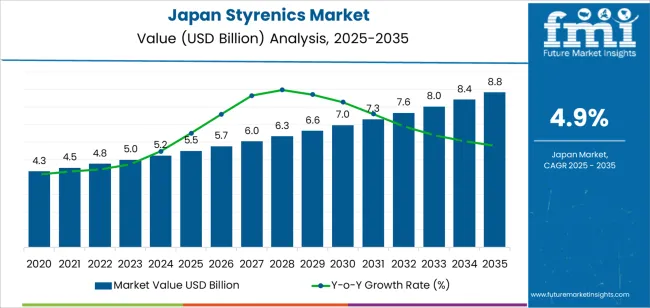

The Japan styrenics demand is valued at USD 5.5 billion in 2025 and is forecasted to reach USD 8.8 billion by 2035, reflecting a CAGR of 4.9%. Demand is influenced by stable utilization across packaging, consumer durables, and automotive components where lightweight properties and formability remain essential. Product selection is driven by processing efficiency, chemical resistance, and compatibility with large-volume fabrication such as injection moulding and thermoforming. Expanded use in rigid containers, household goods, and appliance housings adds continuity in annual consumption. Polystyrene leads polymer adoption. Its transparency, rigidity, and low-cost processing advantage support packaging, electronics, and food storage uses. Engineering styrenics such as ABS and SAN also maintain relevance in automotive interior parts, dashboards, and small appliances due to impact resistance and tailored finishes. Performance requirements for rigidity-weight balance continue to grow as manufacturers prioritise improved ergonomics and durability in finished products.

Packaging and automotive record the strongest application utilisation. Packaging retains priority due to high food distribution standards and demand for protective materials. Automotive requirements continue due to interior component production and interest in lightweight alternatives to metals for improved fuel efficiency. Key suppliers include Asahi Kasei Corporation, Denka Company Limited, PS Japan Corporation, Mitsubishi Chemical Corporation, and Toray Industries, Inc. Their product portfolios include standard polystyrene, high-impact polystyrene, and engineering styrenics supporting long-term use in packaging conversion and vehicle component manufacturing.

Demand for styrenics in Japan reflects a distributed contribution pattern across packaging, automotive, consumer electronics, and construction applications. Packaging holds the largest influence on incremental growth due to consistent usage in containers, food trays, and protective housings. Its steady order volumes ensure a reliable base contribution. Automotive interiors and lightweight components provide secondary support, driven by material substitution for weight reduction and durability. Electronics housings and insulation parts add further volume, although production cycles introduce mild variability in their contribution strength.

Construction and household goods deliver smaller but stable contributions as renovation and living-standard upgrades continue in urban areas. Ecofriendly policies influence contribution shifts as producers adjust toward recyclable or low-emission styrenic grades. This does not remove demand but redirects growth to applications compatible with environmental compliance. The resulting Growth Contribution Index illustrates a balanced structure where no single application dominates expansion. Instead, packaged-goods usage anchors resilience, while industrial sectors provide incremental lift tied to equipment manufacturing and consumer-technology renewal cycles.

| Metric | Value |

|---|---|

| Japan Styrenics Sales Value (2025) | USD 5.5 billion |

| Japan Styrenics Forecast Value (2035) | USD 8.8 billion |

| Japan Styrenics Forecast CAGR (2025-2035) | 4.9% |

Demand for styrenics in Japan is increasing because industries such as automotive, electronics, packaging and construction require lightweight polymer materials with reliable processing performance. Polystyrene and ABS support high dimensional stability and ease of moulding, which suits Japan’s precision engineering and compact product designs. Automotive manufacturers use styrenics for interior components, panels and trim parts as part of material-reduction strategies that improve fuel efficiency. Electronics producers rely on styrenics for housings and structural parts in devices including appliances, office equipment and consumer electronics manufactured in Japan.

Packaging companies use styrenics for food containers, trays and protective cushioning due to strength and clarity requirements across supermarket and convenience store channels. Growth in healthcare and diagnostic devices also reinforces demand for styrenic materials that maintain hygiene standards and allow accurate part fabrication. Constraints include environmental pressure to reduce single use plastics, competition from polypropylene and engineering resins in high-performance applications and fluctuations in styrene monomer pricing that influence procurement decisions. Recycling infrastructure for specific styrenic grades is still developing, which affects adoption in applications with strict green targets.

Demand for styrenic polymers in Japan is influenced by packaging circulation, mobility component production, and electrical equipment supply chains. Procurement decisions center on rigidity, impact strength, and chemical resistance that support durable molded components. Domestic users adopt styrenics for lightweight parts in consumer electronics and automotive interiors where dimensional accuracy and consistent surface finish are required. Packaging manufacturers prioritize clarity and cost-controlled production using established processing infrastructure.

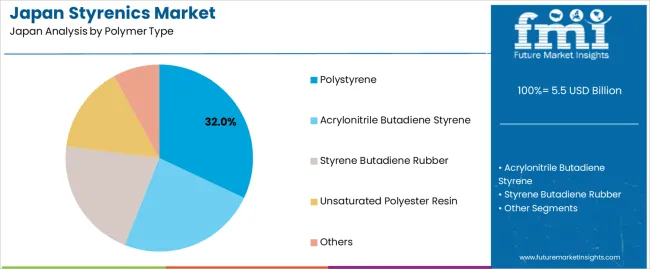

Polystyrene represents 32.0%, supported by widespread use in food packaging, protective containers, and single-use goods requiring stiffness and processed clarity. Acrylonitrile butadiene styrene holds 24.0%, used in automotive instrument panels, home appliances, and electronics housings due to impact strength and surface quality. Styrene butadiene rubber accounts for 21.0%, aligned with tire production and seals requiring elasticity and abrasion resistance. Unsaturated polyester resin represents 15.0%, used in fiberglass composites for construction and industrial components. Others total 8.0%, serving specialized performance needs. Selection reflects Japan’s reliance on precise molding, dimensional stability, and optimized weight in consumer and mobility applications.

Key points:

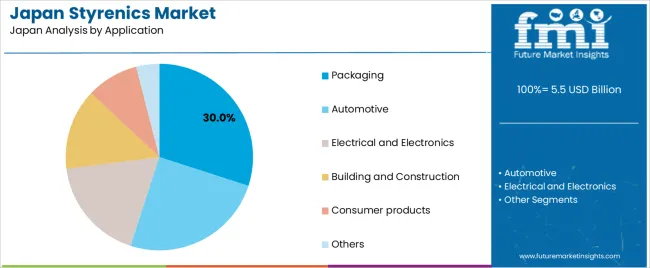

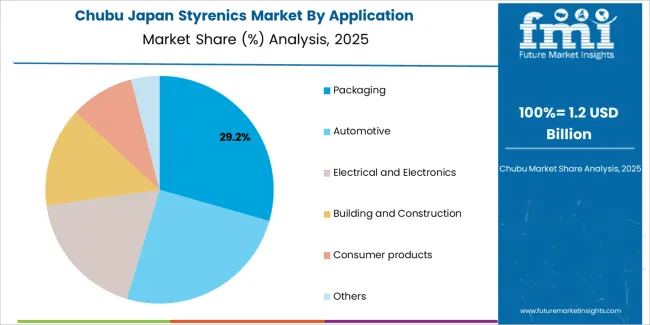

Packaging accounts for 30.0%, driven by food safety requirements and lightweight material handling in Japanese retail. Automotive holds 25.0%, reflecting interior components, trim parts, and engineered assemblies that support vehicle durability objectives. Electrical and electronics represent 18.0%, where styrenics provide dimensional precision and insulation properties. Building and construction represents 14.0%, focused on composite structural panels and molded fittings. Consumer products hold 9.0%, including household goods requiring shape retention and cost efficiency. Others total 4.0%, used in limited industrial applications. Application distribution corresponds with Japan’s focus on advanced manufacturing sectors where high-throughput processing and reliable performance guide resin choice.

Key points:

Automotive light weighting, expansion of electronics component manufacturing and strong demand for food-grade packaging are driving demand.

In Japan, styrenics remain important materials for automotive applications such as interior components, instrument panels and lightweight structural parts produced by suppliers in Aichi, Shizuoka and Hiroshima. Automakers adopt ABS and other styrenic polymers to improve vehicle fuel efficiency and support electric vehicle range goals through weight reduction. Electronics manufacturing hubs in Osaka and Nagano rely on styrenics for housings, connectors and display components due to good moldability and heat performance in consumer devices. Food packaging applications continue to support baseline procurement as major convenience-store chains require disposable containers and trays compatible with high-frequency ready-meal consumption, reinforcing strong material flow in packaging supply networks.

Pressure to reduce single-use plastics, competition from engineering polymers and volatility in feedstock costs restrain adoption.

Japan’s policies encouraging plastic reduction influence packaging design decisions, leading some food and beverage suppliers to shift toward paper-forward containers or recyclable polyolefin alternatives. Engineering polymers such as polycarbonate and POM replace styrenics in higher-performance electronic and automotive applications where durability and heat stability are prioritized. Dependence on imported raw materials exposes domestic producers to feedstock price swings, compelling manufacturers to manage cost pressures through cautious procurement. These sustainability and economic dynamics contribute to slower uptake in specific category transitions.

Shift toward heat-resistant ABS grades, increased use in appliance miniaturization and rising development of recyclable styrenic blends define key trends.

Manufacturers are introducing higher heat-resistant styrenic formulations to support components used in home appliances and compact electronics that require stable performance under continuous operation. Miniaturization of consumer devices drives demand for styrenics compatible with thin-wall injection molding to reduce material usage without sacrificing component strength. Recycling-focused R&D efforts are increasing interest in monomaterial packaging structures and improved sorting technologies to support circular usage of styrenic materials, particularly in food-contact applications. Industrial clusters are also exploring styrenics tailored for smaller EV parts and battery peripheral components, supporting alignment with Japan’s evolving mobility sector. These trends suggest a steady but selective role for styrenics within Japan’s manufacturing and packaging landscapes.

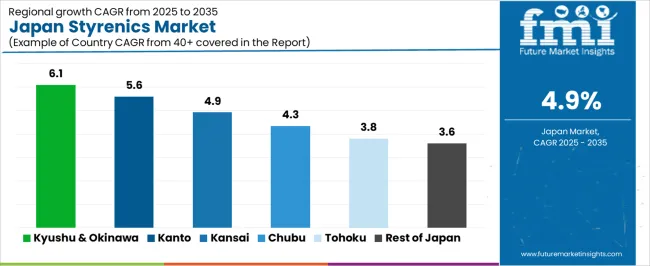

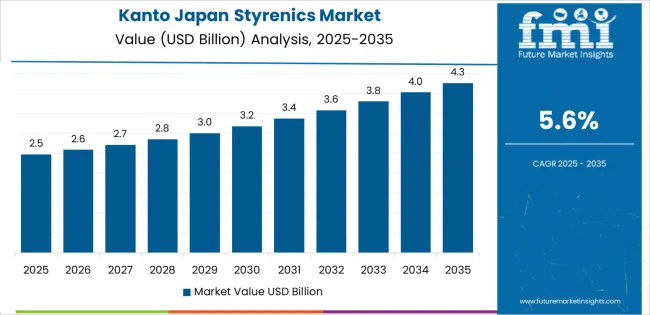

Demand for styrenics in Japan reflects usage in packaging, consumer electronics housings, automotive interior parts, insulation materials, and durable consumer goods requiring lightweight strength. Procurement focuses on resin molding stability, impact resistance, and compatibility with established extrusion and injection systems. Circular material initiatives influence interest in recycled styrenics, particularly in packaging. Kyushu & Okinawa leads at 6.1% CAGR, followed by Kanto (5.6%), Kinki (4.9%), Chubu (4.3%), Tohoku (3.8%), and Rest of Japan (3.6%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.1% |

| Kanto | 5.6% |

| Kinki | 4.9% |

| Chubu | 4.3% |

| Tohoku | 3.8% |

| Rest of Japan | 3.6% |

Kyushu & Okinawa posts 6.1% CAGR, supported by consumer electronics distribution and packaging usage linked to active retail sectors. Electronics housings favor polystyrene and ABS materials to maintain structural consistency and precise detailing through repeated handling. Retail packaging uses styrenic films and trays for food and small consumer products that require dimensional stability in humid climates. Ports support resin logistics for molding operations located near population centers. Procurement teams evaluate impact behavior and stress-crack resistance, especially where temperature variance occurs during warehouse storage. Gradual sustainability measures encourage lighter molding designs to reduce material intensity while preserving rigidity. Demand remains stable across seasonal retail cycles where packaged goods and electronic accessories maintain turnover.

Kanto records 5.6% CAGR, driven by Tokyo-area packaging converters and consumer-good manufacturers requiring styrenics for protective housings and transparent display applications. Electronics brands prioritize ABS blends for durable casings used in home appliances and smart devices. Convenience retail networks distribute food packaged in styrenic formats designed to preserve appearance in high-traffic environments. Pharmaceutical and cosmetic packaging relies on surface-finish stability to support label adhesion and clean shelf presentation. Waste-sorting infrastructure supports recovery of specific styrenics grades where material identification is reliable. Resin buyers focus on molding precision for automated assembly systems operating at high throughput in major industrial hubs.

Kinki expands at 4.9% CAGR, supported by consumer-goods manufacturing and appliance assembly near Osaka. Styrenics provide lightweight housing options for everyday devices and storage items distributed across Japan. Retail packaging for bakery and ready-to-eat foods uses styrenic trays with defined shape control. Regional processors adopt incremental changes in resin composition to enhance performance without new equipment installation. Procurement teams review stiffness-to-weight ratios and resistance to marking during shelf handling. Household product producers maintain demand for ABS, where durability and form retention support long product lifecycles.

Chubu posts 4.3% CAGR, shaped by automotive supply operations and industrial packaging requirements across Aichi and surrounding prefectures. Automotive interior parts utilize ABS for dimensional stability under vibration exposure. Durable packaging solutions support machinery components and goods moving through the manufacturing network. Resin selection prioritizes processing repeatability to minimize scrap rates in continuous production. Buyers evaluate weathering tolerance for components that face varied temperature during distribution.

Tohoku reaches 3.8% CAGR, reflecting demand for consumer packaging and everyday electronics that travel through long-distribution routes. Regional manufacturing favors styrenics with predictable molding behavior at moderate production scales. Retailers adopt rigid trays and cases that sustain shape through extended logistics. Cold climate regions require materials with impact resilience during low-temperature handling. Procurement choices align with material availability through regional distributors offering standardized grades.

Rest of Japan advances at 3.6% CAGR, driven by moderate packaging and electronics accessory uses in distributed retail channels. Procurement stability and molding ease outweigh rapid resin innovations. Buyers favor established material specifications that align with small-scale production and predictable inventory replenishment. Local recycling participation shapes interest in simplified styrenic formats.

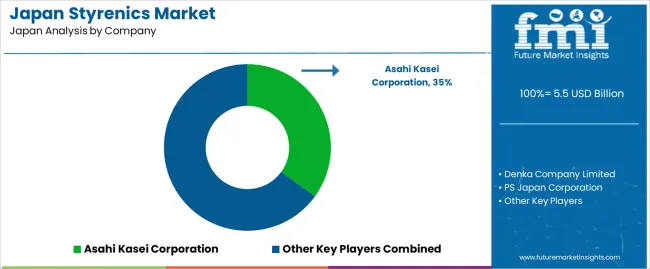

Demand for styrenics in Japan is driven by polymer producers supplying ABS, polystyrene, and high-performance styrenic blends used in domestic manufacturing. Asahi Kasei Corporation holds an estimated 35.0% share, supported by controlled resin-modification capability and stable strength-to-processability performance required in Japanese automotive and electronics production. Its materials offer dependable dimensional stability and consistent surface finish on high-precision molded parts. Denka Company Limited maintains strong participation through polystyrene and EPS grades that provide predictable thermal properties and processing consistency in packaging and insulation. PS Japan Corporation contributes focused supply of general-purpose and high-impact polystyrene with controlled flow characteristics valued in appliance molding.

Mitsubishi Chemical Corporation supports demand in specialty styrenics with reliable weatherability and chemical-resistance properties suited to industrial components. Toray Industries, Inc. adds engineered blends for applications where strength retention and heat resistance must be maintained through repeated use. Competition in Japan centers on resin purity, mechanical-performance stability, forming consistency, supply certainty, and recyclability alignment. Demand continues where lightweight, moldable polymers support domestic production efficiency in consumer-goods, mobility, and construction applications across Japan’s industrial base.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Polymer Type | Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Unsaturated Polyester Resin, Others |

| Application | Packaging, Automotive, Electrical and Electronics, Building and Construction, Consumer Products, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Asahi Kasei Corporation, Denka Company Limited, PS Japan Corporation, Mitsubishi Chemical Corporation, Toray Industries, Inc. |

| Additional Attributes | Dollar sales by polymer class and application; demand influenced by automotive lightweighting and electronics miniaturization; recycling initiatives impacting polystyrene adoption; regional concentration driven by industrial hubs in Kanto and Chubu; supply chain involving petrochemical infrastructure and styrene monomer derivatives across Japan. |

The demand for styrenics in Japan is estimated to be valued at USD 5.5 billion in 2025.

The market size for the styrenics in Japan is projected to reach USD 8.8 billion by 2035.

The demand for styrenics in Japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in styrenics in Japan are polystyrene, acrylonitrile butadiene styrene, styrene butadiene rubber, unsaturated polyester resin and others.

In terms of application, packaging segment is expected to command 30.0% share in the styrenics in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA