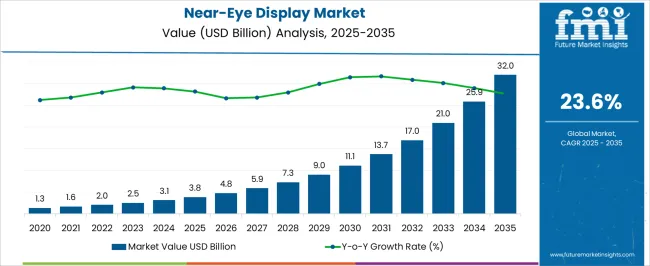

The near-eye display market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 32.0 billion by 2035, registering a compound annual growth rate (CAGR) of 23.6% over the forecast period.

The near-eye display market is valued at USD 3.8 billion in 2025 and is expected to reach USD 32.0 billion by 2035, with a CAGR of 23.6%. From 2021 to 2025, the market grows gradually from USD 1.3 billion to USD 3.8 billion, progressing from USD 1.6 billion, 2.0 billion, 2.5 billion, and 3.1 billion. This phase reflects early adoption in niche applications such as augmented reality (AR), virtual reality (VR), and wearable tech. The inflection point occurs around 2025, when the market sees a significant acceleration, driven by advancements in display technology and increasing demand from industries like gaming, healthcare, and automotive.

From 2026 to 2030, the market experiences a steep upward curve, growing from USD 3.8 billion to USD 13.7 billion. Values progress from USD 4.8 billion to USD 5.9 billion, 7.3 billion, 9.0 billion, and 11.1 billion as near-eye displays become more mainstream in consumer electronics, with applications expanding into immersive media and professional tools.

Between 2031 and 2035, the market reaches USD 32.0 billion, with intermediate values passing through USD 17.0 billion, 21.0 billion, 25.9 billion, and 32.0 billion. This phase sees rapid adoption and scaling across various sectors, with near-eye displays becoming a dominant technology in industries like entertainment, education, and telecommunications, solidifying its position as a key growth driver in the tech landscape.

| Metric | Value |

|---|---|

| Near-Eye Display Market Estimated Value in (2025 E) | USD 3.8 billion |

| Near-Eye Display Market Forecast Value in (2035 F) | USD 32.0 billion |

| Forecast CAGR (2025 to 2035) | 23.6% |

The display technology market is a major contributor, accounting for around 30-35%, as near-eye displays, including head-mounted displays (HMDs) and augmented reality (AR) glasses, are based on advancements in display technology, offering high-quality, immersive experiences. The consumer electronics market plays a significant role, contributing approximately 25-30%, driven by the increasing demand for immersive experiences in entertainment, gaming, and media, with near-eye displays being integral to VR headsets and AR glasses. The augmented and virtual reality market is another key driver, contributing about 20-25%, as near-eye displays are essential for providing the visual interface in AR and VR systems, enhancing gaming, training, healthcare, and education experiences.

The healthcare and medical devices market also contributes around 10-12%, as near-eye displays are used in medical applications such as surgery assistance, rehabilitation, and therapeutic exercises, improving visualization and supporting healthcare professionals. Finally, the automotive industry market contributes approximately 8-10%, as near-eye displays are being integrated into vehicles for heads-up displays (HUDs), driver assistance systems, and in-car entertainment, enhancing both driver safety and experience. These parent markets collectively demonstrate the growing demand for near-eye display technology in consumer electronics, AR/VR systems, healthcare, and automotive applications.

The near-eye display market is experiencing accelerated growth, driven by rising demand for immersive visual technologies across augmented reality, virtual reality, and mixed reality applications. Increasing deployment of wearable headsets in sectors such as healthcare, education, industrial design, and consumer electronics is elevating the need for lightweight, high-resolution displays capable of delivering natural visual experiences. Continuous improvements in microdisplay technologies, optical waveguides, and low-latency rendering engines are enhancing image clarity and field of view.

Investments from technology leaders and startup ecosystems are further advancing near-eye display capabilities, making devices more compact, energy-efficient, and visually compelling. Growth in spatial computing and enterprise-grade virtual collaboration platforms is expanding use cases beyond entertainment and gaming.

Governments and commercial organizations are supporting innovation through funding and partnerships aimed at accelerating the adoption of smart wearables As component miniaturization, battery efficiency, and optical precision continue to evolve, the near-eye display market is expected to expand rapidly, positioning itself as a critical interface technology for next-generation human-machine interaction across diverse verticals.

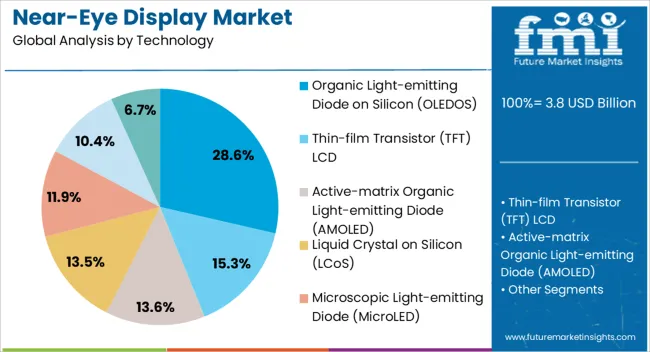

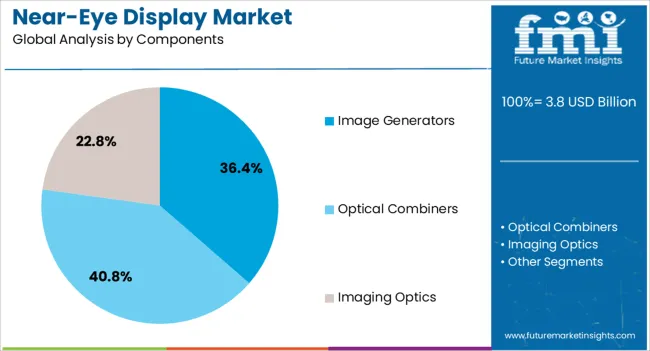

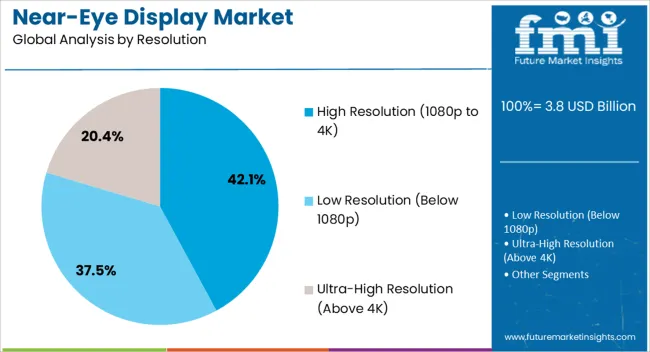

The near-eye display market is segmented by technology, components, resolution, application, end use industry, and geographic regions. By technology, near-eye display market is divided into organic light-emitting diode on silicon (OLEDOS), thin-film transistor (TFT) LCD, active-matrix organic light-emitting diode (AMOLED), liquid crystal on silicon (LCoS), microscopic light-emitting diode (MicroLED), digital light processing (DLP), and laser beam scanning. In terms of components, near-eye display market is classified into image generators, optical combiners, and imaging optics. Based on resolution, near-eye display market is segmented into high resolution (1080p to 4K), low resolution (Below 1080p), and ultra-high resolution (Above 4K). By application, near-eye display market is segmented into head-mounted displays (HMDs), heads-up displays (HUDs), and smart glasses. By end use industry, near-eye display market is segmented into consumer electronics, healthcare, automotive, aerospace & defense, education, industrial & manufacturing, sports & entertainment, and others. Regionally, the near-eye display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic light-emitting diode on silicon segment is projected to hold 28.6% of the near-eye display market revenue share in 2025, making it the leading technology type. This dominance is being attributed to the ability of OLEDOS to deliver superior brightness, deep contrast, and high-speed response times in a compact form factor suitable for head-mounted displays. The self-emissive nature of OLEDOS allows for high pixel density and reduced power consumption, which are critical for wearables where space and battery life are constrained.

Its compatibility with silicon backplanes enables integration with advanced driver circuits, contributing to smoother frame delivery and reduced visual artifacts. As user experience expectations rise, particularly in gaming, enterprise training, and medical imaging, OLEDOS is being preferred for its ability to render lifelike visuals and reduce eye strain.

Manufacturing scalability and improved yields are also enhancing commercial viability, encouraging adoption across device categories With growing investment in OLED microdisplay R&D, the segment is positioned to maintain its lead by supporting high-resolution, low-latency, and durable visual solutions for both consumer and industrial-grade near-eye applications.

The image generators segment is anticipated to account for 36.4% of the near-eye display market revenue share in 2025, establishing itself as the leading component category. This leadership is being driven by the central role image generators play in processing and rendering visuals that are projected through the optical systems of AR and VR devices. As demand increases for low-latency, high-frame-rate, and high-fidelity images, manufacturers are focusing on improving graphical engines and integrating AI-based enhancements for real-time performance optimization.

Image generators are becoming more compact and power-efficient while supporting complex visual workloads such as 3D modeling, object tracking, and contextual overlays. Their adaptability with emerging display technologies, including OLEDOS and microLED, is contributing to their widespread adoption in head-mounted displays.

Increased investment in silicon photonics and chip-level integration is allowing for better thermal management and enhanced processing capabilities The segment is expected to benefit from the growing deployment of near-eye systems in enterprise settings, where high-quality visual rendering is crucial for training, simulation, and field operations.

The high resolution category, defined as 1080p to 4K, is expected to capture 42.1% of the near-eye display market revenue share in 2025, positioning it as the dominant resolution segment. This preference is being fueled by increasing consumer and enterprise expectations for visual clarity, realism, and immersion in wearable displays. High-resolution near-eye systems are essential for reducing the screen-door effect and providing detailed visuals required in design, simulation, and entertainment environments.

The segment’s growth is being supported by technological advancements that allow high pixel density displays to be manufactured in smaller, lighter, and more power-efficient formats. Headset manufacturers are leveraging this resolution range to deliver enhanced experiences across AR and VR platforms, where fine detail and edge sharpness are critical.

The ability of 1080p to 4K displays to support wider fields of view and superior color depth is further reinforcing demand As content ecosystems evolve and next-generation applications demand more visual precision, this resolution category is expected to remain the preferred choice across both professional-grade and consumer-level near-eye display systems.

The near-eye display market is witnessing rapid growth driven by the increasing adoption of augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies across a variety of industries, including gaming, healthcare, automotive, and industrial applications. These displays are crucial for providing immersive experiences by delivering high-resolution, compact, and lightweight visual output directly in the user's field of view. As AR and VR applications continue to expand, the demand for near-eye displays that offer superior image quality, lower latency, and enhanced user comfort is intensifying.

Challenges include high production costs, the need for miniaturization, and the development of technologies that address user comfort, such as reducing eye strain and improving field-of-view. Opportunities lie in the growing interest in wearable technology, such as smart glasses and head-mounted displays, and in the development of more affordable and energy-efficient near-eye display solutions. Trends indicate a move toward integration with 5G, AI, and IoT for more connected, interactive experiences, driving the evolution of the market.

The near-eye display market is experiencing significant growth due to the increasing demand for immersive AR, VR, and wearable experiences. As industries like gaming, healthcare, and education explore the potential of AR and VR for training, entertainment, and medical applications, near-eye displays are becoming a core component of these technologies. These displays, often integrated into wearable devices such as smart glasses or headsets, provide users with an enhanced visual experience by placing images directly in their line of sight. The rise in demand for wearables, especially in the context of fitness and navigation, is further accelerating the adoption of near-eye displays. Additionally, the expansion of AR in retail, automotive, and industrial sectors for real-time data visualization and enhanced user interfaces is driving market growth.

The near-eye display market faces several challenges related to high production costs, complex manufacturing processes, and the need for miniaturization. The development of high-quality, compact, and lightweight near-eye displays often requires the use of advanced technologies such as microdisplays and optical lenses, which can drive up the price of the final product. Additionally, ensuring compatibility across a wide range of devices and applications adds complexity to the design and development process.

Regulatory constraints, particularly around consumer safety and data privacy in AR and VR applications, also play a significant role in shaping the market. Furthermore, challenges around eye strain, prolonged usage comfort, and field-of-view limitations remain critical concerns for both manufacturers and consumers. Overcoming these technical barriers will be crucial for the widespread adoption of near-eye display technologies.

Opportunities in the near-eye display market are expanding in the development of smart glasses, automotive, and industrial applications. Smart glasses, which integrate near-eye displays for tasks like navigation, communication, and information overlay, are gaining popularity in both consumer and professional settings. As automotive companies integrate AR and VR technologies into vehicles for enhanced driver assistance and infotainment systems, the demand for near-eye displays is expected to rise.

In industrial applications, near-eye displays are being used for real-time data visualization, training, and remote support, improving productivity and safety. The rise of 5G and edge computing will also enable faster, more efficient processing of AR and VR content, offering further opportunities for near-eye displays to be used in connected devices, smart environments, and immersive experiences.

The near-eye display market is trending toward miniaturization, improved energy efficiency, and enhanced connectivity. As manufacturers strive to create more compact, lightweight, and comfortable wearable devices, there is a growing emphasis on miniaturizing the components of near-eye displays while maintaining high image quality. This trend is also driving innovation in battery technology, with companies developing energy-efficient solutions to extend the runtime of devices like smart glasses and AR headsets.

Additionally, the integration of 5G, AI, and IoT is transforming the near-eye display market by enabling more interactive, responsive, and connected experiences. These technologies allow for faster data processing, lower latency, and real-time communication, making near-eye displays more effective in applications like remote assistance, live training, and immersive entertainment. As connectivity and energy efficiency continue to improve, the adoption of near-eye displays is expected to expand across various industries and consumer segments.

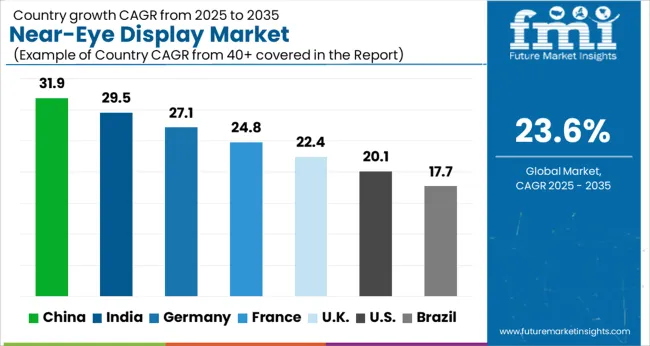

| Country | CAGR |

|---|---|

| China | 31.9% |

| India | 29.5% |

| Germany | 27.1% |

| France | 24.8% |

| UK | 22.4% |

| USA | 20.1% |

| Brazil | 17.7% |

The global near-eye display market is projected to grow at a CAGR of 23.6% from 2025 to 2035. China leads with a CAGR of 31.9%, followed by India at 29.5% and Germany at 27.1%. The UK and USA show growth rates of 22.4% and 20.1%, respectively. The market is driven by the rising demand for AR, VR, and MR technologies in industries such as gaming, education, healthcare, and automotive. Technological advancements, including improved 5G connectivity, wearable devices, and immersive digital experiences, are further fueling the growth of the near-eye display market. The analysis includes over 40+ countries, with the leading markets detailed below.

The near-eye display market in China is projected to grow at a CAGR of 31.9% from 2025 to 2035. Rapid expansion is fueled by the country’s leadership in technology innovation, especially in the fields of augmented reality (AR), virtual reality (VR), and mixed reality (MR). The growing adoption of AR and VR technologies in gaming, entertainment, healthcare, and education sectors is driving the demand for near-eye displays. Moreover, China’s increasing investments in smart wearable devices and consumer electronics, such as smart glasses and AR headsets, are propelling market growth.

The country’s strong manufacturing base and large consumer market further contribute to the widespread availability and affordability of near-eye display devices. China’s government push for innovation in the digital and technology sectors, coupled with the growing demand for advanced display technologies in industries such as e-commerce and digital marketing, is expected to significantly boost the market.

The near-eye display market in India is expected to grow at a CAGR of 29.5% from 2025 to 2035. As a growing tech hub, India is experiencing a rise in the demand for AR and VR technologies, particularly in sectors such as gaming, education, healthcare, and manufacturing. The increasing adoption of smart devices, including smart glasses and AR headsets, is driving market growth. Moreover, India’s burgeoning consumer electronics industry and strong focus on digitalization are expected to propel the market further.

The country’s young population, with a high affinity for new technology, is fueling the demand for immersive experiences offered by near-eye displays. The rise of e-commerce platforms and the increasing accessibility of AR/VR devices are contributing to the market’s expansion. As India continues to invest in digital technologies and smart city initiatives, the demand for advanced near-eye display solutions in various applications is anticipated to increase.

The near-eye display market in Germany is projected to expand at a CAGR of 27.1% from 2025 to 2035. As one of the leading countries in technology innovation, Germany’s demand for near-eye displays is driven by advancements in AR, VR, and MR applications, particularly in the automotive, manufacturing, and healthcare sectors. The country’s strong emphasis on Industry 4.0 and automation is fostering the use of immersive technologies in industrial settings, such as training simulations and remote maintenance.

The growing interest in gaming and entertainment applications is further boosting the demand for near-eye display devices. Germany’s thriving tech startup ecosystem and increasing investments in smart electronics and wearables are contributing to market growth. The country’s push towards digitalization, combined with the rise of smart cities and intelligent systems, is expected to fuel the adoption of near-eye displays.

The UK’s near-eye display market is expected to grow at a CAGR of 22.4% from 2025 to 2035. As the country increasingly embraces digital transformation, the demand for immersive technologies, including AR and VR, is rising in sectors such as education, healthcare, and entertainment. The UK is witnessing increased adoption of smart glasses, AR headsets, and other wearable devices for professional and consumer applications.

The market’s growth is also supported by the country’s thriving gaming industry and the rise of VR-based experiences. Additionally, the UK’s focus on technological innovation and the ongoing advancements in 5G connectivity are expected to drive the demand for high-performance near-eye display solutions. The use of AR and VR in industries like real estate and retail for virtual tours and product experiences is also propelling market growth.

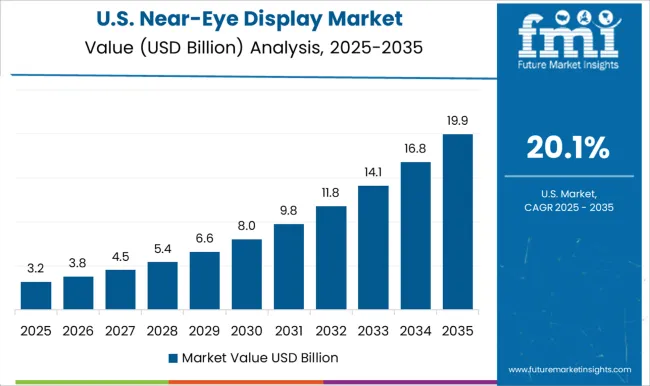

The USA near-eye display market is projected to grow at a CAGR of 20.1% from 2025 to 2035. As a global leader in technology and innovation, the USA is seeing significant growth in the adoption of AR and VR devices in sectors such as healthcare, education, and retail. The USA has a well-established gaming industry, which is a major contributor to the growing demand for immersive technologies, including near-eye displays. The increasing use of AR/VR in training, simulation, and medical applications is also driving market expansion.

Moreover, the USA is witnessing a rise in consumer interest in wearable devices such as smart glasses and AR headsets. With advancements in 5G and improvements in battery technology, the demand for lightweight, efficient, and high-performance near-eye display devices is expected to rise. The market is further supported by the country’s strong venture capital ecosystem, which is fueling innovation in the AR/VR space.

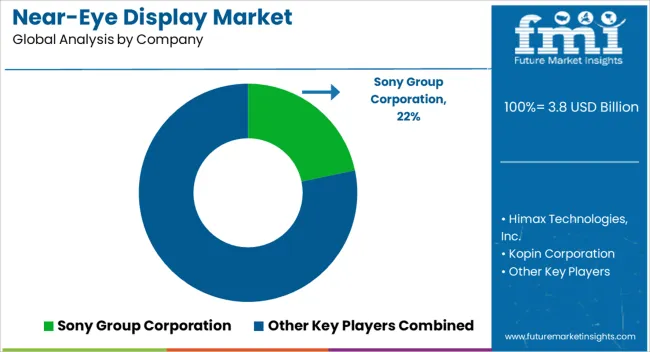

The near-eye display market is highly competitive, driven by advancements in augmented reality (AR), virtual reality (VR), and wearable technologies. Sony Group Corporation is a major player, offering high-performance near-eye displays that cater to both consumer electronics and industrial applications. Sony’s near-eye displays are widely used in VR headsets and smart glasses, with a focus on delivering high-resolution visuals, compact designs, and superior color accuracy. Himax Technologies, Inc. competes by providing innovative microdisplay solutions, particularly for AR glasses and wearable devices. The company’s displays are known for their power efficiency, low heat generation, and high pixel density, which are crucial for providing clear visuals in compact, lightweight devices.

Kopin Corporation is a prominent competitor, offering advanced near-eye display solutions designed for AR and VR applications, particularly in the industrial and military sectors. Kopin’s displays feature high brightness, low power consumption, and a wide field of view, making them ideal for both consumer and professional-grade devices. eMagin Corporation focuses on providing OLED-based near-eye displays for VR and AR devices, offering superior contrast, color richness, and fast response times. Their displays are widely used in head-mounted displays (HMDs) and tactical systems, with a focus on immersive, high-quality visuals. MicroOLED Technologies specializes in OLED microdisplays, providing compact and high-resolution near-eye solutions for applications such as smart glasses, medical devices, and surveillance systems.

BOE Technology Group Co., Ltd. competes by offering high-resolution microdisplays for a wide range of AR and VR applications, with a focus on scalability and cost-effectiveness. Syndiant, Inc. is another strong competitor, providing LCoS-based microdisplays for AR and VR headsets, known for their excellent image quality and low power consumption. Product brochures from these companies highlight key features such as high-resolution visuals, low power consumption, lightweight designs, and superior color accuracy. Competitive strategies focus on integrating advanced technologies like OLED and microLED for enhanced user experiences, while meeting the growing demand for compact, wearable, and immersive near-eye displays across consumer and industrial markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 billion |

| Technology | Organic Light-emitting Diode on Silicon (OLEDOS), Thin-film Transistor (TFT) LCD, Active-matrix Organic Light-emitting Diode (AMOLED), Liquid Crystal on Silicon (LCoS), Microscopic Light-emitting Diode (MicroLED), Digital Light Processing (DLP), and Laser Beam Scanning |

| Components | Image Generators, Optical Combiners, and Imaging Optics |

| Resolution | High Resolution (1080p to 4K), Low Resolution (Below 1080p), and Ultra-High Resolution (Above 4K) |

| Application | Head-Mounted Displays (HMDs), Heads-Up Displays (HUDs), and Smart Glasses |

| End Use Industry | Consumer Electronics, Healthcare, Automotive, Aerospace & Defense, Education, Industrial & Manufacturing, Sports & Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sony Group Corporation, Himax Technologies, Inc., Kopin Corporation, eMagin Corporation, MicroOLED Technologies, BOE Technology Group Co., Ltd., and Syndiant, Inc. |

| Additional Attributes | Dollar sales by display technology type (OLED, LCD, microLED, DLP), application (AR, VR, wearable devices, automotive), and end-use industry (gaming, healthcare, industrial, military). Demand dynamics are driven by the increasing adoption of AR/VR devices in gaming, healthcare, training, and manufacturing sectors. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with advancements in consumer electronics, industrial applications, and entertainment driving demand for high-quality, lightweight near-eye displays. |

The global near-eye display market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the near-eye display market is projected to reach USD 32.0 billion by 2035.

The near-eye display market is expected to grow at a 23.6% CAGR between 2025 and 2035.

The key product types in near-eye display market are organic light-emitting diode on silicon (oledos), thin-film transistor (tft) lcd, active-matrix organic light-emitting diode (amoled), liquid crystal on silicon (lcos), microscopic light-emitting diode (microled), digital light processing (dlp) and laser beam scanning.

In terms of components, image generators segment to command 36.4% share in the near-eye display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA