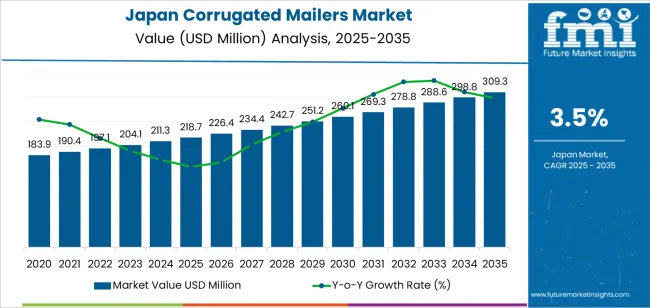

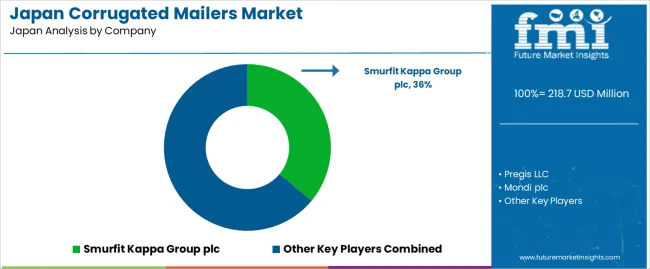

The Japan corrugated mailers demand is valued at USD 218.7 million in 2025 and is forecasted to reach USD 309.3 million by 2035, reflecting a CAGR of 3.5%. Demand is shaped by stable consumption of fibre-based protective packaging, steady parcel volumes, and the continued use of corrugated formats in fulfilment operations. Adoption is supported by requirements for impact resistance, product security, and lightweight packaging across retail, e-commerce, and small-parcel logistics. Increased emphasis on recyclable materials and consistent shipping performance also influences procurement choices among commercial users.

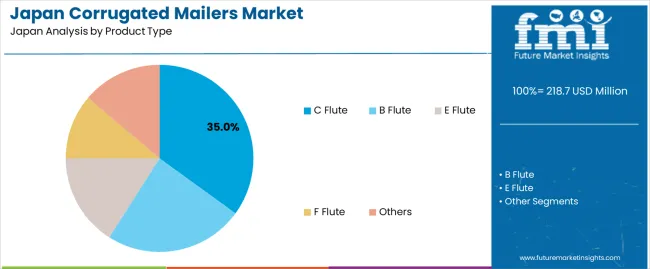

C Flute remains the leading product type. It is selected for balanced rigidity, cushioning performance, and compatibility with automated packing lines. Its structure supports reliable load-bearing behaviour and reduces deformation during transport, which makes it suitable for diverse postal and distribution conditions. Continued improvements in board strength, fibre composition, and print-ready surfaces sustain its preference across packaging converters and brand owners.

Kyushu & Okinawa, Kanto, and Kinki record the highest utilisation levels due to concentrated warehousing clusters, active parcel-handling networks, and established packaging-conversion facilities. These regions also support strong procurement channels for corrugated materials used in commercial shipping and distribution. Key suppliers include Smurfit Kappa Group plc, Pregis LLC, Mondi plc, DS Smith plc, and WestRock Company. These companies supply corrugated mailers designed for consistent stacking strength, impact protection, and recyclability used in fulfilment, retail shipping, and industrial dispatch applications.

The 10-year growth comparison shows a steady early expansion from 2025 to 2030, supported by consistent parcel volumes in e-commerce, subscription services, and small-parcel logistics. Early growth is reinforced by routine shifts toward lightweight mailer formats, improved structural designs for product protection, and steady procurement by fulfilment centres and postal networks. This period reflects utilisation-driven demand rather than large structural changes, giving the early curve a predictable upward trajectory.

From 2030 to 2035, the late growth curve maintains positive expansion but follows a more mature pattern. Parcel-handling processes stabilise, and most large shippers will have completed optimisation of packaging footprints, leading to growth shaped primarily by replacement cycles and incremental improvements in corrugated-material performance. Late-period gains stem from enhancements in liner-board strength, moisture-resistant coatings, and compatibility with automated sorting lines. The comparison shows an early phase defined by logistics-driven adoption and a later phase marked by operational stability, producing a balanced long-term growth path across Japan’s corrugated-mailer applications.

| Metric | Value |

|---|---|

| Japan Corrugated Mailers Sales Value (2025) | USD 218.7 million |

| Japan Corrugated Mailers Forecast Value (2035) | USD 309.3 million |

| Japan Corrugated Mailers Forecast CAGR (2025-2035) | 3.5% |

Demand for corrugated mailers in Japan is increasing as e-commerce, direct-to-consumer packaging and logistics operations expand. Online retail platforms and subscription services require strong, lightweight protective packaging for shipping smaller parcels and goods, which corrugated mailers provide. Ecofriendly trends also support adoption of these mailers because they are recyclable and more environmentally friendly compared with many plastic alternatives.

Japanese manufacturers of consumer goods, cosmetics and health-wellness products are investing in branded, differentiated packaging that employs printed corrugated mailers for unboxing experiences and secure transit. The industry growth is moderated by factors such as relatively modest new-parcel growth compared with some regions, high cost of printing and converting for short-run custom mailers, and competition from flexible mailer bags and foam-liners for lightweight goods. Some smaller e-commerce sellers may continue using generic packaging until customised mailers demonstrate clear value.

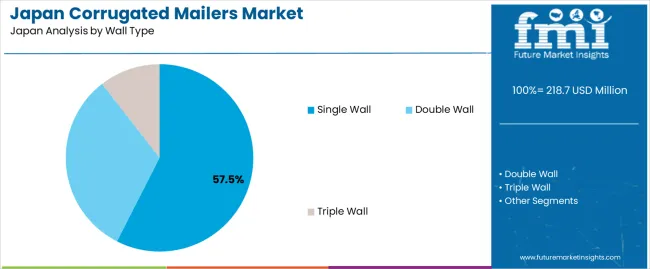

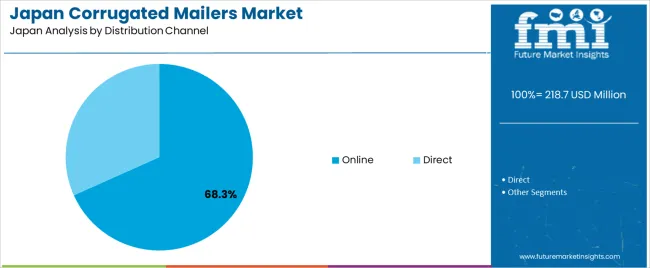

Demand for corrugated mailers in Japan reflects widespread use across e-commerce, retail, and small-parcel distribution. Product-type preferences correspond to packaging strength, cushioning performance, and compatibility with automated packing systems. Wall-type choices indicate varying durability requirements for shipments of different weights and handling conditions. Distribution-channel patterns show how businesses and individuals source corrugated mailers based on convenience, price consistency, procurement structure, and supply-chain scale.

C flute holds 35.0% of national demand and represents the leading product type. Its balance of cushioning strength and crush resistance supports frequent use in online retail shipments and commercial packaging. B flute represents 24.0%, offering improved printability and rigidity for smaller consumer parcels. E flute accounts for 16.0%, supporting lightweight packaging with finer fluting for enhanced surface quality. F flute holds 11.2%, serving compact parcels requiring high-quality printing and reduced material thickness. Other flute grades represent 13.8%, covering specialty combinations used for brand-oriented packaging. Product-type distribution reflects strength requirements, print expectations, and packaging-line compatibility across Japanese parcel-shipping needs.

Key drivers and attributes:

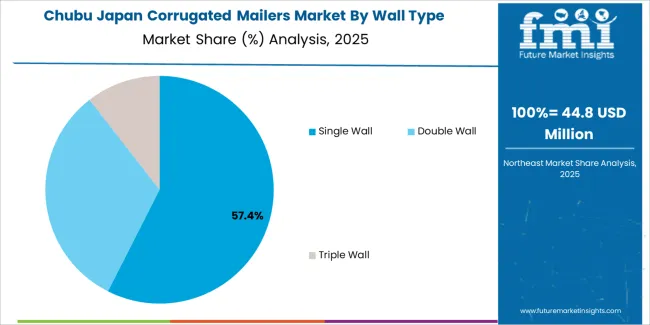

Single-wall mailers hold 57.5% of national demand and represent the dominant wall-type category. They support everyday parcel shipments involving lightweight to moderate-weight goods commonly handled in Japan’s high-frequency e-commerce network. Double-wall mailers account for 32.0%, used for heavier or fragile items requiring added compression resistance during transport. Triple-wall mailers represent 10.5%, supporting industrial or bulk shipments where high stacking strength is required. Wall-type distribution reflects balancing weight, material efficiency, and protection needs across shipment categories. Businesses adopt different wall structures based on product fragility, storage duration, and transport conditions across domestic and interregional delivery networks.

Key drivers and attributes:

Online procurement holds 68.3% of national demand and represents the leading distribution channel. Buyers use online platforms for bulk ordering, price comparison, subscription-based replenishment, and rapid delivery. Direct distribution accounts for 31.7%, serving businesses sourcing corrugated mailers through manufacturers, converters, or packaging distributors for consistent supply and negotiated pricing. Distribution-channel patterns reflect procurement habits shaped by delivery convenience, cost predictability, and volume-purchase requirements. Online channels support flexibility and low-order thresholds, while direct sourcing supports stable, contract-based purchasing for firms with predictable shipping volumes.

Key drivers and attributes:

Growth in e-commerce shipment volumes, desire for lightweight recyclable packaging and increased direct-to-consumer fulfilment are driving demand.

In Japan, demand for corrugated mailers is rising sharply as online retail continues to expand and home delivery becomes more frequent. Brands facing high fulfilment volumes look for packaging solutions that protect goods during transit, reduce weight and maintain rigidity during vessel movement or fast courier networks. Corrugated mailers meet these needs as they combine structural strength with efficient shipping performance. The increasing focus on packaging sustainability in Japan, including consumer preference for recyclable and minimally processed materials, further supports switch from plastic envelopes or mixed packaging to corrugated mailers.

Supply constraints, cost pressure and competition from flexible packaging formats restrain growth.

Corrugated mailers may cost more than simple poly-bags or padded mailers, especially when customised in size or print. Smaller e-commerce sellers may delay upgrade due to cost sensitivity. Production capacity in corrugated board is subject to raw-material price fluctuations (kraft liner, paperboard) and shipping weight changes. Some shipment categories such as soft goods or low-risk items may prefer lighter padded envelopes or flexible mailers which may challenge mailer uptake.

Trend toward pre-printed premium mailers, increasing use of right-sized and auto-mated mailer insertion lines and rising adoption of lightweight board with high-rigidity facings define industry direction.

In Japan, e-commerce brands are investing in customised corrugated mailers featuring brand messaging, variable print and premium finishing to enhance unboxing experience and consumer engagement. Packaging equipment suppliers are installing automated mailer-insertion systems to support high-volume fulfillment centres with minimal manual handling which improves throughput and reduces packaging cost per unit. Materials suppliers are developing lighter corrugated board grades with enhanced side-wall stiffness and tailored flute profiles to maintain protection while reducing board weight and enhancing carry-cost efficiency. These developments support continued growth in demand for corrugated mailers in Japan’s fast-evolving e-commerce logistics sector.

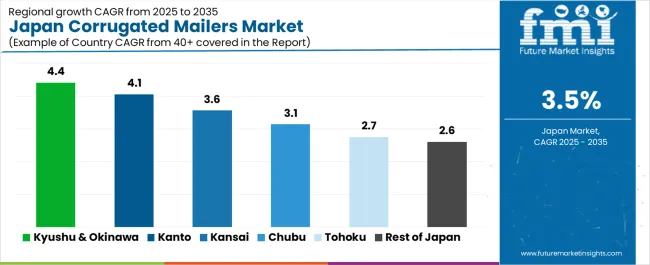

Demand for corrugated mailers in Japan is increasing through 2035 as e-commerce growth, parcel-shipping expansion, and stricter packaging-sustainability requirements drive adoption across consumer goods, electronics, pharmaceuticals, and specialty-retail sectors. Corrugated mailers support lightweight protection, material efficiency, and improved recyclability in domestic and cross-regional distribution networks. Growth is influenced by retail digitization, subscription-box models, and logistics operators shifting toward fiber-based mailers to reduce plastic use. The Kyushu & Okinawa region leads with 4.4%, followed by Kanto (4.1%), Kinki (3.6%), Chubu (3.1%), Tohoku (2.7%), and the Rest of Japan (2.6%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.4% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

Kyushu & Okinawa grows at 4.4% CAGR, supported by expanding regional logistics, rising parcel volumes, and strong adoption of green packaging solutions. E-commerce activity across Fukuoka, Kumamoto, and Kagoshima continues to increase, strengthening demand for mailers designed to withstand multi-stop handling. Electronics and household-goods sellers rely on corrugated formats for cost-efficient protection in short-distance distribution. Agricultural exporters adopt reinforced mailers for specialty food items shipped to other regions. Regional airports and shipping terminals influence packaging standards that prioritize recyclability and lightweight structures. Small and mid-sized businesses using digital sales channels further support consistent demand.

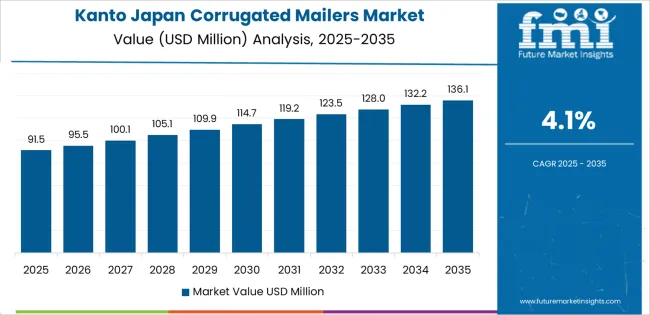

Kanto grows at 4.1% CAGR, driven by Japan’s largest e-commerce concentration, extensive third-party logistics networks, and high parcel-traffic density across Tokyo, Kanagawa, Chiba, and Saitama. Online retailers adopt corrugated mailers for electronics, cosmetics, apparel, and specialty consumer goods. Pharmaceutical and medical-device distributors use mailers designed for lightweight protective functions during regional fulfillment. Subscription-box services rely on corrugated formats for consistent sizing and ease of processing. High regulatory focus on packaging recyclability reinforces use of paper-based mailers. Large-scale fulfillment centers support continuous, high-volume demand.

Kinki grows at 3.6% CAGR, supported by diversified retail activity, strong electronics distribution, and a broad logistics ecosystem across Osaka, Kyoto, Hyogo, and Nara. Electronics and appliance sellers use corrugated mailers for compact devices and accessories. Fashion and lifestyle brands adopt lightweight mailers for regional and intercity delivery. Food producers distributing packaged snacks and specialty items rely on reinforced corrugated formats. Fulfillment centers located around Osaka and Kobe continue to expand automated packaging workflows that favor mailer standardization.

Chubu grows at 3.1% CAGR, influenced by manufacturing-linked shipments, regional e-commerce penetration, and industrial-goods distribution across Aichi, Shizuoka, and Mie. Automotive-parts suppliers adopt corrugated mailers for small components and aftermarket items. Specialty manufacturers use protective mailers for tools, equipment accessories, and testing materials. Retail expansion in Nagoya supports higher parcel traffic requiring consistent packaging formats. Growing online grocery and specialty food distribution contributes to additional use of reinforced mailers.

Tohoku grows at 2.7% CAGR, supported by regional manufacturing, agricultural outbound shipments, and expanding parcel networks across Sendai, Morioka, and Aomori. Agricultural cooperatives adopt durable corrugated mailers for specialty goods shipped to urban industries. Local manufacturers use mailers for compact components and precision parts. Growing e-commerce adoption increases small-parcel demand, especially in rural delivery areas requiring lightweight packaging. Logistics providers strengthen regional shipping routes that favor standardized corrugated formats.

The Rest of Japan grows at 2.6% CAGR, shaped by steady consumer-goods distribution, small-business online retailing, and regionally distributed manufacturing clusters. Local producers of household items, stationery, and crafts rely on corrugated mailers for cost-efficient shipping. Tourism-driven specialty product sellers use protective mailers for lightweight goods shipped post-purchase. Regional courier networks expand their service capacity, promoting adoption of standardized mailers across SMEs. Gradual increases in e-commerce participation continue to generate consistent baseline demand.

Demand for corrugated mailers in Japan is shaped by a concentrated group of packaging producers serving e-commerce shipments, subscription boxes, electronics, pharmaceuticals, and branded retail distribution. Smurfit Kappa Group plc holds the leading position with an estimated 36.1% share, supported by controlled corrugated-board engineering, consistent crush resistance, and established relationships with Japanese fulfilment networks. Its position is reinforced by predictable die-cut accuracy and reliable performance in automated packing environments.

Pregis LLC and Mondi plc follow as significant participants. Pregis supplies protective and lightweight mailer formats with stable cushioning characteristics suited to electronics, health products, and small-parcel shipments. Mondi provides corrugated mailers with controlled dimensional accuracy and dependable sealing behaviour, supporting brands that require uniform print surfaces and consistent structural integrity.

DS Smith plc maintains a notable presence through engineered corrugated solutions aligned with e-commerce packing requirements, offering consistent rigidity, moisture resistance, and pallet optimisation. WestRock Company contributes additional capability with high-strength mailers designed for retail and subscription-box applications, emphasizing material stability, stacking strength, and reliable converting standards.

Competition across this segment centres on board strength, fold precision, print quality, weight efficiency, and compatibility with automated fulfilment. Demand continues to grow as Japanese retailers and logistics operators expand direct-to-consumer shipping, requiring corrugated mailers that support secure transport, controlled material use, and consistent performance across high-volume parcel-distribution systems.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | C Flute, B Flute, E Flute, F Flute, Others |

| Wall Type | Single Wall, Double Wall, Triple Wall |

| Distribution Channel | Online, Direct |

| End Use | Commercial, Institutional, Household |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Smurfit Kappa Group plc, Pregis LLC, Mondi plc, DS Smith plc, WestRock Company |

| Additional Attributes | Dollar sales by product type, wall type, distribution channel, and end-use categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of corrugated mailer producers; developments in lightweight flute technologies, recyclable packaging, e-commerce-ready mailer formats, and high-strength wall constructions; integration with online retail fulfilment, institutional packaging, and household parcel shipments across Japan. |

The demand for corrugated mailers in japan is estimated to be valued at USD 218.7 million in 2025.

The market size for the corrugated mailers in japan is projected to reach USD 309.3 million by 2035.

The demand for corrugated mailers in japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in corrugated mailers in japan are c flute, b flute, e flute, f flute and others.

In terms of wall type, single wall segment is expected to command 57.5% share in the corrugated mailers in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Demand for Corrugated Mailers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Octabins in Japan Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA