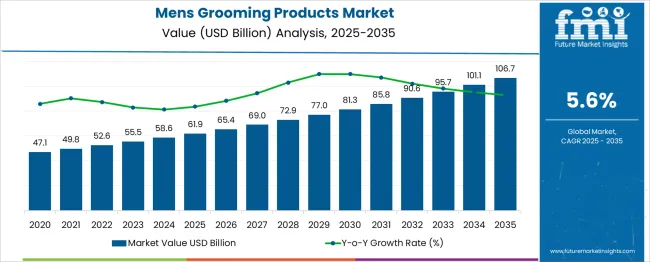

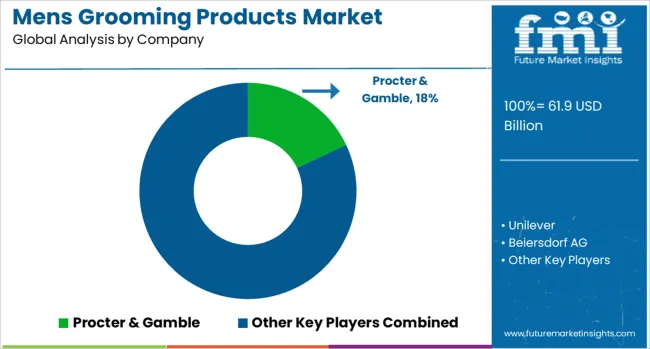

The Men’s Grooming Products Market is estimated to be valued at USD 61.9 billion in 2025 and is projected to reach USD 106.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. Two key inflection points are identified during this period. The first occurs in 2029 when the market surpasses USD 77.0 billion. This phase is expected to see stronger uptake of premium grooming products and increased demand for customized skincare and haircare.

Growth in online retail and targeted digital campaigns aimed at younger male consumers is projected to contribute to this expansion. The second inflection point is anticipated by 2033, as the market exceeds USD 95.7 billion. At this stage, innovation in natural formulations and multifunctional grooming products is forecasted to influence consumer preferences.

Increased penetration into emerging regions with rising male grooming awareness is also likely to drive value growth. Between these points, the adoption of environmentally friendly packaging and technology-enabled grooming tools is expected to impact market dynamics. These shifts indicate a move toward higher-value segments and broader geographic coverage, shaping competitive positioning through 2035.

| Metric | Value |

|---|---|

| Men’s Grooming Products Market Estimated Value in (2025 E) | USD 61.9 billion |

| Men’s Grooming Products Market Forecast Value in (2035 F) | USD 106.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

Shift has been driven by rising disposable incomes, expanding awareness of grooming routines, and a broader acceptance of skincare and cosmetic products among men across both developed and emerging economies. A growing influence of social media, celebrity endorsements, and the normalization of self-care have reshaped traditional perceptions, prompting demand for specialized grooming solutions.

Brands have responded with tailored formulations, inclusive marketing strategies, and digital-first retail experiences, further accelerating market penetration. The emphasis on clean-label ingredients, dermatologically tested formulations, and functional benefits has positioned grooming products as essentials rather than luxuries.

Looking ahead, the market is expected to gain additional traction from urbanization trends, evolving fashion consciousness, and a sustained focus on holistic wellness. These factors are projected to support continuous innovation and deeper category engagement across product lines and demographics..

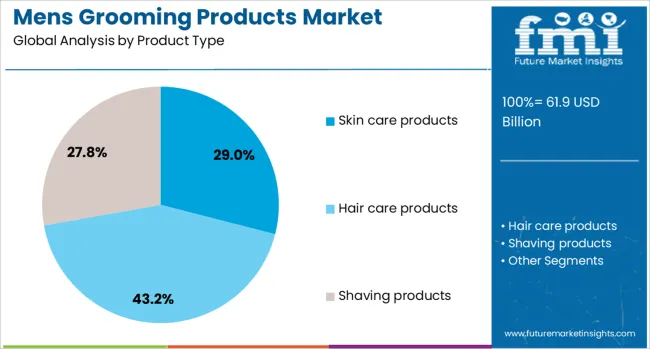

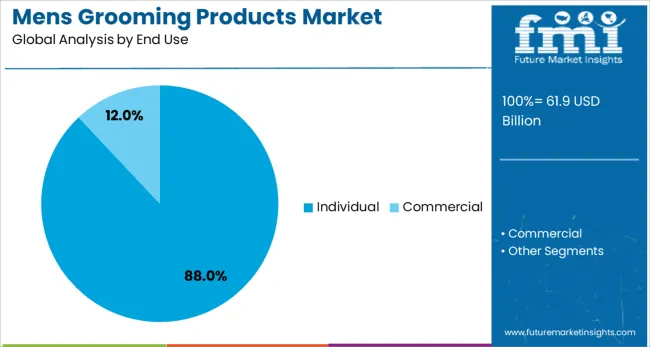

The men’s grooming products market is segmented by product type, end use, price range, distribution channel, and geographic regions. By product type, the men’s grooming products market is divided into Skin care products, Hair care products, shaving products, Razors & blades, and other product types. In terms of end use, the men’s grooming products market is classified into Individual and Commercial.

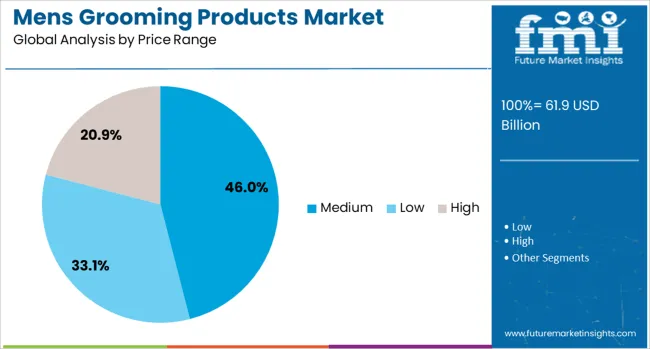

Based on the price range, the men’s grooming products market is segmented into Medium, Low, and High. The distribution channel of the men’s grooming products market is segmented into offline and online. Regionally, the men’s grooming products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The skin care products segment is projected to account for 29% of the Mens Grooming Products market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by a heightened awareness among male consumers regarding skin health, aging concerns, and daily personal care routines. Increasing product availability, especially those formulated specifically for male skin types, has reinforced demand across geographies.

The segment has also been supported by the introduction of multi-functional products that combine hydration, sun protection, and anti-fatigue benefits, simplifying skincare routines for men. The influence of social trends encouraging self-care has further boosted regular usage of moisturizers, face washes, serums, and sunscreens.

This behavioral shift has translated into higher repeat purchase rates and brand loyalty. Retail expansion through e-commerce platforms and specialty grooming outlets has ensured broader accessibility, while educational campaigns have bridged knowledge gaps regarding skin care best practices, reinforcing the dominant position of this product type in the overall market..

The individual segment is estimated to hold 88% of the Mens Grooming Products market revenue share in 2025, establishing its dominance in terms of end use. This leadership position has been reinforced by increasing personal awareness and autonomy in grooming decisions among male consumers. A growing cultural shift toward self-maintenance and the desire for a polished appearance in both personal and professional settings have driven this segment’s growth.

Direct-to-consumer models, personalized grooming routines, and the proliferation of grooming tutorials have empowered individuals to explore and adopt a wide range of products independently. Subscription services, mobile applications, and AI-powered skin assessments have also contributed to higher product engagement at the individual level.

The preference for convenience and privacy in purchasing and using grooming products has reduced reliance on professional services, supporting stronger growth in this category. As self-care continues to gain cultural importance, the individual end-use segment is expected to remain the primary driver of market expansion..

The medium price range segment is expected to contribute 46% of the Mens Grooming Products market revenue share in 2025, marking it as the most preferred pricing tier. This segment's strength lies in its balance between affordability and product efficacy, catering to a broad spectrum of consumers seeking quality grooming solutions without premium pricing. Brands operating in this range have successfully introduced dermatologist-tested, performance-driven formulations that resonate with urban and middle-class consumers.

Demand has also been reinforced by the increasing willingness of men to invest in personal care products that offer visible results and align with their lifestyle aspirations. Accessibility through both retail and online channels has widened reach, while promotional campaigns and bundled offerings have further increased value perception.

The medium price tier has emerged as the sweet spot for consumers prioritizing both function and budget, making it the central focus of brand competition. As grooming habits mature, this segment is projected to sustain consistent growth across age groups and regions..

The men's grooming products market has grown steadily due to increasing awareness of personal care among male consumers. Shifts in cultural norms and rising urban populations have broadened acceptance of grooming routines. Diverse products such as skincare, haircare, shaving essentials, and fragrances are increasingly sought. Digital marketing and influencer engagement have amplified consumer education. Innovation in product formulations and eco-conscious packaging also contribute to appeal. Market expansion is supported by enhanced distribution through online and offline channels, enabling wider accessibility for various consumer segments worldwide.

Consumer behavior is being reshaped by evolving attitudes towards grooming and wellness. A growing number of men now seek multifunctional and natural products that address specific needs like anti-aging, acne control, and hydration. Preference for organic and cruelty-free formulations has increased by over 20% in recent years. Social media trends and celebrity endorsements have further influenced male grooming habits, leading to greater experimentation with new products. The demand for convenience, including easy-to-use packaging and quick application, has driven innovation. Brands focusing on personalized solutions and transparency in ingredients have gained market traction, reflecting a shift toward wellness-focused lifestyles.

Technological advancements have enhanced product quality and variety in men’s grooming. New formulations incorporating peptides, vitamins, and botanical extracts target skin and hair issues more effectively. Innovations such as sulfate-free shampoos and moisturizers with SPF have gained traction. Grooming devices including electric shavers, beard trimmers, and skincare tools equipped with smart sensors have improved user experience and precision. These devices are increasingly integrated with mobile apps to customize grooming routines. Additionally, packaging innovations promoting recyclability and refillability address growing environmental concerns. The continuous investment in R&D has resulted in a diverse product portfolio that meets the expectations of health-conscious consumers.

The men’s grooming products market benefits from expanding distribution networks encompassing traditional retail, specialty stores, and e-commerce. Online sales channels have grown by approximately 25% year-over-year, driven by increased smartphone usage and consumer preference for home delivery. Subscription-based models have gained popularity, offering curated grooming kits tailored to individual needs. Brick-and-mortar stores maintain importance through in-person consultation and brand experience. Emerging markets have witnessed growth in retail infrastructure, improving product accessibility. Partnerships between brands and local distributors have further extended reach. This omnichannel distribution strategy ensures product availability across diverse demographics and geographies, supporting sustained market expansion.

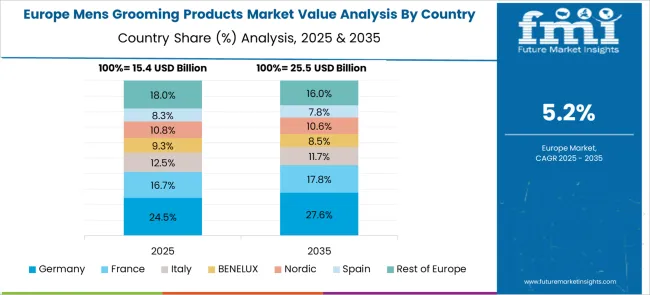

Regional differences affect the men’s grooming products market with mature markets like North America and Europe exhibiting high penetration due to widespread consumer awareness and sophisticated retail systems. These regions account for over 55% of global market share. Asia-Pacific markets are experiencing accelerated growth driven by rising urban middle-class populations and changing social perceptions of male grooming. Latin America and Middle East & Africa show moderate adoption rates with increasing influence from Western grooming trends. Regulatory environments and economic conditions shape product availability and consumer behavior across regions. Growing digital connectivity and localized marketing efforts are helping brands tailor offerings to regional preferences, contributing to diversified market growth.

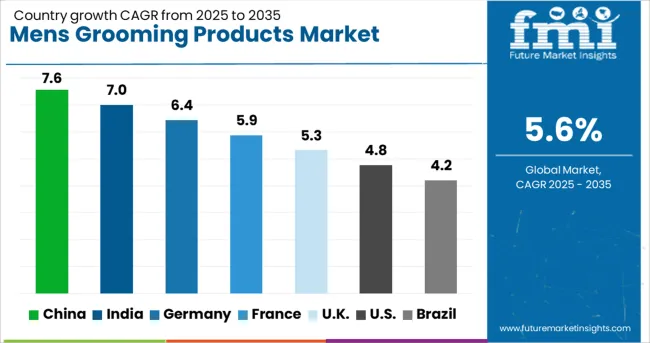

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

Global demand for mens grooming products is projected to grow at a CAGR of 5.6% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads at 7.6%, followed by India at 7.0%, Germany at 6.4%, the United Kingdom at 5.3%, and the United States at 4.8%. These figures indicate a +36% premium for China over the baseline, with India and Germany posting above-average growth at +25% and +14% respectively. The UK remains close to global growth, trailing by –5%, while the US records a slower expansion at –14%. Rising demand in China and India is linked to evolving grooming habits and product innovation, whereas mature markets show incremental gains influenced by shifting male consumer preferences. The report covers detailed analysis of 40+ countries, with top five referenced.

China is forecast to grow at a CAGR of 7.6% in the mens grooming products market through 2035. The growth is driven by expanding product adoption in urban and semi-urban regions, supported by rising awareness of male-specific skincare and haircare products. Leading domestic brands such as Herborist and Pechoin have increased focus on natural ingredient formulations tailored for men. Online retail platforms are crucial for distribution, enabling access to younger consumers. Furthermore, marketing campaigns targeted at millennials and Gen Z have enhanced brand visibility and product trial. Rising disposable spending on personal care contributes to increasing market penetration.

India is projected to register a CAGR of 7.0% in the mens grooming products market between 2025 and 2035. Market expansion is supported by rising acceptance of grooming routines beyond basic shaving and haircare. Brands like Bombay Shaving Company and Beardo have enhanced product portfolios with premium beard oils, face washes, and styling gels. Urban centers show increased penetration, with metro areas leading demand. Growing male grooming salons and spas complement product sales. Social media influence and celebrity endorsements have accelerated brand awareness. Supply chain improvements have facilitated broader retail reach in both offline and online channels.

The United Kingdom is forecast to grow at a CAGR of 5.3% in the mens grooming products market through 2035. Growth drivers include rising interest in grooming trends and premium product offerings in skincare and haircare. Brands such as Bulldog Skincare and Murdock London focus on natural ingredients and ethical sourcing, gaining traction among environmentally aware consumers. Online channels remain vital for distribution. Barbershops and grooming lounges contribute to product trial and repeat purchase. Growth is moderated by mature market dynamics and competition from unisex products. Awareness campaigns have targeted male consumers aged 25 to 45.

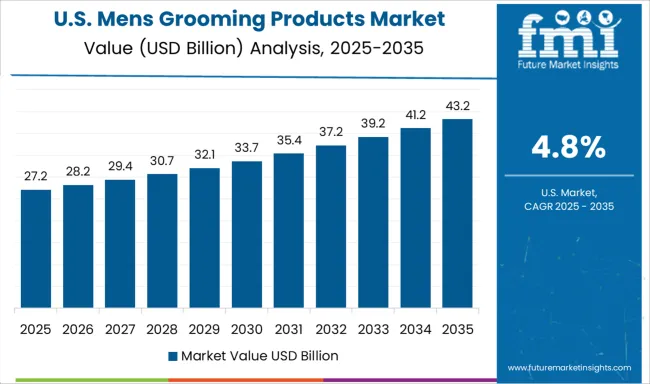

The United States is anticipated to grow at a CAGR of 4.8% in the mens grooming products market through 2035. Market growth is driven by increasing acceptance of advanced grooming routines and product innovation, especially in beard care and anti-aging segments. Key players such as Gillette and Baxter of California emphasize premium formulations and diverse product portfolios. Retail penetration spans mass merchandisers and e-commerce platforms. However, growth is moderated by saturation and competition from unisex skincare brands. Marketing efforts targeting younger demographics and multicultural consumers are increasing to support incremental growth.

Germany is expected to grow at a CAGR of 6.4% in the mens grooming products market through 2035. Demand is primarily driven by high standards for natural and organic formulations. Key players such as Nivea Men and Beiersdorf have introduced certified organic lines focusing on anti-aging and sensitive skin care. Retail penetration through drugstores and specialty cosmetic outlets remains strong. Consumer preferences show increased interest in multifunctional products. Collaborations with dermatologists and sustainability certifications have enhanced product credibility. Urban professionals and millennials constitute the major consumer base driving consistent growth.

Procter & Gamble has maintained a strong market presence through product innovation in shaving and skincare segments, with frequent launches under brands like Gillette targeting precision and comfort. Investment in R&D has focused on skin-friendly formulations and multi-functional grooming kits for modern male consumers. Unilever’s approach emphasizes expanding grooming ranges across personal care lines such as Axe and Dove Men+Care, supported by targeted digital marketing campaigns and strategic retail partnerships across emerging and mature markets.

Beiersdorf AG has concentrated on premium skincare for men with Nivea Men, combining product line extensions and regional customization to meet varied skin types. L’Oréal has enhanced its portfolio by incorporating anti-aging and styling products designed specifically for men, while broadening distribution through salons and e-commerce channels.

Edgewell Personal Care and Reckitt Benckiser have pursued acquisitions and product relaunches to strengthen their shaving and personal hygiene offerings. Philips focuses on electric grooming devices with ergonomic design improvements and battery longevity, targeting urban male segments.

Direct-to-consumer brands Harry’s Inc. and Dollar Shave Club leverage subscription models and affordable pricing to capture younger demographics. Marico Ltd. has expanded natural and herbal grooming solutions primarily for South Asian markets, driven by localized formulations and broad retail access.

Athlete-backed brands entered the market, offering accessible and eco-conscious grooming options, expanding the product range. Market value reached over USD 60 billion in 2024, reflecting rising demand for skincare, haircare, and shaving products among men. This growth is supported by changing grooming habits and a preference for products that combine effectiveness with environmental responsibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 61.9 Billion |

| Product Type | Skin care products, Hair care products, Shaving products, Razors & blades, and Other product types |

| End Use | Individual and Commercial |

| Price Range | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble, Unilever, Beiersdorf AG, L'Oréal, Edgewell Personal Care, Reckitt Benckiser, Philips, Harry's Inc., Dollar Shave Club, and Marico Ltd. |

| Additional Attributes | Dollar sales lead in skincare and shaving products, with North America holding the largest market share. Innovations include precision electric razors and beard care. Rising demand for natural formulations and men's makeup in Asia supports market growth globally. |

The global men’s grooming products market is estimated to be valued at USD 61.9 billion in 2025.

The market size for the men’s grooming products market is projected to reach USD 106.7 billion by 2035.

The men’s grooming products market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in men’s grooming products market are skin care products, _face wash, _moisturizers, _face mask, _other skin care products, hair care products, _shampoo & conditioners, _styling products, _hair colorants, _other hair care products, shaving products, _pre-shave, __shaving cream, __pre-shave oil, __shaving soap, __other pre-shave products, _post-shave, __after-shave, __balms, __other post-shave products, razors & blades and other product types.

In terms of end use, individual segment to command 88.0% share in the men’s grooming products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pet Grooming Market Trends - Size, Share & Forecast 2025 to 2035

Men's Grooming Product Market Size and Share Forecast Outlook 2025 to 2035

Beard Grooming Products Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Mobile Grooming Services Market Size and Share Forecast Outlook 2025 to 2035

UK Pet Grooming Market Analysis - Size, Demand & Forecast 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Menstrual Care Market - Size, Share, and Forecast Outlook 2025-2035

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Menstrual Cup Foam Wash Market Trends - Growth & Demand From 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA