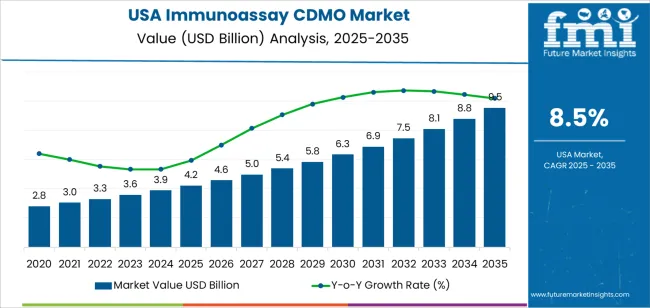

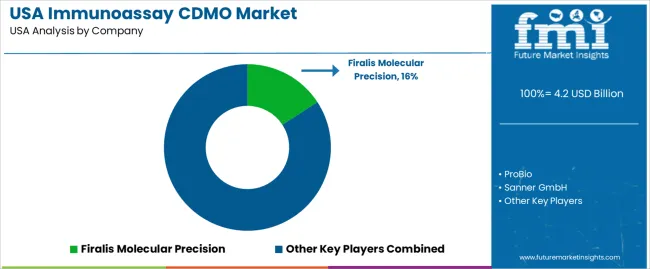

The demand for Immunoassay CDMO (Contract Development and Manufacturing Organizations) in the USA is expected to increase from USD 4.2 billion in 2025 to USD 9.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5%. Immunoassay CDMO plays a pivotal role in the production of diagnostic tests and biological assays, crucial for clinical diagnostics, biotechnology, and pharmaceutical sectors. These organizations are responsible for the development, manufacturing, and scaling up of immunoassay kits used to detect various conditions, ranging from infectious diseases to chronic conditions like cancer and cardiovascular diseases. As the demand for diagnostic testing grows, driven by advancements in personalized medicine, the need for Immunoassay CDMO services is projected to expand.

The rising healthcare focus on early disease detection, personalized treatments, and preventive medicine is expected to further boost the demand for immunoassay-based solutions. The increased focus on point-of-care testing, molecular diagnostics, and automated testing systems will continue to influence the growth of immunoassay services in the diagnostic and pharmaceutical industries. As the healthcare sector pushes for cost-effective solutions that provide accurate and rapid results, Immunoassay CDMO services will be integral in supporting the scale-up and production of these tests.

Between 2025 and 2030, the demand for Immunoassay CDMO in the USA is expected to grow from USD 4.2 billion to USD 4.6 billion. This initial phase will see gradual growth, driven by increased demand from the pharmaceutical industry, diagnostic labs, and biotechnology companies. The early growth will be steady, supported by the increasing use of immunoassays in diagnostics and research, particularly in oncology, autoimmune diseases, and infectious diseases. This period will experience moderate fluctuations in growth as companies continue to adapt to evolving regulatory standards and integrate new technologies in the development of immunoassays.

From 2030 to 2035, the demand for Immunoassay CDMO will accelerate, growing from USD 4.6 billion to USD 9.5 billion. This period will see a sharp rise in demand, driven by the increasing adoption of point-of-care diagnostics, biosimilars, and personalized healthcare. The industry will experience significant growth volatility, with rapid expansion as the need for high-throughput immunoassay manufacturing rises due to demand for customized tests in diverse healthcare applications. As the industry continues to innovate, there will be more focus on automation, rapid testing technologies, and global expansion to cater to growing international demand.

| Metric | Value |

|---|---|

| Demand for Immunoassay CDMO in USA Value (2025) | USD 4.2 billion |

| Demand for Immunoassay CDMO in USA Forecast Value (2035) | USD 9.5 billion |

| Demand for Immunoassay CDMO in USA Forecast CAGR (2025-2035) | 8.5% |

The demand for immunoassay CDMO (Contract Development and Manufacturing Organization) services in the USA is growing due to the increasing demand for diagnostic tools, especially in immunoassay testing, which is vital for detecting and quantifying biomarkers in healthcare applications. Immunoassays are widely used in clinical diagnostics, drug discovery, and environmental testing, which has driven a greater need for reliable, scalable manufacturing solutions. As the global focus on healthcare and diagnostics intensifies, the demand for high-quality, outsourced manufacturing services is expected to rise significantly.

A primary driver of this growth is the rapid advancement of personalized medicine and the increasing need for advanced diagnostic tests. As healthcare becomes more focused on tailored treatments, the use of immunoassay tests in identifying disease biomarkers has become more critical. The growing prevalence of chronic diseases and the demand for faster, more accurate diagnostic methods are fueling the need for robust immunoassay solutions. Immunoassay CDMOs play a crucial role in supporting the development and production of these diagnostics, ensuring that they meet regulatory standards while maintaining cost-effectiveness.

The rise in outsourcing by biotechnology and pharmaceutical companies is another key factor contributing to the growth of immunoassay CDMO services. By outsourcing the development and manufacturing of immunoassays, companies can focus on their core competencies while relying on specialized CDMOs to provide expert knowledge, high-quality production facilities, and compliance with stringent regulatory standards. As the demand for advanced diagnostic solutions continues to rise, the immunoassay CDMO industry in the USA is expected to see continued growth, driven by advancements in healthcare, diagnostics, and outsourcing trends.

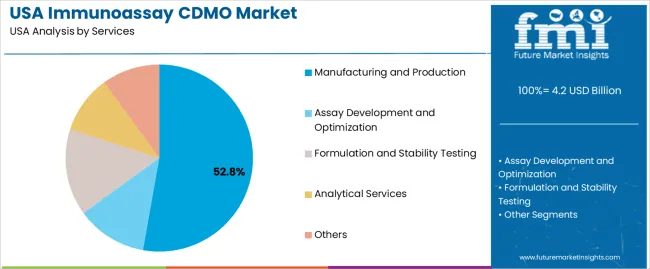

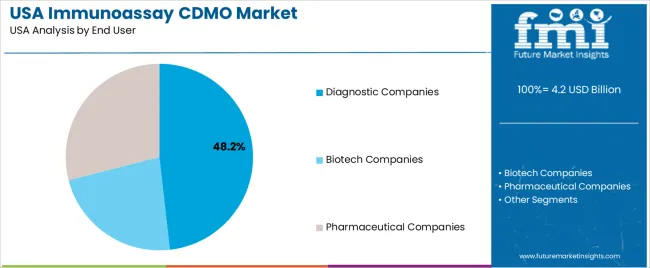

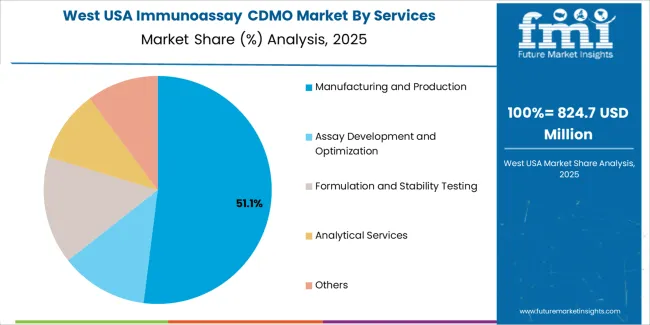

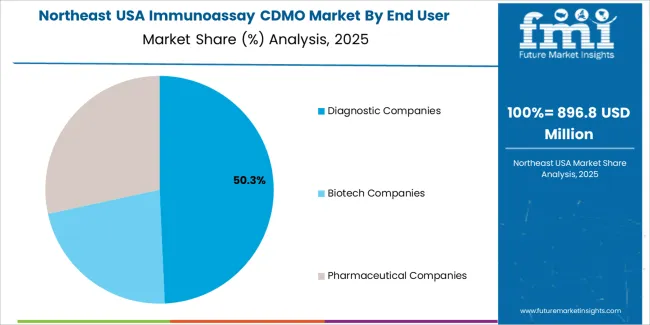

Demand for immunoassay CDMO (Contract Development and Manufacturing Organization) services in the USA is segmented by services, end-users, and company size. By services, demand is divided into manufacturing and production, assay development and optimization, formulation and stability testing, analytical services, and others. The demand is also segmented by end-user, including diagnostic companies, biotech companies, and pharmaceutical companies. In terms of company size, demand is divided into small companies, mid-size companies, and large companies. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Manufacturing and production account for 53% of the demand for immunoassay CDMO services in the USA. These services are critical for diagnostic companies, biotech firms, and pharmaceutical companies that require large-scale, high-quality production of immunoassay tests. The growing demand for diagnostic tests, including rapid antigen and PCR tests, has led to an increase in the need for reliable, efficient manufacturing and production services. Immunoassay CDMOs help in the mass production of these diagnostic products while maintaining stringent quality control, ensuring that they meet regulatory requirements. As the healthcare industry continues to expand and the demand for diagnostic testing grows, particularly in the wake of global health challenges, manufacturing and production services will remain essential to meeting the needs of the industry.

Diagnostic companies account for 48.2% of the demand for immunoassay CDMO services in the USA. These companies rely on CDMOs to provide the expertise and infrastructure needed to develop and manufacture diagnostic tests, including immunoassays, that are crucial for disease detection, monitoring, and treatment. With the increasing demand for diagnostic testing, especially in areas such as infectious diseases, cancer, and chronic conditions, diagnostic companies are seeking reliable partners to handle the production of these tests efficiently and at scale. CDMOs play a crucial role in offering specialized services like assay development, optimization, and manufacturing, enabling diagnostic companies to meet the growing industry needs. As healthcare becomes more focused on early diagnosis and personalized medicine, diagnostic companies will continue to drive the demand for immunoassay CDMO services in the USA.

Demand for immunoassay CDMO services in the USA is growing as diagnostic companies, biotech firms, and pharma increasingly outsource immunoassay development and manufacturing rather than build in‑house capacity. Growth in the overall in‑vitro diagnostics (IVD) industry supports this demand, driven by rising rates of chronic and infectious diseases, increased testing volumes, and demand for timely, scalable diagnostics. Automated immunoassay platforms and high‑throughput testing are especially sought after, which strengthens CDMO demand. On the restraint side, the high cost of specialized equipment, regulatory compliance, and quality‑control requirements make it expensive to operate immunoassay CDMOs; competition among many service providers also pressures margins and can discourage new entrants or smaller players from scaling up.

Immunoassay CDMO demand in the USA is rising because diagnostic firms and biotech companies need rapid, reliable, and regulatory‑compliant solutions to develop immunoassays from early R&D through manufacturing and commercialization. Outsourcing allows these firms to access specialized expertise and infrastructure without the capital burden, enabling faster time‑to‑industry for diagnostic kits. As diagnostics become more central to disease detection, monitoring, and personalized medicine (e.g., biomarkers, therapeutic monitoring, infectious‑disease screening), the need for high‑quality production capacity increases. In addition, growing demand for routine lab testing, hospital diagnostics, and point‑of‑care immunoassays fuel the uptake of CDMO services to meet volume and quality demands efficiently.

Technological and industry trends are significantly fueling immunoassay CDMO demand in the USA. Advances in assay automation, high‑throughput instrumentation, and improved reagent and kit‑manufacturing technologies make outsourced immunoassay production attractive and cost‑effective. Many CDMOs now offer full‑service packages from assay design and validation to large‑scale manufacturing, quality control, and regulatory support which reduce burden on diagnostic or biotech firms. Increased collaboration between diagnostic developers and CDMOs helps accelerate innovation and expand the range of tests (e.g., for emerging diseases, personalized diagnostics). As assay complexity rises (multiplex testing, high-sensitivity diagnostics), reliance on specialized CDMOs for consistent, scalable production becomes more pronounced.

Despite strong demand, several factors limit the growth of immunoassay CDMO services in the USA. The high upfront investment in specialized equipment, clean‑room facilities, quality‑control systems, and regulatory compliance makes it costly to establish or expand a CDMO facility which may deter smaller providers or limit scaling by newer entrants. Regulatory and quality requirements for diagnostic assays are stringent, requiring rigorous validation, documentation, and consistent manufacturing standards, which adds complexity and cost. increasing competition among many CDMOs creates pressure on pricing and margins. Industry saturation or overcapacity especially for common diagnostic assays may lead to reduced utilization of CDMO capacity, limiting returns and discouraging new investments.

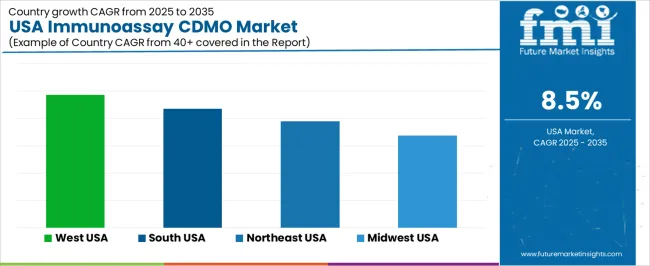

| Region | CAGR (%) |

|---|---|

| West USA | 9.7% |

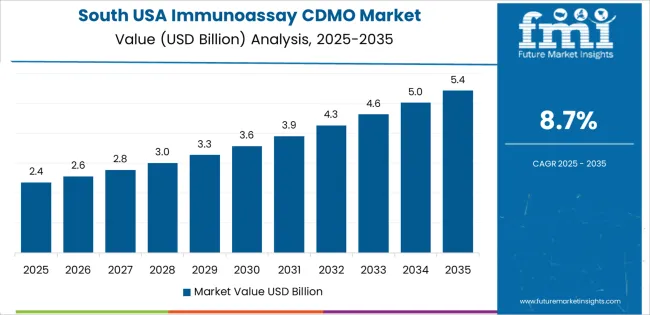

| South USA | 8.7% |

| Northeast USA | 7.8% |

| Midwest USA | 6.8% |

Demand for Immunoassay CDMO services in the USA is growing steadily across all regions. The West leads with a 9.7% CAGR, driven by its biotechnology and pharmaceutical industries. The South follows with an 8.7% CAGR, supported by the region’s expanding healthcare and life sciences sectors. The Northeast shows a 7.8% CAGR, fueled by its well-established pharmaceutical and biotechnology hubs. The Midwest experiences a 6.8% CAGR, with steady demand coming from its pharmaceutical and medical device sectors. As the demand for personalized medicine, advanced diagnostics, and medical research continues to rise, demand for Immunoassay CDMO services is expected to grow across all regions, providing crucial support for the development and manufacturing of innovative diagnostic solutions.

The West USA is leading the demand for Immunoassay CDMO services, with a 9.7% CAGR. The region’s biotechnology and pharmaceutical industries, particularly in California, Washington, and Oregon, are the main drivers of this demand. These states have a strong concentration of biotech firms and healthcare providers that rely on CDMO services to develop and manufacture immunoassays for diagnostics and therapeutic applications. The West’s focus on innovative healthcare solutions and personalized medicine has spurred the adoption of immunoassay technologies, driving the need for outsourcing development and manufacturing. With the region's strong investments in medical research and clinical trials, the demand for immunoassay CDMO services is expected to remain robust. The region’s emphasis on advanced diagnostics and immunotherapy is further fueling the demand for CDMO services to meet the growing need for customized diagnostic solutions.

The South USA is experiencing strong demand for Immunoassay CDMO services, with an 8.7% CAGR. This growth is driven by the region's expanding healthcare and life sciences industries, particularly in states like Texas, Florida, and Georgia, where there is a growing focus on medical research, drug development, and healthcare innovation. The demand for immunoassays in the South is being supported by the increasing prevalence of chronic diseases and the rising focus on diagnostics and personalized medicine. With healthcare and pharmaceutical companies in the South seeking to meet the growing demand for high-quality, cost-effective immunoassay solutions, the need for outsourced CDMO services is on the rise. As the region continues to invest in medical infrastructure and biotech innovation, demand for immunoassay CDMO services is expected to grow, providing critical support for the development of new diagnostic tools and treatments.

The Northeast USA is seeing steady demand for Immunoassay CDMO services, with a 7.8% CAGR. This demand is largely driven by the region's well-established pharmaceutical and biotechnology industries, particularly in cities like Boston, New York, and Philadelphia. These hubs are home to major pharmaceutical companies, research institutions, and hospitals, all of which require high-quality immunoassay development and manufacturing services to support clinical trials, diagnostics, and drug development. The Northeast’s strong focus on precision medicine, diagnostics, and advanced therapeutic solutions is fueling the demand for immunoassay CDMO services. As the region continues to lead in healthcare innovation and biotechnology research, demand for immunoassay services, including outsourcing of development and manufacturing, is expected to grow. The region’s emphasis on cutting-edge diagnostics and personalized medicine will continue to support the expansion of CDMO services.

The Midwest USA is seeing moderate demand for Immunoassay CDMO services, with a 6.8% CAGR. The demand in this region is driven by its strong pharmaceutical, medical device, and healthcare sectors, particularly in cities like Chicago, Indianapolis, and Detroit. As the Midwest continues to see growth in medical research, clinical trials, and diagnostic development, the need for outsourced Immunoassay CDMO services is increasing. The region's focus on advancing healthcare solutions and improving patient outcomes through diagnostics and personalized medicine is also contributing to the growing demand for immunoassay technologies. As the Midwest's pharmaceutical and medical device industries modernize and expand, they increasingly rely on contract development and manufacturing services to meet the growing demand for high-quality immunoassays. The moderate growth rate in this region reflects steady progress in both diagnostic and therapeutic applications, with continued demand expected as healthcare innovation advances.

Demand for Immunoassay Contract Development and Manufacturing Organizations (CDMO) in the USA is increasing as the biotechnology and pharmaceutical sectors continue to advance in diagnostics and therapeutic development. Immunoassays play a vital role in medical diagnostics, particularly in detecting diseases and monitoring patient conditions. As the demand for rapid and accurate testing increases, so does the need for CDMOs specializing in the development and manufacturing of immunoassay kits and reagents. The USA industry is seeing growth driven by the rising demand for personalized medicine, point-of-care testing, and improved diagnostic capabilities.

Key players in the Immunoassay CDMO industry in the USA include Firalis Molecular Precision, ProBio, Sanner GmbH, Biopharma Group, and GTP Bioways©. Firalis Molecular Precision leads the industry with a significant share of 15.8%, providing innovative services in the development and manufacturing of immunoassays for various therapeutic and diagnostic applications. ProBio offers a range of solutions for immunoassay production, focusing on high-quality, scalable manufacturing processes. Sanner GmbH specializes in packaging solutions and components for immunoassays, while Biopharma Group provides integrated services for the production of immunoassay reagents and diagnostics. GTP Bioways© provides custom manufacturing services for immunoassay kits, targeting both diagnostic and research sectors.

The competitive dynamics of the Immunoassay CDMO industry are driven by the increasing demand for more precise and rapid diagnostic tools, as well as the need for customized solutions. Companies compete by offering flexible, cost-effective, and high-quality development and manufacturing services. The ability to scale production, ensure regulatory compliance, and meet the specific needs of pharmaceutical and biotech companies is crucial. Advancements in immunoassay technologies, such as multiplex assays and point-of-care testing, are pushing companies to innovate and provide specialized solutions that cater to a broad range of medical and research applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Services | Manufacturing and Production, Assay Development and Optimization, Formulation and Stability Testing, Analytical Services, Others |

| End User | Diagnostic Companies, Biotech Companies, Pharmaceutical Companies |

| Company Size | Small Companies, Mid-size Companies, Large Companies |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Firalis Molecular Precision, ProBio, Sanner GmbH, Biopharma Group, GTP Bioways© |

| Additional Attributes | Dollar sales by service type and end user; regional CAGR and adoption trends; demand trends in immunoassay CDMO services; growth in diagnostics, biotech, and pharmaceutical sectors; technology adoption for assay development and production; vendor offerings including manufacturing, testing, and optimization services; regulatory influences and industry standards |

The demand for immunoassay CDMO in USA is estimated to be valued at USD 4.2 billion in 2025.

The market size for the immunoassay CDMO in USA is projected to reach USD 9.5 billion by 2035.

The demand for immunoassay CDMO in USA is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in immunoassay CDMO in USA are manufacturing and production, assay development and optimization, formulation and stability testing, analytical services and others.

In terms of end user, diagnostic companies segment is expected to command 48.2% share in the immunoassay CDMO in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Immunoassay Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA