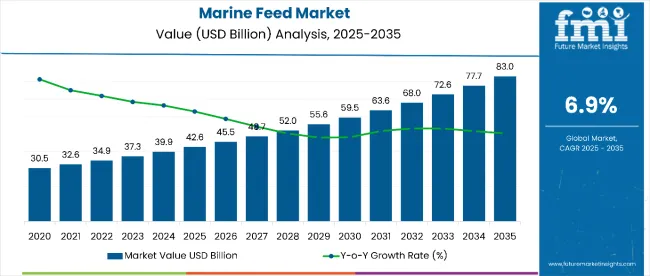

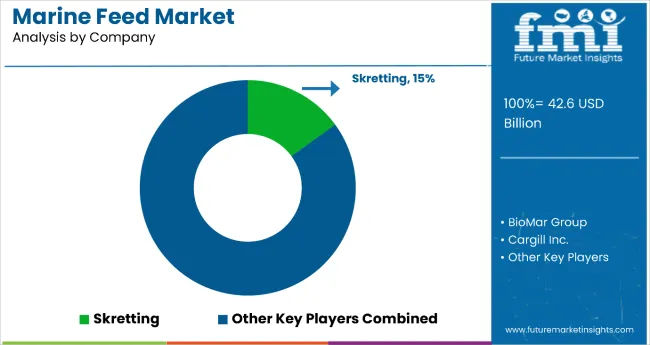

The marine feed market is estimated to be valued at USD 42.6 billion in 2025 and is projected to reach USD 83.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 40.4 billion during 2025 to 2035.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 42.6 billion |

| Market Forecast Value in (2035F) | USD 83.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

This reflects a growth at a healthy compound annual growth rate of 6.9%. Market evolution is expected to be shaped by rising seafood consumption, aquaculture intensification, and demand for nutritionally efficient feed formulations.

By 2030, the market is likely to reach approximately USD 59.5 billion, representing an incremental value of USD 18.4 billion in the first half of the decade. The remaining USD 22.0 billion is expected to be generated during the second half, suggesting a balanced but slightly back-loaded growth pattern. Overall, the market is projected to add an absolute dollar opportunity of USD 40.4 billion between 2025 and 2035. Product adoption is gaining traction due to the efficiency of formulated feeds in improving fish and crustacean yields, alongside rising attention toward sustainable aquaculture practices.

Companies such as Skretting, BioMar Group, Cargill Inc., Aller Aqua, and Zeigler Bros., Inc. are advancing their competitive positions through investment in feed innovation, sustainable raw material sourcing, and scalable aquaculture solutions. Innovation-led production and distribution models are driving expansion into functional fish diets, specialty formulations for crustaceans and mollusks, and eco-responsible aquafeed systems. Market performance will remain anchored in nutritional efficiency, regulatory compliance, species-specific customization, and sustainable sourcing benchmarks.

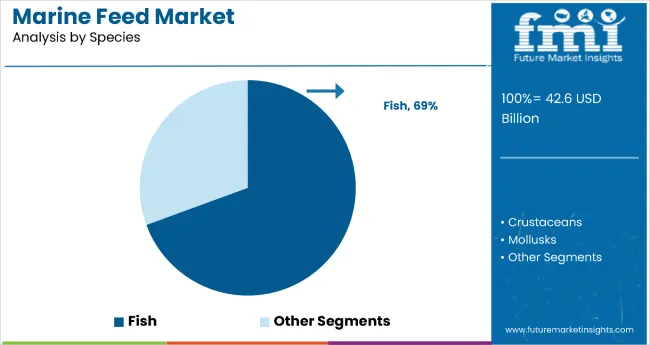

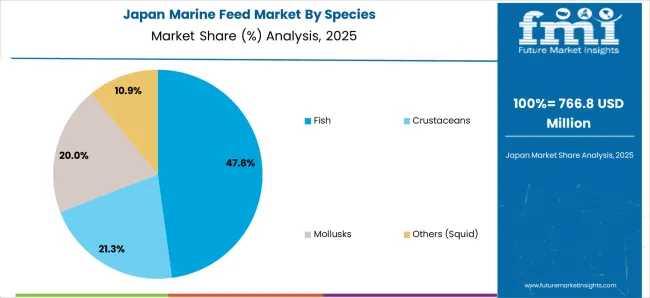

The market holds a significant share of the global aquafeed industry, supported by its role in enhancing aquaculture productivity and meeting rising seafood demand. Fish accounts for nearly 69% of the marine feed segment, reflecting its dominance in providing balanced nutrition for aquaculture production.

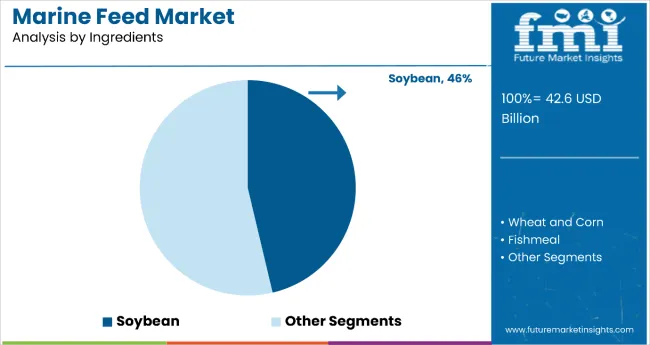

The market contributes around 46% of total feed formulations through soybean inclusion, highlighting its reliance on plant-based proteins. In terms of feed form, pellets capture 62.7% share, driven by their efficiency in feed conversion and ease of handling. The distribution landscape is led by business-to-business channels with a 52.8% share, indicating bulk sales to aquaculture producers and feed distributors.

The market is undergoing structural transformation driven by sustainability concerns, species-specific feed innovations, and increasing adoption of alternative protein sources such as algae, krill meal, and microalgae. Advanced formulation technologies have improved nutrient digestibility, reduced environmental impact, and optimized growth performance in fish, crustaceans, and mollusks. Manufacturers are introducing eco-friendly feed solutions, precision nutrition, and species-tailored formulations that support the expansion of global aquaculture production.

Rising global demand for seafood, coupled with the rapid expansion of aquaculture, is driving growth in the marine feed market. Fish and other marine species require nutritionally balanced feed to enhance growth rates, improve disease resistance, and optimize yields, making high-quality feed essential for sustainable aquaculture practices.

Increasing focus on food security, protein demand, and sustainable fisheries management is further propelling market adoption. Regulatory support for responsible aquaculture, along with innovations in feed formulations using alternative proteins such as algae, krill meal, and microalgae, are enhancing both nutritional value and environmental sustainability.

As seafood consumption rises in emerging economies and advanced farming practices expand in mature markets, the outlook for marine feed remains highly favorable. With producers and governments prioritizing efficiency, eco-friendly solutions, and species-specific nutrition, the marine feed market is well-positioned to expand across global aquaculture systems.

The market is segmented by species, ingredients, form, distribution channel, and region. By species, the market is segmented into fish, crustaceans, mollusks, and others (squid). Based on ingredients, the market is divided into soybean, wheat and corn, fishmeal, fish oil, krill meal, shrimp meal, squid meal, algae and microalgae, seaweed and seagrass, and others (spirulina, yeast).

In terms of form, the market is categorized into pellets, powder, granules, and flakes. By distribution channel, the market is bifurcated into business-to-business and business-to-consumer. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The fish segment is the most dominant and lucrative category in the global marine feed market, commanding a significant 69% market share in 2025. This overwhelming share reflects the central role of fish in global aquaculture production, which has become the fastest-growing food production sector in the world.

With aquaculture surpassing capture fisheries in meeting global seafood demand, feed designed specifically for farmed fish has emerged as the backbone of the marine feed industry. The segment’s dominance stems from its economic scale, diverse species demand, and the continuous innovation in feed formulations aimed at maximizing efficiency, sustainability, and profitability.

Fish represents the single largest contributor to global animal protein consumed from aquatic systems. Popular farmed species include salmon, carp, tilapia, catfish, and trout, each requiring tailored feed blends to ensure rapid growth and high feed conversion ratios (FCR). Unlike crustaceans and mollusks, which are niche or regionally concentrated, fish farming is globally distributed and serves both high-value and mass-market protein needs.

Soybean, accounting for 46% market share, is the most dominant ingredient in the marine feed industry. Its popularity stems from high protein content, affordability, and wide availability compared to traditional fishmeal. As aquaculture grows, soybean meal has become the preferred plant-based protein substitute, particularly in fish feed, where balanced amino acids support rapid growth and strong feed conversion ratios. Soy proteins are also used in crustacean diets, reducing dependency on costly marine ingredients.

The shift toward sustainability is further boosting soybean’s demand, as producers seek to lower reliance on wild-caught fishmeal and fish oil. Advances in processing technologies, such as enzyme treatments and fermentation, have enhanced digestibility and reduced anti-nutritional factors in soybean meal, making it more efficient for aquafeeds. Supported by stable global production and lower price volatility, soybean will continue driving profitability in marine feed, positioning itself as the cornerstone ingredient for future sustainable aquaculture expansion.

From 2025 to 2035, the market is shaped by the rising demand for sustainable aquaculture solutions. Health-conscious consumers seeking responsibly farmed seafood are pushing producers to adopt feeds made with alternative proteins, traceable ingredients, and eco-friendly formulations. This trend benefits feed manufacturers offering innovative, high-performance solutions that reduce dependency on traditional fishmeal and fish oil while maintaining growth and nutritional quality.

Sustainable Protein Shift Drives Marine Feed Market Growth

The growing shift toward sustainable and plant-based proteins has emerged as the primary catalyst for growth in the marine feed market, with soybean and other alternative sources steadily replacing conventional fishmeal and fish oil. By 2024, regulatory pressure and retailer-driven sustainability standards accelerated the move toward eco-friendly feed inputs. By 2025, aquaculture developers were expected to expand the use of plant-based and novel proteins across fish, crustaceans, and mollusks, where feed conversion and animal health remain decisive factors in profitability.

These developments show that scientifically proven outcomessuch as faster growth, improved immunity, and reduced wasterather than marketing trends, are fueling market expansion. Suppliers offering standardized, traceable, and eco-certified feed formulations are positioned to capture growing demand from both global aquaculture leaders and regional producers.

Value-Added Feed Innovation Creates Market Opportunities

Manufacturers began focusing on advanced feed technologies to create multifunctional formulations that enhance digestibility, nutrient absorption, and water quality management while meeting sustainability requirements. By 2025, innovative formats such as specialized hatchery powders, functional grower pellets, and fortified blends were being introduced, improving performance across diverse farming systems.

These developments show that when processing innovation is combined with sustainable ingredient adoption, acceptance and applications expand across aquaculture. Companies investing in novel proteins, functional additives, and precision-engineered feed formats are well-positioned to capture expanding opportunities as the market moves toward long-term growth.

| Countries | CAGR(%) |

|---|---|

| UK | 10.3% |

| India | 8.5% |

| China | 7.9% |

| Japan | 7.3% |

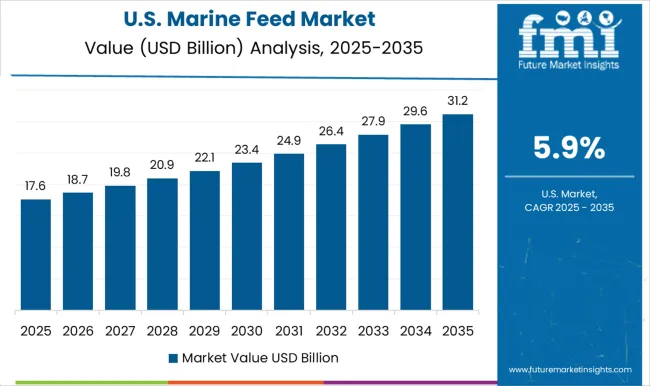

| USA | 6.2% |

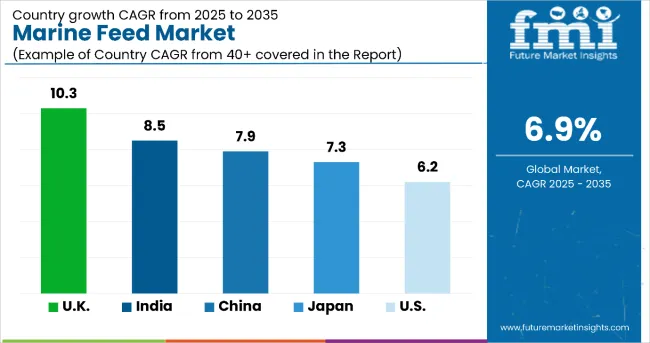

The market demonstrates varied growth across key countries, reflecting distinct aquaculture strengths and priorities. The UK leads with the highest CAGR of 10.3%, supported by modern aquaculture systems, salmon farming, and strong sustainability adoption. India follows at 8.5%, benefiting from its leadership in shrimp farming, rising exports, and government-led feed modernization initiatives.

China, the largest aquaculture producer, is projected at 7.9% CAGR, driven by its scale in carp, tilapia, and shrimp, alongside shifts toward soy- and algae-based feeds. Japan, expanding at 7.3%, emphasizes premium fish species, advanced R&D, and technological integration to sustain high-value aquaculture growth. The USA, at 6.2% CAGR, is propelled by sustainable aquafeed demand, growing adoption of alternative proteins, and regulatory support for marine resource efficiency.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The UK marine feed market is projected to grow at a CAGR of 10.3% during the forecast period. Strong aquaculture expansion, driven by salmon and trout farming, continues to increase demand for specialized marine feed formulations.

The UK is also focusing on sustainable fishmeal substitutes, including algae-based proteins and plant-derived alternatives. Advanced feed technologies and government-supported sustainability regulations are shaping industry dynamics. Export opportunities across Europe strengthen its position as a leading producer. Furthermore, growing R&D in alternative marine proteins is ensuring reduced dependence on traditional fishmeal. The country’s modern aquaculture infrastructure further supports adoption of high-performance marine feed blends.

Revenue from marine feed in India is projected to grow at a CAGR of 8.5% during the forecast period. India’s aquaculture sector, especially shrimp and carp farming, forms the backbone of feed demand. With its position as a leading shrimp exporter, India requires consistent marine feed supply chains.

Local feed mills are expanding capacity, while international companies are entering the market through joint ventures. Government schemes supporting aquaculture modernization further encourage feed innovation. Rising domestic seafood consumption also fuels demand for nutrient-rich feed formulations. India’s diverse climatic zones support varied aquaculture species, strengthening the need for customized marine feed.

Demand for marine feed in China is projected to grow at a CAGR of 7.9% during the forecast period. As the world’s largest aquaculture producer, China represents a massive market for marine feed. Demand is driven by carp, tilapia, shrimp, and shellfish farming, along with growing focus on high-value species.

China is transitioning towards sustainable feed practices, with greater use of microalgae, seaweed, and soy protein concentrates. Government policies emphasizing food security and reduced overfishing further stimulate feed innovation. Rapid urbanization and rising incomes are fueling seafood consumption domestically. The presence of leading feed producers enhances scalability of sustainable marine feed formulations.

Sales of marine feed in Japanare projected to grow at a CAGR of 7.3% during the forecast period. Japan’s aquaculture sector emphasizes premium fish species such as tuna, yellowtail, and sea bream, requiring highly specialized marine feed. The country invests heavily in advanced aquafeed R&D, with strong focus on reducing environmental impacts.

Technology adoption, including precision feeding systems and alternative protein integration, plays a key role. Japan’s seafood consumption culture remains strong, sustaining steady demand for feed. The government supports marine sustainability initiatives, encouraging reduced fishmeal dependency. High consumer expectations for quality further shape feed innovations in the Japanese market.

Sales of marine feed in the USA are projected to grow at a CAGR of 6.2% during the forecast period. Growth is fueled by rising aquaculture activities, particularly in salmon, catfish, and shellfish farming. The USA is focusing on sustainable feed practices, incorporating alternative protein sources like algae, insect meal, and plant-based proteins.

Technological innovations in feed conversion efficiency strengthen competitiveness. Domestic seafood demand and rising imports also support market growth. USA companies are actively investing in eco-friendly feed technologies, aligning with strict environmental regulations. Strategic partnerships between global feed producers and local aquaculture farms further enhance industry development.

The market is moderately consolidated, with leading suppliers competing through innovation, sustainable sourcing, and application-specific expertise. Companies such as Cargill, Skretting (Nutreco), and BioMar Group dominate the premium aquafeed segment, leveraging advanced R&D and digital platforms to design high-performance marine feed formulations that enhance growth rates, feed conversion ratios, and fish health while aligning with sustainability and traceability requirements. Their strength lies in developing patented feed technologies and omega-rich formulations tailored for salmon, shrimp, and marine fish farming.

ADM and Aller Aqua focus on scalable feed solutions across diverse aquaculture species, addressing rising demand for protein-rich, functional, and environmentally responsible marine feed. Their competitive advantage comes from extensive formulation expertise and wide distribution networks catering to multinational aquaculture producers and regional feed distributors.

Regional innovators such as Avanti Feeds (India) and Tongwei Co., Ltd. (China) emphasize localized sourcing and cost-efficient production, delivering high-quality feed solutions for rapidly expanding aquaculture industries in Asia. These players leverage regional expertise, government partnerships, and sustainability certifications to strengthen their market position while meeting evolving regulatory and consumer-driven demands for safe and eco-friendly marine feed.

Key Developments in the Marine Feed Market

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 42.6 billion |

| Species | Fish, Crustaceans, Mollusks, Others (Squid) |

| Ingredients | Soybean, Wheat and Corn, Fishmeal, Fish Oil, Krill Meal, Shrimp Meal, Squid Meal, Algae and Microalgae, Seaweed and Seagrass, Others (Spirulina, Yeast) |

| Form | Pellets, Powders, Granules, And Flakes |

| Distribution Channel | Business-to-Business and Business-to-Consumer |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Cargill, Inc., Zeigler Bros., Inc., Archer Daniels Midland, Alltech Inc., Sonac B.V., BioMar Group, Nutreco N.V., Biomin Holding GmbH, Ridley Corp. Ltd, Others (On Additional Request), Skretting AS, Aller Aqua A/S |

| Additional Attributes | Dollar sales by feed type and application sector, rising adoption of sustainable and functional aquafeed, increasing demand for high-protein formulations, advancements in bio-based and algae-derived feed ingredients, strong growth in Asia-Pacific aquaculture, evolving regulations around marine feed sustainability |

The global marine feed market is estimated to be valued at USD 42.6 billion in 2025.

The market size for the marine feed market is projected to reach USD 83.0 billion by 2035.

The marine feed market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in marine feed market are fish, crustaceans, mollusks and others (squid).

In terms of ingredients, soybean meal segment to command 32.8% share in the marine feed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA