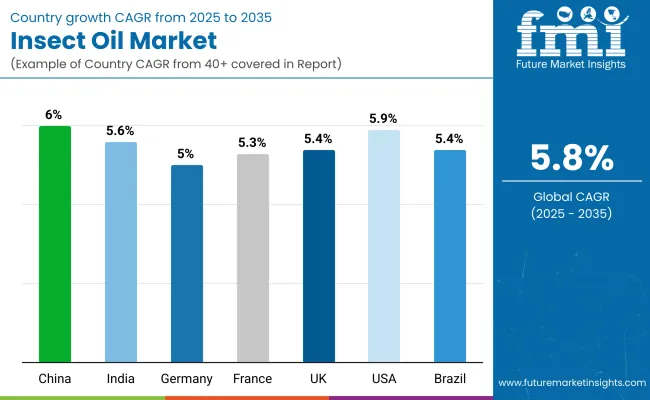

In 2025, the Insect Oil Market is projected to be valued at USD 390 million , reaching USD 690 million by 2035. This increase of USD 295.8 million over the decade reflects a compound annual growth rate (CAGR) of 5.8%. The market is anticipated to almost double in size as feed, pet nutrition, cosmetics, and industrial sectors integrate insect-derived lipids more widely into their value chains.

| Metric | Value |

|---|---|

| Insect Oil Market Estimated Value In (2025e) | USD 390 million |

| Insect Oil Market Forecast Value In (2035f) | USD 690 million |

| Forecast CAGR (2025 to 2035) | 5.80% |

During the first half of the forecast period from 2025 to 2030, market revenues are expected to rise from USD 390 million to USD 515.4 million. This expansion of USD 125.4 million accounts for nearly 42% of the decade’s total growth. Adoption in this phase is likely to be driven by aquaculture and poultry nutrition, where insect oil demonstrates high potential as a substitute for fish oil due to its omega-rich composition, consistent yield, and sustainable sourcing credentials.

The second half of the period, from 2030 to 2035, is forecast to deliver USD 170.4 million in new value, representing nearly 58% of overall decade growth. This stronger momentum is expected to be underpinned by scale efficiencies, widening use in pet food formulations, and premiumization trends in cosmetics and personal care. Industrial channels such as bio-lubricants, biofuels, and surfactants are also anticipated to establish a firmer position in the latter phase, diversifying end-use demand.

Black Soldier Fly oil is expected to maintain dominance, while aquafeed applications are projected to remain the leading demand driver across regions.

From 2020 to 2024, the insect oil market transitioned from pilot-scale commercialization toward structured regional adoption, supported by aquafeed and poultry feed trials. Global leaders established nearly 50% of revenue through capacity expansion and regulatory certifications. Differentiation was achieved through yield efficiency, sustainability narratives, and cost alignment with fish oil alternatives.

By 2025, market value is projected at USD 0.39 billion, with insect-derived oils positioned as mainstream alternatives in aquafeed and premium niches in pet nutrition. By 2035, demand is expected to reach USD 0.69 billion, supported by expansion into cosmetics, industrial lubricants, and bio-surfactants. Competitive advantage is shifting from farming scale alone toward ecosystem control spanning co-product valorization, verified carbon benefits, and traceable digital supply chains.

Growth in the insect oil market is being propelled by a combination of sustainability imperatives, nutritional advantages, and widening regulatory acceptance. Demand is being stimulated as aquaculture and poultry producers seek viable substitutes for fish oil, which faces cost volatility and environmental scrutiny. Insect-derived lipids are being recognized for their omega-rich composition, biodegradability, and lower carbon footprint, making them attractive across feed and pet food applications.

Adoption is being reinforced by rising consumer preference for sustainable proteins and oils, which has encouraged formulators in cosmetics and personal care to explore insect oil for its emollient and stabilizing properties. Industrial users are also expected to advance uptake, driven by bio-based lubricant and surfactant opportunities. Market expansion is being enabled by advancements in insect farming efficiency, extraction technologies, and supply chain certifications, which are ensuring quality consistency and scalability. These combined dynamics are expected to sustain robust market momentum through 2035.

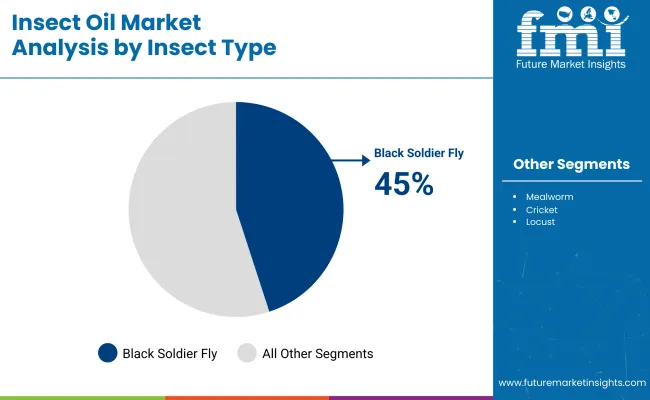

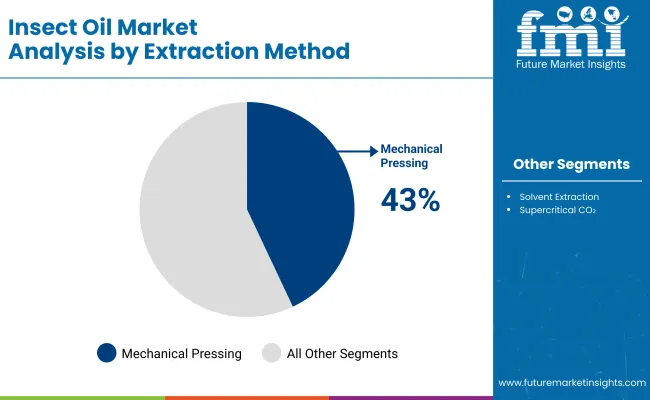

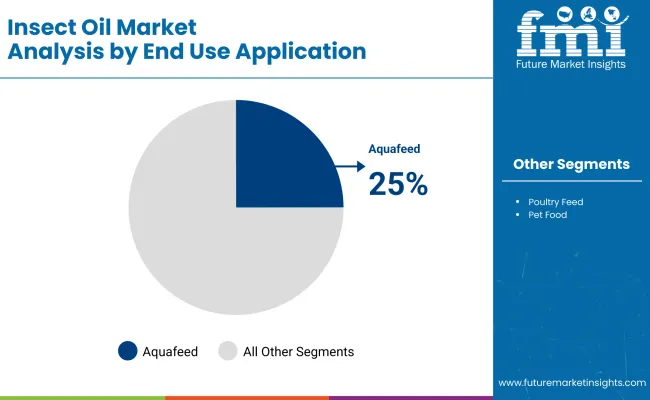

The Insect Oil Market is structured across multiple dimensions including insect type, extraction method, and end-use applications. Each segment is contributing differently to market expansion, reflecting both technological maturity and application readiness. Black Soldier Fly oil is expected to dominate within insect types due to scalability and consistent yield profiles. Mechanical pressing continues to hold the largest extraction share because of cost efficiency, while supercritical CO₂ is anticipated to emerge as the fastest-growing method for high-purity oils. Among end-use categories, aquafeed is forecast to lead adoption, supported by sustainability-driven substitution of fish oil. Together, these segments are shaping the growth trajectory of insect oil across global feed, personal care, and industrial value chains.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Black Soldier Fly | 45% |

| Mealworm | 23% |

| Cricket | 15% |

| Locust | 9% |

| Others | 8% |

The Black Soldier Fly segment is projected to account for 45% of the Insect Oil Market revenue in 2025, establishing it as the dominant insect type. Growth is expected to be driven by its superior oil yield, balanced fatty acid composition, and scalability in controlled farming systems. Rising demand from aquafeed producers and cosmetic formulators is anticipated to secure its leadership over the forecast period. Mealworm oil is forecasted to strengthen its position, supported by steady adoption in food and feed applications in Europe and Asia. Cricket and locust oil are expected to remain niche contributors, shaped by regional consumption patterns and regulatory acceptance. Diversification across insect types is projected to enhance market resilience while reducing reliance on a single species.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Mechanical Pressing | 43% |

| Solvent Extraction | 34% |

| Supercritical CO₂ | 23% |

The supercritical CO₂ extraction segment is projected to register the fastest CAGR of 8.1% between 2025 and 2035, positioning it as the most dynamic method in the insect oil market. Demand is anticipated to be driven by its ability to deliver high-purity, solvent-free oils that meet stringent requirements of nutraceutical and cosmetic industries. Mechanical pressing is expected to remain the most widely adopted method, accounting for 43% share in 2025, due to its cost efficiency and strong alignment with bulk feed applications. Solvent extraction is projected to retain significance, supported by its higher recovery efficiency in industrial uses. Over time, technological innovations and sustainability imperatives are forecasted to accelerate the shift toward supercritical CO₂ as the premium standard for insect oil processing.

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Aquafeed | 25% |

| Poultry Feed | 21% |

| Pet Food | 10% |

The aquafeed segment is projected to contribute 25% of the insect oil market revenue in 2025, making it the largest end-use application. Growth is forecasted to be powered by the urgent need for sustainable alternatives to fish oil in commercial aquaculture. Adoption is expected to intensify in Asia Pacific and Europe, where pressure on marine resources is accelerating demand for omega-rich insect-derived lipids. Poultry feed is anticipated to emerge as the second-largest contributor, with adoption supported by nutritional efficiency and reduced dependence on conventional oilseed inputs. Pet food is forecasted to grow consistently, reinforced by consumer demand for natural, high-quality ingredients. Over the forecast period, animal feed applications are projected to anchor overall insect oil market expansion, while aligning with sustainability-focused feed strategies.

The Insect Oil Market is being reshaped by sustainability imperatives, technology advancements, and evolving consumer priorities, even as regulatory pathways, production costs, and cultural acceptance present complex challenges that influence adoption across feed, pet food, cosmetics, and industrial applications.

Integration into Sustainable Aquaculture Systems

Insect oil adoption is being propelled by the strategic repositioning of aquaculture nutrition around sustainability and resilience. Traditional fish oil sources are increasingly constrained by environmental limits, traceability issues, and volatile pricing. Insect oil, by contrast, is being validated in aquaculture systems as a resource-efficient, circular ingredient that reduces dependence on overfished marine resources while maintaining essential fatty acid requirements. Trials are being supported by life cycle assessments that quantify reductions in land use, greenhouse gas emissions, and feed conversion ratios. This sustainability alignment is expected to strengthen contract-based inclusion of insect oil in aquafeed formulations, particularly in regions with stringent environmental standards and growing demand for certified sustainable seafood.

Complexity of Extraction Technology Scaling

Despite strong potential, the pace of insect oil market expansion is being constrained by challenges in scaling extraction technologies beyond pilot levels. Mechanical pressing remains cost-efficient but suffers from limited recovery rates, while solvent-based approaches raise concerns over chemical residues in feed and personal care applications. Supercritical CO₂ extraction offers high purity, but capital intensity, operational expertise, and energy requirements elevate production costs significantly. These constraints create a gap between laboratory validation and large-scale commercialization. The inability to scale extraction methods economically and consistently across geographies is expected to delay broader adoption, especially in premium applications where quality and safety certifications are non-negotiable.

| Countries | CAGR |

|---|---|

| China | 6.02% |

| India | 5.63% |

| Germany | 5.04% |

| France | 5.33% |

| UK | 5.42% |

| USA | 6.66% |

| Brazil | 5.43% |

The global insect oil market reflects a clear differentiation in growth dynamics, influenced by regulatory openness, sustainability mandates, and industrial integration pathways. China is projected to expand at 6.02% CAGR, driven by structured investment in large-scale insect farming and strong alignment with aquaculture industry needs. India, growing at 5.63%, is expected to integrate insect oil into poultry and aqua diets, supported by government initiatives promoting alternative proteins and rising acceptance of sustainable feed ingredients.

In Europe, Germany is anticipated to grow at 5.04% CAGR, supported by high compliance standards in feed and cosmetics, while France at 5.33% and the UK at 5.42% are expected to advance through pet nutrition and clean beauty product innovations. Regulatory clarity and premium positioning in sustainability-focused consumer markets are projected to sustain steady European growth.

The United States, leading with 6.66% CAGR, is expected to drive adoption through high-value applications in pet food, cosmetics, and bio-lubricants, where performance and traceability standards are critical. Brazil, expanding at 5.43%, is likely to build momentum in aquafeed and poultry feed, benefitting from abundant organic residues and regional protein demand. Collectively, these key markets illustrate how local drivers and sectoral readiness are shaping global insect oil adoption.

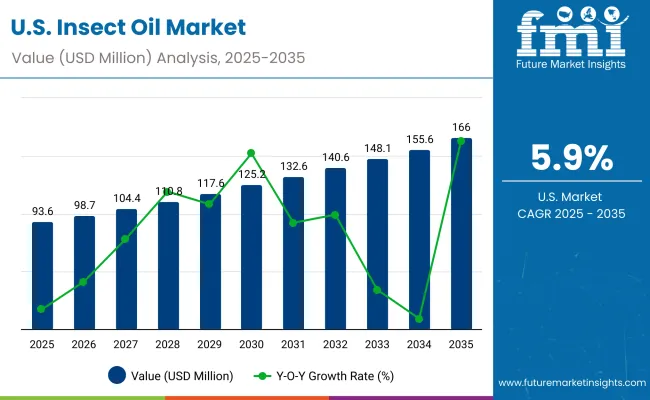

| Year | USA Insect Oil Market (USD Million) |

|---|---|

| 2025 | 93.60 |

| 2026 | 98.7 |

| 2027 | 104.4 |

| 2028 | 110.8 |

| 2029 | 117.6 |

| 2030 | 125.2 |

| 2031 | 132.6 |

| 2032 | 140.6 |

| 2033 | 148.1 |

| 2034 | 155.6 |

| 2035 | 166.0 |

The Insect Oil Market in the United States is projected to expand from USD 93.6 million in 2025 to USD 166.0 million by 2035, reflecting a compound annual growth rate of 5.9%. Growth is being driven by the structured integration of insect lipids into pet food formulations, where premiumization and functional nutrition are accelerating adoption. Regulatory approvals in feed applications are expected to broaden opportunities in aquaculture and poultry sectors, while personal care manufacturers are increasingly evaluating insect-derived oils for high-performance and sustainable cosmetic formulations. Industrial applications, particularly in bio-lubricants and surfactants, are anticipated to create complementary demand as circular economy initiatives gain traction.

The Insect Oil Market in the United Kingdom is forecast to expand at a CAGR of 5.42% from 2025 to 2035. Growth is expected to be shaped by stringent sustainability targets, pet nutrition innovation, and cosmetics integration. Feed applications are anticipated to evolve steadily, supported by EU-aligned regulations and consumer preference for circular ingredients. Premium positioning in cosmetics and personal care is projected to accelerate adoption, with insect oils increasingly tested as emollients and moisturizers. Retail expansion through health-focused channels is expected to support awareness. By 2035, insect oil is anticipated to be a recognized sustainable input in the UK’s consumer and feed industries.

The Insect Oil Market in India is projected to grow at a CAGR of 5.63% during 2025-2035. Expansion is expected to be shaped by rapid growth in poultry feed and aquaculture, alongside rising policy interest in sustainable agriculture. Insect oil is being positioned as a viable alternative to fish oil in aquaculture diets, supporting both cost efficiency and resilience. Poultry feed integration is projected to accelerate as domestic protein consumption expands. Cosmetic applications remain niche but are likely to benefit from the rising popularity of natural and sustainable ingredients in urban markets. The market’s evolution is expected to be supported by local farming innovations and lower-cost processing techniques.

The Insect Oil Market in China is forecast to expand at a CAGR of 6.02% over 2025-2035, supported by large-scale insect farming investments and alignment with aquaculture growth. Government-backed policies promoting circular agriculture are expected to accelerate integration of insect oils in animal feed formulations. Strong demand for fish oil alternatives in aquaculture diets is projected to create long-term opportunities. Industrial applications, including bio-lubricants and surfactants, are anticipated to gain traction as sustainability mandates strengthen. Cosmetics applications are expected to advance cautiously but are supported by China’s rapidly expanding clean beauty market. By 2035, China is likely to stand as one of the largest global insect oil demand centers.

| Countries | 2025 |

|---|---|

| UK | 18.92% |

| Germany | 20.03% |

| Italy | 10.18% |

| France | 14.44% |

| Spain | 11.87% |

| BNELUX | 6.76% |

| Nordic | 5.11% |

| Rest of Europe | 13% |

| Countries | 2035 |

|---|---|

| UK | 18.69% |

| Germany | 21.73% |

| Italy | 9.06% |

| France | 13.64% |

| Spain | 10.53% |

| BNELUX | 5.63% |

| Nordic | 5.04% |

| Rest of Europe | 16% |

The Insect Oil Market in Germany is projected to grow at a CAGR of 5.04% from 2025 to 2035. Market expansion is expected to be supported by strict regulatory standards, high consumer awareness, and strong presence of sustainable food and cosmetic industries. Feed applications are anticipated to remain dominant, particularly in poultry and aquaculture, as sustainability frameworks drive substitution of conventional oils. Cosmetics integration is projected to increase steadily, supported by innovation in natural emollients and eco-friendly formulations. Industrial adoption is expected in niche bio-based lubricants and specialty surfactants. Germany’s role as a regulatory benchmark is likely to set adoption standards for the broader European market.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Black Soldier Fly | 46% |

| Mealworm | 22% |

| Cricket | 15% |

| Locust | 9% |

| Others | 8% |

The Insect Oil Market in Japan is projected to expand steadily from 2025 onward, with Black Soldier Fly oil accounting for 46% of the segment share, reflecting its efficiency, scalable farming practices, and high lipid yield. Mealworm oil at 22% is positioned as the second-largest contributor, benefiting from favorable nutritional profiles for feed applications. Cricket oil, holding 15%, is expected to find niche adoption in specialty feed and health-related uses, while locusts (9%) and other insect types (8%) will remain limited by production constraints and consumer acceptance challenges.

Growth is anticipated to be supported by strong demand for sustainable aquafeed, regulatory openness toward alternative proteins, and Japan’s rising interest in clean-label cosmetics and personal care. Premium applications in functional foods and nutraceuticals are also likely to be tested, building on Japan’s culture of innovation in wellness.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Skin Creams | 6% |

| Soaps | 5% |

| Hair Products | 3% |

The Insect Oil Market in South Korea is projected to expand steadily through 2035, with personal care emerging as one of the most dynamic areas of application. Skin creams are expected to lead with 6% share in 2025, reflecting demand for emollient-rich, natural formulations that align with South Korea’s globally influential skincare industry. Soaps, holding 5%, are being positioned as sustainable alternatives in the natural cleansing segment, where insect-derived oils offer biodegradability and functional stability. Hair products, accounting for 3%, remain a smaller share but are anticipated to gain traction as cosmetic innovation broadens into scalp and hair nutrition.

Adoption is expected to be strengthened by South Korea’s role as a beauty innovation hub, where clean-label claims and novel bio-based ingredients are highly valued. Strong consumer preference for eco-friendly cosmetics, combined with global export potential of K-beauty brands, is projected to amplify demand for insect oil in high-value formulations.

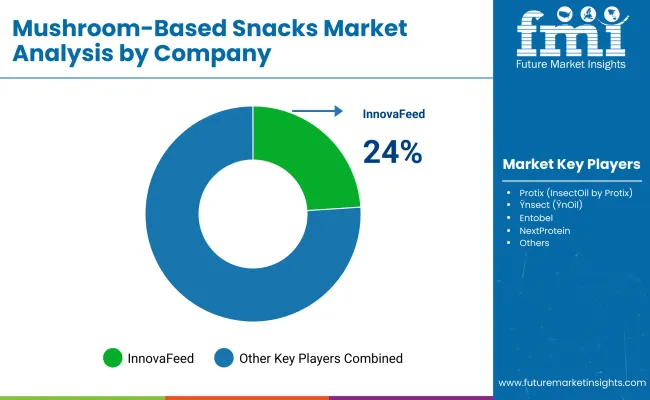

| Company | Global Value Share 2025 |

|---|---|

| InnovaFeed | 24% |

| Protix (InsectOil by Protix) | 18% |

| Ÿnsect (ŸnOil) | 15% |

| Entobel | 6% |

| NextProtein | 5% |

| Others | 32% |

The Insect Oil Market is moderately fragmented, with a mix of global leaders, regional innovators, and emerging specialists. Large-scale players such as Ÿnsect (ŸnOil), Protix (InsectOil by Protix), and InnovaFeed hold prominent market positions, driven by vertically integrated insect farming models, advanced oil extraction technologies, and strong partnerships with feed and pet food industries. Their competitive strategies emphasize scaling production capacity, regulatory certifications, and expanding applications in aquafeed and cosmetics, ensuring steady market penetration.

Mid-sized innovators, including NextProtein and Entobel, are building relevance by targeting niche applications and regional markets. Their operations are being reinforced through cost-efficient farming systems, circular waste utilization, and collaborations with local feed manufacturers. These players are expected to contribute significantly to regional diversification and adoption of insect oils in both feed and personal care categories.

Differentiation across the market is increasingly shifting toward sustainability credentials, application versatility, and downstream partnerships. Value creation is being defined not only by oil yields but also by lifecycle assessments, carbon footprint reduction, and integration into certified supply chains. The competitive environment is therefore projected to evolve from capacity-driven competition to ecosystem-driven collaboration, where traceability, branding, and consumer awareness play critical roles in shaping leadership positions.

Key Developments in Insect Oil Market

| Item | Value |

|---|---|

| Market size (2025) | USD 390 million |

| Market size (2035) | USD 0.686 Billion |

| CAGR (2025–2035) | 5.80% |

| Component | Farming systems; substrate sourcing; extraction systems; refining and stabilization; quality assurance and certifications; distribution (B2B/B2C) |

| Range | Feed-grade; personal care grade; food/nutraceutical grade; industrial grade |

| Technology | Mechanical pressing; solvent extraction; supercritical CO₂; winterization/filtration; deodorization; antioxidant stabilization |

| Type | Black Soldier Fly; Mealworm; Cricket; Locust; Others |

| End-use Industry | Animal feed (aquafeed, poultry); Pet food; Cosmetics and personal care; Industrial (bio-lubricants, surfactants, biofuels); Nutraceuticals |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Country Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Korea |

The global Insect Oil Market is estimated to be valued at USD 390 million in 2025.

The market size for the Insect Oil Market is projected to reach USD 685.8 million by 2035.

The Insect Oil Market is expected to grow at a compound annual growth rate (CAGR) of around 5.84% between 2025 and 2035.

The key product types in the Insect Oil Market are based on insect sources, including Black Soldier Fly (45% share in 2025), Mealworm (23%), Cricket (15%), Locust (9%), and Others (8%).

The Animal Feed segment, particularly Aquafeed (25% share), is expected to dominate the Insect Oil Market in 2025, supported by a strong CAGR of 8.00%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Insect-based Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Insect Repellent Apparel Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Insect Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insect Feed Market Size, Growth, and Forecast for 2025 to 2035

Insect Cell Lines Market - Growth, Applications & Forecast 2025 to 2035

Insect-Based Pet Food Market Growth - Sustainable Nutrition & Demand 2025 to 2035

Bioinsecticides Market Growth - Trends & Forecast 2025 to 2035

Japan Insect Feed Market, By Type, By Application, By Region, Opportunities and Forecast, 2025 to 2035

Korea Insect Feed Market Analysis and Forecast by Product Type, End-User and Region 2025 to 2035

Natural Insect Repellent Market Analysis - Trends, Growth & Forecast 2025 to 2035

Carbamate Insecticides Market Trends & Outlook 2025 to 2035

Western Europe Insect Feed Market Analysis by Insect Type, Application, and Country Through 2025 to 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA