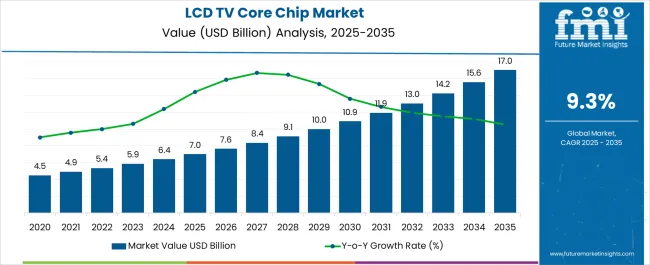

The LCD TV Core Chip Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 17.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period. Examining the rolling CAGR over shorter periods within this decade shows a strong and steady upward trajectory. From 2025 to 2030, the market expands from USD 7.0 billion to around USD 10.0 billion, reflecting a CAGR close to 7.6%. This period is marked by increased demand for LCD TVs featuring improved core chip performance, which supports smoother displays and enhanced user experience.

The replacement of older TV models and rising consumer interest in upgraded electronics help sustain market growth during these years. Between 2030 and 2035, the growth rate accelerates, with the market climbing from USD 10.0 billion to USD 17.0 billion, resulting in a CAGR of approximately 10.9%. This boost is driven by the broader adoption of LCD TVs with more advanced core chips across different markets and the growing penetration of high-definition content.

Additionally, demand from emerging consumer segments and replacement cycles for core chip components installed in earlier models contribute to this strong expansion. The rolling CAGR analysis underscores the market’s robust and consistent growth, reflecting steady product demand and periodic upgrades that maintain the momentum throughout the decade.

| Metric | Value |

|---|---|

| LCD TV Core Chip Market Estimated Value in (2025 E) | USD 7.0 billion |

| LCD TV Core Chip Market Forecast Value in (2035 F) | USD 17.0 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The LCD TV Core Chip market is undergoing a dynamic transformation as global demand for high-resolution and smart television features continues to accelerate. Market growth is being driven by advancements in video processing technologies, increasing adoption of system-on-chip architectures, and consumer preference for ultra-high-definition display formats.

With the television industry shifting toward intelligent, energy-efficient, and compact solutions, core chipsets are being reengineered to support faster data processing, real-time content enhancement, and seamless integration with connectivity standards. The growing penetration of 4K content, expansion of OTT platforms, and rapid digitalization of emerging economies are playing a crucial role in shaping the market outlook.

Manufacturers are focusing on developing chipset solutions that can handle both software-defined updates and complex image rendering in real time. As display technologies evolve and viewer expectations rise, the demand for high-performance, multi-functional LCD TV core chipsets is anticipated to remain strong, with innovation and miniaturization at the core of future growth trajectories..

The LCD TV core chip market is segmented by type of chipset, technology, resolution, application end use, and geographic regions. By type of chipset, the LCD TV core chip market is divided into Video processing chipsets, Audio processing chipsets, Tuner & demodulator chipsets, Power management ICs, Timing Controller (TCON) ICs, System-on-Chip (SoC), and Others. In terms of technology, the LCD TV core chip market is classified into Single-chip Solution (SoC) and Multi-chip Solution.

Based on resolution of the LCD TV core chip market is segmented into 4K UHD, HD (720p), Full HD (1080p)8K UHD. By application of the LCD TV core chip market is segmented into Smart TVs and Non-smart (Conventional) LCD TVs. By end use, the LCD TV core chip market is segmented into Residential, Commercial, and Others. Regionally, the LCD TV core chip industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

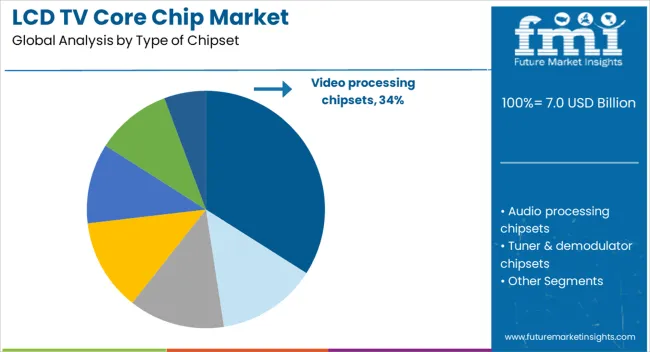

The video processing chipsets subsegment is projected to account for 34% of the LCD TV Core Chip market revenue share in 2025, making it the leading chipset type. This segment has gained significant traction due to its critical role in enhancing image clarity, motion smoothing, and color optimization in modern televisions. The integration of advanced algorithms for dynamic contrast adjustment, frame interpolation, and noise reduction has made video processing chipsets essential for high-quality viewing experiences.

As consumer expectations shift toward lifelike visuals and immersive content delivery, demand for chipsets capable of real-time video analysis has increased substantially. Manufacturers have also adopted custom video processing units to differentiate performance across premium and mid-tier models.

These chipsets support high frame rates and are optimized for energy efficiency, making them particularly valuable for large-screen and smart TV applications. Their adaptability to various panel technologies and compatibility with content upscaling functions further solidify their position as the preferred choice in the market..

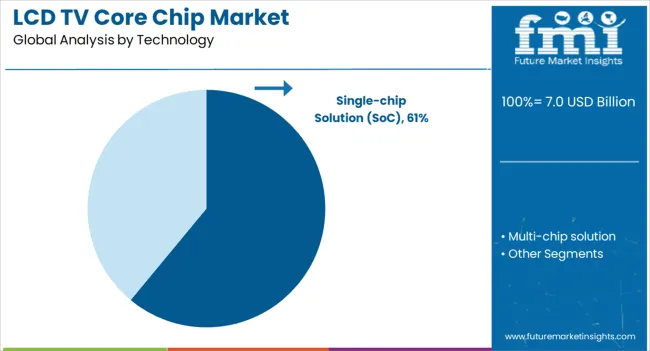

The single chip solution segment is expected to hold 61% of the LCD TV Core Chip market revenue share in 2025, positioning it as the dominant technology. The segment’s leadership has been established through the consolidation of multiple functions such as video decoding, signal processing, connectivity, and power management into a single integrated chipset. This approach has significantly reduced board space, power consumption, and production costs while enhancing system reliability.

With growing demand for slim and energy-efficient television designs, single chip solutions have been increasingly adopted to streamline manufacturing and simplify thermal management. These chipsets offer flexible software programmability, enabling manufacturers to deliver feature updates and compatibility enhancements through firmware.

The trend toward smart TVs with AI-based voice recognition and app integration has also reinforced the need for powerful, all-in-one solutions. By supporting scalable architecture and facilitating rapid innovation cycles, the single chip solution has emerged as a vital enabler of modern LCD TV functionality..

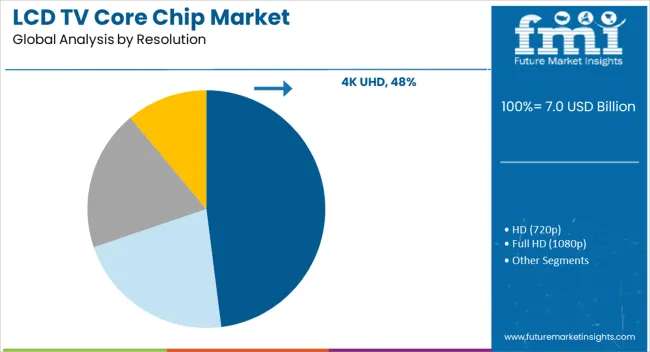

The 4K UHD subsegment is projected to command 48% of the LCD TV Core Chip market revenue share in 2025, establishing it as the leading resolution format. The widespread adoption of 4K technology has been influenced by consumer demand for highly detailed visuals, cinematic experiences, and immersive entertainment across larger screen sizes.

Core chipsets tailored for 4K UHD displays have been optimized for enhanced pixel processing, upscaling of lower-resolution content, and superior color rendering. As streaming platforms, broadcasters, and content creators continue to deliver native 4K content, chipsets capable of decoding and displaying such material with precision have become essential.

The shift from full HD to 4K has also prompted manufacturers to embed more powerful graphics and memory controllers within the chipset architecture. Additionally, rising affordability of 4K televisions and growing content availability have contributed to the rapid penetration of this resolution category, reinforcing its leadership position in the global market..

The LCD TV core chip market is growing steadily due to increasing demand for high-performance televisions offering better picture quality, faster processing, and smart functionalities. Core chips serve as the processing backbone managing display control, image enhancement, and connectivity features. Challenges include high development costs and rapid technology shifts. However, advancements in chip design, integration with AI capabilities, and rising smart TV penetration drive market expansion. Consumer preference for immersive viewing experiences and rising adoption in emerging regions contribute to sustained growth.

Core chips are critical for delivering sharp visuals, smooth motion, and enhanced color accuracy in LCD TVs. As consumers expect better resolution, HDR support, and faster refresh rates, manufacturers focus on powerful chips that optimize image processing. These chips also manage smart TV functionalities, enabling seamless connectivity with streaming services, voice assistants, and IoT devices. The rise of 4K and 8K panels heightens the need for advanced chipsets capable of handling large data bandwidth efficiently. Furthermore, integration with energy-efficient designs reduces power consumption without compromising performance. The market benefits from continuous innovation to meet evolving consumer expectations for immersive and smart viewing experiences.

Developing sophisticated core chips requires substantial investment in research and design, which can be a barrier for smaller manufacturers. The fast pace of technological advancements demands frequent upgrades and new product launches, increasing costs and supply chain complexity. Additionally, compatibility issues with diverse LCD panel types and operating systems create challenges for chipmakers aiming for broad adoption. Price pressure from competitive markets and the demand for affordable TVs further constrain profit margins. Manufacturers must balance high-performance features with cost efficiency to remain competitive. Navigating patent landscapes and securing supply of advanced semiconductor materials are also critical challenges. These factors require strategic partnerships and focused innovation to sustain growth.

Integrating artificial intelligence into core chips opens new avenues for enhanced picture optimization, voice recognition, and user personalization in LCD TVs. AI-powered chips can dynamically adjust brightness, contrast, and sound based on content and ambient conditions, improving viewer satisfaction. Enhanced smart features such as advanced gesture control, content recommendations, and home automation compatibility drive consumer appeal. The increasing popularity of connected smart homes fuels demand for chips supporting multiple wireless standards and seamless device interoperability. Manufacturers investing in AI-enabled chipsets gain a competitive edge by offering next-generation viewing experiences. This trend is expected to accelerate with the adoption of edge computing and cloud services integrated with smart TVs, expanding core chip functionalities beyond traditional display control.

The LCD TV core chip market is influenced by regional manufacturing capacities and trade policies affecting semiconductor production and distribution. Asia Pacific, as a hub for electronic manufacturing, leads in chip fabrication and assembly. However, geopolitical tensions and trade restrictions have disrupted supply chains, prompting companies to diversify manufacturing locations and secure component sources. Policies promoting local semiconductor industries and investments in chip design centers shape market dynamics. Regulatory standards related to electronic safety and energy efficiency impact product development and acceptance in different markets. Navigating these regional variations requires agile supply chain management and compliance strategies. Companies with global manufacturing footprints and strong regional partnerships are better positioned to mitigate risks and capitalize on growing demand for advanced LCD TV technologies.

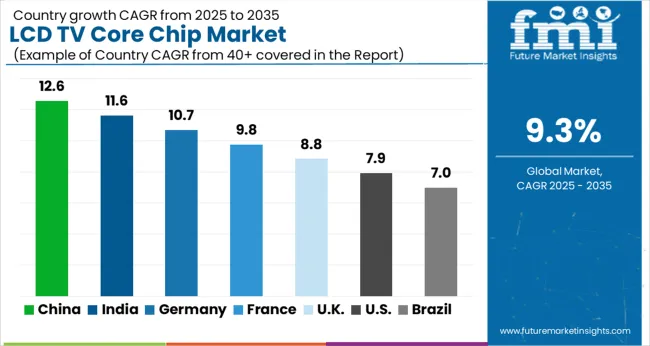

| Country | CAGR |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| France | 9.8% |

| UK | 8.8% |

| USA | 7.9% |

| Brazil | 7.0% |

The global LCD TV core chip market is growing rapidly with a CAGR of 9.3%, led by strong performances in key regions. Among BRICS nations, China dominates at 12.6%, driven by its vast electronics manufacturing base and export-oriented strategies. India follows closely with an 11.6% growth rate, supported by expanding consumer electronics demand and local production capabilities. Within the OECD group, Germany reports 10.7% growth, reflecting advanced semiconductor technology and stringent quality standards. The United Kingdom grows at 8.8%, fueled by innovation in display technologies and supply chain modernization. The United States, a mature market, shows 7.9% growth, shaped by investments in high-performance chip design and integration. These countries collectively influence market trends through advancements in processing power, energy efficiency, and miniaturization. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is experiencing a robust 12.6% CAGR in the LCD TV core chip market, driven by its large-scale electronics manufacturing industry and growing domestic consumption. The expanding middle class and rising disposable incomes are boosting demand for affordable, high-quality LCD televisions equipped with advanced core chips. Chinese semiconductor manufacturers are investing in research and development to enhance chip performance, focusing on energy efficiency, picture quality, and integration capabilities. Strong government support for the semiconductor sector through incentives and infrastructure development accelerates innovation. The rise of smart TVs and increased demand for 4K and 8K resolution models are further propelling the market. Additionally, China’s export-oriented electronics industry benefits from continuous improvements in core chip technology, solidifying its position as a global supplier.

India is seeing an 11.6% CAGR in the LCD TV core chip market, fueled by rising consumer electronics demand and increasing penetration of smart TVs. The expansion of organized retail and e-commerce platforms enhances accessibility to high-end LCD TVs with improved chip technology. Indian consumers are becoming more quality conscious, driving demand for televisions with better display performance and energy efficiency. Local manufacturers and international brands are investing to cater to price-sensitive segments with affordable yet technologically advanced core chips. Additionally, government initiatives to promote electronics manufacturing and the Digital India program contribute to sector growth. Increasing urbanization and improving internet connectivity also support smart TV sales, indirectly benefiting the core chip market.

Germany is witnessing a 10.7% CAGR in the LCD TV core chip market, supported by a mature consumer electronics industry and high demand for premium television sets. German consumers prioritize energy efficiency, picture clarity, and reliability, prompting manufacturers to supply LCD TVs with state-of-the-art core chips. The market benefits from strong innovation ecosystems and partnerships between chip designers and electronics manufacturers. Sustainability and eco-friendly production methods are important factors influencing product development. Additionally, the demand for 4K and HDR-compatible TVs remains high, encouraging continued improvements in core chip performance. Retail chains and online platforms ensure broad distribution, while warranty and after-sales services help maintain customer loyalty.

The United Kingdom is registering an 8.8% CAGR in the LCD TV core chip market, driven by consumer preference for high-resolution smart TVs and increasing digital content consumption. The UK market favors brands offering enhanced picture quality, faster processing speeds, and better energy ratings. Retailers emphasize integrated features such as internet connectivity and voice control, increasing the need for powerful core chips. Government efforts to encourage technology adoption and reduce electronic waste support the transition to newer, more efficient TV technologies. Additionally, increasing awareness of environmental impacts encourages the purchase of energy-efficient LCD TVs. The availability of competitive pricing through online sales channels boosts market penetration.

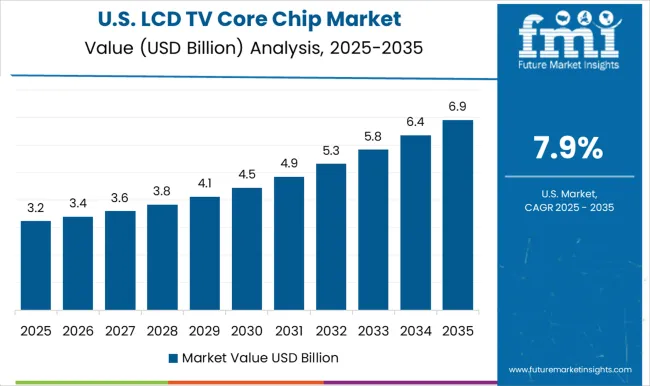

The United States is posting a 7.9% CAGR in the LCD TV core chip market, driven by strong demand for large-screen smart TVs with advanced features. Consumer preferences for 4K resolution, HDR, and seamless streaming capabilities are pushing manufacturers to enhance core chip technology. The USA market is competitive, with many brands focusing on innovation in chip processing power and energy consumption. E-commerce platforms and big-box retailers contribute to widespread availability. Increasing investment in semiconductor fabrication facilities supports domestic chip production growth. Moreover, environmental regulations encourage energy-efficient product designs. The trend towards smart home integration and voice-controlled devices further expands the role of core chips in LCD TVs.

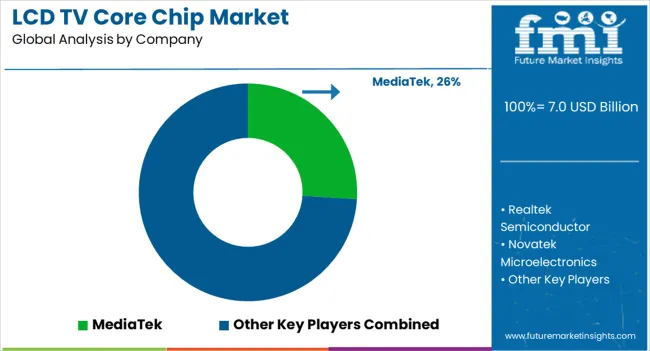

MediaTek has established itself as a dominant supplier by offering highly integrated system-on-chip platforms that combine video processing, image enhancement, connectivity, and AI-driven features, making it a preferred partner for many mainstream and premium TV brands. Novatek Microelectronics competes strongly with chipsets optimized for high-definition and ultra-high-definition panels, emphasizing advanced motion compensation, HDR support, and efficient power consumption that align with the requirements of global display manufacturers.

Realtek Semiconductor leverages its broad portfolio of multimedia solutions to provide cost-effective LCD TV chips with strong performance in mid-range and entry-level models, supporting a wide range of panel resolutions and display technologies.

Hisilicon, backed by Huawei’s semiconductor expertise, has sought to expand in the TV chipset domain with solutions that integrate advanced graphics and secure connectivity, though regulatory factors and supply chain dynamics influence its global footprint. Sigma Designs, though more specialized, has contributed by offering chipsets designed for media-rich TV environments, emphasizing image processing and system flexibility. Renesas and STMicroelectronics, while more diversified across semiconductor markets, supply components and integrated solutions that contribute to LCD TV system performance and reliability. Smaller fabless design firms in Taiwan and China focus on cost-driven production, catering to local panel makers and budget TV brands seeking to compete on price.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Type of Chipset | Video processing chipsets, Audio processing chipsets, Tuner & demodulator chipsets, Power management ICs, Timing Controller (TCON) ICs, System-on-Chip (SoC), and Others |

| Technology | Single-chip Solution (SoC) and Multi-chip solution |

| Resolution | 4K UHD, HD (720p), Full HD (1080p), and 8K UHD |

| Application | Smart TVs and Non-smart (Conventional) LCD TVs |

| End Use | Residential, Commercial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MediaTek, Realtek Semiconductor, Novatek Microelectronics, MStar Semiconductor, and Samsung Electronics |

| Additional Attributes | Dollar sales vary by chip type, including 8-bit, 16-bit, 32-bit, and 64-bit; by application, covering residential, commercial, and educational sectors; by region, led by Asia‑Pacific in production, North America in premium integration, and Europe in mid‑range innovation. Growth driven by smart TV adoption, AI integration, and HDR/UHD compatibility. |

The global LCD TV core chip market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the LCD TV core chip market is projected to reach USD 17.0 billion by 2035.

The LCD TV core chip market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in LCD TV core chip market are video processing chipsets, audio processing chipsets, tuner & demodulator chipsets, power management ics, timing controller (tcon) ics, system-on-chip (soc) and others.

In terms of technology, single-chip solution (soc) segment to command 61.0% share in the LCD TV core chip market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA