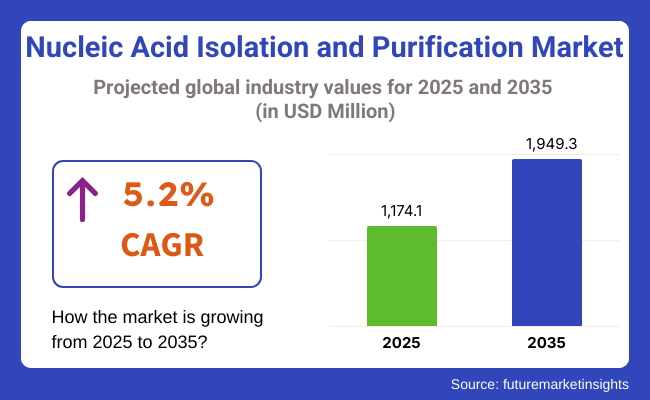

The global Nucleic Acid Isolation and Purification Market was valued at USD 902.9 million in 2020 and is projected to reach USD 1,174.1 million by 2025. From 2025 to 2035, the market is forecast to expand at a robust CAGR of 5.2%, ultimately surpassing USD 1,949.3 million by 2035. Growth is being driven by the essential role of nucleic acid purification in molecular diagnostics, genomics research, and the development of personalized medicine.

The increasing adoption of next-generation sequencing (NGS), rapid expansion of infectious disease surveillance programs, and the ongoing evolution of CRISPR-based gene editing platforms are intensifying demand for high-quality nucleic acid extraction solutions. Research efforts centered on cancer biomarkers, liquid biopsies, and transcriptomic profiling have further elevated the need for robust, contamination-free isolation kits.

Additionally, improvements in sample preparation automation-particularly magnetic bead-based and column-free extraction systems-have streamlined workflows and enhanced reproducibility. Strategic investments from both life sciences companies and public-sector precision medicine initiatives are accelerating innovation, while the demand for scalable, automation-compatible purification platforms continues to grow among clinical laboratories and biotechnology firms worldwide

Leading players in the nucleic acid isolation and purification market include Thermo Fisher Scientific, Qiagen N.V., Promega Corporation, and Roche Diagnostics. These companies are actively expanding their molecular biology portfolios through targeted R&D investments, acquisition of platform technologies, and product line extensions.

In 2024, New England Biolabs launched the Monarch Mag Viral DNA/RNA Extraction Kit, aimed at enabling highly sensitive detection of viral pathogens. “Isolating viral nucleic acids is crucial for several areas of life sciences research, including viral genome sequencing, infectious disease detection, and wastewater surveillance,” noted James Deng, Senior Product Marketing Manager at New England Biolabs, Inc.

This product launch is expected to accelerate clinical diagnostics workflows by improving turnaround time, enhancing scalability, and supporting integration with PCR platforms and LIMS. Similarly, Qiagen introduced a dual-phase extraction system combining magnetic bead and membrane-based methods, allowing for simultaneous RNA and DNA purification from a single sample with improved purity and reduced cross-contamination. These innovations reflect the sector’s focus on addressing evolving laboratory needs and improving assay sensitivity across a range of clinical and research applications.

North America dominates the nucleic acid isolation and purification market, owing to significant funding for genomics research, a mature clinical trial landscape, and the widespread availability of advanced molecular diagnostics labs. The USA National Institutes of Health (NIH) continues to prioritize funding for precision oncology, rare disease genomics, and viral surveillance, all of which are fueling sustained demand for automated and high-throughput sample preparation tools.

In addition, vendor consolidation and integration with digital diagnostics platforms are creating a more streamlined and competitive landscape for clinical laboratories. In Europe, market growth is underpinned by the implementation of national genomic testing strategies and the modernization of biobanking infrastructure. Stringent CE-IVD compliance requirements have increased demand for high-quality purification kits that ensure reproducibility, traceability, and regulatory conformity.

The expanding uptake of RNA-based therapeutics and biomarker validation studies, particularly in oncology and virology, is also propelling adoption across public hospitals, academic institutions, and CROs. With translational research and clinical genomics becoming central to national healthcare frameworks, demand for nucleic acid purification technologies is expected to rise steadily across both regions

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the nucleic acid isolation and purification market between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global nucleic acid isolation and purification industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 is January to June, and H2 is July to December. For the first half (H1) of the period between 2024 and 2034, the company is expected to grow at a CAGR of 6.3%, followed by a rate of growth marginally lower at 6.0% in the second half (H2) of the decade between 2024 and 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2024 to 2034) |

| H2 | 6.0% (2024 to 2034) |

| H1 | 5.6% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

For the later period, going from the H1 2025 to the H2 2035 horizon, growth will slow ever so slightly. It will record about 5.6% of compound annual growth rate (CAGR) growth in the half-decade preceding the current timeline and decelerate further in the following five years down to 5.1%. This market is supposed to shed a 70 basis point slide during the initial five years as well as yet another 90 basis point loss over the latter.

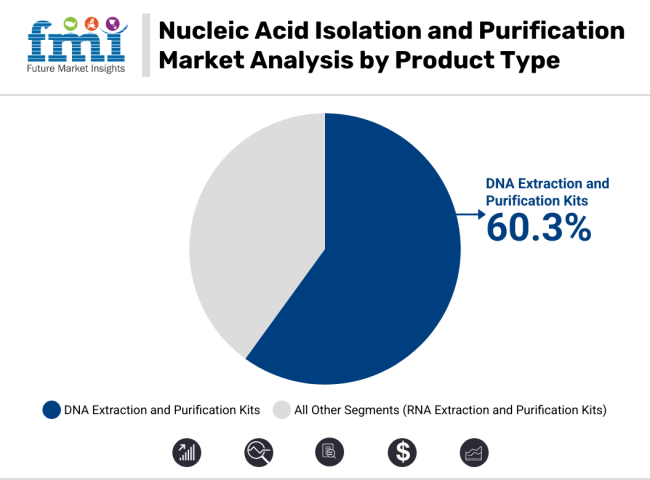

In 2025, DNA extraction and purification kits are projected to account for 60.3% of the total market revenue, cementing their position as the leading product segment. This dominance is fueled by the broad applicability of DNA-based assays in molecular diagnostics, pharmacogenomics, oncology research, and agricultural biotechnology.

These kits are preferred due to their ability to deliver high-purity, contaminant-free yields with minimal user intervention-ensuring compatibility with downstream platforms such as qPCR, sequencing, and microarrays. The growth of the segment has been accelerated by the shift toward magnetic bead-based and column-free systems, which allow for automation, high-throughput processing, and reduced error rates.

Academic and clinical laboratories have increasingly adopted these solutions to improve reproducibility, reduce processing time, and accommodate a wider range of sample types and throughput demands. In the wake of the COVID-19 pandemic, demand for pathogen-specific DNA prep solutions surged, prompting further innovation in ready-to-use, pathogen-agnostic kits. As a result, DNA purification systems continue to form the backbone of nucleic acid sample preparation across diagnostic and research sectors..

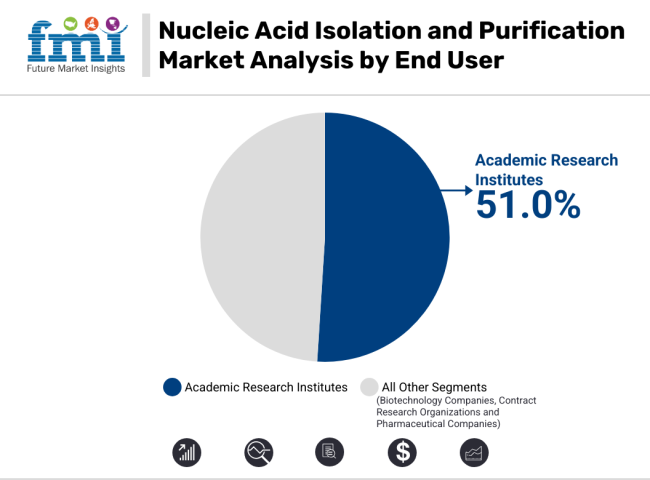

Academic research institutions are projected to account for 51.0% of the total revenue share in the nucleic acid isolation and purification market by 2025. This leading position is driven by substantial public and private investments in molecular biology, oncology, virology, and precision medicine initiatives.

Universities, national research labs, and academic medical centers have expanded their genomics infrastructure, supported by programs such as the NIH’s All of Us Research Program and the European Union’s Horizon Europe. These institutions require scalable and reliable purification platforms that support a diverse range of biological samples and experimental designs.

Cost-effectiveness and adaptability have been key purchasing considerations, particularly in high-volume teaching and translational research environments. Integration of nucleic acid isolation into academic curricula and skill-building programs has also contributed to the widespread adoption of standardized kits.

Moreover, academic-industry collaborations and participation in clinical trial networks have heightened the need for high-quality DNA/RNA samples that meet stringent data integrity and reproducibility standards. With the increasing role of biobanks, multi-omics studies, and longitudinal cohort research, academic institutes are expected to remain at the forefront of market demand.

Manufacturers' Focus on Introducing New Products Expected to Drive Market Growth

An eminent alert of bringing new products by manufacturers is one of the major driving forces behind the market for nucleic acid isolation and purification.

For instance, manufacturers develop an improved efficiency, speed, and accuracy for new demands in research, clinical diagnosis, and personalized medicine by working on the provision of new kits and solutions. Because of this emergence, automated systems, user-friendly kits, and application-oriented solutions were developed for areas like Oncology, Infectious Disease Testing, and Pharmacogenomics.

Moreover, the trend for developing portable and rapid purification kits is apt for the emergent requirement for point-of-care and home-based testing, which would be more convenient and accessible to the consumers. While this will increase the reach of the market, it also aids in personalized health monitoring and management.

Continuous launching of new differentiated products positions the manufacturers in capturing competitive market shares, fostering continued market expansion. Apart from increasing regulatory clearances, an innovation-led strategy will play a key role in determining the future growth trend of the nucleic acid isolation and purification market.

The Rising Trend towards Point-of-Care and Home-Based Testing is Likely to Increase the Application of Nucleic Acid Isolation and Purification Kits

The point-of-care or at-home testing trend that is expanding the use of nucleic acid isolation and purification test kits is now changing the very genesis of accessibility and convenience in healthcare. These testing methods allow for rapid diagnostics outside the traditional laboratory setting and help address the need for timely, accurate results.

An increase in self-testing kits regarding genetic disorders, infectious diseases, and chronic condition monitoring-for example, COVID-19 or personalized DNA analysis-emphasizes this trend.

The demand in the market is sustained by consumer needs of portable diagnostic solutions that are easy to use and affordable. A crucial step in these tests is nucleic acid purification, which ensures high-purity nucleic acids to allow valid test results. Test kits targeting saliva or blood spot samples are, for example, easy to collect yet provide clinically accurate results.

The decentralization of healthcare, relieving the burden on hospitals, and the need for patients to be independent in the management of their health-these have hastened the integration into day-to-day use. All these promise continued growth, with manufacturers striving to make nucleic acid isolation and purification kits even more reliable, quicker, and cheaper to further promote diagnostic solutions.

Nucleic acid isolation and purification kits are the latest tools to bring new business opportunities in infectious disease management.

An increase in infectious diseases, both viral and bacterial, has resulted in a rising demand for the effective and reliable diagnosis. Since these diseases may be diagnosed easily using nucleic acid isolation and extraction kits like those utilized in PCR and other molecular diagnostic methods, the growth in market demand for the product is anticipated.

These improvements in diagnostic performance, speed, and reliability ensure the quicker identification and treatment of infectious diseases. With increased global health concerns, such as pandemics and newly emerging infections, governments and healthcare institutions are increasing their investments in diagnostic tools, thus opening up a market for nucleic acid isolation and purification kits.

Development of portable, easy-to-use, and low-cost kits creates opportunities for low-resource settings, hence expansion of market reach. Companies can bring about innovation in how these kits are integrated with next-generation technologies like automation and multiplexing to make the process even more efficient.

Furthermore, the collaborations of diagnostic companies, healthcare providers, and research institutions in enhancing disease surveillance and response further expand the market.

Competition from Alternative Methods for Nucleic Acid Isolation and Purification test kits hinders their market growth

Tests involving antigens or antibodies, for instance, are being more favored lately, given the less complex processes, quicker times, and no substantial laboratory equipment or specialized skill requirements associated with nucleic acid-based tests. These can be deployed at the point of care to yield immediate results, which is really important in an emergency or resource-poor setting.

With the advancement in molecular diagnostics and testing technology, new techniques such as CRISPR-based diagnostics and microfluidics have begun to emerge. These provide much better speed, sensitivity, and ease compared to the traditional processes of nucleic acid isolation and purification. As these alternatives become more available and at a lower cost, they pose significant competition in the diagnostic testing market.

Moreover, these alternatives are going to be more attractive for healthcare providers in resource-poor regions due to the low cost and ease of establishment. This again will limit demand for the more complex nucleic acid isolation kits. These factors can hampers the growth of nucleic acid isolation and purification kits.

The global nucleic acid isolation and purification industry recorded a CAGR of 5.6% during the historical period between 2020 and 2024. The growth of the nucleic acid isolation and purification diagnostics industry was positive as it reached a value of USD 2,038.1 million in 2035 from USD 1,178.6 million in 2025.

Isolation and purification of nucleic acid is the process through which DNA or RNA is obtained from biological samples-blood, tissues, or cells-for use in applications such as genetic testing, PCR, and sequencing. It is concerned with the breaking of cell membranes to release the nucleic acids, removing impurities from the nucleic acids, and high-purity preparation for further analyses. Nucleic acid integrity is very crucial to achieving accurate results in research and clinical diagnostics.

Isolation and purification of the nucleic acids have been increasing in recent years, driven by the COVID-19 pandemic. It accelerated the use of molecular diagnostics, as they were utilized for the diagnosis of infections. In addition, home diagnostic kits and mobile health solutions extend accessibility to those technologies beyond conventional laboratories.

Recent developments in nucleic acid isolation and purification products are toward automation on user-friendly platforms that make the process seamless. Innovations in magnetic bead-based extraction techniques and miniaturized kits improve nucleic acid isolation in speed, efficiency, and accuracy. Such technologies have also been made more accessible and user-friendly by the introduction of mobile applications and real-time data analysis tools.

Going forward, nucleic acid isolation and purification find emerging growth in health technologies where it is capable of collecting a biological sample and its real-time analysis.

The complete automation of nucleic acid isolation processes and the use of artificial intelligence will further enhance accuracy and efficiency. With the development of home-based diagnostics such as liquid biopsies and multi-analyte tests, these technologies will continue to form the future of healthcare diagnostics, extending their use even more.

With a contribution of 48.1% to the global market share, Tier 1 firms are designated as the bigger firms. They have large production facilities, heavy investments in research and development, and wide distribution channels, which qualify them as market leaders and innovators.

Their capacity to produce in bulk establishes a market in which they can satisfy the high demand from consumers. Tier 1 has the major players such as Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG and Agilent Technologies Inc.

Tier 2 firms are comparatively smaller when compared to Tier 1 companies. Tier 2 firms capture a market share of 32.5% globally. Tier 2 firms, though being smaller in magnitude when compared to Tier 1, still hold significant importance within the nucleic acid isolation and purification sector.

Tier 2 firms concentrate in niche or nascent markets or offer specialized solutions or products intended for regionalized markets or specific consumer requirements. Their power comes in the form of agility and being able to craft creative solutions for underprivileged or niche market segments. Primary Companies under this group are Illumina, Inc., Danaher Corporation and QIAGEN

The section below covers the industry analysis for the nucleic acid isolation and purification sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided.

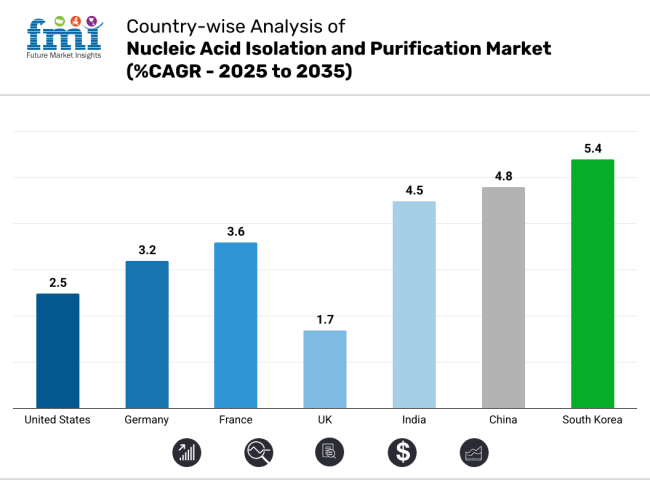

The United States is anticipated to remain at the forefront in North America, with a CAGR of 2.5% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 4.5% by 2035.

The United States leads the global market with superior share in 2024. The United States is anticipated to reflect a CAGR of 2.5% over the forecast period (2025 to 2035).

Technological developments in biotechnology, particularly in genomics and molecular diagnostics, have been a major factor in the increasing need for efficient and accurate nucleic acid extraction methods.

Boosting DNA and RNA in diverse diagnostic uses-PCR, gene sequencing, and discovery of biomarkers-adds fuel to this demand. Moreover, USA precision medicine is in its frontiers, where accurate genetic analysis is needed in the majority of cases for targeted therapy and individualized treatment. With accelerating advancements in biotech and continued maturation of effective testing solutions, additional growth is anticipated within the USA market for nucleic acid isolation and purification.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.2%.

Driving factors for nucleic acid isolation and purification technologies in Germany include the established pharmaceutical and biotech industries. Germany is one of the leading countries in pharmaceutical and biotechnology research, with various companies and research institutions committed to furthering molecular diagnostics and genomic medicine.

This strong industry foundation increases the demand for a reliable and efficient method of nucleic acid isolation important in drug development, genetic testing, and personalized medicine. In addition, while this country is paying high attention to precision medicine and molecular biology, there is an urgent need for high-quality nucleic acid extraction technologies.

Besides, Germany's highly developed manufacturing enables the production of innovative isolation and purification kits to meet domestic and international marketplace demands. Besides, the close cooperation between academia, pharmaceuticals, and healthcare providers in innovating and vastly disseminating nucleic acid isolation technologies contributes a lot to the market growth of the country.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 5.4% during the forecasted period.

Among some of the major factors contributing toward the demand for nucleic acid isolation and purification technologies in South Korea are governmental investments in healthcare and biotechnology research. The Government of South Korea has been notably investing in the biotechnology sector through funding, grants, and strategic initiatives to drive improvement in medical research and diagnostics.

The investment of such a kind in molecular biology, genetics, and precision medicine increases the demand for valid ways of nucleic acid isolation. Establishment of infrastructures for biotechnology, specifically those for genomic research and drug development, further develops the country for the demand at the top of the line technologies in nucleic acid extraction.

To the same extent, improvement in diagnostics and prevention of disease, as was emphasized by South Korea, makes way for accelerated use of these technologies. Government commitment to healthcare innovation, along with South Korea's position in global diagnostic supply chains, gives the nucleic acid isolation and purification solutions market significant momentum.

The nucleic acid isolation and purification market is highly competitive, with both established leaders and new players constantly vying for market share. Leading companies focus on offering cutting-edge solutions by collaborating with the established players that combine advanced technology with user-friendly features.

Many of these competitors incorporate smart technology into their products, ensuring seamless integration with mobile apps and cloud-based platforms for real-time data monitoring.

Recent Industry Developments in Nucleic Acid Isolation and Purification Market

In terms of product, the industry is divided into DNA extraction and purification kits and RNA extraction and purification kits

In terms of application, the industry is divided into plasmid isolation and purification, DNA isolation and purification and RNA isolation and purification

In terms of sample, the industry is divided into pharmaceutical companies, biotechnology companies, contract research organizations and academic research institutes

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global nucleic acid isolation and purification industry is projected to witness CAGR of 5.2% between 2025 and 2035.

The global nucleic acid isolation and purification industry stood at USD 1,105.3 million in 2024.

The global nucleic acid isolation and purification industry is anticipated to reach USD 1,949.3 million by 2035 end.

South Korea is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the global nucleic acid isolation and purification industry include Thermo Fisher Scientific, Inc., Promega Corporation, Agilent Technologies Inc., Illumina, Inc., Takara Bio, Inc., F. Hoffmann-La Roche AG, Danaher Corporation, QIAGEN, Bio-Rad Laboratories, Inc., Merck KgaA and New England Biolabs.

Table 01: Global Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 02: Global Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 03: Global Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 04: Global Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Region

Table 05: North America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 06: North America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 07: North America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 08: North America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 09: Latin America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 10: Latin America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 11: Latin America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 12: Latin America Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 13: Europe Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 14: Europe Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 15: Europe Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 16: Europe Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 17: East Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 18: East Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 19: East Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 20: East Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 21: South Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 22: South Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 23: South Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 24: South Asia Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 25: Oceania Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 26: Oceania Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 27: Oceania Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 28: Oceania Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 29: MEA Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Country

Table 30: MEA Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 31: MEA Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 32: MEA Market Value (US$) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 32: Global Market Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Region

Table 34: China Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Product Type

Table 35: China Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Applications

Table 36: China Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by End User

Table 37: Brazil Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Product Type

Table 38: Brazil Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Applications

Table 39: Brazil Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by End User

Table 40: India Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Product Type

Table 41: India Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by Applications

Table 42: India Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029 by End User

Figure 01: Global Market Value Share, by Region (2021)

Figure 02: Global Market Value Share, By Product Type(2021)

Figure 03: Global Market Value Share, by Application (2021)

Figure 04: Global Market Value Share, by End User(2021)

Figure 05: Global Market Size and Y-o-Y, 2014 to 2021

Figure 06: Global Market Size (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 07: Global Market Absolute $ Opportunity, 2021 to 2029

Figure 08: Global Market Share Analysis (%) By Product Type, 2022 & 2029

Figure 09: Global Market Y-o-Y Growth (%) By Product Type, 2022 to 2029

Figure 10: Global Market Attractiveness Analysis, By Product Type

Figure 11: Global Market Share Analysis (%) By Application, 2022 & 2029

Figure 12: Global Market Y-o-Y Growth (%) By Application, 2022 to 2029

Figure 13: Global Market Attractiveness Analysis, By Application

Figure 14: Global Market Share Analysis (%) By End User, 2022 & 2029

Figure 15: Global Market Y-o-Y Growth (%) By End User, 2022 to 2029

Figure 16: Global Market Attractiveness Analysis, By End User

Figure 17: Global Market Share Analysis (%) By Region, 2022 & 2029

Figure 18: Global Market Y-o-Y Growth (%) By Region, 2022 to 2029

Figure 19: Global Market Attractiveness Analysis, By Region

Figure 20: North America Market Value Share, by Country (2022)

Figure 21: North America Market Value Share, By Product Type (2022)

Figure 22: North America Market Value Share, by Application (2022)

Figure 23: North America Market Value Share, by End User (2022)

Figure 24: North America Market Size (US$ Million) Analysis, 2014 to 2021

Figure 25: North America Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 26: North America Market Attractiveness Analysis, By Country

Figure 27: North America Market Attractiveness Analysis, By Product Type

Figure 28: North America Market Attractiveness Analysis, By Application

Figure 29: North America Market Attractiveness Analysis, By End User

Figure 30: Latin America Market Value Share, by Country (2022)

Figure 31: Latin America Market Value Share, By Product Type (2022)

Figure 32: Latin America Market Value Share, by Application (2022)

Figure 33: Latin America Market Value Share, by End User (2022)

Figure 34: Latin America Market Size (US$ Million) Analysis, 2014 to 2021

Figure 35: Latin America Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 36: Latin America Market Attractiveness Analysis, By Country

Figure 37: Latin America Market Attractiveness Analysis, By Product Type

Figure 38: Latin America Market Attractiveness Analysis, By Application

Figure 39: Latin America Market Attractiveness Analysis, By End User

Figure 40: Europe Market Value Share, by Country (2022)

Figure 41: Europe Market Value Share, By Product Type (2022)

Figure 42: Europe Market Value Share, by Application (2022)

Figure 43: Europe Market Value Share, by End User (2022)

Figure 44: Europe Market Size (US$ Million) Analysis, 2014 to 2021

Figure 45: Europe Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 46: Europe Market Attractiveness Analysis, By Country

Figure 47: Europe Market Attractiveness Analysis, By Product Type

Figure 48: Europe Market Attractiveness Analysis, By Application

Figure 49: Europe Market Attractiveness Analysis, By End User

Figure 50: East Asia Market Value Share, by Country (2022)

Figure 51: East Asia Market Value Share, By Product Type (2022)

Figure 52: East Asia Market Value Share, by Application (2022)

Figure 53: East Asia Market Value Share, by End User (2022)

Figure 54: East Asia Market Size (US$ Million) Analysis, 2014 to 2021

Figure 55: East Asia Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 56: East Asia Market Attractiveness Analysis, By Country

Figure 57: East Asia Market Attractiveness Analysis, By Product Type

Figure 58: East Asia Market Attractiveness Analysis, By Application

Figure 59: East Asia Market Attractiveness Analysis, By End User

Figure 60: South Asia Market Value Share, by Country (2022)

Figure 61: South Asia Market Value Share, By Product Type (2022)

Figure 62: South Asia Market Value Share, by Application (2022)

Figure 63: South Asia Market Value Share, by End User (2022)

Figure 64: South Asia Market Size (US$ Million) Analysis, 2014 to 2021

Figure 65: South Asia Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 66: South Asia Market Attractiveness Analysis, By Country

Figure 67: South Asia Market Attractiveness Analysis, By Product Type

Figure 68: South Asia Market Attractiveness Analysis, By Application

Figure 69: South Asia Market Attractiveness Analysis, By End User

Figure 70: Oceania Market Value Share, by Country (2022)

Figure 71: Oceania Market Value Share, By Product Type (2022)

Figure 72: Oceania Market Value Share, by Application (2022)

Figure 73: Oceania Market Value Share, by End User (2022)

Figure 74: Oceania Market Size (US$ Million) Analysis, 2014 to 2021

Figure 75: Oceania Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 76: Oceania Market Attractiveness Analysis, By Country

Figure 77: Oceania Market Attractiveness Analysis, By Product Type

Figure 78: Oceania Market Attractiveness Analysis, By Application

Figure 79: Oceania Market Attractiveness Analysis, By End User

Figure 80: MEA Market Value Share, by Country (2022)

Figure 81: MEA Market Value Share, By Product Type (2022)

Figure 82: MEA Market Value Share, by Application (2022)

Figure 83: MEA Market Value Share, by End User (2022)

Figure 84: MEA Market Size (US$ Million) Analysis, 2014 to 2021

Figure 85: MEA Market Size (US$ Million) Forecast & Y-o-Y Growth (%), 2022 to 2029

Figure 86: MEA Market Attractiveness Analysis, By Country

Figure 87: MEA Market Attractiveness Analysis, By Product Type

Figure 88: MEA Market Attractiveness Analysis, By Application

Figure 89: MEA Market Attractiveness Analysis, By End User

Figure 90: Emerging Countries Market Value Share (2019A)

Figure 91: Emerging Countries Market Value (US$ Million) by Key Countries, 2018A, 2023F & 2029E

Figure 92: China Market Revenue Share by End User, 2022

Figure 93: China Market Revenue Share by Product Type, 2022

Figure 94: China Market Revenue Share by Application, 2022

Figure 95: China Value (US$ Million) Analysis, 2014 to 2021

Figure 96: China Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 97: China Attractiveness Analysis by Product Type

Figure 98: China Market Attractiveness Analysis by Application

Figure 99: China Market Attractiveness Analysis by End User

Figure 100: Brazil Market Revenue Share by End User, 2022

Figure 101: Brazil Market Revenue Share by Product Type, 2022

Figure 102: Brazil Market Revenue Share by Application, 2022

Figure 103: Brazil Value (US$ Million) Analysis, 2014 to 2021

Figure 104: Brazil Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 105: Brazil Attractiveness Analysis by Product Type

Figure 106: Brazil Market Attractiveness Analysis by Application

Figure 107: Brazil Market Attractiveness Analysis by End User

Figure 108: India Market Revenue Share by End User, 2022

Figure 109: India Market Revenue Share by Product Type, 2022

Figure 110: India Market Revenue Share by Application, 2022

Figure 111: India Value (US$ Million) Analysis, 2014 to 2021

Figure 112: India Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 113: India Attractiveness Analysis by Product Type

Figure 114: India Market Attractiveness Analysis by Application

Figure 115: India Market Attractiveness Analysis by End User

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nucleic Acid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Test Kits for Pets Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Testing Market is segmented by product, indication and end user from 2025 to 2035

Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market Size and Share Forecast Outlook 2025 to 2035

Nucleic acid electrophoresis and blotting market

Automated Nucleic Acid Extraction Systems Market Analysis – Growth, Trends & Forecast 2024-2034

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA