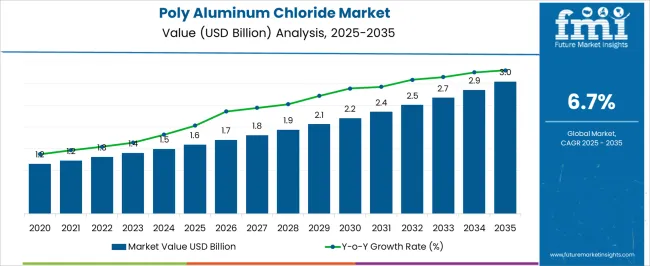

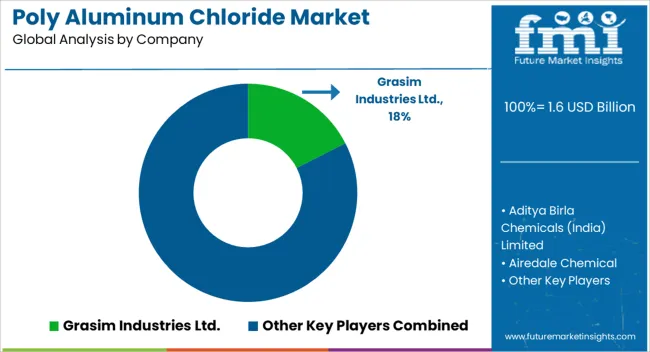

The poly aluminum chloride market is projected to grow from USD 1.6 billion in 2025 to USD 3.0 billion by 2035, registering a CAGR of 6.7% during the forecast period. Between 2025 and 2030, the market is expected to increase from USD 1.6 billion to USD 2.2 billion, driven by rising demand in water and wastewater treatment applications. Year-on-year analysis shows steady gains, with values reaching USD 1.7 billion in 2026 and USD 1.8 billion in 2027, supported by stringent water quality regulations and the expansion of municipal and industrial treatment facilities.

By 2028, the market is forecasted to reach USD 1.9 billion, followed by USD 2.1 billion in 2029 and USD 2.2 billion by 2030. Growth will be further fueled by increased adoption in the paper and pulp industry for sizing and retention processes, as well as in various chemical manufacturing applications. Technological advancements in production processes aimed at improving efficiency and reducing environmental impact will enhance competitiveness. These dynamics position poly aluminum chloride as a critical coagulant in multiple sectors, with sustained demand driven by global infrastructure development and environmental compliance requirements.

| Metric | Value |

|---|---|

| Poly Aluminum Chloride Market Estimated Value in (2025 E) | USD 1.6 billion |

| Poly Aluminum Chloride Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The poly aluminum chloride (PAC) market is witnessing steady expansion due to increased demand for efficient, cost-effective coagulants in water purification and industrial treatment systems. Growth is being supported by regulatory mandates targeting potable water quality and the reduction of industrial effluents. PAC’s versatility in both municipal and industrial applications, combined with its high charge density and reduced sludge generation, has positioned it as a preferred alternative to conventional coagulants.

Government-led initiatives promoting access to clean water, especially in developing regions, are further accelerating adoption. Technological improvements in production processes are enabling better control of basicity and polymerization levels, enhancing application-specific performance.

Rising awareness of environmental compliance and cost optimization in end-use sectors like textiles, pulp & paper, and oil & gas continues to broaden market scope. Looking ahead, the market is expected to benefit from strategic investments in local manufacturing capacities and the development of customized PAC formulations for niche industrial needs.

The poly aluminum chloride market is segmented by form, basicity end user, and geographic regions. By form, the market is divided into Liquid and Solid. In terms of basicity, the market is classified into Medium, Low, and High.

Based on end user, of the poly aluminum chloride market is segmented into Water treatment, Pulp and Paper, Textiles, Oil and Gas, and Others. Regionally, the poly aluminum chloride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

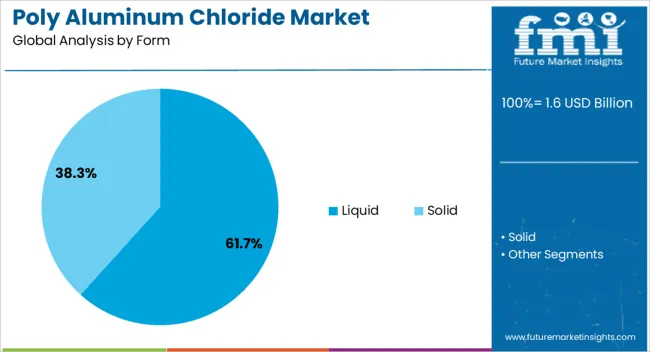

Liquid poly aluminum chloride is expected to account for 61.70% of the total market revenue by 2025, making it the most widely used form in the industry. This segment’s dominance is attributed to its ease of handling, faster dissolution rate, and compatibility with continuous dosing systems in water treatment plants.

Liquid PAC requires less processing time compared to its solid counterpart and is particularly favored in large-scale operations due to reduced labor and energy inputs. Its use also minimizes dust formation and handling risks, enhancing safety during transportation and application.

Furthermore, increased investments in municipal infrastructure and centralized treatment facilities have strengthened the demand for liquid formulations, which align with automation-based dosing technologies used in modern purification systems.

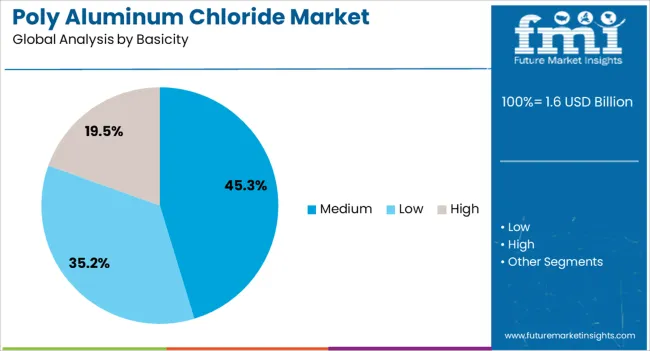

The medium basicity category is projected to hold 45.30% of the market share by 2025, emerging as the leading basicity range. This segment is gaining preference due to its balanced performance characteristics—delivering efficient coagulation while maintaining low residual aluminum content in treated water.

Medium basicity PAC offers optimal charge density for effective flocculation in varying water chemistries, making it suitable for both municipal and industrial systems. It also demonstrates superior adaptability to temperature and pH fluctuations, which enhances operational consistency.

As utilities and industries prioritize reliable performance and regulatory compliance, medium basicity formulations are being increasingly adopted to ensure clarity, safety, and minimal environmental footprint in treated effluent streams.

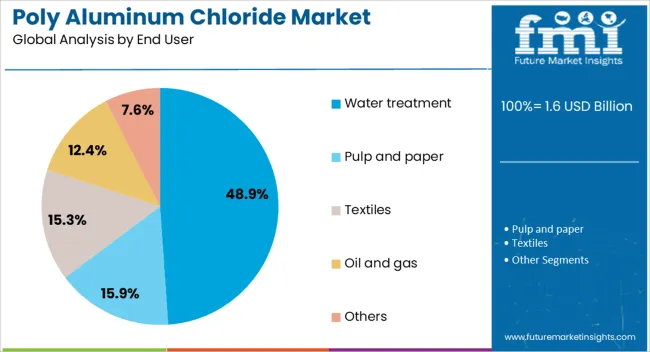

Water treatment is expected to contribute 48.90% of the poly aluminum chloride market revenue in 2025, positioning it as the dominant end-use segment. This leadership is driven by expanding global investments in drinking water infrastructure, wastewater management, and effluent reuse.

PAC’s ability to perform across a wide range of turbidity and contamination levels has made it a cornerstone chemical in municipal treatment plants. Its use reduces sludge volume and enhances sedimentation efficiency, thereby lowering operational costs and improving throughput.

Urbanization, industrial growth, and increasing awareness of waterborne health risks are prompting governments and private operators to adopt high-efficiency coagulants. The segment's prominence is further reinforced by ongoing capacity expansions and technological upgrades in water utility networks, particularly across emerging economies.

The poly aluminum chloride market has been driven by rising demand in water treatment, paper manufacturing, and industrial processing. In 2024 and 2025, government regulations on wastewater discharge boosted its adoption in municipal treatment plants. Opportunities are emerging in developing economies where infrastructure upgrades are underway. Trends include the shift toward high-purity and low-iron grades for sensitive applications. However, raw material cost volatility and competition from alternative coagulants remain challenges, making pricing strategies and supply chain efficiency critical for sustained market growth.

The major growth driver for the poly aluminum chloride market is its increasing application in water and wastewater treatment. In 2024, stricter discharge regulations in Asia-Pacific and the Middle East boosted the adoption of PAC in municipal facilities. Industrial users in textile and food processing sectors also expanded consumption due to its high coagulation efficiency. The ability of PAC to perform under varying pH conditions and its lower sludge production compared to traditional coagulants has positioned it as a preferred choice, fueling demand across both developed and emerging regions.

Significant opportunities exist in developing economies where water treatment infrastructure is expanding. In 2025, multiple African and Southeast Asian countries initiated large-scale wastewater treatment projects, creating demand for cost-effective and efficient coagulants. Beyond water treatment, growth in the paper and pulp industry is driving usage due to PAC’s superior performance in paper sizing. Chemical suppliers are exploring partnerships with local distributors in high-growth regions, enabling faster market penetration. This expansion potential underscores the market’s ability to diversify revenue streams beyond traditional applications.

An emerging trend is the increasing preference for high-purity and low-iron grades of poly aluminum chloride, particularly for industries requiring stringent water quality standards. In 2024, electronics manufacturing and pharmaceuticals significantly increased demand for these grades to minimize contamination risks. Paper mills producing premium-grade products also leaned toward high-purity PAC for consistent results. This shift is influencing manufacturers to upgrade production facilities and focus on quality assurance, reinforcing the premium segment as a lucrative area of long-term market growth.

One of the key restraints is raw material cost volatility, particularly related to aluminum hydroxide prices. In 2025, supply disruptions in major producing countries created short-term pricing spikes, affecting procurement strategies. Competition from alternative coagulants like ferric chloride and alum also impacts PAC demand in price-sensitive markets. Furthermore, smaller municipal projects in developing regions often choose cheaper options despite PAC’s efficiency advantages. These challenges emphasize the importance of cost management, strategic sourcing, and product differentiation to maintain competitive positioning.

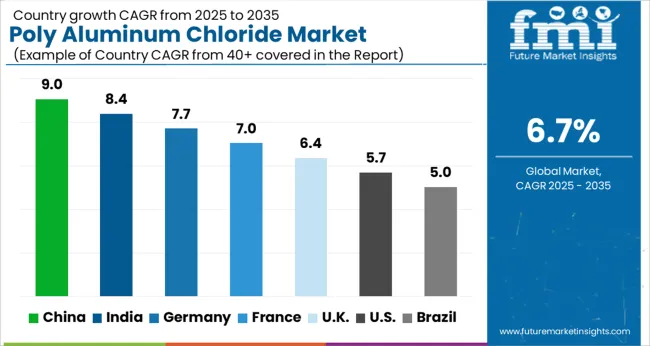

The global poly aluminum chloride (PAC) market is projected to grow at 6.7% CAGR from 2025 to 2035. China leads with 9% CAGR, driven by strong industrial demand, especially in water treatment and paper industries. India follows at 8%, supported by rapid infrastructure growth and rising water treatment needs.

Germany records 8% CAGR, driven by growing regulations around water treatment, waste management, and industrial applications. The United Kingdom and the United States both grow at 6%, reflecting stable demand in mature markets with a focus on sustainability and water treatment solutions. Asia-Pacific leads growth due to industrial demand and urbanization, while Europe and North America focus on regulatory compliance and product innovation.

The poly aluminum chloride market in China is forecasted to grow at 9% CAGR, supported by the country's rapid industrialization, urbanization, and increasing water treatment requirements. The growing demand from various sectors, such as municipal water treatment, paper, and textiles, drives the market. Additionally, China’s increasing regulatory measures for water quality and wastewater treatment further contribute to the demand for PAC. Furthermore, the growing demand for PAC in industrial applications such as mining, oil and gas, and food processing accelerates market growth.

The poly aluminum chloride market in India is projected to grow at 8% CAGR, driven by increasing industrial activities and urbanization. As India's population grows, the need for potable water and wastewater treatment solutions rises, driving demand for PAC. The Indian government’s initiatives to improve water quality and infrastructure in urban and rural areas also contribute to the market expansion. Moreover, the rising demand from various industries, such as textiles, chemicals, and food processing, further supports market growth.

The poly aluminum chloride market in Germany is expected to grow at 8% CAGR, supported by the country’s stringent water quality regulations and the need for effective waste treatment solutions. Germany's advanced industrial infrastructure, combined with a focus on sustainable water treatment practices, fuels the demand for PAC. Additionally, growing environmental concerns and an increasing emphasis on chemical-free solutions in water treatment and industrial processing further contribute to the demand for PAC.

The poly aluminum chloride market in the United Kingdom is projected to grow at 6% CAGR, driven by increasing demand for water treatment solutions in urban areas and the need for chemical-free and efficient alternatives. The UK government’s strict water and wastewater treatment regulations boost the demand for PAC in municipal and industrial applications. Furthermore, the growth of the food processing industry and rising awareness about water conservation further enhance the demand for poly aluminum chloride in the country.

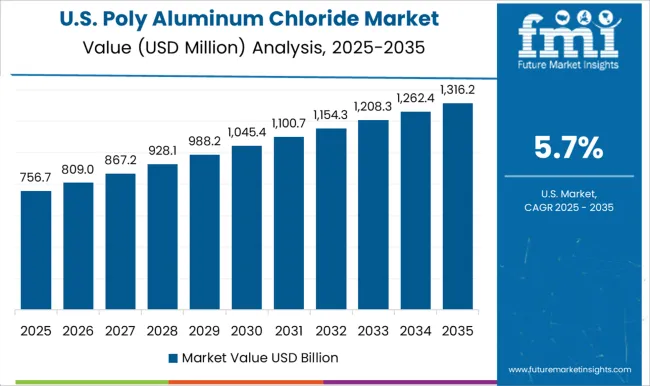

The poly aluminum chloride market in the United States is projected to grow at 6% CAGR, reflecting steady demand in a mature market with a focus on water treatment, industrial processes, and waste management. Government regulations and environmental standards for water quality continue to drive the use of PAC in municipal and industrial applications. Additionally, PAC’s growing use in industries such as paper and pulp, mining, and oil and gas strengthens market growth, especially with the increasing trend toward sustainable water treatment solutions.

The poly aluminum chloride market is highly competitive. Multiple regional and global suppliers are active. GEO Specialty Chemicals, Feralco AB, USALCO, Kemira Oyj, Aditya Birla Chemicals, BASF SE, Airedale Chemical, and Central Glass all compete directly. Rivalry is defined by price tiers, dosing efficiency, purity grades, and regional regulatory alignment. Performance in municipal water treatment remains the core differentiator. Distribution is executed through direct supply contracts with utilities, chemical distributors, and industrial OEMs. Partnerships with paper, textile, and food industries are used to secure captive demand. Pricing is often linked to formulation grade, aluminum content, and delivery format, with liquid and solid PACs positioned for different treatment infrastructure.

Strategies are shaped by capacity expansion, portfolio diversification, and compliance positioning. Investments have been made in new production units in North America and Asia to ensure resilience and reduce import dependence. Research has been directed toward low-residual, high-purity PAC grades to meet stricter potable water and industrial discharge regulations. Product families are being scaled so that standard coagulants serve bulk municipal plants, while specialized variants support pulp and paper or food-grade needs. Go-to-market execution is framed around winning public tenders, securing multi-year supply agreements, and embedding trial support for plants transitioning from traditional alum to PAC. Sustainability messaging is emphasized, with PAC positioned as a lower-sludge, lower-dose alternative, reducing handling costs and environmental footprint.

Product brochures emphasize technical clarity. GEO’s materials specify dosing ranges, sludge generation rates, and application notes for wastewater and potable water. Feralco’s brochures highlight liquid stability, tailored formulation for European wastewater, and dosing consistency. USALCO details capacity availability, dosing guidance, and compatibility with existing infrastructure. Kemira stresses residual aluminum reduction, broad pH efficacy, and verified pilot data. Aditya Birla Chemicals presents energy-efficient production processes, municipal compliance certifications, and region-specific dosing curves. BASF focuses on high-purity applications, trace-metal specifications, and premium water quality assurance. Airedale emphasizes flexible packaging, dissolution rates, and suitability for food-processing plants. Central Glass showcases low-aluminum residue, automation-ready packaging, and high-grade potable applications. Across all players, brochures are pragmatic, prioritizing dosing instructions, performance metrics, and compliance certifications rather than narrative marketing.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Form | Liquid and Solid |

| Basicity | Medium, Low, and High |

| End User | Water treatment, Pulp and paper, Textiles, Oil and gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grasim Industries Ltd., Aditya Birla Chemicals (India) Limited, Airedale Chemical, Central Glass Co., Ltd., De Dietrich Process Systems, Feralco AB, GEO Specialty Chemicals, Inc., Gongyi Filter Industry Co. Ltd., Gujarat Alkalies and Chemical Ltd., Henan Aierfuke Chemicals Co. Ltd, Kanoria Chemicals & Industries Limited, Kemira Oyj, Lvyuan Chem, NALCO, and USALCO LLC |

| Additional Attributes | Dollar sales by grade and end use, demand dynamics across water treatment and paper manufacturing, regional trends in poly aluminum chloride consumption, innovation in high-purity and low-residue formulations, environmental impact of manufacturing and disposal, and emerging use cases in specialty chemical and industrial applications. |

The global poly aluminum chloride market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the poly aluminum chloride market is projected to reach USD 3.0 billion by 2035.

The poly aluminum chloride market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in poly aluminum chloride market are liquid and solid.

In terms of basicity, medium segment to command 45.3% share in the poly aluminum chloride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyphenylene Market Forecast Outlook 2025 to 2035

Polyimide Film and Tape Market Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Polydimethylsiloxane Market Forecast and Outlook 2025 to 2035

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polysaccharide Films Market Size and Share Forecast Outlook 2025 to 2035

Polysilicon Market Size and Share Forecast Outlook 2025 to 2035

Polytetrahydrofuran (Poly THF) Market Size and Share Forecast Outlook 2025 to 2035

Polysulfide Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polyhydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Polyethersulfone (PES) Market Size and Share Forecast Outlook 2025 to 2035

Polyisocyanurate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polybenzoxazine Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA