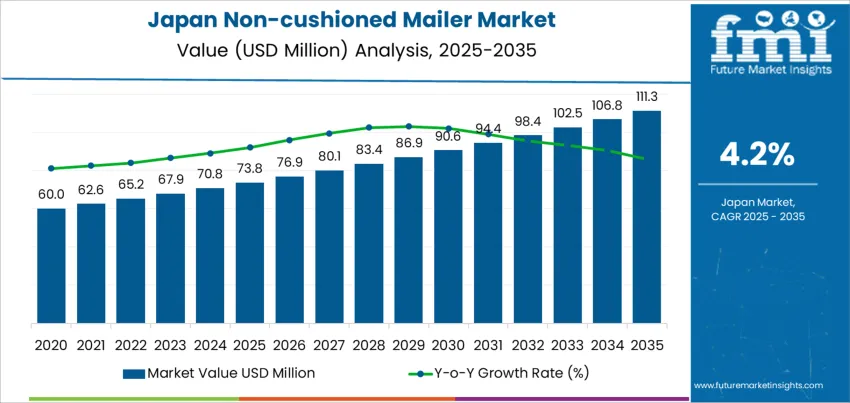

The demand for non-cushioned mailers in Japan is projected to grow from USD 73.8 million in 2025 to USD 111.3 million by 2035, with a CAGR of 4.2%. The growing e-commerce market in Japan is a significant factor driving the increased use of non-cushioned mailers. As more consumers and businesses turn to online retail, there is a greater need for cost-effective, durable, and lightweight packaging solutions. Non-cushioned mailers, which offer a more economical alternative to traditional packaging, provide an efficient and reliable option for sending various items such as documents, small products, and non-fragile goods. Their ability to reduce overall shipping costs by being lightweight while still providing adequate protection for items makes them highly attractive to businesses.

In addition to the e-commerce boom, the rising demand for eco-friendly packaging options is further fueling the growth of non-cushioned mailers. As environmental concerns become more prominent, both businesses and consumers are seeking eco-friendly alternatives to traditional packaging materials. Non-cushioned mailers made from recyclable, biodegradable, or recycled materials are increasingly in demand, particularly from companies looking to meet durability goals. This trend is not only driven by consumer preference for environmentally responsible products but also by regulatory pressures pushing for greener solutions. As the push to reduce packaging waste continues, non-cushioned mailers are positioned as a key solution in this effort.

From 2025 to 2030, demand for non-cushioned mailers is expected to grow from USD 73.8 million to USD 94.4 million, representing an increase of USD 20.6 million in value. This period will see considerable growth, driven by the expansion of e-commerce and the increasing preference for cost-effective, lightweight packaging options. As more businesses turn to online sales and demand for shipping solutions rises, non-cushioned mailers will play an essential role in meeting packaging needs. Furthermore, the ongoing shift toward eco-friendly packaging practices will further support the adoption of non-cushioned mailers, particularly as businesses seek ways to reduce their environmental footprint.

From 2030 to 2035, the demand for non-cushioned mailers will grow from USD 94.4 million to USD 111.3 million, contributing USD 16.9 million in value. Growth will continue, but at a slower pace as the market matures. However, the demand for non-cushioned mailers will remain strong, driven by the sustained growth of e-commerce, the increased adoption of eco-friendly packaging solutions, and ongoing consumer demand for affordable shipping options. Even as the market reaches maturity, the continued need for efficient and eco-friendly packaging will ensure steady demand for non-cushioned mailers throughout the forecast period.

| Metric | Value |

|---|---|

| Demand for Non-cushioned Mailer in Japan Value (2025) | USD 73.8 million |

| Demand for Non-cushioned Mailer in Japan Forecast Value (2035) | USD 111.3 million |

| Demand for Non-cushioned Mailer in Japan Forecast CAGR (2025-2035) | 4.2% |

The demand for non-cushioned mailers in Japan is growing as e-commerce continues to expand, driving the need for cost-effective and efficient packaging solutions. Non-cushioned mailers, which are lightweight and versatile, are used extensively for shipping a wide range of products such as clothing, documents, and non-fragile items. As Japanese consumers increasingly shop online, the demand for reliable and eco-friendly packaging options like non-cushioned mailers is on the rise.

A major factor contributing to this growth is the continued growth of the e-commerce sector, particularly in Japan's retail and fashion industries. Non-cushioned mailers offer an affordable and practical solution for shipping items that do not require additional padding or cushioning. With the increasing volume of online orders, these mailers are being adopted by businesses looking to reduce packaging costs while maintaining the efficiency of their logistics operations.

The demand for eco-friendly and recyclable packaging solutions is contributing to the growth of non-cushioned mailers. As businesses and consumers alike become more eco-conscious, there is a growing preference for packaging materials that are lightweight, recyclable, and have a smaller environmental footprint. Non-cushioned mailers meet these criteria, making them an attractive option for businesses focused on durability. With the ongoing expansion of e-commerce and the increasing focus on durability, the demand for non-cushioned mailers in Japan is expected to continue growing steadily through 2035.

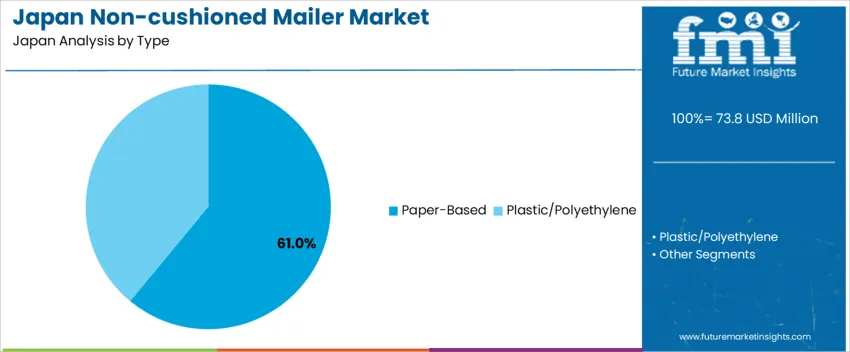

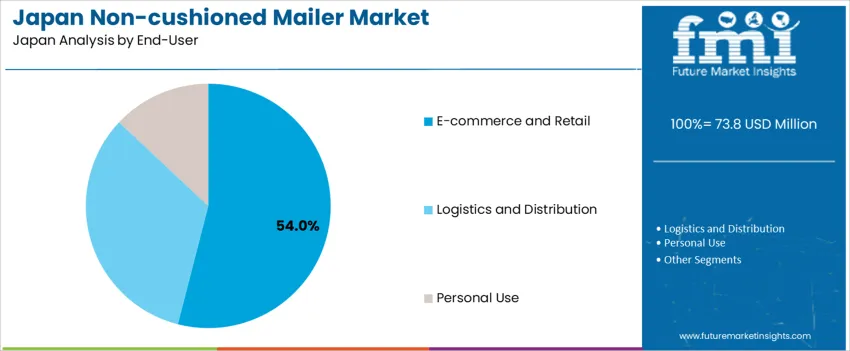

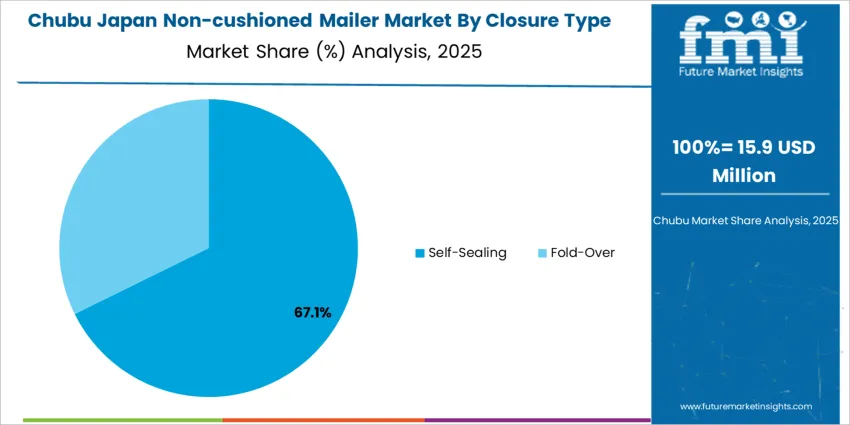

Demand for non-cushioned mailers in Japan is segmented by type, end-user, closure type, and region. By type, demand is divided into paper-based and plastic/polyethylene mailers, with paper-based mailers holding the largest share at 61%. The demand is also segmented by end-user, including e-commerce and retail, logistics and distribution, and personal use, with e-commerce and retail leading at 54%. Closure type is divided into self-sealing and fold-over, with self-sealing mailers being the preferred option. Regionally, demand is distributed across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

Paper-based non-cushioned mailers account for 61% of the demand in Japan due to their durability and cost-effectiveness. As consumer awareness of environmental issues grows, paper-based mailers are increasingly preferred because they are recyclable and biodegradable. In addition to their eco-friendly appeal, paper mailers offer strength and protection for a variety of products, making them ideal for packaging goods in e-commerce and retail. Paper-based mailers are lightweight, which helps reduce shipping costs, while still providing sufficient durability for protecting items during transit. As e-commerce continues to expand in Japan, driven by both domestic and international sales, the demand for paper-based mailers is expected to remain strong. Furthermore, businesses and consumers alike are adopting eco-friendly practices, which further drives the demand for paper-based non-cushioned mailers over plastic alternatives.

E-commerce and retail account for 54% of the demand for non-cushioned mailers in Japan, primarily due to the rapid growth of online shopping and the need for cost-effective, lightweight packaging solutions. As online retailers and e-commerce platforms continue to grow, the demand for efficient and eco-friendly packaging for small to medium-sized goods rises. Non-cushioned mailers, especially paper-based options, are ideal for packaging books, clothing, and other non-fragile items, making them highly suitable for e-commerce transactions. The convenience of self-sealing mailers further enhances their appeal, as it allows for quick and secure packing. Many e-commerce businesses in Japan are focusing on reducing their environmental footprint, which drives the preference for recyclable and biodegradable packaging like paper-based mailers. As online shopping remains a major retail trend, e-commerce and retail sectors will continue to be the largest drivers of demand for non-cushioned mailers.

Demand for non-cushioned mailers in Japan is rising as the country’s e‑commerce and parcel‑delivery sectors expand rapidly. Non-cushioned mailers, such as paper or plastic envelopes and mailer bags without padding, are increasingly used for shipping lightweight goods like clothing, documents, books, and other nonfragile items. The shift toward online retail, direct‑to‑consumer brands, and frequent small-parcel shipments supports this demand as non-cushioned mailers offer a cost‑effective and lightweight packaging solution that reduces shipping weight and cost while enabling efficient handling. Interest in eco-friendly and recyclable packaging solutions also encourages adoption of paper‑based or recyclable non-cushioned mailers over heavier or plastic‑heavy alternatives.

Why is Demand for Non-cushioned Mailers Growing in Japan?

Demand for non-cushioned mailers in Japan is growing as e‑commerce retailers and logistics providers look for efficient, low-cost ways to ship small and medium-sized items. These mailers, being lightweight, easy to store, and inexpensive compared to cushioned or rigid packaging, are increasingly preferred. As online shopping continues to rise, the need for simple, cost-effective packaging for non-fragile goods has become more pronounced. Non-cushioned mailers help reduce shipping costs due to their minimal weight and compact size. Growing consumer preference for eco-friendly packaging solutions, especially those with lower carbon footprints and better recyclability, further drives the demand for non-cushioned mailers, particularly among environmentally conscious consumers and brands in Japan.

How are Technological & Industry Innovations Driving Non-cushioned Mailer Demand in Japan?

Technological advancements in material and manufacturing processes are enhancing the attractiveness of non-cushioned mailers in Japan. Improved paper quality, better sealing and printing technologies, and the use of recyclable or recycled materials help meet both functional and aesthetic demands. E-commerce businesses are increasingly opting for custom-printed mailers with brand logos or secure closures, combining branding with cost efficiency. Innovations in automation and high-volume shipping have led to the production of standardized, stackable, and easy-to-handle mailers, aligning with the needs of retailers and logistics providers. These developments support the overall trend towards more efficient, eco-friendly, and cost-effective packaging solutions, boosting demand for non-cushioned mailers.

What are the Key Challenges and Risks That Could Limit Non-cushioned Mailer Demand in Japan?

Despite their advantages, non-cushioned mailers face several challenges in Japan. Their lack of padding or cushioning makes them unsuitable for fragile or heavy goods, such as electronics or glassware, leading retailers to choose more protective packaging. Growing concerns about packaging waste and plastic usage may also challenge non-cushioned mailers, especially those made of plastic film, driving a shift towards eco-friendly alternatives. Moreover, as consumer expectations rise and product diversity increases, non-cushioned mailers may not meet all shipping requirements, limiting their appeal in certain markets. The need for better protection during transit, especially for delicate items, could further reduce demand for these simple packaging solutions.

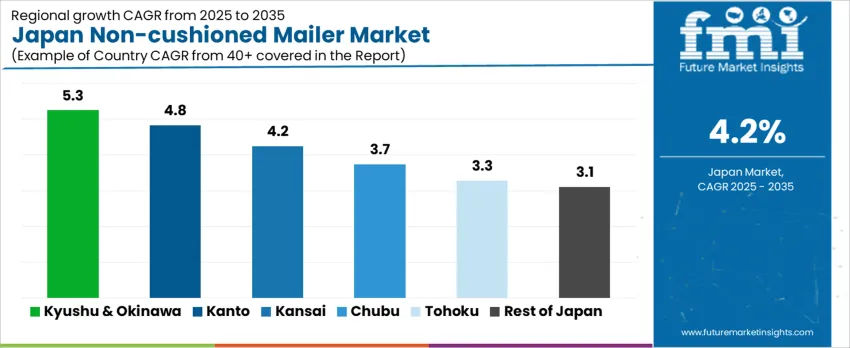

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.3% |

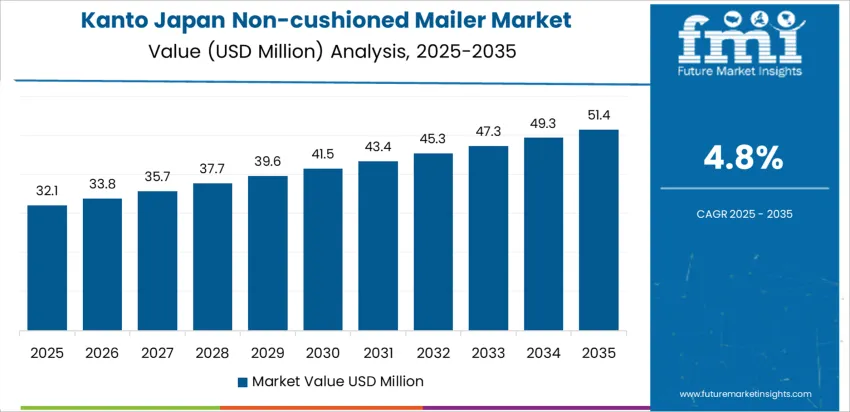

| Kanto | 4.8% |

| Kansai | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.3% |

| Rest of Japan | 3.1% |

Demand for non-cushioned mailers in Japan is steadily growing, with Kyushu & Okinawa leading at a 5.3% CAGR, driven by the region’s expanding e-commerce sector and rising interest in direct-to-consumer businesses. Kanto follows with a 4.8% CAGR, supported by the region's large e-commerce market and focus on eco-friendly packaging solutions. Kansai shows a 4.2% CAGR, with the growing demand driven by its hospitality and retail sectors. Chubu experiences a 3.7% CAGR, fueled by the rise of online shopping in cities like Nagoya. Tohoku sees a 3.3% CAGR, with moderate growth driven by local businesses transitioning to e-commerce. The Rest of Japan shows a 3.1% CAGR, with steady growth fueled by increasing online retail in rural areas.

Kyushu & Okinawa leads the demand for non-cushioned mailers, growing at a 5.3% CAGR. The region’s growing e-commerce sector, combined with the rise in direct-to-consumer businesses, is driving the demand for cost-effective and efficient shipping solutions. Non-cushioned mailers are particularly popular for sending lightweight items, making them an ideal choice for online retailers. The increasing trend of small businesses and local brands shipping products directly to consumers contributes significantly to this growth. Kyushu & Okinawa’s growing focus on durability and eco-friendly packaging options further boosts the demand for recyclable and lightweight non-cushioned mailers. As e-commerce continues to thrive in the region, the demand for non-cushioned mailers is expected to rise steadily.

Kanto is experiencing steady demand for non-cushioned mailers, with a 4.8% CAGR. The region’s large e-commerce market, especially in Tokyo, is a key driver of this growth. Kanto’s dominance in online retail and logistics creates significant demand for lightweight, cost-effective packaging solutions. Non-cushioned mailers are increasingly used by businesses to reduce shipping costs while maintaining packaging efficiency. As the demand for quick and efficient shipping grows, non-cushioned mailers are becoming more popular for packaging small, non-fragile items like clothing, books, and accessories. Kanto’s focus on eco-friendly packaging and eco-friendly solutions further supports the adoption of non-cushioned mailers. With continued growth in the e-commerce sector, Kanto’s demand for non-cushioned mailers is expected to remain strong.

Kansai is seeing moderate growth in demand for non-cushioned mailers, with a 4.2% CAGR. The region’s growing e-commerce market, particularly in Osaka, is contributing to the rise in demand for cost-effective and efficient packaging solutions. As more businesses in Kansai shift to online retail, the need for lightweight and affordable packaging like non-cushioned mailers is increasing. These mailers are ideal for shipping non-fragile items at a lower cost, making them popular for various industries, including fashion and consumer goods. Kansai’s commitment to durability and reducing packaging waste is also contributing to the demand for non-cushioned mailers, as many companies seek recyclable and eco-friendly packaging alternatives. As the e-commerce market continues to grow in Kansai, the demand for non-cushioned mailers is expected to expand steadily.

Chubu is experiencing steady demand for non-cushioned mailers, with a 3.7% CAGR. The region’s growing e-commerce sector, especially in cities like Nagoya, is contributing to the increased adoption of non-cushioned mailers. These mailers are favored for shipping lightweight and non-fragile products, which are common in Chubu’s e-commerce market, particularly in the fashion and electronics sectors. Chubu’s focus on logistics innovation and supply chain efficiency is driving demand for packaging solutions like non-cushioned mailers that offer cost savings and speed. As businesses in Chubu continue to expand their online retail operations, the need for eco-friendly and cost-effective packaging solutions like non-cushioned mailers is expected to grow steadily, supporting the region’s market for these products.

Tohoku is seeing moderate demand for non-cushioned mailers, with a 3.3% CAGR. While the region’s e-commerce market is smaller compared to major urban areas, the increasing shift towards online shopping and local business growth is driving demand for cost-effective packaging solutions. Non-cushioned mailers, which offer efficient and affordable shipping for non-fragile items, are becoming popular among local retailers. As more businesses in Tohoku embrace online retail and direct-to-consumer models, the need for packaging solutions like non-cushioned mailers is rising. Tohoku’s focus on durability and eco-friendly packaging alternatives supports the growing adoption of recyclable non-cushioned mailers. As the region’s e-commerce market expands, the demand for non-cushioned mailers is expected to grow at a steady pace.

The Rest of Japan is experiencing steady demand for non-cushioned mailers, with a 3.1% CAGR. While the market is smaller compared to larger urban areas, the growing interest in e-commerce, particularly in rural areas, is driving demand for affordable and efficient packaging solutions. Non-cushioned mailers are ideal for small, lightweight items, making them a popular choice for businesses shipping products directly to consumers. The rising number of local retailers and small businesses adopting online sales models contributes to the growing demand for non-cushioned mailers in the Rest of Japan. As the focus on eco-friendly packaging grows, the demand for recyclable, eco-friendly mailers is expected to continue increasing in these areas. The Rest of Japan’s steady shift toward online retail ensures consistent demand for non-cushioned mailers in the future.

The demand for non-cushioned mailers in Japan is growing as e-commerce continues to expand, driving the need for efficient and cost-effective packaging solutions. Non-cushioned mailers, typically used for lightweight items, are valued for their ability to reduce packaging costs while ensuring safe and secure delivery. As businesses seek eco-friendly and practical packaging options, non-cushioned mailers offer an ideal solution, particularly for the fashion, electronics, and retail sectors. With the increasing emphasis on reducing waste and optimizing logistics, the demand for these mailers is expected to rise.

Leading companies in the non-cushioned mailer market in Japan include Pregis, Sealed Air Corporation, 3M Company, Berry Global Inc., and Smurfit Kappa Group. Pregis leads with a market share of 35.0%, providing high-quality non-cushioned mailers known for their strength and efficiency in e-commerce packaging. Sealed Air Corporation offers a range of packaging solutions, including non-cushioned mailers designed for secure shipping of lightweight products. 3M Company specializes in a variety of protective packaging materials, including non-cushioned mailers for commercial and industrial applications. Berry Global Inc. is known for its eco-friendly and customizable mailer solutions, while Smurfit Kappa Group provides eco-friendly packaging options, including non-cushioned mailers, to meet the growing demand for eco-friendly packaging.

Competition in the non-cushioned mailer market is driven by factors such as cost-efficiency, durability, and product protection. Companies compete by offering high-quality, lightweight, and durable mailers that reduce shipping costs and improve operational efficiency. As durability becomes a key factor in packaging decisions, providers that offer eco-friendly materials and recyclable solutions are gaining a competitive edge. The growing demand for e-commerce packaging and the need for innovative, cost-effective packaging solutions will continue to drive competition in this market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Paper-Based, Plastic/Polyethylene |

| Closure Type | Self-Sealing, Fold-Over |

| End-User | E-commerce and Retail, Logistics and Distribution, Personal Use |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Pregis, Sealed Air Corporation, 3M Company, Berry Global Inc., Smurfit Kappa Group |

| Additional Attributes | Dollar sales by type, closure type, and end-user; regional CAGR and adoption trends; demand trends in non-cushioned mailers; growth in e-commerce, logistics, and personal use sectors; technology adoption for paper-based and polyethylene materials; vendor offerings including mailer solutions; regulatory influences and industry standards |

The demand for non-cushioned mailer in Japan is estimated to be valued at USD 73.8 million in 2025.

The market size for the non-cushioned mailer in Japan is projected to reach USD 111.3 million by 2035.

The demand for non-cushioned mailer in Japan is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in non-cushioned mailer in Japan are paper-based and plastic/polyethylene.

In terms of closure type, self-sealing segment is expected to command 68.0% share in the non-cushioned mailer in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Corrugated Mailers in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA