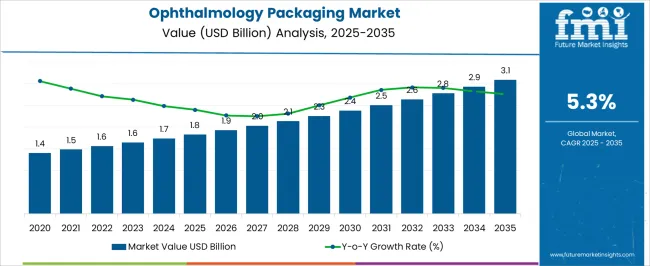

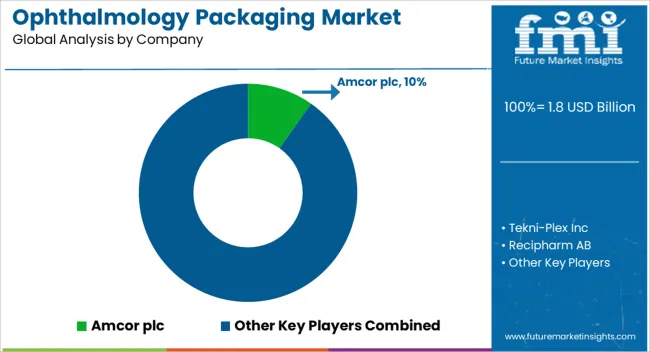

The Ophthalmology Packaging Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Ophthalmology Packaging Market Estimated Value in (2025 E) | USD 1.8 billion |

| Ophthalmology Packaging Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The ophthalmology packaging market is growing steadily, fueled by the increasing prevalence of eye disorders, rising demand for ophthalmic drugs, and expanding healthcare infrastructure. Industry publications and company press releases have emphasized the need for safe, sterile, and precise packaging solutions to ensure product stability and dosage accuracy in ophthalmic therapies.

Stringent regulatory requirements governing pharmaceutical packaging have further accelerated the adoption of advanced materials and designs that protect sensitive formulations from contamination and degradation. Investments in sustainable and lightweight packaging formats are also shaping industry trends, with companies introducing recyclable and eco-friendly solutions.

Additionally, global demographic shifts such as aging populations and lifestyle-related vision issues are driving consistent growth in demand for ophthalmic products, directly impacting packaging volumes. Looking forward, the market is expected to benefit from automation in packaging lines, technological integration for tamper-evident features, and the growing role of e-commerce in pharmaceutical distribution, positioning ophthalmology packaging as a critical enabler of effective therapeutic delivery.

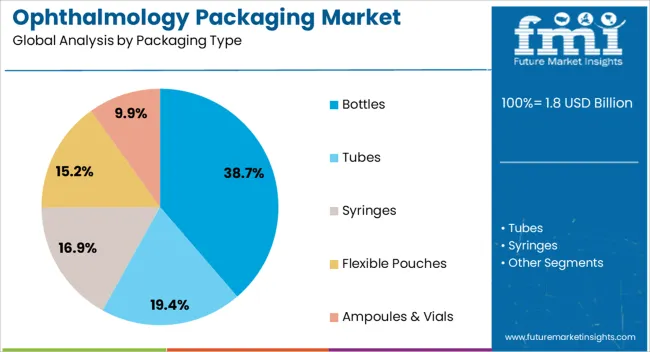

The bottles segment is projected to account for 38.7% of the ophthalmology packaging market revenue in 2025, maintaining its position as the dominant packaging type. This growth has been supported by the widespread use of bottles for liquid ophthalmic formulations such as eye drops, which require precise dosing and sterile dispensing.

Bottles have remained the preferred choice due to their ease of handling, portability, and compatibility with preservative-free formulations. Advancements in material science have introduced lightweight, shatter-resistant, and moisture-impermeable plastics that extend product shelf life and enhance patient convenience.

Pharmaceutical companies have also focused on incorporating features such as drop-control mechanisms and tamper-proof closures, strengthening the segment’s reliability. With consistent global demand for liquid ophthalmic therapies, bottles are expected to retain their market leadership through innovation and strong alignment with patient and provider needs.

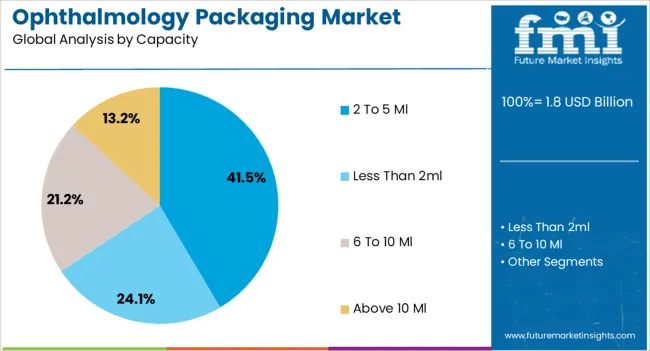

The 2 to 5 ml capacity segment is projected to hold 41.5% of the ophthalmology packaging market revenue in 2025, establishing itself as the leading capacity category. This dominance has been driven by the suitability of smaller volume packaging for single-use and short-duration ophthalmic treatments.

Healthcare professionals and patients have favored this range due to its accuracy in dosing, minimized wastage, and lower risk of contamination. Industry reports have noted that this capacity aligns well with preservative-free products, which are increasingly in demand for sensitive eye conditions.

Additionally, compact packaging has enhanced portability and patient adherence to treatment regimens, particularly in chronic conditions requiring frequent administration. The rise of unit-dose therapies and advancements in sterile filling technologies have further boosted the growth of this segment. As demand for precision packaging continues to expand, the 2 to 5 ml capacity is expected to sustain its leadership position in the ophthalmology packaging market.

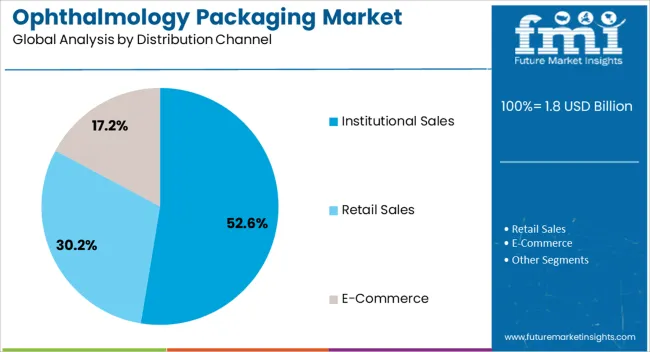

The institutional sales segment is projected to contribute 52.6% of the ophthalmology packaging market revenue in 2025, positioning itself as the leading distribution channel. Growth in this segment has been influenced by the large-scale procurement of ophthalmic products by hospitals, clinics, and specialty eye care centers.

Institutional buyers have prioritized packaging solutions that guarantee sterility, regulatory compliance, and cost efficiency, supporting bulk purchasing trends. Annual reports from pharmaceutical companies have highlighted that institutional channels drive a significant share of sales due to long-term supply contracts and structured tender systems.

Furthermore, the expansion of ophthalmic surgical procedures and the growing use of prescription eye drops in clinical settings have reinforced the importance of institutional demand. With healthcare providers focusing on consistent supply chains and stringent product quality standards, institutional sales are expected to remain the dominant distribution channel, supported by the growing burden of eye diseases and expanding treatment volumes worldwide.

The global ophthalmology packaging market recorded a CAGR of 4.1% from 2020 to 2025. The industry was valued at USD 1,734.5 million in 2025 from USD 1,478.0 million in 2020.

The advent of novel packaging materials and technologies greatly impacted the ophthalmology packaging market in the historical period. The industry adopted innovations, including blister packaging, unit dose packaging, and tamper-evident sealing, as they have high product safety, convenience, and shelf life.

The need for environmentally friendly packaging solutions in the ophthalmology industry increased due to laws supporting sustainability and rising environmental awareness. Manufacturers started using recyclable, biodegradable, and renewable materials more frequently to lessen their ecological impact and win over environmentally concerned customers.

Patient-centric packaging designs that put ease of use, safety, and compliance first have also gained traction. Easy-to-open seals, concise instructions, and ergonomic designs are a few instances of packaging elements intended to improve patient experience and prescription adherence, especially for older or visually impaired patients.

By 2035, the eye drop packaging market is projected to surge at 5.4% CAGR. Increasing population, lifestyle changes, and aging are causing eye-related infections to rise. Increasing prevalence of eye infections is fueling the demand for ophthalmology products.

The pharmaceutical industry is subjected to strong regulations such as good manufacturing practices for ensuring the packaging on delivery of ophthalmology products. Innovative and new pharmaceutical packaging formats are being developed by manufacturing companies to meet the demand for safe & sterile packaging of ophthalmology products across the world.

Rising Prevalence of Eye Infections

Increasing prevalence of eye infections primarily propels ophthalmology packaging. Growing usage of contact lenses, antibiotic resistance, and certain environmental factors contribute to the surging cases of eye infections globally.

For instance, trachoma is a kind of bacterial infection caused by chlamydia trachomatis. It has created a public health issue in around 42 countries. This infection can lead to visual impairment in 1.9 million people worldwide.

People are increasingly affected by eye infections because of improper eye hygiene practices. Using contaminated eye products and not washing hands before touching the eyes are contributing to growth of increased eye infections, further surging demand.

Increasing prevalence of ophthalmology disorders is leading to escalating demand for eye drops and ointments. Conditions such as dry eye syndrome, glaucoma, allergies, and other eye issues are becoming more common among people, surging the demand for eye care products. Growing prevalence of these infections contributes to growth of ophthalmology packaging market.

Development of Affordable, Accessible, and Effective Generic Ophthalmology Drugs

An increasing number of eye disorders and infections is leading to the development of innovative ophthalmology care solutions for treatments. Pharmaceutical companies are investing in developing innovative, affordable, and effective ophthalmology drugs for the patient's well-being. For instance, researchers are reviewing the strategies for enhancing ocular bioavailability in medication administration.

Several studies show that conventional eye drops often lose their effectiveness due to blinking tear production, resulting in less than 5% bioavailability. Nano particles-based drugs are gaining popularity for enhancing bioavailability and accommodating various pharmaceuticals.

Such formulations offer improved ocular permeability, prolonged residence time, and stabilizing medicines. Innovating these drugs with affordability is set to inflate their application to a wider range of people. These innovations and developments are further projected to lead to growth.

The table presents the projected CAGR for the industry over several semi-annual periods from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the industry is set to surge at a CAGR of 5.9%, followed by a slightly lower growth rate of 4.7% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 5.0% in the first half and surge to 6.3% in the second half. These values offer insights into the anticipated growth trends for the industry, aiding stakeholders and investors in making decisions regarding investments & strategies.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

| H1 | 5.0% (2025 to 2035) |

| H2 | 6.3% (2025 to 2035) |

The categorical ophthalmology packaging market analysis is mentioned in the section below. Based on inclusive investigations, the tube sector is controlling the packaging type category. Furthermore, the eye drop segment is set to propel the application category upwards.

| Packaging Type | Value CAGR (2025 to 2035) |

|---|---|

| Tubes | 5.4% |

| Bottles | 4.7% |

Tubes are widely used in packaging because of their durability, versatility, and suitability for different ophthalmology products. This packaging offers transparency, lightweight, barrier, and cost-efficient properties beneficial for ophthalmology products.

Tubes are designed to preserve the sterility of eye medications and protect from external contaminations. The inertness and convenience of tubes are leading to their widespread adoption in the market. Tube segment is anticipated to reach USD 1,296.9 million and is projected to grow 5.4% CAGR by 2035.

| Applications | Value CAGR (2025 to 2035) |

|---|---|

| Eye Drops | 5.0% |

| Ophthalmology Ointment | 6.2% |

Eye drops are the leading application in the industry and are projected to gain a market revenue worth USD 636.2 million by 2035. Eye drops are highly contributing to the growth of the ophthalmology packaging market, propelled by the increased application of eye care products.

Conditions such as dry eye, conjunctivitis, cataracts, and other age-related problems have led to the surging demand for eye drops. The aging population in the world and the occurrence of ocular diseases are further boosting the usage of eye drops. Eye drops are vital in creating relief for eye conditions, and their ease of use is increasing their application in the market.

The section below examines the state of the ophthalmology packaging industry in some of the leading countries on the global stage, such as the United States, Japan, Canada, China, and India. Through in-depth research, the report has evaluated the aspects influencing these nations' acceptability and growth of novel packaging solutions.

In North America, Canada is projected to remain dominant by showcasing a CAGR of 6.2%, while the United States is estimated to remain at 4.7% through 2035. In South Asia & Pacific, India is set to exhibit a CAGR of 8.3% in the same timeframe.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

| Canada | 6.2% |

| Brazil | 4.9% |

| Mexico | 5.3% |

| Germany | 3.8% |

| France | 4.4% |

| United Kingdom | 4.0% |

| China | 6.2% |

| India | 8.3% |

| Japan | 3.7% |

| KSA | 6.5% |

| South Africa | 6.4% |

Increasing prevalence of eye infections due to the growing adoption of contact lenses is projected to push people toward ophthalmology eye drops and ointments in the United States. The country is set to reach a valuation of USD 3.1 million, soaring at a CAGR of 4.7% by 2035.

Age-related macular degeneration, glaucoma, and dry eye syndrome are among the many eye-related illnesses that affect a considerable portion of the United States population. The need for ophthalmology medications is pushed by the aging population and rising incidence of chronic eye illnesses, impacting the ophthalmology packaging industry.

Aged people are more prone to eye diseases, which is an effective key factor for Japan’s ophthalmology packaging market. According to the World Economic Forum, almost 1/3rd of Japan's population is over 65 years old, accounting for 36.23 million people contributing to the older population.

It is a key factor in influencing the demand for ophthalmology packaging as older people get most eye problems due to the weakening of their eyesight. Japan is anticipated to surge at 3.7% CAGR through 2035.

Japan’s ophthalmology packaging market is further shaped by developments in packaging materials and technologies, including unit dosage packaging, preservative-free packaging, and sophisticated drug delivery systems. Enhancing patient comfort, product safety, and compliance are the key goals of these improvements in the ophthalmology packaging market.

China is predicted to experience rapid growth at a CAGR of 6.2% through 2035 due to rising demand for fast and reliable ophthalmology packaging solutions. The industry is propelled by the need for security, patient comfort, tamper-evident technology, and high-quality products. Growing social security and healthcare systems trend in China presents new growth opportunities for ophthalmology packaging providers in the industry.

Canada dominates the ophthalmology packaging market, surging at a CAGR of 6.2% through 2035. Rising ocular disorders, export of ophthalmology products, investments in research & development, and stringent regulatory policies are projected to surge the demand for ophthalmology packaging in Canada.

Canada is also a key consumer of plastics due to their versatility, easy molding, and resistance to water & climate. Furthermore, the aging population, favorable government policies, and increased healthcare expenditure are estimated to surge the industry in the country.

Manufacturers are directed toward developing and launching new products to broaden their reach. Leading companies are integrating with different firms and surging their geographical presence.

They are also collaborating and partnering with brands & companies for product development. Recent activities and developments implemented by leading players are:

The industry consists of five types of packaging solutions, namely, tubes, bottles, syringes, flexible pouches, and ampoules & vials. Both laminated and extruded plastic tubes are mainly demanded by customers. Bottles made of plastic and glass, on the other hand, are gaining impetus.

Packaging solutions in the capacity of less than 2 ml, 2 to 5 ml, 6 to 10 ml, and above 10 ml are showcasing immense popularity globally.

There are several distribution channels in the industry, including institutional sales, retail sales, and e-commerce. Institutional sales channel consists of hospitals, ophthalmology clinics, public health agencies, and veterinary hospitals & clinics. Drug stores and retail pharmacies/supermarkets are estimated to create high popularity in terms of retail sales channels.

Over-the-counter (OTC) and prescription are the two main types of orders.

Several applications, such as eye drops, ophthalmology gels, ophthalmology ointment, and anti-VEGF drugs, are covered.

Some of the significant cases include refractive errors, cataracts & glaucoma, retinal disorders, corneal diseases, pediatric ophthalmology, neuro-ophthalmology, ophthalmology plastic surgery, uveitis & ocular inflammation, and other eye care cases.

Information about leading countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa is provided.

The global ophthalmology packaging market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the ophthalmology packaging market is projected to reach USD 3.1 billion by 2035.

The ophthalmology packaging market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in ophthalmology packaging market are bottles, _glass bottle, _plastic bottle, tubes, _laminated tubes, _extruded plastic tubes, syringes, flexible pouches and ampoules & vials.

In terms of capacity, 2 to 5 ml segment to command 41.5% share in the ophthalmology packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Services Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA