The demand for USB Type C in Japan is projected to reach USD 5.2 billion by 2035, reflecting an absolute increase of USD 3.5 billion over the forecast period. Starting at USD 1.7 billion in 2025, the demand is expected to grow at a robust CAGR of 11.6%. USB Type C has become the universal standard for charging, data transfer, and video output across a range of devices, including smartphones, laptops, tablets, and other consumer electronics. Its reversible design, higher data transfer speeds, and ability to handle both power and data through a single cable have significantly boosted its adoption.

The increasing number of electronic devices requiring USB Type C ports, coupled with regulatory efforts promoting universal standards, will drive continued demand for these connectors. The widespread adoption of USB Type C is further fueled by its use in high-performance devices such as gaming consoles, laptops, and smartphones. The trend toward streamlining charging technologies and reducing the number of cables required for multiple devices is expected to sustain demand for USB Type C, further cementing its role as the go-to connector for modern consumer electronics.

Technological advancements in USB Type C, including the development of faster data transfer rates, enhanced power delivery capabilities, and improved compatibility with other device interfaces, will continue to boost the industry over the next decade. The industry will also benefit from growing investments in the electronics sector and Japan’s focus on innovation in the tech space.

Between 2025 and 2030, the demand for USB Type C in Japan is expected to grow from USD 1.7 billion to USD 1.9 billion, adding USD 0.2 billion. This period accounts for about 5.7% of the total forecasted growth for the decade. During this phase, growth will be steady, driven primarily by the continued transition of consumer electronics, especially smartphones, laptops, and tablets, to the USB Type C standard. As more manufacturers integrate USB Type C into their devices, the technology will continue to expand its presence in personal electronics, making it the dominant charging and data transfer interface. However, the early years will see more gradual adoption, as the full integration of USB Type C across all device types and industries takes time.

From 2030 to 2035, the demand for USB Type C will experience a more substantial acceleration, growing from USD 1.9 billion to USD 5.2 billion, adding USD 3.3 billion. This phase accounts for about 94.3% of the total growth. The sharp increase during this period reflects the widespread adoption of USB Type C across a variety of sectors, including automotive, IoT, 5G infrastructure, and electric vehicles (EVs), as well as the continued integration into smartphones, laptops, and gaming consoles. The rapid pace of technological advancements will significantly boost the adoption of USB Type C during these years, with the demand for faster data transfer rates and higher power delivery driving greater investment in USB Type C solutions.

| Metric | Value |

|---|---|

| Japan USB Type C Sales Value (2025) | USD 1.7 billion |

| Japan USB Type C Forecast Value (2035) | USD 5.2 billion |

| Japan USB Type C Forecast CAGR (2025 2035) | 11.6% |

The demand for USB Type C in Japan is rising as device manufacturers and consumers shift toward a universal connector standard that supports faster data, higher power delivery, and greater convenience. USB Type C offers reversible plug orientation, higher current capacity, and compatibility across smartphones, laptops, tablets, and accessories. This universality reduces cable clutter and improves user experience, making it a preferred choice in modern consumer electronics.

In Japan’s advanced electronics industry, strong demand for compact and high‑performance devices is pushing adoption. With the proliferation of ultra‑thin laptops, gaming consoles, portable monitors, and autonomous vehicle accessory systems, USB Type C is becoming the standard interface. Rapid replacement cycles and the push for multi‑functional charging/data ports further encourage manufacturers to adopt USB Type C across new products and models.

Regulatory and industry forces are also influencing this growth. International movements toward standardized charging ports and Japanese device makers aligning with global trends accelerate the transition. As consumers demand compatibility and faster performance, USB Type C is increasingly seen as a must‑have feature rather than an optional upgrade. Industry focus on higher power delivery (PD) capability, alt‑mode video output, and thinner device profiles ensures USB Type C will continue to expand in Japan’s electronics sector through 2035.

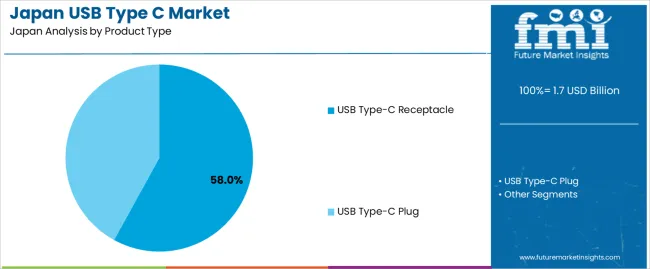

Demand is segmented by product type, standard, and industry. By product type, demand is divided into USB Type C receptacle and USB Type C plug. In terms of standard, the industry is categorized into USB 3.2, USB 2.0, USB 3.0, USB 3.1, and others. The industry is also segmented by industry, including consumer electronics, automotive, media & entertainment, telecom & tech, and healthcare. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

USB Type C receptacle accounts for 58% of the demand for USB Type C in Japan. Receptacles are the most common components in devices, allowing users to connect USB Type C plugs for charging, data transfer, and other functionalities. The growing use of USB Type C in consumer electronics, automotive, and other industries drives the demand for receptacles, as they provide the essential connection points for a wide range of devices.

The preference for USB Type C receptacles is also due to the universal nature of USB Type-C, which supports faster data transfer speeds, higher power delivery, and reversible plug orientation. These features make it ideal for smartphones, laptops, gaming consoles, and various other devices. As more devices adopt USB Type C as the standard connector, the demand for USB Type C receptacles continues to rise, particularly in consumer electronics and tech sectors, where seamless, high-performance connectivity is crucial.

USB 3.2 accounts for 40% of the demand for USB Type C in Japan. This standard is favored due to its superior data transfer speed, supporting rates up to 20Gbps, which is essential for applications requiring high-bandwidth, such as video editing, gaming, and large file transfers. The ability to transfer large amounts of data quickly makes USB 3.2 the preferred choice for high-performance devices like laptops, external drives, and gaming peripherals.

The growing demand for faster, more efficient data transfer solutions in industries such as media & entertainment, telecom & tech, and consumer electronics has significantly contributed to the adoption of USB 3.2. As these industries require high-speed connectivity for increasingly sophisticated devices, USB 3.2 offers the ideal solution, driving its dominance in the industry. With advancements in technology and the expansion of data-heavy applications, USB 3.2 will continue to be a key player in the USB Type C segment.

The consumer electronics industry represents 43% of the demand for USB Type C in Japan. USB Type C is widely adopted in smartphones, laptops, tablets, gaming consoles, and other electronic devices due to its versatility, fast data transfer rates, and ability to deliver high power for charging. As consumers demand more efficient and faster charging and data solutions, USB Type C has become the standard connector in the consumer electronics sector.

The increasing trend of devices with thinner profiles, higher power needs, and greater data throughput requirements further drives the adoption of USB Type-C. The rise of smart home devices, wearables, and personal electronics, all of which require seamless connectivity, fuels the ongoing demand for USB Type-C. With technological advancements and increasing demand for faster, more efficient, and reversible connectors, the consumer electronics industry remains the dominant driver of USB Type C adoption in Japan.

Demand for USB Type C in Japan is accelerating as consumer‑electronics makers, industrial equipment manufacturers and automotive players converge on it as the standard for power and data connectivity. These connectors/cables support faster charging, higher data throughput, reversible plug orientation and compatibility across devices—qualities valued in a quality‑conscious Japanese industry. Key drivers include the upgrade cycle for smartphones/laptops, growth in USB‑C‑only devices, expansion of high‑power charging (e.g., 100 W+), and inclusion of USB‑C in automotive infotainment/EV systems. Major restraints are supply‑chain pressure for premium cable materials, fragmentation of legacy ports (USB‑A, proprietary), and cost sensitivity in accessories amid abundant lower‑price options.

Why is Demand for USB Type C Growing in Japan?

In Japan, demand is growing because device manufacturers and accessory brands are rapidly shifting to USB Type C to meet consumer expectations for universal, high‑performance connectivity. Japanese consumers demand compact, high‑quality electronics; USB‑C enables slimmer device profiles and supports modern functionalities like fast charging, video output and high‑speed data. Moreover, Japan’s automotive electronics segment is embracing USB‑C for in‑car power/data and EV charging ecosystems. This push across consumer electronics, automotive and industrial sectors is pushing overall demand for USB‑C cables and connectors upward as manufacturers and consumers alike upgrade.

How are Technological Innovations Driving Growth in Japan?

Technological innovations are fuelling the growth of USB Type C in Japan by enhancing performance, durability and versatility. New cables/connector systems support high‑wattage charging (e.g., 100 W+), reversible plug design, alternate modes (DisplayPort/Thunderbolt over USB‑C) and braided, ruggedized cable finishes for premium buyers. In Japan, where form‑factor and quality matter, these premium offerings appeal strongly. Integration of smart chips in cables for safety, negotiation of power‑delivery and enhanced data‑transfer rates are elevating USB‑C as a standard rather than an optional port. These innovations help drive replacement of legacy cables/ports and broaden USB‑C adoption in new device categories.

What are the Key Challenges Limiting Adoption in Japan?

First, legacy‑port inertia: many installed base devices still use USB‑A, Micro‑USB or proprietary connectors, requiring users and manufacturers to maintain multiple cable types. Second, cost and margin pressure: premium USB‑C cables or accessories with higher performance costs more, which may reduce uptake in price‑sensitive segments. Third, quality and counterfeit issues: sub‑standard cables can fail or damage devices, which could undermine consumer confidence. Lastly, fragmentation of standards and certification (USB PD power profiles, alternate modes) imposes complexity for manufacturers and consumers choosing compatible solutions. These barriers slow universal penetration despite broad demand.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 14.4% |

| Kanto | 13.3% |

| Kinki | 11.7% |

| Chubu | 10.3% |

| Tohoku | 9.0% |

| Rest of Japan | 8.5% |

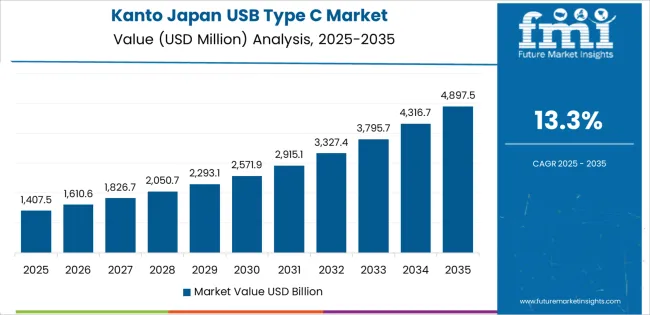

The demand for USB Type C in Japan is growing across all regions, with Kyushu & Okinawa leading at a 14.4% CAGR. This is driven by increasing adoption of USB Type C for mobile devices, laptops, and other consumer electronics. Kanto follows with a 13.3% CAGR, supported by Tokyo’s position as a hub for electronics and technology. Kinki shows an 11.7% CAGR, driven by its technological innovation in consumer electronics. Chubu, with a 10.3% CAGR, experiences growing demand due to its industrial sector. Tohoku and the Rest of Japan have moderate growth rates at 9.0% and 8.5%, respectively, as USB Type C continues to gain popularity across various sectors.

Kyushu & Okinawa is leading in demand growth for USB Type C in Japan, with a 14.4% CAGR. The region’s rapid adoption of advanced technologies and growing consumer electronics industry are key drivers. Kyushu’s cities, including Fukuoka, are emerging as significant hubs for tech companies, contributing to increased demand for modern connectivity solutions like USB Type C. This is supported by rising consumer interest in versatile, fast-charging, and high-speed data transfer solutions offered by USB Type C.

Okinawa is also benefiting from infrastructure improvements and an expanding electronics sector. As more consumers and industries in the region embrace USB Type C for mobile devices, laptops, and accessories, the demand for these cables and connectors is expected to continue growing. With Kyushu & Okinawa’s strong push toward modernizing their tech infrastructure and rising consumer electronics usage, the demand for USB Type C remains robust in this region.

Kanto is experiencing strong demand growth for USB Type C, with a 13.3% CAGR. The region, particularly Tokyo, remains at the forefront of technological advancements and adoption of next-generation connectivity solutions. As Japan's largest tech hub, Kanto drives the demand for USB Type C, particularly in mobile devices, computers, and accessories. The region's strong consumer electronics industry and focus on high-performance devices, such as laptops and smartphones, further contribute to the rising popularity of USB Type C.

The widespread use of USB Type C in various consumer and commercial devices, along with increased interest in universal compatibility for charging and data transfer, fuels demand. As Kanto continues to be a key player in Japan’s tech landscape, the adoption of USB Type C technology is expected to keep growing, supported by both consumer demand and the increasing emphasis on next-generation devices and connectivity standards.

Kinki is seeing steady growth in demand for USB Type C, with an 11.7% CAGR. The region, including Osaka and Kyoto, is a key center for electronics manufacturing and innovation. As the demand for high-speed data transfer and efficient charging systems rises, USB Type C has become a standard for many consumer electronics. The strong presence of tech companies and manufacturing industries in Kinki is contributing to the growing adoption of USB Type C in mobile devices, laptops, and various accessories.

Kinki’s established infrastructure for electronics production, combined with increasing consumer interest in versatile and efficient connectivity options, ensures a steady rise in demand for USB Type C. With Kinki’s significant role in Japan’s electronics industry, the region will continue to be a major adopter of this advanced technology as more devices shift toward USB Type C for universal compatibility and enhanced performance.

Chubu is experiencing steady growth in demand for USB Type C, with a 10.3% CAGR. The region’s industrial base, particularly in cities like Nagoya, is seeing increasing adoption of USB Type C in both consumer and industrial electronics. As the demand for faster data transfer and universal connectivity grows, Chubu’s manufacturing sector is integrating USB Type C into their products, particularly in high-performance computing and telecommunications.

The adoption of USB Type C is being driven by the rising need for versatile, fast-charging solutions and better connectivity standards in various sectors, from automotive to consumer electronics. As more companies in Chubu adopt next-generation technology and embrace the benefits of USB Type C, the demand for these devices will continue to rise, supporting the region’s steady growth.

Tohoku is experiencing moderate demand growth for USB Type C, with a 9.0% CAGR. The region’s growth is driven by increasing consumer and business adoption of advanced electronic devices. As Tohoku continues to modernize its infrastructure and boost technological adoption, more consumers and industries are turning to USB Type C for faster charging and data transfer solutions. The demand is particularly strong in consumer electronics, including smartphones and laptops, as Tohoku’s population increasingly embraces modern technology.

The region’s ongoing focus on improving its tech ecosystem and the national push toward widespread USB Type C adoption in Japan are also contributing to steady growth. As the industry for versatile connectivity solutions continues to expand, the demand for USB Type C in Tohoku will keep rising, supported by its growing consumer electronics sector.

The Rest of Japan is seeing steady growth in demand for USB Type C, with an 8.5% CAGR. This growth is driven by the adoption of USB Type C in rural areas and smaller cities, as businesses and consumers increasingly seek universal connectivity solutions. As more industries shift toward USB Type C for faster charging, data transfer, and device compatibility, the Rest of Japan is experiencing gradual yet consistent demand.

Although the growth rate is slower compared to more industrialized regions like Kanto or Kyushu & Okinawa, the adoption of USB Type C is steadily increasing across various sectors, including consumer electronics, automotive, and telecommunications. As infrastructure and technology adoption improve across these areas, demand for USB Type C will continue to rise, contributing to ongoing industry growth

The demand for USB Type‑C connectivity solutions in Japan is advancing rapidly, driven by the country’s mature electronics manufacturing sector, robust consumer electronics industry, and increasing adoption in automotive and industrial applications. Japanese manufacturers and users are prioritizing devices and components that support faster data transfer, higher power delivery and standardized connectivity factors that position USB Type‑C as a preferred interface for high‑performance devices, consumer gear and emerging smart‑hardware systems.

Within the Japanese landscape, STMicroelectronics NV commands a leading share around 25.0% highlighting its strength in USB Type‑C controllers, power‑delivery chips and interface solutions designed for Japan’s exacting quality and performance standards. Other significant players contributing to Japanese demand include Texas Instruments, Inc., NXP Semiconductors, Infineon Technologies AG, and Analog Devices, Inc., each delivering semiconductor and interface solutions that support USB Type‑C adoption across smartphones, computing devices, automotive electronics and accessories.

Key drivers of this demand include Japan’s strong focus on connectivity and miniaturization in consumer electronics, the integration of USB Type‑C in automotive infotainment and EV charging systems, and the push toward universal, reversible connectors that simplify device ecosystems. While challenges such as component cost pressures and the need for design adaptation remain, the demand outlook for USB Type‑C in Japan is highly positive anchored by ongoing transitions in device design, premium performance requirements and the broader shift toward standardized connectivity.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | USB Type-C Receptacle, USB Type-C Plug |

| Standard | USB 3.2, USB 2.0, USB 3.0, USB 3.1, Others |

| Industry | Consumer Electronics, Automotive, Media & Entertainment, Telecom & Tech, Healthcare |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | STMicroelectronics NV, Texas Instruments, Inc., NXP Semiconductors, Infineon Technologies AG, Analog Devices, Inc. |

| Additional Attributes | Dollar sales by product type, standard, industry, and regional trends with a focus on consumer electronics, automotive, and healthcare sectors |

The global demand for USB type C in japan is estimated to be valued at USD 1.7 billion in 2025.

The market size for the demand for USB type C in japan is projected to reach USD 5.2 billion by 2035.

The demand for USB type C in japan is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in demand for USB type C in japan are USB type-c receptacle and USB type-c plug.

In terms of standard, USB 3.2 segment to command 40.0% share in the demand for USB type C in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USB Type C Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of the USB Type-C Industry

Busbar for Industrial Market Size and Share Forecast Outlook 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Demand for USB Type C in USA Size and Share Forecast Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Type 1 Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA