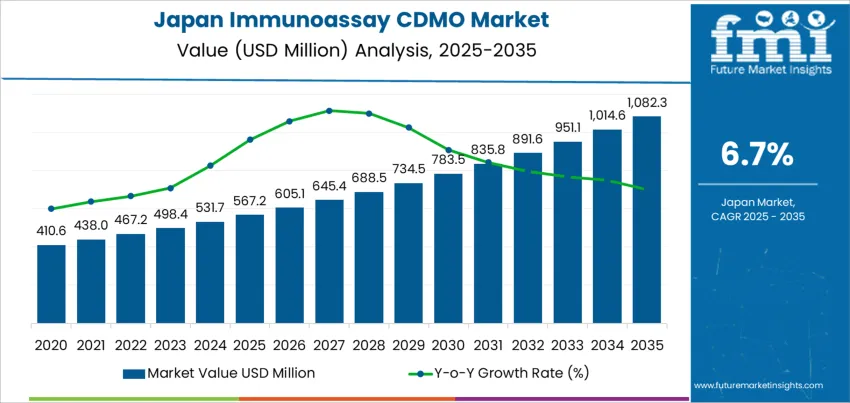

The demand for Immunoassay CDMO (Contract Development and Manufacturing Organizations) in Japan is expected to grow from USD 567.2 million in 2025 to USD 1,082.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.7%. Immunoassay CDMO services play a crucial role in the development, manufacturing, and scaling of immunoassay kits that are essential for the diagnostic and biopharmaceutical industries. These kits, which detect specific substances such as antigens and antibodies, are used in a wide range of applications, including disease diagnostics, clinical trials, and drug discovery. As healthcare needs evolve, especially with the growing demand for personalized medicine and point-of-care diagnostics, the Immunoassay CDMO industry is poised for consistent growth.

The demand for these services is primarily driven by the increasing focus on early disease detection, preventive care, and the global healthcare infrastructure's expansion. Japan's aging population, alongside a rising preference for non-invasive diagnostic solutions, is further accelerating the demand for more advanced immunoassays. The biopharmaceutical sector's focus on biologics and biomarkers in drug development is supporting the continued growth of immunoassay testing solutions, as these are essential in ensuring safety, efficacy, and accuracy in clinical trials and healthcare diagnostics.

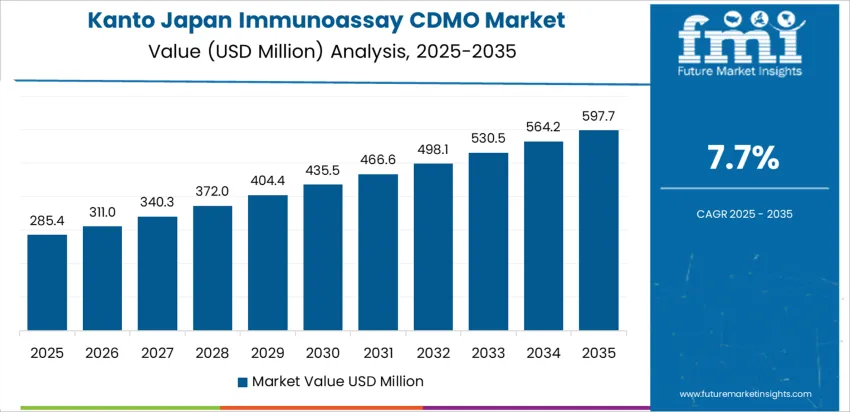

Between 2025 and 2030, the demand for Immunoassay CDMO services in Japan will grow from USD 567.2 million to USD 605.1 million. This initial period will see steady growth as the adoption of innovative diagnostic technologies and biopharmaceutical advancements continues. The steady growth will be driven by consistent investments in immunoassay solutions for detecting diseases like cancer, cardiovascular diseases, and infectious diseases. The pharmaceutical sector’s continuous expansion and focus on research and development will fuel demand during this phase. This early stage will also witness an increase in demand for customized immunoassays and high-throughput screening solutions designed to support rapid testing and ensure better patient outcomes.

From 2030 to 2035, the demand for Immunoassay CDMO services will experience a sharper increase, from USD 605.1 million to USD 1,082.3 million. This significant rise will be driven by the expansion of personalized healthcare, the increasing number of clinical trials, and the growing demand for point-of-care diagnostic solutions. The enhanced adoption of AI-driven diagnostic platforms and automated immunoassays will also contribute to this acceleration, as healthcare systems embrace more efficient, accurate, and cost-effective testing solutions. The industry’s compound absolute growth will be further fueled by the introduction of next-generation immunoassays, which will become essential in precision medicine, biomarker discovery, and the development of therapeutics targeting complex diseases.

| Metric | Value |

|---|---|

| Demand for Immunoassay CDMO in Japan Value (2025) | USD 567.2 million |

| Demand for Immunoassay CDMO in Japan Forecast Value (2035) | USD 1,082.3 million |

| Demand for Immunoassay CDMO in Japan Forecast CAGR (2025-2035) | 6.7% |

The demand for immunoassay CDMO services in Japan is growing due to the increasing need for diagnostic solutions and the rising importance of personalized medicine. Immunoassays are essential for detecting and quantifying biomarkers, and with Japan’s aging population and the rise in chronic diseases, there is a greater demand for advanced diagnostic tests. CDMOs specializing in immunoassays offer critical services, including the development, manufacturing, and scaling of these tests, which are essential for detecting conditions such as cancer, cardiovascular diseases, and infectious diseases.

A significant driver behind this growth is the expansion of the biopharmaceutical industry in Japan, particularly in the field of immunotherapy and targeted treatments. As healthcare becomes more personalized, there is an increasing reliance on biomarkers to tailor treatments to individual patients. This has driven the need for high-quality immunoassays, which in turn is fueling the demand for CDMO services to support the development and manufacturing of diagnostic and therapeutic products.

Advancements in the technology used for immunoassay development, including the use of automation and data analytics, are enhancing the speed and efficiency of CDMO services. The need for compliance with rigorous regulatory standards in Japan also drives pharmaceutical companies to outsource immunoassay development and manufacturing to specialized CDMOs that have the expertise and infrastructure to meet these requirements. As Japan continues to prioritize health innovations and the growing demand for personalized medicine, the demand for immunoassay CDMO services is expected to grow steadily through 2035.

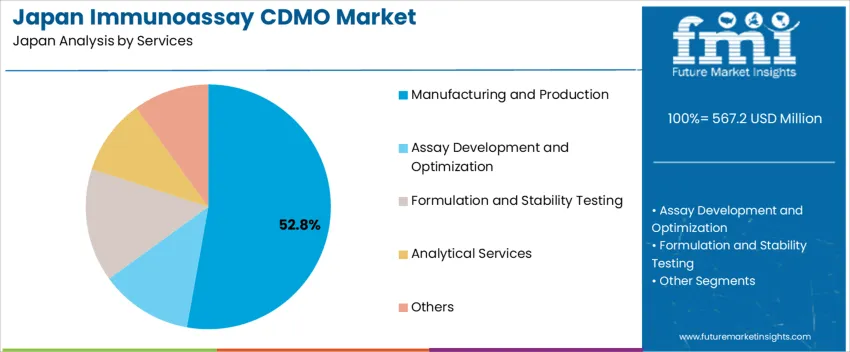

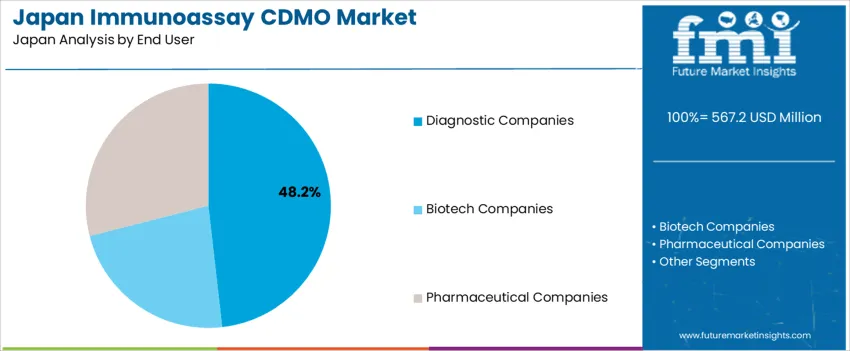

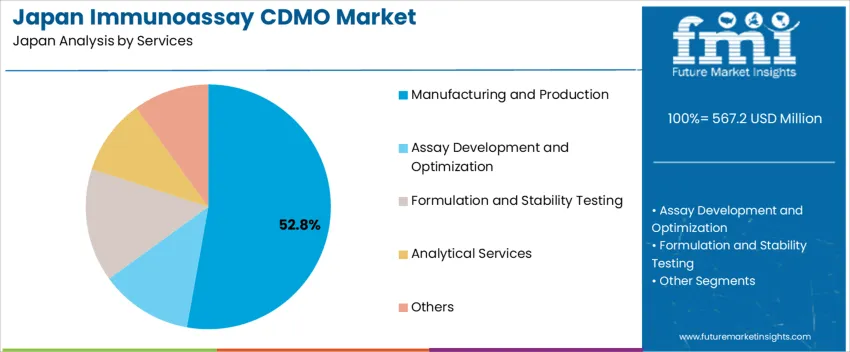

Demand for immunoassay contract development and manufacturing organizations (CDMO) in Japan is segmented by services, end user, and region. By services, demand is divided into manufacturing and production, assay development and optimization, formulation and stability testing, analytical services, and others, with manufacturing and production leading at 53%. The demand is also segmented by end user, including diagnostic companies, biotech companies, and pharmaceutical companies, with diagnostic companies accounting for 48.2% of the demand. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Manufacturing and production account for 53% of the demand for immunoassay CDMO services in Japan. This service is essential for the large-scale production of diagnostic assays and related products, which are in high demand due to the growing healthcare and diagnostics sector. Immunoassay products are widely used in clinical diagnostics, with applications ranging from disease detection to monitoring treatment efficacy. The demand for reliable and high-quality manufacturing services is driven by the need for consistency, regulatory compliance, and cost-effective production methods in the healthcare industry. As the need for diagnostics increases with Japan's aging population, the demand for CDMO services focused on manufacturing and production will continue to rise. Immunoassay CDMOs play a critical role in providing the necessary infrastructure and expertise for the large-scale production of diagnostic assays, ensuring their availability and quality.

Diagnostic companies account for 48.2% of the demand for immunoassay CDMO services in Japan. These companies rely heavily on CDMOs for the development, optimization, and manufacturing of immunoassay products used in diagnostics. Immunoassays are crucial tools in clinical diagnostics, enabling the detection and quantification of biomarkers for a variety of medical conditions. The need for accurate and reliable diagnostic tests drives diagnostic companies to partner with CDMOs that can provide high-quality production and testing services. As the demand for advanced diagnostic solutions grows, especially in areas like infectious diseases, cancer, and chronic conditions, the role of CDMOs in supporting diagnostic companies with specialized services becomes increasingly critical. The continued growth of the healthcare industry, along with the rising demand for personalized medicine and point-of-care diagnostics, ensures that diagnostic companies will remain a leading end-user of immunoassay CDMO services in Japan.

In Japan, demand for immunoassay contract‑development & manufacturing services is rising alongside growth of the overall in‑vitro diagnostics (IVD) industry and increasing healthcare needs due to an aging population. As more diagnostic tests for chronic diseases, infections, cancer markers, and age‑related conditions are required, manufacturers and diagnostic firms seek CDMO partners to supply reagents, kits, and immunoassay components efficiently. Outsourcing to CDMOs lets companies avoid the high fixed costs of in‑house production while meeting regulatory and quality standards.

Why is Demand for Immunoassay CDMO Growing in Japan?

Demand for immunoassay CDMOs is growing in Japan because diagnostic firms and medical‑device companies increasingly rely on external partners to handle complex assay development, manufacturing, and regulatory compliance. As demand rises for accurate, high‑sensitivity immunoassays for early detection, health screening, chronic‑disease monitoring, and oncology diagnostics firms prefer outsourcing to specialized providers to achieve scalability, quality, and faster time‑to‑industry. The expanding elderly population, growing chronic and lifestyle‑related disease burden, and increased public‑health screening programs boost the need for large volumes of immunoassay kits, driving CDMO demand. Outsourcing also helps manage fluctuating production volumes and keeps capital burdens lower for diagnostic firms.

How are Technological and Industry Innovations Driving Growth of Immunoassay CDMO in Japan?

Technological advances in immunoassay development such as automation of assay platforms, high‑throughput manufacturing, improved reagent formulations, and multiplex testing are making CDMO services more attractive in Japan. CDMOs that invest in automated production lines and advanced process controls can deliver high‑quality, consistent immunoassays at scale, supporting large‑volume diagnostic demand. Growing complexity in diagnostics (e.g., biomarker panels, oncology markers, precision diagnostics) pushes firms to outsource to CDMOs with the necessary technical expertise and regulatory know‑how. As CDMOs expand their service portfolio from assay development and validation to mass production and quality control they become key enablers for diagnostic firms needing rapid, compliant, high‑volume output.

What are the Key Challenges Limiting Wider Adoption of Immunoassay CDMO in Japan?

Despite promising growth, adoption of immunoassay CDMO in Japan faces challenges. High capital expenditure is required to set up or upgrade facilities to meet stringent regulatory and quality standards, which may deter small‑ or medium‑sized players. Capacity limitations among existing CDMOs can lead to bottlenecks if demand surges. Regulatory compliance including validation protocols, quality‑assurance, and certification for diagnostic products adds complexity and time. Industry competition and an increasing number of CDMOs can pressure pricing and margins, possibly reducing profitability. Finally, for highly specialized or niche assays, firms may prefer in‑house development or partner with overseas CDMOs, limiting domestic growth potential.

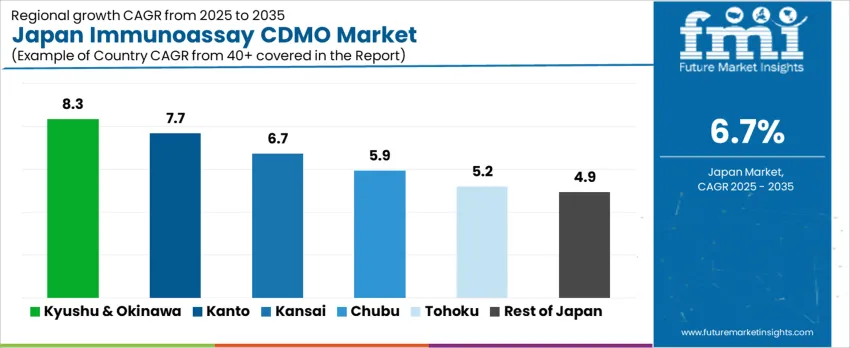

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.3% |

| Kanto | 7.7% |

| Kinki | 6.7% |

| Chubu | 5.9% |

| Tohoku | 5.2% |

| Rest of Japan | 4.9% |

Demand for immunoassay CDMO in Japan is growing steadily, with Kyushu & Okinawa leading at an 8.3% CAGR, driven by increasing investments in pharmaceutical manufacturing and the development of contract manufacturing services. The Kanto region follows with a 7.7% CAGR, supported by its major pharmaceutical hubs and high demand for biopharmaceutical production. Kinki shows a 6.7% CAGR, fueled by strong industrial demand in the biotechnology and life sciences sectors. Chubu experiences a 5.9% CAGR, driven by regional investments in healthcare and pharmaceutical services. Tohoku and the Rest of Japan see moderate growth at 5.2% and 4.9%, respectively, as the demand for contract development and manufacturing services continues to expand in both urban and rural regions.

Kyushu & Okinawa is experiencing the highest demand for immunoassay CDMO in Japan, with an 8.3% CAGR. This growth is primarily driven by the region’s increasing investments in pharmaceutical manufacturing and the expanding contract manufacturing sector. As part of a nationwide effort to strengthen biopharmaceutical production, Kyushu & Okinawa are receiving significant attention from pharmaceutical companies seeking to outsource their development and manufacturing services. The region’s focus on improving healthcare infrastructure and fostering pharmaceutical R&D is contributing to the rising demand for immunoassay services. The presence of pharmaceutical plants and biotechnology firms in Kyushu has further boosted the need for specialized manufacturing services. As the demand for outsourced immunoassay production increases, Kyushu & Okinawa is expected to maintain strong growth in the CDMO sector.

Kanto, home to Tokyo and a major pharmaceutical hub, is witnessing significant demand for immunoassay CDMO services, with a 7.7% CAGR. The region’s pharmaceutical industry is one of the largest in Japan, with numerous global and local pharmaceutical companies located in the area. These companies rely heavily on contract development and manufacturing services to meet growing demand for immunoassay-based diagnostics and therapeutics. Kanto’s strong infrastructure and R&D focus are key drivers, as the region continuously innovates in biotechnology and biopharmaceuticals. Furthermore, the growing trend toward outsourcing production in the life sciences sector is increasing demand for immunoassay CDMO services. As the industry for biopharmaceuticals and diagnostic testing expands, Kanto’s demand for specialized manufacturing services will remain strong, contributing to its 7.7% CAGR in this sector.

In Kinki, demand for immunoassay CDMO is growing steadily at a 6.7% CAGR, fueled by the region’s strong biotechnology and pharmaceutical sectors. Kinki, with major cities like Osaka and Kyoto, has long been a center for innovation in life sciences and pharmaceutical development. The region is home to a diverse range of pharmaceutical manufacturers, research institutions, and biotech companies, all of which drive the need for contract development and manufacturing services. As the demand for diagnostic tests and biologics rises, companies in Kinki are increasingly outsourcing their immunoassay manufacturing needs to specialized CDMOs. Furthermore, Kinki is focusing on advanced pharmaceutical R&D, which encourages the adoption of cutting-edge manufacturing processes. This combination of industrial growth and focus on R&D ensures steady demand for immunoassay CDMO services in Kinki.

Chubu is seeing moderate growth in demand for immunoassay CDMO services, with a 5.9% CAGR. The region’s industrial base, which includes strong manufacturing and technology sectors, is driving the demand for specialized contract development and manufacturing services. Chubu’s pharmaceutical and biotechnology sectors are expanding as companies seek more efficient ways to produce immunoassays and other diagnostic products. The region’s focus on innovation in manufacturing processes and healthcare services further boosts the need for immunoassay CDMO services. Chubu’s central location in Japan makes it a key hub for logistical support, which is important for the distribution of pharmaceutical products. As pharmaceutical outsourcing continues to grow, the demand for immunoassay production services in Chubu is expected to continue at a steady pace, supported by local industry developments.

Tohoku is experiencing moderate growth in immunoassay CDMO demand, with a 5.2% CAGR. The region’s pharmaceutical and biotechnology sectors are evolving, with a growing emphasis on improving healthcare infrastructure and outsourcing services to specialized manufacturers. Tohoku, traditionally known for its manufacturing and agricultural industries, is now expanding into biopharmaceuticals and diagnostic services, which is fueling demand for immunoassay CDMO. The government’s focus on promoting regional development and improving healthcare in rural areas is also contributing to the growth of the pharmaceutical outsourcing industry. As local pharmaceutical companies look to scale up production and innovate in diagnostics, demand for specialized immunoassay manufacturing services is expected to rise. Tohoku’s evolving pharmaceutical ecosystem presents opportunities for immunoassay CDMO services, driving steady demand in the region.

The Rest of Japan is seeing moderate growth in immunoassay CDMO services demand, with a 4.9% CAGR. This growth is driven by the continued expansion of pharmaceutical outsourcing in more rural and suburban areas outside the main industrial hubs. As the pharmaceutical and biotechnology industries grow in these regions, companies are increasingly turning to contract manufacturers to handle immunoassay production and other diagnostic services. The Rest of Japan’s efforts to improve healthcare infrastructure and increase access to specialized biopharmaceutical services are contributing to the rising demand. Regional manufacturers are becoming more reliant on outsourcing to meet growing needs for specialized manufacturing without making significant investments in in-house facilities. As the trend toward biopharmaceutical outsourcing continues, the demand for immunoassay CDMO services in the Rest of Japan is expected to grow steadily, though at a more moderate rate compared to more industrialized regions.

The demand for Immunoassay Contract Development and Manufacturing Organizations (CDMO) in Japan is increasing as the pharmaceutical and biotechnology sectors focus on the development of innovative diagnostics and therapeutics. Immunoassays are crucial for disease detection, monitoring, and personalized medicine, making them essential in medical diagnostics. With advancements in healthcare and the rising need for accurate, high-quality testing solutions, there is a growing need for reliable CDMOs to provide comprehensive services, from assay development to manufacturing. Japan's well-established healthcare infrastructure and growing biotech sector further contribute to the rising demand for these services.

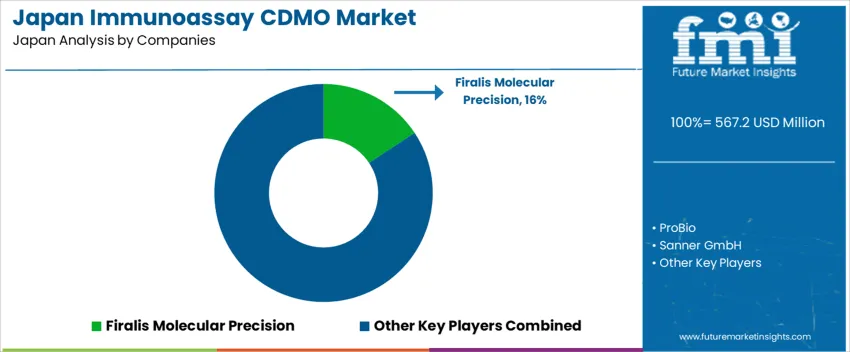

Key players in the Immunoassay CDMO industry in Japan include Firalis Molecular Precision, ProBio, Sanner GmbH, Biopharma Group, and GTP Bioways©. Firalis Molecular Precision leads with a industry share of 15.7%, specializing in the development and manufacturing of precision immunoassays for both diagnostic and therapeutic applications. ProBio offers services in the production of immunoassay kits, focusing on high-quality, scalable manufacturing solutions. Sanner GmbH provides packaging solutions and components for immunoassays, ensuring reliable and efficient delivery of diagnostic kits. Biopharma Group offers integrated services for the production of immunoassay reagents and diagnostics, while GTP Bioways© provides custom manufacturing solutions for immunoassays, catering to both the diagnostic and research sectors.

Competition in the Immunoassay CDMO industry in Japan is driven by the growing demand for rapid, accurate, and cost-effective diagnostic solutions. The increasing focus on personalized medicine, as well as the rise in point-of-care testing, is pushing for more advanced and efficient immunoassay technologies. Companies compete by offering innovative, high-quality, and scalable manufacturing services, with a focus on regulatory compliance and customized solutions for various diagnostic needs. As Japan's healthcare industry continues to evolve, CDMOs that can provide flexibility, technical expertise, and faster turnaround times are gaining a competitive edge in the sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Services | Manufacturing and Production, Assay Development and Optimization, Formulation and Stability Testing, Analytical Services, Others |

| End User | Diagnostic Companies, Biotech Companies, Pharmaceutical Companies |

| Company Size | Small Companies, Mid-size Companies, Large Companies |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Firalis Molecular Precision, ProBio, Sanner GmbH, Biopharma Group, GTP Bioways© |

| Additional Attributes | Dollar sales by service type, end user, and company size; regional CAGR and adoption trends; demand trends in immunoassay CDMO services; growth in diagnostics, biotech, and pharmaceutical sectors; technology adoption for assay development and production; vendor offerings including manufacturing, testing, and optimization services; regulatory influences and industry standards |

The demand for immunoassay CDMO in Japan is estimated to be valued at USD 567.2 million in 2025.

The market size for the immunoassay CDMO in Japan is projected to reach USD 1,082.3 million by 2035.

The demand for immunoassay CDMO in Japan is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in immunoassay CDMO in Japan are manufacturing and production, assay development and optimization, formulation and stability testing, analytical services and others.

In terms of end user, diagnostic companies segment is expected to command 48.2% share in the immunoassay CDMO in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

Demand for Immunoassay CDMO in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Immunoassay Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA