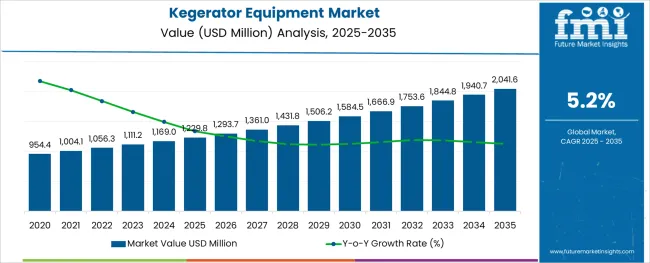

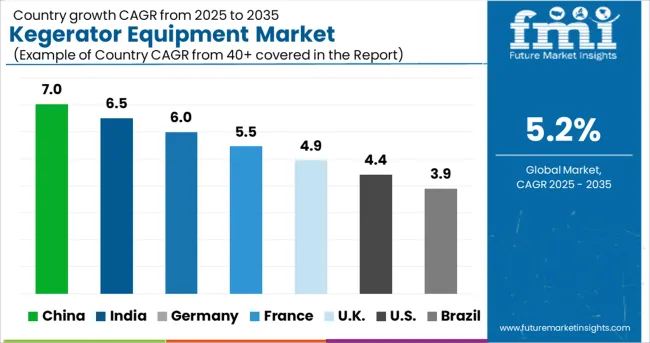

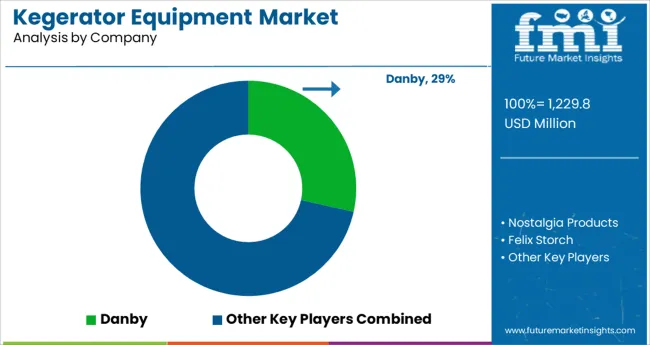

The Kegerator Equipment Market is estimated to be valued at USD 1229.8 million in 2025 and is projected to reach USD 2041.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The kegerator equipment market is witnessing notable growth driven by increasing consumer preference for draft beer experiences at home and in hospitality settings. Rising disposable incomes, growing beer culture, and a shift toward personalized beverage solutions have been influencing adoption across both residential and commercial segments.

Manufacturers have been innovating in design and functionality to cater to diverse consumer demands while aligning with energy efficiency and compact form factor trends. Future market expansion is expected to be supported by the proliferation of craft breweries, heightened interest in home brewing, and the integration of smart features for temperature and pressure management.

Consumer expectations for convenience, freshness, and premium drinking experiences have been paving the path for broader acceptance and higher-value product development in the kegerator equipment space.

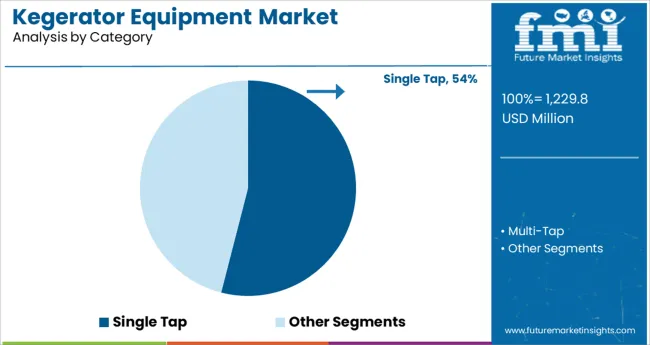

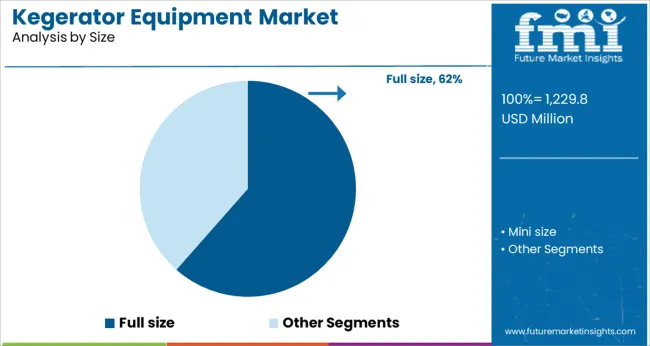

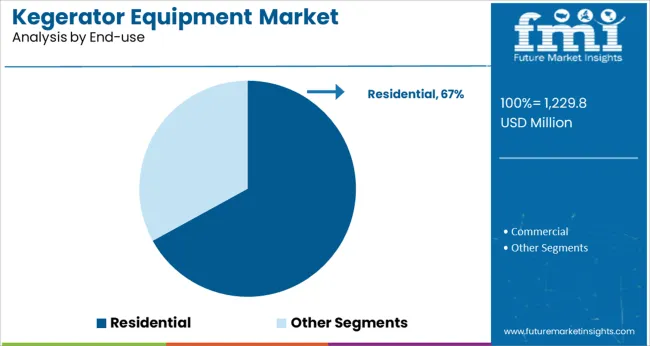

The market is segmented by Category, Size, End-use, and Application and region. By Category, the market is divided into Single Tap and Multi-Tap. In terms of Size, the market is classified into Full size and Mini size. Based on End-use, the market is segmented into Residential and Commercial. By Application, the market is divided into Draft Beer, Wine, Cold Brew Coffee, and Kombucha. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by category, single tap kegerators are projected to hold 54% of the market revenue in 2025, making it the leading category. This leadership has been supported by the compact design and affordability of single tap units, which appeal strongly to first-time buyers and space-constrained environments.

Their ease of installation and maintenance has positioned them as a preferred choice among residential users and small-scale establishments. The lower initial investment compared to multi-tap alternatives has further driven their popularity, allowing consumers to enjoy draft beer without complexity.

In addition, manufacturers have focused on enhancing aesthetics and efficiency in this segment, ensuring that single tap kegerators remain the dominant choice for consumers prioritizing simplicity and value.

Segmented by size, full size kegerators are expected to account for 61.5% of the market revenue in 2025, maintaining their leading position. This dominance has been attributed to the superior capacity and versatility of full size units, which cater effectively to households and commercial settings requiring higher volume dispensing.

Consumers have shown preference for these models due to their ability to accommodate larger kegs and support extended usage without frequent refills. Enhanced cooling performance and durability offered by full size units have also contributed to their sustained demand.

The segment’s leadership has been further reinforced by manufacturers offering customizable configurations, advanced controls, and improved energy efficiency, aligning with user expectations for performance and reliability in both home and professional environments.

When segmented by end use, the residential segment is forecast to capture 67% of the market revenue in 2025, securing its position as the leading end use segment. This prominence has been driven by rising home entertainment trends and growing interest in replicating bar-quality experiences at home.

Consumers have increasingly viewed residential kegerators as both a lifestyle upgrade and a cost-effective alternative to frequenting bars. The segment’s growth has been supported by greater availability of user-friendly and aesthetically pleasing models tailored specifically for household spaces.

Additionally, the cultural shift toward hosting gatherings and personalizing home beverage solutions has strengthened demand. Enhanced marketing efforts targeting homeowners and the integration of smart, space-efficient designs have further cemented the residential segment’s leadership in the kegerator equipment market.

The global market for kegerator equipment increased from USD 1,446.5 million to USD 1,057.2 million between 2020 and 2025, with a CAGR of 3.7%.

The industry has seen consistent growth over the past few years and is projected to continue this trend in the future. The industry is expected to continue its strong growth in the coming years. This is likely to be driven by the increasing popularity of craft beer and the continued expansion of the retail market.

During the forecast period, the global kegerator equipment market is anticipated to grow from USD 1,111.2 billion in 2025 to USD 1,846.5 billion by 2035, with a healthy CAGR of 5.2%.

Ability to store large quantities of beer and dispense without foam

One of the biggest advantages of using a kegerator is its ability to store large quantities of beer. This is expected to further increase the sales of kegerator equipment. Moreover, the ability to keep beer fresh for long periods of time and the ability to dispense beer without foam has surged the market share of the kegerator equipment.

Ease of beer dispensing

The process of dispensing beer becomes seamless using kegerator equipment, as a result of which these are being increasingly used in the brewery market. They are becoming increasingly popular as they allow people to enjoy fresh draft beer at home kegerator without having to invest in expensive brewing equipment.

The commercial sector is responsible for a significant portion of the demand for kegerator equipment. This is due to the fact that businesses in the commercial sector often need to serve large quantities of beer at once, and kegerators are an efficient way to do so. In addition, commercial businesses often have a higher budget than individual consumers, so they are more likely to purchase high-end kegerator models.

Multi-tap kegerator equipment has many advantages that make it a great choice for those who are looking for an efficient and effective way to dispense beer. Multi-tap kegerator equipment is able to provide a consistent flow of beer, meaning that there is less wastage and fewer foam pours.

Additionally, the ability to have multiple taps allows for a greater variety of beers on tap, which can be a big selling point for customers or guests. Finally, multi-tap kegerator equipment is easy to clean and maintain, which is an important consideration when choosing any type of keg system.

The draft beer segment has the largest market. This type of equipment is used to store and dispense kegs of beer. There are many different types and sizes of kegerators, but they all have one common purpose: to keep your draft beer cold and fresh, as a result of which the adoption of kegerator equipment has been increasing.

Kegerators also allow us to store multiple kegs of beer at once, so you always have a cold one on hand, as a result of which they are highly preferred in bars. They also help to maintain the carbonation in the beer, so it tastes fresher for longer.

North America is expected to be the largest market during the forecast period.

North America is also the largest craft beer market, and as of 2025, North America had a market valuation of USD 97 billion, which is roughly 40% of the global craft beer market. The major market driver of craft beer is the emergence of new flavors. The market is currently dominated by the current generation

The hotels, restaurants, and bars where craft beers are served are making use of the kegging equipment because of the shelf life associated with the usage of this equipment.

Apart from that, there is also an increase in the consumption of functional beverages worldwide. Based on the research conducted by FMI, the functional beverages market is expected to grow at a CAGR of nearly 6% during the forecast period. The inclination of youth towards flavored drinks is expected to drive the market.

The kegerator equipment can be used to store these beverages in bulk quantities. Owing to their ability to restore the freshness of the beverages for a long time, these are preferred by the manufacturers who are operating in the kegerator equipment market.

Moreover, the companies that are operating on the basis of achieving sustainable development, the application of kegerator equipment is of great significance as the kegs which are used in this equipment are reusable. Consequently, the accumulation of wastage reduces. Furthermore, the application of kegerator equipment also assists in freeing up space in the refrigerator.

The USA accounted for 33.9% of the Global market with a value of USD 1229.8.0 million in 2025. The kegerator equipment market in the United States is evolving rapidly. In recent years, there has been an explosion in the number of new kegerator equipment manufacturers and suppliers. This has led to a more competitive market with lower prices and better-quality products.

One of the most notable trends in the kegerator equipment market is the move toward online sales. This is a result of the growing popularity of online shopping and the convenience it offers consumers. More and more kegerator equipment manufacturers are now selling their products online, which has made it easier for consumers to compare prices and find the best deals.

Europe is expected to be one of the most significant markets during the forecast period.

The region is mainly meant for wine consumption and is the largest wine market. Based on the research, the Europe wine market has a valuation of USD 1229.8 billion as of 2025, and the market is expected to surge further. One of the key reasons behind the increased consumption of wine is the health benefits associated with it, like being an antioxidant and assisting in the healthy functioning of the heart.

The ability of the kegerator equipment to dispense beer without foam is something that has caught the attention of wine manufacturers, and this might increase the demand for kegerator equipment during the forecast period. These also assist in winemaking.

The United Kingdom Market will grow at 6.4% CAGR between 2025 and 2035. The United Kingdom is home to some of the world's leading manufacturers of kegerator equipment, so it's no surprise that the country has a significant share of the global market.

The India kegerator equipment market will grow at 6.4% CAGR between 2025 and 2035. India is a key player in the global kegerator equipment market. India is expected to see significant growth in the kegerator equipment market over the next few years.

This growth will be driven by factors such as the increasing popularity of craft beer and the growing middle class. India presents a unique opportunity for manufacturers of kegerator equipment. The country's large population and rapidly growing economy make it an attractive market for companies looking to expand their business.

Japan is expected to be one of the best-performing Markets. Thanks to a growing whiskey market in the country, which makes Japan is one of the largest markets for kegerator equipment.

The whiskey market in Japan was valued at close to USD 1.3 billion as of 2025 and is expected to grow further during the forecast period. The whiskey manufacturers are depending on the kegerator equipment because of its ability to retain the freshness of the drink for longer periods of time.

The South Korean market is expected to showcase significant growth during the forecast period.

A huge PBCL market in South Korea is expected to increase the sales of kegerator equipment during the forecast period. A rising preference for alcoholic beverages, coupled with an increase in nightlife and late-night parties is the major factor that has led to an increase in the PBCL market in South Korea.

The PBCL market is making use of kegerator equipment because of its ability to store huge quantities of drinks in a single go, and at the same time assist in the seamless dispensing of beer.

The start-ups operating in the kegerator equipment market are on a mission to diversify their offerings. Rather than just focusing on cold beverages, the focus is also on managing food.

Crafty was founded in 2020. It is a centralized platform that managed food, beverages, and supplies for the in-office, remote, and hybrid teams working across the globe. The start-up has been managing pantries, catering, café, and supplies across their clients.

In April 2025, the company managed to raise USD 10 million in series A funding, which was led by Tribeca Venture Partners.

Till date, Craft has managed to raise USD 15 million from Greycroft, OCA Ventures, Manifold, Firebrand, Rubicon Venture Capital.

The kegerator equipment market is highly competitive with a large number of players. The market is also fragmented with small and medium-sized players. The competition in the market is intense with all the players trying to gain market share.

The key strategies adopted by the players in the market are product innovation, mergers and acquisitions, and expansion into new markets.

Some of the recent developments are:

Danby, Haier, and Versonel are taking up all the major steps to maintain the image of being the dominant forces in the market

Danby has been serving the niche for more than seven decades with a vision of creating truly innovative appliances that would offer unmatched features. The company has been able to evolve with time and has always offered solutions as per the situation.

Danby is currently one of the leading refrigeration and specialty appliance in North America, offering unique appliances loved by people. The company has operated on the principle of creating brilliant and inspired appliances to fit into its customer’s space. To ensure that the customer is taken care of, the company has been providing 12 months, 18 months, and 24-month warranties, that include parts, labor, and in-home service.

Haier is a world-class provider of a better life and digital transformation solutions. Haier has topped in Global Major Appliances Brand Rankings by Euromonitor International for 13 years. Haier has deployed 10+N innovation ecosystems, 71 research institutes, 33 industrial parks, and 133 manufacturing centers.

Haier majorly serves three major sectors: smart home and living, industrial internet, and great healthcare. The company is committed to working with world-class ecosystem partners to continuously develop high-end brands, scenario brands, and ecosystem brands. Haier has been making use of technological innovation to customize a personalized smart life for enabling the digital transformation of business, and promoting high-quality economic growth and sustainable social development.

Versonel has the image of developing innovative, dependable, and stylish products for home and business. The focus has always been on intensive product research, testing, and customer feedback. The goal has always been to provide the best product that one can buy and maintain the balance between flawlessness and stylishness.

The global kegerator equipment market is estimated to be valued at USD 1,229.8 million in 2025.

It is projected to reach USD 2,041.6 million by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are single tap and multi-tap.

full size segment is expected to dominate with a 61.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Hunting Equipment and Accessory Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA