increases exposure to identity theft and synthetic fraud, encouraging use of multi-factor authentication, document checks, biometrics and analytics-driven verification services.

Privacy concerns, regulatory complexity and cost of high-quality solutions restrain wider adoption.

Japanese consumers and regulatory regimes place strong emphasis on data protection, personal information handling and appropriate use of biometrics, which may slow adoption of advanced verification technologies. Implementation of robust identity systems involves costs for software, hardware, integration, and staff training, which may deter smaller businesses from full deployment. The regulatory landscape spans multiple ministries and sectors, leading to implementation uncertainty and potential delay in rollout of unified verification standards.

Integration of biometrics and digital ID ecosystems, expansion of verification across government and private services, and trend toward reuse of verified identity credentials define key trends.

Providers are increasing deployment of biometric checks, such as facial recognition and liveness detection, combined with document verification to enable remote service access in Japan. Public-sector initiatives aimed at digital identity frameworks are encouraging private-sector services to integrate verification solutions beyond banking, including health, e-commerce and public utilities. Reusable digital credentials that once verified can be leveraged across multiple services are gaining traction, reducing onboarding friction and cost for users and providers.

Demand for identity verification in Japan is increasing through 2035 as financial institutions, telecom operators, e-commerce platforms, healthcare networks, and government agencies expand the use of digital verification tools for onboarding, fraud prevention, and regulatory compliance.

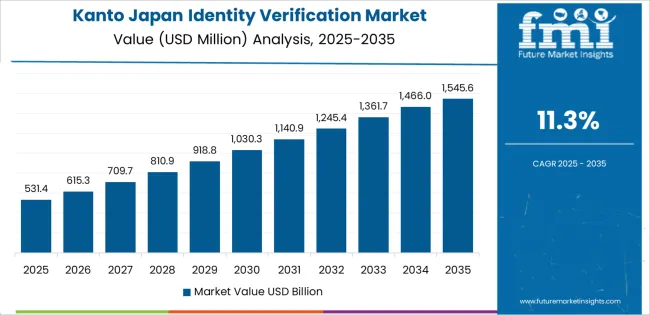

Adoption includes document-authentication modules, biometric identity checks, facial-recognition workflows, and account-verification systems integrated into online and mobile services. Growth varies by region based on digital-infrastructure maturity, enterprise density, and sector-specific compliance requirements. Identity verification also expands across public services requiring secure access management. Kyushu & Okinawa leads with a 12.3% CAGR, followed by Kanto (11.3%), Kinki (9.9%), Chubu (8.7%), Tohoku (7.7%), and the Rest of Japan (7.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 12.3% |

| Kanto | 11.3% |

| Kinki | 9.9% |

| Chubu | 8.7% |

| Tohoku | 7.7% |

| Rest of Japan | 7.3% |

Kyushu & Okinawa grows at 12.3% CAGR, supported by strong adoption across financial institutions, telecom operators, and e-commerce platforms. Banks in Fukuoka, Kagoshima, and Kumamoto implement identity-verification systems for new-account onboarding, digital banking access, and fraud prevention. Telecom providers rely on verification modules for SIM registration and customer authentication, strengthening security requirements across service networks. E-commerce platforms use document-check systems to validate seller identities and reduce fraudulent listings. Public-sector offices adopt digital identity workflows for access to administrative services, particularly in Okinawa, where distributed populations rely heavily on remote verification. Growing digital transactions and secure-service requirements sustain recurring demand for identity-verification solutions.

Kanto grows at 11.3% CAGR, driven by dense financial hubs, corporate activity, and extensive digital-service usage across Tokyo, Kanagawa, and Chiba. Major banks and insurance providers depend on identity-verification tools for customer onboarding, regulatory compliance, and ongoing account-access validation. Large e-commerce platforms use automated verification to manage high transaction volumes and prevent fraudulent activities. Technology companies deploy biometric login systems and identity APIs across consumer applications. Public-sector agencies rely on identity verification for administrative services requiring secure authentication. The region’s large population and extensive digital adoption create continuous demand for scalable verification workflows integrated into mobile and online channels.

Kinki grows at 9.9% CAGR, supported by broad adoption of verification systems across Osaka, Kyoto, and Hyogo. Regional banks and credit unions use identity-verification workflows to support regulatory compliance, remote onboarding, and fraud-control procedures. Telecom companies rely on automated document checks for service activation. Retail and e-commerce firms implement verification to manage seller accounts and reduce fraudulent transactions. Universities and healthcare institutions adopt identity systems for access control to digital platforms and online services. Although enterprise density is lower than in Kanto, consistent digitalization across financial, retail, and education sectors sustains strong demand for verification technologies.

Chubu grows at 8.7% CAGR, supported by expanding digital workflows across automotive, manufacturing, financial-services, and logistics companies. Banks in Aichi and Shizuoka implement identity-verification systems for secure remote onboarding and compliance workflows. Manufacturing and logistics firms adopt authentication tools to manage employee access to digital systems and internal platforms. E-commerce operators rely on verification modules to screen sellers and prevent transaction-related risks. Healthcare networks in the region use identity verification for patient registration and digital-record access. While the region’s digital-service concentration is moderate, steady adoption across multiple service segments supports sustained growth.

Tohoku grows at 7.7% CAGR, supported by increasing digital adoption across regional banks, public institutions, and healthcare networks in Miyagi, Fukushima, and Iwate. Financial institutions use identity-verification systems for secure digital banking and account-opening procedures. Public agencies rely on digital identification tools for administrative services and citizen-access workflows. Healthcare providers adopt verification tools for digital-record systems, appointment platforms, and secure patient access. E-commerce and retail operators use identity checks to reduce fraudulent transactions. Despite lower population density, essential-service digitalization continues to drive stable verification requirements across the region.

The Rest of Japan grows at 7.3% CAGR, supported by distributed financial institutions, retail networks, and public-service offices across rural prefectures. Local banks use identity-verification systems to support remote account-opening and compliance needs. Municipal offices rely on digital identity tools for secure citizen-service access. Retailers and online-service providers adopt verification tools to manage customer authentication and reduce transaction fraud. Healthcare centers implement identity-check systems for managing patient access to digital portals. Although digital-service penetration is slower than in metropolitan regions, ongoing modernization ensures continuous use of verification solutions across essential sectors.

Demand for identity verification in Japan is shaped by a concentrated group of authentication and digital-security providers supporting financial institutions, telecom operators, mobility platforms, and enterprise services. Entrust holds the leading position with an estimated 34.0% share, supported by long-standing credentialing frameworks, strong certificate-management infrastructure, and stable delivery of high-assurance identity solutions. Its position is reinforced by reliable cryptographic capability and broad adoption in sectors requiring strict regulatory compliance.

Onfido and IDEMIA follow as significant participants, offering document-authentication, biometric verification, and identity-proofing systems used in digital onboarding and fraud-prevention workflows. Their strengths include scalable machine-learning models, established document-recognition engines, and alignment with Japan’s identity-verification and eKYC requirements. Transmit Security maintains a notable presence through passwordless authentication and orchestration tools that simplify end-user access while supporting enterprise security controls.

Secret Double Octopus contributes additional capability through credential-resilience and multi-factor authentication solutions suited to organizations seeking to strengthen enterprise identity protection and reduce exposure to credential compromise. Competition across this segment centers on verification accuracy, biometric reliability, system latency, integration flexibility, and compliance with Japan’s security and privacy regulations. Demand continues to expand as financial institutions, mobility services, and digital platforms adopt high-assurance identity verification and passwordless authentication to reduce fraud risk and support secure digital transactions across consumer and enterprise environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Component | Solution, Services |

| Industry | BFSI, Retail & E-commerce, Healthcare, IT & Telecom, Government & Defense |

| Deployment | On-Premise, Cloud-based |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Entrust, Onfido, IDEMIA, Transmit Security, Secret Double Octopus |

| Additional Attributes | Dollar sales by component, industry, and deployment categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of identity verification and digital authentication providers; advancements in biometrics, AI-driven fraud detection, and secure cloud identity platforms; integration with Japanese financial institutions, e-commerce verification flows, telecom KYC, and government digital ID initiatives. |

The global demand for identity verification in japan is estimated to be valued at USD 0.7 billion in 2025.

The market size for the demand for identity verification in japan is projected to reach USD 1.8 billion by 2035.

The demand for identity verification in japan is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in demand for identity verification in japan are solution and services.

In terms of industry, bfsi segment to command 32.7% share in the demand for identity verification in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

Identity Analytics Market Size and Share Forecast Outlook 2025 to 2035

Identity & Access Management Market Growth – Demand, Trends & Forecast 2025-2035

Identity-as-a-Service (IDaaS) Market Outlook 2025 to 2035 by Access Type, Enterprise Size, Service Type, Application, Industry, and Region

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Cloud Identity Management Market

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Digital Identity Services Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

e-Government Identity Management Market

ID Verification Market

Ex-Employee Verification Market Size and Share Forecast Outlook 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA