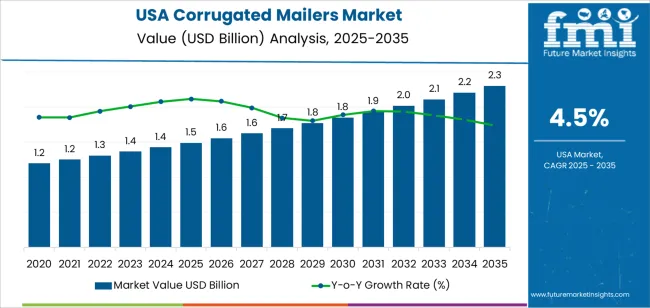

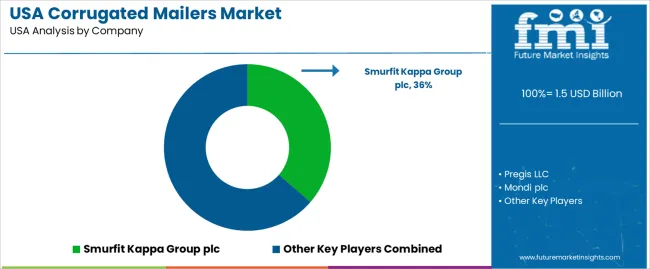

The demand for corrugated mailers in USA is valued at USD 1.5 billion in 2025 and is projected to reach USD 2.3 billion by 2035, reflecting a compound annual growth rate of 4.5%. The overall growth path remains steady, driven by ongoing parcel shipments across e-commerce, subscription services and direct-to-consumer fulfillment models. Corrugated formats retain broad use due to strength, printability and compatibility with automated packing lines. Inflection point mapping shows the first subtle shift between 2026 and 2027 as demand moves from USD 1.5 billion to USD 1.6 billion, marking the earliest acceleration tied to rising small-parcel throughput. A second shift appears around 2030 when values reach USD 1.8 billion, reflecting broader adoption across retail consolidation and diversified shipping workflows.

The progression from 2031 onward shows a more defined upward tilt as demand rises from USD 1.9 billion to USD 2.0 billion, signaling sustained strengthening rather than short-term increases. This phase corresponds to stable growth in return logistics, expanded micro-fulfillment centers and regular packaging upgrades within large operators. By 2033, values approach USD 2.1 billion, representing the third inflection where growth becomes more consistent due to recurring replacement cycles and standardized mailer specifications. The final inflection appears near the forecast horizon as demand moves from USD 2.2 billion to USD 2.3 billion, completing a curve defined by small but identifiable acceleration points across the decade, shaped primarily by continuous parcel handling and evolving distribution patterns across USA.

Demand in USA for corrugated mailers is projected to grow from USD 1.5 billion in 2025 to USD 2.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.5%. Starting from USD 1.2 billion in 2020, demand rises gradually to USD 1.4 billion in 2024 and USD 1.5 billion in 2025. Between 2025 and 2030, demand is expected to increase from USD 1.5 billion to around USD 1.8 billion, supported by growth in e commerce shipments, rising consumer preference for doorstep delivery, and wider adoption of corrugated mailers as an eco-friendly and cost-effective packaging solution. By 2035, demand is forecast to reach USD 2.3 billion, reflecting steady adoption across multiple sectors.

Year-on-year growth shows a consistent upward trajectory. From 2024 to 2025, demand rises from USD 1.4 billion to USD 1.5 billion, representing approximately 7.1% growth. From 2025 to 2030, the CAGR moderates to around 4 5% annually as demand reaches USD 1.8 billion. Between 2030 and 2035, annual growth averages roughly 5% as the segment matures and stabilizes. The YoY pattern indicates stronger growth in the early phase, followed by consistent mid-single-digit increases through the latter half of the decade, reflecting steady adoption, incremental volume gains, and moderate value enhancement through premium or sustainable mailer formats.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.5 billion |

| Forecast Value (2035) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The demand for corrugated mailers in USA is being driven primarily by the continued growth of e-commerce and parcel delivery services that require lightweight yet sturdy packaging. As online shopping habits grow, brands and fulfillment centres seek mailer formats that can protect goods during transit while minimising material and shipping costs. Corrugated mailers offer strength, stackability and recyclability, which makes them well-suited for direct-to-consumer shipments of apparel, electronics, subscription boxes and retail goods.

At the same time, environmental and regulatory pressures are shaping demand in USA. Recyclable packaging, lightweighting initiatives and consumer preference for eco-friendly solutions are prompting users to select corrugated mailers over heavier or less sustainable alternatives. Packaging designers and converters are responding with single-wall or customised flute-structures that reduce weight without compromising protection. Cost inflation on paper and board, supply-chain disruptions and shifts in packaging habits represent constraints. Nonetheless, the twin forces of online fulfilment growth and sustainability focus suggest steady expansion in demand for corrugated mailers in USA.

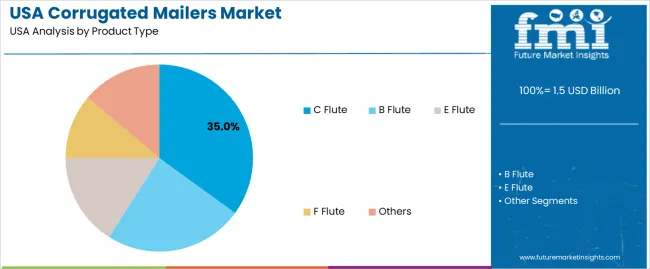

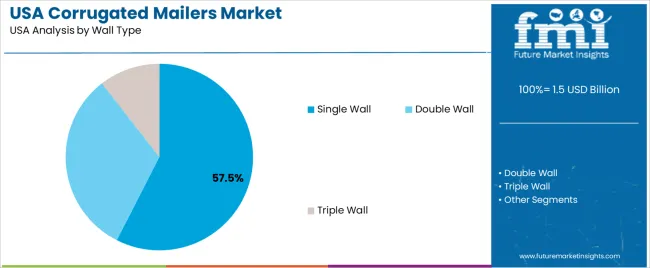

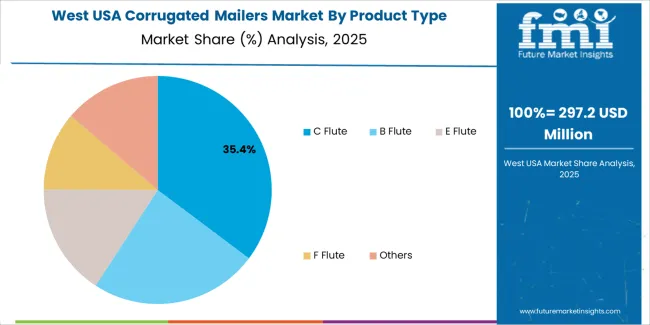

The demand for corrugated mailers in USA is shaped by the flute profiles used in mailer construction and the wall types selected for strength, handling and protection requirements. Product types such as C flute, B flute, E flute, F flute and other formats support varied rigidity, cushioning and printability needs across retail, e-commerce and industrial shipping. Wall types including single wall, double wall and triple wall align with different load conditions and durability expectations. As businesses focus on reliable packaging for transport, storage and presentation, the combination of flute design and wall structure guides adoption across USA’s shipping and fulfillment networks.

C flute mailers account for 35% of total demand for product types in USA. Their leading share reflects the balance they provide between cushioning performance and structural rigidity, making them suitable for a wide range of items shipped through postal and courier channels. C flute offers stable crush resistance and consistent edge strength, which helps protect goods during stacking and transit. Many retailers choose this format for its compatibility with common folding and sealing equipment. Its print surface supports clear branding and labeling, which benefits shippers needing dependable presentation and performance across routine fulfillment cycles.

Demand for C flute mailers also increases as e-commerce shipments require packaging that withstands varied handling conditions. The flute’s thickness supports protection for medium-weight items such as books, electronics accessories and home goods. Its predictable performance helps reduce product damage rates while maintaining manageable packaging weight. Facilities appreciate the ease of inventory management due to the flute’s broad usage across different mailer sizes. As shipping volumes remain high across USA, C flute continues to serve as a core option for protective and versatile mailing solutions.

Single wall mailers account for 57.5% of total demand for wall types in USA. Their leading position reflects widespread use in applications requiring lightweight yet protective packaging suitable for small and medium items. Single wall structures combine reliable rigidity with efficient material use, making them practical for businesses prioritizing cost-effective shipping. These mailers handle routine transport conditions while maintaining compatibility with automated packing lines used in high-volume fulfillment settings. Their manageable weight also supports economical shipping rates, which strengthens adoption among online retailers and small businesses.

Demand for single wall mailers continues to grow as the e-commerce sector expands. The structure provides adequate protection for apparel, accessories, printed materials and other items that do not require heavy-duty reinforcement. Facilities value the ease of storage, quick assembly and consistent performance during daily packing operations. The format also allows for varied flute combinations, giving producers flexibility when balancing strength and weight. As users emphasize efficiency and reliable handling, single wall mailers remain the primary choice across USA’s corrugated packaging landscape.

Demand for corrugated mailers in the USA remains influenced by the rise of e-commerce, direct-to-consumer shipping and increased focus on packaging protection and sustainability. Brands view mailer boxes as opportunities for enhanced unboxing experiences and recyclable shipping solutions. At the same time, barriers include softening overall corrugated board and box volumes, tight material cost control, and competition from alternative mailing formats or lighter packaging substrates. These factors together determine how fast corrugated mailers grow in U.S. parcel and shipping applications.

How Are E-commerce Growth and Sustainability Expectations Shaping Demand for Corrugated Mailers in the USA?

U.S. consumers increasingly purchase products online, generating demand for packaging that protects items during transit, offers branding appeal and aligns with recycling expectations. Corrugated mailer boxes serve these needs by providing cushioning, printability and recyclability. At the same time, sustainability goals drive brands to prefer mailers made from recycled content or designed for single-use circularity. Because of these shifts, packaging buyers are replacing generic wrap-films or poly mailers with corrugated mailers where feasible. However macroeconomic slowdowns and downward pressure on packaging volumes influence adoption.

Where Are Growth Opportunities Emerging for Corrugated Mailers in USA’s Market?

Growth opportunities in the U.S. lie in subscription-box services, premium consumer-goods shipping, custom branded mailers and protective packaging for electronics, health/beauty products and fragile items. The need for mailers that offer variable sizing, short-run custom printing and drop-ship logistics support presents space for conversion from standard boxes. Suppliers who offer efficient manufacturing, on-demand digital print, and mailers optimised for parcel services can capture this demand. Additionally, brands that emphasise sustainable packaging offer opportunities to upgrade to higher-value corrugated mailer formats.

What Challenges Are Limiting Wider Uptake of Corrugated Mailers in the USA?

Despite positive drivers, there are challenges slowing uptake in the U.S. market. The broader corrugated box industry is facing soft demand—U.S. corrugated board producers are closing capacity due to reduced shipments. Some packaging buyers are reducing pack structure complexity to lower cost and weight. Also, corrugated mailers carry higher cost and shipping weight compared to ultra-light poly mailers or flexible pouches, which can deter cost-sensitive segments. These constraints moderate how rapidly corrugated mailers become standard across all shipping and mail-service applications in the USA.

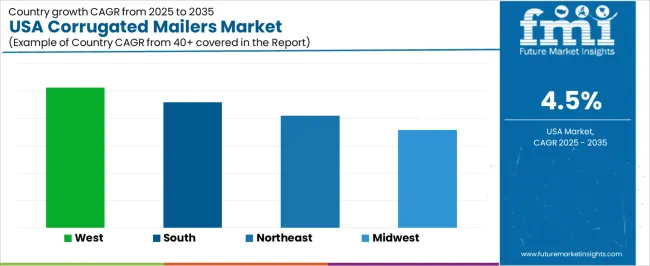

| Region | CAGR (%) |

|---|---|

| West | 5.1% |

| South | 4.6% |

| Northeast | 4.1% |

| Midwest | 3.6% |

Demand for corrugated mailers in the USA is rising across all regions. The West leads at 5.1%, supported by strong e-commerce activity, high parcel shipment volumes, and steady use of lightweight protective packaging. The South follows at 4.6%, driven by expanding fulfillment centers and increasing adoption of corrugated formats among regional retailers. The Northeast records 4.1%, shaped by dense urban delivery networks and steady demand from small businesses. The Midwest grows at 3.6%, where manufacturing and distribution hubs rely on durable mailer formats for shipping needs. These regional patterns highlight consistent national reliance on corrugated mailers as parcel movement continues to expand.

West USA is projected to grow at a CAGR of 5.1% through 2035 in demand for corrugated mailers. California and neighboring states are increasingly adopting corrugated mailers for e-commerce, retail shipments, and logistics packaging. Rising online retail activity, demand for durable packaging, and consumer convenience drive adoption. Manufacturers supply high-strength, recyclable, and customizable corrugated mailers suitable for various shipping applications. Retailers and distributors ensure accessibility across warehouses and fulfillment centers. E-commerce growth, increasing parcel volumes, and supply chain modernization support steady adoption of corrugated mailers in West USA.

South USA is projected to grow at a CAGR of 4.6% through 2035 in demand for corrugated mailers. Texas, Florida, and Georgia are increasingly using corrugated mailers for e-commerce, retail, and logistics packaging applications. Rising demand for secure packaging, shipping efficiency, and recyclable materials drives adoption. Manufacturers provide customizable, high-strength corrugated mailers suitable for different parcel sizes. Retailers and distributors expand availability across urban and suburban warehouses. Online retail growth, packaging efficiency improvements, and logistics modernization support steady adoption of corrugated mailers across South USA.

Northeast USA is projected to grow at a CAGR of 4.1% through 2035 in demand for corrugated mailers. New York, Boston, and Philadelphia are increasingly adopting corrugated mailers for retail, e-commerce, and shipping operations. Rising demand for durable, recyclable, and cost-effective packaging drives adoption. Manufacturers supply mailers compatible with automated fulfillment and shipping systems. Retailers and distributors ensure accessibility across warehouses and fulfillment centers. Online retail expansion, logistics efficiency improvements, and growing parcel volumes support steady adoption of corrugated mailers across Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.6% through 2035 in demand for corrugated mailers. Chicago, Detroit, and Minneapolis are gradually adopting corrugated mailers for e-commerce, retail, and logistics applications. Rising demand for packaging durability, recyclable materials, and operational efficiency drives adoption. Manufacturers provide high-strength, customizable mailers suitable for multiple shipping needs. Retailers and distributors expand accessibility across urban and semi-urban warehouses. Growth in online retail, parcel volumes, and logistics modernization ensures steady adoption of corrugated mailers across Midwest USA.

The demand for corrugated mailers in the USA is largely driven by the rapid growth of e-commerce and direct-to-consumer shipping, which require durable, lightweight and protective packaging for products in transit. As online shopping volumes continue to increase, retailers and fulfilment centres are choosing corrugated mailers for their combination of strength, recyclability and cost-effectiveness. Additionally, heightened consumer and regulatory focus on sustainability is encouraging adoption of paper-based mailers over plastic alternatives. Improvements in material technology—such as lighter board grades, enhanced flutes and better printability—also support uptake across retail, electronics and subscription-box segments.

Key companies shaping the corrugated mailer segment include Smurfit Kappa Group plc, Pregis LLC, Mondi plc, DS Smith plc and WestRock Company. These firms provide corrugated mailer solutions tailored to U.S. e-commerce, retail and logistics clients. Smurfit Kappa and Mondi design and supply paper-based mailer formats optimised for sustainability. DS Smith and WestRock bring scale-manufacturing, conversion capabilities and customisation services. Pregis offers protective mail-er formats and integrated packaging solutions. Their global expertise, regional manufacturing footprint and service networks enable them to influence how corrugated mailers are selected, customised and deployed within U.S. supply chains.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Wall Type | Single Wall, Double Wall, Triple Wall |

| Distribution Channel | Online, Direct |

| End Use | Commercial, Institutional, Household |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Smurfit Kappa Group plc, Pregis LLC, Mondi plc, DS Smith plc, WestRock Company |

| Additional Attributes | Dollar by sales by wall type and distribution channel; regional CAGR and adoption trends; usage across e-commerce, retail, and logistics applications; compatibility with automated fulfillment and shipping systems; recyclable and sustainable packaging adoption; fluting type and board grade variations; premium or custom print options; recurring replacement cycles and consistent adoption; projected value uplift and incremental growth across the forecast period; impact of e-commerce expansion, direct-to-consumer shipping, and sustainability initiatives on product selection. |

The demand for corrugated mailers in usa is estimated to be valued at USD 1.5 billion in 2025.

The market size for the corrugated mailers in usa is projected to reach USD 2.3 billion by 2035.

The demand for corrugated mailers in usa is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in corrugated mailers in usa are c flute, b flute, e flute, f flute and others.

In terms of wall type, single wall segment is expected to command 57.5% share in the corrugated mailers in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Demand for Corrugated Mailers in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Octabins in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA