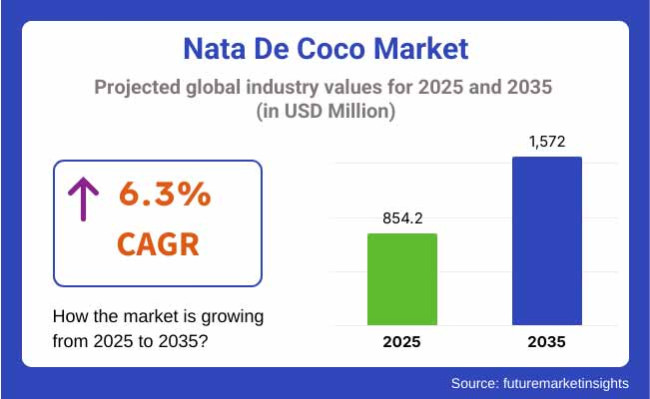

The total world market for nata de coco was USD 807.4 million in 2024. The nata de coco market grew in 2025, and hence the total world market would be USD 854.2 million in 2025. World sales over the forecast period (2025 to 2035) will be valued at a 6.3% CAGR, finally reaching USD 1,572.0 million in 2035.

Growing health awareness among consumers is one of the key drivers of nata de coco demand. It is a high-fiber, low-calorie food that is now a guilt indulgence for health-seeking consumers who need not feel guilty about it. Its versatility of applications is also its driving force - as a dessert topping, for drinks and functional foods.

Large companies are now incorporating these attributes in introducing new products that are responsive to changing trends in health and wellness. Rico Food Industries and Happy Jelly, for example, introduced fruit-flavored and low-sugar nata de coco versions of their products in a bid to win over today's healthy, savvy consumer.

Aside from its nutritional benefits, the culture of vegetarianness has also become a principal factor for nata de coco's popularity. With the news that it is now being sold as a vegan alternative to gelatin and other animal-derived gelatin-type thickeners, it is being used more and more in vegetable yogurts, jellies, and drinks.

The market also sees more convenient nata de coco packaging and pre-conversion nata de coco, driving nata de coco to be a formidable contender among time-conscious consumers. Aside from this, Western market demand for exotic desserts and Asia-Pacific launched products drives export that further employs Del Monte type firms in the package cup with nata de coco flavor. Overall, convenience, health, and flavor innovation convergence will propel the nata de coco industry over the next decade.

Changing consumer view of nata de coco as a functional superfood has contributed heavily to its popularity in the market. With more consumers questioning artificial ingredients, they turn towards natural, plant-based ingredients, and nata de coco is well placed in this regard. Companies like Happy Jelly are emphasizing their clean label strategy, natural fermentation, lack of artificial preservatives, and environmental-friendly packaging, thus winning consumer confidence and company loyalty.

The next table shows a comparative six-month variation in the CAGR between the base year (2024) and the current year (2025) for the overall nata de coco market worldwide. Here, it can be seen that there are significant changes in performance and trends in realizing revenue can be established, thus giving stakeholders a clearer picture of the growth trend during the period. The first half year (H1) is January-June. The second half, or H2, is July-December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.3% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 6.1% |

| H2 (2025 to 2035) | 6.3% |

In the first half (H1) of the decade between 2025 and 2035, the company is expected to increase at a rate of 5.3%, and afterwards at an improved rate of growth of 5.6% during the second half (H2) of the same period.

Shifting to the subsequent phase, between H1 2025 and H2 2035, the CAGR is likely to increase to 6.1% in the first half and be very high at 6.3% in the second half. In the first half (H1), the industry experienced a growth of 30 BPS, while in the second half (H2), the company experienced a decline of 20 BPS.

In Tier 1, the nata de coco market is characterized by a few established food & beverage manufacturers driving the bulk of revenue, distribution coverage, and brand presence throughout Asia-Pacific and in export markets. These corporations are typically vertically integrated and possess significant manufacturing scale, sourcing capabilities, and product development for many end-use sectors including beverages, dairy, and confection.

Warehouses producing nata de coco in Malaysia are one of happy alliance (M) Sdn Bhd (Malaysia) that provides nata de coco in the from of fruit jelly cups and drink toppings to the food and beverage and retail industries around the world.

Another major player is Schmecken Agro Food Products, which produces bulk nata de coco for export as well as custom formulations for OEM customers. Tier 1 firms operate at scale with global reach and a large number of trading partnerships worldwide, and an overall capacity to service high-volume demand for multinational brands.

Tier 2 includes the regional food processor/ plants and specialty dessert brands with moderate market share and focused geographic scope - particularly Southeast Asia, East Asia and the Middle East. Such companies may package and sell nata de coco products, produce value-added variants, such niu ja, flavored or colored nata de coco (e.g., rainbow nata de coco), and supply regional beverage brands and dessert chains.

For example, Jeram Coconut Sdn Bhd (Malaysia) has established itself regionally through innovative packaging and variety in flavors. One such player, Ram Food Products (Philippines), provides nata de coco in cans, jars, and pouches for retailers and foodservice customers. These companies set themselves apart through cheap pricing, flavor innovation, and regional branding.

Tier 3: Small manufacturers, start-ups, and local suppliers whose production capabilities are limited, though gaining traction in some niche segments such as organic nata de coco, fusion desserts, and direct-to-consumer models will scale up to tier 3. These players tend to serve local foodservice outlets, ethnic supermarkets, and online platforms.

Craft-style brands like Del Gusto (India) and Cocoguru emphasize natural ingredients, minimal preservatives, and sustainable packaging, targeting health-conscious and premium-seeking consumers. The nata de coco market is moderately fragmented, wherein Tier 1 companies dominate bulk exports and supply to large-scale production, and Tier 2 & 3 companies benefit from regional focus, product customization, and niche consumers' taste.

Application in Functional Drinks

Shift: East Asian, European, and North American consumers are increasingly conscious of gut health, hydration, and natural energy propel demand for functional drinks that provide texture, nutrition, and natural ingredients. Nata de coco is increasingly sought after as a sports drink, probiotic drink, and collagen drink ingredient ingredient due to its high fiber content and cool and chewy texture. Beauty and fitness consumers are most likely to consume digestive health and skin gain drinks.

Strategic Response: Vietnam's Jelley Brown launched the category with its Glow+ functional drink line, combining nata de coco with collagen peptides, vitamins, and electrolytes. It targeted millennials and Gen Z consumers residing in cities and utilized social media influencers in South Korea and Japan.

Hence, Glow+ achieved 16% more sales in Asia-Pacific in 2024. Jelley Brown, Germany, collaborated with health drink start-ups for European wellness business development and thus achieved an increase of 20% in European functional drinks sales.

Business growth through Ready-to-Eat (RTE) Snack formats

Shift: Exaggerated snacking levels and urbanisation are pushing healthy Ready-to-Eat (RTE) snack demand, which is new, convenient, and nutritious. Nata de coco's low calorie count, high fibre content, and unique texture make it a top fruit cup ingredient, jelly dessert, and yoghurt topping. The trend is occurring in Japan, the US, and the UAE, where on-the-go consumption for snacks is becoming increasingly popular with students and white-collar workers.

Strategic Response: Fragaria Food in Malaysia was able to capitalize on such demand through nata de coco fruit cups of mango, pineapple, and lychee flavors for easy one-time use. With Carrefour UAE and 7-Eleven Japan, the company registered 15% sales increment in the first half of 2024.

Fragaria also introduced multi-layer jelly cups infused with superfoods like chia seeds and aloe vera, which enjoyed strength among wellness-focused consumers, particularly women aged 25-40. Its green, recyclable packaging also gained customers who were aware of sustainability, also expanding the brand.

Increasing demand for Clean-Label and Vegan products

Shift: Global plant consumption and clean-label are encouraging consumers to seek vegan, low-processed, and additive-free foods. Consumers in European, North American, and Oceanian markets also read labels more attentively in these markets to discover natural, non-GMO, and allergen-free foods. Nata de coco's plant character and versatility open it up as a possible milk alternative and vegan dessert food that is likely to be labeled as having zero added sugar and preservatives.

Strategic Response: Coco Republic of Indonesia launched an organic nata de coco product under USDA and EU organic certifications and promoted it as preservative-free, cholesterol-free, and ecologically sustainably produced.

Sales by Whole Foods (USA), Planet Organic (UK), and Woolworths (Australia) brought the brand to more health-conscious retailers. Coco Republic's green packaging buying commitment and partnership with green influencer consciousness also passed on confidence among environmentally friendly millennials, increasing the sales in the Western market in 2024 by 19%.

Bubble Tea and Special Drink Chains' Adoption

Shift: With bubble tea and specialty drink stores on every corner, there must be new taste profiles and textures. Chinese, Taiwanese, American, and Canadian consumers will not be consuming tapioca pearls, so nata de coco is a desirable topping due to its chewy texture, fruit flavor, and lower calories. This is being led by young consumers, specifically Gen Z, who are fashion-forward and willing to try something new in a beverage.

Strategic Response: Rico Foods conducted a strategic foray into the category by shipping flavored nata de coco (lychee, strawberry, green apple) to trendy bubble tea shops in North America and East Asia.

Rico Foods also entered the nata de coco-based RTD beverage market under its Rico Fresh brand in Canada and the United States with cold brew tea and fruit juice blended with pieces of nata de coco. Their TikTok campaigns using mixology-style presentation of cocktails received over 2 million views and equated to a 22% sales spike of drinks throughout 2024.

Innovation of Sugar-Free and Diabetic Products

Shift: Growing health concerns regarding diabetes, obesity, and sugar consumption are driving customer demand for reduced-sugar diabetic treats and snacks. The Asian-Pacific (India, Thailand, and Japan), the USA, are trending towards fewer-calorie treats. Nata de coco, unsweetened, is the direction and addresses in diet-driven product lines.

Strategic Response: Thai Happy Alliance introduced a line of sugar-free nata de coco products naturally sweetened with stevia and erythritol for health-oriented and diabetic consumers.

Retained online on Lazada, Shopee, and local health food stores, the company became even more successful in Southeast Asia with 14% sales increase in the region. It also launched nutrition label campaigns and worked with dietitians and health clinics in attempting to make its brands healthy lifestyle brands, obtaining penetration among health-conscious older generations and families.

The following table presents the estimated growth rates of the top five territories projected to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.6% |

| Germany | 4.3% |

| China | 6.0% |

| Japan | 4.9% |

| India | 6.4% |

United States nata de coco remains to grow steadily as the demand for low-calorie, high-fiber, and vegetable-based functional foods increases. Healthy sweet, high-sugar dessert alternatives continue to win over the hearts of the consumers, and nata de coco, being fermented coconut water, gives the perfect stimulus which fuels the demand because of its chewy form along with high fiber content into the diet.

Also fueling demand for nata de coco is growing popularity for Asian beverages and foods such as bubble tea and yogurt drinks, where it can be utilized as an ingredient and functional food. Additionally, big food chains and innovative beverage firms using nata de coco in their offerings guarantees sustained long-term market expansion. Its clean-label positioning and applications in desserts, beverages, and snacks also qualify it as a player in the USA food and beverage market.

Germany's nata de coco market is driven by the growing demand for clean-label, natural food and plant-based food. German consumers are especially health-conscious and nature-conscious and are willing to search for products which are appealing to vegan, organic, and eco-living.

The past history of nata de coco as a fermented coconut water product and lack of any animal component render it popular among the rising vegan consumers. Its application in low-fat yogurts, fruit salad, and gelatin replacement makes it more accepted. The market in Germany has also developed retail channels and ethnic food product popularity so that consumers now have greater access to foods and beverages with nata de coco.

Urbanization, rising disposable incomes, and an active foodservice market are propelling China into one of the world's fastest-growing nata de coco markets. Demand for fruit-flavored beverages and bubble tea, where nata de coco is used widely as a textural topping, has strongly fueled demand.

Chinese consumers also view healthy dessert food as desirable, and nata de coco's high fiber and low-calorie food align with these wishes. Domestic productive capacity and domestic market access facilitate local market access and availability. With assistance from health-conscious emerging trends, consumption of nata de coco will be increasing with rapid pace in the major metropolitan cities.

Low-calorie functional food with attractive appearance is what Japanese consumers are being compelled to demand due to customer demand for nata de coco. The market in Japan has already become familiar with nata de coco, especially flavored drinks, jellies, and yogurts. Innovative packaging of food and controlled portion sizes of servings have also enhanced its demand.

Furthermore, Japan's advanced convenience store culture and food processing technology have allowed nata de coco to be mixed with other ready-to-drink and ready-to-eat food. Healthy demand from children and adults for healthy snack and drinks that enhance health sustains the demand. Long-term growth in Japan is led by ongoing product innovation and food safety and quality.

| Segment | Value Share (2025) |

|---|---|

| Desserts and Beverages (By End User) | 62.4% |

Nata de coco has also gained rapid popularity as a dessert and beverage ingredient, capturing the largest market share by 2025. In the end, it has a chewy texture, sweet (but not so strong) taste, and low calorie that makes it so desirable to add to most dessert preparations from pudding to fruit salads and yogurt desserts. At the same time, the soft drink industry is using nata de coco as a base ingredient in flavour beverages, fruit drinks and bubble teas to enhance mouthfeel and customer acceptance.

Demand pressure for new, healthier dessert and liquid food products has producers extending nata de coco products into flavor and fortified presentations. Japan, South Korea and the Philippines are solid centers of this trend in the Asia Pacific, with nata de coco a traditional element in the tried and true and in newer applications. Nata de coco-flavored foods and beverages are now seen in Western economies as fusion foods and foreign-theme flavor products, used by international corporations taking advantage of local expertise.

Also, health-conscious customers are in search of high-fiber probiotics and low-sugar products-parameters that nata de coco is quite aligned with. With demand for plant-based and functional ingredients to remain strong in dessert and beverage end-user markets, the segment is also poised for further growth in future.

| Segment | Online Value Share (2025) |

|---|---|

| Online Retail Expands (By Distribution Channel) | 27.1% |

Nata de coco sales are also being driven by online retail channels-a potentially game-changing distribution channel for both established brands and small, niche players. E-commerce platforms provide unparalleled convenience, variety, and product transparency, making them a preferred channel for consumers purchasing specialty food products such as nata de coco.

The demand for nata de coco turned online, in different formats such as jars, pouches and ready-to- use packs, as health and wellness has become a trend and with the rise of humans cooking and preparing desserts themselves at home. Manufacturers can leverage digital platforms to couple innovative products, flavor varieties, and usage ideas to enhance consumer engagement.

This segment is further driven by subscription-based models, targeted promotions, and direct-to-consumer sales strategies. In markets where nata de coco remains relatively unknown (such as North America and Europe) online retail allows educational content, recipe sharing, and influencer marketing to support wider consumer adoption.

Happy Alliance (M) Sdn Bhd (Malaysia), and Schmecken Agro Food Products (India) are identified as the key founders paving the way for the growth of Nata De Coco Market in the forecast period of 2019 to 2026. These companies have increased consumer preference for nata de coco by selling it in various forms i.e., diced, strips, flavored, sweetened, which can be used in applications such as beverages, desserts, fruit cocktails, and yogurts.

By providing so many options, they are able to reach a larger demographic and compete with other fruit productmakers from jellies to dessert. In addition, innovations in packaging like ready-to-eat cups, resealable pouches, and shelf-stable packaging enable increased convenience for the consumer and extend product freshness.

Market growth in nata de coco may be attributed to partnerships within the beverage brands, dessert manufacturers, and foodservice providers. As demand for low-calorie, fiber-rich snacks continues to rise, collaborations with health food brands and international distributors have further expanded these companies’ global reach and brand visibility.

For instance:

By end user, the industry has been categorized into Ice Cream, Dessert, Beverages and Syrups, Jellies, and Confectionery.

By distribution channel, the industry has been categorized into Retailer, Supermarket/Hypermarket, Convenience Store, and Online.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Japan.

The global industry is estimated at a value of USD 854.2 million in 2025.

Some of the leaders in this industry include Asia Farm, Coconut Delight, Fuji Natural Foods, Goya Foods, Jacobi International, Kenkko Corporation, Pan Asia Holdings and Others.

The East Asian region is projected to hold a revenue share of 41.3% over the forecast period.

The industry is projected to grow at a forecast CAGR of 6.3% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: Latin America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 40: East Asia Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 9: Global Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Application, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 27: North America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Application, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natamycin Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Preparation Market Size and Share Forecast Outlook 2025 to 2035

Neonatal and Fetal Monitors Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Nutrition Market Analysis - Size, Growth, and Forecast 2025 to 2035

Prenatal Vitamin Supplement Market Analysis - Size, Share, and Forecast 2025 to 2035

Neonatal Thermoregulation Market – Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Prenatal Vitamin Supplement Industry

Neonatal Phototherapy Devices Market Report – Demand & Forecast 2017-2027

Postnatal Probiotic Supplements Market Size and Share Forecast Outlook 2025 to 2035

Postnatal Health Supplements Market Trends – Demand & Forecast 2025-2035

Postnatal Nutrition Market – Growth, Infant Health & Mother’s Wellness

Antenatal Screening Market

UK Prenatal Vitamin Supplement Market Outlook – Demand, Trends & Forecast 2025-2035

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

ASEAN Prenatal Vitamin Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Europe Prenatal Vitamin Supplement Market Analysis – Size, Share & Forecast 2025-2035

Fetal And Neonatal Care Equipment Market Size and Share Forecast Outlook 2025 to 2035

Australia Prenatal Vitamin Supplements Market Insights – Size, Growth & Forecast 2025-2035

Demand for Postnatal Health Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA