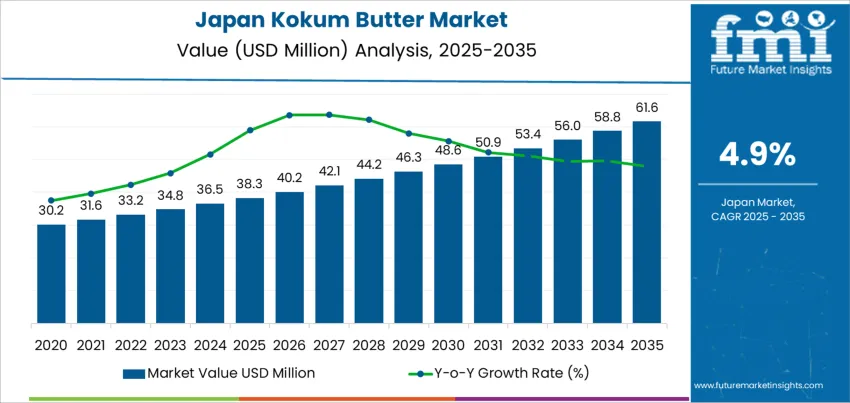

The demand for kokum butter in Japan is expected to grow from USD 38.3 million in 2025 to USD 61.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.9%. Kokum butter, derived from the seeds of the Garcinia indica tree, is valued for its moisturizing and healing properties, making it popular in the cosmetic and personal care industries. It is also gaining traction in the food and wellness sectors due to its potential health benefits. The increasing awareness of natural, sustainable ingredients is expected to drive the demand for kokum butter in Japan, as both consumers and manufacturers increasingly prioritize clean and eco-friendly products.

The market is expected to experience steady growth, starting at USD 38.3 million in 2025 and gradually increasing to USD 40.2 million in 2026, USD 42.1 million in 2027, and continuing its upward trajectory. By 2029, the demand for kokum butter will reach USD 46.3 million, with steady growth continuing through the 2030s. By 2035, the market is forecasted to reach USD 61.6 million, reflecting a consistent rise in demand driven by the continued expansion of the personal care and wellness industries in Japan.

The kokum butter market in Japan is expected to show gradual and sustained growth over the next decade. Starting at USD 38.3 million in 2025, the market will rise to USD 40.2 million in 2026, followed by USD 42.1 million in 2027. Demand will continue to grow, reaching USD 44.2 million in 2028, USD 46.3 million in 2029, and USD 48.6 million in 2030. By 2035, the kokum butter industry is projected to reach USD 61.6 million, driven by expanding applications in skincare, cosmetics, and health products.

The absolute dollar opportunity for kokum butter between 2025 and 2035 is USD 23.3 million. This growth reflects a steady increase in both consumer awareness of natural ingredients and the broader adoption of kokum butter in cosmetic formulations. The constant expansion of demand for kokum butter underscores its growing role in the personal care and wellness industries, with continued interest in sustainable, plant-based ingredients driving strong growth potential throughout the forecast period.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 38.3 million |

| Industry Forecast Value (2035) | USD 61.6 million |

| Industry Forecast CAGR (2025-2035) | 4.9% |

The demand for kokum butter in Japan is rising as Japanese cosmetic and personal care manufacturers increasingly seek natural, plant based ingredients for moisturizers, creams, lip balms and hair care formulations. Kokum butter, derived from the seeds of the Garcinia indica tree, is known for a relatively high proportion of stearic oleic stearic triglycerides, a firm texture at room temperature, and a melting point close to human skin temperature. These properties make it useful for cosmetics intended to absorb smoothly, deliver deep skin hydration, and remain stable in formulations. As consumer awareness grows around skin health, ingredient safety, and clean beauty, products featuring such natural butters gain popularity over synthetic alternatives. This trend aligns with broader interest in organic, minimal additive formulations and eco friendly personal care that appears to influence Japanese beauty market preferences.

Beyond personal care, kokum butter may gain traction where alternatives such as cocoa butter or synthetic fats had predominated. The global kokum butter market is forecast to grow at a compound annual growth rate around 6 9% in the coming decade, driven especially by cosmetic and personal care applications and rising demand for natural ingredients globally. That growth suggests potential for increased imports or supply into markets like Japan, particularly given Japan’s established cosmetics industry and consumer sensitivity to skin care quality. As extraction and refining techniques improve globally, supply becomes more consistent and quality more uniform, making kokum butter more feasible for inclusion in mid to premium tier formulations. These supply side improvements, combined with demand for natural, moisturizing, stable ingredients, point toward steady growth of kokum butter demand in Japan over coming years.

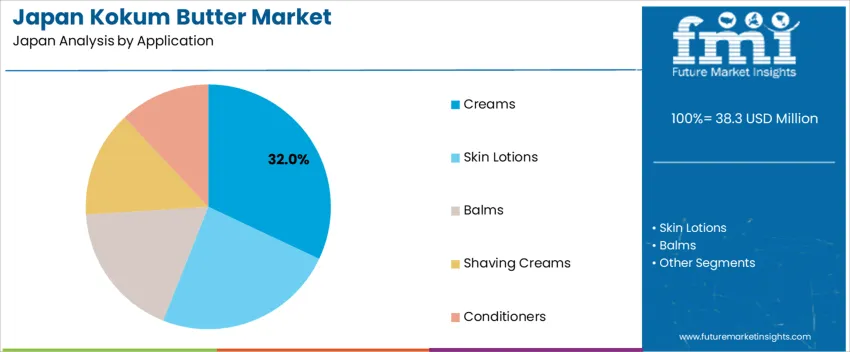

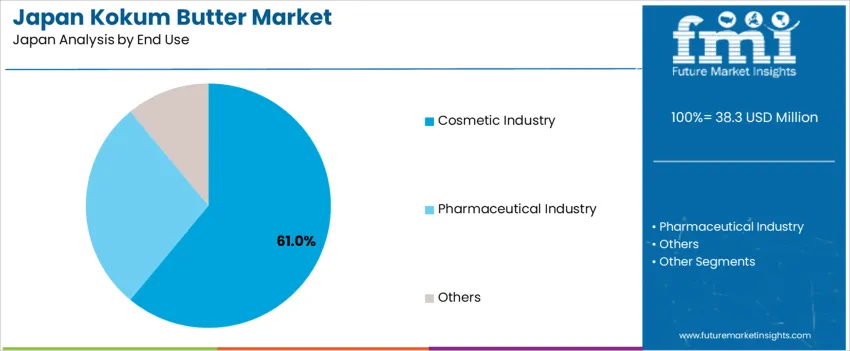

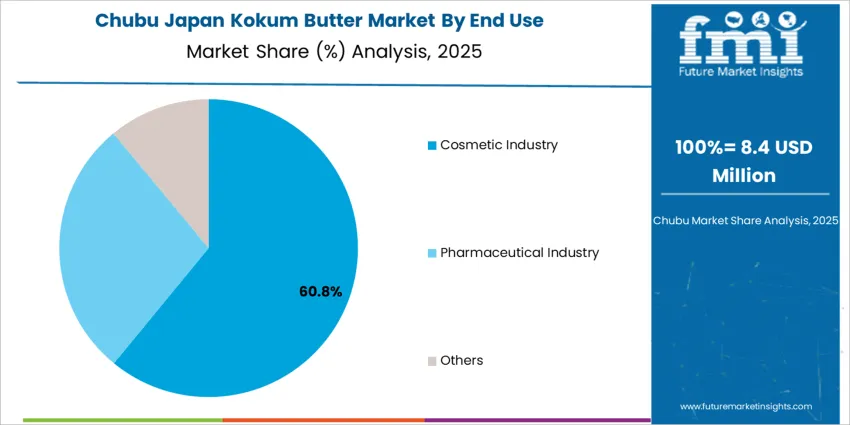

The demand for kokum butter in Japan is primarily driven by application and end-use industry. The leading application is creams, capturing 32% of the market share, while the cosmetic industry is the dominant end-use sector, accounting for 61% of the demand. Kokum butter, known for its moisturizing, healing, and skin-softening properties, is increasingly used in skincare products such as creams, lotions, and balms. The growing consumer interest in natural, sustainable ingredients continues to drive the demand for kokum butter in Japan's skincare and cosmetic products.

Creams are the leading application for kokum butter in Japan, holding 32% of the market share. Kokum butter’s emollient properties make it an ideal ingredient in cream formulations, particularly for moisturizing and nourishing dry or sensitive skin. It is commonly used in high-end skincare products due to its ability to provide deep hydration without being greasy, offering a smooth, soft finish on the skin. Additionally, kokum butter is valued for its antioxidant content, which helps protect the skin from environmental stressors.

The demand for kokum butter in creams is driven by its natural and gentle properties, making it suitable for a wide range of skin types, including sensitive skin. With the increasing preference for products that are both effective and made from natural ingredients, kokum butter’s role in creams continues to grow. As the demand for eco-friendly and sustainable beauty products rises in Japan, kokum butter is becoming a popular ingredient in premium skincare formulations that aim to provide nourishment and protection.

The cosmetic industry is the leading end-use sector for kokum butter in Japan, capturing 61% of the demand. Kokum butter is widely used in the formulation of skincare products such as moisturizers, balms, and lotions. Its deep moisturizing and skin-soothing properties make it an essential ingredient in a variety of cosmetic products that focus on hydration, anti-aging, and skin repair. The growing demand for natural and organic beauty products in Japan has further boosted kokum butter’s popularity in the cosmetic sector.

The demand for kokum butter in the cosmetic industry is driven by consumer preferences for high-quality, natural ingredients that are gentle on the skin. With increasing awareness about the harmful effects of synthetic chemicals in skincare, the demand for natural alternatives like kokum butter continues to rise. As Japan’s cosmetic industry continues to prioritize natural beauty solutions, kokum butter is expected to remain a key ingredient in skincare and personal care products, helping brands cater to consumers who seek safe, effective, and eco-friendly options.

Demand for Kokum butter in Japan is rising gradually, driven by growth in the cosmetics and natural personal care sectors. This butter is increasingly used in creams, lotions, balms, and other skincare and hair care formulations owing to its emollient, antioxidant, and skin nourishing properties. As the Japanese market shifts toward natural, plant based ingredients and simpler ingredient lists, Kokum butter finds a place in “clean beauty” and wellness oriented products. The expanding natural cosmetics market and rising consumer interest in gentle and effective skincare support growing use of Kokum butter by manufacturers.

What are the Drivers of Demand for Kokum Butter in Japan?

Several factors drive demand for Kokum butter in Japan. First, growing consumer preference for natural and plant derived ingredients leads cosmetics and personal care companies to seek alternatives to synthetic oils and butters. Kokum butter, with its light texture, rapid skin absorption, and moisturizing and emollient properties, matches these preferences. Second, the aging population and rising interest in skincare and anti aging products create demand for high moisture, skin friendly fats that support skin barrier, elasticity, and hydration. Third, the expanding natural cosmetics segment in Japan encourages product launches that highlight simple and clean ingredient lists, with Kokum butter serving as a core natural ingredient in creams, balms, soaps, and hair care. Additionally, demand for sensitive skin and non comedogenic care supports Kokum butter’s adoption, since it tends to be non greasy and less likely to clog pores relative to heavier butters. Finally, growth in e commerce and niche beauty brands enables wider distribution and experimentation with exotic butters imported from abroad, supporting steady demand increase for Kokum butter–based products.

What are the Restraints on Demand for Kokum Butter in Japan?

Despite favorable drivers, some factors restrain wider adoption of Kokum butter in Japan. Supply constraints and import dependency may limit availability, since Kokum butter is produced chiefly outside Japan and must meet quality, certification, and shipping standards. Variability in supply and potential import delays may discourage some manufacturers from relying on it. Cost is another restraint: exotic plant butters like Kokum may be more expensive than common alternatives, which can affect pricing and margins for mass market cosmetic products, deterring use in price sensitive segments. Regulatory and certification requirements for cosmetic ingredients in Japan add complexity; companies may prefer well established ingredients with clear compliance history instead of newer or less common butters. Also, some consumers or brands may remain cautious about ingredient novelty or potential skin reactions, limiting widespread adoption. Finally, competition from other plant butters whose supply chains are well established (like shea, cocoa, or domestic oils) may reduce impetus for large scale switch to Kokum butter in some product lines.

What are the Key Trends Influencing Demand for Kokum Butter in Japan?

A key trend is rising demand for clean beauty and natural ingredient cosmetics. Consumers increasingly prefer products with plant derived components, minimal synthetic chemicals, and simple ingredient lists. In response, more Japanese skincare and hair care brands are formulating with butters like Kokum, marketed as natural moisturizers and emollients. Another trend is specialized skin care targeting-including products for sensitive skin, anti aging, moisturizing, and skin barrier support-where Kokum butter’s light texture and moisturizing properties are valued. Growth in small and niche beauty brands, including indie and artisanal producers, encourages experimentation with alternative butters and exotic ingredients, increasing use of Kokum butter. Also, expansion of online beauty retail channels facilitates easier sourcing and distribution of imported ingredients, which supports entry of Kokum based products. Finally, as global demand for ethically and sustainably sourced natural ingredients rises, suppliers and manufacturers promoting traceability and quality may help Kokum butter to gain acceptance and market share in Japan’s beauty and personal care industry.

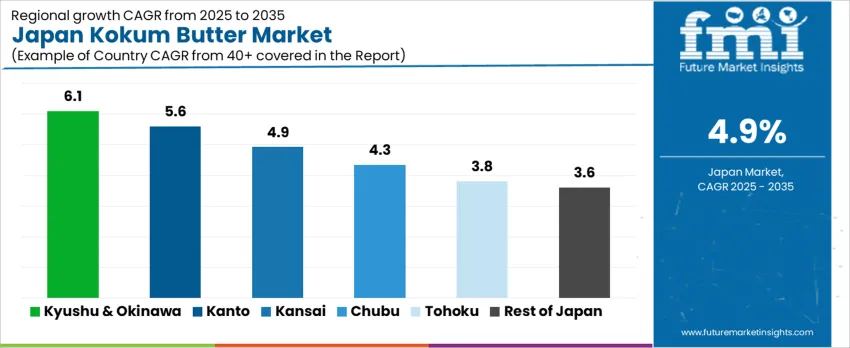

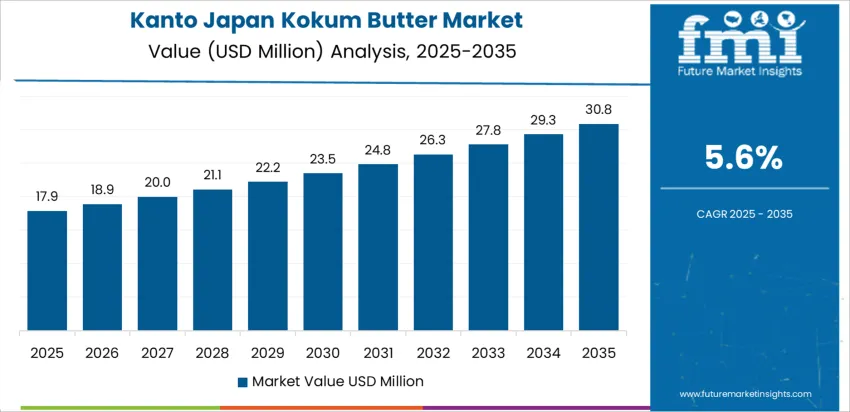

The demand for kokum butter in Japan is growing steadily across regions, with Kyushu & Okinawa leading at a CAGR of 6.1%. Kanto follows with a CAGR of 5.6%, driven by its strong cosmetics and skincare industries. The Kinki region shows moderate growth at 4.9%, while Chubu, Tohoku, and the Rest of Japan exhibit more modest growth, with respective CAGRs of 4.3%, 3.8%, and 3.6%. These variations are influenced by regional consumer preferences, industry applications, and the adoption of natural ingredients in skincare and food products.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.1 |

| Kanto | 5.6 |

| Kinki | 4.9 |

| Chubu | 4.3 |

| Tohoku | 3.8 |

| Rest of Japan | 3.6 |

The demand for kokum butter in Kyushu & Okinawa is projected to grow at a CAGR of 6.1%, driven by the region’s increasing use of natural and organic ingredients in cosmetics, skincare, and wellness products. Kyushu & Okinawa have strong traditions of utilizing indigenous and natural materials in beauty and health products. Kokum butter, known for its moisturizing and healing properties, is gaining popularity in skincare formulations, especially among consumers who prefer sustainable and eco-friendly products. The region’s growing focus on sustainability and the rising awareness of the benefits of natural ingredients in personal care products are major contributors to this demand. As more companies in Kyushu & Okinawa incorporate kokum butter into their product lines, the demand for this natural ingredient is expected to rise significantly.

In Kanto, the demand for kokum butter is expected to grow at a CAGR of 5.6%, supported by the region’s strong cosmetics and personal care industry. Kanto, home to Tokyo and other major urban centers, is a hub for consumer goods, including high-end skincare and beauty products. As consumers become more aware of the benefits of natural and plant-based ingredients, demand for kokum butter in cosmetic formulations is increasing. Kokum butter is valued for its deep moisturizing, anti-aging, and soothing properties, which make it popular in premium skincare products. The region’s growing preference for eco-conscious, organic beauty products aligns well with the demand for kokum butter. Furthermore, the continuous innovation and expanding product offerings in the cosmetics and wellness industries ensure that the demand for kokum butter in Kanto will remain strong.

The demand for kokum butter in Kinki is projected to grow at a CAGR of 4.9%, driven by the region’s strong focus on natural ingredients in skincare and food products. Kinki, which includes Osaka and Kyoto, has a well-established cosmetics industry, with a growing shift toward the use of sustainable and organic ingredients. Kokum butter is gaining popularity in Kinki for its skin-healing and hydrating properties, which make it a preferred choice in creams, lotions, and balms. The region’s increasing focus on wellness, natural beauty, and eco-friendly products has contributed to the rise in demand for kokum butter. As consumer preferences continue to shift towards cleaner and more sustainable ingredients, Kinki’s demand for kokum butter is expected to grow steadily.

The demand for kokum butter in Chubu is expected to grow at a CAGR of 4.3%, supported by the region’s expanding food and cosmetics sectors. Chubu, home to Nagoya and other industrial centers, is seeing increasing interest in natural and organic products. In the cosmetics industry, kokum butter is valued for its deep moisturizing and skin-softening qualities, making it ideal for use in skincare products targeting dry or sensitive skin. Additionally, Chubu’s growing consumer interest in health and wellness products that incorporate plant-based ingredients is contributing to the steady rise in demand for kokum butter. As awareness of natural and sustainable ingredients continues to grow, demand in Chubu for kokum butter in both personal care products and food applications is expected to increase.

In Tohoku, the demand for kokum butter is projected to grow at a CAGR of 3.8%, reflecting moderate growth driven by the region’s increasing awareness of natural ingredients and their benefits. Tohoku has a smaller but growing market for eco-friendly and natural products, especially in the skincare and wellness sectors. As consumers in Tohoku become more conscious of the environmental and health benefits of plant-based ingredients, kokum butter is gaining popularity in personal care formulations for its nourishing and moisturizing properties. While growth in Tohoku is slower compared to other regions, the region’s expanding interest in wellness and natural beauty products is expected to contribute to steady demand for kokum butter over time.

In the Rest of Japan, the demand for kokum butter is expected to grow at a CAGR of 3.6%, reflecting gradual but steady adoption. This region, which includes smaller cities and rural areas, is witnessing an increasing demand for natural ingredients in skincare and food products. Kokum butter’s benefits for skin health and its use in natural wellness products are driving its adoption, particularly in rural areas where organic and sustainable products are becoming more popular. As consumer preferences for eco-friendly, plant-based ingredients continue to grow, the Rest of Japan is expected to see a consistent rise in the demand for kokum butter, although at a slower pace compared to more urbanized regions like Kyushu & Okinawa and Kanto.

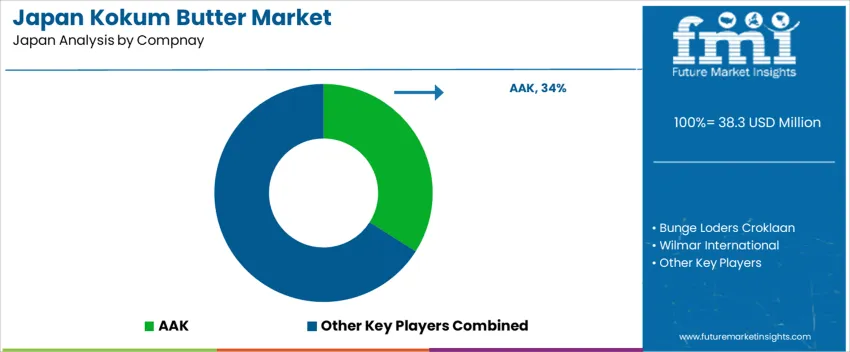

Demand for kokum butter in Japan is growing as food, cosmetics, and personal-care manufacturers increasingly seek alternatives to cocoa butter and other plant-derived fats. Kokum butter is derived from the seeds of the kokum tree (Garcinia indica) and is known for its firm texture at room temperature and melting at near skin temperature-traits that suit both edible fat use and cosmetic formulations. Key suppliers in this segment include AAK (holding about 34% market share among major producers), Bunge Loders Croklaan, Wilmar International, Fuji Oil, and Olam International. These firms supply refined kokum butter for use in confectionery, chocolate substitutes, creams, lip balms, soaps, lotions, and other personal-care products.

Competition in the Japanese kokum butter market centers on product quality, purity, and supply reliability. Producers emphasize refined kokum butter with consistent triglyceride profiles, low impurity levels, and stable melting behavior-important for both food and cosmetic applications. Another area of competition is formulation flexibility: kokum butter that blends well with other vegetable fats or oils allows manufacturers to create cost-effective cocoa butter equivalents, vegan-friendly chocolates, or skin-care items suitable for sensitive skin. Cosmetic uses exploit kokum butter’s non-greasy emollient character and gentle absorption on skin and lips. Companies that can ensure steady supply, batch-to-batch consistency, and regulatory compliance for edible or cosmetic use are better positioned to capture demand in Japan’s growing kokum butter market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Application | Creams, Skin Lotions, Balms, Shaving Creams, Conditioners |

| End-Use Industry | Cosmetic Industry, Pharmaceutical Industry, Others |

| Key Companies Profiled | AAK, Bunge Loders Croklaan, Wilmar International, Fuji Oil, Olam International |

| Additional Attributes | The market analysis includes dollar sales by application, end-use industry, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of Kokum butter in cosmetics such as creams, lotions, and balms. The competitive landscape highlights key manufacturers focusing on innovations in Kokum butter sourcing, production, and formulation for skincare and pharmaceutical applications. Trends in the growing demand for natural and sustainable ingredients in personal care products are explored, along with advancements in Kokum butter’s use as a moisturizing agent and in therapeutic formulations. |

The demand for kokum butter in Japan is estimated to be valued at USD 38.3 million in 2025.

The market size for the kokum butter in Japan is projected to reach USD 61.6 million by 2035.

The demand for kokum butter in Japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in kokum butter in Japan are creams, skin lotions, balms, shaving creams and conditioners.

In terms of end use, cosmetic industry segment is expected to command 61.0% share in the kokum butter in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Demand for Butter in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Butter Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA