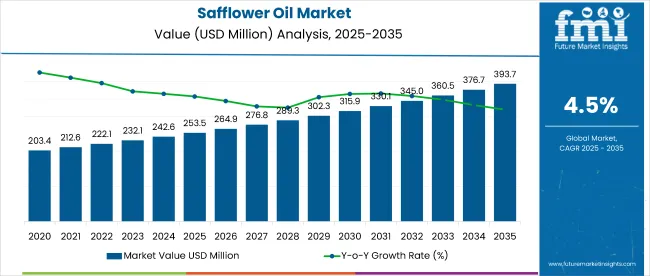

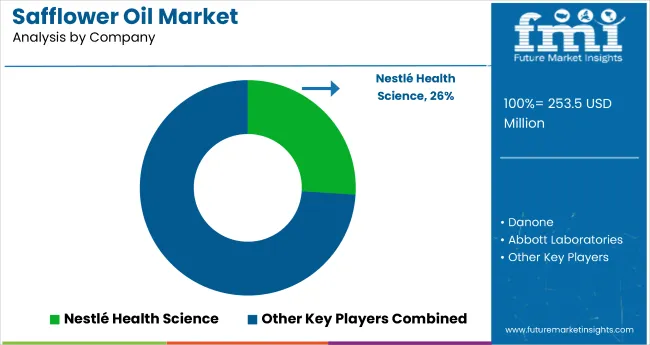

The global safflower oil market is projected to grow from USD 253.5 million in 2025 to USD 393.7 million by 2035, registering a CAGR of 4.5%. The market expansion is being driven by increasing consumer demand for healthy, heart-friendly oils and the rising awareness of the benefits of high oleic and cold-pressed oils.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 253.5 Million |

| Industry Value (2035F) | USD 393.7 Million |

| CAGR (2025 to 2035) | 4.5% |

Additionally, the growing trend towards organic and natural food products is propelling the demand for organic safflower oil. As health-conscious consumers shift away from oils high in saturated fats, safflower oil is gaining traction due to its high content of monounsaturated fats and essential fatty acids.

The market holds a relatively small share in its parent markets. Within the edible oils market, it accounts for 0.1%, while its share in the specialty oils market is around 4-5%. In the organic food market, safflower oil holds about 1-2%, and in the functional food ingredients market, it contributes around 0.5-1%. It holds a 0.2% share of the vegetable oils market and around 0.5-1% within the health and wellness market.

Its role in the personal care and cosmetics market is about 0.2%, and in the biodiesel market, it stands at 0.1%. In the broader agricultural products market, its share is minimal at 0.05%. These shares highlight its niche but growing presence across several industries.

Government regulations impacting the market focus on food safety, labeling, and production standards. The Food Safety and Standards Authority of India (FSSAI), the USA Food and Drug Administration (FDA), and the European Food Safety Authority (EFSA) have set strict guidelines for edible oil production, ensuring quality and consumer safety. These regulations are driving the adoption of sustainable and clean production practices in safflower oil production, while promoting consumer trust and improving market penetration for organic safflower oil.

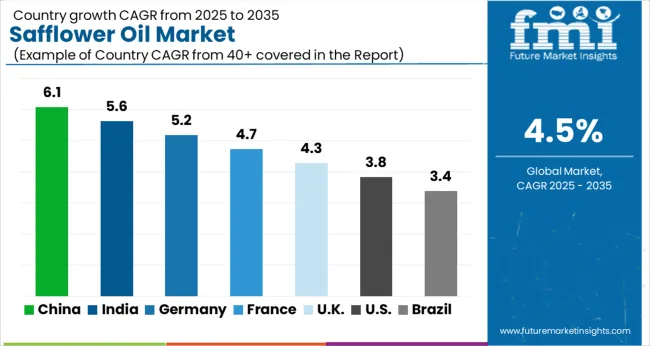

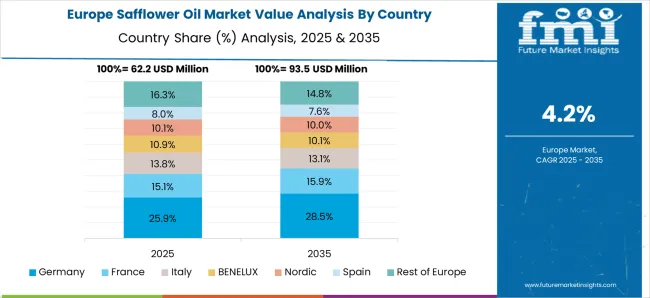

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 5% from 2025 to 2035. The food & beverage industry will lead the end use segment with a 50% share, while conventional will dominate the nature segment with a 55% share. The UK and USA markets are also expected to grow steadily at CAGRs of 4.3% and 4.5%, respectively, while Germany and France will witness moderate growth at 4.1% and 4.7% CAGR, respectively.

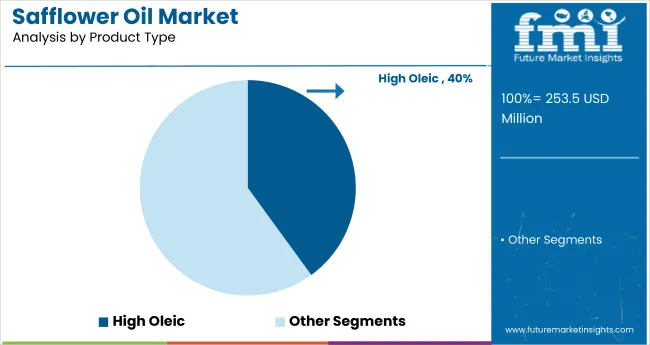

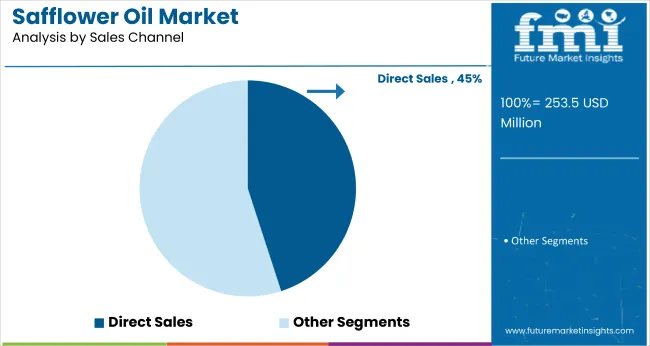

The market is segmented by product type, nature, sales channel, end use, and region. By product type, the market is bifurcated into high linoleic and high oleic. In terms of nature, the market is classified into conventional and organic. Based on sales channel, the market is segmented into direct sales, convenience stores, modern trade, online stores, specialty stores, and other channels (cooperatives, wholesale food distributors, health & wellness expos, and b2b bulk supply contracts).

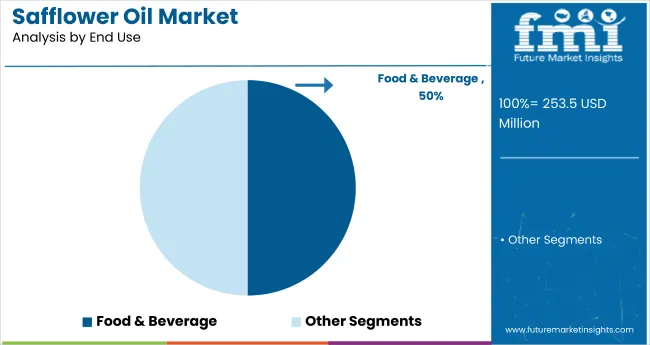

In terms of end use, the market is divided into cosmetics & personal care, dietary supplements, food & beverage industry, foodservice, pharmaceuticals, retail, and others (biodiesel production, animal feed, lubricants, and textile applications). Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

High oleic is expected to dominate the product type segment, capturing 40% of the market share by 2025. Its heart-health benefits, versatility in cooking, and growing demand in dietary supplements drive this growth.

Conventional is expected to capture 55% of the market share by 2025, driven by its affordability, widespread availability, and continued demand in food production, cooking, and various industrial applications.

Direct sales are projected to dominate the sales channel segment, capturing 45% of the global market share by 2025, driven by strong distributor networks and direct relationships between manufacturers and end-users in various industries.

The food & beverage industry is expected to lead the end use segment, capturing 50% of the global market share by 2025, driven by safflower oil's versatility in cooking, frying, and health-conscious consumer demand.

The global safflower oil market is experiencing steady growth, driven by rising consumer awareness about health and the increasing demand for heart-healthy cooking oils. Safflower oil’s versatility in food and cosmetic applications is enhancing its market presence.

Recent Trends in the Safflower Oil Market

Challenges in the Safflower Oil Market

Japan’s momentum is driven by its growing demand for heart-healthy oils, particularly in food & beverages and dietary supplements, with a strong focus on clean-label and organic products. Germany and France maintain consistent demand, driven by European Union sustainability mandates and funding for eco-friendly product sourcing. In contrast, developed economies such as the USA (4.5% CAGR), UK (4.3%), and Japan (5%) are expected to expand at a steady 0.91-1.00x of the global growth rate.

Japan leads the market, driven by increasing health consciousness and the rising demand for organic, heart-healthy products. Germany and France follow closely, fueled by EU sustainability initiatives and a growing preference for plant-based oils.

The USA market is expanding due to health trends, with a focus on clean-label and plant-based oils in food & beverages. The UK experiences slower growth, influenced by the demand for clean-label products and plant-based diets. Japan’s growth momentum is the strongest, followed by France, Germany, and the USA in terms of market demand.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan safflower oil revenue is growing at a CAGR of 5% from 2025 to 2035. Growth is driven by increasing health-consciousness, with safflower oil being popular for its heart-healthy properties and as a preferred choice for clean-label and organic products. Japan is also seeing rising adoption in the food & beverage sector, especially in products promoting cardiovascular health.

The sales of safflower oil in Germany are expected to expand at a CAGR of 4.1% during the forecast period, driven by EU sustainability goals and an increasing preference for healthier cooking oils. The organic food sector is a key driver, with a growing trend for plant-based, heart-healthy oils.

The French safflower oil market is projected to grow at a 4.7% CAGR during the forecast period, in line with the European demand for healthier oils. France has been a leader in the organic food sector, with safflower oil being favored for its light flavor and high unsaturated fat content.

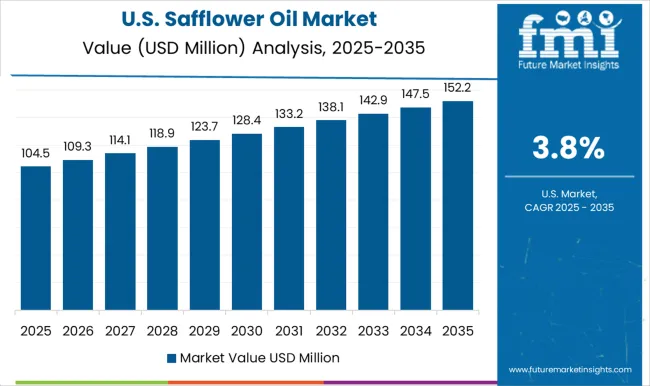

The USA safflower oil revenue is projected to grow at a CAGR of 4.5% from 2025 to 2035. The USA market is heavily driven by health trends, with safflower oil gaining traction due to its heart-health benefits and being considered a healthier alternative to traditional cooking oils.

The UK safflower oil market is projected to grow at a CAGR of 4.3% from 2025 to 2035, slightly below the global average. Growth is driven by the increasing demand for sustainable and clean-label products in food & beverage, as well as personal care & cosmetics. The UK also places high importance on plant-based diets, further driving the popularity of safflower oil due to its health benefits.

The market is moderately consolidated, with leading players such as Marico Ltd., Gustav Heess Oleochemische Erzeugnisse GmbH, SunOpta, Connoils LLC, and Oilseeds International, Ltd. dominating the industry. These companies provide high-quality safflower oil catering to diverse sectors, including food & beverages, personal care, and pharmaceuticals.

Marico Ltd. focuses on value-added, heart-healthy oils, while Gustav Heess Oleochemische Erzeugnisse GmbH specializes in premium, organic safflower oil. SunOpta offers sustainable, plant-based oil solutions, and Connoils LLC is known for its customizable safflower oil formulations.

Other key players like Adams Group Inc, Centra Foods, Henry Lamotte OILS GmbH, Spectrum Organic Products, LLC, and Moksha Lifestyle Products contribute by providing specialized, high-quality safflower oil for a variety of industrial and consumer applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 253.5 Million |

| Projected Market Size (2035) | USD 393.7 Million |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Product Type Analyzed | High Oleic and High Linoleic |

| Nature Analyzed | Conventional and Organic |

| Sales Channel Analyzed | Direct Sales, Convenience Stores, Modern Trade, Online Stores, Specialty Stores, and Other Channels (Cooperatives, Wholesale Food Distributors, Health & Wellness Expos, and B2B Bulk Supply Contracts) |

| End Use Analyzed | Cosmetics & Personal Care, Dietary Supplements, Food & Beverage Industry, Foodservice, Pharmaceuticals, Retail, and Others (Biodiesel Production, Animal Feed, Lubricants, and Textile Applications) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Marico Ltd., Gustav Heess Oleochemische Erzeugnisse GmbH, SunOpta, Connoils LLC, Oilseeds International, Ltd., Adams Group Inc, Centra Foods, Henry Lamotte OILS GmbH, Spectrum Organics Products, LLC, Moksha Lifestyle Products |

| Additional Attributes | Dollar sales by product type, share by nature, regional demand growth, policy influence, health and wellness trends, competitive benchmarking |

The global safflower oil market is estimated to be valued at USD 253.5 million in 2025.

The market size for the safflower oil market is projected to reach USD 393.7 million by 2035.

The safflower oil market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in safflower oil market are high linoleic and high oleic.

In terms of nature, conventional segment to command 63.5% share in the safflower oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA