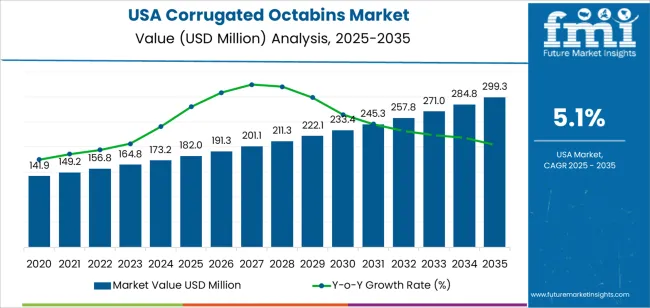

The demand for corrugated octabins in the USA is expected to grow from USD 182.0 million in 2025 to USD 300.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.10%. Corrugated octabins are increasingly favored in industries such as packaging, warehousing, and distribution due to their ability to handle large quantities of products, offering an efficient and cost-effective solution for bulk storage and transportation. As businesses continue to focus on improving supply chain operations and reducing packaging waste, corrugated octabins offer a robust, recyclable alternative to traditional packaging solutions like wooden crates and plastic containers.

One of the key drivers of growth in the demand for corrugated octabins is the continued expansion of e-commerce and retail industries in the USA. As the volume of goods shipped grows, there is an increasing need for durable and scalable packaging solutions that can handle a variety of products, from bulk goods to fragile items. The octabin’s large capacity and structural integrity make it an ideal choice for businesses looking to reduce shipping and handling costs while maintaining product protection. This shift towards efficient, eco-friendly packaging solutions is a critical factor contributing to the steady growth of corrugated octabins.

Industries focused on eco-friendly packaging solutions are increasingly choosing corrugated octabins for their environmental benefits. As regulations around packaging waste become stricter and consumer demand for eco-friendly practices rises, businesses are opting for reusable and recyclable packaging materials, with corrugated octabins providing an effective solution. The materials used in the production of these octabins, primarily corrugated cardboard, are easily recyclable and represent an eco-friendly alternative to other packaging options, such as plastic bins and containers.

Between 2025 and 2030, the demand for corrugated octabins in the USA will increase from USD 182.0 million to USD 191.4 million, adding USD 9.4 million. This growth will be driven primarily by the increasing demand for packaging solutions that offer both cost savings and durability. As the retail and e-commerce sectors continue to experience strong growth, the use of corrugated octabins will rise, particularly in sectors like food and beverage, consumer goods, and industrial applications. The industry’s emphasis on reducing packaging costs while optimizing storage and shipping efficiency will further support this growth.

From 2030 to 2035, the demand is expected to grow from USD 191.4 million to USD 300.2 million, adding USD 108.8 million. This later phase will witness a more substantial increase in demand, driven by the widespread adoption of eco-friendly packaging practices and the expanding e-commerce and logistics sectors. The shift toward greater durability in packaging, coupled with the increasing preference for bulk packaging in retail and industrial applications, will further accelerate the demand for corrugated octabins. As companies invest in more efficient logistics and packaging systems, corrugated octabins will play a crucial role in optimizing storage and transportation, while also contributing to the reduction of environmental impact.

| Metric | Value |

|---|---|

| Demand for Corrugated Octabins in USA Value (2025) | USD 182.0 million |

| Demand for Corrugated Octabins in USA Forecast Value (2035) | USD 300.2 million |

| Demand for Corrugated Octabins in USA Forecast CAGR (2025 to 2035) | 5.10% |

The demand for corrugated octabins in the USA is growing as industries, particularly in the packaging, logistics, and food sectors, seek more efficient and cost‑effective packaging solutions. These large, heavy-duty containers provide a versatile alternative to traditional boxes and plastic bins, offering a higher capacity for storage and transport of bulk materials. The growing need for efficient, reliable packaging in industries dealing with high-volume goods is driving the increasing adoption of corrugated octabins.

One of the key drivers of demand is the rise in e‑commerce and online retail. With an increasing volume of products being shipped to consumers and businesses, particularly in the consumer electronics, automotive, and food industries, the need for space-efficient and durable containers is critical. Corrugated octabins provide a practical solution for handling large quantities of goods, offering better stackability, strength, and protection during transportation.

The increasing use of corrugated octabins in supply chain operations is driven by their ability to be customized for different applications and products, from bulk powders to delicate electronics. As industries focus on improving logistics efficiency and reducing overall packaging costs, the adoption of corrugated octabins is expected to continue rising steadily, with demand forecast to grow through 2035.

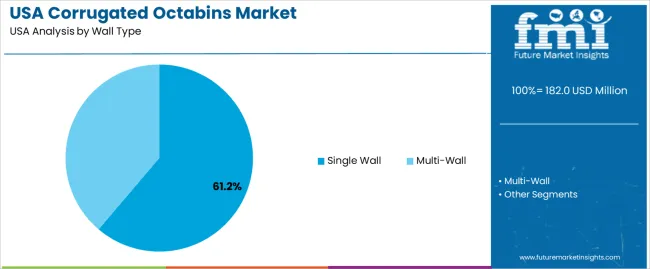

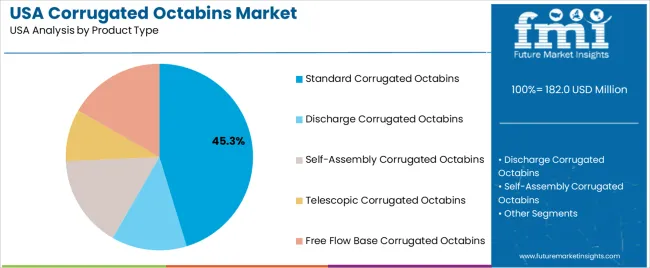

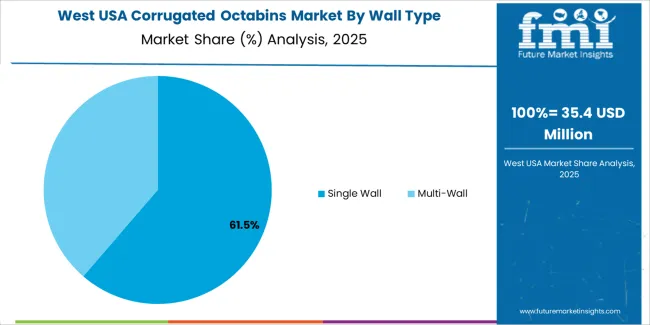

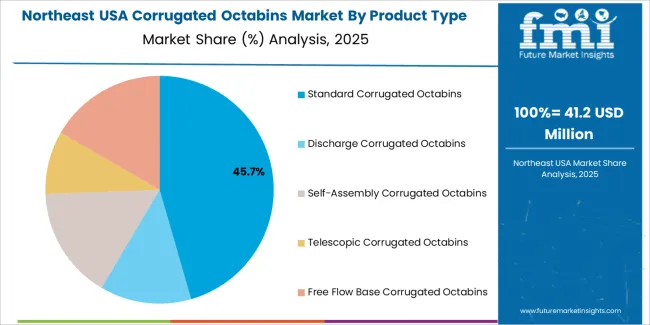

Demand for corrugated octabins in the USA is segmented by wall type, product type, end-use industry, and other key factors. By wall type, the demand is divided into single wall and multi-wall corrugated octabins, with single wall holding the largest share. The product type category includes standard corrugated octabins, discharge corrugated octabins, self-assembly corrugated octabins, telescopic corrugated octabins, and free flow base corrugated octabins, with standard corrugated octabins being the most common. In terms of end-use, the demand is led by the food and beverages industry, followed by sectors like pharmaceuticals, building and construction, and other industries. Regionally, demand is divided into West, South, Northeast, and Midwest.

Single wall corrugated octabins account for 61% of the demand for corrugated octabins in the USA. Single-wall octabins are the preferred choice due to their balance of strength, lightweight nature, and cost-efficiency. They offer sufficient structural integrity for many applications while being lighter and more affordable than multi-wall versions, which makes them particularly attractive for industries focused on maximizing shipping efficiency and cost reduction.

The demand for single wall corrugated octabins is driven by their widespread use in packaging and transportation in sectors like food and beverages, pharmaceuticals, and other industries where durability and efficiency are important but not as critical as for more heavy-duty applications. These octabins are ideal for storing and shipping bulk products and are capable of holding significant weight while maintaining their structural integrity during handling and transit. As businesses continue to focus on reducing packaging costs and improving operational efficiency, the demand for single-wall corrugated octabins will likely remain dominant, with their widespread applicability ensuring continued growth.

Standard corrugated octabins account for 45.3% of the demand for corrugated octabins in the USA. These are the most commonly used type of octabin, offering a simple and effective packaging solution for a wide range of products. Standard octabins are known for their versatility, strength, and ability to hold substantial quantities of bulk goods. They are primarily used in industries like food and beverages, pharmaceuticals, and manufacturing for storing and transporting bulk materials efficiently.

The demand for standard corrugated octabins is driven by their cost-effectiveness and simplicity in design, which meets the needs of many industries for reliable, durable, and easily stackable packaging. Their wide usage across various applications, such as storing ingredients, finished goods, and components, further drives their dominance. As industries continue to prioritize operational efficiency, standard corrugated octabins remain an essential packaging solution, expected to see sustained demand in the future due to their low cost and high versatility in a range of applications.

The food and beverages industry represents 56.4% of the demand for corrugated octabins in the USA. This sector relies heavily on bulk packaging solutions that can securely store and transport ingredients, raw materials, and finished products, ensuring that they remain safe and intact throughout the supply chain. Corrugated octabins are particularly well-suited for this purpose due to their sturdy design and ability to hold large volumes of product while being lightweight and easy to handle.

The demand for corrugated octabins in the food and beverages industry is driven by the need for eco-friendly and cost-effective packaging solutions that can withstand handling, transportation, and storage in various conditions. As consumer preferences shift toward eco-friendly packaging, corrugated options like octabins are increasingly favored because they are recyclable and reusable. With the ongoing expansion of the food and beverage sector, driven by both consumer demand and the need for bulk storage solutions, corrugated octabins will continue to be in high demand, especially for the storage and transportation of bulk ingredients and packaged food items.

Key drivers include the rise of e-commerce, a focus on reducing plastic waste, and the adoption of reusable packaging to reduce overall logistics costs. Corrugated octabins are becoming a preferred choice due to their stackability, ease of collapse when empty, and recyclability. Growing environmental concerns and regulatory pressures on packaging materials are boosting demand for paper-based alternatives. High upfront costs compared to traditional wooden or plastic crates, along with challenges in handling extremely heavy or wet products, may limit adoption in certain industries.

Why is Demand for Corrugated Octabins Growing in USA?

In the USA, demand for corrugated octabins is growing due to increased focus on supply chain optimization and durability. Industries in need of bulk packaging solutions, such as agriculture, chemicals, and food & beverages, are moving toward eco-friendly alternatives to plastic and metal containers. E-commerce growth is also driving the need for flexible and space-saving packaging, with octabins offering the advantage of being collapsible when empty, saving on storage space. As businesses face rising pressure to meet durability targets and reduce packaging waste, corrugated octabins provide a recyclable and efficient solution. The shift towards reusable and returnable packaging is contributing to the growth of this industry, especially in logistics-heavy sectors.

How are Technological and Product Innovations Driving Growth of Corrugated Octabins in USA?

Technological innovations are accelerating the adoption of corrugated octabins in the USA. Manufacturers are incorporating advanced materials and designs, such as moisture-resistant coatings, to ensure the containers perform well in various environments, including food and chemical packaging. Furthermore, improvements in the manufacturing process have allowed for better stacking strength, ease of assembly, and increased durability. Custom features like integrated pallet bases, handles, and RFID tags for inventory tracking are adding value, making octabins even more versatile and attractive to industries that rely on high-efficiency logistics. Innovations in the production process have made octabins more affordable and easier to integrate into automated supply chains, increasing their appeal to larger companies in the USA

What are the Key Challenges Limiting Adoption of Corrugated Octabins in USA?

A significant barrier is the higher cost of production compared to traditional wood or plastic containers, which may deter smaller companies or those with tight budgets from switching. Another issue is the potential durability limitations for some applications, especially those involving extremely heavy loads or exposure to wet environments. Corrugated octabins may not always provide the same level of protection as plastic or metal alternatives for sensitive or perishable goods. Finally, while these containers are highly recyclable, the infrastructure for collecting and processing large volumes of recycled octabins may not be as established as for other materials, which can impact the durability benefits they offer.

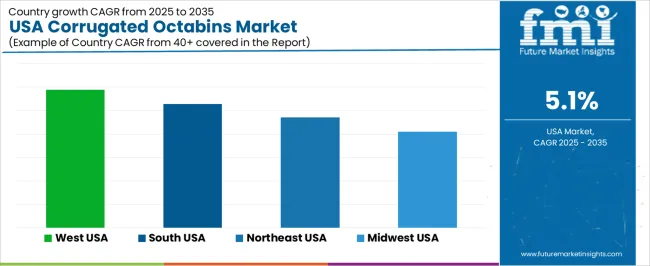

| Region | CAGR (%) |

|---|---|

| West | 5.9% |

| South | 5.3% |

| Northeast | 4.7% |

| Midwest | 4.1% |

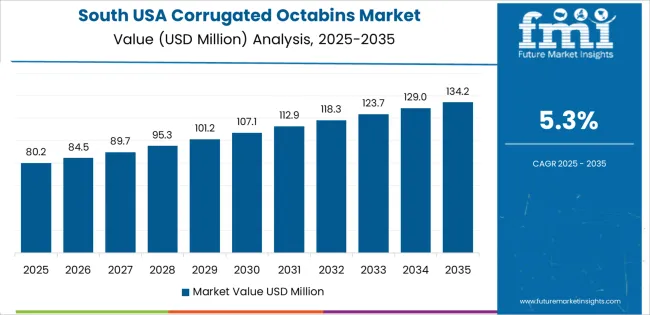

The demand for corrugated octabins in the USA is rising in all regions, led by the West at a 5.9% CAGR. Growth is driven by increasing use in bulk packaging, especially in industries like food ingredients, chemicals, and agriculture, where cost‑efficient yet robust packaging is required. The South follows at 5.3%, supported by expanding production and logistics facilities. The Northeast shows a 4.7% CAGR, influenced by strong manufacturing and distribution networks. The Midwest grows at 4.1%, driven by its industrial base adapting to efficient packaging and packaging‑waste reduction trends.

The West is experiencing the highest demand for corrugated octabins in the USA, with a 5.9% CAGR. This is due to the region's large agricultural and food‑processing sectors, where bulk packaging is essential for handling ingredients and agricultural produce. States like California, Oregon, and Washington are key players in these industries, creating strong demand for cost‑efficient, durable packaging solutions. Corrugated octabins are increasingly favored for their favorable cost‑to‑strength ratio, which is ideal for industries requiring bulk storage and transit.

The West’s emphasis on efficient logistics, particularly around major ports like Los Angeles and Seattle, is contributing to the rise in octabin adoption. The region’s growing export and manufacturing activities require packaging solutions that reduce idle space, enhance handling efficiency, and streamline storage processes. With rising volumes to ship and store, businesses are opting for octabins due to their stackability, reusability, and ability to withstand the rigors of long‑distance transport.

The South is seeing solid growth in demand for corrugated octabins, with a 5.3% CAGR. The region's expanding manufacturing, agriculture, and chemical processing sectors—particularly in states like Texas, Florida, and Georgia—are key drivers behind this trend. These industries require efficient, cost-effective packaging solutions for transporting large volumes of products, and corrugated octabins provide a practical solution. Their ability to handle bulk goods while remaining cost-efficient makes them a preferred choice.

The South's growing logistics infrastructure and warehouse expansion are supporting increased adoption of octabins. With a large number of distribution centers in the region, companies are looking for packaging that maximizes storage space, reduces transportation costs, and improves handling efficiency. Octabins fit these requirements perfectly. As regional industries continue to grow and modernize, the need for durable, stackable, and reusable packaging solutions like corrugated octabins will only rise, making the South one of the key regions for this product's growth.

The Northeast is experiencing steady growth in demand for corrugated octabins, with a 4.7% CAGR. The region’s strong industrial and manufacturing sectors, particularly around major hubs like New York, Boston, and Philadelphia, drive this demand. Industries such as food processing, pharmaceuticals, and chemicals rely heavily on efficient bulk packaging, making corrugated octabins an ideal solution for handling large quantities of goods while ensuring they are transported and stored safely.

The Northeast’s focus on packaging optimization and waste reduction is boosting the use of recyclable, space-efficient solutions like corrugated octabins. As businesses in the region look to maximize storage density and reduce operational costs, the preference for octabins increases. The region’s combination of manufacturing growth and increasing demand for eco-friendly packaging alternatives is ensuring that demand for corrugated octabins will continue to grow. As industries adapt to more efficient packaging solutions, the Northeast will maintain steady demand for these durable, reusable containers.

The Midwest is experiencing moderate growth in demand for corrugated octabins, with a 4.1% CAGR. This growth is largely driven by the region's robust manufacturing base, particularly in cities like Chicago, Detroit, and Indianapolis. As industries in the Midwest look to streamline their operations and improve efficiency, the use of bulk packaging solutions like corrugated octabins is becoming more widespread. Octabins are particularly useful for storing and transporting raw materials, parts, and finished goods in a variety of sectors, including automotive, food processing, and chemicals.

While growth in the Midwest is slower compared to other regions, the increasing focus on cost‑effective packaging solutions and reducing waste is driving the adoption of corrugated octabins. The demand for space-efficient, stackable containers that help businesses maximize storage capacity and reduce logistics costs is rising. As the region continues to modernize its supply chains and adopt more efficient packaging practices, the demand for corrugated octabins will continue to grow, supporting steady progress in the industry.

The demand for corrugated octabins in the USA is increasing steadily, driven by the need for efficient, eco-friendly bulk packaging solutions. Industries such as food & beverage, chemicals, and e‑commerce are adopting octabins for their ability to handle high volume, bulky goods with reliable protection while offering recyclability and space efficiency. As USA manufacturers and logistics operators focus on optimising storage, transport, and durability, these octagonal corrugated containers are becoming more widely used.

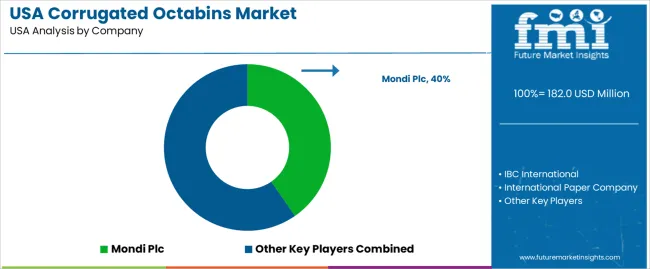

In the USA demand landscape, Mondi Plc holds an estimated share of 40.4%, demonstrating its significant role in supplying corrugated octabin solutions to American supply chains. Other major contributors in the industry include IBC International, International Paper Company, Smurfit Kappa, Rondo Ganahl AG, and DS Smith, each of which supplies bulk‑packaging formats and supports the shift toward more eco-friendly container formats.

Key drivers of USA demand include the push for circular‑economy packaging (where recyclability and reduced material use matter), the growth of bulk logistics and large‑format shipping (where octabins reduce handling cost and warehouse footprint), and growing regulatory and consumer pressure to adopt environmentally favourable materials. While challenges such as competition from plastic or metal bulk containers, cost pressures, and the requirement for moisture or heavy‑duty handling capacity remain, the outlook for corrugated octabin demand in the USA is favourable, underpinned by structural shifts in bulk packaging and durability.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Wall Type | Single Wall, Multi-Wall |

| Product Type | Standard Corrugated Octabins, Discharge Corrugated Octabins, Self-Assembly Corrugated Octabins, Telescopic Corrugated Octabins, Free Flow Base Corrugated Octabins |

| End-Use | Food and Beverages Industry, Pharmaceuticals Industry, Building and Construction, Other Industries |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Mondi Plc, IBC International, International Paper Company, Smurfit Kappa, Rondo Ganahl AG, DS Smith |

| Additional Attributes | Dollar sales by wall type, product type, end-use, and regional distribution trends focusing on the food and beverage, pharmaceutical, and construction sectors. The growing preference for more eco-friendly and efficient packaging solutions drives demand in these industries. |

The global demand for corrugated octabins in USA is estimated to be valued at USD 182.0 million in 2025.

The market size for the demand for corrugated octabins in USA is projected to reach USD 299.3 million by 2035.

The demand for corrugated octabins in USA is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in demand for corrugated octabins in USA are single wall and multi-wall.

In terms of product type, standard corrugated octabins segment to command 45.3% share in the demand for corrugated octabins in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Corrugated Octabins Market

Corrugated Octabins Market Trends & Forecast through 2035

Demand for Corrugated Octabins in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA