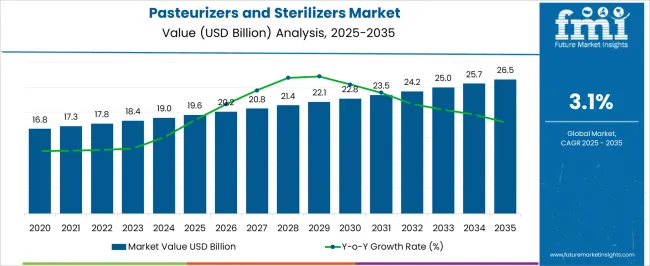

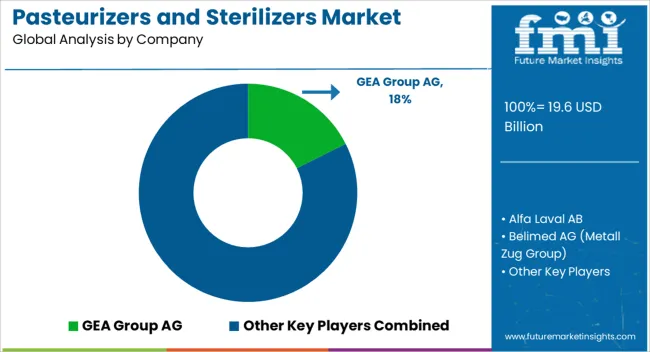

The pasteurizers and sterilizers market is estimated to be valued at USD 19.6 billion in 2025 and is projected to reach USD 26.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

The growth pattern reflects stable demand, supported by the rising need for food safety, pharmaceutical processing, and beverage preservation worldwide. From 2020–2024, the market increases from USD 16.8 billion to USD 19.0 billion, driven by heightened regulatory emphasis on hygiene standards and consumer preference for safe, long-shelf-life products. Annual increments, including USD 17.3 billion in 2021, USD 17.8 billion in 2022, and USD 18.4 billion in 2023, demonstrate steady progress fueled by upgrades in dairy, meat, and beverage processing facilities. Between 2025–2030, the market expands from USD 19.6 billion to USD 23.5 billion, accounting for nearly 60% of the overall growth.

This phase benefits from increasing automation in food and pharmaceutical manufacturing, adoption of energy-efficient sterilization technologies, and growing demand from emerging economies investing in modernized production infrastructure. By 2031–2035, the market progresses from USD 24.2 billion to USD 26.5 billion, contributing the remaining share of growth. This stage reflects broader integration of continuous sterilization equipment, higher adoption of advanced thermal and non-thermal pasteurization techniques, and sustained investment in healthcare-grade sterilizers. The pasteurizers and sterilizers market demonstrates consistent and gradual growth through 2035, underpinned by evolving safety regulations, technological improvements, and rising consumption of processed and packaged products.

| Metric | Value |

|---|---|

| Pasteurizers and Sterilizers Market Estimated Value in (2025 E) | USD 19.6 billion |

| Pasteurizers and Sterilizers Market Forecast Value in (2035 F) | USD 26.5 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The pasteurizers and sterilizers market holds a notable position within the broader thermal processing and food safety ecosystem, accounting for approximately 18–20% share of the global thermal equipment industry, where conventional cooking and chilling equipment continue to dominate. Within the food and beverage processing machinery segment, pasteurizers and sterilizers represent nearly 22–24%, driven by the need for microbial control, extended shelf life, and adherence to stringent hygiene standards. In dairy and liquid processing applications, these systems capture around 25–27% share, reflecting their critical role in ensuring product safety and quality. Within canned and packaged food processing operations, pasteurizers and sterilizers account for close to 15–17%, providing controlled heat treatments that prevent spoilage and maintain nutritional integrity. In pharmaceutical and biotech production, their adoption represents approximately 8–10%, supporting sterilization of liquid formulations, laboratory media, and consumable solutions.

Market expansion has been propelled by increasing regulatory scrutiny on food safety, rising consumer awareness regarding product hygiene, and growing investments in modern processing plants with automated thermal treatment solutions. Industry players are focusing on developing energy-efficient, modular, and digitally monitored pasteurization and sterilization systems to enhance throughput, reduce operational costs, and comply with international quality certifications. While these systems operate alongside other thermal and preservation technologies, their share underscores their essential role in ensuring food, beverage, and pharmaceutical safety, positioning them as indispensable components within processing value chains globally.

The pasteurizers and sterilizers market is witnessing strong momentum due to heightened regulatory scrutiny on food safety, rising demand for shelf-stable consumables, and technological advancements in thermal processing equipment. Changing consumer habits around ready-to-eat and packaged foods are compelling manufacturers to invest in reliable sterilization and pasteurization systems.

Automation, energy efficiency, and modular designs are emerging as critical differentiators in purchasing decisions across industries. Moreover, food exports and private label expansions in emerging economies are bolstering the installation of high-capacity units to meet international safety standards.

With ongoing innovation in heat exchangers and container sterilization systems, the market is positioned for sustained growth.

The pasteurizers and sterilizers market is segmented by product type, application, end use, distribution channel, and geographic regions. By product type, pasteurizers and sterilizers market is divided into sterilizers and pasteurizers. In terms of application, pasteurizers and sterilizers market is classified into dairy products, juices, medical devices, water treatment, chemical sterilization, and others (surgical equipment, Etc). Based on end use, pasteurizers and sterilizers market is segmented into food & beverage, healthcare and pharmaceuticals, chemical, and industrial. By distribution channel, pasteurizers and sterilizers market is segmented into direct and indirect. Regionally, the pasteurizers and sterilizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

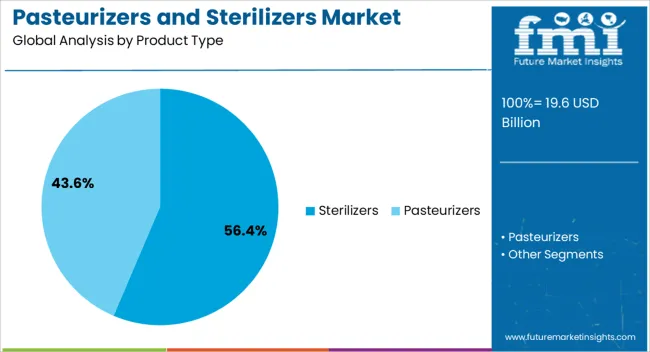

Sterilizers are projected to account for 56.4% of the total market share in 2025, making them the dominant product type in the pasteurizers and sterilizers market. This growth is driven by their broader applicability in neutralizing pathogens across food, beverage, and pharmaceutical products. Enhanced consumer sensitivity to microbial contamination and rising expectations for product longevity have spurred the integration of sterilizers in end-to-end production lines. High-pressure and ultra-high temperature sterilization methods are gaining prominence due to their efficacy in preserving nutritional and sensory properties. Additionally, sterilizers are becoming increasingly important in meeting compliance with food safety regulations and clean-label demands from global buyers.

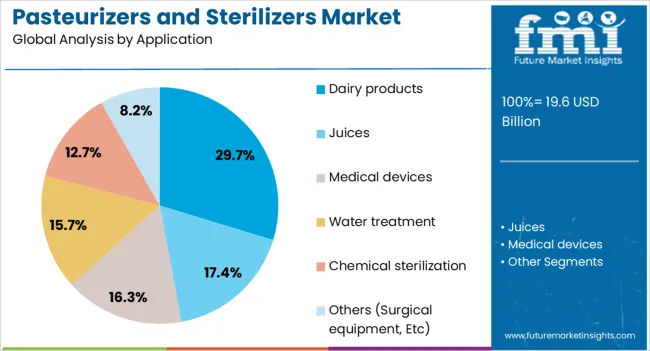

Dairy products are expected to lead application-based demand with a 29.7% market share by 2025. The segment's prominence stems from the perishability and microbial sensitivity of dairy items, which require precise and reliable thermal processing for safety and extended shelf life. Rising global consumption of milk-based beverages, yogurt, and cheese especially in single-serve and ambient formats is pushing dairy producers to invest in modern pasteurization and sterilization systems. The growing prevalence of lactose-free and fortified dairy offerings is also necessitating adaptable processing equipment. As urbanization expands cold chain limitations in many regions, shelf-stable dairy products enabled by sterilization are witnessing surging demand.

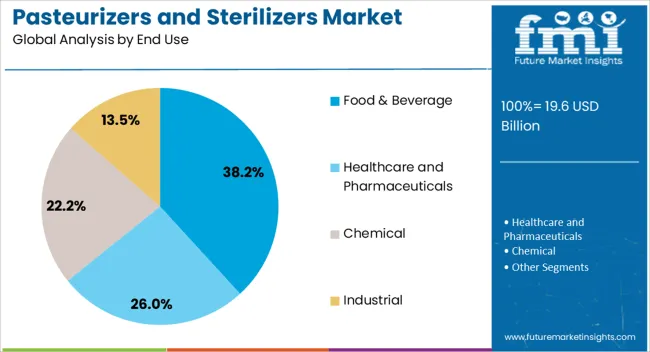

Food & beverage applications are expected to command 38.2% of the market share in 2025, representing the top end-use segment. This leadership is supported by the broad integration of pasteurization and sterilization across packaged meals, juices, sauces, baby food, and ready-to-drink beverages. Growing global demand for minimally processed yet safe and transportable food products has underscored the importance of heat treatment technologies. Increased investment by multinational food brands and co-packers in sterilization lines is enhancing throughput and ensuring compliance with international standards. The push toward longer shelf life, reduced food waste, and preservation without additives is reinforcing the critical role of sterilizers and pasteurizers in food manufacturing strategies.

Pasteurizers and sterilizers are essential for maintaining product safety, quality, and compliance across food, beverage, and pharmaceutical sectors. Market expansion is driven by regulatory adherence, liquid processing growth, sterility requirements, and efficiency optimization.

Strict regulatory frameworks across regions have intensified the adoption of pasteurizers and sterilizers, particularly in food and beverage processing sectors. Authorities mandate precise microbial control, extended shelf life, and consistent quality for consumable products. Compliance with international standards, such as FDA 21 CFR Part 110, ISO 22000, and HACCP, drives manufacturers to integrate advanced thermal processing equipment in production lines. Heightened inspections and audits by food safety agencies compel companies to upgrade conventional systems with automated pasteurizers and sterilizers. In emerging economies, regulations are becoming more stringent, prompting local producers to invest in certified thermal processing solutions. Consumer demand for safe, hygienic products further reinforces regulatory compliance as a central driver, ensuring market expansion and adoption across dairy, beverages, and packaged foods globally.

The pasteurizers and sterilizers market is heavily influenced by growth in dairy and liquid food sectors, where microbial safety and product stability are critical. Milk, juices, and liquid-based nutritional products require precise heat treatment to maintain freshness and prevent spoilage. Rapid demand for value-added dairy products, flavored beverages, and ready-to-drink formulations has encouraged widespread adoption of continuous-flow and batch pasteurization systems. Manufacturers are investing in scalable solutions to process high-volume liquid products efficiently while minimizing energy consumption. Functional beverages and fortified liquids, which require strict temperature control, are also contributing to market expansion. As liquid consumption rises globally, pasteurizers and sterilizers remain vital in ensuring compliance with health standards, meeting consumer expectations, and sustaining quality across the supply chain.

Pasteurizers and sterilizers are increasingly applied in pharmaceutical and biotechnology industries to ensure sterility, extend product shelf life, and maintain formulation integrity. Sterilization of liquid medications, laboratory media, and consumable solutions is essential to meet stringent clinical and manufacturing guidelines. Facilities are integrating automated systems with precise temperature and pressure controls to reduce contamination risk and enhance process reliability. High adoption is seen in biopharmaceutical production, vaccine manufacturing, and injectable formulation processes. Regulatory approvals and quality certifications encourage facility upgrades, while digital monitoring allows continuous verification of sterilization parameters. Market growth is reinforced by expanding pharmaceutical production, stringent hygiene protocols, and the rising complexity of liquid formulations requiring consistent, validated thermal processing methods.

Energy-efficient, modular, and digitally monitored pasteurizers and sterilizers are being developed to reduce operational costs and increase productivity. Companies are adopting continuous flow systems, multi-stage sterilization units, and automated batch controls to optimize heat transfer and minimize energy consumption. Maintenance requirements are being reduced through durable materials, corrosion-resistant components, and improved system monitoring. Plant managers prioritize equipment that offers precise temperature control, faster cycle times, and flexible integration with existing production lines. Demand for smart process monitoring, data logging, and predictive maintenance features drives adoption in high-volume manufacturing sectors. Cost savings, combined with consistent output quality and minimized downtime, strengthen the market position of advanced thermal processing systems in food, beverage, and pharmaceutical industries.

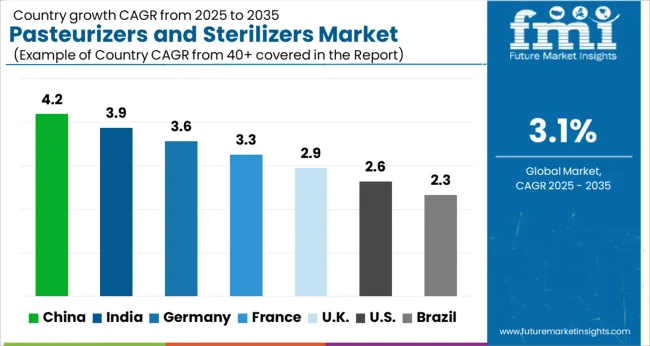

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

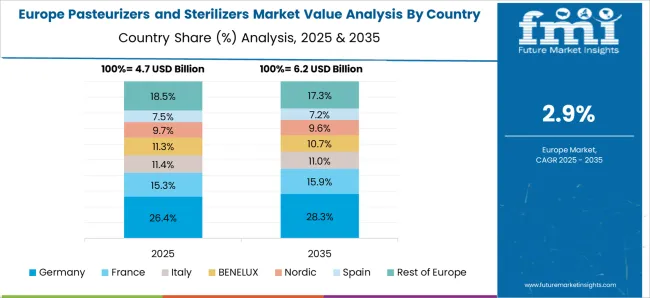

The pasteurizers and sterilizers market is projected to grow globally at a CAGR of 3.1% from 2025 to 2035, driven by increasing food safety regulations, rising demand for dairy and liquid products, and expanding pharmaceutical applications. China leads with a CAGR of 4.2%, supported by rapid industrialization in food processing, government-mandated hygiene standards, and investment in modern thermal processing plants. India follows at 3.9%, with growth propelled by increasing dairy consumption, beverage production, and adoption of automated pasteurization systems. France posts 3.3%, reflecting stringent regulatory compliance, high-quality standards in dairy and packaged foods, and steady industrial adoption. The United Kingdom achieves 2.9%, supported by controlled processing in beverage and dairy sectors, while the United States grows at 2.6%, where established facilities and mature production processes result in moderate expansion. This trajectory indicates Asia as the fastest-growing hub, Europe ensuring compliance-driven adoption, and North America exhibiting steady yet slower market development in pasteurization and sterilization technologies.

The CAGR for the Chinese pasteurizers and sterilizers market stood at 3.6% during 2020–2024 and increased to 4.2% between 2025 and 2035, reflecting rising adoption of thermal processing systems. The early phase was supported by growth in dairy and beverage sectors, increasing consumer awareness for hygienic products, and gradual enforcement of food safety regulations. In the following decade, expansion is driven by large-scale investments in automated processing plants, continuous-flow pasteurization systems, and enhanced regulatory monitoring for microbial control. China’s position as a leading manufacturing hub and government-backed initiatives for plant modernization further reinforce its market leadership. With industrial growth and regulatory compliance converging, China continues to post the highest CAGR globally for pasteurizers and sterilizers.

India recorded a CAGR of 3.2% between 2020 and 2024, which then rose to 3.9% for the 2025–2035 period, showing accelerated adoption of pasteurization and sterilization systems. Earlier expansion was driven by growing dairy consumption, rising beverage production, and gradual integration of modern thermal processing equipment in mid-sized facilities, though fragmented supply chains limited widespread adoption. In the following decade, growth improves due to increasing establishment of automated dairy plants, stringent food safety regulations, and scalable pasteurization solutions. Corporate demand for packaged and ready-to-consume liquid foods further accelerates adoption. India’s dual role in regulatory-driven and consumer-driven adoption strengthens its position as one of Asia’s fastest-growing pasteurizer and sterilizer markets.

The CAGR for France stood at 2.9% during 2020–2024 and is expected to increase to 3.3% between 2025 and 2035, reflecting gradual modernization in food processing infrastructure. The early phase was influenced by established dairy and packaged food industries, strict hygiene regulations, and steady demand for pasteurized and sterilized products. Limited replacement cycles and mature facilities constrained growth. In the following decade, enhanced automation, digital monitoring of thermal systems, and rising demand for long-shelf-life dairy and beverage products drive market expansion. France’s stringent compliance standards, high-quality expectations, and structured inspections continue to encourage adoption of certified pasteurizers and sterilizers.

The CAGR for the UK market was 2.5% during 2020–2024 and is projected to rise to 2.9% for 2025–2035, indicating moderate acceleration relative to global trends. Early growth was constrained by mature production facilities, established operational processes, and limited expansion in new plants. Adoption was supported by strict food safety regulations and demand for dairy and liquid beverage sterilization, though replacement cycles slowed investments. In the following decade, modernization initiatives, automated batch and continuous-flow systems, and rising consumer preference for shelf-stable dairy and juice products are expected to increase adoption. Regulatory inspections and compliance mandates remain key drivers for further system integration.

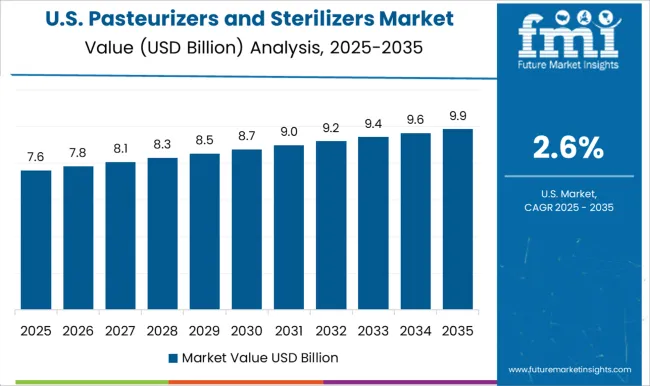

The CAGR for the United States was 2.2% during 2020–2024 and is projected to reach 2.6% between 2025 and 2035, reflecting steady adoption in a mature market. The early period was supported by established dairy, juice, and packaged food industries, but growth was moderated by replacement cycles and mature plant infrastructure. Compliance with FDA and USDA standards ensured baseline adoption, maintaining food safety and quality. In the next decade, growth is expected from energy-efficient pasteurizers, digital monitoring systems, and rising demand for value-added dairy and beverage products. Although expansion is slower than in Asia, the United States continues to demonstrate steady adoption due to stringent regulations and incremental modernization.

The pasteurizers and sterilizers market is shaped by a mix of global process engineering leaders, specialized thermal processing equipment manufacturers, and integrated food and beverage technology providers. GEA Group AG maintains a strong position, leveraging its extensive portfolio of continuous and batch pasteurization systems to serve dairy, beverage, and liquid food sectors worldwide. Alfa Laval AB differentiates itself through heat exchangers, sterilizers, and cleaning systems, focusing on operational efficiency and hygiene compliance. Belimed AG (Metall Zug Group) strengthens its market presence in sterilization for healthcare and laboratory applications. Cantel Medical and Fortive Corporation (Advanced Sterilization Products) focus on medical sterilization, providing high-reliability autoclaves and low-temperature sterilizers. Getinge AB continues to lead with integrated sterilization solutions for hospitals and food processing plants.

INOXPA and JBT Corporation provide custom pasteurization and sterilization systems for beverage and dairy processing. Krones AG, Lyco Manufacturing, and Matachana Group emphasize turnkey processing lines and equipment innovation for hygiene-critical applications. Mitsubishi Heavy Industries, Ltd. and SPX FLOW Inc. offer large-scale industrial thermal systems, while Tetra Pak International S.A. provides integrated aseptic processing and sterilization solutions. TSO3 (Stryker Corporation) specializes in low-temperature sterilization technologies for medical and laboratory tools. Competitive strategies across this landscape emphasize integration with automated production lines, compliance with stringent hygiene standards, and energy-efficient processing systems. Leading players focus on expanding regional footprints, enhancing digital monitoring and process control, and offering service-based solutions for lifecycle management. Continuous R&D investment, certifications, and strong after-sales support remain critical to retaining client trust and scaling adoption across dairy, beverage, and healthcare sectors globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.6 billion |

| Product Type | Sterilizers and Pasteurizers |

| Application | Dairy products, Juices, Medical devices, Water treatment, Chemical sterilization, and Others (Surgical equipment, Etc) |

| End Use | Food & Beverage, Healthcare and Pharmaceuticals, Chemical, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GEA Group AG, Alfa Laval AB, Belimed AG (Metall Zug Group), Cantel Medical, Fortive Corporation (Advanced Sterilization Products), Getinge AB, INOXPA, JBT Corporation, Krones AG, Lyco Manufacturing, Matachana Group, Mitsubishi Heavy Industries, Ltd., SPX FLOW Inc., Tetra Pak International S.A., and TSO3 (Stryker Corporation) |

| Additional Attributes | Dollar sales, share, regional adoption rates, CAGR by country, regulatory compliance trends, demand by industry (dairy, beverage, pharmaceuticals), technological differentiation, competitive strategies, and growth opportunities in emerging markets. |

The global pasteurizers and sterilizers market is estimated to be valued at USD 19.6 billion in 2025.

The market size for the pasteurizers and sterilizers market is projected to reach USD 26.5 billion by 2035.

The pasteurizers and sterilizers market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in pasteurizers and sterilizers market are sterilizers, _plate pasteurizers, _tubular pasteurizers, _spiral and flash pasteurizers, pasteurizers, _heat sterilizers (low-temperature and high-temperature), _filtration sterilizers and _ionizing radiation sterilizers.

In terms of application, dairy products segment to command 29.7% share in the pasteurizers and sterilizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA