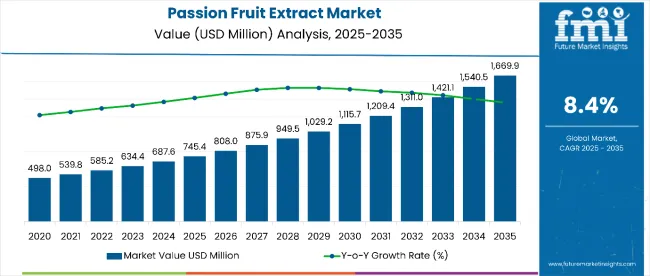

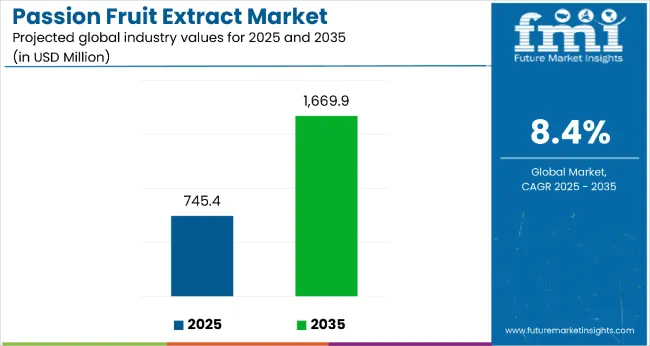

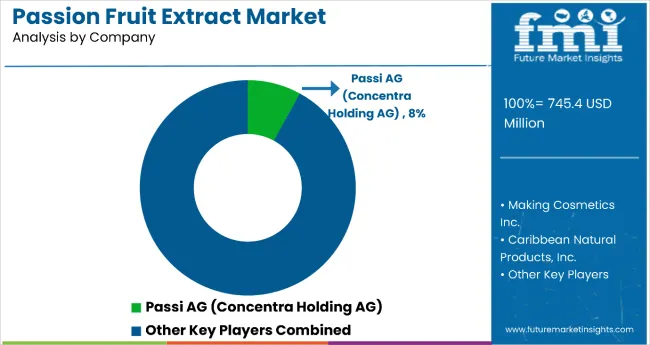

The passion fruit extract market is estimated to be valued at USD 745.4 million in 2025 and is projected to reach USD 1669.9 million by 2035, registering a CAGR of 8.4% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 924.5 million over the forecast period. This reflects a 2.24 times growth at a compound annual growth rate of 8.4%. The market’s evolution is expected to be shaped by rising demand for natural flavoring agents, growing awareness of passion fruit health benefits, and broader applications across beverages, confectionery, cosmetics, and nutraceuticals in developed and emerging economies.

By 2030, the market is likely to reach approximately USD 1,115.7 million, accounting for USD 370.3 million in incremental value over the first half of the period. The remaining USD 554.2 million is expected during the second half, suggesting a moderately back-loaded growth pattern, with an absolute dollar opportunity of USD 924.5 million over the forecast period. Product diversification across organic, concentrated, and powdered variants is gaining traction due to evolving consumer preferences and wider adoption in functional food and beverage formulations.

Companies such as Nutrativa Global, Givaudan, and Firmenich are advancing their competitive positions through investments in sustainable sourcing, advanced extraction technologies, and innovative product development. Premium positioning strategies and certifications such as organic and non-GMO are supporting expansion into health-conscious consumer segments and specialty retail channels. Market performance will remain anchored in nutritional awareness campaigns, robust supply chain networks, and adherence to stringent quality standards.

| Metric | Value |

|---|---|

| Passion Fruit Extract Market Estimated Value in (2025E) | USD 745.4 million |

| Passion Fruit Extract Market Forecast Value in (2035F) | USD 1,669.9 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The market holds approximately 42% of the healthy snacking market, driven by its nutritional density, convenience, and versatility in consumption patterns. It accounts for around 35% of the plant-based protein sources market, supported by growing awareness of passion fruit extract as a complete protein alternative. The market contributes nearly 28% to the premium food ingredients segment, particularly for incorporation into bakery, confectionery, and processed food applications. It holds close to 22% of the organic food market, where certified passion fruit extract commands premium pricing among health-conscious consumers. The share in the functional foods market reaches about 31%, reflecting preference among consumers seeking natural sources of healthy fats, vitamins, and minerals.

The market is undergoing structural change driven by rising health consciousness and expanding applications across food and beverage industries. Advanced processing methods including concentration, powdering, flavoring, and packaging innovations have enhanced shelf life, taste profiles, and consumer convenience. Manufacturers are introducing value-added products including fortified beverages, dessert mixes, and functional supplements tailored for specific dietary preferences. Strategic collaborations between growers and food manufacturers have accelerated adoption in processed food applications.

The market is segmented by form, source, nature, species type, application, extraction method, and region. By form, the market is divided into powder, oil, and concentrate. Based on source, the market is classified into peel, pulp, and seed. In terms of nature, the market is bifurcated into organic and conventional. By species type, the market is categorized into Passi floraedulis, Passi flora flavicarpa, Passi floraligularis, Passiflora caerulea, and other species types.

By application, the market is segmented into skincare (sunscreen, moisturizer/cream & lotion, eye revitalizers, face cleanser & body wash), haircare (shampoo, conditioner, oil & serum), cosmetics (lip care, nail care), and others (functional foods, beverages, nutraceuticals, and aromatherapy). Based on extraction method, the market is divided into cold process/cold pressed, spray drying, distillation, ultrasound-assisted leaching extraction (UE), supercritical fluid extraction, and others (solvent extraction, microwave-assisted extraction, and fermentation-based methods). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

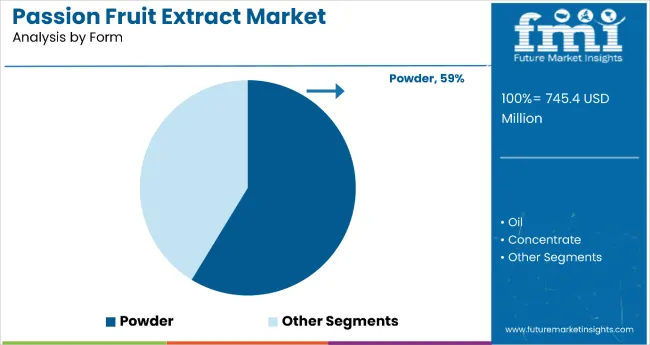

Powder form dominates the market, accounting for 59% of total revenue, making it the most lucrative segment. Its leadership stems from high demand in cosmetics, nutraceuticals, and functional foods, where powdered extracts offer superior stability, ease of formulation, and longer shelf life compared to oil or concentrate. Powder is widely preferred in skincare formulations for its high antioxidant retention and in dietary supplements for its concentrated nutrient profile.

Additionally, powder form is easier to transport, requires less storage space, and maintains bioactive compounds during extended shelf periods, making it ideal for global distribution. Rising consumer interest in natural, plant-based ingredients has also boosted adoption across clean-label food products, protein blends, and beverages. The segment benefits from advancements in spray-drying and microencapsulation technologies, which enhance solubility and bioavailability. With expanding applications in premium beauty and wellness products, powder form is projected to sustain its market leadership over the forecast period.

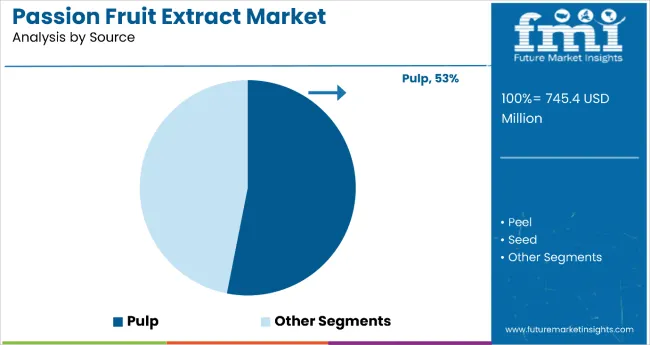

Pulp stands out as the most lucrative source segment, holding a commanding 53% share of the global passion fruit extract market. This leadership is underpinned by the pulp’s superior nutrient profile, intense natural flavor, and exceptional versatility across multiple industries. In the food and beverage sector, pulp-based extracts are prized for their authentic tropical taste, appealing aroma, and vibrant color, making them a staple in premium juices, smoothies, bakery fillings, and confectionery products.

Within the cosmetics and personal care industry, pulp extract is rich in antioxidants, vitamins A and C, and essential minerals, which contribute to its popularity in anti-aging, brightening, and hydrating skincare formulations. From a production perspective, pulp offers higher extraction efficiency than peel or seed, reducing costs while ensuring consistent quality. Rising global demand for clean-label, plant-based ingredients and exotic flavor profiles further amplifies its market potential. With expanding applications in both functional foods and wellness-focused products, pulp is expected to remain the key growth driver of the passion fruit extract market through 2035.

From 2025 to 2035, the market is set to benefit from rising consumer demand for natural, exotic flavoring agents coupled with scientific studies highlighting the fruit’s rich antioxidant profile, vitamin content, and skin-health benefits. This positions manufacturers that emphasize functional wellness claims and clean-label credentials as key beneficiaries in food, beverage, nutraceutical, and personal care sectors.

Rising Demand for Natural and Functional Ingredients Drives Market Growth

Increasing awareness of plant-based nutrition and preventive wellness has emerged as the primary catalyst for passion fruit extract consumption. In 2024, antioxidants and vitamin C content were widely promoted in skincare formulations, while in 2025, pulp-derived extracts gained traction in immunity-boosting beverages and functional foods. Consumer preference for tropical, authentic flavors and products free from synthetic additives is expanding usage across premium juices, flavored teas, and herbal supplements. Manufacturers with verifiable sourcing transparency and scientifically backed benefits are positioned to capture sustained growth from health-driven and clean-label product demand.

Premium Applications and Sustainable Sourcing Create Market Opportunities

In 2024, value-added formats such as organic-certified extracts, freeze-dried powders, and blended functional beverages were gaining market share via premium positioning. By 2025, ethical sourcing practices, fair-trade certifications, and eco-friendly packaging became key differentiators for accessing high-value export markets and eco-conscious consumer segments. These trends show that innovation beyond standard extracts through diversified formats, enhanced sensory profiles, and sustainability credential scan command premium pricing, strengthen brand loyalty, and expand presence in competitive global markets.

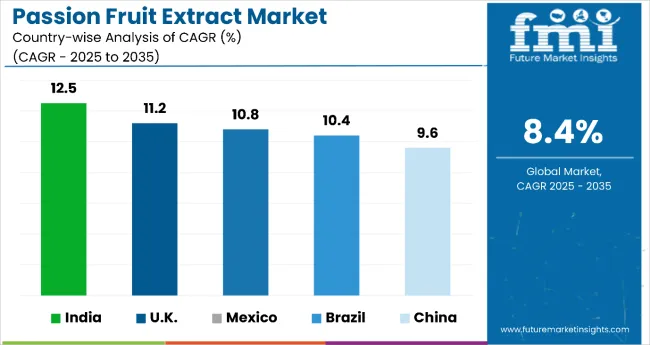

| Country | CAGR |

|---|---|

| India | 12.5% |

| UK | 11.2% |

| Mexico | 10.8% |

| Brazil | 10.4% |

| China | 9.6% |

Among the top five markets for passion fruit extract, India leads with the highest CAGR of 12.5%, reflecting rapid production expansion, government-backed export incentives, and strong domestic wellness product demand. The UK follows at 11.2%, driven by a mature functional food and beverage sector, along with high-value cosmetic applications. Mexico posts a robust 10.8%, leveraging abundant local production and proximity to USA markets for export-led growth. Brazil records a 10.4% CAGR, supported by its dominant global production capacity and diversified application base in food, beverage, and cosmetics. China, while the lowest among the five at 9.6%, still shows healthy growth from rising health-conscious consumption, technological integration, and expanding e-commerce channels.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Sales of passion fruit extract in India are projected to grow at a CAGR of 12.5%, supported by expanding cultivation areas in states like Kerala and Mizoram. Increasing domestic consumption of natural health products, coupled with demand from nutraceutical and cosmetic sectors, is fueling capacity expansion. Farmers are adopting improved cultivation techniques and processing technologies, reducing post-harvest losses. Strong government support for agri-based exports and rural entrepreneurship is attracting private investments. The growing wellness industry is a major consumer of passion fruit extract, while India’s strategic position enables strong export potential. Rising urban incomes and e-commerce penetration are further accelerating distribution growth.

The UK passion fruit extract revenue is set to expand at a CAGR of 11.2%, driven by rising demand for exotic fruit-based beverages and functional food products. Importers are securing direct sourcing agreements with Latin American and African producers to maintain year-round supply. Health-conscious consumers are embracing passion fruit extract for its antioxidant and vitamin-rich profile, fueling product launches in smoothies, sports drinks, and supplements. The cosmetic sector is increasingly incorporating passion fruit oil in skincare products due to its hydrating and anti-aging benefits. The UK’s strong retail distribution network and advanced R&D capabilities support innovative product formulations.

Demand passion fruit extract in Mexico is projected to grow at a CAGR of 10.8%, supported by abundant local production of passion fruit and strong processing capacity. The country’s tropical climate allows for consistent year-round harvesting, ensuring supply stability for both domestic and export markets. Manufacturers are investing in modern extraction facilities to improve yield and maintain high purity standards. Passion fruit extract is being incorporated into juices, alcoholic cocktails, and traditional desserts, enhancing its market presence. Mexico’s proximity to the USA gives it a competitive advantage in fulfilling North American demand, while growing domestic wellness trends further support market expansion.

Revenue from passion fruit extract in Brazil is anticipated to grow at a CAGR of 10.4%, driven by its position as one of the world’s largest passion fruit producers. The country’s processing industry benefits from abundant raw material supply and established export channels to Europe, Asia, and North America. Government incentives for agri-processing, coupled with sustainable farming initiatives, are boosting production efficiency. Brazilian manufacturers are diversifying supply chains to mitigate climate and logistics risks. Passion fruit extract’s growing role in health drinks, confectionery, and personal care products is reinforcing domestic demand alongside expanding global interest.

Sales of passion fruit extract in China are expected to expand at a CAGR of 9.6%, fueled by rapid adoption of modern agricultural practices in southern provinces. Domestic production is being supported by government-led initiatives to promote fruit-based health products. Manufacturers are integrating advanced extraction technologies to ensure consistent quality for use in nutraceuticals and beverages. The rising middle-class population is driving demand for functional foods and supplements. Strategic import partnerships ensure a steady supply of passion fruit during off-season months, while e-commerce platforms are making the product more accessible to urban consumers nationwide.

The market is moderately consolidated, with leading companies Passi AG (Concreat Holding AG) holding 8% strong foothold through vertically integrated operations, advanced extraction technologies, and diversified product portfolios catering to food, beverage, nutraceutical, and cosmetic industries. Market leaders leverage global sourcing networks, R&D capabilities, and strategic partnerships to maintain quality consistency, scale production, and meet evolving consumer demands for natural and functional ingredients.

Key players include Döhler GmbH, Nactarome S.p.A., Symrise AG, Kerry Group plc, Flavorcan International Inc., Flavour tech Pty Ltd, Blue Pacific Flavors, Givaudan SA, Kalsec Inc., Archer Daniels Midland Company, Citromax Group, and Ingredion Incorporated. These companies specialize in producing passion fruit extracts in various formsliquid, powder, and concentrate stailored for applications in juices, flavored water, functional foods, dietary supplements, personal care products, and fragrances.

Market growth is driven by rising consumer demand for natural and exotic flavor profiles, increasing use of passion fruit extract in clean-label formulations, expanding applications in health and wellness products, growing awareness of antioxidant and vitamin-rich properties, and premiumization trends in both developed and emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 745.4 Million |

| Form | Powder, Oil, and Concentrate |

| Source | Peel, Pup, and Seed |

| Nature | Organic and Conventional |

| Species Type | Passiflora Edulis, Passiflora Flavicarpa, Passiflora Ligularis, Passiflora Caerulea, Others (including lesser-known passion fruit species and hybrids) |

| Application | Skincare (Sunscreen; Moisturizer, Cream & Lotion; Eye Revitalizers; Face Cleanser & Body Wash), Haircare (Shampoo; Conditioner; Oil & Serum), Cosmetics (Lip Care; Nail Care), Others (including aromatherapy, spa products, and specialty formulations) |

| Extraction Method | Cold Process/Cold Pressed, Spray Drying, Distillation, Ultrasound Assisted Leaching Extraction (UE), Supercritical Fluid Extraction, Others (including solvent extraction, microwave-assisted extraction, and fermentation-based methods) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa , Australia add 40+ countries |

| Key Companies Profiled | MakingCosmetics Inc., Passi AG (Concentra Holding AG), Caribbean Natural Products, Inc., DENNICK FRUITSOURCE, LLC., NOF Corporation, Jedwards International, Inc., Natural Sourcing, LLC., Symrise |

| Additional Attributes | Increasing demand for natural flavoring agents, rising application in functional foods & beverages, growing clean-label product trends |

The global passion fruit extract market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the passion fruit extract market is projected to reach USD 1.6 billion by 2035.

The passion fruit extract market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in passion fruit extract market are powder, oil and concentrate.

In terms of source, peel segment to command 53.1% share in the passion fruit extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Passion Fruit Extract Providers

Passion Flower Extract Market Analysis by Nutraceutical Use, Dietary Supplements, Cosmetic and Personal Care and others Through 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Elaeis Guineensis (Palm) Fruit Extract Market Size and Share Forecast Outlook 2025 to 2035

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA