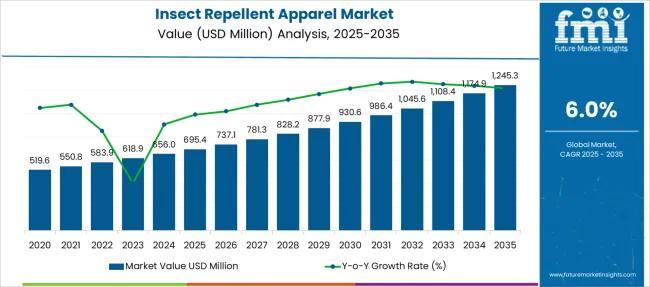

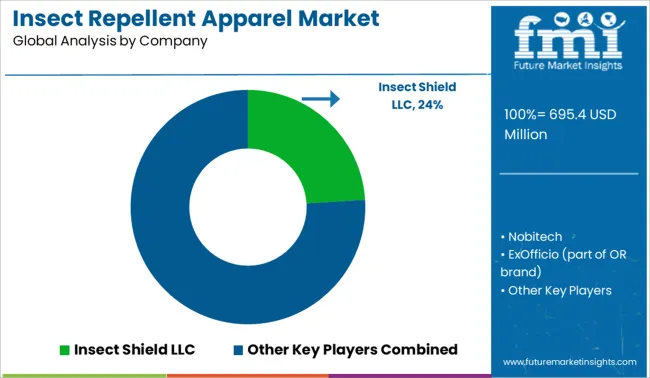

The Insect Repellent Apparel Market is estimated to be valued at USD 695.4 million in 2025 and is projected to reach USD 1245.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Insect Repellent Apparel Market Estimated Value in (2025 E) | USD 695.4 million |

| Insect Repellent Apparel Market Forecast Value in (2035 F) | USD 1245.3 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The insect repellent apparel market is gaining strong momentum due to rising concerns about vector-borne diseases and increased outdoor recreational activities. The shift toward functional clothing that combines fashion with protection is supporting higher adoption across both developed and emerging regions. Governments and health organizations are increasingly promoting insect-repellent solutions as part of broader public health strategies, which is enhancing consumer awareness and driving demand.

Technological advancements in fabric treatment processes and longer-lasting repellency are further contributing to product innovation. As outdoor lifestyle trends continue to rise, particularly in camping, hiking, and travel, apparel that offers comfort as well as functional safety is being prioritized.

The market outlook remains optimistic, with a growing preference for natural and non-toxic repellent treatments aligning with sustainability goals. Manufacturers are leveraging e-commerce and direct-to-consumer channels to expand market reach, while ongoing R&D investments are expected to deliver new product lines tailored to specific climates and regional insect threats..

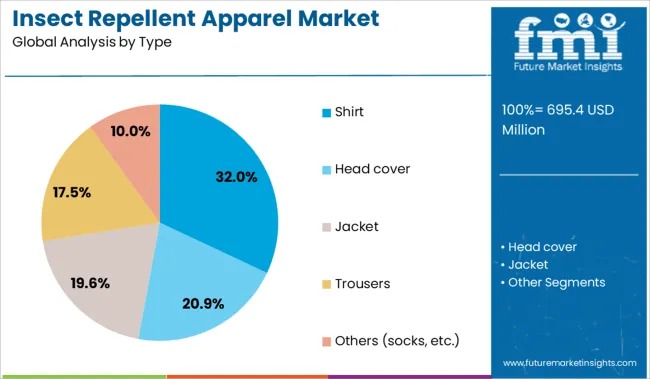

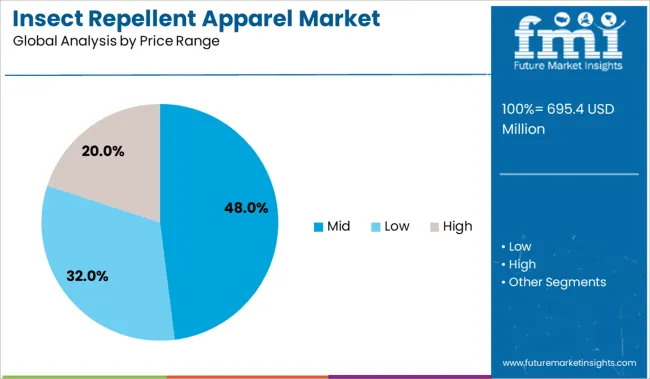

The market is segmented by Type, Price Range, End-User, and Distribution Channel and region. By Type, the market is divided into Shirt, Head cover, Jacket, Trousers, and Others (socks, etc.). In terms of Price Range, the market is classified into Mid, Low, and High.

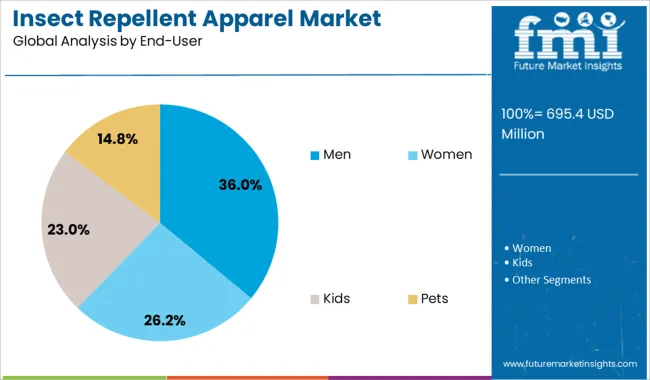

Based on End-User, the market is segmented into Men, Women, Kids, and Pets. By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shirt type segment is anticipated to hold 32% of the insect repellent apparel market revenue share in 2025, positioning it as the leading product category. This leadership has been driven by the high demand for versatile upper body protection that integrates easily into daily wear. Shirts treated with insect-repelling agents are offering coverage for the most commonly exposed areas of the body, making them effective for both casual and outdoor usage.

Their compatibility with lightweight, breathable fabrics has made them suitable for varied climatic conditions, supporting widespread adoption. Additionally, shirts are offering ease of application for long-lasting repellents without compromising style or comfort, which has enhanced their consumer appeal.

Their adaptability for both urban use and field environments has allowed brands to target multiple demographics, including hikers, travelers, and workers in vector-prone zones. The convenience of integrating repellent technologies directly into garments like shirts has continued to position this subsegment at the forefront of product innovation and consumer choice..

The mid price range segment is expected to capture 48% of the insect repellent apparel market revenue share in 2025, establishing itself as the dominant pricing tier. This segment has benefited from a balance between affordability and quality, offering consumers functional protection without significant financial burden. Products within this price range are often incorporating advanced repellency technologies while maintaining durability and comfort, which is appealing to price-conscious but quality-driven buyers.

The availability of branded offerings with trusted efficacy in this segment has reinforced buyer confidence and widened distribution through both online and offline retail channels. As awareness increases, consumers are seeking value-driven products that combine safety with style, making mid-range options the preferred choice for families, travelers, and outdoor enthusiasts.

Brands have also targeted this price point to penetrate emerging markets where health concerns related to insect exposure are growing but high-end products remain inaccessible. The scalability and accessibility of this tier have solidified its position as the market leader..

The men segment is projected to account for 36% of the insect repellent apparel market revenue share in 2025, emerging as the leading end-user category. Growth in this segment has been driven by higher male participation in outdoor occupations, recreational activities, and adventure travel where protection against insects is essential. Functional clothing tailored specifically to male body structures and style preferences has been integrated with repellent treatments to meet both aesthetic and health-related needs.

The increased awareness of vector-borne diseases such as Lyme disease and dengue among male consumers has contributed to the uptake of specialized protective wear. Product development in this segment has focused on ruggedness, performance, and comfort, aligning with usage in trekking, forestry, military, and construction environments.

Moreover, marketing strategies aimed at male consumers have emphasized practicality and safety, resonating with their purchasing behavior. The continued expansion of outdoor culture and health-conscious apparel trends among men is reinforcing this segment’s leading position in the market..

The insect repellent apparel market has been driven by rising cases of vector-borne diseases and increasing outdoor activity participation. Protective clothing integrated with insect-repelling agents has gained traction among hikers, travelers, and caregivers seeking non-topical alternatives. Public health campaigns and regional disease outbreaks have expanded product visibility. This shift has enabled insect-repellent clothing to transition from niche outdoor gear into widely accepted lifestyle and healthcare apparel.

The rise in global vector-borne disease incidents has been identified as a key driver of the insect repellent apparel market, with protective garments being favored in 2023 to counteract outbreaks of malaria, dengue, and Lyme disease. Increased preference for outdoor recreation during 2024 has been reflected in higher demand for clothing integrated with insect-repelling agents, as hikers and campers have sought convenient, non-topical protection methods. In 2025, heightened awareness arising from public health campaigns has been credited with encouraging wider adoption, especially in regions prone to tick and mosquito exposure. These drivers have been viewed as fundamental in shifting insect protection apparel from niche to mainstream applications.

As outdoor activities and adventure travel surged in 2023, insect repellent garments were adopted by hikers and backpackers seeking built‑in protection rather than topical sprays. By 2024, multifunctional apparel that combined insect resistance with moisture management and UV defense was being embraced in activewear and sporting gear segments. In early 2025, expansion into children’s and pet clothing lines has been witnessed, reflecting rising demand for passive protection across consumer categories. Smart partnerships between outdoor brands and textile specialists have been forged, and greater assortment has been enabled through online retail platforms. These trends suggest that insect repellent apparel is poised to move beyond niche camping gear into everyday wear across diverse demographic groups.

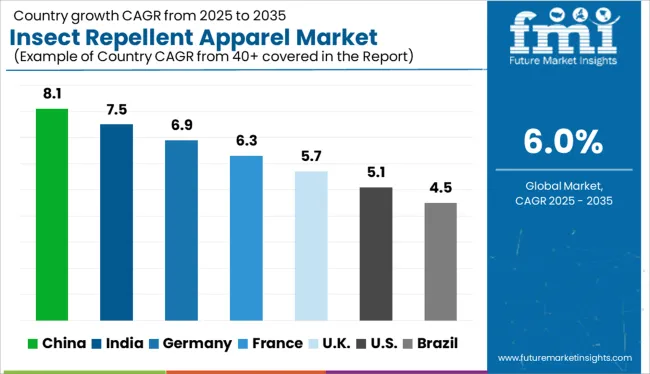

| Country | CAGR |

|---|---|

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The insect repellent apparel market is forecast to grow globally at a CAGR of 6% between 2025 and 2035. Among the 40 countries assessed, China leads with 8.1%, followed by India at 7.5% and Germany at 6.9%. France posts moderate growth at 6.3%, while the United Kingdom trails slightly at 5.7%. China and India demonstrate faster expansion due to large outdoor labor forces and rising cases of vector-borne diseases. Germany benefits from eco-certified repellents in recreational wear. France aligns growth with regulations and military use, while the UK reflects controlled uptake limited to seasonal and travel-related apparel categories.

China is projected to lead the insect repellent apparel industry with an 8.1% CAGR, spurred by increased outdoor activity and national health campaigns targeting mosquito-borne illnesses. Domestic brands have adopted microencapsulation techniques using permethrin and plant-based actives. The apparel is being increasingly integrated into school uniforms, field gear, and military kits. Expanded retail presence and health authority collaboration have increased product acceptance in both urban and rural zones.

India is expected to grow its insect repellent apparel market at a 7.5% CAGR, fueled by concerns over dengue, malaria, and chikungunya. Garment exporters have partnered with textile chemical firms to embed long-lasting repellency in uniforms and sportswear. NGOs and state-run public health programs are distributing treated garments in vector-prone regions. Smart textiles with wash-resistant technology are gaining visibility in the consumer segment.

The market in Germany is forecast to grow at a 6.9% CAGR, supported by demand for eco-certified functional wear for hiking, camping, and forestry. Outdoor brands are integrating bio-based repellents like eucalyptus citriodora into performance textiles. German consumers value certified, skin-safe formulations with extended efficacy. Additionally, increased summer tourism to vector-rich zones in Europe has driven seasonal demand. Retailers emphasize product transparency and sustainability in labeling.

France is projected to expand its insect repellent apparel segment at a 6.3% CAGR, with key adoption in defense, travel, and babywear. The military sector uses permethrin-treated uniforms during foreign deployments. Retail interest in babywear and maternity clothing with embedded repellents is increasing. The French market favors garments that meet EU biocide regulations and dermatological safety certifications. Product development focuses on low-odor formulations and fabric softness.

The United Kingdom is forecast to grow its insect repellent apparel market at a 5.7% CAGR, shaped by seasonal demand and travel apparel segments. Consumers purchase repellency clothing primarily for holidays in high-risk regions. Local apparel brands offer treated garments for gardening, fishing, and pet-walking categories. Limited vector presence domestically keeps household demand moderate. The UK focuses on DEET-free and odorless formulations to appeal to sensitive skin users.

The insect repellent apparel market is moderately consolidated, led by Insect Shield LLC. The company holds a dominant position through its EPA-registered permethrin-treated clothing line catering to outdoor, military, and travel applications. Tier 1 leadership is held exclusively by Insect Shield LLC. Tier 2 suppliers include ExOfficio (part of OR brand), Craghoppers, Burlington, Arcteryx, and Nobitech—each offering functional apparel designed for protection against vector-borne threats, with varied brand positioning across adventure, lifestyle, and tactical segments. Market expansion is driven by increased demand for long-lasting insect-repellent clothing in endemic regions and the growing integration of bioactive textiles in performance wear.

| Item | Value |

|---|---|

| Quantitative Units | USD 695.4 Million |

| Type | Shirt, Head cover, Jacket, Trousers, and Others (socks, etc.) |

| Price Range | Mid, Low, and High |

| End-User | Men, Women, Kids, and Pets |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Insect Shield LLC, Nobitech, ExOfficio (part of OR brand), Burlington, Arcteryx, and Craghoppers |

| Additional Attributes | Dollar sales by apparel type (t-shirts, hats, socks, full-body garments), Dollar sales by repellent technology (permethrin-treated, micro-encapsulated, phase-change), Trends in long-lasting and eco‑friendly repellent fabrics, Use of factory-impregnation vs post-treatment methods, Growth in outdoor, travel, and military wear segments, Regional patterns of insect-borne disease–driven adoption across North America, Europe, Asia‑Pacific. |

The global insect repellent apparel market is estimated to be valued at USD 695.4 million in 2025.

The market size for the insect repellent apparel market is projected to reach USD 1,245.3 million by 2035.

The insect repellent apparel market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in insect repellent apparel market are shirt, head cover, jacket, trousers and others (socks, etc.).

In terms of price range, mid segment to command 48.0% share in the insect repellent apparel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Insect Oil Market Size And Share Forecast Outlook 2025 to 2035

Insect-based Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Insect Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insect Feed Market Size, Growth, and Forecast for 2025 to 2035

Insect Cell Lines Market - Growth, Applications & Forecast 2025 to 2035

Insect-Based Pet Food Market Growth - Sustainable Nutrition & Demand 2025 to 2035

Bioinsecticides Market Growth - Trends & Forecast 2025 to 2035

Japan Insect Feed Market, By Type, By Application, By Region, Opportunities and Forecast, 2025 to 2035

Korea Insect Feed Market Analysis and Forecast by Product Type, End-User and Region 2025 to 2035

Natural Insect Repellent Market Analysis - Trends, Growth & Forecast 2025 to 2035

Carbamate Insecticides Market Trends & Outlook 2025 to 2035

Western Europe Insect Feed Market Analysis by Insect Type, Application, and Country Through 2025 to 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Tick Repellent Manufacturers

Tick Repellent Market Growth – Size, Trends & Forecast 2024-2034

Water Repellent Agent Market

Mosquito Repellent Candles Market Analysis – Trends, Growth & Forecast 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA