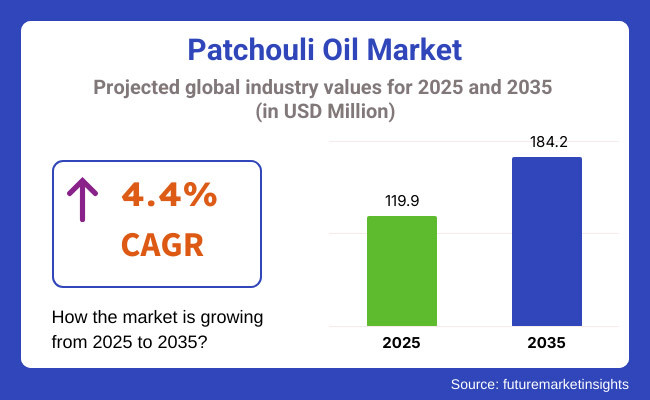

The global patchouli oil market is estimated to be worth USD 119.9 million by 2025 and is projected to reach a value of USD 184.2 million by 2035, reflecting a CAGR of 4.4% over the assessment period 2025 to 2035.

The ongoing transformation within the fragrance and personal care industries has positioned patchouli oil as a cornerstone of the natural scent portfolio, especially in light of increasing scrutiny toward synthetic fragrance components. Anchored by rising consumer awareness of essential oils’ functional properties-ranging from anti-inflammatory to mood-enhancing effects-patchouli oil has found renewed relevance in clean beauty, natural perfumery, aromatherapy, and wellness formulations.

Companies across the value chain are leveraging geographic traceability and chemical standardization to enhance product appeal and regulatory compliance. Indonesian-sourced patchouli, known for its high patchoulol content and earthy depth, remains the global benchmark, prompting multinationals to form direct-sourcing partnerships with local distillers. Moreover, sustainability imperatives are reshaping procurement and marketing strategies, compelling brands to showcase eco-certifications, regenerative practices, and fair-trade commitments.

While pricing volatility persists due to weather-dependent yields and limited arable land, innovation in distillation technologies and post-processing techniques is enhancing oil purity and olfactive complexity.

This has opened new white space in niche luxury perfumery and spa-grade wellness products, especially in premium markets across Europe, North America, and Japan. As such, the market is projected to retain a positive outlook driven by authenticity, efficacy, and the enduring appeal of natural aromatic profiles.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global patchouli oil industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2024 to 2034) |

| H2 | 4.1% (2024 to 2034) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.7%, followed by a higher growth rate of 4.1% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 4.6% in the first half and remain high at 5.1% in the second half. In the first half (H1) the sector witnessed an increase of 90 BPS while in the second half (H2), the business witnessed an increase of 100 BPS.

Holding a 36.2% share of the global patchouli oil market in 2025, the cosmetic and personal care segment is set to expand steadily in alignment with the overall CAGR of 4.4% through 2035. This segment maintains strategic dominance due to the convergence of clean beauty principles and rising interest in aromatherapeutic efficacy.

Patchouli oil’s resurgence within this segment stems from its multifaceted value-serving both as a base note in perfumery and a functional ingredient in skincare, thanks to its antimicrobial and soothing properties. The pivot away from synthetic fragrance compounds has strengthened its role in formulations positioned as natural, non-toxic, and wellness-oriented.

Demand is particularly resilient in mature markets where consumers are willing to pay a premium for olfactive authenticity and traceable sourcing. Furthermore, the intersection of personal care with wellness-spanning products such as facial oils, solid perfumes, and bath blends-has elevated patchouli from a traditional fixative to a sensorial and therapeutic asset.

Major cosmetic companies and boutique brands alike are now collaborating with certified distillers and origin-specific suppliers, notably in Sulawesi and Aceh, to ensure consistent quality and responsible sourcing. Over the next decade, this segment is poised to benefit from increased product segmentation, formulation diversity, and storytelling around indigenous aromatic heritage.

Forecasted to capture over 25% of the global patchouli oil market share by 2025, the aromatherapy and wellness segment continues to gain traction, expanding at a stable CAGR of 4.4% through 2035. Its growth is underpinned by the sector’s broader pivot toward preventative health, mindfulness, and emotional well-being.

Patchouli oil remains a cornerstone in essential oil-based therapy due to its grounding aroma, anxiolytic potential, and perceived mood-stabilizing effects. As integrative wellness regimens become mainstream-from yoga studios to corporate stress-relief programs-demand for high-purity, certified natural oils has intensified. Patchouli's role in diffuser blends, massage oils, and roll-on stress relievers underscores its therapeutic versatility, appealing to both institutional buyers and self-care consumers.

Regulatory shifts favoring natural actives in aromatherapeutic applications, especially in Europe and North America, are accelerating product innovation with controlled-release formats, synergistic blends (e.g., with lavender or frankincense), and wellness gift kits. In parallel, wellness tourism and luxury hospitality sectors are sourcing patchouli oil for spa rituals and ambiance design, reinforcing its premium perception.

To sustain this momentum, stakeholders are investing in origin verification systems, organic certifications, and carbon-neutral production. These efforts not only meet rising transparency standards but also differentiate offerings in a highly fragmented, brand-driven landscape poised for experiential growth.

Multinational fragrance and flavor giants dominate the patchouli oil market in Tier 1, channelling significant revenues, massive distribution systems, and well-advanced research. Givaudan, the leader of the market with extensive processing facilities with patchouli oil across continents, has also partnered with farmers in Indonesia to deal successfully with consistent quality and supply.

Firmenich SA maintains a major presence in the market through its Natural product division while heavily investing in sustainable patchouli cultivation programs in Indonesia and Malaysia. Symrise rounds up the top tier with its many different portfolio offerings of patchouli oil targeting premium fragrance houses and cosmetic manufacturers throughout the world.

In the second tier are mid-sized specialists with well-established regional footprints and an ever-growing international presence. Takasago International Corporation leverages its Asian market power, expanding distribution to Europe and North America with specialty formulations. PT. Indesso Aroma is an Indonesian producer specializing in organic patchouli oil production via a setup of vertically integrated operations from cultivation to processing. Meanwhile, PT. Mitra Ayu Adi Pratama has carved out significant power based on direct relationships with smallholder farmers and a focus on traditional processing methods to preserve unique aromatic profiles. These companies compete through specialized product offerings, regional expertise, and flexible production capacities that could respond swiftly to market trends.

Tier 3 features smaller niche players focusing on specific market segments or production methods. doTERRA has grown rapidly through its direct selling model and emphasis on therapeutic-grade essential oils. Nusaroma maintains a solid position in the Indonesian market with expansion into specialty organic formulations. Treatt leverages its advanced fractionation technology to produce highly standardized patchouli oil components.

PT Van Aroma distinguishes itself through traceable supply chains and community development programs with smallholder farmers. These companies compete on product differentiation, sustainability credentials, and close customer relationships, often pioneering innovative applications that larger players later adopt.

Premiumization and Quality Standardization

Shift: The demand by consumers for excellent quality patchouli oils is supported by their consistent aromatic profiles as well as therapeutic benefits. The growth of the premium segment moves to at least 15% per year mostly influenced by professional aromatherapists, luxury perfumers, and demanding customers.

These oils must have certain chemical properties, and they are attached to specific origins. This creates the gap between commodity and specialty patchouli oils. Prices of the premium variants range upwards of 60%.

Strategic Response: Givaudan applies its unique gas chromatography analysis for all imported patchouli oils to ensure that they contain significant patchoulol above 30%, thereby resulting in a 22% growth in the premium segment.

An individualistic network of certified Indonesian farmers employing standardized harvesting techniques increased their market share by 13%. Symrise, meanwhile, launched the prized single-origin patchouli oils with detailed terroir profiles akin to wine appellations, requiring a 40% price premium, and won the heart of a big luxury perfume house seeking unique fragrance profiles.

Sustainable Sourcing and Ethical Manufacturing

Shift: Consumers have begun demanding an ever-increasing emphasis on both environmental sensitivity and ethical sourcing as the most important motivators behind their purchases. Currently, 65% of professional buyers look for sustainability in their purchases.

Consumers are increasingly aware of their habitats, conditions of fair labour, and carbon footprints. Patchouli oils also tend to be perceived to increasingly come from transparent sources: increasingly in the European and North American markets, where a regulatory compliance usually becomes broad with the addition of environmental and social governance metrics.

Strategic Response: PT Indesso Aroma is establishing a blockchain-traced supply chain for every production stage, resulting in an increase in the proportion of sales for Europe by 28%. Treatt established a partnership with Indonesian cooperatives that adopt fair-trade premiums to attract more conscious brands and gain 17% advantages in price. doTERRA increased its Co-Impact Sourcing initiative for Indonesian patchouli growers by training in agriculture and community-owned distillation facilities, which appealed well to direct sales network and achieved a 23% growth in its patchouli oil line.

Extension of Applications in Aromatherapy

Shift: The market for aromatherapy has turned from pure relaxation to specifying applications for wellness, such as stress reduction, promotion of sleep, and maintenance of skin anywhere on the body. The scientific paper that confirms patchouli oil as anti-anxiety and anti-inflammatory rapidly speeds up the trend with an increase of professional aromatherapists and wellness centres acquiring patchouli oil in the last two years, running at a rate of 25%.

Strategic Response: Nusaroma developed a specific blend containing patchouli oil optimized for diffusion using highly calming terpene profiles, boosting the wellness market share by 19%. PT. Van Aroma has developed patchouli oil of clinical grades where therapeutic compounds have been identified and evaluated within it to earn the trust of 30% of professional aromatherapists from Asia and Pacific regions.

Symrise established research partnerships with universities doing studies about the skin microbiome effects of patchouli oil which led to new anti-aging products developed and 24% growth in their cosmetic ingredients division.

Specialized Formulations for Cosmetics

Shift: Patchouli oil is beginning to find its way into skincare formulations of beauty brands. Of course, those formulations are intended for not only fragrances but also for their antimicrobial and anti-inflammatory properties. Sales of cosmetic-grade patchouli oil saw a spike of 28% because of this improved demand for clean preservatives and active ingredients further intensified as consumers turned onto patchouli oil as a multifunctional agent in premium skincare.

Strategic Response: Givaudan's Active Beauty division developed a proprietary extraction method that allows retaining active compounds from patchouli while removing sensitizing components, translating to a 35% increase in sales coming from the cosmetic industry.

Firmenich SA's new microencapsulation technology for patchouli oil allowed controlled release of the oil in skincare products, quantitatively resulting in partnerships with three multinational juggernauts in the field of cosmetics. Takasago International Corporation commercialized a cosmetic-grade patchouli oil that was said to have superior stability and lessened the color for clear formulations, adopted by over forty premium Asian skincare brands.

Expansion of Direct-to-Consumer Model

Shift: The evolving of direct-to-consumer channels has disrupted patchouli oil distribution through traditional means. Increasingly, online specialized sellers and producer-owned platforms claim their share of the market. DTC channels grow at twice the average speed of those constructively old forms of distribution in essential oil categories, while increasingly, consumers want to be informed on how their oil sources have been processed and how they should be used-from the producer himself at such an increased rate.

Strategic Response: doTERRA recorded patchouli line sales 29% higher after conducting consumer education on the benefits of using patchouli oil through its existing direct selling network. Nusaroma set up an e-commerce site on terroir and batch details for each batch offering of patchouli oil gaining margins of 40% over conventional distribution.

Subscription programs are established for professional users by PT. Mitra Ayu Adi Pratama securing constant supply of specific batches and ensuring long-term reliable revenues while market volatilities are reduced with 22% of the production now sold in advance through direct channels.

Implementation of Digital Technologies for Authentication

Shift: The increase in patchouli oil prices has heightened the authenticity concern, thereby considered adulteration, and mislabelled a genuine issue. The professional buyers require scientific proof for purity and origin. The public awareness about the quality variations has raised more suspicion on product claims, leading to even higher demand for third-party verification.

Strategic Response: PT. Indesso Aroma launched digital certificates of analysis with QR codes linking to full GC-MS test results, thereby increasing sales in the premium segment by 24%. At the same time, Givaudan developed a molecular fingerprinting technology that guarantees patchouli oil authenticity and origins, lending protection to its brand reputation and allowing a 15% price premium in the market.

Meet stringent regulatory requirements in pharmaceutical applications, Firmenich SA's blockchain tracing consists of every production step from field to final product, growing this segment by 31%.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 3.9% |

| Germany | 4.1% |

| China | 5.3% |

| Japan | 4.8% |

| India | 5.8% |

Among the main drivers of increased USA demand for patchouli oil is growth in the aromatherapy sector, with wellness centres and professional aromatherapists adding it to treatments to reduce stress and promote relaxation. Companies like doTERRA and Givaudan have developed specialized formulations with enhanced therapeutic profiles to meet this growing demand.

The clean beauty movement has further accelerated market growth by using patchouli oil in cosmetic formulations for its anti-inflammatory and antimicrobial properties. Major cosmetic manufacturers reformulate existing product lines to add certified patchouli oil to both active ingredients and natural preservatives.

Germany's stringent regulatory environment established the highest quality standards for patchouli oil in Europe, thus making it barricaded as the benchmark market for premium grades to win such acceptances among these high requirements, Symrise and Firmenich SA are two recurrent examples of companies that have gained a major market advantage in other European markets.

Increased emphasis on sustainability certification is transforming market supply chain attitudes in Germany. Ecologically documented cultivation and equally traceability of fair-trade sources are the new conditions for market access. Major German natural product manufacturers also formed partnerships with Indonesian producer communities to enable them through regulations while ensuring supply continuity.

The added value of the pharmaceutical-grade applications represents an extremely lucrative segment, as German pharmaceutical companies standardize patchouli oil for dermatological formulations and for adjunctive treatments with aromatherapy.

Developing agricultural programs have created newer areas of production with improved plant varieties and modernized processing facilities. Integration of patchouli oil into modern Ayurvedic formulations represents one of the highest growth segments, with major wellness brands developing proprietary formulas that combine traditional wisdom with modern delivery systems.

Two types of consumers, domestic and foreign, searching for authenticated natural wellness solutions, have very much warmed to this linking of ancient wisdom with its new applications. With modernization, India's fragrance industry has engendered yet another huge demand driver, where more attar producers are adopting latest extraction techniques to retain classical compositions and yet satisfy the best international quality standards.

The industry has been categorized into Dark Patchouli Oil, Light Patchouli Oil, and Specialty Formulations.

This segment is further categorized into Organic Certified and Conventional.

This segment is further categorized into Aromatherapy & Essential Oils, Cosmetics & Personal Care, Food & Beverage, Pharmaceutical, and Home Fragrance.

This segment is further categorized into Direct B2B, Specialty Retailers, Online/E-commerce, and Traditional Retail.

Industry analysis has been conducted in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global industry is estimated at a value of USD 119.9 million in 2025.

The market is projected to grow at a CAGR of 4.4% between 2025 and 2035.

Leading manufacturers include Givaudan, Firmenich SA, Symrise, Takasago International Corporation, and PT. Indesso Aroma.

Cosmetics & Personal Care represents the largest application segment with 42% of market consumption, followed by Aromatherapy & Essential Oils at 31%.

Key growth factors include expanding aromatherapy applications, natural cosmetics demand, sustainable sourcing trends, and integration into traditional medicine systems.

Technological advancements include improved extraction methods, constituent standardization, molecular distillation techniques, and digital authentication systems ensuring quality and authenticity.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Metric Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 6: Global Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 8: Global Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 10: Global Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 12: Global Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 13: Global Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 14: Global Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 16: North America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 18: North America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 20: North America Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 22: North America Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 24: North America Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 25: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 26: North America Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 27: North America Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 28: North America Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 30: Latin America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 32: Latin America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 34: Latin America Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 36: Latin America Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 38: Latin America Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 40: Latin America Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 42: Latin America Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 44: Western Europe Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 46: Western Europe Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 48: Western Europe Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 49: Western Europe Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 50: Western Europe Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 51: Western Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 52: Western Europe Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 53: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 54: Western Europe Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 55: Western Europe Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 56: Western Europe Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: Eastern Europe Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 60: Eastern Europe Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 61: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 62: Eastern Europe Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 63: Eastern Europe Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 64: Eastern Europe Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 65: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 66: Eastern Europe Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 67: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 68: Eastern Europe Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 69: Eastern Europe Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 70: Eastern Europe Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 71: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: Asia Pacific Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 73: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 74: Asia Pacific Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 75: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 76: Asia Pacific Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 77: Asia Pacific Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 78: Asia Pacific Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 79: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 80: Asia Pacific Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 81: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 82: Asia Pacific Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 83: Asia Pacific Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 84: Asia Pacific Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 86: Middle East and Africa Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 88: Middle East and Africa Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 90: Middle East and Africa Market Volume (Metric Tons) Forecast by Nature, 2017 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Extraction Process, 2017 to 2033

Table 92: Middle East and Africa Market Volume (Metric Tons) Forecast by Extraction Process, 2017 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 94: Middle East and Africa Market Volume (Metric Tons) Forecast by End Use, 2017 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2033

Table 96: Middle East and Africa Market Volume (Metric Tons) Forecast by Distribution Channel, 2017 to 2033

Table 97: Middle East and Africa Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 98: Middle East and Africa Market Volume (Metric Tons) Forecast by Function, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 9: Global Market Volume (Metric Tons) Analysis by Region, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 13: Global Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 17: Global Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 21: Global Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 25: Global Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 26: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 29: Global Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 30: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 32: Global Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 33: Global Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 34: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 35: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 36: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 37: Global Market Attractiveness by Nature, 2023 to 2033

Figure 38: Global Market Attractiveness by Extraction Process, 2023 to 2033

Figure 39: Global Market Attractiveness by End Use, 2023 to 2033

Figure 40: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 41: Global Market Attractiveness by Function, 2023 to 2033

Figure 42: Global Market Attractiveness by Region, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 49: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 51: North America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 55: North America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 59: North America Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 60: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 61: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 62: North America Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 63: North America Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 64: North America Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 65: North America Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 66: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 67: North America Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 71: North America Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 72: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 73: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 74: North America Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 75: North America Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 76: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 77: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 78: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 79: North America Market Attractiveness by Nature, 2023 to 2033

Figure 80: North America Market Attractiveness by Extraction Process, 2023 to 2033

Figure 81: North America Market Attractiveness by End Use, 2023 to 2033

Figure 82: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 83: North America Market Attractiveness by Function, 2023 to 2033

Figure 84: North America Market Attractiveness by Country, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 93: Latin America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 97: Latin America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Latin America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 101: Latin America Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 105: Latin America Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 108: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 109: Latin America Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 110: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 113: Latin America Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Latin America Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 117: Latin America Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 118: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 121: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 122: Latin America Market Attractiveness by Extraction Process, 2023 to 2033

Figure 123: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 124: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 126: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 129: Western Europe Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 130: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 132: Western Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 133: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 134: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 135: Western Europe Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: Western Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 139: Western Europe Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 140: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Western Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 143: Western Europe Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 144: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 145: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 146: Western Europe Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 147: Western Europe Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 150: Western Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 151: Western Europe Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 152: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 153: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 154: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 155: Western Europe Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 156: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 157: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 158: Western Europe Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 159: Western Europe Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 160: Western Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 161: Western Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 162: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 163: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 164: Western Europe Market Attractiveness by Extraction Process, 2023 to 2033

Figure 165: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 166: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 167: Western Europe Market Attractiveness by Function, 2023 to 2033

Figure 168: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 169: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 172: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 173: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 174: Eastern Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 175: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 176: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 177: Eastern Europe Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 178: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 181: Eastern Europe Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 185: Eastern Europe Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 186: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 187: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 188: Eastern Europe Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 189: Eastern Europe Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 190: Eastern Europe Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 191: Eastern Europe Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 192: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 193: Eastern Europe Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 194: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 195: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 196: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 197: Eastern Europe Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 198: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 199: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 200: Eastern Europe Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 201: Eastern Europe Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 202: Eastern Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 203: Eastern Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 204: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 205: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 206: Eastern Europe Market Attractiveness by Extraction Process, 2023 to 2033

Figure 207: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 208: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 209: Eastern Europe Market Attractiveness by Function, 2023 to 2033

Figure 210: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 211: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 213: Asia Pacific Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 214: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 216: Asia Pacific Market Value (US$ Million) by Function, 2023 to 2033

Figure 217: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 219: Asia Pacific Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 220: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 223: Asia Pacific Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 224: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 225: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 226: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 227: Asia Pacific Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 228: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 229: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 230: Asia Pacific Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 231: Asia Pacific Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 232: Asia Pacific Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 233: Asia Pacific Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 234: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 235: Asia Pacific Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 236: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 237: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 238: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 239: Asia Pacific Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 240: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 241: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 242: Asia Pacific Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 243: Asia Pacific Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 244: Asia Pacific Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 245: Asia Pacific Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 246: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 247: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 248: Asia Pacific Market Attractiveness by Extraction Process, 2023 to 2033

Figure 249: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 250: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 251: Asia Pacific Market Attractiveness by Function, 2023 to 2033

Figure 252: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Extraction Process, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Function, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 260: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 261: Middle East and Africa Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 262: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 264: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 265: Middle East and Africa Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 269: Middle East and Africa Market Volume (Metric Tons) Analysis by Nature, 2017 to 2033

Figure 270: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 271: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 272: Middle East and Africa Market Value (US$ Million) Analysis by Extraction Process, 2017 to 2033

Figure 273: Middle East and Africa Market Volume (Metric Tons) Analysis by Extraction Process, 2017 to 2033

Figure 274: Middle East and Africa Market Value Share (%) and BPS Analysis by Extraction Process, 2023 to 2033

Figure 275: Middle East and Africa Market Y-o-Y Growth (%) Projections by Extraction Process, 2023 to 2033

Figure 276: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 277: Middle East and Africa Market Volume (Metric Tons) Analysis by End Use, 2017 to 2033

Figure 278: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 279: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 280: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2033

Figure 281: Middle East and Africa Market Volume (Metric Tons) Analysis by Distribution Channel, 2017 to 2033

Figure 282: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 284: Middle East and Africa Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 285: Middle East and Africa Market Volume (Metric Tons) Analysis by Function, 2017 to 2033

Figure 286: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 287: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 289: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 290: Middle East and Africa Market Attractiveness by Extraction Process, 2023 to 2033

Figure 291: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 292: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 293: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 294: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA