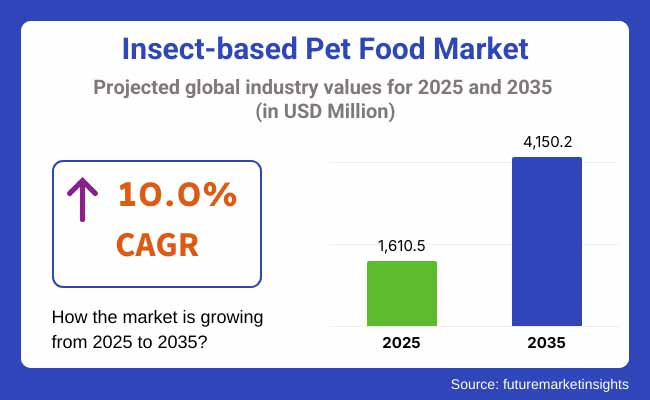

The insect-based pet food market is poised for significant expansion between 2025 and 2035, fuelled by the rising demand for sustainable, protein-rich, and hypoallergenic pet food alternatives. The market was valued at USD 1,610.5 million in 2025 and is projected to reach USD 4,150.2 million by 2035, expanding at a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The increasing focus on eco-friendly and ethical pet nutrition is driving the adoption of insect-based pet food. Compared to traditional protein sources like chicken and beef, insect protein production requires fewer resources, emits lower greenhouse gases, and is highly sustainable. Key insects used in pet food include black soldier fly larvae, mealworms, crickets, and grasshoppers, which offer high protein content, essential amino acids, and digestible fiber, making them an ideal choice for pet diets.

The growing pet humanization trend has led to an increased demand for premium, organic, and grain-free pet food options, further boosting the market. Pet owners are becoming more conscious of allergy-friendly, gut-health-improving, and nutritionally balanced diets, where insect-based pet food provides a highly digestible and nutrient-dense solution. In addition, regulatory approvals in Europe and North America are facilitating market penetration, allowing brands to expand their product offerings.

The global insect-based pet food market provides reliable research insights into emerging trends that can shape the market potential in several regions around the world. Functional ingredients, innovative processing, and probiotic blends will also increase the attractiveness of insect-based pet nutrition, laying the industry's vision for the next ten years.

North America is a leading region in the insect-based pet food market as consumers are increasingly aware towards sustainability and alternative protein sources. North America is being the leading market due to increasing adoption of eco-friendly pet diets and high demand for high-protein and hypoallergenic pet food products.

The main players in the regional scene emphasize product innovation and employ a wide range of protein sources particularly mealworms, crickets, and black soldier fly larvae. Moreover, supportive regulatory for alternative proteins in the pet food, along with the ascending e-commerce channels, is fuelling the growth of the overall market. Nonetheless, due to insect-based diets consumer scepticism and premium pricing, such products might not experience wide adoption.

When asked about insect-based pet food specifically, Schmidt notes that Europe is a large market, driven by significant demand (compared to the rest of the world) in countries like Germany, the UK, France, and the Netherlands. Adoption of alternative protein sources is driven by the region's strong focus on sustainability, circular economy practices, and high-quality pet nutrition.

Pet food ingredients from insects are subject to government regulations for EU approvals that play a key role in shaping the market. The growing demand for organic and natural pet diets among pet owners is also driving market demand. However, these new offers might face complications from regulation or high production costs that can affect pricing strategies and product availability.

The demand for insect-based pet food is becoming increasingly prevalent in the Asia-Pacific (APAC) region, where widespread pet ownership, urbanization, and rising disposable incomes are contributing to robust growth of the market. Market expansion is consistently driven by countries like China, Japan, South Korea, Australia, etc. with increasing demand for sustainable pet nutrition solution which goes in favour of North American Pet Food Ingredients market.

The areas benefit by having a strong agricultural base allowing for insect farming for pet food production at economical rates. Moreover, consumer knowledge regarding the health benefits of insect protein, including high digestibility and amino acid content, is driving market penetration. Though, cultural factors around insect consumption as a whole and availability of premium insect-based pet food brands can act as deterrents towards market penetration.

Challenges

Consumer Perception and Regulatory Constraints

One of the biggest issues in the insect-based pet food market is consumer acceptance. Although insect protein focuses on their high nutrition levels and sustainability, many pet owners are still hesitant to feed their pets non-traditional protein sources. Moreover, regulatory approvals are different across regions, and some markets have stricter regulations for safety and labelling, delaying the product launches and expanding to markets.

Opportunities

Sustainability and Nutritional Benefits

Traditional forms of animal protein are facing growing concern regarding their environmental impacts, making insect-based pet food a highly sustainable and environmentally friendly alternative. Compared with traditional animal protein, insects need less land, water, and feed, making them a potential protein source for environmentally conscious consumers.

Moreover, insects are a great source of essential amino acids, omega fatty acids and micronutrients, making them nutritionally better for pets. Market players benefit from the increasing demand for grain-free, hypoallergenic, and novel proteins diets.

From 2020 until 2024, there was more investment in research and development in the market, as more companies were trying to enhance insect-based formulation and palatability. Major pet-food brands began using black soldier fly larvae, crickets and mealworms in their products, expanding options for consumers. However, the increased production costs and lack of large-scale availability were still major barriers to entry.

Insect farming, cost-effective production, and the loosening of regulatory approvals will play a significant role in the adoption of this technology from 2025 to 2035 and beyond. There will be even more diversity in product offerings, with insect-based kibble, wet food, treats, and supplements entering the market. Emerging market trends will include AI-driven customization of pet nutrition and fortified insect proteins.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Selective approvals in North America & Europe |

| Technological Advancements | Optimized insect farming techniques |

| Industry Adoption | Emerging niche brands promoting insect protein |

| Supply Chain and Sourcing | Challenges in large-scale insect farming |

| Market Competition | Presence of start-ups and specialty brands |

| Market Growth Drivers | Sustainability awareness and hypoallergenic pet diets |

| Sustainability and Energy Efficiency | Focus on reducing carbon footprint in pet food |

| Consumer Preferences | Gradual shift toward alternative protein sources |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global regulations for insect-based pet food |

| Technological Advancements | Automated insect protein extraction and fortification |

| Industry Adoption | Widespread adoption by major pet food manufacturers |

| Supply Chain and Sourcing | Expansion of insect farming hubs worldwide |

| Market Competition | Entry of multinational pet food companies into the segment |

| Market Growth Drivers | High-protein, eco-friendly pet food demand surges |

| Sustainability and Energy Efficiency | Circular economy adoption with zero-waste insect farming |

| Consumer Preferences | Preference for personalized, insect-based pet nutrition |

The USA is seeing a surge in demand for insect protein pet food, reflecting increased consumer awareness of sustainable pet nutrition. As more people become aware of the environmental impact of traditional pet diets, many are turning to eco-friendly alternatives.

Additionally, the presence of leading manufacturers along with positive government initiatives to support sustainable protein alternatives are boosting the market growth. There is also demand for health-specific dog foods, which have led some pet food brands to incorporate more insect-based proteins into their offerings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.8% |

The UK insect-based pet food market is on the rise, driven by a growing consumer demand for sustainable and hypoallergenic pet food options. The UK government's focus on reducing carbon emissions and encouraging alternative protein sources has also played a role in helping the market.

Enter a start-up or even pet food company with an existing presence most recently, many of them are toying with cricket additives in their formulations, which urban pet owners have recently been showing interest in for their pets as food novelties and sustainable sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.4% |

Apart from EU, Germany, France, and the Netherlands lead the race for insect-based pet food market growth. A robust market has been established due 1) regulatory support, such as the European Food Safety Authority (EFSA), 2) strong acceptance by consumers.

A growing amount of moon-shot capital is pouring into the sector, with researchers working on both insect farming and protein extraction. In addition, as EU's ambitious sustainability targets that sync with surging demands for eco-friendly pet food solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.6% |

Japan's pet food market is changing with a growing interest in insect options fuelled by concerns about sustainability and pet health. Food consumption by high digestibility, protein-rich diet and the aged pet population in the country is driving the adoption of insect-based diet. Additionally, Japanese pet food manufacturers are dedicating efforts towards studying ways to improve both the taste and nutritional content of insect based pet food to suit the needs of pet owners in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.7% |

From the government incentives for alternative protein sources, to the increasing consumer awareness, South Korea is quickly becoming a player in the insect-based pet food market. Demand for premium and sustainable pet food products in Argentina is driven by a strong pet care market and increasing disposable income. In addition, improvements in insect production and processing technologies are providing more options for mainstream consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.9% |

The insect-based pet food market is experiencing significant expansion due to the increasing demand from pet owners for sustainable, high-protein, and eco-friendly alternatives to conventional pet food ingredients. Recent interest in using insects as a protein source in pet food has been driven by an increased demand for alternative protein sources, and greater scrutiny over the environmental sustainability of cat and dog food formulations based on traditional meat sources. Companies in this category are creating new products from insects like crickets, mealworms and black soldier flies known to supply pets with necessary vitamins, amino acids and good fats.

The evolution of insect-based pet food sector is influenced by growing consumer awareness of pet health, and an increasing preference for natural and organic food formulations. Moreover, the expansion of the market has also been attributed to regulatory approvals and advances in processing techniques.

Interest in insect-based proteins has also been boosted by the fact that the demand for hypoallergenic pet food has been driving sales of the product, as insects tend to be easier to digest than more traditional protein sources like beef or chicken.

The organic and monoprotein segments are gaining acceptance by nature as these segments provide biological value which aligns with the demands for clean-label pet food.

A natural diet without chemicals and additives is being preferred by the pet owners, therefore, the organic insect-based pet food is gaining popularity. These formulations contain insects free from pesticides and antibiotics, sourced from farms practicing sustainability, making them a high-quality protein for pets. The segment is propelled by the growing awareness about the harmful effects of artificial additives, making the organic insect-based pet food a preferred choice among health-aware consumers.

Monoprotein Insect-based Pet Food is gaining popularity, especially in pets with food sensitivities or allergies. Monoprotein pet food is made with one main protein source, allowing pet owners to pinpoint and deal with dietary issues that their pets may have (which can be really difficult when multi-protein formulas have). Being hypoallergenic and highly digestible, insects ensure that pets face a lesser risk of gastrointestinal issues. This segment is forecasted to grow at a rapid pace, when a large number of pet owners are looking for alternative proteins with little implications of allergy.

However, due to having the best nutritional profile and sustainability calliper as compared to other species, crickets and black soldier flies have taken the lead by becoming the most consumed insect protein in the pet food industry by source.

Pet food based on crickets is high in protein, amino acid profile, vitamins, and mineral. Crickets consume far less land, water and feed than traditional livestock this makes them a highly sustainable source of protein for pet food production. Its mild taste and digestibility have lead to an increased acceptance of its use in both dry and wet pet food formulations. An additional advantage of this protein source is that chitin, a natural fiber present in cricket exoskeletons, promotes daily gut health and immunity in pets.

Black Soldier Fly Larvae (BSFL)-based pet food insects such as the Black Soldier Fly Larvae (BSFL) have become increasingly popular recently due to their capacity to metamorphose organic waste into high-grade protein. BSFL is high in many fats, especially healthy medium-chain fatty acids that help support pets: skin, coat and overall health. Moreover, it saves food waste and its related greenhouse gas emissions, as it is produced according to the standards of circular economy. With sustainability fast emerging as a key consideration at the point of purchase, BSFL may see accelerated adoption, especially in the premium end of the pet nutrition market.

As technology has advanced, ensuring food safety has become more achievable in the insect-based pet food market. With pet humanization trends continuing to rise and pet owners making purchasing decisions influenced by environmental issues, insect-based pet food is set to become a mainstream pet food industry segment globally.

Due to growing conscious consumerism when it comes to sustainable pet nutrition, alternative sources of protein for pets, and eco-friendly pet food products contributing to the growth of insect-based pet food market. Among those, the pet food that is high in protein, hypoallergenic and grain-free, are in high demand, which, in turn, is supporting the market growth. Pet food manufacturers are finding more nutritious and sustainable options, such as insect-based proteins like black soldier fly larvae, crickets, and mealworms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ynsect | 20-24% |

| Protix | 15-19% |

| InnovaFeed | 12-16% |

| Mars Petcare | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ynsect | Produces black soldier fly-based pet food with a focus on sustainability and high protein content. |

| Protix | Develops insect-based protein powders and pet food formulations for eco-friendly nutrition. |

| InnovaFeed | Specializes in premium insect protein sources for pet food and animal feed industries. |

| Mars Petcare | Introduces alternative protein pet food lines, including cricket and insect-based treats. |

Key Company Insights

Ynsect (20-24%)

Ynsect is the key player in the insect-based pet food market, catering to top-brand pet foods with its high-quality insect protein. Its specialization in vertical farming technology, sustainability and high digestibility proteins continues to cement its leading position in the market.

Protix (15-19%)

Proteins suited to pet food manufacturers, Protix is a leader in insect based pet food ingredients. The company invests heavily in R&D focused on insect farming, positioning it to compete.

InnovaFeed (12-16%)

InnovaFeed offers high-quality pet food solutions by creating nutritionally optimized insect proteins. Its specialism in organic and ethically sourced insect ingredients helps to gain market share.

Mars Petcare (10-14%)

Mars Petcare is capitalizing on its global reach in the pet food industry by launching insect-based pet food under its existing brands. All in all, the company’s investments towards innovations for sustainable pet food means it will have a great role to play in making pet food sustainable.

Additional Significant Players (30-40% Combined)

The upcoming report by our team of analysts offers an elaborate analysis of the global insect-based pet food market, which can be summarized as follows: Key players include:

The overall market size for the insect-based pet food market was USD 1,610.5 million in 2025.

The insect-based pet food market is expected to reach USD 4,150.2 million in 2035.

The demand for insect-based pet food is expected to rise due to the growing preference for sustainable, protein-rich, and hypoallergenic pet food alternatives, increasing pet ownership, and heightened awareness of environmentally friendly pet nutrition.

The top five countries driving the development of the insect-based pet food market are the USA, Germany, France, the UK, and China.

Dog and cat food segments are expected to dominate the market due to their widespread pet adoption rates and growing demand for high-quality, nutrient-dense alternative protein sources.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 58: Asia Pacific Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 66: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 70: MEA Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Nature, 2023 to 2033

Figure 32: Global Market Attractiveness by Source, 2023 to 2033

Figure 33: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Pet Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Nature, 2023 to 2033

Figure 68: North America Market Attractiveness by Source, 2023 to 2033

Figure 69: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Pet Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Pet Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 140: Europe Market Attractiveness by Source, 2023 to 2033

Figure 141: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 142: Europe Market Attractiveness by Pet Type, 2023 to 2033

Figure 143: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 156: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 160: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 164: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 168: Asia Pacific Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Pet Type, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 192: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 196: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 200: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 204: MEA Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 208: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 212: MEA Market Attractiveness by Source, 2023 to 2033

Figure 213: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 214: MEA Market Attractiveness by Pet Type, 2023 to 2033

Figure 215: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA