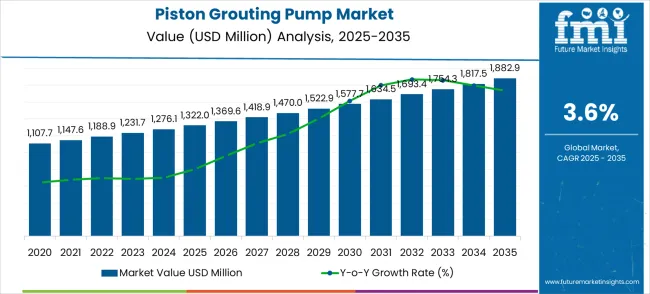

The piston grouting pump market is set to witness consistent growth from USD 1,322 million in 2025 to USD 1,883 million by 2035, with an anticipated compound annual growth rate (CAGR) of 4%. This gradual growth trajectory indicates a steady demand for piston grouting pumps across various industries, driven by their essential role in ensuring structural integrity in construction, mining, and civil engineering projects. The need for high-pressure, durable pumps that perform reliably under challenging conditions is expected to continue fueling market expansion.

As construction projects, particularly in emerging regions, increase in scale and complexity, the demand for specialized equipment such as piston grouting pumps is projected to rise. Their ability to inject grout at higher pressures for more efficient and precise applications in underground and large-scale infrastructure projects will remain a key growth driver for the market.

Market stability is further supported by the ongoing trends in industrial operations that prioritize operational efficiency and the reduction of downtime. The piston grouting pump market is seeing steady growth in demand, as industries seek more reliable and cost-effective solutions. Companies are focusing on pumps that offer improved durability and longevity, minimizing maintenance requirements and maximizing output. As industries continue to prioritize efficiency, the demand for high-performance equipment, such as piston grouting pumps, which can withstand harsh environments and demanding conditions, is expected to increase. The forecasted CAGR of 4% for this market indicates that the growth trajectory will remain relatively steady, with key sectors relying on these pumps to ensure safe and effective grouting solutions in critical infrastructure and construction applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,322 million |

| Forecast Value in (2035F) | USD 1,883 million |

| Forecast CAGR (2025 to 2035) | 4% |

The piston grouting pump market has been evaluated as a key segment within several industrial domains, holding approximately 6.4% of the construction equipment market, 7.1% of the industrial pumps market, 5.3% of the grouting equipment market, 4.8% of the civil engineering machinery market, and 3.9% of the mining equipment market. Together, this represents a combined market share of around 27.5%. This highlights the growing demand for piston grouting pumps in industries that require precise and efficient injection of grout materials, such as construction, mining, and civil engineering. These pumps are recognized for their reliability in handling complex grouting tasks, making them indispensable for projects involving soil stabilization, foundation strengthening, and tunnel construction.

Market expansion is being supported by the rapid increase in infrastructure development projects worldwide and the corresponding need for specialized grouting equipment for foundation work, tunnel construction, and structural repairs. Modern construction projects rely on precise material injection systems to ensure proper soil stabilization, void filling, and structural reinforcement. Even complex underground projects require comprehensive grouting solutions to maintain structural integrity and prevent water infiltration.

The growing complexity of construction technologies and increasing safety standards are driving demand for professional-grade piston grouting pumps from certified manufacturers with appropriate performance capabilities and reliability. Construction contractors are increasingly requiring advanced pumping systems that can handle various grouting materials including cement, chemical, and specialized compounds. Regulatory requirements and engineering specifications are establishing standardized grouting procedures that require precise equipment and trained operators.

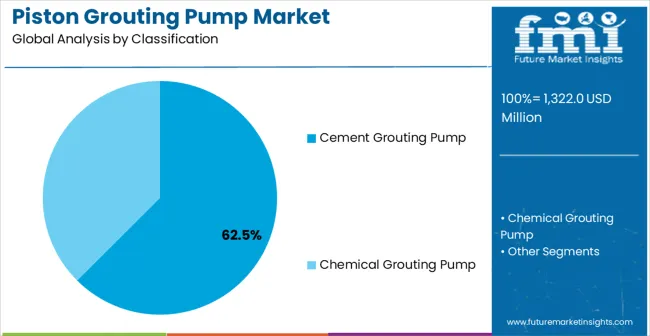

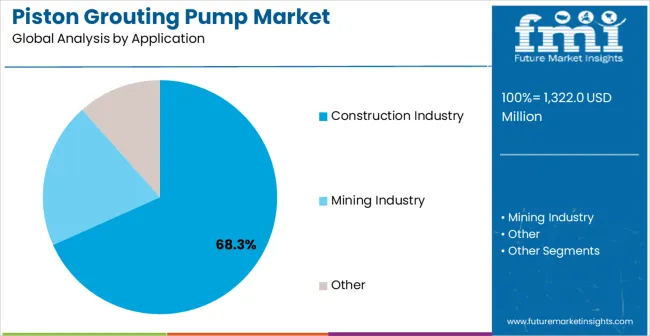

The market is segmented by type, end-use industry, and region. By type, the market is divided into cement grouting pump and chemical grouting pump. Based on end-use industry, the market is categorized into construction industry, mining industry, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Cement grouting pumps are projected to account for 62.5% of the piston grouting pump market in 2025. This leading share is supported by the widespread adoption of cement-based grouting materials for foundation strengthening, void filling, and structural repair applications across diverse construction and infrastructure projects. Cement grouting provides reliable performance characteristics, excellent bonding properties, and cost-effective solutions for most construction applications including tunnel sealing, foundation underpinning, and crack injection procedures.

The segment benefits from established application procedures and comprehensive material compatibility across diverse project requirements, making it the preferred choice for general contractors and specialized foundation repair companies. Cement grouting pumps demonstrate superior performance in handling various cement-based materials including Portland cement, bentonite-cement mixtures, and specialized repair compounds. These systems provide consistent pressure delivery, reliable material flow control, and reduced maintenance requirements compared to alternative pumping technologies. The versatility of cement grouting applications extends from residential foundation repairs to large-scale infrastructure projects including dam rehabilitation, tunnel waterproofing, and bridge foundation strengthening.

Modern cement grouting pumps incorporate advanced mixing systems, automated pressure controls, and enhanced durability features that improve operational efficiency and reduce material waste. Construction companies increasingly prefer cement grouting solutions due to their proven track record, regulatory compliance, and compatibility with standard construction practices and safety protocols.

Construction industry is expected to represent 68.3% of piston grouting pump demand in 2025. This dominant share reflects the high utilization of grouting systems in building construction, infrastructure development, renovation projects, and specialized foundation work across residential, commercial, and industrial construction segments. Modern construction projects increasingly require specialized grouting applications for foundation stabilization, structural repairs, waterproofing systems, and soil stabilization procedures that ensure long-term structural integrity and safety compliance.

The segment benefits from growing infrastructure investment, increasing emphasis on structural durability standards, and expanding renovation activities in aging building stock throughout developed markets. Construction industry applications encompass foundation underpinning, crack injection, void filling, post-tensioning duct grouting, and curtain wall installation procedures that require precise material placement and consistent performance characteristics. Large-scale infrastructure projects including highway construction, tunnel development, and commercial building construction drive substantial demand for reliable grouting equipment capable of handling diverse material types and application requirements.

The construction segment demonstrates strong growth potential driven by urbanization trends, government infrastructure spending, and increasing adoption of advanced construction methodologies that require specialized grouting capabilities. Professional construction contractors increasingly recognize the value of high-quality grouting equipment for ensuring project quality, meeting regulatory requirements, and maintaining competitive advantages in specialized construction applications.

The piston grouting pump market is advancing steadily due to increasing infrastructure development activities worldwide and growing recognition of grouting system importance in ensuring structural integrity and safety compliance across construction and mining applications. Infrastructure rehabilitation programs, urbanization trends, and expanding construction activities are driving substantial demand for reliable grouting equipment capable of handling diverse material types and application requirements. Government spending on transportation infrastructure, including highway construction, bridge rehabilitation, and tunnel development projects, continues to support market expansion through increased demand for specialized pumping equipment.

However, the market faces significant challenges including high initial equipment costs that can limit adoption among smaller contractors, substantial need for skilled operators with specialized training in grouting procedures, and varying material compatibility requirements across different applications that demand versatile equipment capabilities. Equipment maintenance costs, spare parts availability, and technical support requirements present additional barriers for market participants, particularly in developing regions with limited service infrastructure. Material handling complexities, including abrasive cement mixtures and chemical compounds, can impact equipment durability and operational costs over time.

The growing deployment of automated grouting systems is enabling precise material injection control, consistent application quality, and reduced operator dependency across diverse construction applications. Advanced control systems equipped with digital monitoring capabilities provide accurate pressure regulation, flow rate management, and material consumption tracking while minimizing waste and improving operational efficiency. These technologies prove particularly valuable for large-scale infrastructure projects and repetitive grouting applications that require consistent performance standards and comprehensive documentation for quality assurance and regulatory compliance.

Modern piston grouting pump manufacturers are incorporating advanced monitoring equipment and data logging systems that improve operational efficiency, enhance performance tracking capabilities, and provide comprehensive documentation for quality control procedures. Integration of sensor-based monitoring systems enables real-time pressure measurement, flow rate control, material consumption tracking, and equipment performance analysis that support optimal system operation and maintenance scheduling. Advanced equipment configurations also support remote monitoring capabilities, predictive maintenance programs, and data analytics that optimize equipment utilization and reduce operational costs across diverse construction applications.

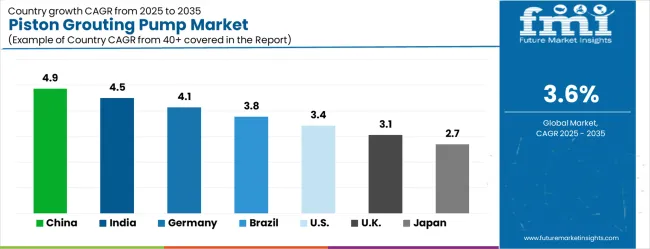

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

The piston grouting pump market is experiencing steady growth globally, with China leading at a 4.9% CAGR through 2035, driven by massive infrastructure development programs, urbanization initiatives, and increasing construction activity. India follows at 4.5%, supported by government infrastructure investment, expanding metro construction projects, and growing industrial development. Germany records 4.1%, emphasizing precision engineering, quality construction standards, and advanced grouting technologies.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The piston grouting pump market in China is projected to exhibit the highest growth rate with a CAGR of 4.9% through 2035, driven by extensive infrastructure development programs including high-speed rail construction, urban subway systems, massive building projects, and comprehensive urbanization initiatives across tier-1 and tier-2 cities. The country's expanding construction industry and growing emphasis on advanced building technologies are creating significant demand for specialized grouting equipment capable of handling complex foundation work, tunnel sealing, and structural rehabilitation projects. Major construction companies and equipment manufacturers are establishing comprehensive supply networks, service centers, and technical support facilities to support the growing infrastructure development activities across urban and rural markets throughout the nation.

The rapid expansion of underground transportation systems, including metro rail networks in major cities, requires sophisticated grouting solutions for tunnel waterproofing, soil stabilization, and structural support applications. China's Belt and Road Initiative continues to drive infrastructure investment both domestically and internationally, creating sustained demand for high-performance grouting equipment. The construction sector's modernization efforts emphasize quality standards, safety compliance, and advanced construction methodologies that require reliable pumping systems.

The piston grouting pump market in India is expanding at a CAGR of 4.5%, supported by increasing infrastructure development including metro rail projects, highway construction, urban development initiatives, and expanding industrial construction activities driven by government programs such as Smart Cities Mission and National Infrastructure Pipeline. The country's expanding construction industry and growing emphasis on quality building practices, structural safety standards, and modern construction methodologies are driving substantial demand for reliable grouting equipment across residential, commercial, and infrastructure project segments. Government infrastructure programs and private sector construction activities are gradually establishing comprehensive demand for specialized pumping systems across diverse project applications including foundation work, structural repairs, and waterproofing systems.

The development of transportation infrastructure, including highway networks, metro systems, and airport construction projects, requires advanced grouting solutions for soil stabilization, foundation strengthening, and structural support applications. India's growing manufacturing sector and industrial development programs continue to drive demand for grouting equipment in factory construction, warehouse development, and industrial facility upgrades.

The piston grouting pump market in Germany is projected to grow at a CAGR of 4.1%, supported by the country's emphasis on construction technology innovation, precision equipment manufacturing, and stringent quality standards that drive demand for high-performance grouting systems across construction and industrial applications. German construction companies are implementing advanced grouting systems that meet rigorous engineering specifications, environmental regulations, and safety standards while providing superior performance characteristics and long-term reliability. The market is characterized by focus on technical excellence, equipment precision, advanced automation capabilities, and comprehensive compliance with construction safety regulations and environmental protection requirements.

The country's leadership in engineering and manufacturing excellence extends to grouting equipment development, with companies investing heavily in research and development, advanced materials, and innovative control systems. Germany's emphasis on sustainable construction practices and environmental protection drives demand for grouting systems that minimize material waste and environmental impact. The construction industry's focus on energy-efficient buildings and green construction practices requires specialized grouting applications for insulation installation and weatherproofing systems.

The piston grouting pump market in Brazil is growing at a CAGR of 3.8%, driven by increasing infrastructure development including transportation projects, building construction, industrial facility development, and comprehensive urban renewal programs across major metropolitan areas and industrial regions. The country's established construction industry is gradually adopting advanced grouting technologies to serve modern project requirements, safety standards, and quality specifications while addressing the growing demand for infrastructure rehabilitation and expansion. Construction contractors and equipment suppliers are investing in grouting systems, technical training, and service capabilities to address growing market demand for quality construction equipment that can handle diverse application requirements and challenging operating conditions.

Brazil's focus on infrastructure modernization, including highway rehabilitation, bridge construction, and urban development projects, creates sustained demand for reliable grouting equipment. The country's industrial sector expansion and manufacturing facility construction require specialized grouting solutions for foundation work, structural support, and facility upgrades. Growing emphasis on construction safety and quality standards drives adoption of professional-grade equipment.

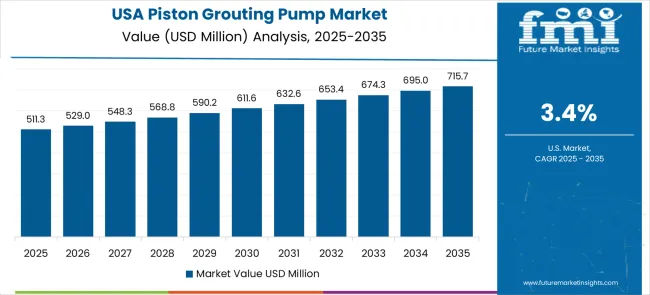

The piston grouting pump market in the USA is expanding at a CAGR of 3.4%, driven by infrastructure rehabilitation projects, growing emphasis on construction safety and quality standards, and comprehensive regulatory requirements that mandate proper equipment performance and documentation procedures. Large construction contractors and specialized foundation companies are establishing comprehensive grouting capabilities to serve diverse project needs including highway construction, building foundation work, tunnel construction, and infrastructure maintenance applications. The market benefits from stringent regulatory requirements for construction documentation, quality assurance procedures, and safety compliance following infrastructure development and repair activities across public and private sector projects.

The American construction industry's focus on productivity, safety, and quality drives demand for advanced grouting equipment that provides reliable performance, operator safety features, and comprehensive monitoring capabilities. Infrastructure aging and rehabilitation requirements create sustained demand for grouting solutions in bridge repair, tunnel maintenance, and foundation strengthening applications. The growing emphasis on sustainable construction practices and environmental protection influences equipment selection and operational procedures.

The piston grouting pump market in the UK is projected to grow at a CAGR of 3.1% through 2035, supported by comprehensive infrastructure renewal initiatives, construction equipment reliability requirements, and growing emphasis on safety standards across diverse construction applications including transportation, residential, and commercial building projects. British construction companies are investing in advanced grouting systems that provide consistent performance, durability, and compliance with stringent safety regulations while addressing the country's aging infrastructure rehabilitation needs. The market benefits from established construction industry expertise, professional contractor networks, and comprehensive regulatory frameworks that ensure equipment quality and operational safety standards.

The UK's focus on infrastructure modernization, including railway upgrades, highway maintenance, and urban development projects, creates sustained demand for reliable grouting equipment capable of handling diverse application requirements. Construction industry emphasis on productivity improvement and cost efficiency drives adoption of advanced grouting technologies that reduce project timelines and improve quality outcomes. Growing investment in renewable energy infrastructure and sustainable construction practices requires specialized grouting solutions for foundation work and structural support applications.

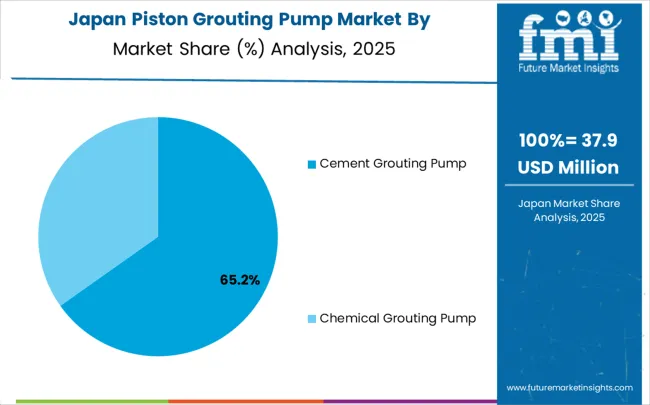

The piston grouting pump market in Japan is projected to grow at a CAGR of 2.7% through 2035, driven by the country's strong focus on construction technology innovation, precision equipment manufacturing, and comprehensive quality standards that emphasize reliability, performance, and safety across diverse construction applications. Japanese construction companies consistently demand high-performance grouting equipment that delivers precise material placement, automated control capabilities, and long-term durability while meeting stringent engineering specifications and environmental regulations. The market is characterized by advanced technology integration, comprehensive testing requirements, and emphasis on equipment efficiency and operational excellence.

Japan's leadership in construction technology development extends to grouting equipment innovation, with companies investing substantially in research and development, advanced materials science, and automated control systems. The country's focus on disaster-resistant construction practices and seismic engineering requires specialized grouting applications for foundation strengthening, structural reinforcement, and building retrofit projects. Construction industry emphasis on lean manufacturing principles and quality control drives demand for grouting systems that provide consistent performance and comprehensive monitoring capabilities.

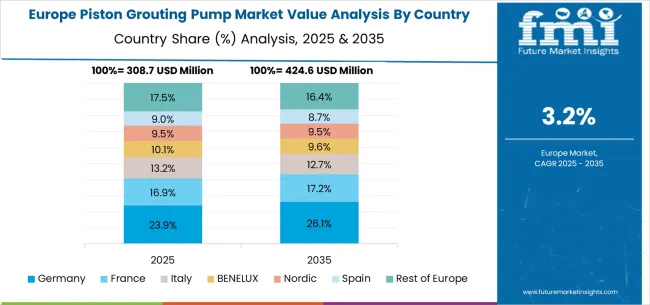

The piston grouting pump market in Europe is projected to grow from USD 295.4 million in 2025 to USD 398.7 million by 2035, registering a CAGR of 3.1% over the forecast period. Germany is expected to maintain its leadership with a commanding 26.8% share in 2025, rising slightly to 27.2% by 2035, supported by its expansive construction industry ecosystem, advanced engineering capabilities, and strong emphasis on precision grouting equipment for infrastructure and industrial applications.

France accounts for 18.5% of the European market in 2025, with share expected to remain stable at 18.3% by 2035, driven by extensive infrastructure modernization programs, sophisticated construction methodologies, and comprehensive adoption of advanced grouting technologies across transportation and building construction sectors. The UK represents 16.2% market share in 2025, projected to maintain 16.1% through 2035, supported by infrastructure renewal initiatives, construction equipment reliability requirements, and growing emphasis on safety standards across construction applications.

Italy holds 12.4% share in 2025, expected to grow to 12.7% by 2035, benefiting from expanding infrastructure investment, construction industry modernization, and increasing adoption of specialized grouting solutions for structural rehabilitation projects. Spain contributes 9.1% in 2025, with share projected to increase to 9.4% by 2035, driven by construction sector recovery, infrastructure development programs, and growing demand for professional-grade grouting equipment.

The Rest of Europe region, including Eastern European countries and Nordic markets, accounts for 16.9% share in 2025, expected to expand to 17.8% by 2035, attributed to rising infrastructure investment, construction industry development, and increasing accessibility of advanced grouting technologies across emerging construction markets throughout the region.

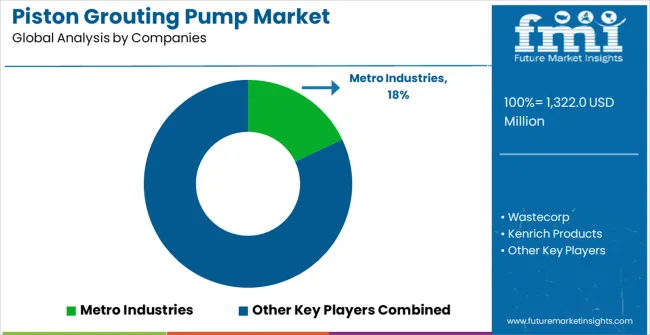

The piston grouting pump market is characterized by competition among specialized equipment manufacturers, construction machinery companies, and industrial pump suppliers. Companies are investing in advanced pump technologies, automated control systems, durable construction materials, and comprehensive service support to deliver reliable, efficient, and cost-effective grouting solutions. Product innovation, technological advancement, and market expansion are central to strengthening equipment portfolios and market presence.

Metro Industries, USA-based, offers comprehensive piston grouting pump solutions with emphasis on reliability, performance, and operator safety for construction applications. Wastecorp provides specialized pumping equipment with focus on material handling capabilities and system durability. Kenrich Products delivers engineered grouting systems with advanced control technologies and precision material injection. R-2 Mfg. emphasizes compact pump designs and versatile application capabilities for diverse project requirements.

Lianhe RongDa offers cost-effective grouting solutions with reliable performance for construction and industrial applications. Airplaco provides comprehensive grouting equipment with focus on ease of operation and maintenance efficiency. ChemGrout Inc specializes in chemical grouting systems with advanced material compatibility and precision control. M-Tec, IMER Group, Schwing Stetter, and Putzmeister offer specialized grouting expertise, advanced pump technologies, and comprehensive service support across global and regional construction markets.

Piston grouting pumps represent essential equipment for infrastructure development, foundation strengthening, and structural rehabilitation across construction and mining sectors. With the market projected to grow from USD 1.32 billion in 2025 to USD 1.88 billion by 2035 at a 4% CAGR, scaling adoption requires coordinated action across government agencies, construction industry associations, equipment manufacturers, construction contractors, and financial institutions to address high equipment costs, operator training requirements, and diverse application complexities across cement and chemical grouting applications.

How Governments Could Accelerate Infrastructure Development and Equipment Adoption?

Infrastructure Investment and Standardization: Establish comprehensive infrastructure development programs that mandate use of professional-grade grouting equipment for foundation work, tunnel construction, and structural repairs, while developing technical specifications that ensure equipment quality and performance standards across public construction projects.

Training and Certification Programs: Fund specialized technical training centers that educate construction workers and equipment operators in proper grouting procedures, safety protocols, and equipment maintenance, while establishing certification requirements for operators working on government infrastructure projects.

Equipment Financing and Procurement Support: Create equipment financing programs and tax incentives that help small and medium construction contractors acquire advanced grouting equipment, while implementing bulk procurement initiatives that reduce equipment costs through government purchasing power and standardized specifications.

Construction Quality and Safety Regulations: Develop comprehensive construction standards that require proper grouting procedures for foundation work, soil stabilization, and structural repairs, while establishing inspection protocols that ensure compliance with engineering specifications and safety requirements.

Research and Development Investment: Support research initiatives focused on grouting technology advancement, material innovation, and environmental impact reduction, while funding university programs that develop next-generation equipment and improve construction methodologies.

How Industry Associations Could Strengthen Market Standards and Adoption?

Technical Standards and Best Practices: Establish comprehensive industry standards for grouting equipment performance, material compatibility, and application procedures that ensure consistent quality across construction projects, while developing technical guidelines that optimize equipment selection for specific applications.

Professional Training and Certification: Create comprehensive training programs that educate construction professionals in grouting equipment operation, maintenance procedures, and troubleshooting techniques, while establishing certification standards that validate technical competency and promote safe operating practices.

Market Development and Awareness: Organize trade shows, technical conferences, and educational seminars that demonstrate grouting equipment capabilities and showcase successful project applications, while promoting awareness of equipment benefits and return on investment among construction contractors.

Quality Assurance and Performance Verification: Develop testing protocols and performance verification procedures that validate equipment reliability and performance characteristics, while establishing quality certification programs that help contractors select appropriate equipment for specific project requirements.

Industry Research and Innovation Support: Coordinate research initiatives that advance grouting technology, improve equipment efficiency, and develop new application techniques, while facilitating collaboration between equipment manufacturers, construction contractors, and academic institutions.

How Equipment Manufacturers Could Enhance Market Penetration and Technology Development?

Product Innovation and Technology Integration: Develop advanced grouting pump systems with automated controls, digital monitoring capabilities, and predictive maintenance features that improve operational efficiency and reduce maintenance costs, while creating modular equipment designs that address diverse application requirements.

Customer Support and Service Networks: Establish comprehensive service networks with technical support, spare parts availability, and equipment maintenance services that ensure reliable equipment operation, while providing training programs that educate customers on optimal equipment utilization and maintenance procedures.

Application Engineering and Technical Solutions: Provide technical expertise and application engineering support that helps customers select appropriate equipment configurations for specific project requirements, while developing customized solutions that address unique grouting challenges and performance specifications.

Cost-Effective Equipment Solutions: Design equipment configurations that balance performance capabilities with cost considerations, while offering flexible financing options and equipment rental programs that improve accessibility for smaller construction contractors and specialized applications.

Digital Technology Integration: Incorporate IoT sensors, remote monitoring capabilities, and data analytics systems that optimize equipment performance and enable predictive maintenance, while developing digital platforms that support equipment management and operational efficiency improvement.

How Construction Contractors Could Optimize Equipment Utilization and Project Performance?

Equipment Investment and Fleet Management: Develop comprehensive equipment acquisition strategies that balance owned and rental equipment based on project requirements and utilization patterns, while implementing fleet management systems that optimize equipment deployment and maintenance scheduling across multiple job sites.

Operator Training and Skill Development: Invest in comprehensive training programs that develop operator expertise in grouting equipment operation, safety procedures, and troubleshooting techniques, while establishing internal certification programs that ensure consistent performance standards and operational safety.

Project Planning and Application Optimization: Implement systematic project planning procedures that optimize grouting equipment selection and application procedures based on soil conditions, material requirements, and performance specifications, while developing standardized procedures that ensure consistent quality and efficiency.

Quality Control and Performance Monitoring: Establish comprehensive quality control systems that monitor grouting performance, material properties, and equipment operation during project execution, while implementing documentation procedures that track performance metrics and support continuous improvement initiatives.

Maintenance and Reliability Management: Develop preventive maintenance programs that maximize equipment reliability and minimize downtime, while establishing spare parts inventory and service relationships that ensure rapid equipment repair and maintenance support.

How Financial Enablers Could Support Market Growth and Equipment Access?

Equipment Financing and Leasing Programs: Provide flexible financing solutions including equipment loans, leasing programs, and rental-purchase options that improve equipment accessibility for construction contractors with diverse financial capabilities and project requirements, while offering competitive interest rates and flexible payment terms.

Project Financing and Infrastructure Investment: Support infrastructure development projects through construction financing, project bonds, and development funding that creates demand for grouting equipment, while investing in construction companies that demonstrate expertise in specialized grouting applications and infrastructure development.

Technology Investment and Innovation Funding: Provide venture capital and development funding for equipment manufacturers developing advanced grouting technologies, digital monitoring systems, and automation capabilities that improve equipment performance and market competitiveness.

Risk Management and Insurance Solutions: Develop insurance products and risk management solutions that protect equipment investments and project performance, while providing warranty programs and performance guarantees that reduce financial risks associated with equipment acquisition and deployment.

Market Development and International Expansion: Support equipment manufacturers and construction contractors in international market development through export financing, trade facilitation, and market entry support that expands global market opportunities and technology transfer initiatives.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1,322 million |

| Type | Cement grouting pump and chemical grouting pump |

| End-Use Industry | Construction industry, mining industry, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Metro Industries, Wastecorp, Kenrich Products, R-2 Mfg., Lianhe RongDa, Airplaco, ChemGrout Inc, M-Tec, IMER Group, Schwing Stetter, Putzmeister |

| Additional Attributes | Dollar sales by pump type and capacity range, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for automated versus manual operation systems, integration with digital monitoring and control technologies, innovations in material compatibility and multi-purpose pumping capabilities, and adoption of predictive maintenance solutions with advanced sensor integration and performance optimization features for enhanced operational efficiency. |

The global piston grouting pump market is estimated to be valued at USD 1,322.0 million in 2025.

The market size for the piston grouting pump market is projected to reach USD 1,882.9 million by 2035.

The piston grouting pump market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in piston grouting pump market are cement grouting pump and chemical grouting pump.

In terms of application, construction industry segment to command 68.3% share in the piston grouting pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Piston Seals Market Size, Growth, and Forecast 2025 to 2035

Axial Piston Motor Market- Analysis and Forecast by Product Type, End-User and Region 2025 to 2035

Axial Piston Pumps Market

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Radial Piston Motor Market Size, Share, and Forecast 2025 to 2035

Radial Piston Pumps Market

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Grouting Machine Market

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA