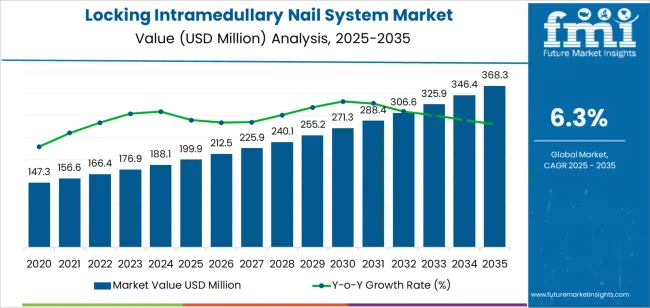

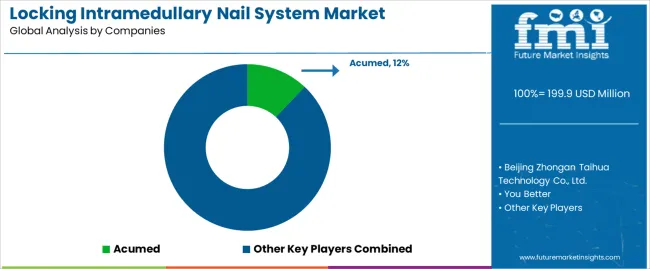

The global locking intramedullary nail system market is valued at USD 199.9 million in 2025. It is slated to reach USD 368.3 million by 2035, recording an absolute increase of USD 168.4 million over the forecast period. This translates into a total growth of 84.2%, with the market forecast to expand at a CAGR of 6.3% between 2025 and 2035. The market size is expected to grow by nearly 1.84 times during the same period, supported by increasing demand for advanced fracture fixation solutions in orthopedic surgery, growing adoption of minimally invasive surgical techniques in trauma care, and rising focus on early patient mobilization across diverse hospital trauma centers, orthopedic specialty clinics, and ambulatory surgical applications.

Between 2025 and 2030, the market is projected to expand from USD 199.9 million to USD 271.3 million, resulting in a value increase of USD 71.4 million, which represents 42.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing incidence of long bone fractures requiring surgical intervention, rising adoption of anatomically contoured nail designs with multiple locking options, and growing demand for reliable fixation systems in complex fracture patterns and geriatric trauma cases. Orthopedic surgeons and trauma care specialists are expanding their locking intramedullary nail capabilities to address the growing demand for biomechanically stable fixation solutions that ensure bone healing and functional recovery optimization.

From 2030 to 2035, the market is forecast to grow from USD 271.3 million to USD 368.3 million, adding another USD 97.0 million, which constitutes 57.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of patient-specific implant designs and 3D printing applications, the development of advanced biomaterials with enhanced osseointegration properties, and the growth of specialized applications for periprosthetic fractures and revision surgeries. The growing adoption of robotic-assisted surgical systems and computer navigation technologies will drive demand for locking intramedullary nail systems with enhanced precision and comprehensive surgical planning integration.

Between 2020 and 2025, the market experienced steady growth, driven by increasing trauma care capabilities and growing recognition of locking intramedullary nails as essential implants for achieving stable fracture fixation and enabling early weight-bearing in diverse long bone fracture management and orthopedic trauma applications. The market developed as orthopedic surgeons and trauma specialists recognized the potential for locking intramedullary nail technology to provide angular stability, maintain fracture alignment, and support comprehensive bone healing while meeting biomechanical strength requirements. Technological advancement in nail design optimization and locking screw configurations began emphasizing the critical importance of maintaining fixation stability and minimizing surgical complications in challenging fracture scenarios.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 199.9 million |

| Forecast Value in (2035F) | USD 368.3 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

Market expansion is being supported by the increasing global incidence of traumatic injuries and long bone fractures driven by road traffic accidents, sports injuries, and aging population falls, alongside the corresponding need for advanced fixation technologies that can provide angular stability, enable minimally invasive insertion, and maintain fracture alignment across various femoral fractures, tibial fractures, and humeral fracture applications. Modern orthopedic surgeons and trauma care providers are increasingly focused on implementing locking intramedullary nail solutions that can achieve biomechanical stability, support early patient mobilization, and provide reliable fixation outcomes in demanding clinical conditions.

The growing focus on minimally invasive surgery and rapid patient recovery is driving demand for locking intramedullary nail systems that can offer percutaneous insertion techniques, enable reduced surgical trauma, and ensure comprehensive fracture stabilization across diverse patient populations. Orthopedic surgeon preference for fixation systems that combine mechanical strength with anatomical design optimization and surgical versatility is creating opportunities for innovative locking intramedullary nail implementations. The rising influence of geriatric trauma care and osteoporotic bone management is also contributing to increased adoption of locking intramedullary nails that can provide superior fixation security without compromising surgical safety or healing potential.

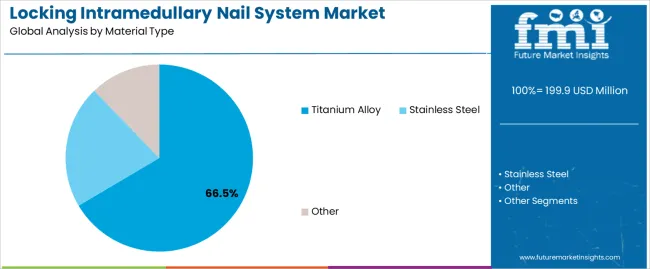

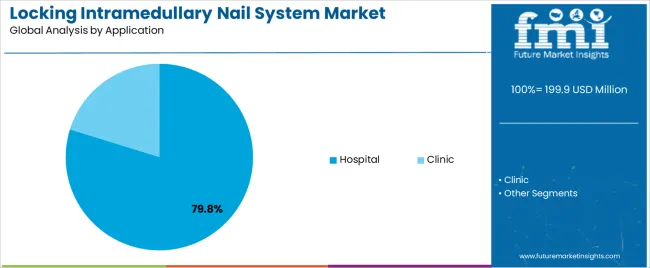

The market is segmented by material type, application, and region. By material type, the market is divided into titanium alloy, stainless steel, and other. Based on application, the market is categorized into hospital and clinic. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

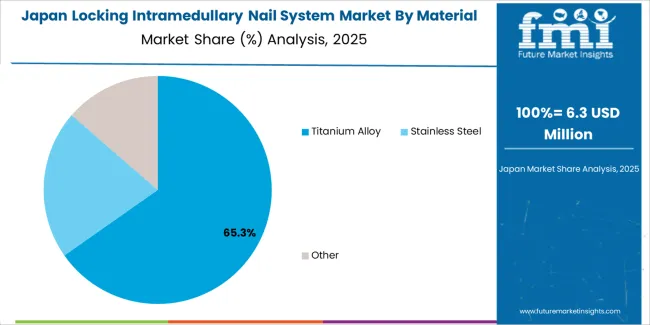

The titanium alloy segment is projected to maintain its leading position in the market in 2025 with a 66.5% market share, reaffirming its role as the preferred material for high-performance orthopedic implants and advanced fracture fixation applications. Orthopedic surgeons and medical device manufacturers increasingly utilize titanium alloy intramedullary nails for their superior biocompatibility characteristics, excellent strength-to-weight ratio, and proven effectiveness in providing long-term implant stability while maintaining corrosion resistance. Titanium alloy material technology's proven effectiveness and clinical performance directly address the industry requirements for reliable fracture fixation and comprehensive bone healing support across diverse trauma scenarios and patient populations.

This material segment forms the foundation of modern orthopedic trauma care, as it represents the material with the greatest contribution to implant longevity and established clinical success record across multiple fracture types and anatomical locations. Medical device industry investments in titanium processing technologies continue to strengthen adoption among implant manufacturers and surgical systems. With patient demands requiring biocompatible materials and improved clinical outcomes, titanium alloy locking intramedullary nails align with both performance objectives and patient safety requirements, making them the central component of comprehensive fracture management strategies.

The hospital application segment is projected to represent the largest share of locking intramedullary nail system demand in 2025 with a 79.8% market share, underscoring its critical role as the primary driver for implant adoption across trauma centers, tertiary hospitals, and orthopedic specialty hospitals performing complex fracture surgeries. Hospital-based orthopedic departments prefer locking intramedullary nail systems for trauma management due to their proven surgical outcomes, comprehensive procedural support, and ability to address complex fracture patterns while supporting multidisciplinary care coordination and patient safety protocols. Positioned as essential implants for modern hospital trauma services, locking intramedullary nail systems offer both clinical effectiveness advantages and surgical workflow efficiency.

The segment is supported by continuous expansion in trauma care capabilities and the growing establishment of dedicated orthopedic trauma programs that enable specialized fracture management with enhanced surgical expertise and reduced complication rates. Hospitals are investing in comprehensive orthopedic implant inventories to support increasingly complex trauma cases and operational demands for immediate surgical intervention throughout emergency departments and operating room facilities. As trauma care complexity increases and clinical standards advance, the hospital application will continue to dominate the market while supporting advanced fixation technology utilization and surgical outcome optimization.

The locking intramedullary nail system market is advancing steadily due to increasing incidence of traumatic fractures driven by vehicular accidents and aging populations and growing implementation of minimally invasive surgical approaches that require implant technologies providing angular stability and reliable fixation capabilities across diverse femoral shaft fractures, proximal tibial fractures, and diaphyseal fracture applications. The market faces challenges, including high implant costs limiting access in emerging markets, technical complexity requiring specialized surgical training, and competition from alternative fixation methods including plate-and-screw constructs and external fixation systems. Innovation in implant design optimization and surgical instrumentation continues to influence product development and market expansion patterns.

The growing aging population is driving demand for specialized fixation solutions that address unique challenges including compromised bone quality, increased fracture complexity, and elevated surgical risk factors requiring implant designs with enhanced fixation security. Geriatric trauma applications require locking intramedullary nail systems that deliver reliable stability in osteoporotic bone while supporting early mobilization and reducing hospitalization duration. Orthopedic surgeons are increasingly recognizing the clinical advantages of locking intramedullary nail integration for elderly patient management and fragility fracture treatment, creating opportunities for implant designs specifically engineered for low bone density scenarios and patient populations requiring optimized fixation performance.

Modern locking intramedullary nail system manufacturers are incorporating computer navigation compatibility and robotic surgery integration to enhance surgical precision, optimize nail placement, and support comprehensive preoperative planning through digital imaging analysis and intraoperative guidance systems. Leading companies are developing implant systems with navigation-compatible instrumentation, implementing reference array attachment points, and advancing surgical technique protocols that enable precise nail insertion and accurate locking screw placement. These technologies improve surgical outcomes while enabling new clinical capabilities, including minimally invasive approaches for complex anatomical regions, computer-optimized screw trajectories, and real-time procedural verification. Advanced technology integration also allows surgeons to support comprehensive outcome optimization objectives and surgical excellence beyond traditional fluoroscopy-guided techniques.

The expansion of personalized medicine approaches and increasing availability of 3D printing technologies is driving development of patient-specific locking intramedullary nail designs with customized anatomical contours and optimized mechanical properties. These advanced applications require sophisticated imaging analysis and additive manufacturing capabilities that enable production of implants matching individual patient anatomy, creating premium market segments with differentiated value propositions. Manufacturers are investing in 3D printing technologies and patient-specific planning software to serve complex fracture cases requiring customized solutions while supporting innovation in deformity correction, malunion treatment, and anatomically challenging fracture patterns.

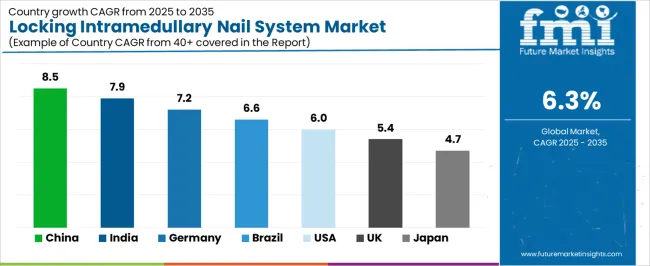

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| United States | 6.0% |

| United Kingdom | 5.4% |

| Japan | 4.7% |

The market is experiencing solid growth globally, with China leading at an 8.5% CAGR through 2035, driven by expanding orthopedic trauma care infrastructure, growing road traffic accident rates, and increasing adoption of advanced fracture fixation technologies in tertiary hospitals. India follows at 7.9%, supported by rising trauma incidence, expanding private hospital networks, and increasing access to modern orthopedic surgical procedures. Germany shows growth at 7.2%, emphasizing orthopedic surgical excellence, trauma care leadership, and comprehensive health insurance coverage for advanced implant technologies. Brazil demonstrates 6.6% growth, supported by trauma care infrastructure development, growing orthopedic specialty services, and increasing adoption of modern fixation systems. The United States records 6.0%, focusing on established trauma networks, comprehensive Medicare coverage, and advanced orthopedic surgical capabilities. The United Kingdom exhibits 5.4% growth, emphasizing National Health Service trauma care pathways and orthopedic surgery standards. Japan shows 4.7% growth, supported by aging population trauma needs and established orthopedic implant market maturity.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

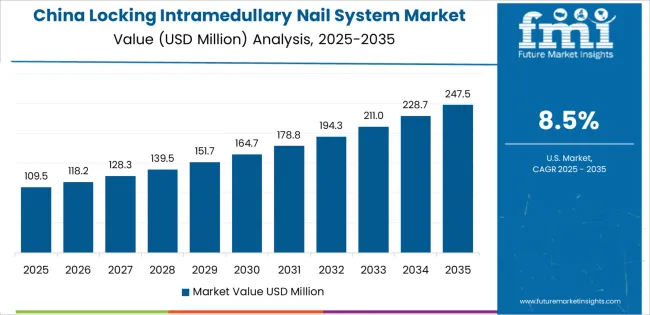

China is projected to exhibit exceptional growth with a CAGR of 8.5% through 2035, driven by expanding orthopedic trauma care infrastructure and rapidly growing healthcare capabilities supported by government healthcare reform initiatives and medical facility modernization programs. The country's large trauma patient population and increasing investment in advanced orthopedic technologies are creating substantial demand for locking intramedullary nail solutions. Major orthopedic device manufacturers and international companies are establishing comprehensive production and distribution capabilities to serve both domestic markets and regional opportunities.

Revenue from locking intramedullary nail systems in India is expanding at a CAGR of 7.9%, supported by the country's rising trauma incidence, expanding private hospital networks, and increasing access to modern orthopedic surgical procedures among urban and semi-urban populations. The country's comprehensive healthcare development programs and growing surgical capabilities are driving demand for locking intramedullary nail solutions throughout diverse hospital settings. Leading orthopedic device companies are establishing distribution networks and surgical training programs to address growing demand.

Germany is expanding at a CAGR of 7.2%, supported by the country's orthopedic surgical excellence, trauma care leadership, and comprehensive health insurance coverage for advanced implant technologies. The nation's medical expertise and quality standards are driving sophisticated locking intramedullary nail implementations throughout hospital systems. Leading orthopedic device manufacturers are investing extensively in clinical research and product development for German market requirements.

Brazil is expanding at a CAGR of 6.6%, supported by the country's trauma care infrastructure development, growing orthopedic specialty services, and increasing adoption of modern fixation systems. Brazil's healthcare system expansion and rising surgical volumes are driving demand for locking intramedullary nail technologies. Orthopedic device distributors and surgical equipment suppliers are investing in market development to serve both public and private healthcare sectors.

The United States is expanding at a CAGR of 6.0%, supported by the country's established trauma networks, comprehensive Medicare coverage, and advanced orthopedic surgical capabilities. The nation's mature healthcare infrastructure and innovation focus are driving demand for sophisticated locking intramedullary nail technologies. Orthopedic device manufacturers are investing in clinical evidence generation and surgeon education to support market expansion.

The United Kingdom is expanding at a CAGR of 5.4%, supported by the country's National Health Service trauma care pathways, orthopedic surgery standards, and comprehensive implant evaluation frameworks. The UK's centralized healthcare system and evidence-based practice focus are driving structured adoption of locking intramedullary nail technologies. Orthopedic device suppliers are establishing clinical evidence packages and health economics data to support NHS procurement.

Japan is expanding at a CAGR of 4.7%, supported by the country's aging population trauma needs, established orthopedic implant market, and comprehensive health insurance system. Japan's healthcare sophistication and quality focus are driving demand for high-specification locking intramedullary nail products. Orthopedic device manufacturers are investing in product development for Japanese regulatory requirements and clinical preferences.

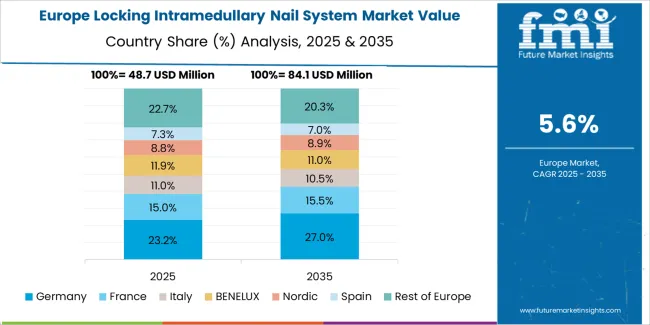

The locking intramedullary nail system market in Europe is projected to grow from USD 69.6 million in 2025 to USD 129.6 million by 2035, registering a CAGR of 6.4% over the forecast period. Germany is expected to maintain leadership with a 28.7% market share in 2025, moderating to 28.4% by 2035, supported by orthopedic surgical excellence, trauma care leadership, and comprehensive health insurance coverage.

France follows with 19.4% in 2025, projected at 19.6% by 2035, driven by trauma care networks, orthopedic surgery capabilities, and comprehensive healthcare reimbursement. The United Kingdom holds 17.0% in 2025, expected to reach 16.7% by 2035 due to NHS trauma care pathways and orthopedic surgery standards. Italy commands 13.4% in 2025, rising slightly to 13.6% by 2035, while Spain accounts for 10.1% in 2025, reaching 10.3% by 2035 aided by trauma care development and orthopedic service expansion. The Netherlands maintains 4.7% in 2025, up to 4.8% by 2035 due to advanced trauma care systems and orthopedic innovation. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.7% in 2025 and 6.6% by 2035, reflecting steady development in trauma care infrastructure, orthopedic surgery capabilities, and advanced implant technology adoption.

The market is characterized by competition among established orthopedic device manufacturers, specialized trauma fixation companies, and regional medical device producers. Companies are investing in anatomical nail design optimization, biomaterial development, surgical instrumentation enhancement, and surgeon education programs to deliver biomechanically superior, surgically efficient, and clinically validated locking intramedullary nail solutions. Innovation in patient-specific implants, computer navigation compatibility, and minimally invasive instrumentation is central to strengthening market position and competitive advantage.

Acumed leads the market with comprehensive orthopedic trauma solutions focusing on innovative nail designs, anatomical contouring, and surgical technique development across diverse fracture applications. Beijing Zhongan Taihua Technology Co., Ltd. provides specialized orthopedic implants with focus on Chinese market requirements and cost-effective solutions. You Better delivers orthopedic fixation products with focus on regional markets and product accessibility. Xiamen Zhonkexing Medical Equipment Co., Ltd. offers comprehensive orthopedic implant systems with focus on quality manufacturing. Zimede specializes in orthopedic trauma products for emerging markets. B Braun provides integrated surgical solutions with comprehensive orthopedic implant portfolios.

Additional market participants include Ideal Medical, Double Medical Technology Inc., Lepu Medical, BioMedtrix, Zimmer Biomet, DePuy Synthes, Czmeditecxl, Stryker, and Smith+Nephew, each contributing specialized expertise in orthopedic trauma technologies, surgical innovation, and clinical application solutions.

Locking intramedullary nail systems represent a specialized orthopedic implant category within trauma care and fracture management applications, projected to grow from USD 199.9 million in 2025 to USD 368.3 million by 2035 at a 6.3% CAGR. These advanced fixation devices, providing angular stability through interlocking screw mechanisms for long bone fracture treatment, serve as critical implants in orthopedic trauma surgery, emergency fracture care, and elective orthopedic procedures where biomechanical stability, early patient mobilization, and reliable bone healing are paramount. Market expansion is driven by increasing trauma incidence, growing geriatric fracture cases, expanding minimally invasive surgical adoption, and rising demand for advanced fixation technologies across diverse hospital trauma centers, orthopedic specialty clinics, and surgical care facilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 199.9 million |

| Material Type | Titanium Alloy, Stainless Steel, Other |

| Application | Hospital, Clinic |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Acumed, Beijing Zhongan Taihua Technology Co., Ltd., You Better, Xiamen Zhonkexing Medical Equipment Co., Ltd., Zimede, B Braun |

| Additional Attributes | Dollar sales by material type and application category, regional demand trends, competitive landscape, technological advancements in anatomical nail design, biomaterial development, minimally invasive instrumentation, and computer navigation integration |

The global locking intramedullary nail system market is estimated to be valued at USD 199.9 million in 2025.

The market size for the locking intramedullary nail system market is projected to reach USD 368.3 million by 2035.

The locking intramedullary nail system market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in locking intramedullary nail system market are titanium alloy, stainless steel and other.

In terms of application, hospital segment to command 79.8% share in the locking intramedullary nail system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Locking Pliers Market Size and Share Forecast Outlook 2025 to 2035

Flocking Tape Market Size, Share & Forecast 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Interlocking Boxes Market Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Interlocking Boxes

Self-Locking Nuts Market

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Water Blocking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Self - Locking Trays Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Blocking Glasses Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Child Resistant Locking Pouches Market from 2025 to 2035

Demand for Metal Locking Plate and Screw System in USA Size and Share Forecast Outlook 2025 to 2035

Revolutionary Moisture Locking Systems Market Size and Share Forecast Outlook 2025 to 2035

Intramedullary Osteosarcoma Treatment Market - Growth & Forecast 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA