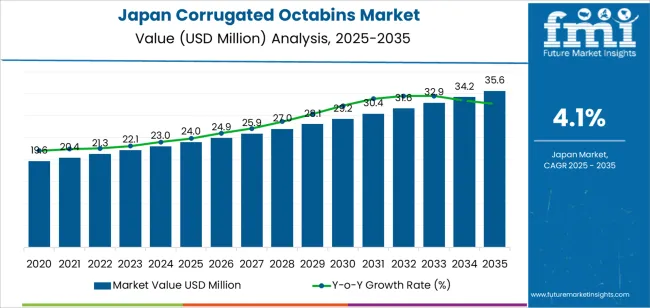

The Japan corrugated octabins demand is valued at USD 24.0 million in 2025 and is forecasted to reach USD 35.6 million by 2035, indicating a CAGR of 4.1%. Demand is shaped by the continued use of heavy-duty bulk packaging across chemicals, food ingredients, agricultural commodities, and plastic resin handling. Corrugated octabins provide stable load containment for powders, granules, and semi-bulk materials, offering a lighter and more cost-efficient alternative to rigid intermediate bulk containers. Their compatibility with palletised transport and automated filling systems supports adoption in high-volume distribution environments.

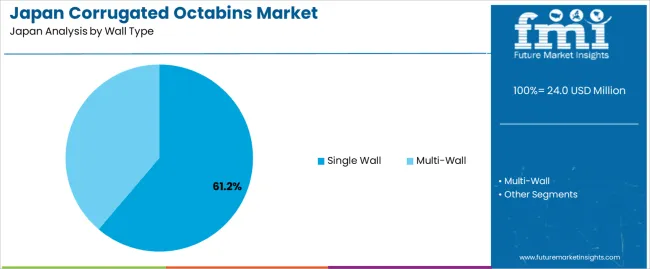

Single-wall corrugated octabins represent the leading wall type. Their structural performance is sufficient for a wide range of dry bulk goods, and their lower material weight helps reduce handling effort and disposal requirements. Single-wall formats remain widely used in industries with standardised pallet dimensions and controlled indoor storage conditions, where high stacking strength is not critical. Their ease of assembly and integration into established supply-chain workflows reinforces their position in routine bulk-goods transport.

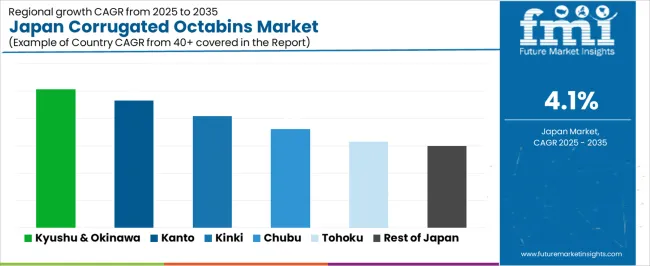

Kyushu & Okinawa, Kanto, and Kinki account for the highest demand. These regions include major industrial centres, food-processing clusters, and logistics hubs that rely on corrugated bulk packaging for raw-material distribution and export shipments. Their dense manufacturing footprints support continuous use of octabin formats for inbound and outbound material movement. Mondi Plc, IBC International, International Paper Company, Smurfit Kappa, Rondo Ganahl AG, and DS Smith are the key suppliers. Their product ranges include single-wall and multi-wall corrugated octabins engineered for automated filling lines, moisture-resistant coatings, and reinforced corner designs.

The early growth curve from 2025 to 2029 shows a moderate upward trajectory supported by consistent demand in bulk packaging for chemicals, food ingredients, polymers, and agricultural products. Early expansion is shaped by the shift from rigid intermediate containers to lighter corrugated formats that reduce handling effort and transport weight. Manufacturers and distributors adopt octabins to optimise pallet loads and streamline storage within constrained warehouse environments, giving the early period a steady, utilisation-driven rise.

From 2030 to 2035, the late growth curve transitions into a more stable pattern as largest users reach mature adoption levels. Replacement cycles rather than new conversions drive procurement, with annual growth tied to liner-board durability improvements, enhanced structural reinforcement designs, and increased compatibility with automated filling and discharge equipment. Demand becomes more predictable as bulk-handling processes standardise across chemicals, food-processing, and industrial supply chains. The comparison shows a segment shifting from early operational gains linked to packaging optimisation to a later phase defined by stability, long container lifespans, and incremental performance enhancements across Japan’s bulk-handling workflows.

| Metric | Value |

|---|---|

| Japan Corrugated Octabins Sales Value (2025) | USD 24.0 million |

| Japan Corrugated Octabins Forecast Value (2035) | USD 35.6 million |

| Japan Corrugated Octabins Forecast CAGR (2025-2035) | 4.1% |

Demand for corrugated octabins in Japan is increasing because manufacturers and logistics operators require large-format, bulk packaging solutions that are lightweight, cost-effective and recyclable. Industries such as chemicals, pharmaceuticals, food processing and electronics use octabins to transport powders, granules and bulk materials safely in domestic and export shipping. The broader trend toward ecofriendly packaging in Japan, driven by corporate environmental goals and regulation, favours corrugated octabin designs over heavy plastic or wooden containers.

Regional manufacturing hubs in automotive, electronics and food sectors also support steady procurement of octabin containers as part of their supply chain-packaging inventory. Constraints include standardisation challenges because octabin sizes and configurations often need to be customised for specific products, which raises tooling or manufacturing cost. Japan’s relatively high labour and materials cost also increase unit price compared with some alternatives. Smaller firms may delay switching to octabin systems until packaging-return logistics or cost-benefit are better established.

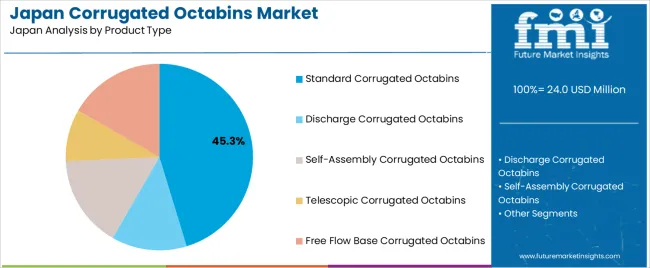

Demand for corrugated octabins in Japan reflects packaging requirements across bulk-handling operations involving food ingredients, chemicals, pharmaceuticals, and construction materials. Wall-type preferences correspond to load strength, stacking stability, and transport conditions. Product-type distribution is shaped by discharge needs, assembly convenience, and handling processes within warehouses and production facilities. End-use distribution highlights the industries relying on bulk corrugated containment for dry goods, granules, powders, and intermediate materials.

Single-wall corrugated octabins hold 61.2% of national demand and represent the leading wall-type category. These structures support bulk loads with adequate compression strength while remaining lightweight and cost-efficient for high-volume packaging. Multi-wall octabins account for 38.8%, serving applications requiring additional rigidity for heavy or fragile materials sensitive to deformation during transport or stacking. Wall-type distribution reflects differences in load characteristics, expected transit duration, and storage conditions across Japanese distribution networks. Manufacturers select single-wall units when balancing strength and material efficiency, while multi-wall units support goods with elevated structural requirements within industrial workflows.

Key drivers and attributes:

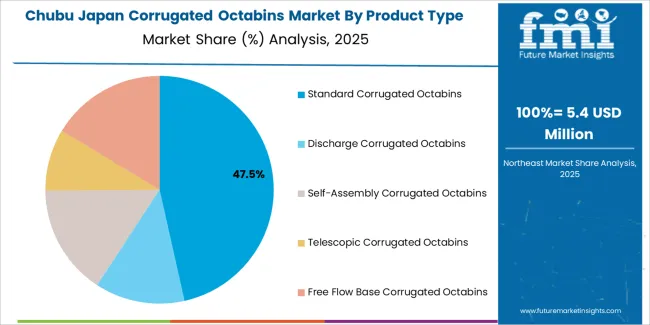

Standard corrugated octabins hold 45.3% of national demand and represent the dominant product type. These units support general-purpose bulk storage and are used widely across agriculture, chemicals, processed foods, and mixed industrial goods. Free-flow base designs represent 16.7%, supporting materials discharged through controlled openings. Self-assembly variants account for 16.0%, providing flat-pack convenience for facilities requiring rapid setup. Discharge-type octabins represent 13.0%, enabling easier emptying of granules or powders. Telescopic designs hold 9.0%, supporting adjustable containment for variable product heights. Product-type distribution reflects handling requirements, filling methods, and space-efficiency considerations in Japanese industrial operations.

Key drivers and attributes:

The food and beverages industry holds 56.4% of national demand and represents the largest end-use segment. Corrugated octabins support bulk packaging of ingredients, additives, grains, powders, and processed intermediate materials. Pharmaceuticals account for 16.0%, relying on secure, hygienic packaging suitable for controlled materials. Building and construction represents 15.0%, using octabins for dry mixes, fillers, and lightweight aggregates requiring protected storage. Other industries hold 12.6%, including chemicals, plastics, pigments, and general manufacturing. End-use distribution reflects differences in regulatory requirements, hygiene standards, and load-handling practices across Japanese bulk-packaging environments.

Key drivers and attributes:

Drivers: growth in bulk packaging needs, expansion of chemical and food processing sectors, and preference for lightweight shipping containers.

Demand for corrugated octabins in Japan is increasing as manufacturers seek bulk packaging solutions that balance strength, weight efficiency and cost. Chemical producers, polymer manufacturers and food processors use octabins for powders, granules, concentrates and semi-bulk raw materials that require stable stacking and safe transport. Japan’s strong export orientation encourages adoption of packaging that reduces shipping weight while maintaining structural integrity during long-distance transport. Corrugated octabins offer a favourable balance of durability and handling efficiency, which aligns with modern warehousing practices and the need to optimise pallet space in compact Japanese facilities.

Restraints: competition from rigid intermediate bulk containers, limited reuse cycles and sensitivity to moisture exposure.

Corrugated octabins, while strong, are less reusable than rigid plastic or metal bulk containers, which limits their appeal for closed-loop logistics. Some industrial users prefer containers that withstand multiple cycles of heavy handling, especially in sectors with continuous return flows. Octabins must also be protected from excessive moisture during storage or transport which may reduce structural performance and require additional liner or coating costs. These constraints can influence buyer decisions where long-term durability or controlled environments are required.

Key Trends: rising use in plastics and chemical resins, development of moisture-resistant and reinforced grades, and increased adoption in export-oriented supply chains.

Manufacturers in Japan are using corrugated octabins more frequently for polymer resins, specialty chemicals and food-grade ingredients where one-way export shipments are common. Suppliers are designing octabins with improved inner liners, water-resistant coatings and reinforced wall structures to support heavier product loads. Adoption is also expanding within export supply chains that prioritise lightweight, collapsible packaging to reduce handling and disposal costs. These developments support steady demand growth for corrugated octabins across Japanese industrial and processing sectors.

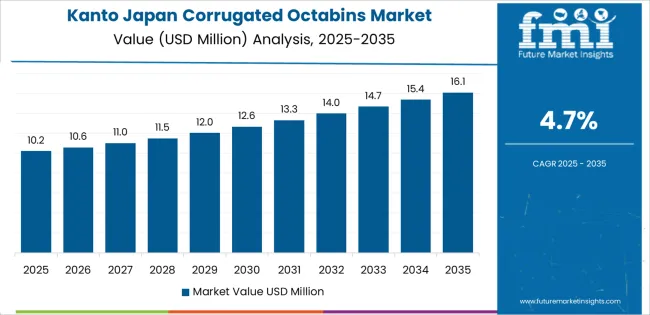

Demand for corrugated octabins in Japan is increasing through 2035 as manufacturers, agricultural producers, chemical suppliers, and logistics operators expand the use of heavy-duty bulk packaging. Octabins support safe transport of resins, granules, powders, fruits, vegetables, and semi-processed industrial materials. Their high stacking strength, reduced tare weight, and compatibility with palletized handling make them suitable for long-distance shipment and warehouse storage. Adoption is also influenced by export-oriented supply chains, automation in filling and discharge lines, and the shift toward recyclable packaging formats. Growth varies by region based on industrial activity, agricultural output, and the scale of distribution networks. Kyushu & Okinawa leads with 5.1%, followed by Kanto (4.7%), Kinki (4.1%), Chubu (3.6%), Tohoku (3.2%), and the Rest of Japan (3.0%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.1% |

| Kanto | 4.7% |

| Kinki | 4.1% |

| Chubu | 3.6% |

| Tohoku | 3.2% |

| Rest of Japan | 3.0% |

Kyushu & Okinawa grow at 5.1% CAGR, supported by strong agricultural production, regional manufacturing sites, and active export corridors. Agricultural cooperatives depend on octabins for bulk shipment of sweet potatoes, citrus, leafy vegetables, and other produce requiring ventilation, cushioning, and stable pallet loads. Chemical and plastics processors use octabins for resin granules and powder packaging destined for mainland Japan or export industries. Food-processing facilities adopt octabins for intermediate raw-material handling in warehouses with limited floor space. Ports in Okinawa benefit from lightweight bulk containers that reduce shipping costs for inter-island and international movement.

Kanto grows at 4.7% CAGR, driven by dense industrial activity, expansive logistics networks, and high packaging turnover across Tokyo, Kanagawa, and surrounding prefectures. Manufacturing plants use octabins for bulk components, intermediate raw materials, and polymer resins. Distribution centers rely on strong, stackable octabins that allow efficient warehouse organization and reduced pallet changeover times. Food-processing operations adopt lined octabins for dry ingredients and semi-processed materials. Export-oriented suppliers benefit from octabins’ recyclability and reduced storage footprint when collapsed after use. High warehouse density and strong industrial demand sustain the region’s adoption trajectory.

Kinki grows at 4.1% CAGR, supported by manufacturing clusters, regional logistics hubs, and food-processing operations across Osaka, Kyoto, and Hyogo. Automotive and machinery suppliers use octabins to handle bulk components and packaging materials. Beverage and food producers require hygienic bulk containers for dry mixes, concentrates, and pre-processed materials. Electronics manufacturers adopt rigid corrugated formats to secure lightweight but sensitive parts during warehouse storage. Retail distribution centers use octabins to consolidate bulk shipments and reduce pallet movements. Consistent industrial activity and diverse supply chains support stable adoption.

Chubu grows at 3.6% CAGR, shaped by industrial production, automotive supply chains, and agricultural output across Aichi, Shizuoka, and neighboring prefectures. Resin and polymer producers employ octabins for granules shipped to manufacturing plants. Agricultural groups utilize strong corrugated containers for bulk movement of high-volume produce such as cabbage and root vegetables. Export-driven industries adopt octabins for secure, lightweight packaging that lowers freight weight. Manufacturing plants use octabins within automated handling systems where stable, uniform bulk containers are required.

Tohoku grows at 3.2% CAGR, supported by agricultural distribution, seafood-processing networks, and essential manufacturing across Miyagi, Fukushima, and Akita. Producers of apples, onions, and other high-volume crops use octabins for long-distance transport to national retail and wholesale industries. Food-processing facilities adopt lined octabins for bulk frozen or dried inputs. Manufacturing and chemical companies use corrugated formats for powders, pellets, and packaging intermediates. Regional logistics operators employ foldable or semi-rigid designs to reduce warehouse storage requirements.

The Rest of Japan grows at 3.0% CAGR, driven by mixed agricultural production, small and mid-scale manufacturing, and regional supply chains with recurring bulk-packaging needs. Local farmers use octabins for produce consolidation and seasonal shipments. Smaller manufacturing units adopt corrugated containers for raw-material handling and storage. Food processors use lightweight octabins for bulk dry ingredients. Regional distributors favor octabins for cost-efficient pallet loads and standardized stacking. While demand is lower than major industrial regions, steady operational requirements maintain consistent usage.

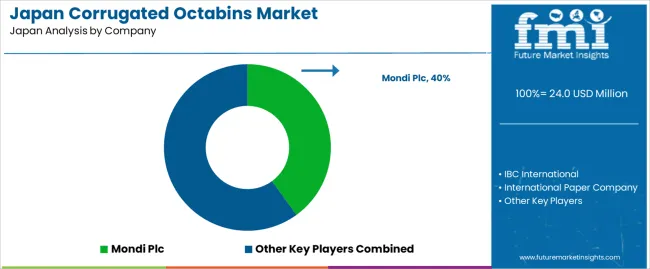

Demand for corrugated octabins in Japan is shaped by a concentrated group of packaging producers supplying bulk dry goods, polymers, chemicals, agricultural products, and export-oriented industrial materials. Mondi Plc holds the leading position with an estimated 40.0% share, supported by controlled corrugated-board engineering, stable stacking performance, and long-standing supply relationships with Japanese industrial and chemical distributors. Its position is reinforced by reliable compression strength and predictable behaviour in high-load warehouse and export environments.

IBC International and International Paper Company follow as significant participants. IBC International provides heavy-duty bulk containers designed for granular, powdered, and pelletised materials, emphasising consistent structural integrity and dependable inner-liner performance. International Paper supplies octabins with stable dimensional accuracy and robust wall construction suited to automated filling and long-distance transport.

Smurfit Kappa maintains a notable presence through engineered corrugated solutions supporting bulk export flows, characterised by controlled moisture resistance and uniform board strength. Rondo Ganahl AG contributes capability with reinforced designs used in specialised industrial applications requiring strong pallet interface stability. DS Smith supports additional demand with high-strength corrugated formats optimised for both domestic distribution and global shipping.

Competition across this segment centers on compression strength, burst resistance, pallet compatibility, dimensional precision, moisture endurance, and reliability during high-volume filling and transport. Demand remains steady as Japanese manufacturers and exporters adopt durable, space-efficient corrugated octabins that support bulk handling, protect high-value materials, and ensure consistent performance in both domestic and international supply chains.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Wall Type | Single Wall, Multi-Wall |

| Product Type | Standard Corrugated Octabins, Discharge Corrugated Octabins, Self-Assembly Corrugated Octabins, Telescopic Corrugated Octabins, Free Flow Base Corrugated Octabins |

| End Use | Food and Beverages Industry, Pharmaceuticals Industry, Building and Construction, Other Industries |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Mondi Plc, IBC International, International Paper Company, Smurfit Kappa, Rondo Ganahl AG, DS Smith |

| Additional Attributes | Dollar sales by wall type, product type, and end-use categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of corrugated bulk packaging manufacturers; developments in high-strength multi-wall corrugated structures, food-grade liners, and lightweight self-assembly systems; integration with food processing, pharmaceutical bulk handling, and construction material transport across Japan. |

The demand for corrugated octabins in Japan is estimated to be valued at USD 24.0 million in 2025.

The market size for the corrugated octabins in Japan is projected to reach USD 35.6 million by 2035.

The demand for corrugated octabins in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in corrugated octabins in Japan are single wall and multi-wall.

In terms of product type, standard corrugated octabins segment is expected to command 45.3% share in the corrugated octabins in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA