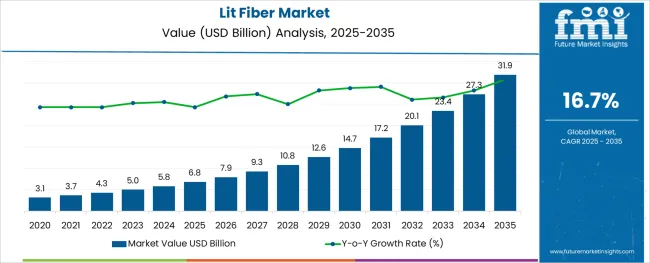

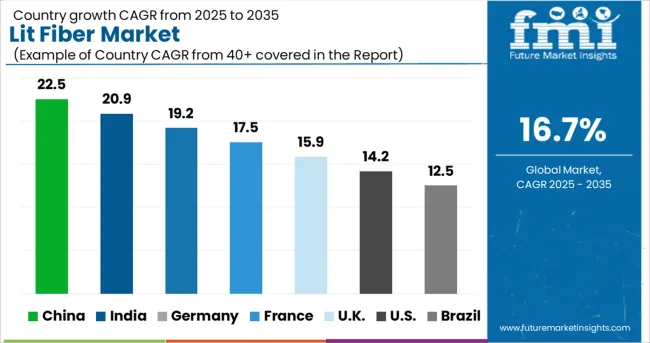

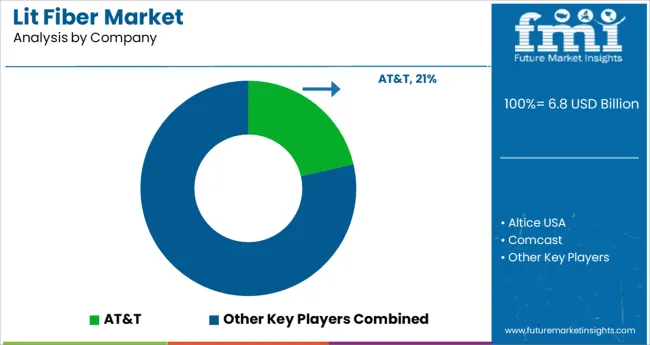

The Lit Fiber Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 31.9 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

The lit fiber market is expanding rapidly as demand for high-speed data transmission and reliable network infrastructure intensifies globally. Telecommunications providers are investing heavily in fiber optic networks to meet increasing bandwidth needs driven by cloud computing, video streaming, and 5G deployments. The push for digital transformation across industries has elevated the importance of fiber connectivity in IT and telecommunications sectors.

Advances in fiber technology have enhanced signal quality and transmission distances, making fiber an attractive solution for network operators. Additionally, government initiatives to expand broadband access in underserved areas have accelerated fiber network rollouts.

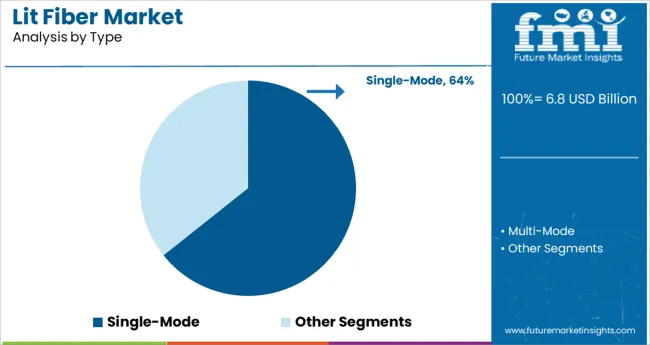

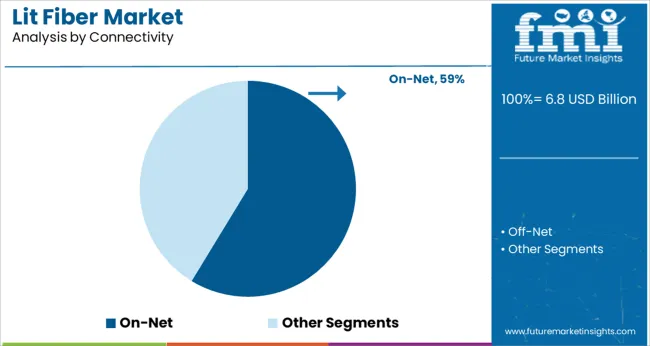

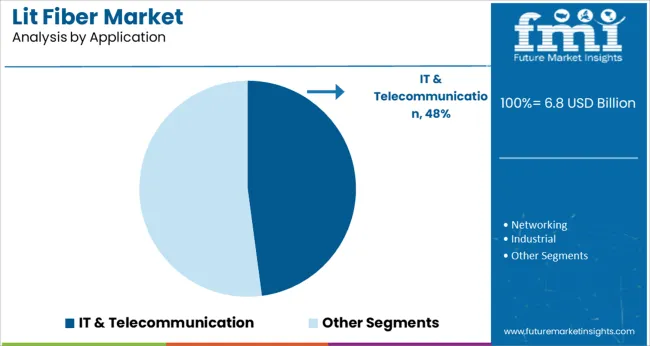

The market is expected to continue its growth trajectory as enterprises and service providers adopt next-generation connectivity solutions. Segment growth is anticipated to be led by Single-Mode fiber types due to their superior long-distance performance, On-Net connectivity services offering reliable access, and the IT & Telecommunication sector as the dominant application area.

The market is segmented by Type, Connectivity, and Application and region. By Type, the market is divided into Single-Mode and Multi-Mode. In terms of Connectivity, the market is classified into On-Net and Off-Net. Based on Application, the market is segmented into IT & Telecommunication, Networking, Industrial, Aerospace & Defense, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Single-Mode fiber segment is projected to hold 64.3% of the lit fiber market revenue in 2025, securing its leading position. This segment benefits from the ability of single-mode fibers to transmit data over longer distances with minimal signal loss, making them essential for backbone and long-haul networks.

Network operators have favored single-mode fiber for its high bandwidth capacity and low attenuation characteristics. The growth of metropolitan and wide-area networks has increased demand for single-mode fibers that support high-speed, long-distance connectivity.

Moreover, as data traffic volumes continue to surge, the need for robust fiber infrastructure has reinforced single-mode fiber’s dominance. Its compatibility with evolving network technologies ensures sustained demand in the years ahead.

The On-Net connectivity segment is expected to contribute 58.7% of the market revenue in 2025, establishing itself as the preferred connectivity type. On-Net connectivity provides direct fiber access to end-users within the service provider’s network footprint, offering enhanced reliability, speed, and lower latency compared to off-net alternatives.

Service providers have invested in expanding their on-net fiber infrastructure to deliver differentiated services and improve customer experience. The demand for high-quality business internet and data center connectivity has further fueled adoption of on-net solutions.

Additionally, on-net connectivity enables providers to reduce operational costs by leveraging owned assets rather than leasing third-party networks. As enterprises increasingly require dedicated and secure connections, on-net connectivity is poised to remain a key growth driver.

The IT & Telecommunication segment is projected to account for 47.9% of the lit fiber market revenue in 2025, maintaining its dominant role in applications. This sector demands high-capacity and low-latency networks to support data centers, cloud services, and communication infrastructure.

The rapid expansion of digital services and the growing number of internet users have intensified the need for fiber-based networks. Network upgrades, including 5G backhaul and enterprise connectivity solutions, have driven fiber deployments.

Furthermore, the sector’s focus on reliability and scalability has made lit fiber a preferred choice for mission-critical applications. As digital transformation accelerates globally, the IT & Telecommunication segment will continue to lead demand for lit fiber infrastructure.

Governments around the world have adopted this lit fiber technology to provide a foundation for digitalapplications pertaining to community safety and establishment of smart cities, bygivingtheir citizens strong internetconnectivity for accessing e-government services.

A rapid gush in the sales of lit fiber was observed in the recent past, owing to its higher adoption by gaming and entertainmentfirms for video game players.

High implementation cost of advanced lit fiber technology is regarded as the major hindrance for the target market growth. Moreover, many establishments prefer to continue with the pre-existing conventional fiber optics network that could pose as a major challenge for the sales of the lit fiber in the regional markets.

In the coming days, with the better awareness about the several advantages available with the modern lit fiber connections the lit fiber manufacturers are anticipated to overcome these obstructions against their magnification.

As per the new research report on lit fiber market for years 2025 to 2035, the multi-mode segment, which also accounted for the highest revenue share in the year 2024, is again anticipated to grow at a CAGR of about 16.3%. The global popularity of this segment of multi-mode lit fiber is growing because it has a bigger core and is more affordable that can be deployed for connections of more than 400 meters.

Moreover, these multi-mode wires are contributing significantly to the present day lit fiber market key trends as these are perfect for use in a data center for utilizing less power than single-mode. With more dispersion but less brightness, numerous information beams can be transmitted concurrently at lower overall expense. Other than that, the major network professionals can swiftly deploy and remove multi-mode fiber cables, while upgrading a network across a building.

The single-mode category, but from the other end, is anticipated to expand at a quicker CAGR of nearly 17.2% as evident from the lit fiber market statistics report. Compared to multi-mode fiber, single-mode lit fiber has a smaller core, making it suitable for several other areas of application. For long-distance deployments it has a 9 m optical core, enabling greater bandwidth usage as well as extended delivery distances

With a higher CAGR of 17% recorded by the lit fiber market survey report for the historical period 2020 to 2024, the on-net category outgrew all other market segments during that time. On-net lit fiber connection is provided by an operator that is the owner of the network infrastructure present at a specific spot.

Using the hardware set up in a nearby BT exchange, the carrier establishes a connection to the telecom service providers' network. Since the carrier network's cables are really present in the vicinity, these interconnections become more affordable over off-net connections rendering it as the dominant segment of the global lit fiber market.

Over the planning horizon of this lit fiber market analysis report, the off-net category is anticipated to have significant expansion as it mostly consists of a solution provider who rents an extended connection at a local wireless facility.

Also therefore, every off-net lit fiber connection includes unintended and far-off factors that might impair the network's connectivity and service quality. This also makes updates and solutions to out-of-service situations more difficult limiting the popularity of this global lit fiber market segment.

Until the end of the year 2024, as per the global market study on lit fiber, the networking category had the highest revenue share of 31.7%.

Attributed to the increasing use of information technology in data transfer and communication services, the telecommunications sector is expected to experience significant development. Greater data transfer via short- and long-distance communications is made possible by fiber optics.

Furthermore, it is anticipated that the growing demand for cloud-based apps, multimedia communications, and livestreaming platforms and other websites services would fuel the expansion of the telecommunications segment of the global lit fiber market.

According to broad geographical regions,North America, which had a 28% sales share by the end of year 2024, is expected to maintain its dominance throughout the projection timeframe. An advanced foundation in this area makes it simpler to construct illuminated fiber links across United Statesthat has settled USA lit fiber market as the most lucrative segment for the target product.

As evident from the recent developments in lit fiber market during the predicted period, Asia Pacific is probably going to surpass Europe as the next most promising area.

The reasons driving the Asia Pacific lit fiber market growth in the coming years include the expansion of technology and its widespread acceptance in the information technology, telecommunications, and organizational sectors. Secondly, the Asia Pacific market is strengthened by the extensive use of such cables in parallel with the acceleratingindustrial, aerospace, and defense sectors in the several of the economies.

Due to the existence of several lit fiber market competitors, the target business is severely fragmented and is expected to experience heightened rivalry. The main lit fiber companies concentrate on expanding their marketfootprint by providing relevant services to underserved areas as well.

To secure a sizeable market share, the major lit fibermarket players prioritize R&D, bilateral agreements, and collaborations with variousregional and local competitors.

Recent Developments in Global Lit Fiber Market

The global lit fiber market is estimated to be valued at USD 6.8 billion in 2025.

It is projected to reach USD 31.9 billion by 2035.

The market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types are single-mode and multi-mode.

on-net segment is expected to dominate with a 58.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Litigation Consulting Services Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA