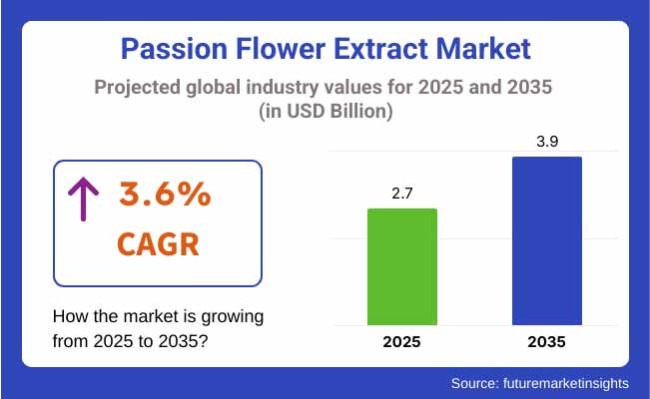

Global value of passion flower extract was USD 2.4 billion in the year 2021. Demand for passion flower extract grew with the year-on-year growth rate of 12.5% in the year 2024 and global demand in the year 2025 will be USD 2.7 billion. Global sales during the forecast period (2025 to 2035) will have 3.6% CAGR in the said period, thus reaching the value of sales to be USD 3.9 billion in the year 2035.

Market demand is further supported by rising awareness of passion flower extract's health benefit, i.e., stress relief, anxiety blockage, and sleep. Passion flower has also been well marketed because it is plant and natural in origin, since customers are shifting towards natural well-being and health products. Its application in diet supplements, herbal tea, and functional foods has also gained pace, thus rising demand.

Sedative and tranquilizing activities of passion flower also get their entry into sleeping pills and anxiolytic drugs in enormous quantities all over the world, with disease breaking out in a stressful situation. Anti-inflammatory and antioxidant activity of passion flower extract also get their entry into cosmetics and skincare so much so that it gets its entry into products applied for relaxing and moisturizing the skin.

Apart from that, rising consumer demands for nature products and higher knowledge of sustainable purchasing are also impacting the passion flower extract market positively. Green and organic passion flower product providers are benefiting from the trend, securing market share and trust among consumers.

Market for passion flower extract is booming because demand for the utilization of herbal and natural products as an ingredient in well-being and well-wellness products is rising. As the population continues to use natural medicine rather than drugs when they get ill mentally, the market will continue to expand in future years.

Below is comparative six months' gap in CAGR between base year (2024) and run year (2025) of passion flower extract industry globally. Analysis depicts a picture of changed performance in the market in order to facilitate stakeholders to better grasp development patterns for the year. January to June is also known as the first half of the year (H1), whereas July to December is known as the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2025) | 3.2% |

| H2 (2024 to 2025) | 3.4% |

| H1 (2025 to 2035) | 3.4% |

| H2 (2025 to 2035) | 3.6% |

Development of the industry will rise in the first half (H1) of the decade 2025 to 2035 by a CAGR of 3.4% and proceed to a better growth rate of 3.6% in the second half (H2) of the decade. Development of the industry will be 20 BPS in the first half (H1) of the forecasting decade and, in the second half (H2), 20 BPS higher.

There is a group of companies that are big in terms of market share, sales, and broad coverage of the market in Tier 1. They have brand equity and spend heavily in R&D on products and in marketing. Herb Pharm and Gaia Herbs are typical examples of Tier 1 companies in the market for passion flower extracts. They are market leaders to supply their extensive portfolio of herbal products, such as passion flower extract, and have an established name in dietary supplement and well-being enterprises.

They market their products using extensive distribution channels to distribute their products through many channels of selling, such as health food shops, pharmacies, and the internet. Herb Pharm, for instance, is globally renowned for its highest quality, natural passion flower extract, and Gaia Herbs is globally renowned for its highest quality, natural herbal supplements. Mass-scale status with global reach and focus on quality, becoming industry leaders, they fall under Tier 1.

Tier 2 include companies with revenues lower than Tier 1 but with adequate market reach and specialization. Nature's Way and Swanson Health Products both fall in this tier, both of which sell passion flower extracts as one of their extensive lines of herbal supplements.

Both are industry-level brand players with decent quality but low-price products which best sell to health-conscious consumers. They are not industry leaders as Tier 1 players but not at the industry bottom either but have an acceptable customer base with good pricing policies. Their aim of offering integrated health supplements, typically low-price and low-priced, places them in the market.

Tier 3 are small and rising firms more seen due to niche market ventures and innovations. Tier 3 companies have thin coverage but growing immensely with their strategy of innovation and focused selling effort. Biosana and Botanic Choice Are Tier 3 companies. Such companies would be having direct customer and small-volume models of businesses, either web-based. Such companies' passion flower extracts sell mainly as organic stress and relaxation products on the basis of specialty consumers.

Their ability to create niches through sales of organic or specialty products and online marketing has helped them build loyal customers. Although they don't have any free access to industry giants' marketplace, customer centrism and innovation grant them the power of expanding exponentially in this competitive market.

Health-Conscious Reformulations

Shift: Consumers become increasingly interested in organic and natural solutions to wellness, and passion flower extract continues to gain Favor as a highly desired product that boasts positive stress-relief and calming properties. Off-the-counter retail sale of functional ingredients offering perceived health value by consumers grows, especially in the case of European and North American consumers. This is brought about by rising demand for mental health and wellbeing.

Strategic Response: Similar to the trend, other firms such as Gaia Herbs and Nature's Way brought passion flower extract into the market as a product with the value addition of having the ability to soothe a person and the advantage of it being a way of coping with stress. Other companies such as Puritan's Pride and Herbal Secrets added passion flower extract in insomnia treatment products and relaxant tablets due to the fact that customers are seeking natural medical supplements with increasing regularity.

Penetration to Ready-to-Use (RTU) and Functional Beverage Forms:

Shift: Buyers are moving toward convenience-filled, ready-to-use forms of functional wellness drinks offering wellness benefits in relaxation, stress, and sleep. Calming plant passion flower extract is used more and more in such functional beverage forms.

Strategic Response: As a way of benefiting from this trend, passion flower extract herbal teas have been introduced by Tazo Tea and Celestial Seasonings as relaxing. Lively Vitamin Co. has introduced passion flower extract functional water for active, health-conscious consumers. RTU and functional beverages are fueling the market growth for passion flower extract market through rising demand for convenience wellness products.

Younger Consumer Positioning by Natural and Sustainability Trend:

Shift: Youths like Millennials and Gen Z are choosing plant-based, natural, and sustainable products in the practice of well-being and health. Passion flower extract is perfectly suited for the kind of trend because it's a natural sleeping disorder and stress cure.

Strategic Response: Yogi Tea and Teavana have been retailing passion flower-based products on neutrality and greenness. Traditional Medicinal also gained because of green sourcing and potency of passion flower extract utilized in herbal products among young consumers seeking health value and green brands.

Exploding Demand for Sleep Aids and Stress-Relief Products

Shift: Growing degrees of stress and stress, especially during the post-pandemic era, have developed a demand for herbal sleeping tablets as well as stress relief. Passion flower extract is in huge demand in terms of being anti-stress as well as insomnia-healing, and therefore, it is demanded extremely by customers for an organic solution.

Strategic Response: To meet this need, firms such as Nature Made and NOW Foods launched sleep supplements with passion flower extract. These firms promoted the sedative nature of passion flower to alleviate anxiety and promote sleep. Life Extension launched passion flower extract-based capsules and tinctures under their brand name as well due to customers' demands for natural sleep disorder remedies.

Ethical Sourcing and Sustainability Pledges

Shift: Consumers prefer the ingredients within what they are buying to be sustainable and seek companies who keep ethics of sourcing and sustainability on top of the list. Passiflora caerulea extract, being an herbal plant extract, is the solution prescriptively.

Strategic Response: Herb Pharm and Mountain Rose Herbs have marketed their green sourcing of passion flower extract as a green desirable option for green consumers. These firms have utilized open sourcing and green packaging as a response to growing consumer demands for ethical sourcing in the wellness industry.

Competitive Pricing Strategies to Enable Market Availability

Shift: Increasing demand for passion flower extract has made consumers more interested in value for money without compromising on quality. The same applies to the shift from the online channel to direct-to-consumer (DTC) with price war being the key factor.

Strategic Response: Amazon Element Nutritional Sciences and Swanson Health Products reduced the prices of their passion flower supplements in an attempt to expand the coverage of passion flower extract products. The move has raised the levels of consumption among consumers, particularly in the emerging markets, due to increased demands for cheap wellness products.

Leverage E-commerce and Subscription Models

Shift: Owing to the pace of e-commerce purchases as a long-run trend during the COVID-19 pandemic, marketing online well-being products is coming forward as a highly feasible resource at a swift growth rate. Subscription portals and web shops are gaining momentum in speeding up passion flower extract products.

Strategic Response: Subscription plans based on passion flower extract created the e-presence of business firms like VitaCost and iHerb through frequent convenient repeated access to well-being solutions. Herbalife also created a strong e-presence by virtue of introducing passion flower extract as one of their stress-management and relaxation products to an educated consumer class during the emerging era of digitization.

Regional Adaptation Strategies

Shift: Plant materials like passion flower and herbal supplements differ with regard to demand across markets. Passion flower extract demand is rising steadily in North American and European markets but is more and more prevalent in other markets like the Asia-Pacific, whose demand for natural medicines is consistently increasing.

Strategic Response: Himalaya regionalized its brand by introducing passion flower extract in regionalizing beauty and wellness product flavors. Amway and Arbonne introduced passion flower extract products under their Asian business, targeting the calming and stress-removing aspect of the product.

The following is provided on the basis of the table of estimated five top territory's growth rates. These are anticipated to identify strong consumption in 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.3% |

| Germany | 4.6% |

| China | 7.1% |

| Japan | 5.8% |

| India | 6.3% |

The USA passion flower extract market is growing at a very big rate due to heightened demand from customers for natural aids to treat sleep disorders and anxiety. Passion flower extract, which is termed to be calming, is more commonly used in food supplements as a step towards inducing the quality of sleep without drug sleep aid side effects.

Increased sensitivity towards the efficacy of plant-based supplements and increased fear of chemical drug dependency are pushing demand for passion flower products. Secondly, the clean-label, plant-based, and organic trend suits American palates. Aside from that, growing demands for wellness and self-care among millennials and Gen Z are propelling demand for natural supplements and therefore driving growth in the market.

China passion flower extract market is expanding at a very fast rate due to the fact that more people are becoming aware and asking for orthodox traditional herbal supplements that would enhance the mental condition and happiness of the consumer. Passion flower, which is one of the oldest Chinese traditional medicines with an age of over several millennia, is being hugely in demand by the customers these days as a natural stress reliever and sedative.

As increasingly more individuals become urbanized and lead stressful lives, natural medicine is being called upon to heal urban stress. Moreover, Chinese youth are slowly embracing natural supplements as more and more people become cognizant of mental health. The nation's strong traditional culture of herbal medicine and government support in traditional Chinese medicine cultivation also guarantee passion flower extract popularity in the market.

Japan, where demand for natural products as well as mental health demand has risen, is using passion flower extract more and more as a natural sedative. Japanese consumers, who have long been linked with holistic health- and wellness-promoting attitudes, are using herbal supplements like passion flower to calm sleep disorders induced by stress, work stress, and city life.

The sedative effect of passion flower without the depressive action of drug use is particularly popular in a society where traditional medicine is most valued. Toward that end, passion flower extract is being incorporated into increasingly large quantities of sleeping pills, tea, and dietary supplements. Even in Japan, market demand is on the rise for nature-based clean-label sleep panaceas well-suited to Japan's rapidly growing greening and wellness lifestyle.

Demand is on the rise for India's passion flower extract market due to heightened consumers' interest in natural ingredients that promote their health, particularly for insomnia and stress conditions. High levels of stress, particularly in urban locations, are driving people towards seeking natural items that will prove to be beneficial for them.

Passion flower extract, used as an anti-stress agent as well as a sedative, is highly in demand in the Indian market to serve as a substitute for traditional medicine-based herbal remedies. Demand from the health and well-being category with increased consumption of organic and natural usage, thus taking control, is further increasing the market size.

As passion flower is increasingly being accepted, application in supplements, beverages, and wellness products will grow among urban consumers looking for organic alternatives to maintain mental balance.

| Segment | Value Share (2025) |

|---|---|

| Organic (By Nature) | 45.6% |

As more health-conscious consumers are on the rise, organic product demand is also increasing, particularly in food and beverages segments. Organic sugar beet juice extract as an organic and even clean-label ingredient is gaining momentum compared to the traditional ones. This is because, as consumers become increasingly health- and environment-aware, customers expect nothing but no artificial pesticides and chemicals in food.

Organic sugar beet juice extract is likewise in demand in functional foods and beverages, food supplements, where natural origin is greatly preferred. Such demand is being fulfilled with organic sugar beet juice in liquid and powder forms that are greatly favoured among healthy consumers.

It is the destiny of this category that it will be permitted to occupy space on the shelves by emerging as a sustainable, all-natural choice and in doing so become Europe and North America's growth driver of highest magnitude. Additional focus on sustainability and clean agriculture was also a factor for increased demand for organic sugar beet juice and therefore it is a critical addition for the brands focusing on clean and clear.

| Segment | Value Share (2025) |

|---|---|

| Food & Beverages (By End Use) | 38.9% |

The most common application of sugar beet juice extract is in food and beverages, simply because it is a natural sweetener that carries health connotations. As a result of the increasingly health-conscious consumer, demand has increased for natural plant sweeteners and more use of sugar beet juice extract as a cleaner, healthier sweetener substitute to chemically made sweeteners and processed sugar.

It is used freely within the food and beverage industry within functional drinks, juice, and smoothies in order to bring naturally sweet flavour without calories or processed foods. Otherwise, with food application, sugar beet juice extract is added to food items like sauces, dressings, and even breads, wherein not only is it used as a sweetener but also used as an extra flavouring additive.

It is also propelled by the clean label, with a need to develop a culture of naturalness and transparency. With more clean eating worldwide, the consumption of sugar beet juice extract as a flavoring and sweetening food and beverage ingredient will be one of the main drivers, especially in Europe and North America, since the consumers are looking for a healthier alternative to sugar.

The international passion flower extract market is competitive in nature, and some leading players are spearheading the growth of the market through innovation, product development, and natural health products orientation. Naturalin Bio-Resources Co. Ltd., Alchem International Pvt. Ltd., Herb Pharm, Indena S.p.A, among others, have established themselves through quality, sustainable, and diversified product portfolios in line with the growing demand for herbal supplements and natural well-being ingredients by the consumers.

These firms have leveraged the growing trend towards wholistic health supplements to market the soothing and tension-reducing benefits of passion flower extract to consumers seeking natural solutions to their mental well-being.

For instance:

Herb Pharm maintained its competitive edge with focus being on superior quality, sustainably cultivated herbal extracts. Passion flower extract is just one of its varied line of products as a specialty ingredient in relaxation and typical sleep pattern. Herb Pharm expanded the customer base with solid distribution channels like health food stores, pharmacies, and mail ordering, with awareness of the brand increased.

Alchem International Pvt. Ltd. has focused on providing quality and affordable herbal extracts, including passion flower extract, to functional foods and dietary supplements industries. Competition survival has been impacted by remaining committed to natural stress relief and sleep, and with the growing demand for plant-based wellness products, those were targeted.

These companies are not only wonderful product performers but also work day and night to meet evolving consumer demands to develop natural, effective, and safe remedies for anxiety, stress, and sleep disorders. The industry also grew by leaps and bounds through

The industry is categorized into Organic Passion Flower Extract and Conventional Passion Flower Extract.

This segment is further categorized into Liquid and Dry forms.

The end-use applications of passion flower extract are divided into Food and Beverages, Pharmacological Uses, Pharmaceutical Uses, Nutraceutical Use, Dietary Supplements, Cosmetic and Personal Care.

This segment is further categorized into Direct Sales, Indirect Sales, Wholesale, Online Retailer, Supermarket, Specialty Stores.

The industry analysis has been carried out in key regions, including North America, Latin America, Europe Passion, Asia Pacific Passion, Middle East & Africa.

The global passion flower extract market is estimated at a value of USD 2.7 billion in 2025.

Sales increased at a 12.5% year-on-year growth rate in 2024, indicating a strong demand for passion flower extract in wellness and dietary supplement products.

Leading manufacturers in the passion flower extract market include Naturalin Bio-Resources Co. Ltd., Alchem International Pvt. Ltd., Herb Pharm, Indena S.p.A., Avena Botanicals, Martin Bauer Holding GmbH & Co. KG, Monterey Bay Spice Company, Saw Palmetto Harvesting Company, Vitacost, The Good Scents Company, and others.

The North American region is projected to hold a significant revenue share due to the increasing demand for natural wellness products and herbal supplements.

The passion flower extract market is projected to grow at a forecast CAGR of 3.6% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 4: Global Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 6: Global Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 8: Global Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 10: Global Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 12: North America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 14: North America Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 16: North America Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 18: North America Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 20: North America Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 24: Latin America Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 26: Latin America Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 28: Latin America Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 30: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: Europe Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 33: Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 34: Europe Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 36: Europe Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 38: Europe Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 40: Europe Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Asia Pacific Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 44: Asia Pacific Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 46: Asia Pacific Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 47: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 48: Asia Pacific Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 50: Asia Pacific Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 52: MEA Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 53: MEA Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 54: MEA Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 55: MEA Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 56: MEA Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 57: MEA Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 58: MEA Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 60: MEA Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Mn) by Nature, 2022 to 2032

Figure 2: Global Market Value (US$ Mn) by Form, 2022 to 2032

Figure 3: Global Market Value (US$ Mn) by End Use, 2022 to 2032

Figure 4: Global Market Value (US$ Mn) by Distribution Channel, 2022 to 2032

Figure 5: Global Market Value (US$ Mn) by Region, 2022 to 2032

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 7: Global Market Volume (Tons) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 11: Global Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 15: Global Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 19: Global Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 23: Global Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 26: Global Market Attractiveness by Nature, 2022 to 2032

Figure 27: Global Market Attractiveness by Form, 2022 to 2032

Figure 28: Global Market Attractiveness by End Use, 2022 to 2032

Figure 29: Global Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Nature, 2022 to 2032

Figure 32: North America Market Value (US$ Million) by Form, 2022 to 2032

Figure 33: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 35: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 37: North America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 41: North America Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 45: North America Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 49: North America Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 53: North America Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 56: North America Market Attractiveness by Nature, 2022 to 2032

Figure 57: North America Market Attractiveness by Form, 2022 to 2032

Figure 58: North America Market Attractiveness by End Use, 2022 to 2032

Figure 59: North America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Nature, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) by Form, 2022 to 2032

Figure 63: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 71: Latin America Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 75: Latin America Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 79: Latin America Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 83: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Nature, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Form, 2022 to 2032

Figure 88: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Europe Market Value (US$ Million) by Nature, 2022 to 2032

Figure 92: Europe Market Value (US$ Million) by Form, 2022 to 2032

Figure 93: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 95: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 97: Europe Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 101: Europe Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 105: Europe Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 108: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 109: Europe Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 113: Europe Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 116: Europe Market Attractiveness by Nature, 2022 to 2032

Figure 117: Europe Market Attractiveness by Form, 2022 to 2032

Figure 118: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 119: Europe Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 120: Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: Asia Pacific Market Value (US$ Million) by Nature, 2022 to 2032

Figure 122: Asia Pacific Market Value (US$ Million) by Form, 2022 to 2032

Figure 123: Asia Pacific Market Value (US$ Million) by End Use, 2022 to 2032

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 127: Asia Pacific Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 131: Asia Pacific Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 135: Asia Pacific Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 139: Asia Pacific Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 143: Asia Pacific Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 146: Asia Pacific Market Attractiveness by Nature, 2022 to 2032

Figure 147: Asia Pacific Market Attractiveness by Form, 2022 to 2032

Figure 148: Asia Pacific Market Attractiveness by End Use, 2022 to 2032

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 150: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 151: MEA Market Value (US$ Million) by Nature, 2022 to 2032

Figure 152: MEA Market Value (US$ Million) by Form, 2022 to 2032

Figure 153: MEA Market Value (US$ Million) by End Use, 2022 to 2032

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 155: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 157: MEA Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: MEA Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 161: MEA Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 162: MEA Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 164: MEA Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 165: MEA Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 166: MEA Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 168: MEA Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 169: MEA Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 170: MEA Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 171: MEA Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 173: MEA Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 176: MEA Market Attractiveness by Nature, 2022 to 2032

Figure 177: MEA Market Attractiveness by Form, 2022 to 2032

Figure 178: MEA Market Attractiveness by End Use, 2022 to 2032

Figure 179: MEA Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 180: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passion Fruit Extract Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Passion Fruit Extract Providers

Flower Box Market Size and Share Forecast Outlook 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Sunflower Seed Market Size and Share Forecast Outlook 2025 to 2035

Safflower Oil Market Size and Share Forecast Outlook 2025 to 2035

Ahiflower Oil Market Analysis – Growth & Forecast 2025 to 2035

Cut Flower Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Industry Share Analysis for Cut Flower Companies

Hibiscus Flower Powder Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Hibiscus Flower Powder Providers

Preserved Flowers Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Packaged Sunflower Seeds Market – Growth, Demand & Consumer Trends

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA