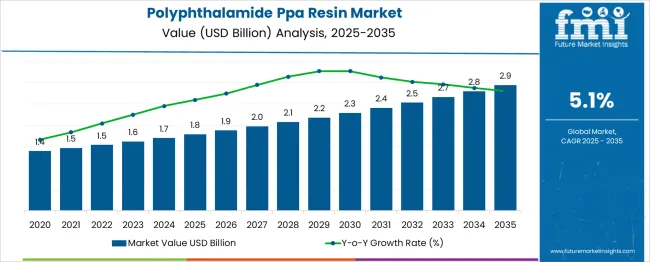

The Polyphthalamide (PPA)Resin Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The year-by-year progression indicates a stable growth pattern with minimal fluctuation in percentage gains, suggesting a low Growth Rate Volatility Index over the forecast period. Annual market expansion remains consistent, with increases ranging from USD 0.1 billion in the early years to USD 0.2 billion toward the end of the decade.

From 2025 to 2030, the market advances to USD 2.3 billion, contributing USD 0.5 billion, or roughly 45% of the total decade’s growth. The increments during this phase remain nearly uniform, reflecting predictable demand supported by established applications in automotive, electronics, and industrial sectors. From 2030 to 2035, the market adds USD 0.6 billion, accounting for about 55% of total growth.

Yearly increments show only a slight acceleration, with no abrupt surges or declines, indicating market stability and consistent end-use adoption. The low volatility in growth rates suggests a mature market with stable demand drivers and limited susceptibility to external shocks. This pattern favors steady capacity planning and long-term supply agreements, as the market’s expansion is likely to proceed at a controlled and predictable pace.

| Metric | Value |

|---|---|

| Polyphthalamide (PPA) Resin Market Estimated Value in (2025 E) | USD 1.8 billion |

| Polyphthalamide (PPA) Resin Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The polyphthalamide (PPA) resin market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.5% of the global engineering plastics market, driven by demand for high performance materials in demanding environments. Within the automotive lightweight materials sector, a share of approximately 3.2% is assessed as PPA replaces metals in under the hood and structural components.

In the electrical and electronics manufacturing industry, around 2.8% is observed, reflecting use in connectors, housings, and thermal management parts. Within the industrial machinery components market, about 2.4% is evaluated due to PPA’s strength and chemical resistance. In the high temperature polymers segment, a contribution of roughly 3.0% is calculated, given PPA’s ability to retain properties under elevated heat and mechanical stress.

Market expansion has been influenced by the shift toward materials that combine durability, heat resistance, and weight reduction. Innovations have been directed toward glass fiber reinforced and mineral-filled PPA grades to improve rigidity and dimensional stability. Interest has been growing in flame-retardant and halogen-free formulations for compliance with safety and environmental regulations.

The Asia Pacific region has been observed to lead production and consumption, supported by growth in automotive and electronics manufacturing, while Europe and North America sustain demand through high specification industrial and transportation applications. Strategic initiatives have included partnerships between resin producers and OEMs to develop application-specific PPA grades, improve processing efficiency, and integrate PPA into parts requiring both precision molding and long-term performance reliability.

The polyphthalamide (PPA) resin market is witnessing sustained growth driven by increasing demand for lightweight, heat-resistant materials in high-performance engineering applications. Industry shifts toward metal replacement, especially in sectors like automotive and electronics, have created a robust pull for advanced thermoplastics such as PPA.

Its superior mechanical strength, thermal stability, and resistance to chemicals have made it a preferred choice in components exposed to harsh conditions. Investments in e-mobility, miniaturized electronics, and energy-efficient systems are paving the way for new use-cases of reinforced PPA blends.

Additionally, tightening regulations around emission control and material recyclability have encouraged OEMs to transition toward fiber-reinforced and bio-based formulations of PPA, opening up long-term opportunities in global manufacturing hubs.

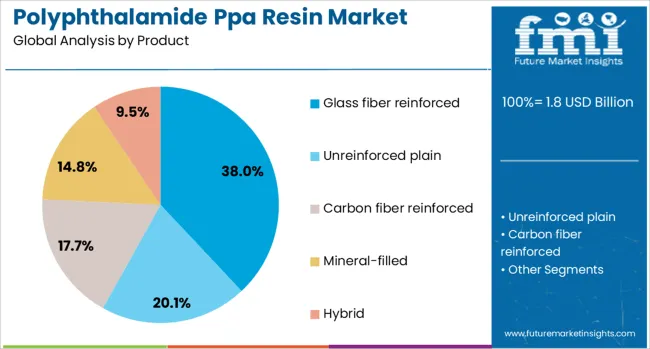

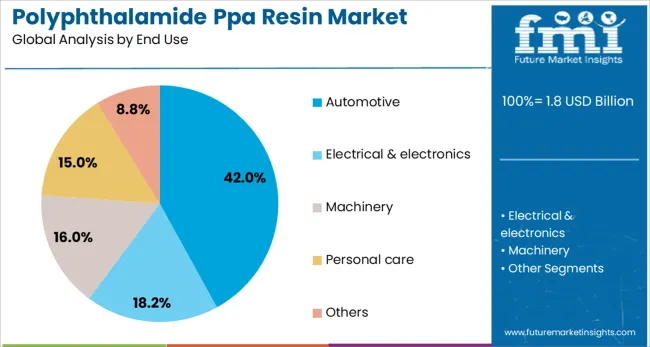

The polyphthalamide PPA resin market is segmented by product, end use, and geographic regions. The product of the polyphthalamide PPA resin market is divided into Glass fiber reinforced, Unreinforced plain, Carbon fiber reinforced, Mineral-filled, and Hybrid. In terms of end use, the polyphthalamide PPA resin market is classified into Automotive, Electrical & electronics, Machinery, Personal care, and Others. Regionally, the polyphthalamide ppa resin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass fiber reinforced PPA is expected to command a 38.0% share of the market in 2025, making it the leading product segment. This dominance is being driven by its high tensile strength, dimensional stability, and excellent heat resistance under prolonged mechanical load.

Industries requiring robust, lightweight alternatives to metals such as automotive and electrical have increasingly specified glass fiber reinforced grades for precision-molded parts. The segment has also benefited from developments in compound modification and fiber-matrix bonding, which have expanded its suitability across various structural and thermal-intensive applications.

As regulatory bodies and OEMs intensify their focus on fuel efficiency and performance optimization, reinforced PPA is projected to remain the material of choice for high-stress, under-the-hood components.

The automotive sector is anticipated to lead the end-use category with a 42.0% market share in 2025. This leadership is being shaped by the industry's growing demand for lightweight materials that can withstand elevated temperatures, mechanical strain, and chemical exposure.

PPA resins have found increasing use in engine components, fuel systems, connectors, and thermal management systems, particularly in electric and hybrid vehicles. Their ability to replace heavier metal parts without compromising strength or durability has aligned with OEM strategies focused on emission reduction and energy efficiency.

In addition, the expansion of EV manufacturing and investment in advanced mobility platforms has further cemented the relevance of PPA in next-generation vehicle design.

Polyphthalamide (PPA) resin has been increasingly used in automotive, electronics, industrial, and consumer goods applications due to its high mechanical strength, heat resistance, and dimensional stability. This semi-aromatic polyamide has offered superior performance in demanding environments compared to conventional engineering plastics. Demand has been supported by the shift toward lightweight components, miniaturization of electronics, and the need for durable materials in high-temperature applications. Manufacturers have been enhancing resin grades with glass fiber reinforcement, flame retardancy, and chemical resistance to meet diverse industry specifications.

The automotive industry has been a major consumer of PPA resin, particularly for under-the-hood components, fuel system parts, and electrical connectors. PPA’s ability to withstand continuous exposure to high temperatures and aggressive chemicals has made it a preferred choice over metals and lower-grade plastics. Automakers have replaced metal parts with PPA to achieve weight savings, contributing to improved fuel efficiency and lower emissions. Hybrid and electric vehicles have also increased demand for PPA in high-voltage connectors, battery housings, and charging system components. The resin’s dimensional stability has ensured tight tolerances even in extreme operating conditions, reinforcing its value in precision-engineered automotive parts.

In the electronics sector, PPA resin has been used extensively for connectors, circuit breakers, LED housings, and other components requiring high heat and flame resistance. Its low moisture absorption and excellent electrical insulation properties have made it suitable for high-speed data connectors and miniaturized devices. Manufacturers in Asia-Pacific, particularly in China, Taiwan, and South Korea, have been expanding PPA usage in consumer electronics and telecom equipment. The material’s ability to maintain performance during surface mount soldering processes has been crucial for modern electronics manufacturing. With growing demand for 5G infrastructure and advanced semiconductor packaging, PPA’s role in precision electrical applications has been further reinforced.

Beyond automotive and electronics, PPA resin has been adopted in industrial machinery, sports equipment, and consumer appliances. Its chemical resistance and structural integrity have made it ideal for pump housings, gear wheels, and precision tools used in harsh operating environments. In consumer goods, PPA has been used for parts that require both strength and aesthetic finish, such as kitchen appliances and power tools. The resin’s compatibility with various processing methods, including injection molding and extrusion, has enabled manufacturers to produce complex shapes with minimal post-processing. This versatility has encouraged adoption across industries seeking to balance performance, durability, and cost-effectiveness.

Despite its benefits, PPA resin has faced adoption challenges due to higher material costs compared to standard polyamides and engineering plastics. The need for specialized processing equipment and strict temperature control during molding has increased production complexity. Smaller manufacturers have been hesitant to switch to PPA due to these additional costs and technical requirements. In cost-sensitive applications, alternative materials with lower performance but better price competitiveness have been preferred. Limited recyclability compared to some other polymers has also been a concern in certain markets. Without advances in cost reduction, improved processing efficiency, and enhanced recycling options, broader penetration of PPA resin may remain constrained.

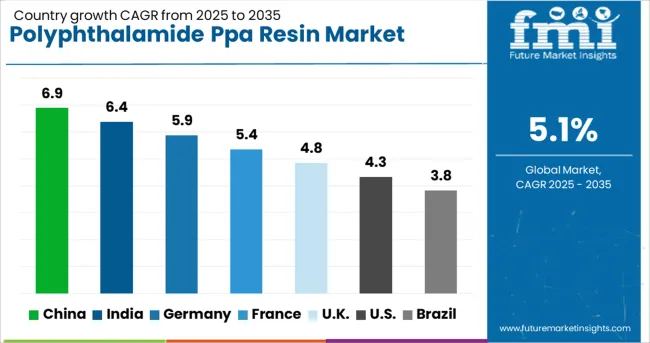

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

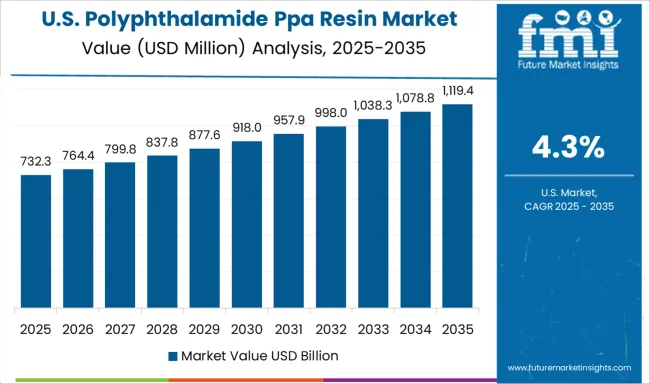

| USA | 4.3% |

| Brazil | 3.8% |

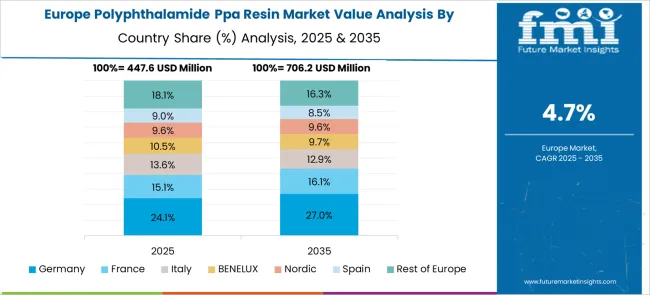

The polyphthalamide (PPA) resin market is expected to grow at a global CAGR of 5.1% between 2025 and 2035, driven by increasing demand in automotive lightweighting, electronics miniaturization, and high-performance industrial applications. China leads with a 6.9% CAGR, supported by expanding automotive manufacturing and electronics production. India follows at 6.4%, fueled by growth in electrical components manufacturing and industrial equipment production. Germany, at 5.9%, benefits from advanced polymer processing technologies and strong automotive engineering capabilities. The UK, projected at 4.8%, sees growth from aerospace and precision engineering applications. The USA, at 4.3%, reflects steady adoption in high-performance automotive and electrical systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 6.9% from 2025 to 2035 in the polyphthalamide resin industry, supported by its expanding electronics manufacturing base and rising use of PPA in automotive components. Producers such as EMS-GRIVORY China and Evonik Industries are increasing capacity to cater to demand for high-heat resistance and lightweight materials in electrical connectors, engine components, and LED housings. The shift toward miniaturized consumer electronics is further driving the adoption of PPA due to its dimensional stability. Strategic collaborations with polymer compounders have accelerated the introduction of application-specific grades. Automotive OEMs are increasingly sourcing PPA components domestically to reduce costs and ensure supply chain security.

India is anticipated to register a CAGR of 6.4% from 2025 to 2035, with strong demand emerging from the automotive and electrical sectors. Companies such as RadiciGroup India and Solvay are targeting applications in under-the-hood components, gear housings, and electric motor parts. The growing production of two-wheelers and compact cars is creating opportunities for PPA use in lightweight and heat-resistant parts. Electrical equipment manufacturers are also adopting PPA for high-performance insulation components. Investments in domestic compounding facilities have reduced dependence on imports, improving availability and cost competitiveness for Indian manufacturers.

Germany is expected to post a CAGR of 5.9% from 2025 to 2035, supported by advanced automotive engineering and the production of high-performance electrical equipment. BASF SE and DSM are focusing on developing PPA grades with improved wear resistance and chemical stability for demanding industrial applications. The German automotive sector is adopting PPA for fuel system components, turbocharger housings, and hybrid drivetrain parts. Growth in renewable energy infrastructure is also boosting PPA usage in electrical connectors and enclosures for wind and solar systems. Export demand for German-made PPA components remains strong across Europe.

The United Kingdom is projected to grow at a CAGR of 4.8% from 2025 to 2035, with applications expanding in automotive lightweighting, electronics, and industrial machinery. Companies like DuPont UK and EMS-CHEMIE are introducing specialized PPA compounds for electric vehicle battery components and heat-resistant gear systems. The aerospace sector is also exploring PPA for lightweight non-structural parts due to its flame resistance and dimensional stability. A steady rise in domestic electronics assembly is further contributing to market demand. Partnerships between raw material suppliers and component manufacturers are enabling faster product development cycles.

The United States is forecasted to record a CAGR of 4.3% from 2025 to 2035, driven by strong demand in automotive, electronics, and oil and gas industries. Major producers such as Solvay, Arkema, and Evonik are investing in advanced PPA grades with superior thermal stability and chemical resistance. The automotive industry is using PPA in coolant system components, air intake manifolds, and electrical connectors. Growth in 5G infrastructure is supporting PPA adoption in high-frequency connectors and antenna components. The oil and gas sector is leveraging PPA for downhole equipment due to its durability in high-temperature environments.

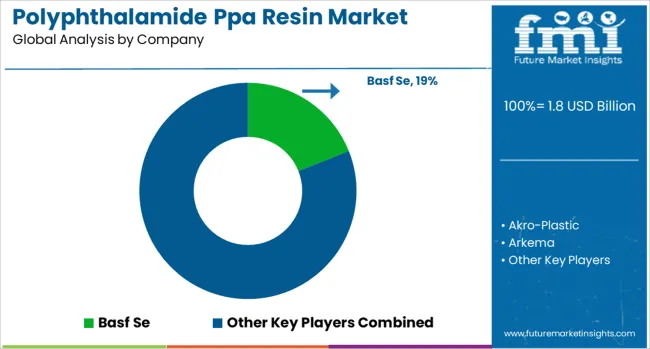

The polyphthalamide (PPA) resin market is led by global chemical companies specializing in high-performance engineering polymers used in automotive, electrical, electronics, and industrial applications. BASF SE and DuPont de Nemours hold significant market positions with PPA grades offering high heat resistance, dimensional stability, and chemical durability, widely adopted in automotive under-the-hood components and electrical connectors.

Solvay and Arkema produce specialty PPA resins tailored for demanding environments, including metal-replacement applications in lightweighting strategies. EMS-Chemie focuses on customized PPA compounds with enhanced glass fiber reinforcement, serving automotive, electronics, and precision industrial markets. Evonik Industries develops PPA formulations with improved moisture resistance and wear properties, targeting applications in fuel system components and mechanical parts.

Akro-Plastic specializes in PPA-based compounds for high-strength structural components, offering tailor-made solutions for OEM and Tier 1 suppliers. Royal supplies performance-grade PPA resins to niche sectors requiring specific property combinations, such as low friction and high dimensional stability under thermal stress.

Key strategies include expanding production capacity for glass- and carbon-fiber-reinforced PPA, developing grades compatible with advanced manufacturing processes like laser welding and overmolding, and collaborating with automotive and electronics manufacturers for application-specific material development. Entry into the PPA resin market is restricted by the need for advanced polymerization technology, stringent performance validation, and established supply agreements with global OEMs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product | Glass fiber reinforced, Unreinforced plain, Carbon fiber reinforced, Mineral-filled, and Hybrid |

| End Use | Automotive, Electrical & electronics, Machinery, Personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Basf Se, Akro-Plastic, Arkema, Dupont De Nemours, Ems-Chemie, Evonik Industries, Royal, and Solvay |

| Additional Attributes | Dollar sales by PPA grade and application segment, demand dynamics across automotive (fuel‑system/connectors), electronics/electrical, industrial equipment, and personal care sectors, regional trends in unfilled vs glass‑fiber reinforced vs carbon‑fiber filled vs mineral/hybrid variants across Asia‑Pacific, North America, and Europe, innovation in bio‑based PPA formulations and high‑temperature composite blends, environmental impact of recyclability, raw‑material sourcing and processor energy use, and emerging use cases in EV under‑hood components, micro‑connectors for high‑voltage electronics, and lightweight parts for medical and aerospace equipment. |

The global polyphthalamide ppa resin market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the polyphthalamide ppa resin market is projected to reach USD 2.9 billion by 2035.

The polyphthalamide ppa resin market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in polyphthalamide ppa resin market are glass fiber reinforced, unreinforced plain, carbon fiber reinforced, mineral-filled and hybrid.

In terms of end use, automotive segment to command 42.0% share in the polyphthalamide ppa resin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Equestrian Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Dew Point Apparatus Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Sweat Resistant Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Insect Repellent Apparel Market Size and Share Forecast Outlook 2025 to 2035

Melting Point Apparatus Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Dosage Unit Sampling Apparatus Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

North and Central America Proppant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA