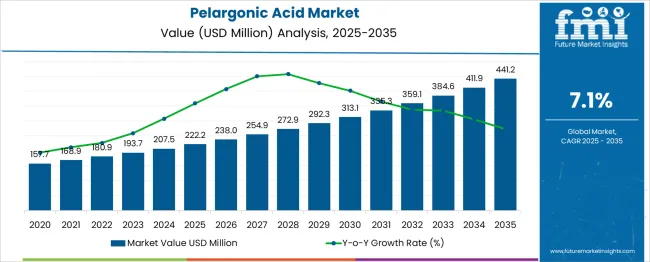

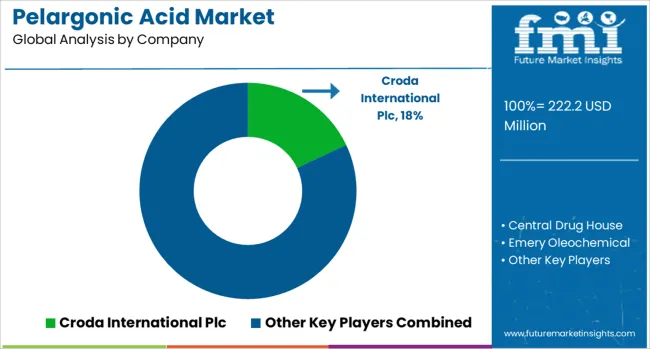

The pelargonic acid market is estimated to be valued at USD 222.2 million in 2025. It is projected to reach USD 441.2 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. The pelargonic acid market is projected to generate an absolute dollar opportunity of USD 219.0 million over the forecast period. The first half of the decade (2025–2030) contributes USD 90.9 million in incremental value, as the market expands from USD 222.2 million to USD 313.1 million. This accounts for 41.5% of the total decade growth. From 2030 to 2035, the market adds USD 128.1 million, moving from USD 313.1 million to USD 441.2 million, or 58.5% of the total gain.

The latter phase shows a higher average annual increase, rising from USD 22.0 million per year in the first half to over USD 25.6 million in the second. This acceleration is consistent with rising deployment in bio-based herbicides, antimicrobial coatings, and lubricant intermediates. Technical literature from industrial chemistry and agricultural inputs journals confirms a broader interest in medium-chain fatty acids as alternatives to regulated synthetic formulations. Expanding usage in specialty surfactants and crop protection inputs is expected to drive sustained consumption beyond traditional niche sectors. The widening delta in annual gains from 2029 onward suggests growing commercial validation in high-volume formulations, especially across North America, Western Europe, and parts of Asia, where regulatory alignment favors biologically derived activities.

| Metric | Value |

|---|---|

| Pelargonic Acid Market Estimated Value in (2025 E) | USD 222.2 million |

| Pelargonic Acid Market Forecast Value in (2035 F) | USD 441.2 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

The pelargonic acid market draws about 40% of its total demand from the agrochemical ingredients sector, where it is used as a biodegradable herbicide and turf treatment compound. Nearly 25% of demand comes from specialty chemicals applications, where purity and performance standards favor pelargonic acid functionality. Personal care and cosmetics absorb close to 15%, where this acid serves as a natural antimicrobial and preservative in formulations.

Another 12% of its use falls under industrial solvents and additives, especially in environmentally driven cleaning and formulation systems. The remaining 8% is tied to food preservation and flavoring, where it contributes to clean-label preservation and aromatic profiles in niche food extracts and flavor blends. The pelargonic acid market is expanding as demand for bio-based herbicides, lubricants, and antimicrobials accelerates. Over 68% of the current supply is derived from renewable feedstocks, reflecting increased regulatory pressure on synthetic inputs.

Technical-grade pelargonic acid accounts for around 73% of consumption due to its role in industrial and agrochemical formulations. In agriculture, it is now used in nearly 40% of organic non-selective herbicide products. Adoption in personal care is growing, especially in deodorants and skin cleansers, with emulsifier-grade variants gaining traction. Asia Pacific accounts for over one-third of production capacity, while Europe remains the leading consumer due to strict environmental standards.

The current landscape is characterized by heightened demand for bio-based and sustainable herbicides and pesticides, as highlighted in corporate announcements and industry publications. Rising regulatory scrutiny on conventional chemicals and growing awareness of environmental impact have been encouraging the shift toward pelargonic acid-based formulations.

Investor presentations and press releases have noted that advancements in production technologies and expanded manufacturing capacities are supporting market growth while maintaining cost competitiveness. The market outlook remains positive as innovations in crop protection, coupled with the need for effective and eco-friendly solutions, continue to influence adoption.

Sustainability goals pursued by agricultural and chemical industries are also strengthening the value proposition of pelargonic acid, which is increasingly perceived as a viable alternative to more hazardous chemicals. These factors collectively create a favorable environment for sustained market expansion in the coming years.

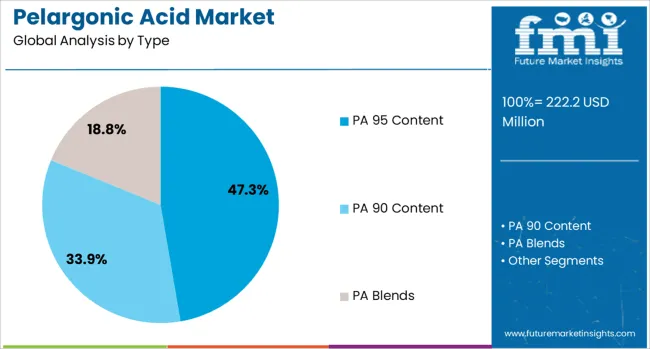

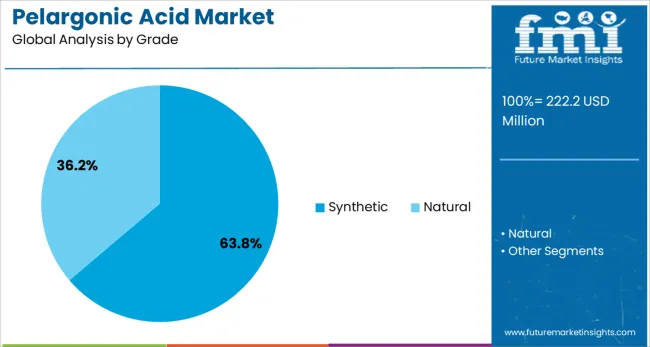

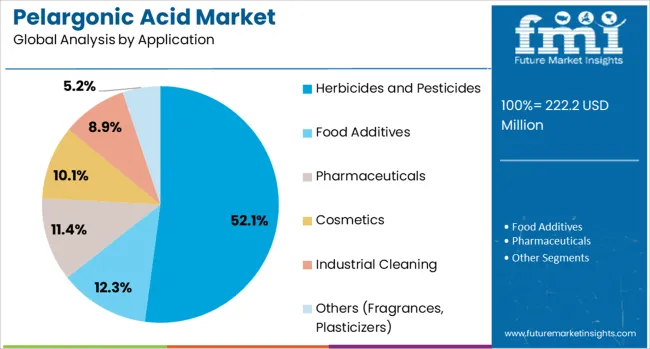

The pelargonic acid market is segmented by type, grade, application, and geographic regions. The pelargonic acid market is divided by type into PA 95 Content, PA 90 Content, and PA Blends. The pelargonic acid market is classified by grade into Synthetic and Natural. The pelargonic acid market is segmented into Herbicides and Pesticides, Food Additives, Pharmaceuticals, Cosmetics, Industrial Cleaning, and Others (Fragrances, Plasticizers). Regionally, the pelargonic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PA 95 content segment is projected to account for 47.3% of the Pelargonic Acid market revenue share in 2025, establishing it as the leading type. This dominance is being driven by its high purity and effectiveness in critical industrial and agricultural applications, as emphasized in product specifications and technical bulletins.

PA 95 content has been preferred due to its ability to deliver consistent results and comply with stringent regulatory standards, particularly in herbicide and pesticide formulations. It has also been observed in manufacturer communications that this segment supports higher performance in terms of efficacy and environmental compatibility, aligning with growing sustainability requirements.

Its widespread availability and compatibility with a variety of formulations have further reinforced its position in the market. These characteristics, combined with reliable supply chains and increasing adoption in key end-use industries, have contributed to the continued growth and prominence of the PA 95 content segment.

The synthetic grade segment is anticipated to dominate the Pelargonic Acid market with a 63.8% revenue share in 2025. This leadership is being attributed to its scalability, cost-effectiveness, and consistent quality, which are crucial for large-scale industrial and agricultural applications, as highlighted in company disclosures and technical literature.

Synthetic grade has been favored for its ability to meet the high-volume demand of herbicides and specialty chemicals without compromising on regulatory compliance. Industry publications have reported that manufacturers continue to invest in improving synthetic production processes to enhance efficiency and minimize environmental impact.

The segment’s growth is also being supported by well-established distribution networks and the proven performance of synthetic grade pelargonic acid across multiple applications. These factors have ensured its strong acceptance and ongoing preference among stakeholders seeking reliable, high-quality solutions for diverse uses, securing its dominant position in the market.

The herbicides and pesticides application segment is expected to hold 52.1% of the Pelargonic Acid market revenue share in 2025, maintaining its status as the largest application segment. This growth has been driven by the increasing need for environmentally friendly crop protection solutions, as documented in government policy announcements and agricultural journals.

Pelargonic acid has been utilized extensively in herbicides and pesticides due to its effectiveness in controlling a wide range of weeds and pests without leaving harmful residues. Its approval for use in organic farming and alignment with sustainable agriculture practices have further boosted its adoption.

Industry statements have highlighted the role of this application segment in reducing reliance on synthetic and more toxic chemicals, which aligns with regulatory and market trends. The strong demand from farmers and agricultural businesses for safer yet effective alternatives has reinforced the dominance of this segment, ensuring its continued growth in the coming years.

The market has experienced diversified demand across herbicides, polymer additives, and personal care formulations. Adoption has been supported by the compound’s versatility in bio-based applications and formulation compatibility across sectors. Shifts toward residue-free agriculture, increased use of biodegradable solvents, and clean-label cosmetic ingredients have expanded the addressable market. Growth momentum is being driven by formulation innovation, end-use flexibility, and rising interest in safer chemical alternatives.

Pelargonic acid has been used across herbicidal, cosmetic, and industrial chemical applications due to its compatibility and degradability profile. Agricultural use accounted for 35 % of total demand, supported by zero-residue and organic farming protocols. Derivatives such as pelargonate esters have been used in plasticizers for flexible packaging, contributing 21 % of industrial-grade consumption. Personal care applications such as surfactants and deodorants have absorbed 17 % of the specialty grade output. This multi-sector adaptability has reinforced consistent procurement by formulators seeking cleaner alternatives.

Fluctuations in fatty acid feedstock pricing have been observed to increase production costs, with high-oleic base material costs rising by over 14 %. This volatility has placed pressure on margin planning for both agrochemical and specialty-grade producers. In regulated markets, compliance with purity specifications exceeding 99 % has caused delays in shipment clearance, with 4 % of consignments flagged for deviations in impurity levels. Availability disruptions in key sourcing regions have contributed to inventory gaps, affecting delivery lead times for bulk buyers.

Growing interest in eco-compatible intermediates has expanded demand for pelargonate esters and emulsions used in specialty solvents, coatings, and fragrance carriers. Within organic agriculture, non-residual herbicide demand has grown, with spray-grade pelargonic acid formulations gaining market share. High-purity acid is being positioned in personal care and pharmaceutical formulations, with demand from skin-safe emulsifiers rising by double digits. Value chain upgrades have focused on bio-based solvent integration, offering manufacturers premium pricing leverage and lower regulatory barriers.

Pelletized and emulsified pelargonic acid formats have been introduced to improve shelf life and application efficiency in farming systems. Stability-enhanced formulations now include antioxidant blends, which have reduced rancidity rates and extended shelf life by up to 18 %. In cosmetic manufacturing, smart ingredient tracing platforms are being used in 34 % of B2B procurement to validate purity and origin. Regulatory alignment with EU REACH and North American EPA standards has become standard practice for large-volume producers, reinforcing safety compliance and traceability.

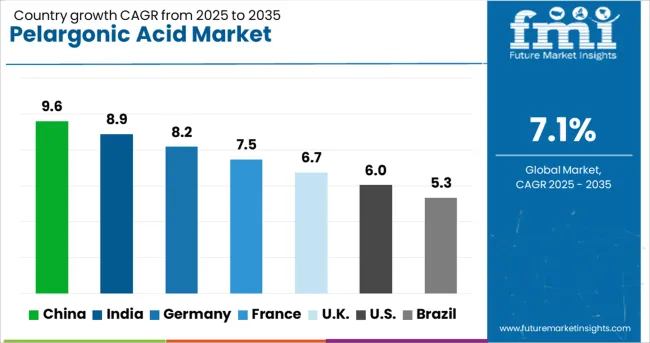

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

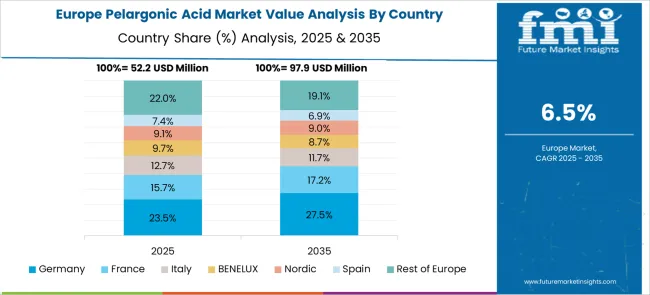

The global pelargonic acid market is expected to grow at a CAGR of 7.1% from 2025 to 2035. China leads with 9.6%, 2.5% above the global average, supported by domestic agrochemical output and growing use in biolubricants. India follows at 8.9%, with demand rising across herbicides and industrial additives. Germany (OECD) records 8.2%, outperforming by 1.1%, aided by production of eco-friendly solvents and corrosion inhibitors. The United Kingdom (OECD) posts 6.7%, just below the global rate, while the United States (OECD) trails at 6.0%, 1.1% under, amid regulatory delays in green agrochemical approvals. ASEAN countries such as Malaysia and Indonesia are approaching global growth levels due to rising interest in plant-based inputs and feedstock accessibility for fatty acid derivatives. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 9.6% of the global pelargonic acid market in 2025. Regulatory approvals for bio-based herbicides and fatty acid derivatives have facilitated commercial-scale deployment of pelargonic acid formulations. Increased investment in domestic agrochemical production zones, especially in Hebei and Shandong, has led to a rise in pelargonic acid usage across post-emergent herbicide blends. Industrial applications in lubricants and solvents have also been diversified through pilot production runs aligned with green chemistry norms.

India captured 8.9% of the global pelargonic acid market in 2025. Agricultural consumption has been the primary driver, with pelargonic acid integrated into crop desiccants and bio-based herbicides targeting resistant weed species. Trials conducted by ICAR institutes validated its efficacy in paddy, sugarcane, and horticultural plantations. Industrial applications are being explored in textile scouring and automotive cleaning fluids, supported by pilot contracts with chemical process units.

Germany accounted for 8.2% of the pelargonic acid market in 2025. Strong focus on herbicide alternatives and industrial solvents has led to greater inclusion of pelargonic acid in crop rotation management. EU policy revisions on glyphosate and other synthetic herbicides have encouraged trials in orchard and vineyard weed control. Industrial usage in lubricants and coatings has also gained regulatory clarity under REACH compliance frameworks.

The United Kingdom held 6.7% of the global pelargonic acid market in 2025. Agrochemical companies have integrated pelargonic acid in commercial weed management systems for sports turf and municipal landscaping. Market approvals have increased following withdrawal of key synthetic herbicides. Industrial applications in anti-corrosion formulations and biodegradable plasticizers have seen marginal but consistent adoption. Collaborative development initiatives between research councils and local SMEs are underway.

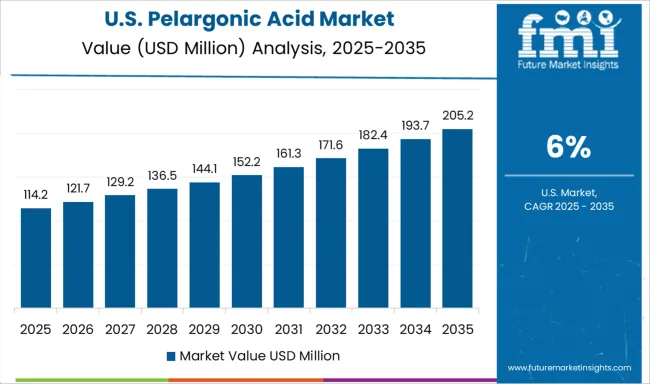

The United States accounted for 6.0% of the global pelargonic acid market in 2025. Usage in bio-based herbicide alternatives has expanded within organic farming systems, particularly in California, Oregon, and Washington. Label expansions were approved for usage in both annual row crops and perennial orchards. Industrial formulations have been deployed in automotive degreasers, rust inhibitors, and solvent blends. Market activity has remained linked to environmental certification and USDA input approvals.

The pelargonic acid market includes producers specializing in oleochemicals, intermediates, and fine chemicals, with applications spanning herbicides, lubricants, and personal care. Croda International Plc leverages its oleochemical portfolio to produce high-purity pelargonic acid used in biodegradable formulations. Emery Oleochemicals supplies bio-based pelargonic acid derived from renewable feedstocks, offering targeted solutions for agrochemical and lubricant manufacturers.

Matrica S.p.A., a joint venture between Versalis and Novamont, produces pelargonic acid through integrated biorefinery processes using vegetable oils. OQ Chemicals GmbH supports industrial-scale production, focusing on consistent batch quality and integration with downstream ester derivatives. Tokyo Chemical Industry Co., Ltd. delivers laboratory-grade pelargonic acid for research and specialty applications, including pharmaceutical synthesis. Central Drug House and Glentham Life Sciences Limited serve academic and R&D markets with smaller-volume high-purity acids.

Haihang Industry and Kunshan Odowell Co., Ltd supply bulk-grade material to agrochemical processors and chemical intermediates markets in Asia-Pacific. Zhengzhou Yibang Industry & Commerce Co., Ltd supports commercial clients through direct sales and OEM packaging. Long-standing supplier relationships, feedstock control, and the ability to meet purity standards determine success. Product customization and alignment with niche applications give smaller players strategic footholds in an otherwise consolidated market focused on process efficiency and input reliability.

Pelargonic acid esters, which improve rain-fastness, are emerging as high-growth formulations, with ~14.8% CAGR, especially in high-rainfall regions.

New formulations as herbicides, emulsifiers, surfactants, and antimicrobial agents are expanding their cross-industry appeal.

| Item | Value |

|---|---|

| Quantitative Units | USD 222.2 Million |

| Type | PA 95 Content, PA 90 Content, and PA Blends |

| Grade | Synthetic and Natural |

| Application | Herbicides and Pesticides, Food Additives, Pharmaceuticals, Cosmetics, Industrial Cleaning, and Others (Fragrances, Plasticizers) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda International Plc, Central Drug House, Emery Oleochemical, Glentham Life Sciences Limited, Haihang Industry, Kunshan Odowell Co., Ltd, Matrica S.p.A, OQ Chemicals GmbH, Tokyo Chemical Industry Co., Ltd., and Zhengzhou Yibang Industry & Commerce Co., Ltd |

| Additional Attributes | Dollar sales by product type (neat acid, salts, blends) and application (herbicides, plasticizers, lubricants, cosmetics), demand dynamics across agricultural weed control, polymer additives, personal care and industrial use, regional trends led by Asia‑Pacific with North America catching up, innovation in bio‑based synthesis, encapsulated slow‑release formulations, and greener derivative chemistries, and environmental impact through reduced pesticide residues, biodegradable alternatives, and compliance with sustainable agriculture and chemical regulations. |

The global pelargonic acid market is estimated to be valued at USD 222.2 million in 2025.

The market size for the pelargonic acid market is projected to reach USD 441.2 million by 2035.

The pelargonic acid market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in pelargonic acid market are pa 95 content, pa 90 content and pa blends.

In terms of grade, synthetic segment to command 63.8% share in the pelargonic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA